Who is entitled to child benefit for up to three years at the expense of the employer?

The current legislation of the Russian Federation defines persons who are entitled to a compensation payment of 50 rubles for up to 3 years:

- those performing military service;

- citizens with an official place of employment;

- citizens who do not have an official place of employment due to undergoing retraining courses;

- disabled;

- students;

- individual entrepreneurs;

- citizens left without a job due to the liquidation of a company;

- citizens caring for a disabled child of group 1.

For the second child, benefits are paid from maternity capital

For the first child, money is taken from the federal budget. And on the second - they deduct it from maternity capital. From 2021, you will be able to receive money until your second child’s third birthday, but in fact you pay it to yourself. The state makes it possible to get more maternal capital with real money and spend it wherever you want without reporting. But these are not additional amounts of state support.

But 50 rubles are not deducted from maternity capital for children until their third birthday. Feel the difference.

Source: journal.tinkoff.ru

Changes in legislation

What is the name of the 50 ruble allowance? for a child? Compensation payment.

At the end of 2021, the President of the Russian Federation signed a Decree, which refers to the abolition of compensation payments during maternity leave. The changes took effect on January 1, 2021.

In 2021, compensation in the amount of 50 rubles has not been canceled for everyone. To receive funds, the following conditions must be met:

- The benefit was assigned until 01/01/2020.

- The child was born before 01/01/2020.

Abolition of 50 rubles by the President of the Russian Federation in 2021

Decree of the President of the Russian Federation dated May 30, 1994 No. 1110 established monthly compensation payments in the amount of 50 rubles for certain categories of persons on parental leave for children under three years of age.

Thus, this compensation was assigned:

- employees who are granted parental leave. This could be the child's mother, father, or other relative. The payment is made by the employer;

- students, graduate students who study full-time and are on academic leave for medical reasons. Payments are made at the place of study (educational or scientific organization);

- female military personnel on maternity leave. The payment is made by the military unit;

- unemployed women or women dismissed due to the liquidation of the organization, if at the time of dismissal they were on maternity leave (provided they did not receive unemployment benefits). For benefits, such women must apply to the social security authority at their place of residence;

- non-working maternity wives of ordinary and commanding staff of internal affairs bodies, the State Fire Service, stationed in remote garrisons and localities, without the possibility of employment for women. Payments are made at the husband's place of service.

The President of the Russian Federation noted this Decree with his Decree No. 570 dated November 25, 2019. Lost force on January 1, 2021.

The procedure for assigning and paying compensation in the amount of 50 rubles

To apply for benefits, an employee just needs to write a corresponding application addressed to the employer. Based on this document, the employer must decide whether to pay the employee money for child support or not.

The employer is given exactly ten working days to make a decision.

If the employer’s decision is positive, then an appropriate order is issued. There is no unified form of such a document, so it can be independently developed by the organization.

The employer will pay benefits until the employee’s child turns 3 years old.

The application must be submitted every year

To receive the payment, you must submit an application at any time up to one and a half years. But if you submit it in the first six months, the payment will be assigned from the date of birth. And if later - from the date of application.

The benefit was paid within a year after submitting the application, and then it was necessary to collect documents again. That is, they had to be submitted once or twice during the entire period. No proof of income was required between applications. A child is born, your average per capita income is confirmed, and you definitely receive benefits for a year. And then confirm again - and you get up to one and a half years.

From 2021. After the first application, the benefit will not be assigned for a year, but until the child turns one year old. If you submit an application at eight months, benefits will be accrued for four months.

When the child turns one, you will need to submit another application for benefits up to two years, and then another one up to three.

You can apply for benefits at any time until the child is three years old. For example, up to a year, maternity mothers were taken into account in family income; the average per capita income was more than the limit - no benefits were provided. And then maternity leave was no longer included in the 12 months for calculating income. This means that you can submit an application, for example, when the child is one year and seven months old. Then the benefit will be assigned for up to two years, and then - according to another application - for up to three years.

Each time, along with the application, you must confirm your income for the previous 12 months. This is fundamental for determining the payment: benefits can be paid for up to a year, but then no longer. Or vice versa.

