3.4 / 5 ( 7 votes)

The procedure for divorcing spouses is often complicated by the issue of establishing property rights. When dividing joint property, according to the law, they are generally guided by the articles of the Family Code, which establishes that it is divided in equal shares between husband and wife. This also applies to cash savings. When dividing through a court, the parties will need to resort to parts of the Code of Civil Procedure of the Russian Federation, the Tax Code of the Russian Federation and a number of federal laws. Let's take a closer look at how spouses' funds are divided in 2021 and whether it is possible to avoid it.

Basic principles for dividing funds between spouses

The RF IC establishes a regime of community for all property acquired by spouses during marriage (Article 34). This also applies to cash savings. The following are considered as such:

- all income from employment, including bonus payments, salaries, etc.;

- income from business activities. Here, profit on shares, proceeds from the sale of common property, etc. will be taken into account;

- income from the intellectual activity of the spouse;

- any benefits, scholarships and pension payments.

Only payments made by the state and other structures cannot be included in general income if they have a designated purpose.

It is easier to divide the funds accumulated in bank accounts; their presence and movement can be traced. Especially if this is not some kind of account that one of the spouses opened in his own name without informing the marriage partner. It is more difficult to divide cash because... sometimes it is difficult to calculate their number if the spouses themselves do not give their consent.

What kind of money is not shared?

If amounts of money are received during marriage, they are recognized as jointly acquired property. There are a couple of exceptions to this rule. For example, one of the spouses will sell real estate that he acquired before marriage and is its sole owner. In this case, the money received from the transaction will be his property and cannot be divided.

The funds that both spouses cannot claim at once are targeted payments. This applies to maternity capital, compensation payments received for causing harm to health at the enterprise, etc. (Article 34 of the RF IC).

Cash section

It would seem that there shouldn’t be any difficulties when dividing cash - they took the available amount and distributed it in half, but you may encounter the following situations:

1. The funds are hidden by the second spouse.

The problem is that sometimes an unscrupulous spouse, when a divorce is approaching, tries to withdraw such money from the division. In this case, the other spouse will need to prove that the amount declared by him for division took place. This is not always possible, since the second spouse denies the existence of money at all or indicates that it has already been spent previously on the needs of the family.

To prove the fact of having money, you can present to the court:

- bank account statements on withdrawals from a joint deposit;

- purchase and sale agreements (for example, when money was received from the sale of joint property);

- certificates of income of the spouses (when the spouses’ wages are significant, but they did not acquire any property, did not spend anything, because they were saving for something specific);

- witness statements.

2. The money was spent by the second spouse.

Sometimes, in the event of an upcoming divorce, a spouse, in order not to divide the accumulated funds, may spend the entire amount on his own needs or by purchasing some property either at an inflated price, or something for which the second spouse would never give his consent.

In such a situation, the second spouse has the following options:

- prove the fact that the money was spent by the spouse on his personal needs, and not in the interests of the family, and ask to recover half of what was spent.

- Contest the completed transaction as concluded without the consent of the second spouse, ask for its termination. If these requirements are met and the buyer returns the money, divide the returned amount.

Arbitrage practice

Tsyplov K.I. asked the court to invalidate the transaction for the purchase of a warehouse building made by his wife O.V. Tsyplova. The plaintiff explained to the court that he and his wife are now in a state of divorce. Previously, the couple sold a common car, receiving 1,000,000 rubles for it. Tsyplova O.V. I spent exactly this money to purchase a warehouse, but he did not give his consent to this deal. Considers this transaction invalid, since the warehouse was purchased from P.R. Piskunov, who is accountable to O.V. Tsyplova. relative (grandfather). The contract specifies the amount of 1,000,000 rubles, but the market value of the building does not exceed 400,000 rubles, therefore, when dividing it as joint property, he will receive no more than 200,000 rubles. In addition, earlier Piskunov P.R. promised to give this warehouse building to his wife, his granddaughter. Thus, the contract must be terminated as concluded in order not to divide 1,000,000 between the spouses.

The court, having assessed all the arguments of K.I. Tsyplov, assessed the warehouse, and heard witnesses, granted the claim. After that, with Tsyplova O.V. 500,000 rubles were collected.

Is money in accounts divided during divorce?

The easiest way is to separate bank deposits. It is enough to request a printout of the movement and balance of funds in the account. Such amounts are divided in a general manner, based on the size of the shares established by a court decision or agreement between the spouses.

Bank deposits that each spouse made before entering into an official marriage will not be subject to division.

In such a situation, the court will take into account the following factors:

- when the bank account was opened;

- on what date the cash receipts are received into the account;

- availability of evidence of the origin of funds deposited into the account.

How should property be divided?

Equally according to the law

There are many options for cases, and therefore court decisions on the division of accounts in 2021. For example, an account was opened by one of the spouses before marriage, but money was placed there already during the existence of the family from the general budget. This means that part of the amount is subject to division. Or the account was opened during marriage, but the money was deposited there from the sale of an apartment inherited by the spouse. In this case, the money from the account is not divided.

