Accounting support and preparation of entries within the framework of accrual and payment of temporary disability benefits (sick leave) to employees at the expense of the Social Insurance Fund is carried out in the following sequence:

- Receiving a certificate of incapacity for work from the employee and checking that it is filled out correctly.

- Calculation of average daily earnings, reconciliation with the minimum values for the current year.

- Determination of benefits per day, calculation of the total amount of benefits.

- Withholding personal income tax.

- Payment to the employee.

- Reimbursement of part of expenses to the Social Insurance Fund.

Any employer is obliged to pay temporary disability benefits to insured employees, while in accordance with Federal Law No. 255 of December 29, 2006, the organization pays for the first 3 days of sick leave at its own expense, and starting from the 4th day - with funds from the Social Insurance Fund. Benefits for temporary disability for reasons not related to illnesses and injuries (for example, child care, maternity leave, etc.) are paid by the Social Insurance Fund starting from the first day.

Something to keep in mind! In 2021, an employee has the right to take sick leave to care for a child under 7 years old for any time, but the accountant must calculate payment only for 60 days (90 in some cases).

Calculation of temporary disability benefits based on sick leave

As a rule, the policyholder calculates the full temporary disability benefit and pays it to the employee, and then reimburses the costs by contacting the territorial social insurance funds. The organization is obliged to accrue benefits within 10 days after presentation of sick leave and pay funds on the nearest date of payment of wages:

- To calculate the payment, you must first determine the employee’s average daily earnings using the formula: employee’s income for previous illnesses 2 calendar years / 730.

- After calculation, you need to check the resulting figure with the minimum average daily earnings for the current year.

Note from the author! To determine the minimum value of average daily earnings, it is necessary to calculate it based on the minimum wage established for the current year: 9489 * 24 / 730 = 311.97 - the minimum for 2021.If the employee’s average daily earnings are below the minimum, further calculations are made based on the minimum established for the current year.

- After the calculation, it is necessary to determine the amount of temporary disability benefits for the employee per day, which will depend on the length of service:

with work experience of more than 8 years, the benefit is paid 100%;5-8 years – 80% is taken into account;

up to 5 years of work experience – 60%.

- The daily allowance is multiplied by the number of calendar days of illness registered on the sick leave.

Author's addition! For employees who have had no income in the previous 2 years (for example, those returning from maternity leave), sick leave is paid based on the minimum wage, based on their total length of service.

Postings for accrual of sick leave in 2018

There have been no changes in the accounting treatment of transactions for calculating temporary disability benefits. Those. Sick leave entries in 2021 are the same as in 2021.

But you need to keep in mind that in 2021 the list of regions participating in the FSS pilot project has been expanded. Thus, from July 1, 2018, the Kabardino-Balkarian Republic, the Republic of Karelia, the Republic of North Ossetia-Alania, the Republic of Tyva, the Kostroma and Kursk regions joined the project (Government Decree No. 619 of May 30, 2018). Consequently, employers in this region have one less entry when recording sick leave transactions.

Accounting support and preparation of entries within the framework of accrual and payment of temporary disability benefits (sick leave) to employees at the expense of the Social Insurance Fund is carried out in the following sequence:

- Receiving a certificate of incapacity for work from the employee and checking that it is filled out correctly.

- Calculation of average daily earnings, reconciliation with the minimum values for the current year.

- Determination of benefits per day, calculation of the total amount of benefits.

- Withholding personal income tax.

- Payment to the employee.

- Reimbursement of part of expenses to the Social Insurance Fund.

Any employer is obliged to pay temporary disability benefits to insured employees, while in accordance with Federal Law No. 255 of December 29, 2006, the organization pays for the first 3 days of sick leave at its own expense, and starting from the 4th day - with funds from the Social Insurance Fund. Benefits for temporary disability for reasons not related to illnesses and injuries (for example, child care, maternity leave, etc.) are paid by the Social Insurance Fund starting from the first day.