Compensation amount

According to the legislation of the Russian Federation, an allowance of 50 rubles is paid for full months of parental leave.

To determine the amount of compensation for an incomplete month, you must adhere to the following formula: 50 rubles / Y x T = R, where

- Y – total number of calendar days in a month;

- T – the number of days of the current month during which the employee was on maternity leave;

- R – amount of compensation.

As an example, consider a situation where an employee who is on maternity leave decides to begin performing her job duties on a part-time basis on December 15th. We apply the above formula: 50 rubles / 31 days x 15 days = 23 rubles.

If a woman works in the Far North, the amount of monetary compensation will be increased in accordance with the regional coefficient.

Compensation 50 rub. Child care is paid as follows:

- the first month - on the day of payment of wages;

- subsequent months - on the first date of payment of wages in a particular organization.

One-time financial support

The types of one-time child care benefits and their amounts in 2021 are presented in the figure:

The amount of the one-time payment increases in proportion to the number of children born and/or adopted.

Example

On February 28, 2021, twins Alexander and Vasily were born into the Paramonov family. The lump sum benefit at birth will be:

18,886.32 × 2 = 37,772.24 rubles.

A day later, in the same maternity hospital, 5 girls were born from the same mother. She can count on the one-time payment required by law, increased by 5 times (Article 11 of the Law “On State Benefits...” dated May 19, 1995 No. 81-FZ):

18,886.32 × 5 = 94,431.60 rubles.

The benefit is paid to one of the parents by the employer or the social security authority (if a non-working citizen applies for payment).

What kind of certificate will be required to process this payment from a parent who does not receive benefits is discussed in this material.

How to apply for benefits

According to the new law, maternity leave for up to 3 years is not paid in 2021. However, some citizens can still qualify for this benefit.

The procedure for applying for child support payments is as follows:

- The employee draws up an application and attaches the required package of documents to it. If a woman does not have an official place of employment, then she must submit papers to the social protection authorities.

- Within ten days, the submitted documentation will be reviewed and only after that the benefit will be assigned.

- If a woman made payments for child support through her employer, then the funds will be credited to the card on the day the salary is paid. If the documents were sent to the social protection authorities, then the funds are transferred to any account specified in the submitted application.

The applicant has the opportunity to receive funds in cash via mail.

Required documents

To apply for child support payments, you must collect the following package of documents:

- child's birth certificate;

- employment history;

- a certificate confirming the fact that the applicant does not receive unemployment benefits (must be obtained from the employment center);

- order to go on maternity leave.

If a woman has an official place of employment, then the collected documentation is sent to the accounting department of the enterprise. If the mother is unemployed, then the application is submitted to the social protection authorities or the Multifunctional Center.

Filling out an application

The application submitted by the employee must necessarily contain the following information:

- The name of the organization where the mother works.

- Information about the general director of the enterprise.

- Information about the applicant (full name, position held).

- Data from the decree on maternity payments.

- Please provide monetary compensation.

- At the end, the date of preparation of the document and the signature of the applicant are indicated.

Deadlines

Submission of the collected documentation is carried out no later than six months after the employee goes on vacation.

If a woman violates the established deadlines, she will receive funds only for a period not exceeding 6 months.

What affects the type and amount of child benefit?

From the moment a child is born until he reaches the age of 3 years (and in some cases for a longer period), the state assumes the responsibility to support citizens with children.

During these 3 years, various benefits and compensations are paid to parents (relatives, guardians and other persons) for the maintenance of the child. They can be regular or one-time. They can be provided under both federal, regional, and local legislation. The type of benefits and payments for a child under 3 years of age is largely determined by his age (see the figure below):

IMPORTANT! From 01/01/2020, compensation payments for up to 3 years are no longer prescribed. Previously assigned compensation is paid until the child reaches 3 years of age.

But not only age determines the type and amount of payment. The assignment of individual benefits is made upon fulfillment of certain conditions related to the level of family income and/or the date of birth of the baby. For example, monthly payments from maternity capital until a child reaches the age of 3 are not available to everyone. The figure below shows the conditions under which such a payment is possible:

Benefits for up to three years in 2021 may also be assigned depending on the fulfillment of other conditions. For example, for large families, regional special payments for the third child are available, introduced in areas with low fertility rates.

