The question of how to apply for sick leave and when to go to work after self-isolation for pensioners over 65 years old in the constituent entities of the Russian Federation in February 2021 worries the majority of residents of the constituent entities of the Russian Federation.

Therefore, it is worth recalling that in all regional regulatory legal acts (RLA) that establish self-isolation for persons over 65 years of age, there is the following condition: “The self-isolation regime may not apply to managers and employees of enterprises, organizations, institutions and authorities whose being in the workplace is critical to their functioning, for healthcare workers.”

That is, if the employer decides that the presence of a person 65+ is critical for the functioning of the organization, then he has the right to involve him in work during the period of restrictions. Thus, the specific dates for people 65+ to return to work are specified in the regional regulatory legal acts, summarizes the famous labor law lawyer Valentina Yakovleva. For example, in Moscow, people over 65 years of age can be recruited to work, but Sergei Sobyanin’s decree states that when making decisions about maintaining workers over 65 years of age visiting workplaces and (or) employer territories, the number of such workers should be minimized.

Electronic sick leave is paid from the funds of the Social Insurance Fund of the Russian Federation directly to the employee for the entire period within 7 calendar days from the date of formation of the sick leave. This mechanism allows you not to divert the employer’s funds even for a short time.

To receive sick leave, citizens do not need to provide any documents or information - it is issued on the basis of data that employers electronically send to the Fund.

The amount of sick leave benefits is calculated according to general principles. So, if the length of service is more than eight years, then sick days are paid at 100%. The calculation takes into account earnings for the two previous years, which is limited to the average maximum earnings of 69,961.65 rubles. per month, informs the portal garant.ru

Who will get paid sick leave and who will not?

Working citizens who were born on April 6, 1955 or earlier are sent to forced sick leave.

Please note: only those employees who are officially employed can apply for paid sick leave.

Sick leave will not be paid for those who work without registration or are registered as an individual entrepreneur (IP).

They will not pay sick leave for those who continue to work remotely (and therefore receive a salary) or are on vacation and have already received vacation pay.

Are there differences in pay for the military?

Service in the bodies of the Ministry of Internal Affairs, as well as military service, are included in the length of service, which is included in the insurance; periods of military service and service provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-1 are taken into account.

Periods of service are converted into whole months and years, respectively 30 days and 12 months, 1 day of service is 1 insurance day.

The period of service can be confirmed by entries in the work book, military ID, certificate from military institutions or other documents that contain information about the period of service.

If the periods coincide in time, one of them is taken into account. Which one specifically is determined by the former employee.

After a serviceman retires, there are several options:

- A military retiree has taken a new job in the civil service; in this case, the length of military service and military service will be taken into account when calculating sick leave. For example, if the duration of military service was 15 years, and he worked in the new organization for 1 year and fell ill, the amount of sick leave benefits will be calculated as 100% of average earnings (since the service is more than 8 years).

- After being discharged, a military retiree did not find a new job; he can also apply for sick pay within 30 days.

The law does not provide for the issuance of sick leave to military retirees to care for a sick family member.

Each soldier or officer during the period of service receives a monthly allowance, for which an insurance contribution to the Social Insurance Fund is not charged. However, according to regulation No. 255-FZ, after retirement from a military pension, the calculation of payments on the certificate of incapacity for work is carried out only on the basis of earnings on which insurance contributions were calculated.

If the person officially did not have earnings, or it is less than the actual one when taking into account allowance payments, a former military pensioner can count on benefits based on the minimum wage.

The issuance of sick leave to an employee is carried out by a medical organization of the Ministry of Internal Affairs of Russia and a medical organization of the state healthcare system.

For outpatient treatment, a sick leave certificate is issued by a doctor of a medical organization of the Ministry of Internal Affairs of Russia on the day when temporary incapacity for work was established, and the period includes weekends, as well as non-working holidays. When undergoing treatment in a hospital, a sick leave certificate is issued on the day of discharge from the medical organization for the entire period of treatment.

