Home / Labor Law / Payment and benefits / Wages

Back

Published: March 15, 2016

Reading time: 7 min

2

17656

The tariff rate is a constant component of an employee’s salary, as opposed to a variable component - bonuses, compensation, allowances and additional payments.

Based on the tariff rate (salary), the salary paid to the employee for performing a certain amount of labor duties (labor standards) at a specified time is calculated. This type of payment is fixed and is the minimum guaranteed amount accrued for work. It is fixed as required by law in the employment contract, along with other conditions.

Tariff rates, depending on the time period, are divided into monthly, daily and hourly.

- What might it be needed for?

- Calculation methods Depending on the standard working hours per month

- Depending on the average monthly number of working hours per year

What might it be needed for?

May be needed for:

- calculating salaries for employees based on accumulated working hours;

- calculating payment for work above the norm;

- determining the amount of payments on weekends and holidays;

- payment for night shifts;

- calculating payment for work in harmful and difficult conditions.

Calculation of the hourly tariff rate is necessary for cumulative recording of working hours.

Such accounting is used for shift work schedules introduced by the organization, when production activities cannot be interrupted on general days off.

Moreover, each employee has a work schedule and an hourly rate that he must work within a certain period of time. Schedules and standards are reflected in the production calendar . Working time in such a schedule is measured in hours, so it is most convenient to calculate the minimum wage for labor exactly per hour. In the event that an employee has exceeded his quota (worked more hours), it is necessary to calculate the hourly tariff rate and make appropriate additional payments.

The size of the long-service bonus for public sector employees primarily depends on their length of service and type of activity. Have you decided to resign of your own free will? Find out what payments employees are entitled to in this case - read our article.

In state-owned enterprises, employees often receive 13 salaries. You can find out how its size is determined from our article.

What is a part-time job? A short educational program.

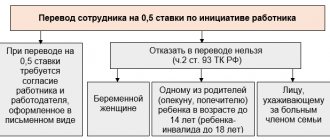

If you don’t have enough money at your main job, then you can get another job and earn more. In personnel accounting, this is called “part-time work.” And here there are two possible options.

The first is that you additionally perform some other duties at your main place of work. That is, here we are talking about the so-called internal part-time job, since you work in the same company.

The second option is to get a job at another company. HR specialists call this part-time job external.

In both the first and second cases, you will not be physically able to fully perform all the duties in both positions, so in an additional place of work you need to get a part-time job , that is, you will work there much less than at your main place. The salary will also, of course, be less, but this is quite normal, because this is just additional work. This is a part-time job.

Now remember one thing well: we were talking about the actual work being done, and not at all about the peculiarities of personnel records at the enterprise. Do you remember? Then read on.

Calculation methods

Depending on the standard working hours per month

The formula used is:

T/h = monthly tariff rate: standard hours (per month)

The norm of hours per month must be taken from the production calendar.

Example:

Inshina N.N. works at JSC Topol as a salesperson on a shift schedule. The salary per month is 20,000 rubles. The production calendar indicates the hourly rate per month - 160 hours. In October 2015, she worked 166 hours.

In order to calculate wages, it is necessary to take into account overtime.

- First, the hourly rate is calculated using the formula: 20,000 rubles: 160 hours = 125 rubles per hour.

- We calculate the overtime: 166 - 160 = 6 hours.

For these six hours worked overtime, Inshina must receive a salary supplement. According to labor legislation, the first two hours of overtime are paid with a coefficient of 1.5, subsequent ones - at double the rate:

125 rubles × 2 × 1.5 + 125 rubles × 4 × 2 = 375 rubles. + 1000 rub. — amount of overtime pay. We add them to the salary and get Inshina’s salary for October: 20,000 + 1375 = 21,375 rubles.

If for one reason or another an employee has worked fewer hours than normal, the daily work rate is calculated and multiplied by the number of hours worked.

