Which form to use

The calculation note (form No. T-61) is a primary accounting document.

It was approved by Decree of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004 and is intended to calculate wages and other payments to an employee upon termination of an employment contract. An employer is not required to use Form T-61 when dismissing employees. It is advisory and convenient in that personnel and accounting programs already contain a unified T-61 form. But it is allowed to develop your own form of calculation note to take into account the characteristics of the organization. Use the T-61 as a base, it will simplify the task.

Filling rules

A unified form of the document is not established by law, therefore each employer can develop its own form of the form and establish the procedure for its issuance, taking into account the norms of the Labor Code of the Russian Federation. The issuance procedure is fixed in the local regulations of the organization, indicating the persons responsible for the issuance.

This is important to know: Dismissal of a military personnel due to general military training in 2021

The legislation does not say in what form the document should be issued. This can be a standard A4 sheet or company letterhead. The sheet can be filled out either handwritten or printed. The pay slip must not contain typos or false information, otherwise the document will be declared invalid.

An accounting department employee is appointed responsible for the formation of the payslip, since he has access to information about payroll for each employee. Since the payslip is only an information document, it does not require the signature of the manager and the seal of the enterprise.

You can hand over a payment document to an employee with or without a signature (what papers must the employee sign?). The first option is more reliable, since the employer can document the receipt by the employee of the sheet at any time. To implement it, choose one of the following methods:

- tear-off spine - upon receipt, the employee puts a personal signature on the tear-off part of the form, after which the spine remains with the employer;

- keeping a journal - upon receipt of a document, employees sign in the journal for issuing pay slips;

- an additional column in payment documents or a separate form where employees sign upon receipt of the document.

An employer may fulfill its obligation to inform staff, but not document this fact. This applies to the following cases:

- employees are informed about the issuance of pay slips, but they apply for the document themselves when necessary, for example, upon dismissal;

- information is provided by sending data by email;

- information is posted in the employee’s personal account on the corporate website (in case of dismissal, it may not be applied due to the employee’s access being blocked).

Who fills out the calculation note

The calculation note is a two-sided register with an introductory part and a calculation table. The form is filled out by responsible personnel and accounting employees. The personnel officer indicates the proper information about the company and the dismissed employee on the front side, the accountant fills out the columns of the tabular part on the back side.

The calculation note is drawn up on the basis of the necessary documents (statements, payment and settlement documents, which reflect all accruals for the billing period).

Part 3. Calculation of payments due to the employee

Here, too, everything needs to be filled out step by step, taking into account all the information from payment and settlement documents. In columns 10 to 19, data is entered to calculate the amount that must be paid to the employee.

Attention! The final amount of payments due to the employee upon dismissal must be entered at the end of the T-61 form, both in numerical form and in words. Here you also need to enter payroll data, which serves as justification for the issuance of cash from the organization’s cash desk.

After completing the last section, the accountant who filled out the document must put his signature under it with a transcript and the date of completion.

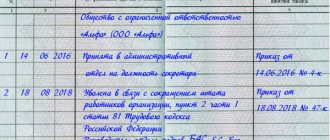

After the entire procedure described above for drawing up the T-61 calculation note, it is necessary to make a corresponding entry in the employee’s work book about the termination of the employment contract. To properly maintain personnel records, the necessary mark must be placed on the personal card of the resigned employee.

How to fill out a note-calculation

Let's look at step by step how to fill out a settlement note upon dismissal.

Step 1. Fill out the front side.

Here the personnel officer indicates:

- full or short name of the organization and its code in accordance with OKPO;

- details of the note itself - document number and date of completion;

- information about the employment contract with the dismissed employee - its number and date of conclusion.

Enter the employee's personnel details:

- last name, first name and patronymic;

- Personnel Number;

- department or structural unit.

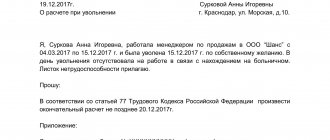

Please provide your resignation details below:

- basis in accordance with the Labor Code of the Russian Federation;

- order details;

- date of termination of the employment agreement.

All that remains is to enter the number of unused or advance vacation days.

After entering all the data, the responsible HR employee certifies the front side of the calculation note with a signature.

Step 2. Fill out the back side.

The reverse side consists of four tables in which the accountant calculates vacation pay and calculates compensation.

The first table includes the year of the billing period (column 1) and the calendar months of the reporting year preceding the date of dismissal (column 2). The lines corresponding to each month (column 3) reflect the total amounts of payments to the employee.

