Opening an inheritance case to obtain a certificate

After the death of the testator, an inheritance case must be opened. To do this, the legal successors of the deceased need to notify the notary office at the place where the inheritance was opened. The case is opened at the last place of residence of the testator . Those wishing to accept an inheritance submit an application to accept the inheritance.

Then a six-month period must pass. Before this time, the notary will not issue a certificate of the right to inheritance under a will.

At any moment, other legal successors may appear, the existence of whom the heirs under the will did not know. During this six-month period, you can submit the missing papers, according to which the notary will have time to make inquiries to the relevant authorities regarding the ownership of the property by the deceased.

Important! A deed of title for an inherited estate is issued earlier than 6 months, but if it is known for sure that there are no heirs who can claim their rights (clause 2 of Article 1163 of the Civil Code).

Obtaining a certificate of inheritance

A certificate of inheritance by will is issued on the basis of an application for acceptance of the inheritance and issuance of a title document , which is submitted by the successor. It should be noted that this is a right, not an obligation, of the heir to whom the property is bequeathed.

If there are several heirs, then each of them must submit such an application. Moreover, this can be done either simultaneously or separately at different times. The notary will issue a document only for part of the inherited property.

A certificate of the right to inheritance under a will is a document of title to the property of the testator.

This paper confirms the ownership of the new owner. Without it, a person will not be able to fully dispose of property.

If a property is transferred by will, then the rights to it must be registered with Rosreestr. Based on the deed of title issued by the notary, information about the transfer of ownership is entered into the unified state register of real estate.

Form of certificate of right to inheritance under a will

The form of the document was approved by Order of the Ministry of Justice of the Russian Federation No. 313 on December 27, 2016. In case of issuance of inheritance under a will, the notary issues to the legal successors a notarial deed in form No. 3.2.

The document contains the following information:

- place of performance of the notarial act;

- date of;

- information about the notary;

- information about the existence of a will;

- testator;

- information about inherited property (description of the object and its characteristics, presence of encumbrances, testamentary refusal);

- number of the inheritance file;

- registration number;

- amount of state fees and notary services;

- signature and seal of the notary.

A certificate of inheritance by will is issued on a special notarial form that has certain degrees of protection.

Fee for issuing a certificate of inheritance by order of the testator

The Tax Code (Article 333.24) provides for the payment of a fee for obtaining a notarial deed of title.

The amount of state duty depends on the degree of relationship between the testator and heir.

The payment amount will be:

- 0.3% of the value of property (not more than 100 thousand rubles) - for children, spouse, parents, brothers, sisters;

- 0.6% of the value of the property (no more than 1 million rubles) – for other persons.

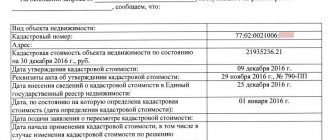

To calculate the payment, the cadastral value is taken. Cadastral valuation is carried out every five years, so information about the value of the property may change. Information about it is contained in the real estate register.

The fee is paid before the issuance of a certificate of inheritance under a will. This is a mandatory payment that is made to the state budget. Each heir pays the fee on his own behalf. Additionally, the notary will charge a fee for his services, this amount is determined by the notary office.

When preparing documents with a notary , such categories of citizens as Heroes of the USSR and the Russian Federation, full holders of the Order of Glory are exempt from paying the fee To confirm your preferential category, you must have the appropriate identification with you.

Issuance of documents for inherited property after six months

It is possible to obtain a certificate of the right to inheritance under a will even after the expiration of the period for accepting the inheritance.

There are several options available:

- restore the missed deadline;

- recognize the right to the testator's property in court;

- recognize the heir as having entered into the inheritance by submitting an application to a notary.

If the inheritance has actually been accepted by the heir, you can receive the title document after the established period.

How much does it cost to inherit?

If the transfer of small items can be carried out by the testator personally before his death, then in order to inherit a piece of real estate it is necessary to evaluate its value. Without such an assessment, it is not possible to calculate the correct amount of duty.

An example of calculating the amount of duty can be the assessment of an apartment. For example, an apartment was valued by a specialist at two million rubles. Accordingly, the amount of state duty on inheritance for a close relative will be calculated as follows:

- 2 million * 0.3% = 6 thousand rubles.

- For a distant relative or other heir under a will, this amount will accordingly be twice as large.

- Also, the assessment of the calculation made will be reflected in the amount that will need to be paid to the notary, since such actions are also paid as a percentage of the total amount.

The state duty for inheritance by law and by will must be paid in the amounts established by law. Payment is made on the basis of a receipt received from a notary or on the basis of personal payment remotely.

