A pension is money that a person receives due to reaching old age, the loss of a sole breadwinner, or disability. In our country there are two types of pensions - insurance (it is also called labor, it may also include a funded part) and social. What each of them is and how they differ from each other, read on.

Confirmation that a Russian is on government support is a pension certificate

Insurance pension

Regular transfers of financial resources to disabled people and old people who worked officially, or to the family of an insured deceased breadwinner, are called labor pensions (in everyday speech - insurance pensions). It always consists of two parts - fixed and variable (for citizens of a certain year of birth and meeting certain conditions, it is possible to receive not only the insurance part, but also the funded part). The insurance is directly proportional to the number of points, the so-called “points,” that were awarded to the resident throughout his life, and the accumulative is directly proportional to the degree of success in investing these funds.

Federal Law of December 28, 2013 N 424-FZ. Articles 4 and 6. Persons entitled to a funded pension and conditions for receiving it

How to calculate?

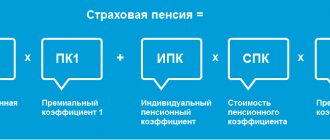

Formula for calculating the pension income of the insured person:

fixed part + number of points * price of one point

Points are awarded based on two parameters:

- how much a person has worked in his entire life;

- how much insurance premiums he (or the employer) paid while working.

The number of points you earn directly depends on your earnings. So, if for a minimum salary of ten thousand rubles you will be awarded only 1 point, then for a salary of 85 thousand - 8.7 points. In this case, only the official part of earnings is taken into account, from which insurance premiums are paid.

Every year the state sets a price for one point. When calculating retiree income, the number of points a person has earned over a lifetime is multiplied by the value of the point. The price of a point increases every year, as does inflation.

The legislation provides for situations when insurance premiums are not received on behalf of a citizen, but his points are still added. Grace periods include:

- Maternity leave until the baby turns one and a half years old (the maximum period of general maternity leave is six years).

- Service in the armed forces upon conscription.

- Caring for a person with disabilities.

- Caring for the elderly over eighty years of age.

It may happen that a citizen was employed during the grace period, but his wages were very low. For example, a maternity leave official was working. In this case, the citizen can independently choose: to count the points as for the grace period or as for the time of work.

Insurance pension calculator

The calculator below will help you calculate the amount of your insurance pension. To do this, you need to indicate the number of pension points.

Go to calculations

Types of insurance payments for pensioners

There are several types of pension payments:

- upon reaching the age established by law;

- in connection with the death of the support of the family, the breadwinner. In this case, pensioners themselves are not required to have work experience. It is enough if the deceased relative-breadwinner paid insurance premiums during his lifetime;

- on disability.

Let's consider each type separately.

What is a funded pension?

To determine it, it is worth highlighting the main differences between accumulative accruals:

- comes from the mandatory contribution amount. They are contributed by employers. 6% of transfers go to needs

- the employee determines where he will invest;

- after retirement, it is proposed to receive it immediately in full without breaking it down into monthly income.

One of the varieties. Relatives can receive it in the event of the death of a pensioner. In addition, it is possible to use it if, during the period of working age, a person became disabled in groups I-III.

Placed in the following category:

- those born after 1966 participating in the compulsory insurance system. Employment after 2001 ;

- born men between 1953-1966 , women born 1957-1966 . The cumulative part is recorded in the period from 2002 to 2004 . The period of 5 years is not relevant for them;

- financing participants.

To receive accumulated funds, you must visit the Pension Fund in person with your passport . You will need to present a document confirming your experience and the presence of an open personal account. The application processing time is 30 days.

Additionally, read how the new type of international passport differs from the old one.

After reaching the legal age

This type of pension is granted only if the applicant meets three important criteria:

- in most cases, a pension can be received by a citizen who has lived to the number of years established by the state. For the fair half of humanity this is fifty-five years, for the stronger sex - sixty, but for some groups of the population the legislation requires earlier retirement in old age;

- if you retire in two thousand and eighteen, your service must be at least nine years. This period is slowly changing upward. So, in two thousand and seventeen, the minimum working period was eight years, but every twelve months 1 year is added to this period. This will continue until the minimum possible working experience reaches fifteen years. This will happen in 2024;

- In addition to experience, you should accumulate a sufficient number of points throughout your life. In two thousand and fifteen, only 6 points were needed, but every year this number increases. In two thousand and twenty-four, the future pensioner must earn at least 30 points.

