Who compiles the statement and its applicability

The responsibility for calculating wages rests with the accountant of the payroll department.

If it is missing, then any other accountant, economist, director, etc. can calculate remuneration. It is these specialists who, when calculating remuneration, draw up the primary documents for calculating salaries, including the payroll. The company has the right to use a form approved by the statistical authorities, or on its basis to build its own, taking into account the specifics of its activities.

The payslip can be drawn up manually on forms purchased from a printing house, which is typical for small businesses. However, it is more efficient to prepare it in accounting programs, where filling is done programmatically with calculations carried out automatically.

The use of form T-51 also presupposes the use of form T-53. The second document is the registration of payment of remuneration to the company's employees. This principle of calculating and paying salaries is typical for enterprises that are not small businesses, in which accounting is kept in full.

Attention! For organizations that are considered small enterprises, it is more effective to use a form such as a payroll in Form 49. The execution of a single document becomes possible due to the small number of employees in order to simplify and optimize accounting.

The payroll is the main source of information for calculating personal income tax and insurance premiums for compulsory types of insurance, as well as for filling out all necessary tax reports.

Payslips are stitched together from month to month with documents attached to them, which include calculations of vacation pay, disability benefits, etc.

Set of charges, deductions and payments sample

A payslip is a document that is used by an organization to pay employees . It indicates all payments, deductions, etc., which ultimately allows you to receive exactly the amount payable that is due to the employee. An accountant can formalize the issuance of wages in the payroll, payroll, and payroll.

statements

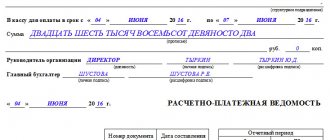

The statement form has a title page and a table on the back ; in a large organization, the form consists of several sheets. The title page of the statement must indicate:

- Name of the organization

- date

- Organization code

- Amount to be paid

- Billing period, in organizations.

As a rule, this is one month for which wages are calculated

According to current legislation, payroll records must be kept for five years . For verification, a turnover sheet can be drawn up, which serves to summarize the data entered in the primary document in order to check the opening balance, turnover for the billing period, and the ending balance.

Summary statement of wages for the 1st quarter of 2001

A separate line indicates the amounts that were paid in kind for wages, as well as payments that are not part of the wage fund.

Salary summary sheet No. 58 includes:

- Section about employees who are engaged in the main activity

- Section on employees not engaged in activities that are core to the enterprise

- Section dedicated to employees not included in the list of enterprise employees

Without this document, it is impossible to conduct a statistical report on the use of funds from amounts intended for payment of wages. It has two sections, one of which reflects the accrued amounts, this is section A. The second section B indicates the amounts that were issued, transferred to accounts, and amounts withheld.

All indicators on the movement of employee wages (accruals, deductions, amounts issued) are summarized using a summary payroll sheet , where data based on the results of payroll and payroll statements is entered every month.

Didn't find the answer? Ask your question to lawyers

Courses 1C 8.3 and 8.2 » Questions about 1C ZUP 8.3 (3.0) » zup-3-osn-modul-1-faq » How to create a summary of the salary for a period without breaking it down by month? Get 200 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.2 and 8.3;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

Question: Please tell me how to create a summary of the salary for a period without breaking it down by month. I can't find the right settings. Answer: In the report, open “Report Settings” (the “Settings” button next to the “Generate” button) and go to the advanced option for viewing settings (the button at the very bottom of the window). On the “Structure” tab there is a grouping “Accrual month, Organization”.

How to create a salary summary for a period without breaking it down by month?

Important

From 8.2 (8.2.13.205) ed. 2.5 (2.5.30.4) 1. Tell me: in ZiK 7.7 you can create a general Summary of accrued salary for a certain period (quarter, year, etc.). In ZiK 8 it is formed, but broken down, T.