How to apply for sick leave at home

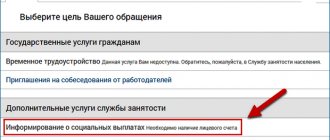

Employees at risk do not need to go anywhere to fill out the paperwork themselves! Your employer was required to send a list of employees in the “65+” category to the Social Insurance Fund (SIF).

If the employer has forgotten about this, still does not know, or is trying to pretend that he does not know, we recommend reminding him by referring to Government Decrees No. 402-PP and No. 417-PP.

Next, the algorithm for considering the application is as follows: information is transferred from the Social Insurance Fund to the medical organization. An electronic certificate of incapacity for work is generated there.

After this, the payment is automatically assigned.

How much will be charged for forced sick leave?

The amount of payments is calculated in the same way as in pre-virus times. According to the general rule for calculating sick leave.

If an employee has more than 8 years of insurance experience, the amount of disability benefits is equal to 100% of average earnings.

If the employee’s work experience is from 5 to 8 years – 80% of average earnings.

If the experience is up to 5 years - 60% of average earnings.

The minimum amount of sick leave payments has also been introduced if the employee does not have enough work experience.

For a full month on forced sick leave, you must pay at least 12,130 rubles.

Possible difficulties when applying for sick leave

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

The assignment and transfer of state assistance for temporary disability occurs only after the employee submits to the employer a ballot issued in accordance with the rules of the current legislation (Federal Law of December 29, 2006 No. 255-FZ).

Main errors in ballots:

- incorrectly filled in personal data;

- Difficult to read doctor's signature, medical institution seal.

Payment of sick leave in LLC

If an employee works in a limited liability company, then in case of illness his actions are as follows:

- Visit your local hospital.

- Create a newsletter.

- Submit it on the first day of work to the human resources department at your place of work.

The first three days of an employee’s sick leave are paid at the expense of the employer, and for more than three days - at the expense of the Social Insurance Fund.

Why sick leave can be canceled

If a pensioner violates the self-isolation regime, the sick leave may be invalidated.

Let us remind you that according to the rules of complete self-isolation, citizens who are part of the risk group can leave the apartment only in the following cases:

– in case of a direct threat to life and health;

– to receive emergency medical care;

– to purchase groceries, medicines and essential goods in nearby stores and pharmacies;

– for walking pets no further than 100 m from the house;

- for taking out garbage.

How are sick leave paid for working pensioners?

Payment for ballots for retired people is essentially no different from payment for sick leave for citizens who have not reached the retirement age limit.

Each party to a professional relationship always has the rights and obligations:

- the employer must transfer sickness benefits to the employee,

- the employee must provide the employer with a ballot.

Sick leave is the basis for legal non-presence at the place of work activity and receipt of material compensation provided for by law.

What is remote mode?

The remote mode applies to working pensioners over 65 years of age, persons with chronic diseases, and pregnant women. It is recommended to switch to a remote format and not leave home unless absolutely necessary. Employers must provide the Social Security Fund with lists of employees required to stay at home. Sick leave for them will be issued automatically, without applications.

This information applies to persons 65 years of age and older from all regions of Russia:

Adygea, Altai, Bashkiria, Buryatia, Dagestan, Ingushetia, Kabardino-Balkaria, Kalmykia, Karachay-Cherkessia Republic, Karelia, KOMI, Crimea, Mari El, Mordovia, Sakha (Yakutia), North Ossetia (Alania), Tatarstan, TUVA, Udmurtia, Khakassia, Chechnya, Chuvashia, Altai Territory, Transbaikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Primorsky Territory, Stavropol Territory, Khabarovsk Territory, Amur Region, Astrakhan Region, Arkhangelsk Region, Belgorod Region, Bryansk Region, Vladimir Region, Volgograd Region, Vologda region, Voronezh region, Ivanovo region, Irkutsk region, Kaliningrad region, Kaluga region, Kemerovo region, Kirov region, Kostroma region, Kurgan region, Kursk region, Leningrad region, Lipetsk region, Magadan region, Moscow region, Murmansk region, Nizhny Novgorod region , Novgorod region, Novosibirsk region, Omsk region, Orenburg region, Oryol region, Penza region, Pskov region, Rostov region, Ryazan region, Samara region, Saratov region, Sakhalin region, Sverdlovsk region, Smolensk region, Tambov region, Tver region, Tomsk region, Tula region, Tyumen region, Ulyanovsk region, Chelyabinsk region, Yaroslavl region, cities of federal significance - Moscow, St. Petersburg, Sevastopol, Jewish Autonomous Okrug, Khanty-Mansi Autonomous Okrug, Yamal-Nenets Autonomous Okrug, Nenets and Chukotka Autonomous Okrug.