Example:

Kulagin K.K, working on a shift schedule, has a salary of 15,000 monthly. In June, its norm is 150 hours. He worked 147 hours this month.

In order to calculate salaries, the accountant makes calculations:

- Determines the hourly tariff rate: 15,000 rubles: 150 hours = 100 rubles/hour.

- Now you should simply multiply the resulting amount by the number of hours actually worked: 100 rubles/hour * 147 = 14,700 rubles.

This is a fairly simple calculation, however, it has a drawback. The tariff rate depends on the hourly rate, which may be different every month. And the lower the standard hours, the higher the hourly rate will be. It turns out that the employee worked less in one month than in another, but will receive a salary higher than in the month in which he worked more.

Example:

Savushkin L.L. works as a security guard. He has a variable work schedule. His salary is 19,000 rubles per month. In accordance with the production calendar, in February the standard hours are 150, in March - 155 hours. In February, Savushkin worked 149 hours, in March - 151 hours.

Salary for February will be equal to:

- We determine the hourly tariff rate: 19,000 rubles: 150 hours = 126.66 rubles per hour.

- We multiply the result by the time worked: 126.66 rubles/hour * 149 hours = 18872 rubles 34 kopecks.

Salary in March:

- Hourly rate: 19,000 rubles: 155 hours = 122.58 rubles/hour

- 22.58 rubles/hour * 151 hours = 18509 rubles 58 kopecks.

It turns out that Savushkin actually worked two hours less in February than in March, but his salary was 362 rubles 76 kopecks.

On what, in your opinion, should remuneration for work depend more?

From the qualifications of the employee From the time spent on work From the conditions of employment From the complexity of job functions I have my own opinion

Depending on the average monthly number of working hours per year

The formula used is:

T/h = tariff rate per month / standard working hours per year: 12 months

Standard working hours are also taken from the production calendar.

Example:

Lavrova store seller E.N. works on a shift schedule. The monthly salary is 21,000 rubles. According to her schedule, in July 2015 she worked 120 hours.

- We calculate the tariff rate per hour using the formula: 21,000 rubles / 1,890 hours: 12 months = 133 rubles 33 kopecks.

- We determine the salary for July: 133.33 rubles * 120 hours = 15999 rubles 60 kopecks.

This calculation method allows you not to calculate the hourly rate monthly, but only once a year. And it will not change all this time. So the employee will receive an amount directly dependent on the amount of time actually worked.

Example:

Watchman Kravtsov P.P. works in shifts. His salary is 12,000 rubles per month. In 2015, the watchman worked 120 hours in March, 130 hours in April, and 110 hours in May. The standard working time for 2015 is 1800 hours.

To calculate wages for each month, you need to find out the hourly rate: 2000 rubles / 1800 hours: 12 months = 80 rubles / hour

Total to be accrued:

- 120 hours * 80 rubles/hour = 9600 rubles in March.

- 130 hours * 80 rubles/hour = 10,400 rubles in April.

- 110 hours * 80 rubles/hour = 8800 rubles in May.

The legislation does not establish one specific method of calculation. Each enterprise sets it at its own discretion, but it must be indicated in the Regulations on remuneration.

Why do they hire part-time employees (legal option)

Let's now look at the situation from the employer's side. What does a part-time employee hire mean to him? To begin with, we will talk about a completely legal situation.

If a company hires a part-time employee, that is, part-time, then this can mean two things. Firstly, a company sometimes needs an additional employee, but it cannot fill him with 100% work. Is it worth hiring a person full-time if the employee spends half of that day doing nothing? This is where people who are willing to settle for half a day come to the rescue.

Secondly, it’s worth keeping in mind that this may be a temporary job. If the workload on employees in this position decreases, they will be fired. And this, it should be noted, is quite normal, both for the company and for the employee. This is not your main job , is it?

In general, I think everyone has realized that getting a part-time job is good extra money. Now let’s talk about how unscrupulous entrepreneurs can use the opportunity to work part-time provided for by the Labor Code.