Something to keep in mind! In 2021, an employee has the right to take sick leave to care for a child under 7 years old for any time, but the accountant must calculate payment only for 60 days (90 in some cases).

Accounting entries for payment of sick leave at the expense of the Social Insurance Fund

Since compensation for temporary disability is the employee’s social insurance, accounting for accrued payments from the Social Insurance Fund is recorded in the accounting records on the account. 69: account credit – summary of information about all accrued benefits, debit – actual payments. Settlements with the employee are directly displayed within the framework of the labor relationship and are recorded separately for each employee on the account. :

- Accrual of part of the temporary disability benefit after checking the correctness of filling out the sick leave, paid with funds from the Social Insurance Fund

Dt 69.01 Kt 70 - Withholding personal income tax

Dt 70 Kt 68Something to keep in mind! According to current legislation, temporary disability benefits due to pregnancy and childbirth are paid in full without withholding personal income tax.

- Issuance of benefits to the employee

Dt 70 Kt 50 – when paying cash from the organization’s cash desk;Dt 70 Kt 51 – non-cash transfer of funds to an employee’s bank account.

- Reimbursement of expenses to the organization's current account

Dt Kt 69.01

Common mistakes

Error:

An accountant of a company from the region that is participating in the FSS pilot project displays in the accounting records the accrual of benefits at the expense of the FSS.

A comment:

Employers of firms from regions participating in the FSS pilot project should not display benefits at the expense of the FSS in their accounting records, since the FSS directly transfers the benefit to the employee’s account, without transferring funds to the employer.

Error:

The accountant reflected in the accounting records the payment of sick leave benefits for an industrial injury at the expense of the employer (for the first 3 days).

A comment:

When an employee receives a work-related injury, sick leave benefits for the entire period of sick leave are paid from the Social Insurance Fund.

Reimbursement of payments

After paying money to an employee, the company has the right to apply to the territorial social insurance fund for reimbursement of costs by providing the following documents:

- Application for reimbursement.

- Help-calculation.

- An employment contract with an employee or a copy of the work record book.

- Benefit calculation.

- Sick leave according to the established template.

To make a decision on the allocation of funds, the branches of the Social Insurance Fund carry out a desk audit of the provided package of documentation, which requires the provision of copies of documents certified by the employer confirming the correctness of the costs incurred and their validity.

How to make entries for accrual of sick leave

The accountant will reflect the accrual of sick leave in accounting as follows:

Dt 20 (and other cost accounting accounts - depending on how the patient works in which department) Kt 70 - sick leave accrued for the first 3 days of the employee’s illness;

Dt 69 (according to the subaccount of settlements with social insurance) Kt 70 - sick leave accrued at the expense of the Social Insurance Fund.

On the payment day, the accountant will make the following entries:

Dt 70 Kt 68 (subaccounts for income tax calculations) – income tax is withheld from sick leave;

Dt 70 Kt 50 (if from the cash register) or 51 (from the current account) - benefits were paid to the employee.

NOTE! For firms in the regions participating in the FSS pilot project, personal income tax must be withheld only from benefits for the first 3 days of incapacity for work (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Example 1 (continued)

The amount of Ignatieva’s benefit for 10 days of illness: 1,836.68 × 10 = 18,366.80 rubles. Minus personal income tax, Ignatieva will receive 15,978.80 rubles.

The accountant will make the following entries:

Dt 20 Kt 70 in the amount of RUB 5,510.04. – sick leave accrued at the expense of the employer;

Dt 69 Kt 70 in the amount of RUB 12,856.76. – sick leave was accrued at the expense of the Social Insurance Fund;

On the day of payment of wages to employees:

Dt 70 Kt 68 in the amount of RUB 2,388.00. – personal income tax is withheld from benefit amounts;

Dt 70 Kt 50 in the amount of RUB 15,978.80. – Ignatieva’s temporary disability benefit was issued under RKO.

