Free legal consultation by phone:

8

A property loan is otherwise called gratuitous use and is often found in everyday life. Many people, at least once in their lives, have borrowed from friends items they needed at the moment, but there was no point in buying them. When an item is inexpensive, there is no need to formalize the transaction on paper. It’s a different matter if we are talking about real estate or a car - in this case, it would be reasonable to formalize the procedure for the relationship between the parties in writing and this must be done correctly.

How is donation interpreted by the civil code?

The definitions and consequences of concluding a gift transaction are interpreted in Article 572 of the Civil Code of the Russian Federation . from which it can be seen that this is a completely free transaction. That is, the owner transfers the property that he legally owns in fact to another person without charging a fee.

If the agreement contains any restrictions or conditions under which another person can own the property, then such agreements cannot be recognized by civil law as a gratuitous gift.

Legal requirements for prohibiting deeds of gift and the possibility of legally circumventing imposed restrictions

It has long become a habit among our citizens to give gifts, for example, to doctors or teachers. This is a kind of sign of gratitude for improved health or a good assessment of the child’s knowledge.

But gifts, like any other property, have their real value . for example, housing or a vehicle can be classified as expensive items. It is precisely for such cases that the so-called donation ban is applied, that is, strict legal measures in relation to both the donor and the recipient.

It would be a violation of the Law to give a gift in the form of an apartment if the owner has a mortgage debt; this protects the rights of creditors to claim their property in the event of non-repayment of the debt. A full list of restrictive measures in relation to donated property is listed in Articles 575 and 66 of the Civil Code of the Russian Federation, which indicate possible infringements of the legal rights of other legal entities or individuals.

But in addition to these legal measures, there is also some relaxation when the gift made will not violate the letter of the law, for example, if the total cost is no more than 5 minimum wages, and everything above this amount is subject to restrictions.

The Law does not directly recognize the fact of a gift if:

- On behalf of a minor citizen, his guardian made a gift. This is how the machinations of unscrupulous guardians are protected at the legislative level;

- If, after a treatment course, a gift was made on behalf of the patient to a doctor, nurse, social worker caring during illness, then this directly falls under restrictive measures - the state is thus trying to stop corrupt officials;

- Employees of subordinate organizations accepted a bank deposit as a gift . cash payment for the provision of transport services or received a number of other acceptable services free of charge from a specific citizen;

- Cash . if they are received by an official in the public service.

But, if a citizen is in a high position, and, for example, it is his birthday, and his colleagues decided to give him a valuable gift, then its value cannot exceed three thousand rubles, and if it is nominally worth more, then such property goes to the state treasury .

Otherwise, they may be recognized as a bribe to an official. But at the same time, an ordinary gift in the form of a box of chocolates, which has nothing to do with the official’s position, is recognized as an ordinary act of goodwill.

The Civil Code does not clearly distinguish between a gift and a bribe . which leads to a contradiction with articles of the Criminal Law, in particular Art. 290-291, which directly indicate the moment of criminal liability for receiving expensive gifts.

Many practicing lawyers come to the conclusion that the dementia of civil law over criminal law needs significant correction, especially when it comes to commercial organizations.

A commercial structure has its own restrictive measures, which are regulated by Art. 576 Civil Code of the Russian Federation:

- The company cannot gift another legal entity (state or municipal entity) with property that is transferred to it under operational management and not as property;

- If there are no property rights to an immovable thing, then it cannot be transferred as a gift to another commercial organization.

Since legal acts contradict each other, you can interpret them in your favor and legally make a gift of almost any value.

Does civil law allow legal entities to make gifts?

Article 572 of the civil legislation of Russia allows the transfer of property as a gift to another organization, subject to complete gratuitousness, such things as:

- Buildings and structures and everything that falls under the definition of real estate;

- Industrial, commercial and other equipment;

- Vehicles;

- Money or valuable shares.

Although, according to civil law, a gift can be an item no more expensive than 3 thousand rubles, Tax norms do not introduce direct restrictive measures. Again there is inconsistency. And this may mean that you can give an item of any value.

But here, too, the legislator introduces restrictive measures: it is impossible to give as a gift:

- Military technical equipment and operational weapons;

- Property related to museum values;

- Mineral subsoil;

- Chemicals that pose a threat to the environment or human life.

If a vehicle was given free of charge, then in order to take ownership, they need to go through a registration process with the transfer of ownership of it.

Legal norms for gift transactions for legal entities

As can be concluded from the above, the donation procedure, as is customary between individuals, is prohibited by law between legal entities. But an organization can simply donate something to another company or municipality; this is not prohibited by law.

Of course, in some specific cases, donations to legal entities are also allowed; the value of the item cannot exceed five times the minimum wage. This is how the Law interprets it.

As for non-profit organizations that do not aim to make a profit from their activities, in this case the opportunities are much wider compared to commercial companies.

If the value of the gift exceeds the legal value of the gift, the gift transaction is formalized in writing, and if necessary, the transfer of ownership and control from one organization to another is registered on a general basis.

