What is financial assistance

According to the provisions of the Labor Code of the Russian Federation, the employer, in addition to salary, has the right to make other payments that improve the financial situation of employees. This could be, for example, financial assistance.

Financial assistance is a one-time sum of money given to an employee of an enterprise, which is not remuneration for work. It is paid in a number of circumstances where a person may be experiencing financial difficulties.

These, for example, include:

- the birth of a son or daughter;

- deterioration of health;

- going on vacation;

- death of loved ones;

- wedding celebration;

- trauma associated with being in an emergency situation.

In addition, material support can be provided at a time by the state from budgets of all levels and extra-budgetary funds, other organizations - both Russian, foreign or international. The types of such financing will be discussed in more detail below.

letters of request for funds

Is financial assistance received from an employer subject to alimony?

The types of material benefits that a person who has obligations to pay alimony for the maintenance of disabled relatives (children, parents, spouses or other persons) receives, and from which this alimony must be withheld, are determined by the List of types of wages and other income..., approved by government resolution dated July 18, 1996 No. 841 (hereinafter referred to as the List).

Based on Art. 57 of the Labor Code (hereinafter referred to as the Labor Code), an employment contract with an employee may include those conditions that would make his position more favorable compared to the general rights provided for in legislation (including social and living conditions, financial situation). A similar rule is established by Art. 41 of the Labor Code regarding collective agreements.

Depending on the grounds for payment of assistance and the method of securing it (collective or labor agreement, other local acts), it can act both as a component of the salary and as social support for the employee under certain circumstances. Subp. “l” clause 2 of the List, as a general rule, provides for the mandatory withholding of alimony from financial assistance.

Judicial practice adheres to a similar conclusion. In particular, this position was voiced in the appeal ruling of the Moscow City Court dated February 16, 2015 in case No. 33-4924, which indicates the existence of grounds for withholding alimony when an employee receives appropriate financial assistance.

EXAMPLE of calculating alimony from ConsultantPlus: Potapov pays alimony in the amount of 25% of income, his salary is 55,500 rubles. The following must be withheld from your salary... Get trial demo access to the system and proceed to the calculation example for free.

Is alimony taken from financial assistance?

According to the norms of Russian legislation, alimony must be taken from her. However, there are exceptions to this rule.

To answer the question of whether alimony is calculated for specific financial assistance, you must do the following.

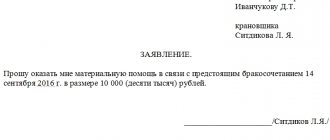

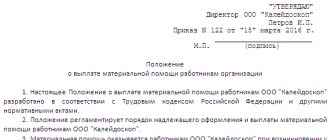

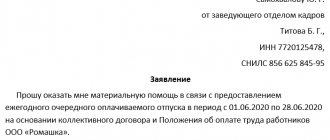

- Firstly, to distinguish it from payments related to production. To do this, you need to draw up a special local regulatory act, which specifies what types of support the organization provides to its employees.

A needy person can write an application addressed to the manager with a request to issue him funds for specific purposes. The director imposes a resolution on such document authorizing payment. In this case, it would be advisable to issue an order, which will make it possible to confidently confirm the legality of the absence of deductions.

- Secondly, decide what type of financial assistance is and, based on regulatory documents, make a conclusion about whether it is subject to alimony obligations.

Alimony payments and their forms

Usually this refers to money that must be paid to people in need, either voluntarily or based on a court decision.

The main regulatory act that regulates their calculation and payment is the Family Code of the Russian Federation. By virtue of its provisions, maintenance funds are collected (section 5 of the RF IC):

- judicially;

- voluntarily, when the parties have entered into an agreement, which is certified by a notary. A notarized agreement has the force of a writ of execution (Article 100 of the RF IC).

Which of the main types of financial assistance are subject to alimony and which are not?

The basic documents indicating the amounts from which alimony can or cannot be withheld are:

- Law “On Enforcement Proceedings” No. 229-FZ dated October 2, 2007.

- Government Decree No. 841 of July 18, 1996.

Let's look at some common types of financial assistance that are paid for:

- birth of children;

- improving health;

- leaving for vacation.

- funeral of relatives.

- accidents and natural disasters.

At the birth of children

Can be paid by both the state and the enterprise. The birth of a new family member always requires financial support, as there are a number of necessary additional costs. They are used to meet the child’s vital needs.

Withdrawal of alimony obligations from the amounts received would lead to infringement of the interests of the newborn and would reduce the level of his consumption of certain benefits, therefore, withholding alimony from financial assistance at the birth of a child is unacceptable.

