When to ask for an advance

An advance is a portion of earnings paid for the first half of the month. The Labor Code does not contain such a concept: there are concepts of the first and second parts of wages.

In accordance with Art. 136 of the Labor Code of the Russian Federation, the employer is obliged to pay wages at least every half month. Payment days are established by a local regulatory document (order).

For example, the first part of the salary is paid on the 20th of the current month, and the salary is paid on the 5th of the next month. If you worked the first 15 days of the month, this means that the money will be given to you on the 20th. You do not need to write any statements for this.

But often unforeseen expenses occur, and the need for money arises earlier. Few people know that in such cases the employee has the right to write a statement requesting an advance payment before the due date.

If in the first 15 days of the month you were on sick leave or on vacation, then you are not entitled to payment. If you have worked at least one day, you will be given an advance in proportion to these days.

For example, employee Timofeev A.V. was on vacation from July 1 to July 7. On July 15, he wrote an application for an advance payment against the upcoming salary. From the cash register he will be given an amount calculated in proportion to the number of working days falling on the period from July 8 to July 15.

ConsultantPlus experts have analyzed the procedure in which personal income tax is paid when wages are paid ahead of schedule. Use these instructions for free.

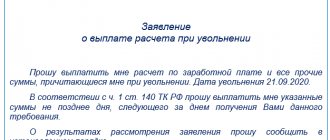

Rules for writing and completing an application for an advance

Today, there is no mandatory, unified sample of this statement, so employees can write it in any form or according to a template developed and approved within the enterprise. Regardless of which option is chosen, the document must meet certain requirements. It must indicate the addressee :

- Company name,

- job title

- and full name of the manager,

as well as similar information about the applicant : his position and full name. In addition, the document itself must include the request for an advance , indicating its reasons.

The main text should be consistent and sufficiently succinct - usually the main idea fits into one - a maximum of three sentences.

If there are any circumstances in connection with which the employee wants to receive an advance and which he can document, this must also be reflected in this document in the form of a clause on attachments.

Finally, the application must be signed by the applicant (with a transcript of the signature) and dated on the day of submission.

The application is drawn up in two copies :

- one of which is endorsed by the secretary and subsequently remains in the hands of the employee,

- and the second is transferred to the organization.

After its consideration, depending on the decision made by the manager, a resolution is written on the application. If it is positive, based on this document, the accounting department calculates and issues the required amount. In any case, after the application loses its relevance, it is transferred for storage to the archive of the enterprise.

How much money to ask

Letter No. 14-1/B-725 of the Ministry of Labor dated August 10, 2017 states that the first part of wages (including salary, bonuses and allowances) is paid in proportion to the time worked.

For example, if the date of payment of the first part of earnings at an enterprise is the 25th, and the employee wrote a statement on the 16th, he has the right to receive approximately half of the monthly income minus personal income tax.

Although personal income tax is not paid on advances to the budget, the following situation is possible: an employee received money in the amount of 50% of the salary without tax deduction, and the next day he went on long sick leave, which will only end after the 15th of the next month. As a result, an overpayment has arisen, which the employer will have to cover somehow: either add a certain amount or demand a refund.

What to do to receive an advance

Issuing an advance (unless it concerns official needs) is the exclusive will of the employer. In other words, the initiator of the application is always an employee of the enterprise or organization, the final decision is made by the manager .

In order for the boss to put a positive resolution on the application, you must not only try to maintain good relations with him and conscientiously fulfill your work duties, but also prepare in advance a package of documents justifying the need to receive funds.

As a rule, employers rarely pay more than half of the average monthly salary in advance, so asking for a large amount is not practical, but getting 25-30% of your salary or salary is very possible.

It should be noted that the manager can leave the advance amount unchanged or adjust it depending on his ideas and the capabilities of the company.

The time period for consideration of such an application has not been established, but as practice shows, it usually takes from several hours to three days.

Is the employer obligated to give money?

The answer to this question depends on the situation:

- The organization's established date for paying wages for the first half of the month is the 20th. An employee whose salary is 40,000 rubles wrote a statement requesting payment of 25,000 rubles on the 7th. In this case, the employer has the right to refuse to issue money, since for the first half of the month the amount of earnings is less. If this employee decides to quit in the next 2 weeks, problems will arise with withholding personal income tax.