The gift agreement can provide for the following legal aspects:

- Transfer of property immediately after the parties sign the agreement;

- Transfer property after a certain time;

- When other legal facts occur.

There are also conditions under which the possibility of making such a transaction arises or disappears:

- The will of the donor alone is not enough; consent is required to accept the gift from the recipient;

- The recipient has the right not to accept the gift for any reasons known only to him;

- At the time of signing the contract, the donee may change the terms of the transfer, on the basis of which he may have the right to refuse to accept the thing;

- If the agreement stipulates the donor’s intention to transfer the thing, but he refuses to perform a legal or actual action, then the recipient has the right to apply to a judicial body to resolve the dispute for the protection of his property rights.

All contractual obligations must be formalized in a notary’s office; this state of affairs is prescribed in the current legislation.

Physics property in use

The relationship between an enterprise and individual individuals, for example its employees or founders, which are often the same thing, are so close that these individuals selflessly strive to help the enterprise in its economic activities. Although in fact this still promises such individuals certain preferences, formally the assistance may appear to be completely free of charge. It can be expressed, for example, in the provision by an individual of his property to an enterprise for temporary use without establishing any payment. On the one hand, this “good deed” looks natural, on the other hand, it is worth assessing whether it will have tax consequences.

Under an agreement for gratuitous use (loan agreement), one party (the lender) undertakes to transfer or transfers an item for gratuitous temporary use to the other party (the borrower), and the latter undertakes to return the item in the condition in which it received it, taking into account normal wear and tear or in the condition stipulated by the contract ( clause 1 of article 689 of the Civil Code of the Russian Federation ).

It should be taken into account that according to paragraph 2 of Art. 689 of the Civil Code of the Russian Federation, the rules on the lease agreement provided for in Art. 607, clause 1 and para. 1 item 2 art. 610, paragraphs 1 and 3 of Art. 615, paragraph 2 of Art. 621, paragraphs 1 and 3 of Art. 623 Civil Code of the Russian Federation .

When receiving property under a gratuitous use agreement, the organization acquires the right to use the specified property free of charge. In this regard, for profit tax purposes, receiving property for gratuitous use should be considered as gratuitous receipt of property rights ( letters of the Ministry of Finance of Russia dated 04/19/2010 No. 03-03-06/4/43 , dated 02/04/2008 No. 03-03-06/ 1/77 , dated 04/13/2007 No. 03-03-06/4/47 , Resolution of the FAS VBO dated 07/02/2008 No. A82-11801/2007-14 1, clause 2 of the Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 12/22/2005 No. 98 ).

Income in the form of gratuitously received property rights is subject to inclusion in non-operating income on the basis of clause 8 of Art. 250 Tax Code of the Russian Federation . True, with the gratuitous use of the property of individuals, determining this income has always been not so easy ( resolutions of the Federal Antimonopoly Service of Ukraine dated December 20, 2010 No. Ф09-10577/10-С3 , FAS Central District of August 3, 2011 No. A64-1458/2010 ): in in accordance with Art. 40 of the Tax Code of the Russian Federation it was necessary to use market prices for similar transactions, but for many reasons it is impossible to find information about them.

From 01/01/2012, when receiving property (work, services) free of charge, income assessment is carried out based on market prices determined taking into account the provisions of Art. 105.3 of the Tax Code of the Russian Federation, but not lower than calculated in accordance with Chapter. 25 of the Tax Code of the Russian Federation, residual value - for depreciable property and not less than the cost of production (purchase) - for other property (work performed, services rendered). Information on prices must be confirmed by the taxpayer - the recipient of the property (work, services) documented or by conducting an independent assessment.

The principle of calculating income when receiving property free of charge, which consists in its assessment based on market prices, determined taking into account the provisions of Art. 105.3 of the Tax Code of the Russian Federation , is also applicable when assessing property rights, including the right to use a thing.

According to paragraph 1 of this article, for tax purposes, prices used in transactions in which the parties are persons who are not recognized as interdependent, and income (profit, revenue) received by persons who are parties to such transactions are considered market prices. Of course, this sounds somewhat absurd in relation to gratuitous transactions, when the price is set equal to zero, but the practice of applying clause 1 of Art. 40 of the Tax Code of the Russian Federation , which contained a similar norm, did not lead to the recognition of such prices as non-market only on this basis.

In accordance with paragraph 2 of Art. 105.1 of the Tax Code of the Russian Federation, interdependent persons are recognized, in particular:

– an individual and an organization if such an individual directly and (or) indirectly participates in such an organization and the share of participation is more than 25%;

– an organization and a person (including an individual together with his interdependent persons specified in paragraph 11, paragraph 2, Article 105.1 of the Tax Code of the Russian Federation , that is, family members) who has the authority to appoint (elect) the sole executive body of this organization or to appointment (election) of at least 50% of the composition of the collegial executive body or board of directors (supervisory board) of this organization;

– organizations whose sole executive bodies or at least 50% of the composition of the collegial executive body or board of directors (supervisory board) of which are appointed or elected by decision of the same person (an individual together with his interdependent persons specified in paragraph 11, paragraph. 2 Article 105.1 of the Tax Code of the Russian Federation );

– organizations in which more than 50% of the collegial executive body or board of directors (supervisory board) are the same individuals together with interdependent persons specified in paragraphs. 11 clause 2 art. 105.1 Tax Code of the Russian Federation ;

– an organization and a person exercising the powers of its sole executive body;

– organizations in which the powers of the sole executive body are exercised by the same person;

– organizations and (or) individuals if the share of direct participation of each previous person in each subsequent organization is more than 50%;

– individuals if one is subordinate to another due to official position.

