What is included in travel expenses?

As a rule, a business trip is an initiative of the employer and therefore must be fully provided for by him.

The manager is obliged to retain his subordinate’s workplace and compensate for all incurred costs associated with travel and work in another city.

The director's responsibilities include:

- pay wages (the amount is calculated for all subsequent days of stay and work outside the company’s territory, including time spent on travel);

- pay for accommodation, meals and other additional services for the entire period of stay in another city;

- pay daily allowances (the employee’s income is recalculated taking into account the increase in pay);

- compensate for other costs associated with work processes (travel, translation services, restaurant services, etc.).

Important! Payment of travel expenses does not include payment for housing and an increase in daily earnings in the event that the employee can return to his home at the end of his work.

How to calculate business trip days for which you need to pay daily allowance

Regardless of the time of departure of the employee on official business, this day is considered a full day.

When an employee returns after 12 o’clock at night, the employer does not have the right to demand that he appear in the office in the morning of the same day: the person is documented to continue to be on a business trip. Read also: Signs of business fragmentation

To calculate daily allowances, an accountant in an organization studies transport tickets and the time of arrival and departure, after which he records the exact number of days of stay on a business trip, draws up a report and determines the amount of compensation. The calculation is made by multiplying the number of days by the daily allowance limit established by management.

Payment of expenses associated with a business trip

According to the standards specified in Article 168 of the Labor Code of the Russian Federation, the employer must pay all expenses associated with travel and stay in another city.

For this purpose, a special travel invoice is drawn up, which lists in detail all possible expenses allowed by the company. For example, the document may indicate that the employer undertakes to pay for the travel of his subordinate after the fact, but the employee can only use a certain type of transport or the cost of the ticket should not exceed the permissible amount.

Thanks to the restrictions set, the employee will not be able to take advantage of the situation and book a luxury ticket to “splurge” on the road, and the employer, in turn, will be able to save money and avoid unexpected expenses.

Video educational program on calculating travel allowances and daily allowances

Consultation, which includes not only detailed instructions on calculating daily allowances, but also on the correct determination of the duration of a business trip and hourly calculations. We also examine in detail the special cases that an accountant encounters when making calculations.

If you want to establish travel allowances and average earnings for an employee during this period, you need to correctly determine the estimated period, after which you can use a simple calculation formula. After completing the business trip, all related papers must be handed over to the accountant.

What documents are needed?

No matter how much the manager tries to calculate all possible expenses and predict the final amount, this is simply impossible to achieve, and therefore upon arrival the subordinate is obliged to submit a report with checks and receipts; in case of excess expenses, the director is obliged to compensate.

Attention! Payment of travel allowances does not have exact terms, but, as a rule, it is divided into two parts: advance payment and payment upon delivery.

To receive funds you must submit the following documents:

- travel: tickets (plane, train, bus), cash register receipts (taxi), documents confirming the use of a personal car (if the trip is made by personal transport);

- premises: cash register receipt and invoice (hotel), lease agreement (rented housing), document confirming payment for the services of the real estate company;

- additional expenses: checks for storing things, food, account replenishment (if you need to make calls abroad) and many other types of expenses related to work issues.

Taxation of personal income tax

Another important criterion that is taken into account when entering allowable expenses from a company is personal income tax and insurance premiums. They can either increase overall consumption or significantly reduce it.

So, according to Art. 217 of the Tax Code of the Russian Federation, Article 20 of Federal Law No. 125 and Article 9 of Federal Law No. 212, payment of the following travel expenses is not taxed:

- purchasing tickets for travel to and from a designated destination;

- payment for airport services and other fees;

- payment for taxi services throughout the business trip;

- funds spent on luggage transportation;

- payment of funds for renting a hotel room or other type of housing;

- payment for replenishment of a mobile account or other method of communication;

- means for registration and obtaining a passport and visa;

- payment for services for exchanging currency or a check at a bank branch.

This list is complete. All other types of services, such as payment for parking or dinner, must be paid taking into account the costs of personal income tax and other contributions.

Attention! Exemption from taxes is possible only if the funds spent have documentary evidence. In the absence of checks and receipts, the employer is obliged to pay personal income tax for the entire amount.

As for housing, if there are no documents, the employer must pay the insurance in full, and personal income tax in the amount of 700 rubles. (in the country), 2500 rub. (when traveling abroad).

