Basic rules for paying salaries

An employee has the right to timely receipt of wages in full (Part 1, Article 21 of the Labor Code of the Russian Federation). Wages are paid to the employee at the place of work or by transfer using the details of an individual’s current account with a credit institution (Article 136 of the Labor Code of the Russian Federation). The conditions for receiving wages are specified in the employment or collective agreement.

An employee can also change the bank at any time to the one in which he wishes to receive wages. To do this, you need to contact your employer with an application (at least 5 working days before the payday).

In what cases is it prohibited to pay wages in cash?

Paying wages in cash is prohibited only when paying foreigners. The range of cash payments with foreigners is limited by Part 2 of Art. 14 Federal Law dated December 10, 2003 No. 173-FZ, and wages are not included in this list. The position that foreigners can only be paid wages in non-cash form was confirmed by the tax authorities in Letter No. 3N-4-17/15799 of the Federal Tax Service dated August 29, 2016.

Paying wages in cash to a foreign person is a violation of currency laws. Fine under Part 1 of Art. 15.25 of the Administrative Code of the Russian Federation will be 75-100% of the amount issued.

We recommend you the cloud service Kontur.Accounting. The program allows you to calculate, accrue and deposit employee salaries. In addition, the service will help you calculate and pay all taxes and contributions due from your salary and submit all reports on time.

How to change non-cash salary payments to cash

Transferring wages to employees under a salary project undoubtedly provides certain bonuses to the employer from the credit institution. However, the employee also has the right to assert his own rights.

It is worth drawing up an application in the form of a free-form petition addressed to the director of the enterprise, indicating the form of cash payment in which the employee wishes to receive the money earned. The application must refer to Art. 136.

There is no need to demand in the application: after all, the law in this case obliges the employee to negotiate with the employer.

The procedure for paying wages in cash by a cashier

In the process of issuing wages, the responsible person is guided by the relevant document. This could be a payroll slip.

Regardless of the type of paper, the procedure for transferring cash to employees can be divided into several stages:

- preparation by the cashier of the amount of cash necessary for payment;

- transferring to the employee a cash receipt order or statement to study the information displayed in the documents;

- salary recalculation. Must be carried out before the eyes of the recipient. The cashier folds each bill separately, carefully counting it;

- employee checking the amount of salary received (if desired);

- leaving signatures by the recipient and the cashier on the document, according to which cash is paid out from the cash register.

There are some rules that must be followed when issuing wages in cash by a cashier.

Among them it is necessary to highlight the following:

- all documentation is signed by the immediate manager of the company, chief accountant and other authorized persons;

- After receiving the papers, the cashier carefully checks the information specified in them. Particular attention is paid to the amounts of money to be paid;

- wages are issued only to employees whose data is included in the payroll or cash register. Issuance of salary to another person is possible only with a special power of attorney.

To confirm identity, the specialist appointed responsible for issuing funds must ask the recipient to present a passport.

If the latter is an authorized person, in addition to the passport, a duly executed power of attorney is provided. The cashier checks the information specified in the passport with the data reflected in the cash register.

If the salary is received by an authorized person, a note about this action is placed in the cash register and statement - “by proxy”. The existing power of attorney is attached to these documents.

Is it possible to issue wages in non-monetary form?

What documents need to be completed?

Before proceeding with the issuance of salaries through the cash register, the responsible persons fill out special documents.

These are the statements - payment and settlement statements.

To fill them out, standardized forms are used - T-53 and T-49.

The first sheet of the salary payment sheet includes general information about the company:

- full name;

- the name of the structural unit whose employees are paid;

- the amount designated for payment from the cash register;

- timing of cash disbursement;

- Full name, signature and position of the chief executive of the organization;

- signature of the chief accountant, transcript;

- paper number;

- Date of preparation;

- boundaries of the billing period.

There is a table on the second page of the statement.

It contains information about each employee who will be paid wages from the cash register.

The following columns are filled in in a certain sequence:

- employee serial number;

- Personnel Number;

- FULL NAME;

- the amount of wages due to be paid in cash by the cashier;

- signature (confirms that the amount of money has been received);

- available notes.

Samples of forms T-53 and T-49

payroll T-53 when paying money through the cash register - word.

payroll statement T-49 - excel.

