Author of the article: Anastasia Ivanova Last modified: January 2021 28233

Although alimony from a military personnel is calculated in the same manner as from other citizens, the system of remuneration for military personnel is slightly different. If alimony obligations are established by the court, then the money on the basis of the writ of execution is withheld and transferred by the accountant of the military unit. If the payment procedure is determined by the alimony agreement, then a conscientious serviceman will independently transfer the money to the child. Let's consider the procedure for withholding alimony from the military.

Collection procedure

In favor of alimony obligations, money is withheld from all categories of military personnel: active duty, under contract, discharged military personnel (from severance pay), military pensioners and other persons with military status.

Alimony payments from all categories of military personnel are calculated every month, transferred to the account of the claimant within three days after the end of the billing period. Payments can only be deducted from official income.

The collection procedure depends on the voluntary consent of the employee to transfer alimony. There are two collection procedures:

- Voluntary agreement – concluded by both parents on the amount and timing of the transfer of child support payments. The agreement must be notarized and submitted to the accounting department or pension fund.

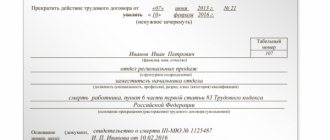

- Executive document - implies a court proceeding in which the amount and procedure for alimony payments will be established. The court makes a decision on the case, guided by the Family Code, makes a decision, after which a writ of execution is issued. The document is sent to the serviceman’s place of work or through the bailiff service.

If a serviceman is dismissed from his place of work, alimony is deducted from the lump sum benefit he receives. Payments may also be deducted from allowances, bonuses and other incentives.

When a serviceman retires, the Russian Pension Fund begins to pay alimony.

Types of income of a military man

Military personnel do not receive regular wages, like all citizens; they are paid a salary, which is paid by the Ministry of Defense of the Russian Federation.

Military personnel pay alimony from their allowance, which is formed by taking into account all allowances for the position and rank of the serviceman, as well as from various allowances.

Supplements can be transferred:

- For difficult conditions of service.

- Cool.

- For dangerous conditions of service.

- Longevity.

- Participation in various operations.

- For keeping state secrets.

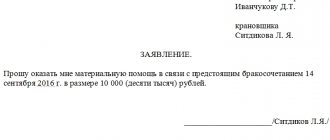

- For the awards received.

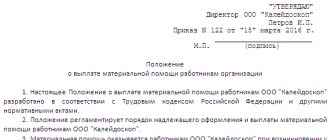

In addition to the basic salary, military personnel are entitled to bonuses and financial assistance from the state. Bonuses are issued before vacations or holidays. But in order to receive financial assistance, you need to provide a report and a certificate about the reason: relocation, official transfer, birth of a child, higher education or marriage.

From what income can alimony be deducted?

Many wives, upon divorce, have a question about why alimony is calculated for military personnel, because in addition to the basic salary they have various allowances and bonuses. The types of income from which alimony can be deducted, according to Article 82 of the Family Code of the Russian Federation, are indicated in Government Decree No. 841 of 1996 “On the list of wages and other income from which alimony is deducted.”

Alimony, according to the Resolution, is withheld from the following income:

- Military citizens - from the amount of salary assigned based on military position and rank, as well as from the amount of constant monthly payments for monetary allowance.

- Employees of the internal affairs department, fire service, drug control officers and customs officers - from the amount of salary assigned by position and rank, as well as from all percentage payments for length of service, rank, degree.

- Military personnel who served in the police department and fire service - from the amount of a one-time and monthly allowance paid upon dismissal.

The issue is resolved through the court through a lawsuit. A package of documents is submitted to the court at the place of residence of the serviceman or the location of his military unit. The following must be attached to the claim:

- Marriage or divorce certificate.

- Birth certificate of the child(ren).

- Documents about the father's place of residence.

- Father's income certificate.

- Certificate of the amount of monetary allowance.

In such cases, payment of state duty is not required. A court decision is made within up to 1 month, on the basis of which a writ of execution is drawn up. Alimony from a contract serviceman is collected in the same manner as from a conscript.

The collection of alimony often causes disagreement and questions. They mainly concern additional payments and allowances.

Alimony from a military man's pension

The specificity of collecting funds for the maintenance of minor children in the case of military personnel is that they retire earlier than other citizens.