There are often situations during which a detailed study of the provided checks for accommodation and housing is carried out, as a result of which it turns out that they are still subject to taxation by the state.

Daily allowance for business trips

According to Article 167 of the Labor Code of the Russian Federation, the procedure for paying cash expenses on a business trip is regulated by a collective agreement.

Most often, the document is presented in the form of an order of the same name. Most businesses do not exceed the limit established in the Tax Code, although this is not a violation of the law. The employer retains the right to either reduce or increase the amount of cash payments.

Article 167 of the Labor Code of the Russian Federation “Guarantees when sending employees on business trips”

Daily allowance for business trips in Russia

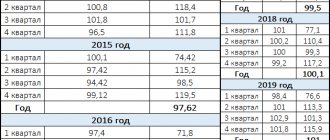

The minimum amount is not established; the maximum often does not exceed 700 rubles. The procedure and amount of payments must be found out at the place of work in the regulations on business trips.

Daily allowance for business trips abroad

The amount of monetary compensation for trips to foreign countries is regulated by the internal regulations of the organization.

In addition to the main provisions, the payment of daily allowance on a business trip varies taking into account Resolution No. 812, which reflects the amount of payments depending on the location of the employee. In private organizations this document may not be taken into account; in budget companies it is mandatory.

Decree of the Government of the Russian Federation dated December 26, 2005 No. 812 “On the amount and procedure for payment of daily allowances in foreign currency and allowances to daily allowances in foreign currency during business trips on the territory of foreign states to employees who have entered into an employment contract to work in federal government bodies, employees of state extra-budgetary funds of the Russian Federation, federal government agencies"

To CIS countries

When an employee is sent on a business trip to one of the CIS countries, the head of the company, when calculating daily allowances, must rely on the provisions for trips abroad.

Important! When crossing the country's border, stamps are not affixed to the international passport. This feature is regulated by Customs legislation.

The employee retains travel tickets as documents confirming his stay on a business trip abroad.

Read also: Compensation for delayed wages

Trip at the expense of the host party

According to the norms, daily allowances for business trips for the 2019-1010 year are paid by the employer sending the employee on the trip.

Payment by the host party is possible upon preliminary conclusion of a written agreement, which stipulates the organization paying for the employee’s stay on a business trip. In budgetary organizations, the limit is limited: the amount of daily allowance should not exceed the norms specified in the legislation.

Two trips in one day

If it is necessary to send an employee several times a day to different places, you must rely on the Business Travel Regulations. The amount of daily allowance will depend on the place of arrival.

For two trips in one day, the employer retains the right to establish other payments to the employee as compensation for expenses.

In case of early termination of the trip

When an employee returns from a business trip ahead of schedule, the company issues an advance report indicating the date of arrival.

After receiving the report, specialists in the economic department of the organization recalculate the daily allowance. Excess funds are returned to the company's budget.

Work on weekends

When an employee is on a business trip, daily allowances are paid for each calendar day, regardless of whether he was working or had a day off.

Important! The right to receive daily allowances on weekends and holidays is reflected in clause 11 of Decree of the Government of the Russian Federation No. 749 of October 13, 2009.

Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 “On the specifics of sending employees on business trips” (together with the “Regulation on the specifics of sending employees on business trips”

Daily allowance for one-day business trips

There is no minimum duration of a business trip. The employer has the right to send an employee for one day. In this case, documenting a multi-day business trip is impossible, and in accordance with the law, daily allowances for one-day business trips are not required. Depending on the organization, compensation for monetary costs may be possible.

Payments for one-day business trips instead of daily allowances

At the discretion of the manager, the employee receives compensation in the amount of 50% of the generally established amount when traveling abroad. A one-day business trip within the territory of Russia is not paid if the organization has not reimbursed the expenditure of funds on a voluntary basis.

Personal income tax on daily allowances for one-day business trips

Each situation with the taxation of daily allowances for business trips for one day is considered individually.

According to the Ministry of Finance of the Russian Federation, only those expenses that have documentary evidence are not subject to personal income tax. Daily allowances that do not exceed the limit of 700 rubles in Russia and 2,500 rubles when traveling abroad are exempt from tax.

According to the Supreme Arbitration Court of the Russian Federation, the definition of “daily allowance” is not applicable to one-day business trips, therefore cash should be recognized as one of the forms of compensation for expenses related to official activities. Therefore, expenses made with the permission of management are not employee income and therefore cannot be subject to personal income tax.