What is a power of attorney

A power of attorney is an official document that gives a citizen the corresponding rights and obligations due to another person. The representative acts in the interests of the principal in government agencies or private organizations. A power of attorney can be issued by any capable or partially capable citizen (with the consent of the trustee).

The interests of young children are protected by their legal representatives:

- mother and father;

- guardian/trustee;

- adoptive parent;

- adoptive parent;

- district guardianship department;

- administration of an organization for orphans.

In this case, a notarized power of attorney is not required. Their powers are confirmed by other documents (passport, birth certificate, decision of the guardianship authority).

Is it possible to register an inheritance by power of attorney?

Yes! The law allows you to enter into inheritance rights through representatives.

The heir needs:

- Select a suitable candidate.

- Issue a power of attorney.

- To pay the costs.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Involving third parties allows you to significantly save time. In addition, if a person does not have a legal education, then registering an inheritance can become a real problem for him.

The law provides for the possibility of issuing a power of attorney not only for friends and relatives, but also for professional lawyers. The assignee must only draw up documents for a specific specialist and pay for the civil contract.

Why does the heir need a representative?

Entering into property rights is not just about submitting an application to a notary.

The heirs need to resolve the following issues:

- searching for a will;

- search for inherited property;

- search for accounts in credit institutions;

- searching for information about the debts of the deceased;

- carrying out property assessment;

- payment of state duty;

- conclusion of an agreement on the division of inheritance.

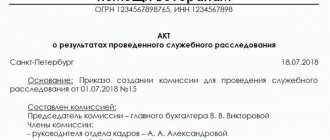

Problems when registering an inheritance

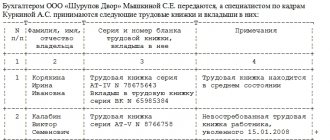

| No. | Possible difficulties | Comments |

| 1 | Problems with co-heirs | For example, if the testator left behind a will. Disagreement of any relative with the contents of the document can lead to protracted litigation. |

| 2 | Allocation of shares in property to obligatory heirs | In some cases, the law allows you to reduce the applicant's share or refuse to award it. Naturally, there is a need to file a claim in court. The preparation of documents must take into account the requirements of the Procedural Legislation. |

| 3 | Lack of necessary documents | To restore them, sometimes you need to contact government agencies in other regions or countries. If it is impossible to obtain a duplicate of the document, you will need to go to court. |

| 4 | Registration of ownership | Although the procedure for registering property rights does not take a long time. However, state registration of each type of property (real estate, transport, shares) takes place in different organizations. The heir needs not just to apply, but to stand in line, submit documents and appear again to receive the result. |

| 5 | Resolving the issue of the procedure for using property | When drawing up an agreement, it is necessary to take into account the interests of all co-owners. Consequently, there will be lengthy negotiations with the heirs. If there are conflicts between relatives, negotiations will most likely reach a dead end. |

Important! To avoid unnecessary tension in a relationship, it is better to involve a third party. The best option is a representative by power of attorney (Article 182 of the Civil Code of the Russian Federation).

Expenses

The legislation determines that the party claiming the property is obliged to pay all costs associated with registration. Naturally, it does not matter who exactly will pay the state duty, appraiser services and other expenses. This can be not only the heir himself, but also his representative acting by proxy. The main expenses are related to the payment of state duties. Its size depends on the degree of relationship between the heir and the deceased. So, if a close relative inherits, the state duty is 0.3% of the appraised value. In addition, there are restrictions on the amount. For heirs who have documented close kinship, the amount of the state duty should not exceed 100 rubles. This applies to spouses, parents, children, sisters and brothers. All other heirs are not considered close relatives. This category will have to pay 0.6% of the value of the property. In this case, the duty can reach a million rubles.

In addition, the heirs will have to pay for the services of a specialist who evaluates the property. Its type directly affects the final cost. For example, if we are talking about an apartment, the appraiser will take about 3 thousand rubles. When receiving a certificate from the BTI, you will have to pay an additional 500-600 rubles. A car appraisal can cost 3-5 thousand rubles. The final cost depends on the condition of the vehicle, its type, and whether it can be used for commerce.

Another cost item is the registration of ownership of the property. For example, if we are talking about real estate, registering property rights will cost about 2,000 thousand rubles.

Rights and obligations of a representative

The powers of the authorized person are determined by the power of attorney.

When registering an inheritance, the presenter can perform the following actions:

- Submit an application to a notary.

- Submit the required documents.

- Pay state fees and third party services.