In 2021, the fixed part is almost 5,000 rubles.

All years worked by citizens before the pension reform were converted into points

In two thousand and eighteen, a citizen who forms only an insurance pension can receive a maximum of 8.70 points. But by 2021 this number will increase to 10. If a person forms not only an insurance pension, but also a funded pension, then the highest number of points he can count on is 6.25.

In Russia, the conditions for assigning a pension are not as strict as, for example, in the European Union countries. There you need to officially work for 25-30 years, and the retirement age comes no earlier than 65 years. True, European pensioners receive much more than Russian ones.

In Russia, there is another type of pension - funded. It is formed from the insurance premiums that the citizen (or employer) paid, as well as income from investment.

A citizen can decide for himself to give preference exclusively to insurance pension payments or to both insurance and funded ones. But the choice is allowed for five years from the date of transfer of the initial insurance payment.

Please note that the insurance pension is guaranteed by the state and is indexed every year. While a funded pension is an investment. And your benefit depends entirely on the success of the investments of the pension organization you choose. Therefore, you can make both profit and loss.

All citizens who were born before 66 of the last century do not have a funded pension, only an insurance pension.

How to apply?

Documents for obtaining a labor pension upon reaching non-working age:

- An internal Russian official document identifying a citizen of the Russian Federation (passport).

- Correctly executed documents that show the number of years worked.

- Information about the applicant's earnings for sixty consecutive months. It is not necessary to indicate the last months worked. This may be any continuous period of sixty months. But you cannot take the time period before 2002.

- An application, the form of which can be downloaded on the official website of the Pension Fund. There you can also see the rules for filling out the document. If you submit a request via the Internet, simply fill out a special form on the government services portal.

- Other documents as required by the Pension Fund.

First page of the application form

The collected papers should be transferred to the nearest Pension Fund branch. The request is considered within ten days from the date of submission of the set of documents.

Old-age maintenance is assigned starting from the day following the day of dismissal. But this is only possible if you contact the Pension Fund with an application no later than thirty days after leaving the company. Otherwise, payments will be accrued from the moment the written request is submitted to the authority.

Who can retire early?

For some categories of Russians, the retirement period begins earlier than for the majority. The “lucky” ones include:

- people who were engaged in intense, dangerous activities (rescuers, miners, pilots, etc.);

- teachers, healthcare workers, etc.;

- women who gave birth and raised at least five children;

- parents and guardians of children with disabilities;

- visually impaired people of the first group;

- citizens who have worked for 20-25 years in the Far North.

The full list of persons entitled to receive an old-age pension before anyone else, as well as the required age and length of service, can be viewed on the public portal of the Pension Fund of Russia.

Types and features of insurance payments

The main difference between an insurance pension and a social pension is that a person has a certain length of service. It is necessary to obtain such security. There are only three main types of age insurance, which will directly affect the amount of payments, which worries almost every Russian today.

By old age

The most common in our country, according to statistics, is the old-age insurance (labor) pension. It’s not difficult to figure it out, since after working all his life, a person, upon reaching a certain age, has the right to go on a well-deserved rest. To receive payments, you need to submit a complete package of documentation to the Pension Fund of the Russian Federation, where it will be reviewed and analyzed by specialists. Only after this will the amount of monthly income be assigned to a personal account, card or by postal transfer.

The basis for accrual is the insurance period, as well as special IPC points accumulated for contributions to the Pension Fund during work. The more such contributions received and the higher they were, the larger the amount of security will be. There is already an article on our website about the conditions and procedure for calculating old-age insurance pensions; it is worth reading it in more detail.

Upon loss of a breadwinner

Another type of pension insurance is payments for the loss of a single or both breadwinners. The state cannot leave its citizens in a difficult situation to their fate. Therefore, if a person who provided a decent life for an incapacitated person dies, then the state takes on all these concerns. Children, grandchildren, brothers and sisters up to eighteen years of age or, subject to full-time study at a station, up to 23 years of age, can receive such payments.

An insurance type benefit can be applied for by the spouses of the deceased, his elderly parents and even indirect relatives. For example, a woman living with a daughter-in-law, an elderly mother-in-law, or a husband’s child from his first marriage who has been in care for more than five years have the right to apply for an insurance pension for the loss of a breadwinner; more about this issue can be read on the corresponding page of the site.

