Temporary changes due to coronavirus

During the coronavirus pandemic, temporary changes have occurred in the conditions for calculating benefits for unemployed citizens:

The following amendments have been made to the calculation of unemployment benefits:

- Until the end of 2021, the monthly benefit amount has increased from 8,000 to 12,130 rubles.

- If you were fired on March 1, 2021, then benefits for April, May, June will be assigned in the maximum amount.

- An additional 3,000 rubles are allocated. in April, May and June for each child in a family where one of the parents was laid off from March 1, 2021.

- It is now possible to register as unemployed remotely.

Video: Unemployment benefits from April 2020

How is it determined and how much is the ruble now?

The conditions, rules and terms of payment of unemployment benefits are determined by Art. 3 of Law No. 1032-1 “On employment in the Russian Federation”. To receive social assistance, you must first contact the Center for Social Protection at your place of registration and submit the necessary documents. After a citizen is recognized as unemployed, it is determined how much money is given and for how long the payments continue.

According to Decree of the Government of the Russian Federation dated March 27, 2021 No. 346, the following payment limits apply in 2021:

- minimum amount – 1,500 rubles;

- maximum size – 12,130 rubles;

Who is an unemployed person and what is unemployment benefit?

The concept of the unemployed is defined in Law of the Russian Federation No. 1032-1 “On Employment of the Population in the Russian Federation” in Article 3. The following are considered unemployed in the Russian Federation:

- an able-bodied citizen (who has reached the age of 16 years and is not deprived of the ability to work due to a disability);

- not carrying out official labor activities and not receiving wages;

- registered with the employment service;

- looking for a job and ready to start work - not officially employed.

Unemployment benefits are financial assistance from the state provided to citizens recognized as unemployed.

It is worth noting that a citizen does not always have to have no income in order to be recognized as unemployed. Receiving severance pay or maintaining the average salary is not a basis for denial of status - if the dismissal occurred due to staff reduction or liquidation of the enterprise.

In the case when a citizen receives a salary, he cannot be recognized as unemployed.

The law prescribes the state's obligations regarding the payment of benefits to the unemployed. Article 28 indicates possible subsidy options: unemployment benefits, scholarships for the duration of vocational training or additional vocational education. And Article 31 already spells out how this financial assistance is assigned and paid. Below we will analyze all this in detail.

Where to see the accrual of payments from the employment center

An unemployed person can at any time clarify information about the assigned benefit and the timing of its payment by calling the telephone number of the local branch of the Labor Center. Contacts can be found on the “Work in Russia” website in the “State Employment Service” section.

view your accruals online :

- In the applicant’s personal account on the “Work in Russia” website (an account from the State Services is required to log in), the status of the application for registration, the date of registration in the Central Employment Center, as well as the amount of the assigned benefit are displayed.

- Using the interactive portal of the employment service of a specific region. To do this, you need to go to your personal account (here you will also need an account from the State Services portal), go to the “Services” section. Next, you need to select the “Information about social payments” subsection. Here you can set a date range and view accruals for the selected periods.

Display of information about the amounts and timing of payments may vary between regional sites!

Who can contact the employment center

Any citizen can contact the employment center. It is necessary to distinguish between two statuses within the legal field:

- The first is an unemployed person who does not have a place to work and does not receive wages. Then he is assigned a monthly allowance from the state and is provided with assistance in finding a job, retraining, and so on.

- The second is a person who is looking for a job, but is employed, and wants to change employer. In this case, the center helps in selecting an employer. But it does not engage in citizen education (for example, providing specialized courses to acquire certain skills or improve qualifications), nor does it provide material support.

We have figured out who can contact the employment center. Next, we’ll talk specifically about the first category of people who are unemployed, looking for work, and consider how voluntary dismissal differs from dismissal by agreement of the parties or due to staff reduction.

Dismissal due to staff reduction

If an enterprise is liquidated, ceases operations, or has made staff reductions, the person is recognized as unemployed.

When dismissing an employee, a note is made in the work book that he was dismissed precisely “due to a reduction in the number or staff of the organization.”