Thus, a taxpayer who receives property for gratuitous use under an agreement includes in non-operating income income in the form of a gratuitously received right to use property, determined on the basis of market prices for the rental of identical property, if the individual who is a party to this agreement for gratuitous use is interdependent face to face with the taxpayer.

True, this is most often the case: an individual who does not charge payment for the use of his property is interdependent with the borrowing enterprise. Transactions between interdependent persons are recognized as controlled, that is, the correctness of setting prices in them is checked by the tax authorities ( Clause 1 of Article 105.14 , Article 105.15 of the Tax Code of the Russian Federation ). But we must take into account some restrictions on recognizing transactions as controlled.

According to paragraph 2 of Art. 105.14 of the Tax Code of the Russian Federation , a transaction between interdependent persons, the place of registration, or the place of residence, or the place of tax residence of all parties and beneficiaries in which the Russian Federation is located, is recognized as controlled if at least one of the circumstances specified in this norm occurs. The situation we are considering may be affected by the following.

The amount of income from transactions between related parties for a calendar year should not exceed 3 billion rubles.2 The amount for a transaction for the gratuitous provision of property for use is large, practically unrealistic, no matter what market analogue is found for it. But the situation may change if there are other transactions, in addition to the one indicated, between the same persons, which in total exceed this limit.

Another circumstance in the presence of which the results of this transaction will become controllable is the application by the borrower organization of a special tax regime in the form of payment of Unified Agricultural Tax or UTII. At the same time, the individual lender may be an entrepreneur, but not using the same special regimes. The combination of this circumstance and a transaction for the gratuitous transfer of property for free use is quite realistic, but the amount of transactions between the relevant persons for a calendar year must exceed 100 million rubles.

There are a number of other circumstances for recognizing control transactions

money, but they also have a minimum limit on transaction amounts for this - 60 million rubles.3

As we can see, the likelihood that a transaction involving the transfer of property by an individual to an enterprise for free use will turn out to be controlled and income from it will have to be determined at market prices is not very high. But this possibility cannot be completely denied. In this regard, let us mention paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation , according to which, when determining the tax base, income in the form of property received free of charge from an individual is not taken into account if the authorized (joint) capital (fund) of the receiving party consists of more than 50% of the contribution (share) of this individual, despite to the obvious interdependence of the lender and the borrower. But often it is the founder who transfers property for free use, and it is possible that he is a party to other transactions with his enterprise. Is it possible to use this rule to avoid additional income tax?

Property received from the founder is not recognized as income for tax purposes only if, within one year from the date of its receipt, the specified property (except for cash) is not transferred to third parties.

From subclause 11, clause 1, art. 251 of the Tax Code of the Russian Federation it follows that at any time the transfer of property from only one of the founders can be exempt from taxation. If each of the founders’ share does not exceed 50% of the authorized capital, for this reason alone none of them can take advantage of this benefit.

However, in paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation refers to the gratuitous transfer of property and does not directly refer to the transfer for gratuitous use. Perhaps here we can use the position that has developed in relation to clause 8 of Art. 250 Tax Code of the Russian Federation ? That is, in this case, we could consider receiving property for free use as free receipt of property rights.

The Ministry of Finance in Letter dated February 13, 2009 No. 03-03-06/1/69 did not justify these hopes, for which it has reasons. Officials recalled that in accordance with paragraph 2 of Art. 38 of the Tax Code of the Russian Federation, property for tax purposes means types of objects of civil rights (with the exception of property rights) related to property in accordance with the Civil Code of the Russian Federation.

Further, the Ministry of Finance concluded that the concepts of “property” and “property rights” are subject to application for the purpose of taxing the profits of organizations in the meaning in which they are used in the civil legislation of the Russian Federation, taking into account the provisions of Art. 38 of the Tax Code of the Russian Federation (see also Letter of the Ministry of Finance of Russia dated December 24, 2007 No. 03-11-04/3/513 ).

But judges can think the same way! As an example, let us cite the Resolution of the FAS VSO dated March 31, 2009 No. A33-4100/08-F02-1119/09 4. The position of the arbitrators boils down to the fact that in paragraph 8 of Art. 250 of the Tax Code of the Russian Federation talks about the accrual of non-operating income when receiving property rights free of charge, and in paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation there is no such clause regarding tax exemption. This rule applies to the transfer of property, but not property rights (see also Resolution of the Federal Antimonopoly Service of the North Caucasus Region dated March 17, 2008 No. F08-1152/08-409A ).