Features of the division of money during divorce

According to Art. 256 of the Civil Code of the Russian Federation, the division of money during a divorce is possible provided that it was received from the moment of marriage until the dissolution. They are recognized as common property along with real estate and other valuables.

Several factors are most important:

- Origin of money. If we are talking about wages, income from the results of intellectual activity, earnings from renting out housing, the funds are considered common. Even if one of the spouses was not working at that time, but was doing housework (Article 34 of the RF IC). If funds are received as an inheritance, under a gift agreement or other gratuitous transaction, they remain with the person for whom they were originally intended and are not subject to division (Article 36 of the RF IC).

- Confirmation of the origin and availability of money. This is necessary for the trial. You should stock up in advance with a bank account certificate, agreement or any other document confirming that you actually have funds.

- Size of shares. By default, property is divided equally between spouses (Article 39 of the RF IC). It does not matter who exactly earned the funds. Even if the husband or wife did not work at that time, the court will divide everything in half.

- Who is the bank account in? If it is opened in the name of the husband or wife, it will be possible to divide the money. If the account is opened in the name of a common child, by law the funds belong to him, even if the father or mother put them there.

- Date of opening of the bank deposit. If it is opened before the official registration of the marriage, you will have to prove that the money arrived there after visiting the registry office and is shared.

- The presence or absence of a marriage contract. If it was issued earlier, everything is divided according to its provisions. There is no need to go to court or enter into a separation agreement.

Important! If money transferred to a bank deposit or salary card is divided, it does not matter which spouse it is open to. If the card or deposit belongs to another person (child, relative), by law they belong to him. In such a situation, it is better to first ask the account owner to transfer funds, and only then go to court.

How to divide joint money savings

The division of marital property, including finances, can be carried out in two main ways:

- In a court.

- Through a peace agreement.

If a couple has similar views on the division of the common property of the spouses, it is cheaper and faster to implement it by signing certain agreements:

- Marriage contract. This document is signed before the wedding or during the marriage. According to it, spouses can establish any property ownership regime that does not contradict Russian laws. Those. they themselves determine how much money and who will receive it. It is valid even for personal property.

- Property division agreement. It occurs during marriage or after divorce. The document allows you to delimit ownership rights only to the joint property of the spouses, i.e. with their common money. Any property regime can be established if it does not contradict the law.

On our website you can do it if necessary.

If the spouses fail to reach an amicable agreement, each of them has the right to file a claim with the court asking for forced separation.

How to divide money in an account during a divorce

As mentioned above, bank deposits, like other joint property, can be divided in three ways:

- in accordance with the marriage contract;

- through a voluntary agreement;

- through the court, in this case there are two options for division: a court decision or a settlement agreement.

Any of the spouses, if it is not possible to reach an agreement peacefully, has the right to go to court with a claim for the division of joint property, including bank deposits. You can file a claim within three years after the divorce or within three years from the moment one of the former spouses learned of a violation of his rights.

The outcome of the court hearing will largely depend on the evidence presented to the court by each party to the trial. These include bank statements, checks for large joint purchases, and other documents that prove the opponents are right. It is also necessary to attach copies of the passports of the parties to the case, documents on registration and divorce, and receipts for payment of state fees.

Important. The original state duty receipt is attached to the statement of claim, unlike other documents that are submitted in copies. But it is necessary to bring the originals of all documents to the court hearing, otherwise the court will not accept them for consideration, since when making a ruling, the court has the right to refer only to original documents, and not to their copies.

If necessary, any of the parties to the case may petition the court to call witnesses in the case; in this case, the plaintiff must indicate the contact information of each witness in the statement of claim. If the testimony of witnesses is required to prove the defendant’s case, then he must submit an application to the court in advance with a request to summon witnesses to court or independently ensure their appearance.

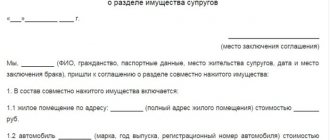

Agreement on the division of funds during divorce

Spouses have the right to draw up an agreement on the division of property during the marriage or after its breakup. They can also do this during the divorce process. The text itself is written in free form. The main thing is to provide detailed information about each object that is subject to division.

If the question concerns cash savings, it is necessary to indicate in which account they are located, bank details, what specific amount and/or amount of interest each spouse will receive upon divorce. In addition, the agreement contains the following information:

- passport details of the spouses (full name, date of birth, residential address, series and numbers of documents);

- information about the existence of marital relations with reference to documents;

- presence of minor children;

- total amount of savings;

- indication of specific bank accounts;

- order of division;

- the effective date of the agreement;

- date of compilation and signatures of the parties with transcript.

An agreement on the division of property must be notarized. Without it, the document is considered void.

On our website you can read the text if necessary.

Division of deposits through the court during divorce

Most spouses divide property by court decision. The judge starts from Art. 38 of the RF IC and shares joint property in equal shares. Cases of departure from this principle occur only when dividing real estate if the couple has minor children.

How to properly divide money deposits between spouses through the court.