During treatment

In most situations, funds paid by the employer to improve health are equal to income, because they are issued for no specific purpose and are aimed at improving the employee’s quality of life. In this regard, they are subject to alimony.

However, payment for treatment in some cases is targeted. This happens when a person receives a serious injury at work, as a result of which he requires long-term, expensive treatment and rehabilitation. In this case, financial assistance is paid both from social insurance funds and from the enterprise (if desired by the management).

To ensure that such amounts are not subject to alimony, documentary evidence of their intended nature is required.

When leaving on vacation

The financial assistance provided by the management of the enterprise when an employee goes on vacation is not of a specific nature. The money can be spent for any purpose, and, just like with co-payments for treatment, they are payments to improve welfare. This leads to an unambiguous conclusion: in this situation, withholding alimony is necessary.

At the funeral of relatives

Financial assistance upon the death of family members has two types: funeral benefits from the Social Insurance Fund and support from the employer on a voluntary basis. Both of these types of payments are of a clearly targeted nature, therefore under no circumstances are they subject to alimony.

In case of accidents and natural disasters

Payments in emergency situations are mandatory provided by the state on the basis of the provisions of the Constitution of the Russian Federation and its constituent entities, laws on states of emergency, on the protection of the population in emergency situations, Presidential Decrees and Government Resolutions. If they are carried out precisely in connection with the conditions specified in the relevant documents, the accrual of alimony is not provided.

From the above examples we can conclude that if material assistance is provided for specific purposes and is properly formalized, then, as a rule, it is not subject to alimony.

List of mats. assistance with which alimony is not withheld

According to the legislation of the Russian Federation, alimony deductions are unacceptable for the following types of financial assistance:

- Payments in emergency situations;

- Money allocated for the burial of a close relative;

- Severance pay upon dismissal;

- Financial support for the birth of a child;

- Cost of therapeutic and preventive nutrition;

- Payments for injury, mutilation;

- Financial assistance in case of property damage, for example, theft of property;

- Help with marriage registration.

What benefits cannot be used to calculate alimony?

The list of types of financial assistance for which alimony is not required is as follows:

- issued to victims of natural disasters and in other emergency situations;

- in connection with a terrorist attack;

- with the funeral of a family member;

- as humanitarian aid;

- when providing assistance in the fight against terrorism and other crimes;

- upon marriage;

- in connection with childbirth;

- when injured at work.

There are situations when the accounting department unlawfully withholds alimony payments from financial assistance. How can I get them back?

In accordance with Art. 116 RF IC and Art. 1109 of the Civil Code of the Russian Federation, it is impossible to take back alimony payments from their recipient. Therefore, you need to contact the accounting service of the enterprise by writing an application addressed to the manager, which indicates the requirement for the return of excessively collected amounts with reference to the relevant articles of the regulations mentioned above.

If it is discovered that the employee making payroll calculations is to blame for the error, the organization can deduct the amount of the overpayment from his income. This is stated in Art. 238 Labor Code of the Russian Federation.

If you receive a refusal from the management of the enterprise to return the excessively withheld amounts of alimony, you need to write a statement of claim to the court. As a rule, judicial practice in such cases indicates positive results in favor of the plaintiff.

claim for cancellation of alimony

Legality of deductions

Russian legislation allows alimony deductions only from certain types of financial assistance provided.

The fundamental criterion for the legislator when determining the legality of deductions from monetary amounts is the social orientation of each type of financial support.

When this support is necessary assistance in resolving critical situations (for example, assistance in case of a fire, death of a close relative) or money is allocated to a citizen in case of a serious illness or injury (help for treatment), the legislator prohibits withholding alimony from these monetary payments.

If financial support is targeted, it is assumed that it can only be spent for the intended purpose. Accordingly, the deductions here are unlawful. For example, payments at the birth of a child are intended specifically for the purchase of necessary things for a newborn, therefore it is impossible to reduce the amount issued by alimony deductions. And material assistance for vacation, which the recipient can spend at his own discretion, is already considered income, and mandatory penalties are made from this amount.

Procedure for withholding payments from financial assistance

Alimony from financial support is withheld in accordance with the general procedure (except for the cases indicated above). In this case, you must adhere to the following basic rules:

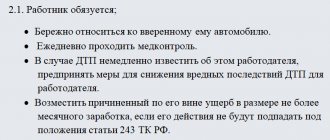

- A supporting document is required, which, in accordance with Art. 109 of the RF IC are: an agreement on the payment of alimony, a writ of execution, a court order.