Payment methods may vary. There are three common ways:

- transfer of funds using the specified details through an operator at the bank (in this case, in addition to the amount of the duty, you will need to pay a commission fee);

- through payment terminals, selecting a function and indicating the amount;

- through online banking (in your personal account) of the payer.

The amount and procedure for paying the state duty for restoration of inheritance is the same as for timely filing of an application for accession to inheritance rights. According to Article 1154 of the Russian Civil Code, a citizen must enter into the right of inheritance within three years after the death of the testator. If this deadline is missed, it can be restored in one of two ways:

- By contacting those heirs who have already entered into the rights of inheritance of the property of the deceased in order to re-issue a certificate of ownership in relation to the part of the inheritance assigned to the applicant by a notary.

- By filing a claim for forced inheritance rights. In this case, the heir also bears all legal costs associated with filing a claim and paying state fees. In addition, the plaintiff must prove that he missed the deadline for a valid reason. It is necessary to go to court at the last place of residence (registration) of the testator.

All issues regarding the payment of state duty for receiving property by inheritance and the amount of state duty are regulated by Art. 333.24 Tax Code of the Russian Federation.

In particular, in the process of entering into an inheritance, the notary must carry out a number of preliminary actions; each service has its own tariff:

- the fee for reading a will is 300 rubles;

- to confirm the authenticity of signatures, the notary’s office will ask for 100 rubles;

- for acceptance and/or certification of a hidden will you will have to pay 100 rubles;

- for the safety of inherited property, which is ensured by a notary – 600 rubles.

After the death of a relative, in order to receive his inherited property, the heirs must visit a notary office to accept the inheritance. According to Art. 1153 of the Civil Code of the Russian Federation, this is done by sending an application for acceptance of the inheritance or issuing a certificate of right to it.

One of the application options must be submitted to the notary at the place of opening of the inheritance, who, according to Art. 1115 of the Civil Code is the last place of residence of the deceased or the location of his property.

The applicant chooses the method of submission independently: in person, by post or through an authorized representative.

Six months after the death of a citizen, the notary is obliged to issue a certificate of the right to inheritance to all called successors.

It can be issued to each heir separately, for each type of property, or for all heirs together.

At this stage, a notary fee is charged for entering into an inheritance. This, however, is not the only payment that a notary may require.

According to Art. 22 Fundamentals of legislation on notaries, all notarial actions are subject to payment in accordance with the requirements of the legislation on taxes and fees, state fees or notarial tariffs.

However, the state fee for registering an inheritance with a notary is far from the only payment. Not only that, such a fee can consist of several amounts depending on the actions performed by the notary. The cost of legal and technical services should also be added to it. The right to pay them is guaranteed to the notary by Art. 23 Fundamentals of legislation on notaries.

Unlike state fees and notary fees, the cost of these services is not regulated by law, and therefore is set by the notary at his own discretion.

Such services may include legal advice, drafting and production of documents, mediation in obtaining the necessary certificates, and the like.

How the state duty is calculated directly depends on the type of payment, the notarial acts for which the fee is paid, in some cases - on the value of the property, as well as the formula used.

For example, the amount of state duty on the inheritance of close relatives in 2021 will be less than the duty on the inheritance of unrelated persons. Different formulas are used when calculating, so it is advisable to consider each payment separately.

The state fee for a certificate of inheritance is one of the mandatory payments. Refusal to pay it will not allow you to receive a document, without which the heir will not be able to formalize the rights to the inherited property.

The amount of payment in this case is determined by paragraphs. 22 clause 1 art. 333.24 of the Tax Code and does not depend on the basis on which the inheritance occurs. Thus, the duty is charged in the amount of:

- 0.3% of the estimated value of inherited things, but not more than 100 thousand rubles, if the successors are spouses, children, parents, and brothers and sisters;

- 0.6% of the estimated value of inherited things, but not more than 1 million rubles for all other legal successors.

The state fee for issuing a certificate is charged to each heir receiving such a document.

But the state fee for the certificate and legal costs do not end with the legal successors’ expenses. For example, when receiving real estate by inheritance, it becomes necessary to re-register it, which requires mandatory re-registration of the transfer of rights.

In this case, a state fee is also charged, the amount of which is determined by paragraphs. 22 clause 1 art. 333.33 Tax Code. This state duty, in particular, is 2 thousand rubles for individuals and 22 thousand rubles for legal entities.

However, there are exceptions regarding:

- rights to a dacha, garden and other plot intended for personal farming, construction, etc. - their registration costs 350 rubles;

- rights to a share in common ownership of agricultural plots – 100 rubles;

- rights to a share in the common property of residents of an apartment building - 200 rubles.

