In 2021, all employers are faced with major changes to their current reporting practices.

If until this moment they reported on pension contributions to the Pension Fund, on contributions in case of temporary disability and injuries - to the Social Insurance Fund, and on accrued and paid taxes - to the Federal Tax Service, now all powers to administer contributions have been transferred to the Tax Inspectorate (except for contributions "for injuries"). In connection with this, Order No. ММВ-7-11/551 of the Federal Tax Service of 2016 approved a unified reporting form RSV-1. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

According to the new rules, all employers, regardless of their form of ownership, rent it out: these can be either individual entrepreneurs with employees or legal entities.

Conditions for filling out reports

RSV-1 reporting is required to be submitted to the Tax Inspectorate by all legal entities and individuals who use hired labor in their work and are payers of insurance premiums. The form and reporting procedure for RSV-1 were approved by Order of the Federal Tax Service of 2021 No. ММВ-7-11/ [email protected]

Part of the benefits for temporary disability on sick leave is paid by the employer from his own funds, the other part is compensated by the Social Insurance Fund.

If the amount of accrued benefits turns out to be less than the amount of benefits paid, then the employer has the right to receive compensation to his current account. In this case, the receipt of such compensation must be reflected in the RSV-1 reporting form.

Thus, the conditions for filling out RSV-1 reporting are as follows: the employer has the status of a legal entity or individual entrepreneur, he employs employees under an employment contract, or he engages persons for certain operations under a civil contract, he is a payer of insurance premiums.

Situation

Let’s assume that in 2021, based on a certificate of the amount of earnings of the insured person, the accounting department recalculated the amount of temporary disability benefits for the previous billing period of 2018. That is, the employee in 2021 was accrued the missing amount of benefits.

Accordingly, the question arises of reflecting in the calculation of insurance premiums the recalculation (additional accrual) of previously accrued benefits for temporary disability and in connection with maternity for the previous billing period in subsequent reporting periods.

How to fill out the RSV form correctly

The RSV-1 calculation contains information that is the basis for the calculation and payment of insurance premiums from the 1st quarter of 2017. One of the sections of the report is devoted to insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.

It consists of a title page and three sections indicating contributions for pension, medical and social insurance of employees, as well as personalized information.

In the RSV-1 form, it is necessary to fill out only those sections in which the employer has something to transfer. For example, if an employer does not have contributions with additional tariffs, then he does not fill it out and submit it to the inspectorate.

After the employer submits a report on contributions to the Federal Tax Service, the inspectorate transmits it to the territorial division of the Social Insurance Fund (Appendix 2-4 to Section 1 with information on accrued contributions and benefits). Therefore, the employer should take into account that the figures calculated for contributions and those transferred to the Social Insurance Fund to receive compensation must be the same.

Report sick leave in 6-NDFL and insurance premium reports differently

Sick leave is one of the accruals that has different rules for the purposes of withholding personal income tax and calculating contributions. This means that sick leave must be displayed differently in reports on these payments. This issue does not lose its relevance due to the receipt of demands from the tax authorities regarding the completion of reports regarding sick leave. Evgenia Dubkova, leading expert of the Department of Small and Medium-sized Businesses of online accounting "My Business", talks about how to reflect sick leave in salary reports (using the example of their formation in the online service "My Business") and explains how to respond to tax requirements

What you need to know about vacation pay in order to fill out salary reports

- must

from sick leave . - The date of receipt of income in the form of sick leave for personal income tax purposes is the date of its payment.

- Sick leave is not subject

to contributions.

As you can see, the differences in the rules for personal income tax and contributions are obvious.

The full amount of sick leave falls into the personal income tax base at the time of payment. However, sick leave is not included in the contribution base, since it is a non-taxable payment. There are control relationships between the 6-NDFL report and the report on insurance premiums. They are not strict, that is, their implementation is not mandatory. However, if they are not fulfilled, the tax office may request clarification (in the form of a demand). And sick leave is just such a case.

So, using an example.

Example

Salary of employee Ivanov I.I. — 50,000 rubles per month. The employee was hired on July 1, 2021. The employee was on sick leave throughout August (from August 1 to August 31). Sick leave in the amount of 6,826.20 rubles was paid to the employee on August 31. Additionally the following were paid:

- salary for July - August 5;

- salary for September - October 5.

Salaries for August were not accrued and paid, since the employee was on sick leave for the entire month.

Using the example of generating reports in the “My Business” online service, we will show how the amount of sick leave will be displayed in the 6-NDFL report and the contribution report.