It is necessary to form a GENERAL CV for the 1st quarter, it is formed, but on a monthly basis (January, February, March). Maybe I'm doing something wrong? I need general numbers. 2.

Where to enter the advance amounts for each employee, in number seven it was entered on the card, in number eight I don’t see.

I made a calculation for the first half of the month, the program calculates it itself, but not like that, we have 40% of the salary.

Salary summary for the year

Let's consider payment through a bank, since this method is the most common in organizations. In the “Salaries and Personnel” menu, select “Statements to the Bank”.

Create a new document from the list form. In its header, indicate the month of accrual, division, type of payment (per month or advance). There is also a field for indicating the salary project.

It will be discussed later.

Next, click on the “Fill” button and after the data is automatically included in the document, enter it. See also video instructions for paying an advance: And the calculation and payment of wages in 1C: Salary project in 1C 8.

3 In the “Salary and Personnel” menu, in the “Directories and Settings” section, select “Salary projects” and create a new document. It requires you to provide your banking information.

The salary project for an employee is indicated on his card in the “Payments and Cost Accounting” section.

Payroll calculation in 1C 8.3 accounting step by step for beginners

In this example, we selected the “In this program” item, since otherwise some of the documents we need will not be available.

Frequency of compilation

The payslip allows you to determine the amount of earnings an employee will receive for the past month.

At the same time, according to recent changes in legislation and letters from supervisory authorities, the organization is obliged to pay an advance not in a fixed amount, but to calculate it based on the number of days worked during this period and the accruals taken into account.

In this regard, it is advisable to determine the advance amount also using a payslip. Further, after the end of the month, the calculation is made using a new document, taking into account the total number of days worked and all necessary accruals. The amount of the salary advance issued is indicated in a separate column in the “Withheld and credited” block.

What documents are drawn up on its basis?

Based on the data contained in the payslip:

- Payroll T-53, contains the names of employees and the amount of salary to be paid;

- Journal in form T-53a - intended for end-to-end registration of all T-53 statements issued by the company;

- Personal account, T-54 or T-54a format - after salary calculation, information about accrual and deduction for each month is transferred to it. A personal account is maintained for each employee of the company.

- Expense cash order - issued to a specific employee when his salary is paid;

- A register for salary transfers is compiled if salaries are transferred to employees’ cards or accounts. Usually contains the card or account number and the amount to be credited.

- Payment order - issued when transferring salaries to cards or bank accounts. It can be issued individually for each employee, or for the entire amount issued if the payment is made according to the register.

You might be interested in:

Non-payment of wages: what the law says, payment terms, employee actions, employer liability

Payroll for payroll: free

This document is intended to reflect salaries paid to employees in cash. For workers whose wages are transferred to bank cards, such a payroll is not prepared (see Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1).

The document is drawn up in 1 copy, signed by the head of the company and the chief accountant. Then it is transferred to the cashier.

Usually, the standardized form T-53, approved by the above-mentioned resolution of the State Statistics Committee, is used for its registration, although from 01/01/2013 the use of a unified form is not mandatory for private organizations, so they can independently develop the appropriate form. At the same time, the form compiled by the organization using its own template must still comply with the requirements imposed by law for primary accounting documents (see Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

The form of the standardized form of the salary payment sheet can be found at the link: Salary payment sheet according to the T-53 form - sample.

Sample of filling out a payslip according to form T-51

Front part

You must begin entering data on the form from the title page. The name of the company is recorded there, as well as the code assigned to it according to the OKPO directory. The statement can be compiled for a specific department. In this case, its name must be written in the column that follows. If the form is issued for all employees of the company, then a dash must be indicated in this column.

Next to the name of the document, its number in order, the date when the form was filled out, and the period of the reporting period for which the calculation was made are written down.

Back part

The main table is located on the back of the form. It is necessary to enter information about the calculation of wages and deductions from it. This side must be filled out line by line, with only one line assigned to one employee.

Column 1 includes continuous line numbering throughout the document.