If the relatives were not fully supported by the deceased, but after his death they actually lost the necessary means of subsistence, minimal assistance may be awarded. Most often, such nuances concern adoptive parents and children. To apply for such a benefit, you will have to provide certificates of death of the breadwinner, as well as of inability to provide for yourself, due to age and other objective reasons.

By disability

Regardless of the reasons for which a person became disabled, he is entitled to an old-age insurance payment if he has worked at least one day in his life. People with disabilities are considered to be one of the most vulnerable categories of the population, since they generally cannot provide themselves with a decent existence. The difference between insurance and social pensions for disabled people will not be very significant, because the state provides such people with a number of other benefits, concessions and privileges.

To obtain disability insurance payments, the status of a citizen must be proven. This means that disability must be confirmed by a medical and sanitary examination commission (MSEC). Based on the conclusion of such a commission, the disability group will be established, and, consequently, the final amount of payments, taking into account the accumulated experience. You should read about the conditions for assigning disability insurance pensions and how to correctly calculate them in a separate article on our website.

Should know

According to the law, in our country there are clear age limits for assigning an insurance-type pension. Women have the right to retire a little earlier, at fifty-five, and men at sixty. However, there are circumstances that allow you to go on vacation in advance, for example, when working in dangerous and difficult work, underground and in the Far North.

In all cases, when calculating insurance payments, personal coefficients (IPC) will be taken into account as a special multiplier introduced after the reform of the entire system in 2013. It is this indicator that directly affects the desire for official employment and “white” wages. After all, the size of the benefit will depend on the size and number of payments, so when figuring out which pension is larger, social or insurance, we can say with confidence that the second, and the “price range” will be significant.

Disability pension

To receive this type of pension payment, you must meet two criteria:

- have official disability status;

- work at least one day to accrue seniority.

A person begins to receive a disability pension from the moment he receives this status.

Cash security can be assigned for a limited period:

- as long as a citizen is considered disabled - if he loses this status, the pension stops receiving;

- As soon as a citizen receives the right to this type of income (i.e. has reached retirement age, has a minimum period of work and a sufficient number of points).

The fixed portion of the income of a pensioner with disabilities of the first and second groups is four thousand nine hundred eighty-two rubles and ninety kopecks. Holders of the third group receive half of this amount, i.e. two thousand four hundred ninety-one ruble forty-five kopecks.

Federal Law of December 17, 2001 N 173-FZ. Types of labor pensions and features of disability payments

How to apply?

To process this type of payment, you must provide the following set of papers to the pension insurance fund or multifunctional center:

- domestic Russian official document confirming the identity of the applicant;

- correctly executed papers (with stamps, signatures, a link to the order for the issuance of this paper, etc.) on the availability and duration of work experience;

- a written request, issued in the form of an application, on behalf of the applicant;

- confirmation of the official status of “disabled person”.

The request is considered no more than ten days.

Reviews

Sometimes it is not always easy to understand the existing types of pensions. Today you can get a complete free consultation at the Pension Fund at your place of residence.

The public is not satisfied with the size of social payments (since they are close to the subsistence level). Russian sociologists note that delaying the retirement age, increasing the pension coefficient and length of service cause additional concerns. However, annual indexation and an increase in the cost of living have a positive impact on the opinion of pensioners.

Loss of a breadwinner

Dependents of a deceased citizen can count on this type of income. It does not matter how long the deceased worked or how he died. It is important that applicants for pensioners did not have the opportunity to work.

To receive the benefit, several requirements must be met:

- the breadwinner relative died;

- the breadwinner had at least some work experience and deductions under the insurance policy in his life;

- the applicant for the benefit was financially dependent on the deceased.

The following categories of persons may qualify for this type of payment:

- minor son, daughter, brother, sister, grandson, granddaughter of the deceased;

- the son, daughter, brother, sister, grandson, granddaughter of the deceased who are not older than twenty-three years of age receiving education;

- son, daughter, brother, sister, grandson, granddaughter, who have been disabled since childhood.

