The concept of escheat property in judicial practice

Escheated property refers to those possessions of a deceased person that have no heirs. It is understood that there are no legal successors at all, or that they voluntarily abandoned the property of the deceased.

When there are heirs, but they are classified as unworthy, the objects will also be escheated. Judicial practice in this direction plays an important role, since a separate legal act regulating the regime of such property has not been developed.

This is confirmed by the decision of the Central District Court of Moscow, adopted in case No. 2-3250/2018 dated May 24, 2018. They considered the claim of citizen I., who indicated that she is the heir of the deceased V. and lays claim to his property.

However, the judge indicated that I. belongs to the category of unworthy legal successors and cannot receive V.’s plot and house. Since there are no other heirs, the property of the deceased V. was transferred to the municipality by court decision.

In a situation where there are no legal successors, the objects are given the status of escheat. When opening an inheritance estate, a notary, despite having access to all the databases of the Ministry of Justice, cannot say with confidence that the heirs will not appear soon.

For this reason, until the expiration of a six-month period from the date of death of a person, the procedure for recognizing objects as escheat is not carried out.

Circumstances under which property will be recognized as escheat

Property will be considered escheat if:

- The testator has no successors in all lines of succession.

- The testators did not submit applications for acceptance of the inheritance within the period established by law.

- The heirs were excluded from the right of inheritance.

- The heirs refused to accept the inheritance.

Lack of successors

If the deceased testator does not have a single successor in all lines of inheritance, his property will be recognized as escheat. But the notary who opens the inheritance case, although he has access to all the registers of the Ministry of Justice, cannot confidently assert that there are no successors for the testator, who did not have close relatives in the direct line.

Therefore, there have been no precedents in Russia for recognizing succession as escheat before the expiration of the period during which it can be accepted.

No statement

If no heir submits an application for acceptance within 6 months from the date of opening of the succession (death of the testator), such an inheritance will also be considered escheated. But such successors can extend the period for accepting the inheritance through the court, and as a rule, such processes take place.

The basis for a positive decision may be significant reasons why the deadline was missed, for example, illness or a long business trip of the successors. Therefore, inheritance of property as escheat is often refused, due to the availability of information about successors who missed the deadline for accepting the inheritance, but want to appeal it.

For example, we received an official written refusal from a notary - a mandatory document for extending the period for accepting succession through the courts.

Removal of applicants

In essence, this circumstance is a special case of the absence of successors. According to the law, heirs who, due to their actions, are unworthy, are excluded from the right to succession, and therefore are no longer considered as such. Negligent successors include:

- Heirs who have not fulfilled their duties to the deceased. In particular, regarding the organization of his burial.

- Successors who attempted the life of the testator or killed him. In the event that such a fact is supported by a court verdict.

- Heirs who tried to illegally increase their share of the inherited property. An appropriate court decision is also required here.

The removal of applicants does not always occur after the testator’s departure to another world. But the presence of established facts that are the basis for the removal of applicants, by default, excludes inheritance by such successors. For example, there is a court verdict in a case of a completed attempt by an heir to murder the testator.

If, at the time of his death, such a judgment is in force, the convicted successor will not have the right to succession without any additional findings or decisions of the court. But the testator, if he remains alive despite the unlawful actions of his negligent successors, has the right to bequeath his property to them again. If there is a will executed by a notary after the above-described circumstances arise, the successors will again receive the right to succession.

refusal of succession

The heirs have the right to refuse succession, for which they issue a written refusal, which is certified by a notary.

If all successors in all lines refuse succession, the inherited property will be considered escheated. But in practice this is difficult to imagine, because the heirs of the fourth and all subsequent lines may not only not communicate with the first line, but may not even be familiar with them.

And the task of the notary who opened the succession case will be to find all living relatives who can inherit from the deceased. Having the opportunity to familiarize yourself with the civil registry data, this will not be a problem if such successors live in Russia.