An example of correct calculation of working hours

Before calculating the standard working time, you need to decide on the billing period. The most difficult thing is to calculate for the year, since you need to take into account all public holidays and weekend transfers. And if employees work on a shift schedule, then in addition to the norm, the number of overtime hours must be determined.

general information

Information on working hours is contained in Article 91 of the Labor Code of the Russian Federation. This period refers to the period of time when a person performs labor functions. By law, the standard duration of this time is 40 hours per week. In practice, such working hours are rarely used.

Firstly, in many enterprises the production process cannot be stopped, so the work schedule there is shifting. Secondly, some categories of employees cannot work for such an amount of time, since by law they are entitled to a reduction in labor standards. These are minors, people with disabilities, etc.

However, the rules for calculating working hours stipulate that a 40-hour working week should be taken as a basis.

Calculation for a month

Determining labor standards allows employers to correctly set work schedules, keep records of hours worked, pay wages and distribute vacations. Knowing how to correctly calculate the standard working time, you can easily determine how many hours an employee must work. One calendar month is often taken as the billing period.

Working hours are calculated as follows:

- First you need to find out how many working days there are in the selected accounting period, and how many weekends, holidays, etc.

- Next, the number of working hours per day is calculated. At the same time, do not forget that the normal length of a working week is 40 hours. This means you calculate the number of hours per working day. Example: 40/5=8.

- The number of days in a month when a subordinate works must be multiplied by 8 hours.

An example of such a calculation could be as follows:

- Let's say there are 21 working days in June.

- The authorized employee must determine the standards by which the personnel will work.

- For this, the time standard will be calculated using the following formula: 21*8=168 hours. This is exactly how much each subordinate must work on average.

To correctly calculate working hours, you need to check the production calendar. It contains all the information about the number of work shifts for each calendar month.

Quarterly calculation

It is also important to know how to calculate the standard working hours for a quarter, that is, for three months. The standard working day is 8 hours. All calculations are carried out very simply. First you need to determine what the labor norm is in each month.

Calculation example:

- Let's assume that there are 168 work hours in July. It remains to calculate the amount of time only for the next 2 months.

- There are also 168 working hours in August, and 160 in September.

- This means that the norm for the quarter is as follows: 168+160+168=496 hours.

If necessary, a similar calculation can be carried out for each quarter. Most often, company management uses the definition of the norm on a quarterly basis.

Calculation for a year

Labor rationing is an important procedure that allows you to determine the number of hours that employees are required to work. When making calculations, the calendar year is often used as the accounting period. Hours are calculated in two ways. You can use the method that is used to calculate the quarter. You just need to determine the amount of the working period for all 12 months.

Another procedure for determining the norm was established by order of the Ministry of Health and Social Development of the Russian Federation No. 588n. The calculation is carried out using the formula: 40/5*number of working days per year. After this, from the resulting number you should subtract the number of hours that the employees did not work. We are talking about reductions before the holidays.

When determining the norm for 2021 according to the billing period, the following nuances should be taken into account:

- Sunday must be counted as a day off. And it doesn’t matter how many days of rest a subordinate actually has per week - 2 or 1. For some categories of subordinates, it is possible to transfer the day of rest to another date.

- Don't forget about official holidays, which are not used in calculations.

- When a holiday falls on a day of rest, the day off is postponed. These rules do not need to be used only when calculating labor standards for January.

- The length of the working day before a holiday is always reduced by 1 hour.

When making calculations, you must follow these rules, otherwise the final number of hours will be incorrect.

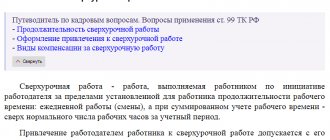

Shift work

When determining standards, the standard number of days of labor per week is used. But not all employers can afford such a working regime. Therefore, the standard working time during a shift schedule has to be calculated a little differently. This is the so-called summation, when the total number of hours worked is determined.