If the company plans to lay off staff due to staff reduction, the employer notifies employees about this in advance, at least 2 months in advance, in an order. Therefore, every employee should know his rights if he is subject to such a reduction:

- It is necessary to find out whether the employee is on the list of persons who are not subject to dismissal due to staff reduction. This includes: pregnant women and women on maternity leave, mothers of many children and single mothers, employees on sick leave or on vacation.

- The employer is obliged to offer the employee another vacancy at the enterprise, and also notify the employment center about staff reductions at least 2 months before the planned dismissal.

- After dismissal, an employee must register with the employment center within 2 weeks in order to receive the average salary at his previous job for 2 months.

- Lawyers in their recommendations always clarify that you cannot agree with the employer and write a letter of resignation at your own request or with the consent of the parties, otherwise the right to receive payments required by law (average earnings for 2 months) will be lost.

Those laid off due to staff reductions retain their average wages and are given severance pay.

So, if Ivanov earned 10, 12 and 11 thousand rubles over the last three months of work, you need to add up these figures and divide by three. The result is 11 thousand - the amount that the company is obliged to pay him in the event of a layoff.

Despite receiving such funding, this does not affect the person's recognition as unemployed. This is stated in Article 31 of the Law of the Russian Federation No. 1032-1. She also indicates in paragraph 3 that benefits begin to accrue upon completion of payment from the employer. From the very first day, compensation from the state begins, if by this time the citizen has not found another place of work.

At your own request and by agreement of the parties

A person is naturally considered unemployed not only after he has been fired, but also if he quit of his own free will or by agreement of the parties.

Dismissal at one's own request occurs after the employee notifies the employer of his intention no later than 2 weeks in advance. It is not necessary to indicate the reason for your dismissal in the application, but if the employee quits without working, the reason will still have to be indicated. A standard entry will appear in the employee’s work book: “dismissed at his own request, in accordance with clause 3, part 1, article 77 of the Labor Code of the Russian Federation.”

Termination of an employment contract by agreement of the parties is prescribed in Article 78 of the Labor Code of the Russian Federation. If both parties: the manager and the subordinate come to mutual agreement, then the manager issues a dismissal order and pays the required compensation to the employee. In this case, there will be an entry in the work book with the wording: “dismissed by agreement of the parties.” There are no restrictions regarding the registration of the unemployed for this category of citizens. In this case, you must contact the employment center. The selection of vacancies takes place within 10 days. If there is no suitable job, a recalculation is made and the citizen is paid benefits from the date of contacting the center.

Persons of pre-retirement age

Persons of pre-retirement age are those employees who have five or less years left until retirement.

If a person has not yet received a pension benefit, then he can count on being recognized as unemployed. Additional guarantees are available to this category of citizens. They relate to the duration of payment of social benefits and its amount:

- In total, financial assistance is prescribed for a period of one year, for 18 months.

- If this category of citizens has an insurance record of more than 20 years for women and 25 years for men, the payment increases. For each year of work in excess of this indicator, the assignment of benefits is extended by two weeks. Limit of 24 months of payments within 36 months.

- Regarding the percentage, the first three months pay 75% of average earnings. The next 4 are 60% each, and then 45%.

- Regardless of the average income, the payment cannot be higher than the maximum and less than the minimum.

Who will be denied payments?

The following categories of citizens cannot be recognized as unemployed and therefore cannot receive social benefits:

- persons who have not yet turned 16 years of age;

- those who receive a pension benefit - the insurance or funded part;

- persons who, within the first 10 days, refuse two employment options - all suitable places are taken into account, including temporary employment (more about this in the paragraph “If the vacancy does not suit you”);

- those who do not have an education, but refuse to receive it at the expense of the employment center;

- persons who have not appeared at the employment center for 10 consecutive days from the date of registration without a valid reason: documented illness, death of a close relative, being involved in an accident, a natural disaster zone;

- those convicted by a court decision - sent to correctional labor or deprived of liberty;

- those who provided false data, false documents.

We will supplement this list with those categories of citizens who are considered employed, and, therefore, be recognized as unemployed and receive financial assistance from the state:

- working under a contract, full-time or part-time, in a permanent place of work, seasonal and temporary work, receiving payment;

- having their own individual enterprise, notaries, lawyers with private practice;

- sellers of products under a contract or workers in auxiliary jobs;

- executed under civil law contracts - for the performance of services, original work;

- those who received a paid position - as a result of elections, appointment by senior management;

- undergoing military or alternative civilian service in the ranks of internal affairs bodies;

- full-time students in an educational organization;

- those who received temporary disability - due to pregnancy and childbirth, illness;

- who are among the founders of a commercial enterprise.