Who and how can obtain a certificate of inherited property

The heir himself can receive a document on the right of inheritance under a will in person or by sending his application by mail.

To confirm your rights to inherited things you must present:

- identification document;

- will.

And if the deceased and the heir were related, then documents are also submitted indicating the presence of a family relationship between the parties.

Thus, in order to issue a certificate, the notary must be provided with indisputable information: about the fact of the death of the testator, the time and place of his death, the grounds for inheritance, the composition of the inheritance mass and the facts of accepting the inheritance in a legal way.

Receive a certificate of inheritance through a representative or by mail

If for one reason or another the heir cannot independently notify the notary’s office and receive a notarial deed, it is possible to do this through a representative or by mail.

First, you need to draw up a power of attorney , which states the powers of the trustee to represent interests in matters of registration of inheritance in the notary authorities and/or other bodies and institutions. If the application is submitted by mail, you must confirm your signature accordingly.

Suspension of the issuance of a certificate to an heir under a will

However, notaries very rarely issue a certificate of the right to inheritance under a will before the due date. On the contrary, in some cases, the issuance of a certificate may be suspended by a notary to request additional documents or by a court decision if there is a dispute between the heirs or if one of the heirs has not yet been born.

The notary is obliged to suspend the procedure for issuing a certificate:

- upon receipt of documents from the court indicating that the judicial authority has received an application from an interested person challenging the right to the inheritance;

- by a court decision if there is such an indication (for example, when making a ruling on securing a claim);

- in the presence of a nasciturus - a conceived but unborn heir.

Thus, the issuance of a certificate is postponed in cases prescribed by law. In addition, receipt of the document is delayed if the notary requires additional information to draw up the title document.

Refusal to issue a certificate of inherited property under a will

In some cases, a notary may refuse to issue a certificate.

The reasons for this may be:

- lack of a complete package of documents;

- unreliability of data in the provided documents;

- missing the deadline established by law for accepting an inheritance;

- the inheritance case has already been opened with another notary;

- the notary was approached by an improper heir (the person is not indicated in the will or is excluded from inheritance);

- there is a dispute between the heirs.

The notary issues a resolution on the refusal to perform notarial acts. The heir has the right to appeal it in court.

Important! An inheritance certificate is not issued if a court decision recognizes the successor as having accepted the testator's property, and the shares of the heirs are determined in a judicial act. In this case, the inheritance case opened with the notary is terminated.

Rosreestr told how to register an apartment by inheritance

In order to preserve inherited property, as well as protect the rights of successors, legatees and other interested parties, sometimes a notary takes a number of measures to protect and manage the inheritance.

He does this at the request of successors, executors of wills, guardianship authorities, local government bodies and other persons interested in preserving the property of the testator.

These measures include:

- inventory and assessment of property;

- placing funds on your own deposit;

- informing law enforcement officers about the presence of weapons in the estate;

- concluding a trust agreement, and so on.

When a notary performs such actions, he also has the right to collect a state fee, which, according to paragraphs. 23 clause 1 art. 333.24 Tax Code, is 600 rubles.

In addition, if security measures concern the placement of funds or securities of the testator on the notary’s own deposit, in accordance with clause 8 of Art. 22.1 Fundamentals of legislation on notaries, for this a state fee is charged in the amount of 0.5% of the cost, but not less than 1 thousand rubles.

If the specified notarial actions are performed by an official outside the office, the cost of the fee, according to Art. 333.25 NK, increases by 50%.

If there are several heirs, each of them pays the specified fee independently.

The disposal and use of property in Russia is regulated by special federal laws. The procedure for registering real estate in Rosreestr is a mandatory condition of the order. It will not be possible to sell, exchange, donate or otherwise transfer an object to third parties without first entering information into the Unified State Register.

Vehicles that have not passed state registration cannot be operated. Legal confirmation of rights to securities is necessary to receive dividends, as well as to carry out transactions with assets. Entering information about new owners into the Unified State Register of Legal Entities is a mandatory condition for admission to the distribution of profits and management of the company.

Normative acts do not contain a unified list of values that are subject to state registration. The rules are established by scattered documents and industry regulations.

| Capital structures, land and other real estate | Art. 131 of the Civil Code of the Russian Federation, Law No. 218-FZ of July 13, 2015. |

| Transport | Art. 8 of Law No. 283-FZ of 08/03/2018, Government Decree No. 1764 of 12/21/2019. |

| Securities | Law No. 39-FZ of April 22, 1996 |

| Shares in the capital of a legal entity | Law No. 129-FZ of 08.08.2001 |

| Intellectual property objects | Art. 1232 Civil Code of the Russian Federation |

Items restricted in circulation are passed on by inheritance subject to obtaining permits and licenses.