Next, we will tell you in more detail about the amounts and types of benefits for a child under 3 years of age.

And you will find the amounts of all benefits provided by law for children (of any age), as well as links to resources that will help you apply for these benefits, in ConsultantPlus. Get trial access to the system for free and go to the Directory.

When payments may stop

The current legislation of the Russian Federation defines situations in which payments for the maintenance of a child under 3 years of age may be terminated:

- The employee wrote a letter of resignation of her own free will.

- The applicant receives unemployment benefits.

- Mom left her vacation early.

- The employee switched from maternity leave to maternity leave.

- The baby was taken to a boarding school.

- The applicant was deprived of rights to the child.

If at least one of the above circumstances occurs, then the payment of benefits stops from the next month.

Administration actions

Accounting does not have the right to make even minimal transfers from company accounts without an administrative document. Therefore, it is necessary to create it. Based on the employee’s application, the personnel service prepares an order. In particular, it specifies the need to calculate and pay compensation. Attention: it is unacceptable to transfer money to his account without the employee’s will.

When payments stop

Assistance is calculated for a woman on maternity leave according to the following rules:

- from the first day of vacation;

- before the end of the month in which the baby turns three years old;

- or until the day the employee returns to work prematurely.

The following regulatory requirements are taken into account:

- For the first month, amounts are calculated proportional to the amount of it. For example, if a woman went on vacation on May 12. 2021, then for May she is entitled to: 50 rubles. / 31 days x 19 days = 30.65 rub.

- The same applies if the recipient is reinstated at work earlier than expected.

- For the month in which the child turns three years old, you will have to transfer the entire amount.

Please note: interruption of vacation results in termination of payments. This does not apply to the following cases:

- part-time work;

- employment at home.

Special situations

Confusion arises when a company employs a mother of many children. When determining the amount of money that needs to be paid to her, one should rely on the following principle of the Presidential Decree:

- compensation is personal;

- it is provided to an employed mother (other relative).

Hint: if a mother takes care of several children, then she is credited with the same 50 rubles.

There is no need to multiply the amount by the number of children. Additional conditions for termination of accruals:

- dismissal of an employee at her own request;

- death of a child;

- deprivation of mother's parental rights (court decision);

- placement of the baby on full state support.

What benefits are paid in 2021

In 2021, changes came into force that affected benefits for up to three years at the expense of the employer. This payment is no longer being made.

Until the child turns 3 years old, the mother will be able to receive a payment equal to one regional subsistence minimum per child, established for the second quarter of the previous year.

Until 2021, women could receive such benefits only until the child reaches 1.5 years of age. The new payment is a replacement for the compensation payment. The family will be able to receive not 50 rubles, but about 11,000 rubles for the first and second baby.

What is this – a new benefit for 1.5 years?

Bill No. 720994-7 involves amending Federal Law No. 418-FZ of December 29, 2017 “On monthly payments to families with children” (hereinafter referred to as Law No. 418-FZ). In other words, the changes will affect the so-called “Putin” benefits. There are no plans to make changes to the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (benefits for employed citizens up to 1.5 years who are granted parental leave at work) , as well as in Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children” (child benefits for the unemployed), and even more so in the Decree of the Government of the Russian Federation of November 3, 1994 (according to which the employer pays its employees 50 rubles until the child reaches three years of age). All of the above benefits have existed and will continue to exist. Only the new “Putin” benefits will undergo changes.

The idea of increasing child benefits from 1.5 to 3 years old appeared 4 years ago. Initially, they planned to pay working citizens from the Social Insurance Fund in the same way as benefits up to 1.5 years (i.e., it is logical to extend it from 1.5 years to 3 years). But the Fund’s resources turned out to be insufficient (it would be necessary to increase the amount of contributions from employers, i.e., they would, in fact, pay the benefit). It was also unreasonable to force employers to pay directly from their own funds. They pay 50 rubles, and that’s good.