Video instruction: How to find a job or receive unemployment benefits

How long can you receive benefits?

Typically, payments are made for a period of 3 to 6 months. But payments can be interrupted at any time, for example, if you get a job. You need to understand that the job of the labor exchange is not to pay you benefits while you are unemployed, but to help you find a job. Financial assistance is support during downtime; it is not profitable for the employment center to produce an army of slackers, so payments are limited in time. Let's figure out who will be paid benefits and for how long.

The payment begins from the moment the citizen is declared unemployed. But then there are different options for how to become this very unemployed.

- For those who are dismissed due to the liquidation of a company, cessation of its activities or reduction of staff, payment of benefits is assigned after the period of payment of average earnings at the last place of work is completed. Two benefits are not accrued at the same time, but assistance in finding a place of work is carried out as standard. In this case, it is necessary that the registered person has at least 26 weeks of work experience during the 12 months preceding the onset of unemployment. The benefit payment period does not exceed 6 months in total over the next 12 calendar months. For example, Svetlana Krasnova was fired due to staff reduction. She has worked for the company for 3 years (which is more than 26 weeks), so she can register and receive benefits for 6 months. If during this time a vacancy was not found on the exchange or, for example, Svetlana started working on the proposed vacancy, and then quit after a month or two, then she can re-register with the employment center only after 6 months.

- For citizens who were called up for military service and served, the benefit payment period cannot exceed 6 months in total within 12 months. In this case, it is necessary that the person was employed during the last 12 months before conscription and that the work experience in this place was equal to or greater than 26 weeks. That is, for example, Petrov worked as a salesman in a store for 2 years, after which he received a summons to the army. Petrov served, and then registered with the Employment Center as unemployed; his work record book had more than 26 weeks of work experience and he was employed for 24 months before conscription, therefore, he will be paid unemployment benefits.

- For those who have not previously worked or lost their job more than 12 months ago, who worked less than 26 weeks in the previous year, who were dismissed for violations and for other reasons, who were expelled from training in the direction of the employment center, the payment is assigned for a period of three months and at the same time it is minimal.

- For those who quit at their own request, benefits will be accrued based on length of service. If a person worked 26 weeks in the 12 months preceding dismissal, he will receive benefits for a total of 6 months in the subsequent year. If a person has worked for less than 26 weeks, then the benefit is assigned for 3 months.

Who is paid?

Money is provided to all citizens, regardless of the reason for dismissal.

Therefore, the benefit is calculated for the following persons:

- dismissed on their own initiative or under the article;

- laid off at the place of employment;

- those who have not had a job in the past;

- having any disability group

If a person has not previously worked officially, then he can only count on the minimum amount of payment, which depends on the subsistence level.

When staffing is reduced

This procedure involves the dismissal of several specialists who can count on severance pay.

The employer is obliged to notify the employee in advance about the planned termination of the contract, as well as pay the required amounts:

- the first payment is represented by payments at the time of dismissal, therefore it includes salary, vacation compensation and the first severance pay;

- the second amount is assigned after the person is registered with the labor exchange, and it is equal to the average salary at the previous place of work, but if the citizen has already got a job in another company, then he will not be able to count on this payment;

- the third payment is made the next month, if even with the help of the employment center employees, the laid-off specialist was unable to find a job.

Severance pay is awarded at the expense of the former employer, not the state.

Upon dismissal on one's own initiative

Any citizen has the right to change his place of employment. Even if he quits of his own free will, he can still receive unemployment benefits, and it is calculated based on the average earnings of a citizen. Therefore, you will have to provide the labor exchange employees with a certificate of income.

The benefit cannot be applied for by persons who work under a GPC agreement or are engaged in private practice. It is not assigned to individual entrepreneurs or military personnel, and people deprived of liberty or engaged in correctional labor are also refused. Funds are not given to students or people with private farms. Even the founders of companies will not be able to register on the stock exchange.

Reference! The benefit is not provided to minors or pensioners.