- The same employee wrote an application for payment of 15,000 rubles. 15th. In this case, the request should be satisfied by calculating the amount of salary in proportion to the days worked minus personal income tax. If the resulting value exceeds RUB 15,000, the employee will receive money. The remainder of the advance must be paid on the due date (20th), since the gap between income payments cannot exceed 15 calendar days. Another option is to pay the second part of the salary earlier so that this legal requirement is met. This is stated in the letter of the Ministry of Labor No. 14-1/OOG-461 dated January 25, 2019.

Let's say there are 22 working days in October 2021. The period from October 1 to October 15 includes 11 working days. At this time, the employee was not sick and was not on vacation. His earnings will be:

40,000/22*11=20,000 rub.

Personal income tax on this amount is 2,600 rubles. (20,000*13%).

Thus, the employee earned: 20,000-2600 = 17,400 rubles. The employer has the right to issue 15,000 rubles upon application. October 15, and the rest (2400 rubles) - October 20.

Reasons for receiving an advance

The reason for writing an application for an advance can be a variety of circumstances: a wedding or the birth of a child, the illness of a relative or loved one, the need for urgent loan repayment, renovations, a large purchase, etc. An advance is the best alternative to urgent loans, the interest on which, as we know, is incredibly high.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

It should be noted that an application for an advance is written when the advance is not provided for in the employment contract between the employee and the employer or its term or amount differs from what is required.

Another, completely separate reason for an employee to receive an advance: a business trip or other corporate needs (purchase of office supplies, materials or equipment).

In this case, in the application for an advance, the future traveler or other employee of the enterprise must write the purpose of receiving the advance, as well as how exactly he intends to spend the funds received. Money is issued strictly on account and the balance must be returned back to the company's cash desk. If there is not enough money, then the accounting department is obliged to pay the employee the missing funds. At the same time, all actions must be documented.

Sample order to change the advance amount

Not only the timing of the advance payment may change, but also its amount. Let's say we want to increase the advance from 40 to 45%. How to formalize this and is the order sufficient? This again depends on which LNA initially fixed the condition on the amount of the advance.

If the amount of the advance is specified in the employment contract, do not forget to notify the staff in advance of the upcoming changes in writing (Article 74 of the Labor Code of the Russian Federation). Next, you will have to conclude additional agreements to the contracts with each employee.

However, indicating the amount of the advance payment is not included in the mandatory conditions of the employment contract (Article 57 of the Labor Code of the Russian Federation), so it is completely unnecessary to fix it there, and you can use other LNA for this, for example, the provision on remuneration, PVTR. In this case, it is enough to issue an appropriate order for changes and familiarize all employees with it.

The order is issued according to the rules discussed above. You can see what an order to change the advance amount looks like here.

For information on how to register it and what other personnel orders there are, read the articles:

- “Journal of registration of orders for personnel - sample.”

- Orders for personnel - what are these orders (types)?

How to make an application

There is no legally established form for applying for an advance. Therefore, it is compiled arbitrarily based on the rules of office work and based on established practice.

- For the application, you need to choose a blank white A4 sheet.

- The text can be entered using a printing device, computer programs, or written by hand.

- If the application is written by hand, choose blue, black or purple paste. Red, green, etc. writing is prohibited.

- The document must not contain strikethroughs, corrections, or significant blots.

- It is necessary that the text be written without gross errors. It is better to double-check it several times so that all names and positions are entered correctly.

Perhaps, when contacting the accounting department, the employee will be provided with a sample application or simply dictated to it. In this case, you need to focus on the established practice of a particular enterprise.

What information should be included in the application:

- Full company name.

- Full name of the manager to whom the applicant is applying; the name of his position.

- Full name of the employee; his position.

- Document's name.

- A request to provide a sum of money as an advance payment before the deadline specified by regulatory documents. It is necessary to indicate by what date the money must be provided.

- The requested amount in numbers and words.

- The reason why funds are needed ahead of schedule.

- List of documents attached to the application. This item is optional. But the employee can attach copies of documents that explain the reason.

- Date of application.

- Employee signature with transcript.