This is what the T-53 form looks like:

This is what the T-49 form looks like:

In addition to the statements, an expense cash order is drawn up. To fill it out, a unified form No. KO-2 is provided for the total amount of cash issued through the cash register.

Payment of wages in cash is carried out on the basis of these documents.

When issuing a cash order for each employee, the statements may not be filled out.

In this case, it displays information about a specific specialist.

His initials, the amount of the calculated salary and other information are indicated.

Based on the data noted in the order, entries are created in the cash book.

In addition, the employee needs to be given a pay slip - methods of issuance.

Term of settlements between the organization and employees

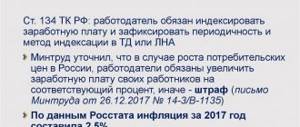

The topic of issuing wages is regulated by the current Labor Code of the Russian Federation. The time frame within which each employee must receive the money earned is specified in Article 136. In 2021, some amendments were made to it.

In accordance with the changes, salaries must be issued to employees no later than 15 days after the end of the period in which they were accrued.

Is it possible to pay salaries ahead of schedule?

At the same time, the employer has the right to set the exact date for performing this action independently.

Only the specified rule must be observed.

This requirement is the same for all organizations, regardless of the method of paying salaries - in cash through a cash register or to a bank card.

Accurate information about the timing of payment of wages must be present in the company’s internal documentation.

If the day of issue of funds falls on an entrance day or a calendar holiday, the salary must be issued on the working day that precedes it.

If an employee requests payment of wages in cash upon employment

An employee has the right to receive wages in cash by default if he has not previously received any applications for the transfer of earned funds. The employer does not have the right to refuse payment in cash (Part 1, Article 21 of the Labor Code of the Russian Federation, Part 3, Article 136 of the Labor Code of the Russian Federation). Since the Labor Code of the Russian Federation guarantees the employee timely payment of labor in a way convenient for him, the right to choose this method remains with him.

That is, if an employee initially aims to receive a salary in cash, he should not fill out an application for the transfer of funds under the salary project provided for in the organization. If there is no application from the employee, there is no permission to open a salary account for him.

An exception is if the employer liquidated the cash register as such.

What's happened?

The Arbitration Court of the Far Eastern District issued a ruling dated May 24, 2018 N F03-1521/2018 in case N A04-8136/2017, in which it confirmed the legality of the decisions made by the court of first instance and the appeal to hold liable an organization that paid its employees wages in cash rather than through bank accounts. It would seem, what is the crime? The fact is that this money was paid to foreign citizens, which the regulatory authorities considered a violation of currency legislation. Although the organization paid the salary in Russian rubles, and there was no talk of any currency. But, according to legal norms, everything is not so simple.

Is it possible to issue salaries through the cash register 2018

- Open an account and link a MIR plastic card to it.

- Open a simple account without a card, and then receive funds from it in cash.

Attention If the client does not open a new account and does not appear at the bank within ten working days, the money will be returned to the payer. Should the employing institution inform employees about innovations? The employer is obliged to inform subordinates about new changes in legislation, according to which a new procedure for issuing earned funds comes into force on July 1, 2021. Employees need to order a MIR card on time and become familiar with the timing and nuances of salary transfers.

New rules for payment of wages from July 1, 2021

For example, if in his locality there are no places where a bank can issue funds without a commission, or if there are religious beliefs that prevent the use of payment cards and accounts. And he cannot be denied satisfaction of such a need.

Employees of budgetary institutions or civil servants can independently choose a credit organization to whose account their salaries will be transferred, provided that this organization works with the national payments system and can provide the opportunity to withdraw earned funds without commissions and restrictions. How are wages paid in cash in 2021? Salaries in cash must be issued, like non-cash payments, at least twice a month and with an interval of no more than 15 calendar days (excluding weekends) from the date of the last payment of wages.

Issuing salaries from the cash register

If the deadline for salary transfer coincides with a weekend or holiday, the Labor Code of the Russian Federation pays the salary on the eve of such a day. This is an isolated case when, according to the Labor Code of the Russian Federation, it is possible to legally pay an employee’s wages ahead of schedule.