The second table of the calculation note reflects the total number of calendar days in the accounting year. Use a production calendar or calculate the number of days based on a conditional average. If the employee worked the entire month, then the number of calendar days will be 29.3.

If the month is not fully worked out, then the number of days is calculated as follows:

(29.3 / total number of days in the reporting month) × number of days actually worked according to the time sheet.

If an employee receives a salary for hours actually worked, then a special column in table No. 2 is filled in.

Now calculate your average daily earnings using the formula:

Average daily earnings = total amount of accruals for the billing period / total number of calendar days (hours).

Information about unused or advance-used vacation is entered into the last table of the calculation note, and then the amount of vacation pay to be paid or the amount of deductions that are made is calculated.

Step 3. Calculation of final payments in the note.

At the end, all calculated data is accumulated and the amount of compensation is calculated. The accountant must enter:

- wages for the reporting month;

- vacation pay (from the previous table);

- other charges;

- the total amount of accrued payments;

- estimated personal income tax on all charges;

- other types of deductions (if any);

- total for all types of deductions;

- debt of an organization to an employee or an employee to a company.

When all amounts are indicated, the final amount of payment to the employee upon dismissal is calculated. Then the same amount is written down in numbers and words. The accountant enters the details of the payroll, on the basis of which the employee received the appropriate funds. The accountant responsible for calculating compensation signs the table.

Filling procedure

The form must be filled out on both sides.

Reference. The front side of the note contains information about the employer and personal information about the employee.

In the upper right corner information about:

- Name of the organization.

- OKPO code according to the form of Rosstat Order No. 211 dated March 29, 2017.

- Form number according to OKUD in accordance with Decree of Rosstandart dated December 30, 1993 No. 299.

- Number of the employment contract and date of its signing.

- Note number and date of compilation.

Employee information

In the center of the sheet information about the employee is displayed, namely:

- FULL NAME.

- Personnel Number.

- Structural unit (if any).

- Position/title/qualification.

- Number and date of the dismissal order/instruction.

- Grounds for termination of working relationships with reference to the Labor Code of the Russian Federation.

- Number of vacation days taken in advance.

- Number of vacation days actually used.

- The duration of the employment contract and working relationship.

At the bottom of the page, the HR employee writes down his position, signs, dates and decrypts.

Features of filling out a note-calculation

Here are the key rules, use them as a reminder:

- The front part of the form contains information about the employee, the grounds for hiring and termination of the employment contract. First, the HR department indicates the date of conclusion and number of the employment contract, full name. employee, his position, department. Then he puts the date of the dismissal order, its number, the basis for termination of the employment relationship, establishes the number of days of unused vacation for calculating compensation or, if the employee took vacation in advance, the amount of days used to make deductions. Signs the first page. Then the calculation note is transferred to the accounting department.

- The reverse side contains information for payment of vacation pay, information about wages and other payments for the period and the final amounts due to the employee. To do this, take a period of 12 months before the month of dismissal and all payments made to the employee during this time.

- After filling out all the columns, the accountant certifies the calculation note with a signature and passes it on for accrual of the amounts due.

- The calculator processes the information received and enters it into the appropriate columns of the form regarding charges and payments. Then it determines the amount of average daily earnings and the amount of compensation or the amount of the employee’s debt due for repayment. The calculation of compensation is determined by multiplying unused days by average daily earnings.

- In addition to compensation, wages are calculated for time worked. All accruals and deductions are reflected in the pay slip, which is issued to the employee, and payment documents for the payment of these amounts are transferred to the appropriate accounting specialist.

How to compose

The calculation note, as a rule, is filled out by two specialists at once: data on the employment contract, its termination, the number of unused vacation days (or taken in advance) are filled out by an employee of the HR department, and the calculation of amounts to be paid (salary, vacation pay, other compensation) is carried out by an accountant .

The basis for filling out is settlement and payment documents, statements confirming accruals. The form, as can be seen from the picture, is double-sided. The first side contains information about the organization, employee, and employment contract, while the second side contains calculations. Accordingly, the first side is filled out by the personnel officer, and the second by the accountant.

What does the document look like?

Each employer develops the form independently. Usually this issue is dealt with by the accounting department together with the human resources department. The payslip consists of several sections:

- Accrual period. The sheet indicates the time period for which the information is displayed and explains how the calculation occurs.

- Total accrued. All components of wages are described in detail: salary, bonuses, benefits, overtime, calculation upon dismissal.

- Total withheld. This section indicates the amount of personal income tax deductions and other deductions at the request of the employee himself, as well as on the basis of writs of execution.

- Total paid. Previously paid amounts for the billing period indicated on the sheet are indicated.

- To payoff. The total amount that the employee will receive is reflected.