This is important to know: Consideration of the case on the merits in civil proceedings: stages and procedure

It is better to write the application in two copies. The first one is transferred to the responsible person. And you need to keep the second one for yourself. But first ask the employee who accepts the applications to sign and date your copy.

How to issue an order to issue money: example

So, the issuance of funds for reporting in 2021 is possible on the basis of an order or other administrative document (clause 6.3 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U). At the same time, there are no restrictions on the amount of accountable amounts and the period for issuing money. Here is an order for the issuance of funds on account (sample):

Moreover, there are no special requirements for how to draw up an order for the issuance of accountable amounts. In our opinion, it makes sense to record in the order: the employee’s full name, amount, goals and terms of issue.

We also note that it is possible to issue a general order for several amounts. So, for example, if the issuance of cash for reporting is necessary for several employees, then the order may look like this:

About general points

Advances are certain amounts of money transferred to people on account of work performed. But not after they are completed, but in advance. Money is given either for the services themselves or for the costs associated with their provision.

Advance payments become a sales method if the buyer purchases something by participating in distance selling. This will allow the seller to receive payment guarantee.

An application for an advance may be written in any form or drawn up using a special form. This is a written appeal to management with certain requirements .

A positive reference from your place of work can be a big plus when applying for a new position. Read about the preparation of this document by following the link.

Regulations on remuneration.

Document and its purpose

There are several situations when the preparation of this paper becomes necessary:

- When sending employees on a business trip.

- If you want to receive an advance amount greater than what is required according to the usual rules . For example, if advances are paid towards salary. After receiving the first advance, it is permissible to request another one, but only if unexpected expenses arise . But management reserves the right to satisfy such demands or leave them unanswered.

Can an employer refuse to issue an advance?

In the case where a change in the monthly amount is implied, the employer can refuse or adjust the payment, guided by internal regulations: many companies regulate the amount of the advance in an amount of no more than 50% of total earnings. Another refusal option may be related to the current financial capabilities of the organization.

You may be interested in: How is an advance payment calculated?

If we consider payment from funds that the employee has not yet worked, but asks for an advance payment ahead of schedule, this is a certain risk for the employer. A situation may arise when a specialist was unable to fulfill the obligations assigned to him, while he had already received money for their fulfillment. In this case, the employer will be forced to withhold part of the funds actually accrued to the employee (with prior warning) in order to compensate for the loss. Another option is dismissal after advance payment. If a former employee refuses to voluntarily return the funds paid but not used, a refund may be requested through the court.

Considering the risks, the Ministry of Labor states in relation to such situations that the organization can meet the employee halfway, but is not obliged to do so.

An alternative here could be financial assistance. For example, at the birth of a child or the death of a close relative. These funds are also issued at the discretion of the employer upon application, but they will not need to be worked off. This assistance is calculated individually, and it is possible to request it even if it is not specified in the organization’s regulations.

ATTENTION! The case when the employer cannot refuse is for official needs, for example, a business trip. However, here too it is possible to change the requested amount.

Dependence of advance on salary

An entrepreneur has the right to pay not a share of the salary, but a part of it in the form of the same amount, and recalculate the rest in accordance with the time worked.

The judges also agree with the above approach (Decision of the Primorsky Regional Court in case No. 33-5948, Appeal determination of the Krasnoyarsk Regional Court in case No. 33-3751/13).O. With this method, the advance payment will remain unchanged, and subsequent payments may differ under different remuneration systems (they will be the same for a fixed salary, but may change for hourly or piecework wages). Sometimes situations arise when an employee urgently needs a larger amount of money than is provided for in the advance payment. The law does not prevent the employer from meeting him halfway by paying this money in advance, taking into account the fact that in the future it will be worked out towards the remainder of the salary.

The employee must contact his superiors with such a request in writing. The salary mass includes not only the tariff rate, but also compensation, social charges, allowances, bonuses, etc.

Employer risks

Giving money to an employee as an advance may turn into an unpleasant surprise for the employer if the employee does not work off what he has already received and quits, for example, a few days after the advance is paid to him.

Article 137 of the Labor Code of the Russian Federation stipulates the right of the employer to withhold an unearned advance from the employee’s salary, provided that:

- the deduction was made no later than one month from the end of the period provided for the return of the advance;

- there is the consent of the employee (that is, if the employee does not dispute the grounds and period for the retention).