- Receive a certificate of inheritance.

- Register property rights.

- If there are controversial issues, the representative by proxy can go to court , increase the amount of claims, and receive writs of execution.

- Based on the results of the court hearing, the attorney has the right to submit an application to the bailiff service and get acquainted with the materials of the enforcement proceedings.

After exercising the granted powers, the representative can count on remuneration. However, such points are not specified in the power of attorney. The parties themselves determine the settlement procedure.

For example, the heir can make an advance payment. If a lawyer is hired for representation, the parties can draw up a separate agreement, which will specify the scope of work, the amount of remuneration and the responsibilities of the parties to the agreement.

Actions after receiving an inheritance

Having received a certificate of inheritance, the representative can proceed with the registration of the object. If we are talking about real estate, then documents are submitted to Rosreestr through a notary. To do this, the heir or his authorized representative writes an application and pays the state fee. The process of registering real estate takes 7-12 days.

Registration of vehicles is carried out at the State Traffic Safety Inspectorate. The new owner is required to register the car within 10 days after receiving the inheritance. Otherwise he will be fined.

What types of powers of attorney are there?

In notarial practice there are 3 types of documents:

- One-time. A power of attorney is issued to perform a specific action. For example, the heir cannot visit the notary on his own. The principal authorizes the representative to submit an application for acceptance of the inheritance. The heir performs all other legally significant actions independently.

- Special. A power of attorney of this type is usually issued for representation in courts, where a number of actions are required within a specific time (filing a claim/petition, participating in court hearings).

- General. The document gives the representative broad powers. The representative can contact any government agencies, receive the necessary certificates, extracts, archival documents, submit applications, pay bills.

To register an inheritance, the third option is usually used. It allows you to exercise not only the powers specified in the power of attorney, but also those derived from it. A general power of attorney practically eliminates the possibility of nitpicking of the representative by officials or a notary.

Duration of the power of attorney

Typically, the validity period is indicated in the document itself - 1 or 3 years . If the document does not contain such a clause, then the power of attorney is valid for a year (Article 186 of the Civil Code of the Russian Federation). If the representation is carried out abroad, the document is valid until its actual cancellation.

At the same time, the power of attorney loses its significance after the necessary legal actions have been completed. For example, immediately after receiving a certificate and registering a right.

The principal can revoke the power of attorney to enter into inheritance at any time. If the representative managed to delegate his powers to third parties, then the power of attorney issued by him also loses force. Additionally, the document loses force in the event of the death of the principal.

Deadlines

You must declare your desire to inherit within six months after the death of a relative. If the interests of the heir will be represented by an attorney, he must also submit a corresponding application during this period. This period is intended for close relatives who are considered first-line heirs. After this period, other heirs can lay claim to the property. If more than six months have passed since death, and a close relative only wishes to inherit, he will have to set aside his interests in court.

Is transfer of rights allowed?

The issue of transfer of powers is resolved when drawing up a primary power of attorney. If it does not contain a prohibition on delegation, then the representative may delegate his powers to third parties.

The representative must notify the principal about the involvement of an additional person. If this rule is ignored, the main representative is responsible for the actions of the person he has attracted.

The power of attorney is also registered with a notary. It is valid within the terms of the primary power of attorney. The powers of the primary representative are retained unless otherwise provided by the primary power of attorney.

How to transfer rights

Article 187 of the Civil Code of the Russian Federation allows an attorney to delegate the duties received to another person. Such a possibility must be indicated in the text of the power of attorney.

When entrusting the right, the attorney must remember the following nuances:

- the principal must be notified of the change of representative;

- the first representative is responsible for the actions of the new attorney;

- to record the change of trustee, a new document is drawn up, which is subject to notarization;

- if the originator revokes the first power of attorney, the second one is also automatically revoked;

- the new representative receives the same list of powers as the previous one (the number of possible actions can be reduced at the request of the heir);

- the validity period of the new power of attorney cannot exceed the period specified in the main document.

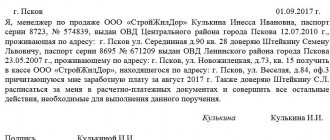

How to correctly draw up a power of attorney for inheritance

The power of attorney is drawn up exclusively in writing.

The document must contain:

- name and address of the notary office;

- name – power of attorney;

- city and date of compilation;

- information about the principal/testator (full name, passport details, registration address);

- similar information about the attorney;

- the essence of the order (the authority of the representative);

- validity period of the document;

- reassignment clause;

- certification inscription to a notary;

- registration number of the form;

- the amount of the withheld state duty;

- signature of the principal.