For citizens of pre-retirement age

These include persons who have less than 5 years left until retirement. Young workers can receive financial assistance for a maximum of six months in one year. For pre-retirees, the conditions are simplified, so they can receive payments for 1.5 years within 1 year. For some pre-retirement people, even these periods increase, for example, if a woman has more than 20 years of experience, and for men it is more than 25 years.

This guarantee is not offered to pre-retirees who have not worked for more than one year or were fired for disciplinary violations. This also includes citizens who were sent to training by the exchange, but were expelled for various illegal actions. For pre-retirees, the benefit is calculated in a standard way, so it takes into account how much money they received at their previous place of work. But to do this you need to work in one company for at least 6 months.

How many times can you register?

There are no restrictions on the number of times you can register with the employment center. Registration is possible even if:

- deregistration due to failure to appear at the employment service;

- deregistration as a result of receiving benefits unlawfully;

- refusal to cooperate with the employment center at your own request;

- lack of employment of a citizen after deregistration.

You can re-register with the employment service only after 6 months. If re-registration is carried out at the employment center within one year (from the date of first registration), then payment is not assigned until the expiration of this period.

When payments stop

As soon as an unemployed citizen finds a job, he is deregistered with the Central Employment Service and the payment of benefits stops. In accordance with Art. 35 of the Employment Law, benefits will also not be paid if the unemployed:

- twice refused to undergo professional retraining as directed by the labor exchange;

- missed visits to the health center without a good reason;

- came to the labor exchange drunk;

- voluntarily refused to receive benefits;

- sentenced to correctional labor or imprisonment;

- moved to another city (in this case, you need to register with the Central Election Commission at your new place of residence);

- retired;

- died.

If an unemployed person received benefits fraudulently (for example, he falsified documents for registration), the labor exchange will recover the illegally paid funds through the court, and the violator may be brought to criminal (Article 159.2 of the Criminal Code of the Russian Federation) or administrative liability (Article 7.27.1 of the Administrative Code ).

When can unemployment benefits be suspended?

Financial assistance to the unemployed may be suspended in a number of cases:

- Refusal from places of work - from two suitable offers;

- Refusal of public works, training, advanced training;

- Visiting an employment center while under any type of intoxication - alcohol, drugs;

- Dismissal from work or expulsion from an educational center due to gross violations of labor/educational discipline;

- Failure to comply with the terms and conditions for extending the status of unemployed;

- Termination of training to which the unemployed person was referred by the employment center.

When do they stop paying benefits?

Payments are terminated in the following cases:

- Obtaining a place of employment;

- Sending for training from the employment service (the student will be paid a stipend);

- Failure to appear at the center for a period of more than a month (in order for the payment not to be stopped, you must provide documents confirming a valid reason for failure to appear: the death of a relative, being in the hospital, etc.). At the same time, unemployed citizens must undergo re-registration (mandatory attendance) within the time limits established by the employment service, but no more than twice a month;

- Moving to another administrative center;

- Obtaining unemployed status by deception;

- Imprisonment or performing correctional labor by court decision;

- Assignment of pension benefits - both by age and early;

- Personal refusal to cooperate with the employment center;

- Death of a person registered as unemployed.

What changes are possible?

Indexation of the amount of social assistance is not established by law.

According to Art. 33 of Law No. 1032-1, the government approves the minimum and maximum benefits every year, but does not necessarily increase them. According to Art. 35 of the Law “On Employment”, the Employment Center has the right to reduce the amount of social assistance or suspend its payment.

A reduction in the amount of social assistance payment is possible by 25% in the following cases:

- failure to appear at the Center for Work or Training without good reason;

- failure to appear for an interview in the direction of the Center for Significance within three days without good reason.

Payment may be suspended for one month in the following cases:

- refusal of two works proposed by the Center for Significance;

- visiting a health center while intoxicated;

- expulsion from training in the direction of central labor education due to the fault of an unemployed person;

- refusal to participate in paid public works - applies after being in unemployed status for more than one month;

- violation of the terms and conditions for re-registration of the unemployed.

The time during which payment was suspended is included in the total period for calculating benefits.

How much do they pay at the labor exchange for unemployment?