Statement of claim for division of funds

Each spouse has the right to file a claim in court. It is advisable to entrust the document preparation procedure to a professional lawyer. If this is not possible, it is necessary to build on Art. 131 Code of Civil Procedure of the Russian Federation when writing text. The claim for division of common property contains the following information:

- Title of the document;

- information about the organization to which the application is being submitted (name of the court and location address);

- passport details of the plaintiff and defendant (first name, surname, patronymic, residential addresses, dates of birth, etc.);

- the essence of the claim, i.e. what the plaintiff sees as an infringement of his property rights;

- ways to resolve the issue proposed by the plaintiff;

- links to regulations confirming the legality of claims;

- preliminary calculation of the finance section;

- date of compilation and signature of the plaintiff with transcript.

The document is submitted to the district court at the defendant’s place of residence. If the divisible amount is less than 50 thousand rubles, then you must contact the magistrate.

Seizure of funds in accounts during divorce

If there is a threat that one of the parties may withdraw funds from the account and dispose of them at its own discretion before the division, it is necessary to seize the property. This can only be done in court. An application for interim measures will be required. It is submitted in the same way as a statement of claim to the court office. If a positive decision is made, it should be referred to the Bailiff Service, which will begin enforcement proceedings. During this process, a request will be sent to the bank, and the accounts will be frozen for the entire duration of the trial.

Peaceful and judicial division of savings

Like other jointly acquired property, investments in a bank can be divided not only in court, but also by drawing up an agreement on the division of the cash deposit. This is the best way out of the situation, but in fairness it must be said that this happens extremely rarely.

When separating, the spouses do everything to save the funds from the division for personal use. If in a situation with savings in banks it is possible to obtain information through the court about the presence or absence of such, then in the case where one of the spouses has savings in cash, it is almost impossible to prove the fact of their existence and make a division.

If the issue of how money is divided when spouses divorce cannot be resolved voluntarily, citizens will have to go to the district court. Investments can be divided either as part of a claim for division of property, or by drawing up a separate application. For example, if the spouse became aware of the existence of savings after the main property was divided.

How not to split money during a divorce

To avoid division of contributions during a divorce in 2021 and to act legally, you should collect and present evidence that the funds are the personal property of only one party. To do this, you can submit payment documents, sales contracts, etc.

If the accounts are not seized, you can withdraw them and transfer them to a small bank. But this option is not suitable for a small locality where there are few credit institutions, which means that bailiffs and a judge can make a simple request about the availability of an account in 2021.

What kind of money is not shared?

In accordance with Art. 36 of the RF IC, the personal property of a husband or wife is not subject to division. This rule outlines the contours of such property and also applies to funds deposited in the bank.

At the same time, it is worth relying on Article 37. It indicates that in a situation in which personal assets have increased in value due to the common property or labor (investments) of the second spouse, the court has the right to consider them joint.

In relation to the contribution, it is appropriate to give the following example. Before marriage, my wife already had a small amount of money in the bank. During family life, the spouses replenished the contribution through a portion of the total income.

Therefore, all savings after marriage registration have the status of common. Next, the conversation will focus specifically on personal savings.

Open until marriage

In this situation everything is quite simple. According to the rules of Art. 36 of the RF IC, savings are classified as personal. When the contract is signed before the day the family relationship is formalized, no problems arise.

The above also applies to situations where people lived together for some time before marriage. In this case, attempts to recognize the contribution as common property cannot be ruled out.

To avoid division, it is enough to present a copy of the agreement with the financial institution to the court. An additional argument will be a savings book.

Received as a gift

It makes sense to describe several options. The first implies that the deed of gift is made in relation to money already in the account. In this case, the gift agreement reflects all information about the contribution.

In the second scenario, one of the spouses is given funds, which are then deposited into the account. In this case, savings according to the rules of Art. 36 of the RF IC also relate to personal ones.

In practice, sometimes it becomes necessary to prove a causal connection between the received gift and the open contribution. The easiest way to justify it is with a contract of donation of money and the absence of other income.

Inherited

There is a certain analogy here with giving. It is possible to inherit both an existing deposit and an amount of cash.

The deposit is considered personal. To avoid problems in the future, it is necessary to ensure that the notary's certificate contains complete information about the deposit.

If a claim is filed for the division of money, its ownership is easily confirmed. In addition to the certificate of inheritance, reference is made to the identity of the amounts and a short period of time before opening an account.

Sale of personal property

Money received from the sale of personal belongings has the same status. Accordingly, the owner has the right to dispose of them at his own discretion, even during marriage.

One way is to place finances in a bank at interest. Such a contribution is classified as personal assets.

If a dispute arises, the rights to the sold property are initially proven. And then the relationship between the funds received and the opening of an account is shown.

Arbitrage practice

The practice of court decisions on the division of funds between spouses is extensive, but generally monotonous.

The judge proceeds in this matter from the principle of equality of shares. The need to prove that the money belongs to only one party is assigned to it. If such evidence is not provided, all savings received into the accounts during the existence of the marriage are automatically considered joint property. The former husband and wife have the right to use the joint property of the spouses even after a divorce. But if we are talking about monetary savings, then it is impossible to realize it, so a division of such is necessary. This can be done by contract or through the courts.