Since 01/01/2012, an individual provides the enterprise of which he is the founder (80% share) with a warehouse for free use. This person is an individual entrepreneur and, before concluding an agreement on free use, provided a warehouse for rent to the enterprise for 200,000 rubles. per month. Let's consider two options. In one of them, no transactions were made between an enterprise and an individual during 2012, except for the provision of a warehouse for free use. In another version, this entrepreneur is a regular supplier of the enterprise and during 2012 he supplied it with products worth 110 million rubles. The enterprise is a payer of UTII; accordingly, it uses the warehouse only within the framework of this activity, as well as the products received from the founding entrepreneur.

In the first case, despite the interdependence, the transaction between an individual and an entrepreneur will not be recognized as controlled. Even if we recalculate its amount at the price at which the warehouse was leased, considering it market value, for the year it will amount to 2,400,000 rubles, which is much lower than the minimum level after which the transaction can be checked for controllability.

In the second case, there are grounds for recognizing the transaction as controlled, since it complies with paragraphs. 3 p. 2 art. 105.14 Tax Code of the Russian Federation . The amount of transactions between related parties exceeded 60 million rubles. per year, while one of the parties applies a special regime in the form of payment of UTII. The tax office can prove that the “zero” value of the transaction is non-market. In this case, the amount of income tax from this transaction will be 480,000 rubles. (RUB 2,400,000 x 20%).

_________________________

- By ruling of the Supreme Arbitration Court of the Russian Federation dated September 22, 2008 No. 11458/08, the transfer of this case to the Presidium of the Supreme Arbitration Court for review in the order of supervision was refused.

- This amount of income is established only for 2012. Further it will decrease and amount to 2 billion rubles in 2013, and 1 billion rubles in 2014. (clause 3 of article 4 of the Federal Law of July 18, 2011 No. 227-FZ).

- Read more about recognizing transactions as controlled in the article by S. N. Zaitseva “On the principles of determining prices for tax purposes: first questions,” No. 3, 2012.

- By decision of the Supreme Arbitration Court of the Russian Federation dated August 12, 2009 No. VAS-9885/09, the transfer of this case to the Presidium of the Supreme Arbitration Court for review in the order of supervision was refused.

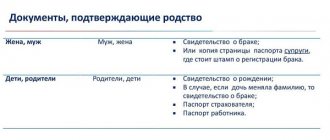

What documents can a notary request?

Each specific case requires its own documentation package, but there is a general order and list:

- Packages of constituent documents of both organizations participating in the transaction;

- Confirmation of tax registration;

- Grounds for carrying out notarial registration for specific persons with a list of their powers (powers of attorney from heads of organizations);

- Identity cards of representatives;

- The basis for the transaction is a certificate of ownership of the transferred property.

How is a transaction properly executed and registered?

A gift that exceeds the minimum permissible value . transferable only under a written agreement. It is possible to formalize the transfer without these formalities, but then the legal consequences that are permissible for legal claims for each party to the transaction in the event of disagreements cannot occur.

- Mutual agreement is reached on the list of property to be donated;

- The owner of the property prepares a package of documentation to formalize the transaction: grounds for ownership and disposal of property;

- A request is submitted to the notary's office to certify the gift agreement;

- Both parties come to the notary’s office on the appointed day and get acquainted with the agreement;

- If both parties have agreed that one transfers and the other accepts property, they sign the contractual obligations, which are approved by a notary in the presence of both parties.

But the transfer of ownership and disposal rights is subject to state registration; without this condition it will not have legal force . Registration takes place according to general rules within the time limits established by law, and only after this significant fact is it fully recognized as the property of the donee.

What taxes are imposed on the gratuitous transfer of property?

The taxable base of property payments to the state treasury directly depends on what tax system is used by legal entities.

For example, under the general tax system, the donor will have to pay value added tax, since, based on the principle of taxation, a gift is regarded as a sale of property. At the same time, the donee will be accrued the tax base for non-operating income received on the basis of Art. 250 Tax Legislation.

But there is also a special type of tax assessment . its validity lies in the fact that both companies belong to the same legal entity, for example, one of them is a branch or separate division of the same organization.

When making a gift in this case, there is no tax accrual for either one or the other organization if the parent company owns half the amount of the authorized capital investment of the other company.

Accounting for gratuitous transfer of property between legal entities

Since there is a decrease in the asset of the enterprise, these operations are carried out as expense items, in accordance with the accepted accounting policy of the enterprise.

For the company to whom the gift is intended, this fact is regarded as an increase in assets . and the cost is determined individually based on the approximate cost of similar property on the market.

To the result obtained are added the costs of transportation, unloading and finishing the property to a state of possible use.

From here, postings are possible: in account 08, in line market value, in account 98, information about gratuitousness is entered, and for expenses incurred, in account 60, accounting data on expenses is entered.

Accounting for gratuitous transfers in accounting

The gratuitous acceptance of the property of a legal entity must necessarily be reflected in the accounting documentation.

The transferred item is accepted as a fixed asset at its original cost. The initial cost is defined as the market value on the day of acceptance for accounting, including the amounts spent on delivery of the asset, its registration, bringing it into a condition suitable for use, and other costs.