Despite the differences in payment recipients, for Moscow the calculation is carried out within the framework of federal law. And this amount will not differ depending on the place of residence. For residents of regions, benefits may be increased by the regional coefficient, in accordance with local legislation.

Minimum and maximum amounts

| Maximum, rub | RUB 12,130 for all categories of recipients. |

| Minimum, rub | 1.5 thousand rubles. for all categories of recipients. |

What determines the size of payments?

The benefit is based on the average income of a citizen. If it was not there, then an amount is assigned, not lower than the minimum wage - it is increased due to the regional coefficient.

So, for example, in the Khanty-Mansiysk Autonomous Okrug, taking into account the regional coefficient (+50%), payments will be:

| Maximum, rub | RUB 18,195 for all categories of recipients. |

| Minimum, rub | 2250 rub. for all categories of recipients. |

But those laid off from March 1, 2021, for each child, instead of the standard 3,000 rubles, taking into account the regional coefficient, are entitled to 4,500 rubles.

Calculation table

From the table below it is clear how to calculate the amount of the benefit.

| Category of citizens | Benefit amount | Payment periods |

| First time job seekers | Minimum benefit amount multiplied by the regional coefficient | 3 months/1 year |

| Those who applied to the central labor center after a year of work | ||

| Having less than 26 weeks of work experience in the last 12 months before applying to the Center for Health Protection | ||

| Individual entrepreneurs who have ceased to operate | ||

| Dismissed for labor violations | ||

| Citizens who have worked for more than 26 weeks 12 months before registering with the Center for Labor Protection |

| 6 months/1 year |

| Orphans under 23 years old | For 6 months in the amount of the average monthly salary in the corresponding subject of the federation. | 6 months/1 year |

| Citizens of pre-retirement age with more than 26 weeks of service 12 months before registration with the Central Labor Protection Center |

| 12 months/18 months |

| Citizens of pre-retirement age with more than 26 weeks of work experience in the 12 months before registration in the Central Labor Inspectorate and a total work experience of more than 20 years for women and 25 years for men. |

| 24 months/3 years |

Unemployed people in 2021 can receive social assistance of at least 1,500 rubles and no more than 12,130 rubles. For people of pre-retirement age, the maximum amount of payments has been raised to 12,130 rubles. The increase can be made at the expense of the regional coefficient and surcharges adopted by local authorities. Violation of the procedures for receiving benefits established by the Central Employment Center may lead to a reduction and termination of cash payments.

How is unemployment benefit calculated?

Those who are fired within a year before receiving unemployment status receive payments in the following order:

- in the first three months – 75% of average income *;

- the next three months – 60% of this indicator *.

If a citizen has not provided a certificate of income, then the benefit is calculated based on the minimum indicator.

* this rule does not apply to the period from April to June 2020 inclusive.

How to calculate average earnings for unemployment benefits

When calculating average earnings, income for the last three months is taken into account. They rely on the dates from the 1st to the 1st, but if the citizen quit earlier, then they calculate the amount in his favor - a larger one. Thus, the income is divided by three and the indicator is compared with the minimum and maximum values.

For example, over the last three months Ivanov received:

- March – 10 thousand;

- April – 12 thousand;

- May – 11 thousand.

Average income is calculated as follows: (10000+12000+11000):3=11000. In a standard situation, payments will be calculated based on 75% of this figure for the first three months. That is, Ivanov will receive 8,250 rubles for three months of being registered with the employment center. If during this period he still does not find a new place of work, then for the next three months the payment will be 6,600 rubles per month. This is already 60% of the average income calculated earlier.

How to apply for benefits for the unemployed

Is recalculation possible?

A pressing question for many unemployed people is whether the PBR will be recalculated. Citizens recognized as unemployed before January 1, 2019 are paid unemployment benefits in the manner, terms and amounts previously established by the Employment Law. That is, the benefit is not recalculated for them. In some cases, the benefit amount may be reduced by 25% for 1 month (Article 35 of the Employment Law). This can happen if a citizen, without good reason:

- does not come to a potential employer within 3 days from receiving the referral;

- does not appear at the employment center to receive a referral.

How to receive unemployment benefits (step-by-step instructions)

To apply for social assistance from the state, you must:

- Contact the employment center - depending on your place of residence. After all, you will need to periodically come to this department for consultations and reporting.