In columns 2-4 you need to write down personal information for each employee. This data is usually transferred from their personal cards. So, in column 2 the assigned personnel number is rewritten, in column 3 - the last name and initials, in column 4 the position in which he works is entered.

Column 5 records the employee's salary or his hourly rate.

Columns 6 and 7 are intended to indicate the number of days worked during the reporting period. The information must be transferred here from the working time sheet.

In this case, the number of working days worked is entered in column 6, and the number of weekends and holidays when the employee performs work duties is entered in column 7. It is necessary to carry out such a division, because according to the law, weekends or holidays must be paid at double the rate.

Columns 8-12 together form the “Accrued” block. At the same time, columns 8 to 11 indicate various types of accruals for the specified period (basic salary, bonuses, vacation pay, dismissal pay, sick leave and others). And in column 12 it is necessary to summarize all accruals.

You might be interested in:

Regional coefficient by regions of Russia in 2021: what is it, what payments does it affect, table

In turn, columns 13-15 are combined into the “Retained and Credited” section. Thus, in column 13 the amount of personal income tax to be withheld from the employee is entered, in column 14 - the total amount of tax benefits provided.

Attention! If it is necessary to indicate a larger number of deductions (for example, alimony, compensation for material damage, etc.), then the number of columns can be increased. Column 15 is the total amount of deductions from the employee.

If on the date of calculation of wages for the new period the employee or company has a debt, then columns 16 and 17 should be used to indicate its amount. The total amount of salary to be paid out is recorded in column 18.

This completes filling out the form. The employee who was involved in its preparation signs the document, indicating the position and decoding.

How to fill it out correctly

The key rules for drawing up documents are enshrined in Resolution of the State Statistics Committee No. 1 of 2004. Let us determine the procedure for drawing up using form No. T-53 as an example.

We start filling out with the title page. First of all, we register the name of the organization, then enter the name of the structural unit. Now we indicate the payment deadline.

We indicate the amount due for issuance first in words and then in numbers. Then the title page is signed by the director and chief accountant of the company, indicating the full name. We indicate the date of signing.

This is important to know: Paying wages ahead of schedule will result in a fine of 50 thousand.

We write down the document number, the date of its formation (drawing up) and the billing period for which the information was reflected.

We proceed to filling out the tabular part of the form. Here we first indicate the record number in order, then enter the employee’s personnel number. Last name and initials, as well as the amount to be paid. The employee must sign for receipt nearby.

After filling out the table, the results are summed up. Certified by the signature of the cashier and the responsible accountant.

Payment terms according to the document

The T-51 form is not directly involved in issuing wages - its functions are only to determine it. However, on the basis of this document, pay slips can be drawn up, according to which employees will be paid.

Every company should have a wage policy. In addition, the order must establish certain dates on which payment must be made. The law states that this must happen at least twice a month. The period between days of issue should not exceed 14 days.

It is not prohibited to make payments more often (for example, once every 10 days or every week).

In addition, the date on which the advance payment of wages is paid should not be later than the 30th day of the month, and the remaining part of the salary - before the 15th day of the month following the settlement month.

Important! If the salary is issued in cash from the cash register, then the payment period cannot be more than 5 days, including the day the funds are received from the account to the cash desk.

According to the salary project

A salary project is an agreement with a bank, according to which the bank opens its own personal account for each employee .

On payday, the organization transfers the wages of all employees to a special salary account in this bank in one amount .

In this case, a statement indicating the personal accounts of employees and the amounts to be paid . In accordance with this statement, the bank itself distributes funds to the personal accounts of employees.

At the same time, different banks have different capabilities and requirements for working with a salary project, if we are talking about electronic document management, that is, when we transfer money to a salary account through a client bank.