The following entries must be made:

- enter the value of assets in debit 08, account 98 “Gratuitous receipts”;

- expenses spent on their acceptance, according to debit 08, account 60 “Related expenses”.

Types of gratuitously transferred property and sample agreement

Such an agreement is essentially very close to an agreement of gift or donation, unless any compensation for the property is agreed upon, immediately after signing the document or in the future. It must be in a form that complies with the requirements of the law and must contain the clear intention of the property owner.

Transfer without the requirement of compensation is possible for both individuals and legal entities, provided that the latter are not a commercial organization and will not use the gift for commercial purposes. You can transfer:

- cash;

- movable property;

- real estate.

Such an agreement is drawn up according to the following template:

- Place of preparation of the document;

- Parties involved in the transfer of property;

- Subject of the agreement (indicate the document that confirms the owner’s ownership, mention his desire to transfer it to a certain person; the recipient assures that he accepts the gift with a feeling of gratitude and will use it for its intended purpose);

- The conditions under which the received values are used;

- Reasons why a recipient may refuse to accept property given to him without payment until the property has actually been transferred to his disposal (if the recipient decides to refuse the gift, this must be done in writing; then the contract is considered terminated).

These are the main features of drawing up a contract of this type. The contract should also include the following standard sections: force majeure, procedure for resolving controversial issues, signatures.

This sample is suitable if the owner has decided to transfer property free of charge with ownership rights.

Gift agreements with the participation of individual entrepreneurs

Transactions whose subject is the transfer of property free of charge in favor of individual entrepreneurs are quite specific. The peculiarity of the corresponding type of legal relationship is that an individual entrepreneur, on the one hand, is not a legal entity. Accordingly, the rule according to which the organization’s property received as a gift must be included in non-operating income may be considered irrelevant for entrepreneurs. On the other hand, for an individual entrepreneur, surprisingly, it might be more profitable to formalize the relevant transaction precisely as a subject of commercial legal relations. Why?

From the point of view of the Tax Code of the Russian Federation, individual entrepreneurs must pay the state, in general, the same types of taxes as a legal entity. That is, it could be an income tax (under the general fee regime) or a transfer of funds within the framework of a “simplified tax regime”. In many cases, the amount of the corresponding fees is lower than the personal income tax, which is 13%. This is exactly the tax rate if an individual receives something as a gift from non-relatives. Obviously, if an individual entrepreneur accepts property free of charge, then it is probably more profitable for him to do this as a subject of commercial legal relations, provided that he and the donor are not relatives.

Agreement on the transfer of property for free use

The transfer of property for free use is different from the transfer of property as a gift. Drawing up an agreement for the gratuitous use of property gives the recipient the opportunity to use the property for some time under certain conditions, but not to dispose of it as his own property.

Such an agreement can be considered a loan agreement, which is regulated by Chapter. 36 Civil Code of the Russian Federation. Its text is compiled according to the following template:

- 1. Data of the parties to the agreement.

For individuals, you must indicate your full name. and passport details; legal entities should indicate the full name of the enterprise, personal data of its representatives, positions, information about the power of attorney, which gives the right to sign.

- 2. The property that is the subject of the contract, its detailed inventory.

The text of the document contains the data of the document on the basis of which the property is transferred, and indicates the persons who can lay claim to it.

- 3. The purpose for which the property is transferred.

The owner is obliged to transfer the property in the condition described in the contract; the recipient must take care to maintain proper technical condition, provide the opportunity to inspect the property within the specified time frame and return it in good condition.

- 5. The value of the property, confirmed by documents: a certificate of book value, an appraiser’s conclusion, a certificate from the manufacturer.

- 6. Payment of costs for the maintenance and use of property. Here it is necessary to set out in detail the responsibilities assigned to the temporary owner (for example, in connection with consumables).

- 7. Responsibility of the parties.

The terms of the transfer, the risk and compensation for losses, the responsibility of the recipient in the event of loss or harm to third parties, the reasons and procedure for early termination of the contract are indicated.

- 8. Additional terms of transfer.

Design features, timing

It is possible to conclude an agreement both for a specific period and without specifying a specific date. When the terms are not determined, the contract is extended automatically. It is enough for the receiving party to continue to use the transferred object, observing other conditions specified in the document. You just need to get the lender’s consent to the extension. In this case, an open-ended contract must necessarily contain conditions for its termination. It must clearly state the cases when the transferring party may demand the return of its property, and the period for notifying the borrower in advance of its intentions. The usual period for such notice, established by the Civil Code, is one month.

The transferring party can terminate the contract early if the borrower uses the received property differently from what was agreed, does not maintain it in proper condition, which causes the characteristics of the property to deteriorate, or transfers it to someone else without obtaining the owner’s consent.

The reasons for termination of the contract at the initiative of the receiving party may be, firstly, defects in the property that were discovered during use, but were not mentioned in the contract. Secondly, justified claims of third parties for ownership of the object of the transaction, about which the borrower was also not informed. And, finally, failure by the lender to transfer the object itself or documents related to it may make it somewhat difficult to use it and is also a reason for termination.