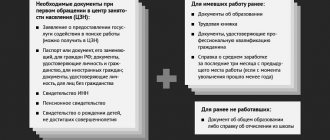

- Submit the following documents: passport, application for registration, SNILS, INN. Work record book, if available (those who are looking for work for the first time will not be able to provide it). For additional identification, it is worth attaching a certificate of education - this will open up more vacancies. It is also worth using a certificate of income. In case of high earnings, the accruals will be higher than the minimum wage.

- Wait for the papers to be reviewed. The employment service will process the submitted data. If there are grounds, the citizen receives the status of unemployed.

After this procedure, they wait 10 days - during this period vacancies are selected. If there is no suitable place of work, then benefits are calculated. But not from the 10th day, but from the moment you contact the employment center.

The first stage is registration in order to find a suitable job

Anyone who wants to “get on the stock exchange” should first of all contact a government agency—the employment center (PEC). You can find a suitable center in your city on the Rostrud website (tab “Employment Service” - “search by region of the Russian Federation”).

If you plan to apply for unemployment benefits, then you need to contact the employment center at the place of registration - you will need to live and look for work in the same region. Thus, only those who have Moscow registration will be able to receive unemployment benefits in Moscow (temporary registration will not work).

You must contact the center in person - you cannot submit an application online. You need to take the following documents with you:

- passport;

- work book (if any);

- documents on education, as well as qualifications, training, academic degrees and academic titles (if any);

- a certificate of average earnings for the last 3 months at the last place of work (if any).

After the documents are submitted, the person begins to look for a suitable job. This period lasts 10 days.

What is a suitable job?

This is a job that formally matches your professional qualities and needs. When searching for a suitable job, they will take into account your profession or specialty, position and type of activity at your last job, level of education and qualifications, experience and work skills, average earnings for the last 3 months at your previous job, compliance of working conditions with your health and transport accessibility of the workplace .

You have the right to refuse a job offer if it does not suit you according to any of the criteria. This should be reported to the employment service.

For those who have never studied anywhere and never worked, the employment center can offer any paid job that does not require prior training. The only criterion by which you can evaluate it is transport accessibility. You may also be offered vocational training.

What to do if you are not satisfied with the vacancy

There are often cases when a person worked in a highly paid position, and on the stock exchange he is offered vacancies with a much lower salary or unsuitable conditions. Unfortunately, the level of wages and its discrepancy with the expectations of the unemployed is not a reason to refuse a vacancy. A job can only be considered unsuitable if:

- it is associated with a change of residence without the consent of the citizen;

- working conditions do not comply with labor protection rules and regulations;

- the proposed earnings are lower than the average earnings of a citizen calculated over the last three months at the last place of work (service). This provision does not apply to citizens whose average monthly earnings exceeded the subsistence minimum for the working population (hereinafter referred to as the subsistence minimum), calculated in a constituent entity of the Russian Federation in the prescribed manner. In this case, a job cannot be considered suitable if the salary offered is below the subsistence level calculated in the constituent entity of the Russian Federation in the prescribed manner.

If a vacancy requires a salary above the subsistence level in the region, then the unemployed person’s refusal of this job is counted in the “refusal bank.” Several refusals and the Employment Center will stop paying benefits and deregister.

Additional payments

The availability and size of additional payments depend on the region in which you are registered as unemployed - it is better to check them on the websites or by calling the employment center of your city.

In Moscow, for example, there is a city supplement to the benefit (850 ₽) and compensation for public transport costs (1,385 ₽). Instead of sick leave, the unemployed can receive additional compensation for each day of temporary disability (based on the amount of 850 rubles per month). In the event of the death of a family member of an unemployed person, one-time financial assistance is provided - 4900 rubles. If an unemployed person agrees to public works or temporary employment, he will be paid up to 80% of the cost of living for the working-age population established in Moscow (as of June 2020, the cost of living is 19,233 rubles).

In some regions there are regional coefficients by which the amount of unemployment benefits is increased. For example, in the Sakhalin region (North Kuril, Kuril, South Kuril regions) or the Chukotka Autonomous Okrug, all payments are doubled (coefficient - 2.0).

Read on the topic: How to join the labor exchange and get the most out of unemployment