- wives/husbands who have reached retirement age or have the status of “disabled”;

- mother/father who have reached retirement age or have the status of “disabled”;

- grandmother or grandfather of retirement age or with the status of “disabled” (a pension is assigned only if there are no other persons alive who must take care of the elderly);

- the disabled wife, husband, mother or father of the deceased who has lost income;

- a close relative who is involved in raising the child of the deceased (in this case, the child is also assigned a pension).

How to apply?

To apply for this type of pension you will need:

- a document confirming the death of the breadwinner;

- domestic Russian official document identifying the applicant (residence permit, passport);

- paper proving relationship with the deceased;

- correctly executed documents on the work activity and length of service of the deceased breadwinner (work book);

- other documents at the request of the employees of the authority accepting your application.

A minor’s pension can be sent both to the name of the pensioner himself and to the name of his legal representative

The fixed portion of payments for the loss of the sole breadwinner is two thousand four hundred ninety-one rubles and forty-five kopecks. If there are several disabled people in the family, everyone receives a pension. For children who do not have both parents, the fixed portion is twice as large as usual - four thousand nine hundred eighty-two rubles and ninety kopecks.

Definition of concepts

The state provides those in need with benefits for old age, disability and loss of a breadwinner. Their value depends on the source from which payments will be made: the insurance pension fund or the budget provided for social support of citizens.

Insurance

The payment that is assigned to disabled persons registered in the OPS system is called an insurance pension. In essence, it is compensation for lost earnings.

The insurance part is paid in addition to the basic pension, the amount of which is fixed and established by the state. The amount of insurance is calculated based on an individual coefficient, which depends on three factors:

- The amount of pension transfers from the employer (which, in turn, is calculated from salary).

- Duration of insurance work experience.

- Availability of increasing coefficients, indexations and grounds for recalculation.

The following periods are counted in the insurance period:

- military service;

- performing paid public works;

- residence of a civilian in a military camp (spouse of a serviceman) for 5 years without the possibility of employment;

- care for children under 1.5 years of age;

- being in the status of unemployed registered at the labor exchange;

- imprisonment before the announcement of the court verdict.

For each year worked, a citizen is awarded pension points.

To qualify for an insurance pension, 2 conditions must be met:

- minimum required experience;

- accumulated points.

An exception to these rules are disabled people: they only need to go to official work for at least 1 day to count on an insurance pension.

If a person has lost his or her ability to work after earning an insurance period, this is taken into account when applying for a disability pension. The benefit amount will be calculated based on salary.

The same principle applies when granting survivor benefits. If a citizen worked and supported dependents, after his death the disabled family members will receive an insurance pension.

Social

Such a benefit in a fixed (minimum) amount is accrued to persons permanently residing in Russia and classified as disabled. The state assumes the responsibility to support low-income citizens regardless of their labor contribution to the country’s economy:

- We are talking about people who have never worked, were employed unofficially, or did not have time to accumulate sufficient insurance coverage. Upon reaching retirement age, such persons receive a minimum old-age benefit from the budget.

- The second category of citizens receiving social benefits are disabled people. Since their ability to work is limited by health conditions, they are paid a monthly pension depending on the group established by a medical examination. This includes adults and children with disabilities.

- The third category of social pensioners is those receiving survivor benefits if the deceased relative was not employed and did not earn the right to an insurance pension. Such dependents are paid a subsidy that covers their minimum needs as part of the social protection of the Russian population. These include minors, student children under 23 years of age, children of a deceased single mother, orphans, families of military personnel and WWII participants (if they lose the right to state support).

- Representatives of small northern peoples who permanently reside in the territory and maintain the traditions of their ancestors can count on a social pension. They retire early for old age.

Social pension

Social pension is a state-guaranteed monetary provision for the elderly, disabled and persons left without the support of the main breadwinner. This type of benefit is received by those who during their lifetime, for some reason, were unable to accumulate a sufficient number of points or work experience for an insurance pension.

Only those who have lived in Russia for at least fifteen years can count on support from the state.

The pension is not paid if the citizen is working

A social pension after the death of a person who is the main source of income for the family is assigned only to children:

- minors;

- students until they reach the age of twenty-three.

The social pension cannot be lower than the minimum income level. In 2021 it is eight thousand seven hundred and forty-two rubles. If for one reason or another a pensioner receives less than the minimum income, he is assigned additional benefits.

How to apply?