NOTE! In accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, income tax on temporary disability benefits in 2021 must be transferred to the budget no later than the last day of the month in which the benefit was paid.

The procedure for calculating sick leave for different regions

From the point of view of calculating the amount due for days of incapacity, all regions of the country are divided into two categories: those participating in the FSS pilot project and those not.

If a region participates in a pilot project of the Social Insurance Fund, then the enterprise’s accounting department calculates and pays only part of the benefit paid by the employer, which is 3 days for illness. The rest will be considered by the Social Insurance Fund and paid directly to the account of the employee who provided the sick leave and the application for its payment.

If the region in which the company operates does not participate in the pilot project, then both parts of the sick leave are calculated and paid by the employer, and the Social Insurance Fund subsequently reimburses the amounts paid.

Let's look at the accounting entries for a certificate of incapacity for work using an example. The employee received compensation for 10 days of illness in the amount of 5,000 rubles. The employee received payments for the period of incapacity for work during pregnancy and childbirth in the amount of 145,000 rubles.

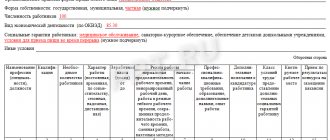

Postings on sick leave in regions not participating in the FSS pilot project:

| Debit | Credit | Amount, rub. | Primary document |

| The amount of payment for days of incapacity for work has been determined and personal income tax has been calculated. | Certificate of incapacity for work, certificate of accounting calculation | ||

| Amount due to employer | 20 (25, 26, 44) | Certificate of incapacity for work, certificate-calculation | |

| Amount due to the Social Insurance Fund | Certificate of incapacity for work, certificate-calculation | ||

| Sick leave benefits paid in cash from the cash register | Expense cash order, payroll | ||

| Reimbursement received from FSS | Bank statement | ||

| Maternity benefits accrued | 145 00 | Certificate of incapacity for work, certificate-calculation | |

| Financial assistance allowance was transferred from the current account | 145 000 | Payment order, bank statement | |

| Reimbursement of financial and economic benefits received from the Social Insurance Fund | 145 000 | Bank statement |

Accrual of sick leave - postings for 44 regions participating in the FSS pilot project:

| Debit | Credit | Sum. rub. | Primary document |

| Sickness benefits accrued at the expense of the employer | 20 (25, 26, 44) | Sick leave, certificate-calculation | |

| Personal income tax accrued on sick leave amount | Help for accounting calculations | ||

| Payment of sick leave benefits in cash from the cash register | Expense cash order, payroll | ||

| Payment of sick leave benefits from a current account | Payment order, payroll |

If the payment is made through a current account, then the posting will be D 70 K 51 in the amount of 1305 rubles.

Sick leave issued for pregnancy does not generate a statement, since it is fully paid at the expense of the Social Insurance Fund. The same applies to payments in connection with an accident at work.

Legislative regulation

| Art. 183 Labor Code of the Russian Federation | On the right of employees to receive sick leave benefits |

| clause 1 part 2 art. 3 of the Federal Law of December 29, 2006 No. 255-FZ | About sources of payment for sick leave |

| Clause 2 Decree of the Government of the Russian Federation dated April 21, 2011 No. 294 | On the dependence of accounting for the payment of sick leave benefits on the participation of the region where the company is located in the Social Insurance Fund pilot project |

| clause 3 of the Amendments, approved. Decree of the Government of the Russian Federation dated December 19, 2015 No. 1389 | On inclusion in the FSS pilot project. Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions |

| Art. 9 Federal Law of July 24, 1998 No. 125-FZ | On compulsory social insurance against accidents and occupational diseases |

| clause 1 art. 217 Tax Code of the Russian Federation | The fact that maternity benefits are not subject to personal income tax |

Registration and calculation of sick leave

Sick leave sheets are located in the “Salaries and Personnel” - “All Accruals” section.

In the list of documents that opens, click on the “Create” button. You will see a menu with a choice of document type. In our case, this is “Sick Leave”.