The content of the document depends on the scope of actions that the principal instructs the representative to perform.

Here you can specify the following:

- registration of inheritance;

- preparation/receipt of necessary papers;

- submitting an application for acceptance of property/receipt of a certificate;

- carrying out property assessment;

- registration of property rights;

- challenging notarial actions;

- contacting any government agency (list);

- filing a claim;

- full/partial refusal of the claim;

- appealing a court decision;

- receiving and submitting a writ of execution to the FSSP.

Structure of a trust deed

A standard sample power of attorney to accept an inheritance is characterized by the following content:

- name of the document – Power of attorney. It is permissible to clarify a specific purpose: simply to join, to join with the right to sell property, etc.;

- date (in words) and place of registration;

- personal information about the parties to the case: full name, passport details, registration address and contact details (valid phone number or current email address);

- the content of the trust deed with clarification of the powers that are granted by the principal to the trustee;

- validity period of the document. In the absence of an explicit indication of the period of validity, the document remains valid for 12 months. Taking into account the fact that the inheritance must be received within six months, this moment is not mandatory;

- clarification of the possibility of entrusting powers to outsiders;

- date of issue of the act (indicated in numbers);

- signatures of the parties.

In addition, the document is filled out by a notary who is authorized to certify such transactions. This part of the document, if we take the power of attorney for inheritance according to the model, has the following structure:

- date and place of certification of the act and when it entered into legal force;

- confirmation of certification by an authorized notary;

- proof of the principal’s full legal capacity;

- confirmation of reading the contents of the act in the presence of the principal;

- registration number of the power of attorney in the general database of notarial documents;

- cost of notary services provided;

- personal signature of the specialist and seal.

When registering a power of attorney to inherit a share in an apartment or other property, there are no significant requirements for the parties. The main conditions for them are to be legally capable and to take part in the transaction solely on a voluntary basis.

How to issue a power of attorney to conduct inheritance business

To issue a power of attorney, the heir must contact a notary. You can use existing samples or offer your own version.

The notary is obliged to include in the text of the power of attorney any powers that may be required by the representative. The only condition is that they must not contradict the law.

Order and procedure

You can issue a power of attorney at any notary office. The text of the document must be clear, without abbreviations/corrections. The power of attorney is signed in the presence of a notary.

Algorithm of actions when registering a power of attorney:

- Visit to a notary's office.

- Presentation of documents.

- Making the project.

- Payment of state fees, legal and technical services of a notary.

- Signature of the document.

- Entering information into the register.

- Entering data into a unified electronic register.

Required documents

To issue a power of attorney you will need:

- civil passport of the principal (original);

- civil passport (copy or original) of the authorized person;

- receipt for payment of state duty.

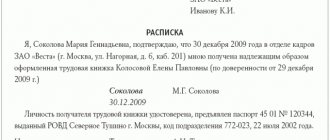

Statement

In order for the representative to begin the inheritance registration procedure, he will need an application from the heir. The document must be notarized.

The application can be drawn up in the same office where the power of attorney was made.

Expenses

To issue a power of attorney you must pay:

- state duty - 200 rub. (Article 333.24 of the Tax Code of the Russian Federation);

- legal and technical services (depending on the region of registration);

- notarization of the heir's signature when submitting an application to a notary (Article 1153 of the Civil Code of the Russian Federation).

Such a document can be made immediately when registering a power of attorney. The cost of notarization of the application is 100 rubles.

The cost of notary services in 2021 in Moscow when drawing up a power of attorney will be from 1300 rubles. up to 1800 rub. When drawing up a document by way of transfer of authority, the price of services increases to 2800 rubles.

What the law says

The opening of an inheritance case in most cases occurs unexpectedly.

By law, all issues with inheritance must be resolved within six months from the date of death of the testator. Extension is permitted only for compelling reasons. This is one of the reasons why granting certain rights to the principal is permitted. The regulations of the Russian Federation contain precise explanations regarding the execution of a power of attorney. If you do not comply with the requirements of the law, the document will not have legal force, which means that the authorized person will not receive the right to perform the prescribed actions.

The execution of a power of attorney is regulated by civil law:

- Art. 182 of the Civil Code of the Russian Federation reveals the concept of “representation”;

- Art. 185-187 regulate the rules of registration;

- Art. 1153 talks about methods of accepting the inheritance mass.

In addition, in Art. 333.24 of the Tax Code of the Russian Federation specifies the amount of the state fee for notarization of a power of attorney.