The agreement can also be terminated in the event of the death of the borrower, if this is an individual, or the liquidation of the organization. Then the property returns to the owner's possession. If the lender no longer exists, the agreement continues to be in force, but all rights and obligations of the transferring party pass to the heirs.

It is important to remember that all reasons for termination must be clearly reflected in the contract.

Free use of municipal property

Municipal property can be transferred for free use to legal entities and individuals, if we are not talking about commercial activities. To obtain this opportunity, the interested person must submit an application to the municipal authorities.

The response must be given within 30 days from the date of filing the application. If the answer is yes, the parties can enter into an agreement on the transfer of municipal property for temporary free use. The transfer of municipal property is confirmed by an act of acceptance and transfer.

Most often, such an agreement involves renting any premises owned by municipal authorities without providing payment. The contract must detail all the rules for using the premises in order to avoid conflict situations and indicate the rental period. After this period, the premises are returned to the owner.

A correctly drafted agreement for the gratuitous transfer of property takes into account all the nuances and allows the parties to conscientiously fulfill their obligations regarding the subject of the agreement, be it movable or immovable property.

Registration under the contract

The transfer of property between legal entities must be registered by contract. The law provides for this purpose two forms of drawing up such a document.

- Donation agreement. It is concluded if the provision of property does not require any reciprocal obligations. The recipient company thus receives income in the amount of the value of the property it received free of charge if it were sold. The donor incurs the expense.

Regarding taxation, such an agreement provides for the donor to receive profit, which implies tax. The amount of the tax base is calculated based on the market price, but should not be less than the residual value shown in the donor’s accounting department.

The transaction is completed by issuing a transfer and acceptance certificate.

Agreement for free use (loan). According to this form of transfer, assets are transferred free of charge, but with the condition of their return in the same form, naturally, taking into account the provided depreciation. At the same time, it is not necessary to stipulate the transfer period in the contract; it can be considered valid until the liquidation of the organization or for life. Formally, the recipient does not take ownership of the transferred property, but in fact can use it as his own.

Documents required for registration

When going to a notary to conclude one of these types of contracts, representatives of organizations need to prepare the following documents:

- statement from the donor (the lawyer will tell you how to draw it up correctly);

- registration documents of both companies;

- papers confirming the authority of persons to enter into contracts on behalf of the company;

- identity cards of authorized representatives;

- title documents for the donated property.

ATTENTION! Check the list of documents that will be needed in your particular case: the list may differ from one notary to another, and for some categories of gifts, special papers are sometimes required.

How does the deal happen?

Even if there is no fee involved in the transfer of certain assets, this operation is legally a transaction. Its registration takes place in the presence of a notary according to the following procedure.

- The process of agreeing on the transfer of part of the property between companies (their representatives).

- The donating company documents the ownership of assets transferred to another legal entity.

- Drafting a statement from the company making the gift declaring this intent.

- Drawing up an agreement on a gift or gratuitous transfer (loan).

- Certification of the contract by a notary in the presence of representatives of both legal entities.

- State registration of the agreement in the local Office of the Federal Registration Service.

Agreement on the gratuitous transfer of property under the Civil Code of the Russian Federation

A loan agreement is a legal agreement that stipulates the rules for the owner to provide property to another person - the recipient of property for free. It is regulated by Chapter 36 of the Civil Code of the Russian Federation and has the following mandatory features:

- There is no fee for the provided property;

- The borrower is not required to take retaliatory steps;

- The transaction is temporary or indefinite;

- The borrower has no right to transfer the rights of use to another person.

At its core, it is similar to a lease and loan agreement, so it is important to know their main differences:

- According to Chapter 34 of the Civil Code, rent. In addition, the tenant must carry out only current repairs, while the recipient assumes obligations for both current and major repairs. There may be an exception if the agreement provides for another option.

- Chapter 32 of the Civil Code states that when provided for free use, a change of owner occurs, that is, the time period is not clearly defined, and the same object of ownership is subject to return.

- The loan is regulated by Chapter 42 of the Civil Code. It states that in return the borrower can return the money or real estate.

The required information to be provided is as follows:

- Data of the lender and borrower;

- Information about the donated object;

- The purpose of the action;

- Duties and responsibilities of the parties to the transaction;

- Cost assessment and documentary confirmation of the object;

- Costs of the borrower for repairs and maintenance;

- Additional terms;

- Signatures.

This agreement can be drawn up for different purposes, between parties of different types, and accordingly the samples will vary.

agreement for the gratuitous transfer of property

Agreement on gratuitous transfer of property between legal entities - sample

In business, it often happens that the provision of goods without payment is carried out with the participation of legal entities. At the same time, according to Art. 575 of the Civil Code of the Russian Federation, the gift of property between legal entities is prohibited by law. The transfer of gifts in this case is possible, but these can be gifts worth no more than 3 thousand rubles.

If one of the parties is a legal entity and the other is an individual, a free transfer of property agreement can be concluded without restrictions on value. A sample loan agreement between participants, one of which is an organization, must contain the obligations of the parties for repairs.

