Sooner or later, every company manager happens to fire an employee due to circumstances beyond the control of the parties. We are talking about the death of an officially employed employee. This procedure is not complicated, but it requires certain knowledge from personnel department employees, accounting departments and the manager himself. We have tried to collect the most complete and up-to-date information on this issue and now we will try to present it as accessible as possible.

Options for employee death

The Labor Code of the Russian Federation clearly defines the algorithm of actions in such situations. When completing all the necessary documents, you must refer to Article 83 “ Dismissal due to the death of an employee ”, Part 1 of the Labor Code of the Russian Federation.

And yet, before we talk in detail about the stages of dismissal, we suggest that you familiarize yourself with all possible situations of death.

- An employee dies not at work, but in his free time (at home, on vacation, etc.);

- An employee dies at work or on a business trip while fulfilling official obligations.

If the event occurs during non-working hours , then the cause of death is determined without the participation of the enterprise management. In this case, the relatives, after receiving the death certificate, bring it to the place of work of the deceased, where the standard procedure for dismissing the deceased is carried out, in accordance with the Labor Code of the Russian Federation.

If the death occurred at work , then in any case an investigation of the accident is ordered, during which they can confirm the non-involvement of the manager, or bring him to justice.

The death of an employee on a business trip is the most difficult case, in which an investigation is also ordered to establish under what circumstances the employee died (during working or free time).

Based on its results, the manager may be required to pay monetary compensation to the family of the deceased.

What injuries are considered work-related?

The law has a strict classification.

An injury is not considered work-related if it was received in the following situations:

- The employee committed criminal acts or omissions. The classification can be determined by law enforcement officials.

- The person was intoxicated or poisoned. However, an injury in the workplace will be recognized as non-industrial only if the occurrence of the condition was not influenced by the processes occurring in the organization during the manufacture of products.

- Death was caused by a general illness.

- The employee attempted suicide.

All of the above facts must be confirmed by medical experts, bodies of inquiry, investigation and court in the manner prescribed by law. The above cases should also be considered by a specially created commission. She is investigating the situation.

Video

Grounds for dismissal

The regulatory documents clearly state that a manager cannot independently dismiss an employee without documents confirming the person’s death. These are:

- Death certificate from the registry office;

- A court decision in which a citizen is declared dead;

- A court decision in which a citizen is declared missing.

If relatives call the company and verbally convey the sad news, or the police report the incident, the manager does not have the right to terminate the employment relationship with the employee without the presence of the above documents. This also applies to certificates from medical institutions.

Relatives can provide a death certificate. If there are none, then the employer can independently contact the registry office to obtain a certificate.

A person is declared dead by a court decision if:

- law enforcement agencies have a statement from relatives that they do not know anything about the whereabouts of the citizen for 1 year;

- there is no information about the citizen at the place of residence or registration for more than 5 years;

- a person found himself in conditions that threatened his life. In this case, by a court decision, the person is declared dead after six months.

You can appeal this decision only within 1 month after it comes into force. After this period, his appeal becomes impossible.

No one has the right to fire an employee without a court decision or a death certificate. Another employee can occupy the position, but his employment must be temporary. That is, without documents confirming the death of an employee, his job is retained.

A package of supporting documents for compensation payment for injury

In order for a victim of an industrial injury to receive a compensation payment from the social insurance fund, the company management must provide a package of documents confirming the industrial injury.

Documents can be either originals or copies:

- A photocopy of the work record book or employment contract;

- Act of investigation of the fact of injury at work;

- The amount of compensation payments assigned by the enterprise.

Also, to compensate for treatment costs, the victim prepares his own package of documents:

- Application for compensation;

- All receipts that confirm the expenditure of funds for treatment;

- The doctor's conclusion that the victim has indeed lost his ability to work;

- Rehabilitation scheme after an industrial injury.

Payments upon death at work

If an employee dies as a result of an accident at work, then the management of the company is obliged to pay the relatives of the deceased a compensation amount for the loss of a loved one.

The amount can be paid as a lump sum, or the company assumes responsibility for the support of the minor children of the deceased employee, with a monthly payment to them of a certain amount.

A one-time payment is usually in the amount of one million Russian rubles.

In order for relatives to receive this compensation payment, they must provide the following documents:

- Death document;

- Conclusion of a forensic medical examination on the cause of injury;

- Information about the income of the deceased;

- Certificate of family composition and minor children;

- Documentary evidence of all funeral expenses.

In the event of the death of an employee at work, the company is obliged to pay compensation to the relatives of the deceased.

Dismissal procedure

The reason for dismissing an employee is a statement. Since the deceased naturally will not be able to write it, the leader must issue an order without one. The basis for termination of the employment relationship in this case is the death certificate.

It is very important to know what number to fire a deceased employee. The law states that the last working day is the day preceding the day of death. That is, if the employee died on March 6, then the last working day will be considered March 5. And the dismissal date is March 6th.

The order is drawn up on the day when the relatives of the deceased presented an official document confirming the death of the employee. In this case, the date of death and the date of the order most often do not coincide.

The procedure for dismissing a deceased employee is quite simple:

- Based on the documents provided, the manager issues a dismissal order . A copy of the death certificate or court decision is attached to it.