1. Let's start with the fact that all events (including reporting submission) are conveniently located in the tax calendar. In addition, three days before the event deadline, you will receive an SMS informing you that the deadline for submitting the report is approaching. Thus, we will protect you from fines for late submission of reports.

2. When you click on a calendar event, you are taken to the wizard for generating the corresponding report, which consists of several steps. At the first step, we usually suggest that you familiarize yourself with general information on submitting a report. On the second step, view the details; if necessary, select an adjustment report form (by default, the primary report is always generated).

Report on insurance contributions to the Federal Tax Service (Step 1. Familiarization)

Report on insurance premiums to the Federal Tax Service (Step 2. Data about the company - the step data goes into the title page of the report)

Next, let’s look at how the amount of sick leave is reflected in the report on insurance premiums (at step 3. Calculation of contributions to the Pension Fund and the Compulsory Medical Insurance Fund

). Sick leave in full amount (6,826.20) is reflected in:

- line 030 “Amount of payments and other remuneration calculated in favor of individuals”;

- in line 040 “Amount not subject to insurance premiums.”

Line 050 “Base for calculating insurance premiums” is calculated as the difference between line 030 and line 040. Thus, in August 2021, the premium base will be equal to 0. And the total premium base for the period January-September will be: 100,000 rubles (then there is a base consisting of salaries for July and September, since the employee was hired on July 1).

Report on insurance contributions to the Federal Tax Service (Step 3. Calculation of contributions to the Pension Fund and the Compulsory Medical Insurance Fund - step data falls into Subsection 1.1 and 1.2 of the report form)

Similarly, the amount of sick leave was displayed in other steps of the wizard:

- at step 4. Calculation of contributions to the Social Insurance Fund (Appendix 2 of the report);

- at step 5. Allocation to employees (Section 3 of the report).

Now let’s look at how sick leave was reflected in the 6-NDFL report for the same reporting period (9 months of 2021). The Report Wizard also consists of several steps. The 6-NDFL report is not a personalized report, that is, it does not highlight data for each employee. However, we understand the complexity of this report. Therefore, in the wizard, as reference information, we have created a special step that shows from which data for each employee this or that report line is generated. At this step, we clearly see: sick leave paid on August 31 was included in the 6-NDFL report for 9 months of 2021 as a taxable payment. Which is completely correct.

Report 6-NDFL. Reference Step 3: Income and Deductions

At step 4 “Dates and amounts of income and withheld personal income tax”

We display data for filling out section 2 of the 6-NDFL report:

And at step 5 “Generalized indicators”

— data for filling out section 1 of the 6-NDFL report. Here we see the amount of sick leave included in line 020, which is completely correct, since sick leave is subject to personal income tax.

At the last step of each wizard, we check the reports and give you the opportunity to immediately send them to the tax office (funds). In addition, you can download and view reports in a format convenient for you.

Based on the example presented above, reports for 9 months of 2021 were completed as follows:

- ;

- ;

- .

As you can see, the reports are filled out completely correctly, but the control ratios are not met, because the bases for contributions and personal income tax for the same reporting period do not coincide:

- in the report on insurance premiums, the base (line 050) is 100,000 rubles;

- in the 6-NDFL report, the tax base (line 020) is 106,826.20 rubles.

If you receive a request from the tax office about a discrepancy between the amounts in lines 050 and 020, you must respond to it within 5 business days ().

As you can see, the generation of reports in the “My Business” online service is completely automatic. We have taken into account all the necessary legal requirements. And if any questions arise (for example, when a request is received), you will be competently advised by the accounting consultation service within 24 hours. You can familiarize yourself with the capabilities of the service by getting free access right now via the link.

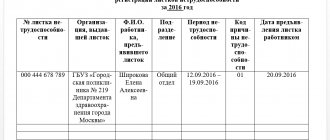

How to reflect sick leave in RSV-1

According to the procedure for filling out the reporting form RSV-1, the amounts of insurance premiums for insurance in connection with temporary disability and maternity are prescribed in Appendix 2 to Section 1.

Line 060 displays accrued contributions from the beginning of the year on an accrual basis , including for the reporting period (quarter) with a monthly breakdown. Line 070 records benefits that have been accrued since the beginning of the year on an accrual basis, including for the reporting period (quarter) with a monthly breakdown.

According to clause 11.14 of the Procedure, line 080 indicates the amount of compensation from the Social Insurance Fund in the column that corresponds to the month of receipt of the actual compensation. For example, if expenses are compensated by the fund in April, then this is displayed in the column for the first month of the 2nd quarter.