Retirement does not mean that you no longer have to pay alimony. According to the already mentioned PP 841, when calculating obligations for the maintenance of minor children, all types of pensions, including military ones, are taken into account.

The changes that have taken place in the pension system have not yet affected the age and procedure for retirement of military personnel.

A military man can voluntarily retire with a pension after 20 years of service in the Armed Forces. This length of service also includes military service. Therefore, if a person served military service from the age of 18 and remained in the army further, then the earliest he can receive a pension is the age of 38 years.

A military man can be discharged from military service upon reaching 45 years of age and 25 years of total work experience (of which at least 12 years are in military service). But for some (higher) ranks and positions, the service life can be extended to 50 and even 65 years.

Before the specified deadlines, a military man may be dismissed due to the consequences of illness or injury, due to reorganization or layoff.

The longer a military man has served and the higher the rank (and position) he has achieved in the process of career growth, the higher the pension he receives.

The range in military pensions is very large - up to 60 thousand. But they are rarely less than 20 thousand, and the national average in 2021 is 24,000. Since October 1, 2021, they have been indexed by an average of 700-1500 rubles.

Additional payments to the pension can be for disability received in the service, participation in hostilities, awards, and ranks. Upon separation from service, a military member typically receives a substantial lump sum payment in connection with retirement.

Alimony is withheld from all these amounts.

If a military man continues to work “in civilian life,” then he is obliged to pay alimony from both his military pension and his salary.

When retiring with a disability, the court may take into account the special condition and needs of the ex-military and reduce alimony, but not cancel it.

The law does not provide for any other features of the collection of alimony from military pensioners in comparison with other (civilian) persons.

See also:

How can you find out your alimony arrears?

From what income is alimony not deducted?

The list of income from which alimony cannot be deducted is specified in Government Decree No. 841. This list is also indicated in the law “On the writ of execution”.

This list includes:

- Compensation for causing moral damage or physical harm of varying severity.

- Reimbursement of travel or translation expenses.

- Financial assistance in connection with the birth of a child.

- Financial assistance for marriage.

- Allowances for performing operations with a risk to life and health.

- Funds from maternity capital.

If the main income of a serviceman consists of compensation, then alimony cannot be withheld from this part.

Collection of alimony from a military pension

The Resolution, in paragraph 2.a of the list of income, indicates an unequivocal answer to the withholding of alimony from a pension. It is impossible to receive payments only from a pension assigned for the loss of a breadwinner.

Pensions for military personnel, as well as monetary allowances, are paid by the Ministry of Defense; employees of the department are also involved in collecting alimony. When transferring payments from a pension, annual allowances and benefit indexation are taken into account.

Alimony payments are also made from the disability pension.

Amount of alimony from a military personnel

The amount of alimony payments calculated from the earnings of military personnel is determined in the same way as for civilians.

According to the general rule established in Article 81 of the RF IC, the amount of deduction is:

- Having one child – 25%.

- The payer has two children – 33%.

- The number of children is three or more – 50%.

In the future, even if there are, for example, five children, the proportion of funds withheld from earnings will not increase.

In addition, alimony payments can be paid in a fixed amount.

You can fulfill an obligation in a fixed amount in two cases:

- the amount is fixed by the parental agreement - the agreement must contain a clause describing the specific amount of alimony;

- by decision of the judicial authorities, if the income of the alimony payer is constantly changing or is temporary.

In the case of financial support cannot be less than that which is due to the child based on the law.

Amount of alimony payments

The amount of alimony for military personnel is indicated in a signed voluntary agreement or writ of execution. Only the court can change the assigned percentage of payments.

Court decisions, based on the stable salaries of military personnel and their positions, establish not a fixed amount of payments, but a percentage of income:

- One child – 25%.

- Two children – 33%.

- Three or more children – 50%.

In cases where payments are made to spouses, ex-spouses, or adult children with disabilities, a fixed amount may be collected.

Regarding the issue of late and arrears of payments, practice in such cases shows that alimony always comes in the prescribed amount and on time.

Amount of alimony payments to military personnel

Since alimony is defined as a share of income, variations are possible, either in the direction of increasing it (up to a maximum of 70% of income) or decreasing it (but the amount should not violate the rights of the child). Decisions on changing the standard share are made by the magistrate court. The claim can be filed by both the alimony obligee and the claimant.