Download the agreement for the gratuitous transfer of property between legal entities

Agreement on gratuitous transfer of property into municipal ownership - sample

The transfer of any object to municipal ownership can be carried out both from federal property, as well as by a legal entity and an individual. However, this procedure does not require the consent of the municipality. The presented process is carried out in accordance with the provisions of the law.

In the case of gratuitous transfer of an object for use to a separate municipality, it is necessary to draw up an appropriate agreement. The contents of the document must reflect all the information as in the standard form of the act.

Download the agreement on the gratuitous transfer of property into municipal ownership

Agreement on the gratuitous transfer of property to a budgetary institution - sample

Providing real estate or other type of property without charging a fee to a budget organization is becoming quite popular. In this case, the owner acts as a lender, and the budgetary institution as a borrower in accordance with Article 288 of the Civil Code of the Russian Federation.

A sample of this document contains the same clauses as the standard form of agreement for the provision of property for free. If the property is real estate, the budgetary institution must be provided with all the necessary documents for the property. The presented sample complies with all the rules, but it is necessary to note key points specific to this case.

agreement for the gratuitous transfer of property to a budgetary institution

Agreement for the gratuitous transfer of property for charity - sample

Many large organizations provide assistance to certain categories of citizens in need. This procedure must be fixed on paper; the procedure for carrying out such activities is regulated by federal legislation.

Such a document can be concluded both between legal entities and between individuals, and its feature is the tax exemption of the receiving party and the expenditure of funds for strictly limited purposes.

The list of categories of items that can be donated for charitable purposes is strictly limited. However, you should know that real estate is included in this list. In this case, it is necessary to draw up an appropriate agreement between the parties to the transaction. The form of such an agreement is not strictly regulated and may be subject to change by the parties. You just need to remember to check the sample document by an experienced lawyer.

agreements for the gratuitous transfer of property for charity

Donation is the prerogative of the non-profit sector

First of all, it can be noted that an agreement on the gratuitous transfer of property as part of a gift implies that the owner of the property directly transfers to the recipient the thing, the property right associated with it, or some kind of concession (for example, forgiveness of a debt). In turn, when drawing up an agreement, the subject of which is a donation, the basis of the relevant transaction can only be a thing or a property right to it. Providing concessions or other preferences within the framework of such a legal category as a donation, as lawyers note, cannot be carried out.

That is, in cases where state or municipal property is transferred, the credit aspect between the subjects of legal relations (which, theoretically, can be traced in the format of budget loans) should not be affected.

Also, differences can be traced in such a nuance as the status of the recipient of property within the framework of a gratuitous transfer. As a rule, when concluding a donation agreement, the circle of persons in whose favor the assets are transferred is much narrower than in the case of a gift. The main subjects of legal relations within the framework of donations, as the party receiving the property, are recognized, in accordance with the law, as non-profit organizations. Including state institutions, in whose favor state property can, as an option, be transferred. Thus, in general, a donation cannot be made to a commercial structure.

Agreement on the transfer of property for free temporary use - sample

Quite often, the owner fears and doubts that the receiving party will return the transferred object honestly and on time. In this case, you can protect yourself by drawing up an agreement for free temporary use.

This document can be compiled in two ways:

- Use the standard agreement form, indicating only the return period. This method will cost you less than a visit to a notary;

- Drawing up an agreement with a notary. This method is used when the cost of the item is high. The downside is the simultaneous presence of the parties at the notary and the cost of specialist assistance.

In the case of a temporary transfer of property, in addition to basic data, it is necessary to indicate the terms, rights and obligations of the parties, possible fines for damage to the item and for delay. After the transaction is completed, a transfer and acceptance certificate is signed. Both documents are drawn up in several copies and remain with the participants.

agreement on the transfer of property for free temporary use

About the pros and cons

A correctly concluded agreement for the gratuitous use of property can be beneficial to both parties to the transaction. The document specifies the rights and obligations of each party, which eliminates the emergence of disagreements and prevents the risk of fraud.

By accepting the property for use, the borrower undertakes to pay bills and maintain the property in acceptable technical condition. This is beneficial to the owner, who no longer has to bear material costs by paying for utilities, repairs, etc. However, he does not claim to receive benefits for rent, since the property is transferred for use free of charge.

The disadvantages of a contract most often arise when it is drafted incorrectly. One of the parties may use gaps in the document to gain advantage. In addition, it is possible that third parties will appear and challenge the transaction at the most inopportune moment.

Agreement on the transfer of property for free, perpetual use - sample

The preparation of a document on the provision of free, unlimited use is regulated by Art. 689 of the Civil Code of the Russian Federation. In this case, the document indicates that the user receives the right to use the property indefinitely. This document is drawn up according to a sample or in any form. The most important thing is that it be certified by signatures on both sides. If the participants in the action have a desire, it can be notarized.