It is important to know that you can refuse to accept an inheritance within the established period for accepting it, so if the successors who lived with the deceased, and therefore are considered to have accepted the inheritance automatically, do not refuse the inheritance within six months, they will no longer be able to do this in the future, even through the courts. Extension of the period for refusal of succession is not provided for by current legislation.

Judicial practice on declaring property escheatable

Judicial practice on escheated property indicates that there is a separate procedure for giving objects the specified status. Persons who are authorized to accept the inheritance draw up an application and submit it to the court six months after the death of the person.

This confirms the decision of the Buturlinovsky District Court of the Voronezh Region in case 2-97/2019 dated March 23, 2019. The document states that the administration of the municipality becomes the heir of the deceased citizen F., since she has no other legal successors. Property passes to the municipality after the decision comes into force.

At this point, the notary should not have statements from other heirs, with the exception of those who have renounced their rights. If a citizen, when applying to the court, can prove that he has the opportunity to receive the estate, the process of recognizing the inheritance as escheat stops.

Even if the procedure for giving objects the specified status is completed, cancellation is allowed if the corresponding decision of the judge is made.

The procedure for registering escheated property in ownership, return of escheated property

In practice, there are cases when the heirs of a deceased person learn about their rights a considerable time after the completion of the inheritance procedure. It happens that such values have long passed into the possession of the state. But this does not mean that a person cannot protect his property rights. In this case, the interested heir must complete three steps.

Step 1: petition for restoration of the inheritance period

Considering that the period of inheritance has already passed, a person needs to prepare a statement of claim in court with a request to restore the period of inheritance of property. The claim is prepared taking into account the following requirements:

- It is mandatory to indicate the reasons why the inheritance period was missed;

- the petition is submitted to the court located at the address where the inherited property is located;

- consideration of the claim takes place in the form of writ proceedings;

- The approximate time frame for making a decision on an application is up to 1.5 months.

Sample statement of claim for restoration of the period for accepting an inheritance:

Consultation on document preparation

The statute of limitations for such disputes is 3 years. It begins to count from the day when the heir learned (or could have learned) about the death of the testator.

Step 2: contacting a notary to resume the process

After receiving a court decision to restore the inheritance period, the interested person with the document approaches a notary located in the region of the deceased testator’s last residence permit. He additionally prepares documents confirming inheritance rights to valuables.

Step 3: inheritance procedure

The actual implementation of enforcement proceedings to receive an inheritance. The notary will tell you what documents are needed and advise the person on how to go through the procedure correctly.

The approximate cost will be 15,000 rubles excluding state duty.

If, at the time of receiving the escheated property back, it turns out that the state/municipality has already sold the values, the state will compensate the cost of the inheritance to the person in monetary terms.

Snezhana Pogontseva

Lawyer, author-editor of the website (Family law, 12 years of experience)

Transfer of rights to escheated property by court decision

The exact moment of transfer of rights to such property is not defined in the legislation. Therefore, it is impossible to talk about the possibility of obtaining this status automatically.

Persons vested with rights to escheatable objects can contact a notary office and formulate a corresponding application. In this case, the transfer of the hereditary mass is implemented on a general basis . This implies that not only rights to objects are transferred, but also obligations.

Important! The main difference between escheat inheritance is the possibility of receiving not the entire estate, but part of it.

To whom does unclaimed property go by court decision?

There are several options for who gets the rights to such objects.

Including:

- Russian Federation;

- regions;

- municipalities.

The mass represented by the housing stock passes to the municipal authorities. The apartment must be located on the territory of a specific municipality and not belong to the state.

Subjects are given succession to objects in accordance with established provisions in local legislation. The remaining property of the deceased passes to the Russian Federation.

Procedure for transferring rights to unclaimed mass and judicial practice

Registration of property rights for municipalities and regions is carried out by contacting a notary office. The powers to accept rights to such property are vested in the territorial divisions of the tax service.

The right to objects arises after six months have passed since the death of the citizen. At the same time, during the specified period no applications should be submitted to accept inheritance from other citizens.