When determining the amount of alimony payments from a military personnel, the court takes into account the same criteria as when collecting alimony from civilians:

- Financial situation of both parents;

- The composition of their families;

- Personal circumstances;

- Medical circumstances;

- Other reasons.

If another child is born into a serviceman’s new family, then payments can be reduced, but only by court decision.

The Family Code requires that children from different marriages receive non-alimony in the amount of at least 16.5% of the payer’s income. This percentage can only be reduced in exceptional cases. As a rule, such cases are considered in court.

When do alimony payments stop?

Termination of alimony obligations depends on the type of recipient.

Termination of alimony payments by mutual agreement occurs in the following cases:

- Death of a soldier.

- Death of a child.

- Expiration of the alimony agreement.

- The occurrence of other grounds specified in the document.

Termination of alimony payments ordered in court:

- The child reaches 18 years of age.

- If the child becomes legally competent before the age of 18.

- Adoption of a child by another person.

- The fact of ability to work and absence of need for alimony payments has been established in court.

- Marriage by a disabled spouse.

- Death of one of the parties to the payments.

In the case of disabled adult children, the payment of alimony stops at the moment they regain their ability to work.

If a serviceman becomes incapacitated or becomes disabled, the court may reduce the amount of payments or completely waive them. Disability groups that are not exempt from paying alimony are 1 and 2.

Who is subject to conscription

Currently, adult men under 27 years of age are eligible for conscription. In 2021, the conscription began on April 1. However, the coronavirus has made its own adjustments here too. Many medical institutions, due to quarantine or workload, are forced to postpone medical examinations of future military personnel to later dates. And in some regions, hospital visits are generally prohibited.

The Ministry of Defense has obliged to ensure that all conscripts are tested for coronavirus. This measure is intended to prevent the emergence of a pandemic among military personnel.

In the current situation, local authorities of the Ulyanovsk, Omsk, and Leningrad regions decided to postpone the conscription dates to a later period. On average, the deadlines have shifted by two to three weeks. There is a possibility that the list of such regions will soon expand.

The procedure for paying alimony under a writ of execution

A writ of execution is a document related to enforcement proceedings that defines all the nuances of collecting alimony. The document issued by the court must indicate:

- Name.

- Date of issue.

- Name of the judicial authority and address where the sheet was issued.

- Information about the debtor and recipient.

- Other data used in legal proceedings.

- Date of entry into force of the writ of execution.

- Deadline for presentation to the performer.

If an appeal has not been filed, then alimony payments begin from the period indicated in the sheet; they must be accrued within a strictly allotted period (no later than three days from the date of payment of the salary) and in full.

If payments do not arrive to the account, you must contact a bailiff, who will begin proceedings.

Based on the Family Code of the Russian Federation and Government Resolutions, payment of alimony by military personnel occurs in the usual manner and does not differ from existing, general rules. The only difference that may be present is the amount of payments, which is set not as a fixed amount, but as a percentage of the salary and material allowance. Judicial practice shows that alimony in such cases is paid regularly and on time.

Applicants for alimony collection

In accordance with Chapter XIII of the Family Code, the following have the right to receive alimony payments:

- children who have not reached the age of majority at the time of the next payment;

- children who, upon reaching 18 years of age, do not have the opportunity to provide for themselves on their own due to health conditions - in particular, disabled people of all groups (read more about this in the article All about child support for a disabled child in 2021 );

- a spouse who is pregnant or raising a common child under 3 years of age (both current and former);

- a spouse (current or former) who has taken care of a common child who has been disabled since childhood or has a first group disability.

In addition, if there is evidence of incapacity for work, the ex-husband or wife can claim benefits, even after a divorce.

If the plaintiff has not yet reached retirement age, this right is retained provided that the loss of the ability to provide for himself on his own occurred no more than a year after the separation; if reached, the period is extended to 5 years.

Most often in the judicial practice of the Russian Federation, the payment of alimony involves the collection of funds in favor of the child.

In this case, the issue of paternity is of fundamental importance: it must be known and not denied by both parties or, if this condition is not met, proven through an examination and recorded by a judge. (Read about this in detail in the article ).