The procedure for applying for a social pension is not much different from the procedure for applying for an insurance pension. Future pensioners should submit documents either to the Pension Fund branch or to the Multifunctional Center. The package of papers includes:

- written request - application;

- domestic Russian official document certifying the identity of a citizen;

- supporting documents. that you have the right to this type of pension;

- other documents at the request of fund employees.

Types of social

According to the Federal Law “On State Pension Provision in Russia” dated December 15, 2001, number 166, disabled Russians, foreigners, stateless persons who cannot work or have restrictions on work have the right to receive these types of financial assistance from the state.

By disability

Provided to persons with disabilities of any category, including children with disabilities and minors.

Upon loss of a breadwinner

Provided to children and citizens who are under 23 years of age, but are studying full-time at an educational institution. The grounds for registration are the loss of either parent, the loss of a single mother.

By old age

Provided to Russians who have reached 60 years of age (female persons) and 65 years of age (male persons). After the changes in 2015, this type of pension can be applied for by foreigners and stateless persons who have lived in Russia for at least 15 years and have reached the appropriate age. The exception is people belonging to small northern ethnic groups. They can start receiving Social Security in Old Age 10 years earlier.

What is the difference between the two types of pension?

Social pension is more of a benefit. It is assigned to those who are not entitled to other types of pension payments. Money is allocated from the budget of the region or region, while labor is allocated from the national budget.

Table. Comparative analysis of social and insurance (labor) pensions

| Insurance | Social | |

| What law governs | Federal Law No. 400 | Federal Law No. 166 |

| Where do the funds for payments come from? | From the national budget | From the budget of the region or region |

| Who gets | Persons who have work experience and have paid insurance premiums | Persons not entitled to other types of pension payments |

| Retirement age | F - 55 years old, M - 60 years old | F - 60 years old, M - 65 years old |

| Payment amount | Directly depends on the length of service and salary level of the citizen + fixed part | The amount is fixed |

It is more profitable to receive an insurance pension than a social pension. The average old-age insurance pension is fourteen thousand rubles, and the social pension is only nine thousand. The social pension is not only smaller in amount, but is also issued five years later. The fair half needs to reach the age of sixty years, and men - sixty-five.

Difference in payment amount

When establishing a fixed size of the social pension, the government is guided by the size of the subsistence minimum. In turn, the cost of living is established by the Budget Law every year and in 2021 it is 8,178 rubles.

The size of the social pension in 2021 for various categories of persons receiving it is:

| Category of citizens | Amount of payments from 04/01/2017 |

| 5034.25 rub. |

| RUB 12,082.06 |

| RUB 10,068.53 |

| 4279.14 rub. |

As for the size of the insurance pension, it is calculated based on the volume of contributions made to the Pension Fund. According to Olga Golodets, the average salary in Russia in 2017 is 13,600 rubles.

What can I do to make my pension bigger?

In order not to bite your elbows in old age, it is important to strive for an insurance pension. But there is a growing number of people in the country for whom either points or years of work are not enough. Consequently, applicants are increasingly being denied an insurance pension. This is due to the fact that many people work unofficially.

Many Russians cannot provide themselves with a decent insurance pension due to the fact that the employer either does not pay insurance premiums for them at all or pays only the “minimum wage”

The number of refusals will progress as the minimum level of experience and points increases every year. If in 2018 at least 9 years of experience are required, then by 2025 - already 15 years. If now to approve a labor pension you must have at least 13.8 points, then in 7 years you will need 30 points.

However, if a person is only a few years short, he can work them off even after reaching retirement age. In this case, he will have the right to a labor pension. If not, the citizen will be assigned a social pension.

Here are some tips to help ensure you have a decent old age with an adequate pension:

- Get officially employed. Organizations pay 30% of employees' salaries to the state. Most of this money (22%) goes to the country's Pension Fund. It is from these funds that cash support for current pensioners is formed. If workers are employed informally and the employer does not pay contributions to the state, it is the pensioners who suffer.

- Agree only to “white” wages. Paying money in an envelope is beneficial for the employer, but not for you and your future. If you receive mediocre wages and the official part of your earnings is minimal, then your pension will be meager. If you don’t know whether your employer pays insurance premiums for you or not, check on the official website of the Pension Fund on your personal page.

- Strive for high earnings. The more you earn now, the more points you will score. This means that your pension in the future will be at a higher level.