But their number during the accounting period should not exceed the established norm. That is, all hours that were worked in excess of the norm are additional or overtime. As an example, you can use the following data: in a calendar month, the employee worked 175 hours against the norm of 160 hours. Therefore, 15 of them are counted as additional.

Summarized accounting at an enterprise is established according to the following rules:

- The duration of the billing period is determined. The standard ones are used - month, quarter, year.

- A specific schedule is established according to which the employee works.

The accounting period can be anything in length, but not more than one calendar year. There are special restrictions that prevent large numbers of overtime hours. For example, there cannot be a 4-hour overtime for 2 days in a row. And per year - no more than 120 hours.

Cumulative accounting implies that wages are paid based on hours worked. Most often, different tariffs are used. Example: a person’s hourly rate is 100 rubles. This means that for a 10-hour shift he receives 1 thousand rubles. If we take into account that he works 50 hours a week, then his earnings will be 5 thousand rubles.

Types of charts

The length of the working day most often depends on production needs. Therefore, it is rare that employers can provide their staff with a standard 5-day period. The most commonly used modes are:

- 24 hour shift with several days off.

- Work shift with 10 or 12 hours of work. Then the staff has more days off than planned.

- Shift is 12 hours, with alternating day and night shifts.

Note: these are not all the regimes that able-bodied citizens have to face. But, based on the specifics of some professions, a regular 8-hour shift may be disadvantageous for both management and the subordinates themselves.

Production calendar

In order for managers to correctly calculate labor standards, there is a special document. This is the so-called production calendar, which takes into account all working days, as well as rest days, including holidays. This document is not a normative act and therefore has no legal force.

However, it is very useful for accountants or HR employees whose responsibilities include keeping time records and calculating earnings.

The production calendar can be found online and used at your discretion. Also, the law does not prohibit organizations from independently developing such documents.

To do this, you can take a regular calendar and indicate working days and weekends in it in accordance with established rules.

https://www.youtube.com/watch?v=meJR-8WMeSM

Standard working time is a very important concept, as it allows you to control the performance of professional duties. In addition, using the obtained result, the employer cannot increase the load on his subordinates by forcing them to work beyond measure. Employees can also follow a procedure to verify the amount of time worked.

Source: https://KadrovyhDel.ru/rabochee-vremya/kak-rasschitat-normu.html

When is “part-time” a scam?

Everything written below does not apply to the search for additional work, where part-time work is quite legal, but to the main place of work itself.

Sometimes you may be offered a full-time job, but at the same time apply for a part-time job. This is usually explained very vaguely or not explained at all. Or they may even tell you that “this is how it is done here and everyone works this way.” If you don’t like it, go look for another job! Considering that you and I live in Russia, where one “financial crisis” smoothly turns into another, such an attitude towards employees has not surprised anyone for a long time.

For your information:

Of all the entrepreneurs with whom I personally have dealt in my life, ALL turned out to be scammers to one degree or another. Probably, another type of people in business does not last long.

Let's return to our sheep. Many people accept the terms offered to them because the alternative is to look for a new job. In big cities like St. Petersburg or Moscow there is a lot of choice, but in all others finding a job is a serious problem. Therefore, they agree to be treated in an obviously illegal manner.

In addition, you may not be informed about such a “feature” immediately, but, for example, a week after starting work in a new position. It seems that you are already accustomed to the new place, and the salary may be quite satisfactory. So we have to give up on such “little things.” If you think that registration under the Labor Code is everywhere from the first day, then obviously you do not live in Russia, but somewhere in St. Petersburg or Moscow. In Russia, you can work without registration at all.

Please note: in the case of such a DESIGN scheme, you will work as usual, that is, full time. You will also receive your salary as if you were working full time. But according to the documents, this will be a part-time job!

Most people will say that if the salary is full time, then there is nothing to worry about. This is wrong! To understand where you are being robbed, let's look at accounting.