- The order is registered in the Order Register.

- An entry is made in the work book, after which it is issued to relatives.

- The accounting department calculates the necessary payments.

Relatives who apply for payments and have expressed a desire to pick up the work book of the deceased must have the following documents with them:

- Death certificate from the registry office + its copy;

- A court decision or act confirming the accident (in case of death at work);

- Original documents and its copies (passport) of the person who will receive payments and work record book;

- Sick leave (if death occurred during illness);

- Invoices or receipts confirming funeral expenses (if relatives are claiming benefits);

- Applications drawn up in any form for payment of the balance of wages, financial assistance, compensation, etc.

Classification of injuries that can occur at work

The gradation of work-related injuries is carried out based on the degree of severity.

Highlight:

- Lungs. The damage does not require seeking medical help. They do not cause significant harm to the human body. Outpatient treatment is usually sufficient.

- Average. Such injuries require mandatory medical intervention, and treatment is carried out in a hospital. The duration of sick leave ranges from 10 to 30 days.

- Serious injury. They differ in the severity of the consequences. Sometimes they can become irreversible. As a result, functional interruptions are observed, which lead to disability for a period of more than 30 days.

So-called occupational diseases are distinguished separately. They arise due to exposure to constant harmful factors at work. As a result, body functions are disrupted. If such a situation is identified, the employer is forced to suspend the employee from performing work duties for a certain or permanent period.

Video

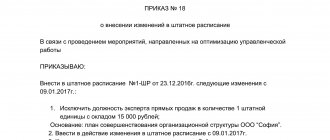

Drawing up a dismissal order

The dismissal order must be drawn up in a certain unified form (T-8). It is inappropriate to use the word “dismiss” in such an order. It is better to formulate this as “terminate the employment relationship” and indicate the reason (in connection with death).

The “Date” field indicates the day on which the relatives provided the death certificate.

It is imperative to refer to clause 4.2 of Article 83 of the Labor Code of the Russian Federation. The date of dismissal of an employee is the date of his death.

The last line “I have read the order” remains blank, because the employee cannot do this, and relatives should not do this.

Filling out a work book

After issuing the order, the personnel department of the enterprise must fill out the personal card of the deceased and make an entry in the work book .

All entries in the work book are made in accordance with the Rules for preparing work books. Abbreviations are not allowed.

The first column is numbered in order. In the second column, you must indicate the date of death of the employee. In the third, a record is made of the dismissal itself. Just as in the order, the word “dismissal” is inappropriate here. Here is an example of an entry in a work book:

The fourth column indicates the order number and its date. After all the entries made, the organization’s seal is affixed and certified by the signature of the head.

There is no need to introduce relatives to the entry in the work book.

The work book is issued to the relatives of the deceased after presenting a document confirming their relationship. A corresponding entry is made in the Journal of the movement of work books, where the person who received the document signs.

If no one applies for personal documents, then the work book is stored until required.

Calculation of payments

After issuing the dismissal order, the accounting department must accrue the appropriate payments . The company can pay the accrued amount within 4 months from the date of death of the employee. If during this period the relatives do not apply, then the entire amount is added to the inheritance. If there is no inheritance, then the money remains with the employer.

Relatives, spouses and persons who were dependent on the deceased can receive payments. If there are several applicants, the entire amount is given to the first applicant. If a controversial situation arises, you can invite relatives to come to an agreement or go to court.

The company must pay the entire amount within 1 week after the relatives apply.

A deceased employee is entitled to payments as for a normal dismissal:

- Salary;

- Sick leave;

- All necessary allowances;

- Awards;

- Compensation for unused vacation.

In addition to them, financial assistance to relatives or compensation for burial may be awarded for consideration by the management. We will consider the procedure for calculating all payments in the table.

| No. | Name of payments | Accrual procedure | Peculiarities |

| 1. | Wage | Payroll continues until the day of death. According to the timesheet, days worked are calculated and wages are calculated. In this case, all allowances, bonuses, etc. are taken into account. | The day of death is not paid. |

| 2. | Vacation compensation | The company is obliged to pay compensation for unused vacation. Accruals are made in accordance with current legislation. If at the time of death the employee was already on leave, which was provided to him in advance, then no one returns the money back. | |

| 3. | Sick leave | If a person died during his illness, then the ballot closes on the day of death. | The day of death is not paid |

| 4. | Compensation for burial | It is calculated based on receipts and invoices provided by relatives. This payment can be received by any person who spent his personal savings on funerals. | From February 1, 2021 it is 5740.24 rubles. |

Working with the risk of dying

For citizens of the Russian Federation whose work is directly related to an increased risk to life, Russian legislation provides additional benefits. Such people receive a legal right to special social insurance, which includes an increased funeral benefit in the event of death. This category of persons includes:

- active military personnel;

- employees of the Ministry of Internal Affairs;

- representatives of the Russian Guard;

- certified employees of the Federal Penitentiary Service;

- employees of the Federal Security Service;

- workers of the federal fire service.

The amount of payments depends on the area of activity of the injured person. The exact amount must be clarified with the social insurance fund or directly with the employer.