The payslip also

- name of the organization and information about the unit;

- Full name of the employee and his personnel number;

- the period for which the document reflects information on accruals and deductions;

- amount of time worked;

- the employee’s income since the beginning of the current year;

- applied personal income tax deductions.

A payslip for each employee can be generated automatically in special payroll programs.

An employer does not have the right to refuse an employee to receive a pay slip upon dismissal. Informing about accrued wages and its components is his responsibility in accordance with the Labor Code of the Russian Federation. If violations of labor legislation are detected, the employee has the right to file a complaint with the labor inspectorate or file a lawsuit in court.

Are they obligated to give it out upon dismissal?

Part 4 art. 84.1 of the Labor Code of the Russian Federation and Part 1 of Art. 140 of the Labor Code of the Russian Federation provides that the employer pays the resigning employee all amounts due directly on the day of his dismissal.

On the same day - the day of termination of the employment contract - the outgoing employee is returned with a work book, certificates and other documentation relating to his professional activities are issued.

As a rule, the departing employee is given the salary due, compensation for unfulfilled vacations, as well as other stipulated payments (for example, severance pay).

As stipulated in Parts 1-2 of Art. 136 of the Labor Code of the Russian Federation, any payment of wages and other payments due to an employee is accompanied by the provision of a payslip with all the necessary information (accruals, deductions, amounts actually issued).

This means that the situation of dismissal of an employee is no exception.

A citizen who has terminated his employment relationship with his employer must also receive his pay slip.

What does it look like?

As established in Part 1 of Art. 136 of the Labor Code of the Russian Federation, a written slip provided to an employee for any payment of wages includes the following information:

- The structure of the salary due to a worker for a specific period of time. You need to indicate its component elements - the basic amount, bonus payments, various allowances.

- Other accruals also due to this employee (vacation compensation, severance pay amounts, other payments).

- The amounts of deductions made, as well as the grounds for making such deductions.

- The total amount of money paid to a working citizen (after all deductions).

The title part of the sheet includes the following information:

- Name of the employing organization.

- Personal information about the working citizen (full name, official title of the position held).

- The time interval for the calculation to be performed.

- Employee number according to the time sheet.

- The name of the unit (department) in which the citizen works.

Typically, the basic information listed above is displayed in tabular form. The left side of such a table includes data on accruals. The right side of this table contains information about withholdings. The final part of the paper in question reflects the amount of money to be paid.

If a working citizen at the time of dismissal has arrears of wages (that is, he owes the employer due to an overpayment), the corresponding data is recorded in a separate sector of this tabular form. It is allowed to indicate any additional information on the payment slip (for example, the date of issue or transfer of money to an individual).

As mentioned earlier, this sheet is approved by the employer, taking into account the opinion of the trade union or other representative body of the workforce. The use of this paper in the company’s document flow is regulated by an appropriate order from its management.

.

Why do you need a payslip?

Art. 136 of the Labor Code of the Russian Federation stipulates that the employer informs each employee in writing about all payments made in his favor for a specific period. We are talking about the wages due, its structure, other accrued amounts and compensations.

In addition, the employee must be informed about the amount of deductions made, the grounds for making them, as well as the amount of money actually paid to the worker in person.

All this data is reflected in the pay sheet, the form of which is approved by the company management by issuing a local act (the opinion of the trade union is taken into account).

Guided by the information in the payslip, the dismissed employee checks the correctness of the accruals, deductions and payments made by the employer in connection with the termination of the employment agreement.

The employer is also interested in properly fulfilling its responsibility by providing the departing employee with the necessary information about the final settlement.

If a discrepancy is detected between the information on the pay slip and actual payments, the dismissed employee has the right to present specific claims to his employer.

The written form of the substantiating salary slip, issued to the employee upon dismissal and final payment, facilitates the successful resolution of emerging contradictions. Without a payslip, such disputes are difficult to resolve.

The issued slip must be recorded in the log book.

How long before dismissal should you write a note?

The legislation does not regulate the period of time during which a settlement note must be drawn up. The norms of the acts only establish the obligation to pay all money due upon dismissal to the employee either on the final day of work, or, if the salary is transferred to the card, then on the next day.

The deadline for its formation is the final working day of the resigning employee. If the employee terminates the contract on his own initiative, then according to the general rules he submits an application two weeks before this date.

This is important to know: Retrenchment of a single mother during staff reduction

Therefore, you can issue a dismissal order and draw up a settlement note from the moment you receive the dismissal application. However, you must also remember the employee’s right to withdraw the application before the end of the notice period. Therefore, the dismissal order and the note may have to be canceled.