There is no need to rush to register the unclaimed estate, since in the coming year people who did not know about the death of a relative may turn up. Then the likelihood that the court will satisfy the claim to restore the deadlines for entering into inheritance is high.

Sometimes escheat can be confirmed by a judicial authority. For example, when a banking organization is refused to recognize the debt of a deceased citizen to one of his heirs due to the fact that no one has accepted the debt.

What is escheat property?

The property of a testator who has no heirs, or who voluntarily refused the inheritance, or, due to certain circumstances, are unworthy of it, will be considered escheated.

According to the Civil Code, as amended to this day, the procedure for registering property as escheat must be regulated by law. But to date, such a law has not been adopted; at the same time, escheated property is being registered. Therefore, judicial practice plays an important role in determining the procedure for acquiring property rights to escheated property.

What does a notary do in relation to escheated property by court decision?

In the Russian Federation, today there are no strictly defined grounds for employees of notary offices regarding the satisfaction or refusal of registration of unclaimed objects. For this reason, the notary decides what answer to give based on the situation. If you refuse, you must justify your decision.

Most often, notaries formalize rights to such property only if they have full confidence that the deceased has no legal successors. If the application is granted, a certificate will be issued confirming ownership of the mass.

This act is a legal one; on the basis of the certificate, adjustments are made to state registers.

Nuances of considering cases of unclaimed objects

If the deceased has heirs, but they abandoned the property, the debts do not pass to such persons. Often citizens prefer not to accept an inheritance, but continue to use it for their own purposes.

In such a situation, the person who uses the inheritance mass is recognized with the corresponding rights to these objects. This most often concerns cases related to debt collection under loan agreements.

This procedure does not give a citizen the status of property owner. Registration is carried out by applying to the judicial authorities, provided that the deadline for acquiring rights has been missed.

If by the time the creditor files the claim, the rights have passed to the escheated heirs, the debt must be collected from them .

How to return escheated property

Successors who missed the deadline for accepting an inheritance for various reasons are puzzled by the question: when does property become escheatable? The legislation does not have a precisely defined period for recognizing valuables as escheat. Based on the fact that for citizens the period of inheritance is limited to 6 months, by default it is considered that after six months the property is transferred to the state.

Failure to accept the property of the deceased by the direct heirs means that other legal successors receive an additional three-month period to enter into the inheritance.

Inheritance of escheated property has no statute of limitations, therefore it can continue for an unlimited amount of time.

Judicial practice on inheritance of debts on escheated property

In this case, what matters is where creditors turn to collect debt. If, by the time the application is submitted to the court, the property has been given the status of escheat, and none of the heirs have yet received a certificate of inheritance, then the bidding procedure is used.

The proceeds will be used to pay off the debt. If anything remains, it is passed on to the escheated heir . When at the time of filing the application the person has assumed rights, he will have to answer for the debts of the deceased himself.

If the powers relate only to part of the property, then the heir is responsible within the limits of its value.

Court decisions on the transfer of rights to shares in land plots

Judicial practice on recognizing property as escheat indicates that nowadays there is often a mistake associated with filing a claim for recognition of rights to shares in land plots that remained unclaimed after the death of a person.

In this situation, it is necessary to take into account whether such a share in the allotment was in demand during the person’s lifetime or not. If a citizen has never acquired rights to a plot or part of it, then this property cannot be included in the inheritance mass.

This is indicated in the decision of the Ponomarevsky District Court of the Orenburg Region in case 2-197/2019 dated March 28, 2019. The essence of the case: citizen I. filed a statement of claim and wanted to receive the plot left after the death of her mother T. However, the municipal administration disputed such a claim , since the land did not belong to T.

The court indicated that during her lifetime T. had not registered ownership of the plot. For this reason, it is not included in the inheritance mass and is the property of the municipality.