In this case (client bank), after sending the payment order to the bank, a letter is sent in any form with one of the following options attached (depending on the requirements and capabilities of the bank):

- printed and scanned statement of payments for personal accounts

- upload file directly from 1C

- upload file from a special program provided by the bank

If we send a statement to the bank in the form of a file (upload), then usually the bank responds by sending us a confirmation file, which we can also upload to 1C.

Creating a salary project

We go to the “Salary and Personnel” section and the “Salary Projects” item:

We create a salary project for Sberbank:

We deliberately do not check the “Use electronic document exchange” checkbox in order to deal with the case when we send the bank statement in printed form.

We introduce personal accounts for employees

Let's assume that the bank has created a personal account for each of its employees. How to enter these accounts into the system? By the way, why do we want to do this? Then, so that in the statement that we will generate for the bank, opposite the employee’s full name, there will also be his personal account.

If we have a lot of employees, we can use the “Entering personal accounts” processing:

But in the example we have only 2 employees, so we will enter their personal accounts manually, directly into their cards (at the same time we will know where they are stored).

Go to the “Salaries and Personnel” section, “Employees” item:

Open the card of the first employee:

And go to the section “Payments and cost accounting”:

Here we select the salary project and enter the personal account number received from the bank:

We do the same with the second employee:

We calculate salaries

Go to the “Salaries and Personnel” section and select “All accruals”:

We calculate and process wages:

We pay salaries

Next, go to the “Salaries and Personnel” section, “Bank Statements” item:

We create a new document in which we indicate the salary project and select employees (note that their personal accounts are picked up):

We post the document and print out the statement for the bank:

This is important to know: Prenatal and postnatal payments in Russia for workers in 2021

Here's what it looks like:

Based on the statement, we generate a payment order:

In it, we transfer the total amount of the salary to the salary account of the bank in which we have an open salary project:

Along with this payment, do not forget to attach a statement (with a register of personal accounts and payments), printed above in the form required by the bank (usually this is an arbitrary letter through the client’s bank).

Uploading the register to the bank

Let's consider the possibility of uploading the statement (register) as a file to the bank. If your bank supports this option (or this is its requirement), then go to the “Salaries and Personnel” section, “Salary projects” item:

Open our salary project and check the box “Use electronic document exchange”:

We go again to the “Salaries and Personnel” section and see that two new items have appeared. We are interested in the item “Exchange with banks (salary)”:

There are three basic options for uploading to a bank:

- Payroll transfer

- Opening personal accounts

- Closing personal accounts

Let's focus on the first point. It allows us to upload our statement to a file, which is then sent by arbitrary letter through the client bank.

To do this, select the statement we need and click the “Upload file” button:

When a response comes from the bank, it will contain a confirmation file. You need to go into the same processing and upload this file through the “Download confirmation” button. Using this wonderful mechanism, we will be able to track which statements were paid by the bank and which were not.

Accounting entries

Based on the data contained in the payslip, the following accounting entries are made. For basic salary, bonus, sick leave and vacation pay, they look like this:

| Debit | Credit | Operation |

| 20 | 70 | Accruals have been made for employees of primary production |

| 23 | 70 | Accrual for auxiliary production workers |

| 25 | 70 | Accrual for employees performing general production duties |

| 26 | 70 | Accrual for employees with administrative functions (management, accountants, etc.) |

| 44 | 70 | Payment to employees who are engaged in trade |

| 91 | 70 | Accrual for employees who do not directly participate in production activities |

The employee may also be entitled to other payments:

| Debit | Credit | Operation |

| 96 | 70 | Accrual of vacation pay from reserve funds |

| 69 | 70 | Accrual of sick leave from social insurance funds. Such an entry is not made if the region has switched to direct sick pay payments. |

| 84 | 70 | Material assistance was issued |

The payslip also takes into account the amounts that must be withheld from the employee’s earnings.

| Debit | Credit | Operation |

| 70 | 68 | Withholding personal income tax from earnings |

| 70 | 76 | Making other deductions (alimony) |