In the form of the newly created document that opens, indicate the month, organization and the employee whose sick leave you want to reflect in the program.

Basic data

The “Main” tab indicates the number of the sick leave and whether it is a continuation of another. The cause of disability is selected from the default list. This could be illness or injury, quarantine, parental leave, etc.

Below, indicate for what period the employee is exempt from work in accordance with the sick leave. The default payment percentage is set at 60%, but depending on the employee’s length of service, you can of course change it.

At the very bottom of the form, on the “Main” tab, accruals and personal income tax are automatically calculated. The accrual is automatically divided into that paid by the employer and the Social Insurance Fund. You can only adjust personal income tax and average earnings data by clicking on the pencil sign.

We will not consider personal income tax adjustments in detail, since everything is already intuitive there. Let's focus on average earnings. Click on the pencil sign.

You will see Form 1C 8.3 with a detailed monthly calculation of the average earnings of employees.

Here you can adjust the data that affects your average earnings. This is done in the case when an employee recently came to work at your company, and there is no data on his earnings from his previous place of work. Or the program did not previously accrue payroll.

There are also very frequent cases where it is necessary to change the billing period. For example, an employee has returned from maternity leave; therefore, she may not have accruals for the time worked, as well as the time worked itself. In this case, when calculating sick leave, she can change the years for calculating average earnings to those when she actually worked (before maternity leave).

Additional data

Go to the “Advanced” tab. In our case, all data was filled in automatically.

In the benefit limitation field, the value “Limit value of the base for calculating insurance premiums” is automatically inserted. You can change this limit to the minimum wage, or to the minimum monthly insurance payment.

Part-time rates and benefits are listed below. The list of available benefits is shown in the figure below.

Accruals

In our case, on the “Accruals” tab, two lines appeared: “Sick leave at the expense of the employer” and “Sick leave”. The fact is that in our case, the employee is entitled to payment of benefits for 8 days. The first three days are paid by the employer, and the subsequent days by the Social Insurance Fund. If the period were no more than three days, then this tab would only have a line with the amount of sick leave at the expense of the employer.

In the tabular part of the accruals, you can only change the benefit amounts. On the “Main” tab, all changes you make will be reflected and the amounts will be recalculated automatically.

Postings on sick leave

Post the document and open its transactions. As we see, the amount of benefits, which is paid at our expense, is related to wages (Dt26). The part of the benefit that is paid at the expense of the Social Insurance Fund is taken into account on Dt 69.01.

See also video instructions:

How is sick leave calculated?

Temporary disability benefits are accrued on the basis of a sick leave certificate, with all the necessary marks and seals.

Sick leave is paid to an employee if he himself is sick or he is caring for a sick relative. The amount of payment depends on the employee’s length of service:

- If the total length of service is less than 5 years, the employee is paid 60% of average earnings

- If the total length of service is less than 8 years, the employee is paid 80% of average earnings

- If the total work experience is more than 8 years, the employee is paid 100% of average earnings

Average earnings are calculated as the sum of payments for the previous 2 years and divided by 730. If during these two years the employee had sick days, then they are deducted from 730, and the payment amounts are deducted from total earnings.

When changing jobs, the employee provides the new employer with a certificate from the previous job so that benefits can be calculated. In its absence, the organization makes a request for the amount of salary for the previous two years in the Pension Fund.

If an employee has no earnings for the previous 2 years, he is paid benefits based on the minimum wage. The amount of the minimum wage (5965 rubles) is multiplied by 24 months and divided by 730. The result is 196.10 - the average daily earnings. It is multiplied by a percentage, depending on the length of service, and only after that - by the number of days on sick leave.

The employer pays for the first three days of sick leave at his own expense, the rest is reimbursed by the Social Insurance Fund.

The accrual of temporary disability benefits is reflected in the entry Debit 69.1 Credit 70, payment – Debit 70 Credit 50 (51). Benefits are paid on the day of salary or advance payment.