The situation is different when rights to unclaimed shares in plots are transferred to municipal authorities on the basis of the Land Code of the Russian Federation. Most often, such claims are satisfied.

Peculiarities of consideration of certain categories of court cases

During the course of judicial practice in cases of escheated inheritance, a generalized assessment of certain facts has been formed that are essential for making a fair decision.

Escheated property and credit debts

If the testator's property has become escheated, his successors, for one reason or another, who have not accepted the succession, will not inherit the testator's debts. Knowing this, cunning successors do not accept succession precisely for this purpose, while continuing to use the property of the deceased.

In order to stop this practice, the courts, in the context of a case of debt collection under loan agreements, recognize the heir using the inherited property as having actually accepted the succession. At the same time, the actual acceptance of the inheritance does not make the successor the owner of the testator's property.

Registration of such property is carried out in accordance with the general procedure, which means only through the court. At the same time, the court's determination of the actual acceptance of succession may be the basis for extending the period for entering into succession. But if, at the time the creditor goes to court, the owner of the property is the escheated successor, the debt will be collected from him.

How are the debts of the testator for escheated property inherited?

It all depends on when the creditor applies for debt collection. If, at the time of going to court, the property is already escheated, but the notary has not issued a notarial certificate to anyone, the succession is sold at auction, the debt to the creditor is repaid with the proceeds, and the remaining funds are inherited as escheat.

If at the time of filing the claim, the escheated successor acquires ownership of the entire escheated property, he will also be liable for the obligations of the testator.

If the escheated successor formalized only part of the inheritance, he will be liable for his debts. only if the proceeds from the sale of property included in the unaccepted part of the succession are not sufficient to repay the debt.

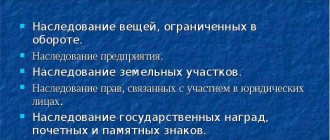

Unclaimed shares of land plots

A common mistake made by municipalities is to file a claim for recognition of ownership of unclaimed shares of land plots of deceased testators without successors. When bringing such a claim, administrations forget that if the share of the land plot was not claimed by the testator during his lifetime, he never acquired ownership rights to it, which means that it is not part of the succession.

Another thing is that municipalities receive ownership rights to unclaimed shares in accordance with the Land Code. Therefore, courts usually satisfy such claims, going beyond the scope of the claims.

But it will no longer be possible to avoid collecting the debts of the successors of the owners of unclaimed land shares. For the same reason - an unclaimed share is not an escheat.

Judicial practice on escheated property

The practice of judicial authorities in this category of cases is extensive. To understand, you need to give a few examples.

According to the Decision of the Tulun City Court of the Irkutsk Region dated February 27, 2019. No. 2-295/2019, the judge satisfied the claim of the plaintiff - the administration of the Azeysky rural settlement and declared the property escheat.

The plaintiff indicated in the application that the plot was transferred to citizen B. during her lifetime. After B.’s death, there were no heirs; no one submitted applications to the notary’s office for six months. B.'s will has not been drawn up. Therefore, the allotment is recognized as escheatable property.

Terms for recognition of escheat

To return the property, you must submit a court decision and an application for state registration of ownership rights to Rosreestr. If authorized employees have found out and made sure that there are no claimants to the estate, then an application for accession to rights can be submitted six months after the death of the testator.

There is no legal limitation on the period during which property can be recognized as escheat. This procedure may take several years.

If it is understood that inheritance of property will occur according to law, then close relatives of the deceased citizen must write an application to a notary to accept the inheritance within six months from the date of death. If no heirs are found, the adoption period is extended for another three months. At this time, subsequent heirs can claim rights to the property.

It may be that potential heirs live in other regions or even countries. In this case, they may not have contact with relatives for a long time; therefore, it will also not be possible to quickly find out about their death and inheritance. Sometimes heirs learn about the inheritance only several years later.

In such a situation, the heir can restore his right to inheritance in court. If the court decision is positive (in favor of the heir), then all property transferred to the state or municipality will return to the legal successor.