The transfer of rights after the death of the owner is associated with certain costs. Part of the funds goes to pay for property registration services. The state duty for inheriting an apartment is 0.3% for close relatives and 0.6% for other persons. At the same time, there is a maximum amount in the first case, limited to 100 thousand rubles, and in the second - 1 million. The following are exempt from making this payment (Article 333.38 of the Tax Code of the Russian Federation):

- minor heirs;

- incapacitated heirs;

- persons living together with the deceased;

- if the testator died while performing military duty or working in law enforcement agencies.

According to Art. 217 of the Tax Code of the Russian Federation, inherited property is not subject to personal income tax. This was done due to the need to pay a high state fee in favor of the notary.

To enter into property rights, interested parties need to:

- Complete all necessary documents.

- Contact a notary office and obtain a certificate. You have 6 months to submit your application.

- Based on the certificate, relatives will need to register ownership at the registration chamber.

Important! However, when submitting an application, the notary needs to find out whether the testator left a will. If such a document is missing, then the inheritance of his property is carried out according to law.

Each heir has the same rights. The identified property is subject to division in equal shares.

The exception is joint property of spouses. From such property, a part of the co-owner is initially allocated. The second half of the assets is distributed among relatives who submitted an application to the notary.

If none of the applicants contacted the notary’s office, then the succession passes to the 2nd line relatives. Heirs are given an additional 6 months to assume their rights.

Sample application for issuance of a certificate of inheritance

Entering into an inheritance under a will differs from the acceptance of property by law by the composition of the heirs.

In 2021, a number of notary services are provided remotely. Russians were able to certify transactions while in different cities, as well as order certificates of translation accuracy. However, registration of inheritance is not included in this list.

Fundamentals No. 4462-1 dated February 11, 1993 allow for filing applications for the acquisition of rights to property by mail or by sending an electronic document to a notary. However, the signature on such documents must be notarized. It will not be possible to enter into an inheritance without a personal visit or a specialist visiting your home.

The basis for entering information into state registers is an application. The form of such an appeal is approved by departmental regulations.

| Inheritance | Statement | Application Suite |

| Real estate | The form was approved by order of the Ministry of Economic Development No. 920 dated December 8, 2015 | 1. Notarial certificate of the right to inherited property by law or will. 2. A court decision that has entered into force. 3. Receipt for payment of the duty. If the inheritance contains previously unaccounted for objects, you will also have to submit a cadastral passport. |

| Transport | Appendix 1 to the order of the Ministry of Internal Affairs of the Russian Federation No. 950 dated December 21, 2019. | 1. Vehicle passport. 2. Certificate of inheritance. 3. Insurance policy. 4. Receipt for payment of the fee.

|

Disposal of inheritance on the basis of a certificate

Often, heirs are faced with the fact that after registering property in their name, difficulties arise in managing and using it. The fact is that the testator could distribute the shares of each heir in the will, or bequeath the entire property to several persons without designating shares.

The following situations are possible:

- if the shares are determined during inheritance, then the property passes to the legal successors as shared ownership. Everyone has the right to dispose of their share at their own discretion;

- if parts of the property are not determined, then the property becomes joint ownership. It can be disposed of with the consent of all co-owners.

The heir has the right to sell, donate, exchange, lease, or pledge his part. However, there are some nuances. In case of shared ownership, the sale of a share of the property is possible subject to the rule of pre-emption . This means that the first thing you need to do is offer to buy it out to the co-owners. If none of them wants to buy a part, then it can be sold to others.

If the property is owned by joint ownership, then all transactions are made with the consent of all co-owners . If only one heir was indicated in the will, then he alone inherits and disposes of everything that remains after the deceased.

Actions of heirs after receiving a certificate of will

When a certificate of the right to inheritance under a will has been received, what the heirs should do next is determined depending on the type of property. It is also necessary to observe the order of inheritance of certain types of property.

Real estate

In accordance with Art. 131 of the Civil Code, the transfer of ownership of real estate to another person must be registered. The body that carries out registration is Rosreestr. The procedure involves entering information about the new owner into the electronic register.

Vehicles

In accordance with clause 4 of the General Provisions of Order of the Ministry of Internal Affairs No. 1001, when changing ownership, vehicles must be re-registered within 10 days. The relevant information is entered into the traffic police register.

Cash deposits, securities

After issuing a certificate of inheritance under a will, you must contact the bank where the deposit is kept or an account is opened in the name of the testator. It is enough to present this document for a bank employee to issue funds.

Please also note that after issuing a certificate of the right to inheritance under a will, the notary will send information to the tax authorities. This information is sent to government agencies no later than 5 days from the date of issuance of the title document.