- Increase your experience. The size of your pension contributions depends not only on how much money you earn, but also on how long you work.

- Apply for your pension as late as possible. If you do not apply for a pension immediately, but after a year or more, your points will increase. So, if you apply for a pension in five years, your points will increase by 1.5 times.

- Create your own pension. If you are not yet able to work officially and earn yourself a decent pension, save the money yourself. Every month, immediately after your paycheck, deposit 10 percent of your income into your bank account. It's not as difficult as it seems. It is best to open several accounts in several different currencies. The main thing is not to withdraw money when necessary. Open a deposit from which it is impossible to withdraw money without losing interest, just report every month.

- Provide yourself with passive income. This could be, for example, an apartment or a garage that can be rented out.

Key differences between social pensions and other types of pension payments

For a certain time, there were many shortcomings in pension legislation. In 2010, all problems were eliminated, and the assignment of pensions became fair. Any citizen of the Russian Federation who is not a recipient of a labor pension has the right to receive a social pension. In this case, you must comply with certain requirements of current legislation.

Four categories of citizens have the right to receive social pensions:

- People who do not meet the requirements of current pension legislation regarding the calculation of a labor pension.

- Persons who submitted documents for the assignment of a labor pension, but withdrew them because the amount of the pension was determined for them.

- Citizens of the Russian Federation who have the right to receive a labor pension, but have not applied to the relevant authorities to calculate it.

- Pensioners are recipients of a labor pension who have refused this payment by submitting a written application approved by law to the Pension Fund authorities.

Based on current legislation, only one pension can be assigned to one citizen of the Russian Federation who meets the requirements of the Pension Fund. If a person qualifies for several categories of pension benefits, then he must decide which payment would be the best option for him.

Where to apply

You can submit a written request for a pension as soon as you have the opportunity to do so. You should contact the nearest branch of the Pension Fund or the MFC.

A written request for a pension can be submitted not only by the future pensioner himself, but also by his representative. The employer can also send an application. But the fastest and most convenient way is to use the government service portal.

How to submit an application through the state portal?

Go to the state portal for the provision of services to the population. Using your login and password, go to your personal page - personal account. Find the “Electronic Services” column. In the menu that appears, select “Pension” and then the phrase “Submit an application”.

The easiest way to apply is through the state website

Decide which written request you are submitting and select it. If you are planning to apply for a pension, find “About the assignment of a pension.” After filling out all the required lines, use the special button to create an application and send it.

In the same personal account, you can view what stage of consideration your application is at. You will be informed about the need to appear in person at the Pension Fund and provide a package of documents.

On your personal page you can not only submit an application, but also see what your work experience is, where you worked and how much insurance premiums your employer paid for you.

The pensioner himself chooses how and where he will receive money:

- At the post office yourself or they will deliver it directly to your home. If you choose the second option, the funds will arrive later as additional delivery time is required. Each branch has its own maximum period during which money is delivered to pensioners.

- Using the services of a banking institution. You won't have to pay a commission. You can withdraw money yourself at the cash desk of a bank branch, or issue a debit card. In this case, funds can be withdrawn on the same day when the Pension Fund transferred funds towards pension payments.

- By signing an agreement with a special organization that brings the pension home. You can also pick up the money yourself at the cash desk of this company. A list of such companies can be found on the official portal of the Pension Fund.

To use any of the methods listed above, it is enough to notify the Pension Fund in writing.

You can apply for pension payments no earlier than a month before reaching the statutory retirement age.

Who is paid

People who have no source of income can count on help from the state. Its size is small, but the amount is indexed annually. Read on to find out who will receive the right to social benefits.

For children

Children receive government payments in the following cases:

- The child was born or became disabled before reaching the age of 18.

- The child has lost both or one parent at once. In this case, payments from the state will go until the age of 18 or until the age of 23 if the recipient is a full-time student at an educational organization. But money is paid only if the deceased parents did not work, that is, they did not have work experience. If there is experience, the child will receive a survivor's insurance pension.

- The child never knew his parents. As a rule, these are orphans who were abandoned by their parents after birth, and social services were unable to establish their identities. Payments also go until the age of 18, or while the child is studying, but not longer than until the age of 23.

The last two types of payments are called survivor's pension.

For disabled people

Recipients of this type of social security are disabled people of any group and age, including children.