In some cases, both parties may refuse the agreement. These cases are described in Art. 699 Civil Code of the Russian Federation. In this case, the party wishing to terminate the agreement must notify of its intention no later than 1 month.

agreement on the transfer of property for free, perpetual use

When concluding any transaction between the parties, especially when it comes to property, the law requires that such a procedure be formalized. To do this, the agreement must be drawn up in writing and notarized. Such a process will ensure the preservation of the interests of each party.

Contractual agreement for the transfer of property for indefinite free use

This agreement is regulated by the Russian Civil Code, Article No. 689. This document states that the party to the transaction who received property assets as a gift has the right to use them indefinitely. It is possible to draw up an agreement not only in the proposed form, but also in any form. In this case, the main condition is the signatures of the participants, as well as, if they wish, notarization.

The Civil Code (Article No. 699) provides for situations in which parties to a transaction may refuse a contractual agreement. The party that has expressed a desire to terminate the transaction is obliged to inform about this intention in advance (at least a month in advance).

Important! When drafting any contract, especially one involving real estate, federal law requires a formal process. That is, any agreements must be drawn up in writing and certified by a notary in order for the document to have legal force. This is a guarantee of protecting the interests of both parties to the agreement.

Agreement on gratuitous transfer (donation) of material assets

Agreement on gratuitous transfer (donation) of material assets

[enter as required] [date, month, year]

[Full name of the legal entity], hereinafter referred to as “Donor”, represented by [position of manager, full name], acting on the basis of [specify document certifying authority], on the one hand, and [F. I.O./full name of the citizen, medical, educational institution, social security institution and other similar institution, charitable, scientific and educational institution, foundation, museum and other cultural institution, public and religious organization, other non-profit organization to which material assets are transferred ], represented by [position of manager, full name], acting on the basis of [insert document certifying authority], hereinafter referred to as the “Done”, on the other hand, collectively referred to as the “Parties”, have entered into this agreement as follows:

1. Under this agreement, the Donor undertakes, before [date, month, year], to transfer free of charge into the ownership of the Donee the material assets, list, units of measurement, quantity and cost of which are indicated in the specification attached to this agreement and which is an integral part of it.

2. The total cost of material assets to be transferred is [value] rubles.

3. Material assets are transferred to the Done for their use in [describe the use of this property for a specific purpose, for a specific generally useful purpose].

4. The transfer of material assets to the Donee is formalized by a transfer and acceptance certificate, which is signed by representatives of the Parties.

5. Rights to material assets subject to transfer under this agreement pass to the Donee after signing the transfer and acceptance certificate.

6. The donee accepts the donation and undertakes to use it in accordance with the purposes and conditions specified in clause 3 of this Agreement.

7. If it is impossible to fulfill the obligation to use donated material assets in accordance with the instructions of the Donor due to changed circumstances, the donated material assets may be used for another purpose with the written consent of the Donor. In case of [death of a citizen-donor/liquidation of a legal entity] - by court decision.

8. The use of donated material assets not in accordance with the purpose specified by the Donor or a change in this purpose in violation of clause 3 of the agreement gives the right to the Donor, his heirs or another legal successor to demand cancellation of the donation.

9. This agreement comes into force from the moment it is signed and is valid until the parties fully fulfill their obligations.

10. Changes and additions to the agreement are made in writing and signed by the Parties.

11. In all other respects that are not provided for in this agreement, the Parties are guided by the legislation of the Russian Federation.

12. This agreement is concluded between the Parties in two copies having equal legal force, one for each Party.

13. Addresses, details and signatures of the Parties.

[fill in as needed] [fill in as needed]

[fill in as needed] [fill in as needed]

When is the gratuitous transfer of property assets subject to taxation?

Current legislation provides for VAT on the gratuitous transfer of property. According to the Russian Tax Code (Article No. 248, paragraph 2), material assets and rights that are transferred by the owner to another person without any reciprocal obligations are considered to be received free of charge. Tax is calculated and paid accordingly only if there is a tax base. For the purpose of taxation and payment of taxes under the simplified tax system, the gratuitous transfer of property assets is considered a sale (TC, Article No. 39, clause 1). This means that the owner of the gratuitously transferred property must pay tax on its value.

VAT is charged in the case of gratuitous transfer of material assets directly during this procedure (TC, Article No. 167, clause 1). The date of transfer of material assets is the date of creation of primary documentation, namely:

- date of issue of the invoice - if the goods are transferred;

- date of signing the acceptance certificate - if work is completed, services are provided.

The tax base is established in accordance with the market value of the provided movable/immovable property at the time of execution of this procedure (TC, Article No. 105.3, paragraph 3, Article No. 154, paragraph 2). The tax rate in the case of gratuitous transfer of material assets corresponds to the rate provided for each specific product, service or work performed.

The price of gratuitously transferred property, any services, and the established tax rate are displayed in the invoice. In the process of transferring material assets, a document is posted in the sales book (Resolution of the Russian Government No. 1137, paragraphs 1, 3 of December 26, 2011 “On the rules for maintaining the sales book”).

Input tax on the gratuitous receipt of items of property, paid to suppliers, is taken as a deduction when calculating and paying VAT (Tax Code, Article No. 171, clause 2, clause 1).