Therefore, in the end, they decided to pay benefits for 1.5 years from the federal budget. Just not everyone.

In fact, “Putin’s” benefits for the first and second child have undergone slight changes for the better:

- The criterion of need has changed. Now the benefit will be paid if the family income per person is below the regional subsistence level x 2. Previously, it was the subsistence level x 1.5.

- The benefit payment period has been extended. It will be paid for up to 3 years (currently they pay for up to 1.5 years).

It should be noted that Bill No. 720994-7 does not make any changes to Part 4 of Article 1 of Law No. 418-FZ. This means that for the second child, parents will still receive benefits from maternity capital, i.e., essentially, from their own money.

It is difficult to imagine that a family in which there are no problems with housing, able to pay for any education of their children and adequately support themselves in old age, has an income below twice the subsistence level in order to take advantage of benefits for a second child. In most cases, many parents still prefer to spend maternity capital on large purposes.

Thus, an increase in benefits from 1.5 to 3 years is really only worth waiting for for families with their first child and low income.

Benefits paid due to coronavirus

Families in which a child under 3 years of age was born from April 1, 2017 to June 30, 2021, will receive a payment of 5,000 rubles. In this case, the presence or absence of the right to maternity capital does not matter.

If only 1 child was born in a family before the beginning of 2021, then one of the parents or a guardian can apply for a benefit.

If the family has the right to maternity capital, then only the child’s mother or adoptive parent will be able to submit an application.

If a child turns 3 years old in April, the family will receive benefits only for April. It follows from this that the payment is made for the month in which the child reaches 3 years of age.

An application for a benefit is submitted either through a single state portal called State Services or through the Pension Fund.

How long will the increased benefit be paid?

Due to the difficult period of the pandemic, families raising a child 0-1.5 years old, instead of 3375.77 rubles, were paid three times more - 6752 rubles monthly. Moreover, the order in which the baby appears no longer matters. Will he be first, second or fifth.

This innovation in the bill appeared on June 1, 2020. The measure is permanent and will remain unchanged after the end of the pandemic. Will be valid until 02/01/2021. Then the payment will be increased according to the inflation rate in the country.

Documenting

To receive compensation, an employee must submit an application to the organization for its appointment. The legislation does not provide for a standard form of such a document. Therefore, it can be compiled in any form. A copy of the order granting parental leave is attached to the application. Additional documents (for example, a certificate from the other parent’s place of work stating that he does not receive compensation) are not submitted. This procedure is established in paragraph 12 of the Procedure approved by Decree of the Government of the Russian Federation of November 3, 1994 No. 1206.

Similar rules apply to employers in the Republic of Crimea (Sevastopol). The fact is that since January 1, 2015, Russian legislation has been fully in force in these regions regarding labor relations (Clause 1, Article 2 of the Law of October 14, 2014 No. 299-FZ). The employer's obligation to pay compensation for caring for a child under 3 years of age is established by Article 256 of the Labor Code of the Russian Federation. Therefore, organizations (entrepreneurs) of Crimea and the city of Sevastopol have no reason to ignore the requirements of the Decree of the Government of the Russian Federation of November 3, 1994 No. 1206.

Compensation must be assigned no later than 10 days from the date of receipt of all necessary documents from the employee.

Document the decision to assign compensation by order. If payment of compensation is refused, the organization must inform the employee about this in writing, indicating the reasons for the refusal and the method of appealing the decision on the refusal. This must be done within five days from the date such a decision is made. All documents are returned at the same time. This procedure is established in paragraph 14 of the Procedure approved by Decree of the Government of the Russian Federation of November 3, 1994 No. 1206.

Attention: the grounds on which an organization can refuse to pay compensation to an employee are not established in law. Therefore, if the employee has submitted the necessary documents, compensation must be paid. The legality of this was confirmed by the court (determination of the Presidium of the Supreme Court of the Russian Federation dated December 24, 2003 No. 56ПВ03).