Line 090 of Appendix No. 2 indicates the amount calculated using the following formula : accrued contributions minus expenses for the payment of temporary disability benefits plus the amount of compensation received from the Social Insurance Fund for the reporting period.

According to the above calculations, either a negative or a positive value can be obtained. The employer should take into account that if the difference is negative, then he does not need to put a minus in front of the number.

The sign of the resulting difference is indicated using the numbers 1 or 2. If the value is set to “1”, this indicates that the contributions are more than the costs of insurance compensation for workers, “2” - the employer’s costs are more than the accrued contributions. Accordingly, if the value according to the formula for line 090 is negative, then the number “2” is entered.

If the amount is positive, this means that the employer must make an additional payment to the budget; if it is negative, then he will be reimbursed from the budget.

If the employer remains in debt, then he fills out one of the lines: 110, 111, 112, 113. When he has an overpayment, then fill out lines 120, 121, 122, 128. At the same time, these lines are not filled in: that is, the employer can or must budget, or overpay into it.

If there is a discrepancy between the data from the DAM report and the financial statements, accountants often have questions about whether the form has been filled out correctly. Typically, a discrepancy arises between the actual state of affairs and the figure indicated in column “090”.

For example, if the Fund has already reimbursed the employer for expenses, and when filling out the reporting form it turned out that the company owes the Social Insurance Fund a larger amount than in reality (after all, reimbursed expenses are added to accrued contributions), then there is no error in this. The employer will have to pay only accrued contributions to the budget , and not the amount from the final line 110 or 90 of the DAM report.

If the costs of temporary disability benefits were taken into account by the employer last year, and the employer received compensation in the current year, then the report is also filled out in the standard manner.

In the above formula, it does not matter for what period the employer received compensation; it is taken into account in the month of actual receipt. This position is confirmed by the explanatory letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 2021. A similar conclusion can be drawn based on the analysis of Art. 34 of the Tax Code, which provides for the offset of expenses for temporary disability and maternity benefits against upcoming payments.

Most accounting programs today are configured to automatically check all ratios and prevent you from filling out lines incorrectly. But if the employer fills out the reporting independently, then the control ratio is given in the Federal Tax Service Letter of 2021 No. GD-4-11/27043 [email protected]

Sample document: an example of filling out the RSV with sick leave can be found here.

Also, the employer can always find out whether taxes have been paid correctly by ordering a reconciliation of calculations from the Federal Tax Service. If the accounting data matches the reconciliation results, then there is nothing to worry about.

General rules

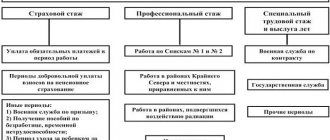

According to paragraph 2 of Article 431 of the Tax Code of the Russian Federation, the amount of insurance contributions for compulsory social insurance for temporary disability and maternity is reduced by payers by the expenses incurred by them to pay insurance coverage for the specified type of insurance.

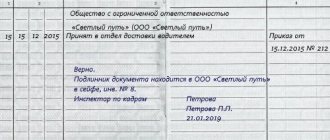

It happens that on the day of applying for temporary disability benefits (maternity benefits/monthly child care benefits) the insured person does not have a certificate(s) of the amount of earnings necessary to assign these benefits in accordance with Parts 5 and 6 of Art. . 13 of Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ). Then the appropriate benefit is assigned on the basis of information and documents submitted by the insured person and available to the employer (territorial body of the Social Insurance Fund) (clause 2.1 of Article 15 of Law No. 255-FZ).

After the insured person submits the specified certificate (certificates) on the amount of earnings, the accounting department recalculates the assigned benefit for the entire past time, but not more than 3 years preceding the day of submission of the certificate (certificates) on the amount of earnings.

Also see “Help for calculating sick leave: form 182n”.

If the data in the DAM differs from the accounting data

In this case, the filling order is also observed and the above formula is used. Regardless of the period for which the Social Insurance Fund reimburses costs, for the previous quarter or for the previous year, this must be reflected in the calculation directly in the month of receipt.

If expenses for payment of benefits were taken into account last year, and compensation was received in the current year

Thus, if the Fund reimbursed the employer’s expenses for paying benefits in August 2021, then this should be reflected on line 080 in the column for the 2nd month of the 3rd quarter. We will describe in detail how to do this in an example.