As a result, in 2021, every half month (and half a month is 14–16 days according to the calendar), the director of the company must transfer his wages to the worker. When the funds are handed over to them, they have the opportunity to immediately check the amount paid on the spot and, if the payment is fair, sign the statement. Does an employer have the right to refuse to pay wages in cash? Based on Article 136 of the Labor Code, the rulings of the Constitutional Court of the Russian Federation, as well as judicial practice, we can confidently say that neither organizations nor individual entrepreneurs have the right to refuse an employee the choice of payment method for his work.

How to avoid a fine?

In order to avoid paying such large fines for payment of wages, it is necessary to provide for this aspect at the time of employment of a foreign citizen. It is enough to simply state in the employment contract with him that the method of payment of wages is a non-cash transfer to a bank account. The employee has the right to choose a bank that is convenient for him and will have to provide his account details. If he does not do this, the organization will not be punished for non-payment of wages. And there will also be no violations of the requirements of currency legislation.

Read more: Application for an old-style international passport

Issuance of wages - posting If wages are paid through the cash register, the posting will be made using the following accounts:

- 70 “Settlements with personnel for wages”

- 50 “Cashier” - when paying wages from the cash register

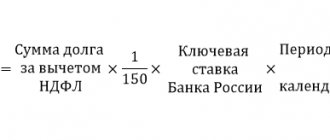

And when paying salaries by transfer to employees’ cards, account 51 “Current Account” is used. Thus: Debit 70 – Credit 50 – when paying wages from the cash register Debit 70 – Credit 51 – when paying wages from a current account by transfer to employees’ cards If wages are not received by the employee on time, then it is deposited, and the following entry is drawn up: Debit 76 subaccount “Calculations for deposited amounts” - Credit 70 - for the amount of wages not received by the employee. 8. Issuance of wages - example Sokol LLC has set the date for issuing wages - the 7th day of the month following the payroll month.

The size of the fine turned out to be significant

For violation by residents of established currency rules, administrative liability is established by Article 15.25 of the Administrative Code. The amount of the administrative fine, according to its sanctions, may be:

- for an organization - from 3/4 to 1 of the amount of the illegal currency transaction;

- for officials - from 20,000 to 30,000 rubles.

In the situation with the organizations, she was given a fine at the lower limit - 75% of the issued salary for the entire time. The result was about 2 million rubles. Paying wages in cash in rubles was very costly for the company.

Is it prohibited or not to pay salaries in cash in 2021?

For workers who are citizens of Russia, there is no such prohibition in Russian legislation. Payment of wages in cash for Russians in 2021 is not prohibited.

The employee himself has the right to choose in what form he wants to receive his earnings: in cash or by transfer to a bank account (card). Moreover, the employer does not have the right to force an employee to use the services of a particular bank. He is obliged to transfer funds to an account in the credit institution indicated by the employee. The employer may be punished for violating this requirement.

If wages are paid in cash, the procedure for such payments prescribed by law must be followed, including the time of their making, the execution of accounting entries, etc.

Of course, from the point of view of the law, it is prohibited to pay wages in cash or by bank transfer if the earnings are “gray”.

In practice, however, the state, at least for now, turns a blind eye to such facts. The practice of paying wages “in an envelope” is the norm for the private sector of the economy - employers thereby save on social contributions for employees.

Payment of wages through the cash register: terms and rules

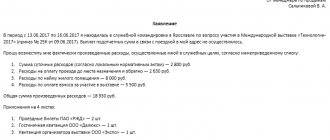

A statement was drawn up for the marketing department for 3 employees in the amount of 50,000 rubles. On July 6, funds were received from the current account in the amount of 50,000 rubles. Debit 50 – Credit 51 – in the amount of 50,000 rubles. – funds were received to pay wages from the bank. Salaries were issued on July 7: 15,000 rubles.

received by proxy by the wife of marketer S.S. Solovyov, 20,000 rubles. received personally by the head of the marketing department, O.L. Chaikin. Copywriter V.V. Vorobiev I was absent from work and could not receive my salary.

Debit 70 – Credit 50 – in the amount of 35,000 rubles. - wages were issued to the employees from the cash register. On July 12, the statement was closed, the wages not received by Vorobyov were deposited and deposited by the cashier Sinitsyna into the bank account. Debit 70 – Credit 76 – in the amount of 15,000 rubles. – wages not received by the employee on time are deposited Debit 51 – Credit 50 – in the amount of 15,000 rubles.