Source

Payment procedure and calculation of sick leave for working pensioners

The volume of state assistance in case of illness, including for working pensioners, is regulated by Federal Law No. 255-FZ dated December 29, 2006.

The form of sick leave or bulletin is regulated by order of the Ministry of Health and Social Development N 347n.

Duration of stay on sick leave

At the first visit to the doctor, a sick leave certificate is issued for ten calendar days. After this, the person must come again for examination by a medical officer. The medical employee has the right to increase the period of incapacity for work up to thirty days. All subsequent extensions are already thirty days.

Payment after dismissal

If the employment contract between a former employee and his employer is terminated, payment for the ballot after the dismissal of a citizen of retirement age is fully borne by the employer.

A legal entity pays only for the first three days of sick leave, the rest is paid from the Social Insurance Fund.

Statute of limitations for payment of sick leave

The period for payment for the newsletter by the enterprise is six months. This is provided that the pensioner no longer works at this enterprise, less than 30 calendar days have passed since the dismissal, and the citizen has not yet contacted the employment service to register.

conclusions

- By law, the employer is obliged to pay sick leave to a working pensioner for as long as necessary, and does not have the right to fire him, even if the employee is absent from the workplace for quite a long time.

- If you fall ill within 30 days after dismissal, you can count on full payment of sick leave at your previous place of work. You can apply for a settlement within six months.

- In order to get an idea of the amount you can count on while on sick leave, you need to know what your salary was for the previous two years, the current minimum wage, work and insurance experience, as well as the number of days spent on sick leave.

- Money for sick leave will be accrued along with the advance payment or final salary. Maybe,

Conditions for paying sick leave to a pensioner who has started working again

If over the past two years the pensioner has worked in another place, he must bring documents to the new place of work confirming this fact and that he has sufficient work experience. This is necessary for the general calculation of wages, on which the amount of sick pay depends. If the pensioner has not worked anywhere over the past two years, the sick leave benefit will be calculated in accordance with the current minimum wage, which for 2021 is 5,965 rubles. Please note that when changing jobs, a pensioner has the right to dismissal without service.

In Moscow and Moscow region

In both regions, restrictive measures are currently in place, and citizens over 65 years of age are prohibited from free movement.

The mayor of the capital ordered employers to send older workers home, with the exception of those whose presence at the enterprise is necessary. They need to organize remote access to work whenever possible.

How to apply for sick leave for persons over 65 years of age in Moscow and the Moscow region: also in electronic form at the request of the employer.

Calculation procedure

You can receive money for sick leave along with an advance payment or salary. Personal income tax will be deducted from the total amount. For more information regarding tax deductions for working pensioners, see below. If the employer delays payment of the temporary disability certificate, you can submit a claim in writing, sent to the regulatory authorities of the organization.

The complaint form must be submitted to the labor inspectorate.

In this complaint, you must clearly state your complaint, and you must also attach to the document photocopies of a sick leave certificate, an employment agreement, a payslip in which the amount due during sick leave is calculated, a certificate from an individual bank account stating that the money is not credited to it arrived. A complete list of documents must be clarified in the accounting department at your workplace, or by calling the local Social Insurance Fund department.