Let's analyze line by line what the unified calculation of insurance premiums in Appendix 2 of Section 1 includes. Line 001 (payment indicator): determined in accordance with clause 2 of Government Decree No. 294 dated 04/21/2011 and Federal Tax Service Letter No. BS- dated 02/14/2020 4-11/ [email protected] We indicate “01” if the organization is located in a region that is a participant in the FSS pilot project, “02” for all others:

Here you need to fill in personalized information about all insured persons in the organization, for each employee separately. Let's give an example of filling out information in the calculation of insurance premiums for a manager.

How to fill out the RSV-1 form correctly

If during the billing period the company’s employees were sick or other types of benefits were accrued in their favor, reimbursed by the Social Insurance Fund, then additional sheets of the report will have to be filled out. If there are payments from Social Insurance, you will also have to fill out Appendix No. 3 to the first section of the calculation of insurance premiums.

Calculation of insurance premiums for the 1st quarter of 2021: form and sample filling

On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form. The Company pays sick leave to employees and receives reimbursement from the Federal Social Insurance Fund of Russia for the payment of insurance coverage. How in such a situation the calculation of insurance premiums is filled out, the Federal Tax Service of Russia explained in a letter from Clause 2 of Art. If, at the end of the accounting reporting period, the amount of such expenses turns out to be greater than the amount of accrued contributions, the difference is either counted by the tax authority against upcoming payments, or reimbursed by the territorial body of the Federal Social Insurance Fund of Russia. Appendix 2 to Section 1 of the calculation of insurance premiums. The calculation form and the procedure for filling it out are approved by order of the Federal Tax Service of Russia dated Appendix 2 shows: by line - the amount of accrued insurance premiums p. Each of these periods contains five columns for indicating values from the beginning of the billing period, for the last three months of the billing reporting period, and also for the first, second and third months of the last three months of the billing reporting period. In the commented letter, the Federal Tax Service of Russia indicated that the amounts of compensation from the Federal Tax Service of Russia are shown in the columns of the line corresponding to the month in which they were actually received by the company.

New calculation of insurance premiums for the 2nd quarter of 2021: sample filling

Zero DAM: example of filling out download What has changed in the calculation of insurance premiums for 9 months of the year Changes in the procedure for filling out the DAM for 9 months of the year are associated with the abolition of benefits on insurance premiums for some categories of policyholders. Now companies in special regimes with preferential types of activities apply not reduced, but regular tariffs. In the letter from the Federal Tax Service from the Letter from the Federal Tax Service from the Calculation form for insurance premiums for 9 months of the year can be filled out on paper or electronically. In the paper version, the report is filled out in blue or black ink. You must write in clear, legible handwriting, with capital letters. Erasures and the use of corrector are not allowed.

Calculation of insurance premiums in electronic form according to the TKS is submitted if the average number of employees for the previous reporting (calculation) period exceeds 25 people. This also applies to newly created organizations in which this indicator exceeds the specified limit.

Are sick leave insurance premiums covered by the employer?

According to Art. 183 of the Labor Code, all citizens who are sick and issue a certificate of incapacity for work receive benefits for all days of absence from work.

According to the general rules, this payment is not subject to insurance premiums, which is confirmed by the provisions of Art. 422 NK.

Therefore, hospital payments do not transfer funds to social, pension or health insurance.

The benefit is assigned exclusively to persons who are officially employed citizens, therefore, for them, the employer makes monthly contributions to the Social Insurance Fund. The current rate is 2.9% of earnings.

Therefore, these funds are withdrawn from a citizen’s salary so that in the future, when going on sick leave, the person can receive the optimal amount. The first three days are paid for by the employer, after which Social Insurance Fund funds are used.

The benefit received on sick leave is not considered a salary, but is represented by a social payment on which insurance contributions are not charged.

Are insurance premiums calculated for temporary disability benefits?

Before you find out whether sick leave is subject to contributions, it is worth understanding what it is and who is entitled to it. Domestic legislation clearly defines the circle of persons who are paid from the Social Insurance Fund and the recipient’s responsibilities regarding the payments received.

It must be taken into account that the state makes payments for sick leave only if the sick person has paid mandatory insurance contributions to the Social Insurance Fund. Their current rate is 2.9%.

Thus, we can say that the citizen pays for the time spent on sick leave thanks to the previously transferred insurance amounts. The amount of payments itself is calculated based on them.

Russian legal norms clearly indicate that sick leave is not subject to insurance contributions. Moreover, this applies not only to those payments that are made at the expense of the state fund, but also at the expense of the employer. Let us remind you that the Labor Code stipulates that payments from social insurance amounts begin only on the fourth day of sick leave.

The above rule applies equally to both sick leave payments in connection with pregnancy and in connection with caring for sick immediate relatives. The situation is different with personal income tax.