- The maximum you can withhold is an amount not exceeding 70% of all salary accruals - in the case of paying alimony for a minor child, and 50% - in cases of accruing maintenance to other persons (Article 138 of the Labor Code of the Russian Federation, Article 99 of Law No. 229-FZ).

- The calculation of alimony occurs during the period of accrual of financial aid and is transferred strictly in accordance with the details specified in the executive documents.

If the person obligated to pay alimony does not work on an official basis and receives benefits not at his place of work, it will be problematic to collect from him the amounts due for financial assistance. To do this, you need to contact the bailiff or the courts to clarify these sources of income.

Summarizing all of the above, we can draw the following conclusion: as a general rule, alimony should be collected from financial assistance. However, there are a number of exceptions, the main ones of which are described in this article, in the event of which payments should not be charged.

Types of material payments

At the birth of a child

Financial assistance aimed at improving the life of a child cannot be included in the item of income that can be recovered. The bottom line is that material assistance in this sense does not directly bring income or profit to the budget.

The state, by allocating such payments, strives to support the needs of children and therefore announces a very specific amount to meet the needs. That is, attempts to withhold alimony will affect social conditions, worsening the child’s life. That's why it's such a swear word. assistance is not considered income.

With help for vacation

However, any payment cannot be adjusted to the concept of such assistance. According to Article 136 of the Labor Code of the Russian Federation, vacation pay at any enterprise must be accrued and paid no more than three days before the start of the vacation itself. If the funds arrived later, the nature of their origin must be established and the possibility of deducting alimony must be determined.

With financial assistance for treatment

By law, these payments are subject to deductions for alimony, since the funds are aimed at improving the quality of living. In most cases, funds for health resorts, for example, are equated to sources of income.

However, it happens that the company allocates funds not just for rehabilitation and restoration. For example, in the event of a serious injury at work, the plant allocated a certain amount for the treatment of a specialist. The specialist’s condition was so severe and treatment was so expensive that without the help of the plant, the man would simply have died. Here you will need to prove that the money was used to solve a specific situation. In this case, the court may exempt you from payment.

This is important to know: Find out the debt by name from the bailiffs for alimony

Due to death

Payments during this period of life are aimed at supporting a person in the most bitter and terrible period of life. These are targeted funds aimed at solving the situation and therefore alimony collections cannot be made from them.

In addition to these cases, there are several more articles included in the list of those for which it is impossible to enforce alimony:

- Disaster Payment;

- Payment for injury or injury;

- For damage received, for example, theft of property;

- Compensation for moral damage.

When alimony is not withheld from financial assistance

Russian legislation determines the rules for making collections from financial assistance. The main factor that determines that deduction is not made from a specific income is its target direction.

Important! Financial assistance intended to support employees in the event of social or physical problems does not allow penalties. Additional income, for example, financial assistance paid on holidays, requires the withholding of alimony payments.

List of financial assistance that does not include withholding alimony:

- being in an emergency situation (terrorism, natural disasters, man-made disasters, etc.);

- in the event of the death of a relative;

- regarding marriage;

- on the occasion of the birth of a child;

- funds allocated for business trip expenses;

- humanitarian aid;

- payments for assistance provided to solve crimes;

- reimbursement of fees for medical nutrition;

- compensation for purchased worn-out production tools.

In all other cases, alimony must be withheld in accordance with current legislation.

Results

So, the answer to the question of whether alimony is withheld from financial assistance depends, first of all, on the grounds for its payment. As a general rule, due to regulatory regulation, the amount of assistance is issued to the recipient minus alimony obligations. At the same time, there are a number of exceptions, which, firstly, are provided for in the List approved by the government, and secondly, follow from the specifics of the payment (for medical treatment, drugs).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

When is alimony from financial assistance not taken from the employer?

There are several exceptions when the deduction of alimony obligations from an employee’s income in the form of financial assistance is not made or is actually impossible to implement. To them on the basis of paragraphs. “c” clause 7, part 1, art. 101 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ include:

- financial assistance paid to an employee in connection with his entry into a marriage relationship, which is confirmed by a marriage registration certificate;

- payment in connection with the appearance of a child in the family of an organization employee;

- assistance from an organization to its employee in the form of compensation payments provided for by labor legislation (in a broad sense this includes local legal acts of the organization), which is provided in connection with the death of his family members.

Should an employer withhold child support under a writ of execution from the amount of one-time financial assistance paid to an employee in connection with the death of a stepfather? The answer to this question can be found in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.