According to the law, a person is recognized as disabled if his vital functions are impaired, which does not allow him to move normally, take care of himself, study, communicate, work, etc. In this case, he needs social protection.

But only a special commission can assign the status of a disabled person. Depending on the severity of the disease, different disability groups are assigned. And children under 18 years of age receive the category “disabled child.”

Disability benefits are awarded only in the absence of any insurance coverage. If a pensioner worked for at least one day, then he becomes a recipient of an insurance pension from the Pension Fund.

A mandatory document for processing the payment is an extract from the medical and social examination report.

By old age

Old-age social benefits are received by people who have not earned an insurance period during their lifetime (in 2021 - at least 10 years, from 2024 - 15 years) or have not accumulated a minimum pension point (in 2019 - 16.2, and from 2025 - thirty).

The age at which a person can count on a social old-age pension is greater than for calculating an insurance pension payment. Women - from 65 years old, men - from 70. It is received not only by citizens of the Russian Federation, but also by people who have lived at least 15 years in Russia. There is a transition period until 2023, when the age rises gradually until it reaches the new level established by law.

If a pensioner gets a job, then social benefits stop.

A separate category are people living in the North. Pensions are not paid to everyone, but only to those belonging to small nations and permanently residing in the areas of their historical location. And the age for obtaining the right to payments is much lower than for ordinary citizens: 55 years for men and 50 years for women. When changing place of residence and leaving the “northern” territory, the pensioner loses the right to social pension.

Pension is

- Ukraine – 4 thousand rubles.

- Belarus – 9916.24 rubles.

- Kazakhstan – 14,166 rubles.

- Greece – RUB 32,468.59.

- Germany – RUB 79,329.99

- USA. Here the payment amount is about 67,997 rubles. But it should be borne in mind that pensions in this country are calculated in a special way. And it cannot be considered as such in the full sense. Here, a significant portion of a retiree's income comes from investment returns.

- Armenia. If the Ukrainian situation can be explained by the war and the reluctance of the elites to work for the good of the country, then this state is simply characterized by a low pension, which amounts to 5666.42 rubles.

- Bulgaria. It has the lowest rate in the entire European Union. It is 7932.99 rubles.

- Georgia. Due to the difficult economic situation in the country, the average payment is approximately RUB 3,399.85.

- Estonia. The size of pensions there is kept at the level of Moscow. And it amounts to 14,449.37 rubles.

- Finland. The leader of our list. The pension in 2021 is 112,317.51 rubles.

What are the features of such income? You need to know that a certain fixed payment is established. It depends entirely on the type of insurance pension. Every year the state indexes the amount of payment. It can be prescribed ahead of schedule, but only under certain conditions. This is only possible if the person worked in types of work where an increased individual pension coefficient applies. An insurance pension is a type of payment in such a case that begins to be paid when a man and a woman reach the age of 60 and 55, respectively. Certain social and professional categories of citizens have the right to do this.

Will labor be rewarded? Why are labor pensions little different from social pensions?

You need to formulate your pension rights today. “At the state level, mechanisms are being created for this, including at the end of last year, Decree No. 500 “On State Social Insurance” was adopted, granting the right to individuals engaged in non-entrepreneurial activities to make contributions to the fund on a voluntary basis,” said Natalia Pavlyuchenko.

Thus, in 2021, in order to receive a labor pension, you must have 17 years of work (insurance) experience with payment of contributions and a total work experience of 20 years for women and 25 years for men. Every year, the requirements for insurance experience increase by six months; by 2025, its duration will be 20 years.

State pension

- if a person has been in the public service for a long time, which, in turn, is divided into the federal civil service and the civil service of the constituent entities of the federation;

- these payments are due to military personnel serving in the armed forces of the Russian Federation, employees of law enforcement services and fire safety agencies;

- people who suffered in radiation and man-made disasters;

- disabled family members of the above categories of citizens in the event of their death.

Also the right to state a pension is granted in the event of dismissal from service upon reaching the age limit, deterioration of health or in connection with other organizational events, persons who have reached the age of forty-five years, whose total work experience is more than 25 years, and at the same time at least 12.5 years of service in the above organizations. In this case, the pension will be 50% of the salary corresponding to their rank. For each year of service over 25 years, 1% of the specified allowance is accrued.