Who can give money for business needs?

Employers are obliged to organize and maintain internal control of the facts of economic life. You can find such a requirement in Part 1 of Article 19 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

The procedure for control over the issuance of money to accountable persons must be determined by the general director of the company. He may issue an order with a list of persons who are entitled to receive funds.

Here is a sample of such an order, according to which funds can be issued on account:

In order to comply with cash discipline, an employee is considered to be a person with whom an employment or civil law contract has been concluded (clauses 5 and 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Consequently, money can be issued, including to the contractor, on account. He may need them, for example, to purchase materials to perform work under a civil contract. This amount can be given to him for the report, for example, from the cash register.

Updated expense reporting rules

From the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, it follows that employees are required to report on the amounts spent within three days from the date of expiration of the period for which the money was issued. Receipts confirming expenses must be attached to the completed expense report.

As of July 1, 2019, the requirements for their details have been updated, and accountants are required to take these amendments into account in order to legally take expenses into account when taxing profits.

- Almost no one issues a strict reporting form (SRF) on paper, and individual entrepreneurs and organizations providing repair, vehicle washing, and transportation services are required to issue clients checks or electronic strict reporting forms;

- in checks for a legal entity or individual entrepreneur, the name and TIN of the buyer, the amount of excise tax, the country of origin of the goods, and the customs declaration number must be specified;

- Receipts contain a breakdown of the goods and services purchased. This rule for generating checks applies to almost all sellers, with the exception of individual entrepreneurs on a patent or simplified tax system. But in this case, the employee describes in detail what he spent the accountable money on;

- expenses for which receipts were sent in electronic format, the employee has the right to print out. The exception is an electronic boarding pass for air travel. It should be printed out and an inspection mark must be placed on it so that the accountant accepts the paper as confirmation of the expense (see Letter of the Federal Tax Service of Russia dated 04/11/2019 N SD-3-3/ [email protected] ).

This is important to know: Agreement on the assignment of rights of claim to each legal entity: sample 2021

Nuances of the procedure

Mandatory deductions to the budget are made from each payment related to the wage category. For this reason, the consolidation of payments will be visible to regulatory authorities. Any suspicion that operations were carried out incorrectly becomes a reason to initiate an unscheduled inspection. During its course, the fact will likely come to light that the employee received a one-time payment.

It is worth noting that legal acts state that it is unacceptable to combine two payments into one, either at the request of the employee or by local regulations. If such an event is recorded, management is subject to administrative punishment.

In order to solve the employee’s financial difficulties and not break the law, the employer needs to make sure that the company’s accounting policy provides for the option of making an advance payment on wages. If it is not in the document, the manager cannot make a positive decision in response to the employee’s request. It is necessary either to refuse it or to correct the contents of the local act by making additions to it.

It is worth noting that if the advance is paid towards wages, and this service is not provided for by the internal documentation of the enterprise, then all penalties will be applied to the management, up to and including the initiation of a replacement of the management team.

A salary advance is defined as a sum of money provided to an employee at the beginning of the month before it is due. If an employee fraudulently obtained an early payment and the employer finds out about this, then he has the right to initiate a reprimand or even terminate the employment contract with the employee. A fine may be charged, the parameters of which are defined as double the advance amount. It is within the competence of management to assign additional time for work.

When paying an advance on salary, the employer must comply with the requirements of legal acts regarding making payments at least twice a month. To ensure this condition, an unscheduled advance must be made not instead of the planned one, but in addition. Its amount can be determined as a third of the total payment. If the accounting policy for the enterprise provides for the possibility of increasing it to 50 percent, then the remaining amount of unpaid funds can be paid at the end of the month, having previously divided them into two parts.

Reflection in accounting

An employer's refusal to request an employee who finds himself in a difficult life situation must be motivated. The employee has the right to seek help from the courts. The basis for this will be a statement denying the request, filed as an annex to the claim. If the employer did not have objective grounds to refuse assistance to the employee, the court, by its decision, will oblige him to do so.

Additional expenses for the head of the business entity will be the costs of ensuring paperwork, paying the state duty and moral damage caused to the plaintiff. After such proceedings, the company will be registered with regulatory authorities for a long time.