If the organization does not pay the compensation that is due to the employee, it can be recovered in court (decision of the Rybinsk District Court of the Yaroslavl Region dated May 27, 2004 from review 12 to the letter of the FSS of Russia dated July 11, 2005 No. 02-18/07-6203 ).

As for fines, the law does not provide for direct liability for non-payment of compensation. At the same time, during an inspection, the labor inspectorate may consider non-payment of compensation a violation of labor legislation. It includes not only the Labor Code of the Russian Federation, but also other regulations, including Decree of the President of the Russian Federation of May 30, 1994 No. 1110 (Article 5 of the Labor Code of the Russian Federation).

The responsibility is as follows:

- for officials of the organization (for example, a manager) - a warning or a fine from 1000 to 5000 rubles;

- for entrepreneurs – a fine from 1000 to 5000 rubles;

- for an organization – a fine from 30,000 to 50,000 rubles.

Repeated violation entails:

- for officials of the organization (for example, a manager) - a fine of 10,000 to 20,000 rubles. or disqualification for a period of one to three years;

- for entrepreneurs – a fine from 10,000 to 20,000 rubles;

- for an organization – a fine from 50,000 to 70,000 rubles.

Such liability measures are established in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.

Are they taxable?

Knowing whether a particular income is taxed will eliminate the risk of a situation arising in which the employer violates his own rights.

How much is the lump sum benefit for the birth of a child in 2021? What is the amount of benefit for caring for a second child? Find out here.

It is not uncommon for unscrupulous persons to enjoy the trust of their own subordinates.

For pregnancy and childbirth

So, it’s worth clarifying once again whether the B&R benefit is subject to income tax.

This state material support is not subject to inclusion in the 2-NDFL certificate and, accordingly, deductions are not made from it according to the provided taxation system.

Additional payment up to average earnings

In a situation where the calculation of maternity benefits has shown that the amount received is less than a woman’s average earnings, the employer can use the option of making additional payments up to the established minimum or higher.

At the same time, he must take into account that the amount of the benefit cannot exceed the maximum bases for insurance premiums approved by the Government of the Russian Federation.

Considering the fact that such an allowance does not belong to the category of state benefits, paying income tax in this case is considered mandatory.

Additional payment income code – 4800 “Other income”.

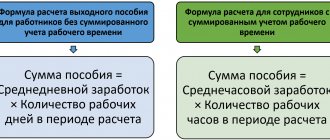

How to calculate the size

Calculating the amount of payments under the BiR is very simple - just find out the average earnings and the number of days of maternity leave, and then get their product.

The amount received is the amount a woman can count on.

Determining the care allowance is somewhat more complicated - you will need to find out the average earnings of the applicant for the previous two years, and then multiply it by the average number of days in a month and a coefficient of 0.4.

Child care allowance up to 1.5 years old

Monthly care allowance for up to 1.5 years or up to three years is also legislatively enshrined in the list of payments that are not subject to taxation - this is specified in paragraph 1 of Article 217 of the Tax Code of the Russian Federation.

Given the fact that there is no mandatory fee, care leave is not reflected in the certificate.

In other words, if a child care benefit is issued, personal income tax reporting is not required, since the employee sits at home and does not receive any payments for her work, only children’s money.

In this case, it is necessary to take into account a similar situation, but completely different from the one described above. It concerns the receipt of payments for caring for a sick child, which are issued on sick leave.

This type of support is not considered an object of the Government’s social policy, therefore the calculation of mandatory fees from it is considered mandatory.

The benefit falls under the category of sick leave, so the question of how to reflect the payment in the certificate can be answered unequivocally - under code 2300.

Reflection in the 2-NDFL certificate

Clarifying all of the above, it is worth noting the following positions regarding the reflection of the corresponding payments in the 2-NDFL certificate:

- child benefits are not included in the document;

- additional payment from the employer is reflected under code 4800;

- sick leave benefits are reflected under code 2300.

What is the maximum amount of child care benefit? What benefits are available to single mothers in 2021? Find out here.

How to calculate severance pay in case of layoff? Read on.

As for whether 6-NDFL reflects payments for employment or care or not, the answer can be negative, since this form is a quarterly report that specifies income subject to taxation.