Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 8 min

2

12497

Forced collection of part of an employee’s wages is regulated by Articles 137-138 of the Labor Code of the Russian Federation.

One of the grounds allowing such deductions is an executive document received by the accounting service of the enterprise.

The legislation regulates the procedure for working with such documentation by Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings”.

- Types of executive documents

- When should it not be used?

- Amount of deductions from wages

- Deduction order

- Several writs of execution: how the debt is retained Writs of execution of one turn

- Writs of execution of different priority (alimony and credit)

Percentage of deduction from wages under a writ of execution: general information

The employer must instruct the accountant to withhold certain amounts from the employee's salary under writs of execution immediately after serving them on him.

Deductions under writs of execution, no matter what payments are made and where, must be made according to the limits approved by law. In any case, the employee must receive a certain part of his salary in order to have a livelihood and be motivated to work.

The percentage of deduction from wages under a writ of execution can be different, depending on the purpose of collecting funds - 20%, 50%, 70% and more, in certain cases. Withholding money under a single writ of execution usually does not cause any difficulties, but there are also employees for whom the employer receives several writs of execution at once. It also happens that an employee must compensate for material damage that he previously caused to the manager, and therefore amounts are also periodically withheld from his salary to pay off the debt to the employer.

What payments do bailiffs have the right to withhold?

50% of my salary is withheld according to the writ of execution. I'm going on maternity leave in July. What payments do bailiffs have the right to withhold (maternity pay, child care benefits up to 1.5 years)?

Article 101 of the Federal Law of the Russian Federation No. 229-FZ “On Enforcement Proceedings” defines the types of income that cannot be levied:

1. Collection CANNOT BE APPLIED to the following types of income:

1) sums of money paid in compensation for harm caused to health; (child support is withheld)

2) sums of money paid in compensation for damage in connection with the death of the breadwinner;

3) sums of money paid to persons who received injuries (wounds, injuries, concussions) in the performance of their official duties, and members of their families in the event of the death of these persons;

4) compensation payments from the federal budget, budgets of constituent entities of the Russian Federation and local budgets to citizens affected by radiation or man-made disasters; (child support is withheld)

5) compensation payments from the federal budget, budgets of constituent entities of the Russian Federation and local budgets to citizens in connection with caring for disabled citizens;

6) monthly cash payments and (or) annual cash payments accrued in accordance with the legislation of the Russian Federation to certain categories of citizens (compensation for travel, purchase of medicines, etc.);

7) amounts of money paid as alimony, as well as amounts paid for the maintenance of minor children during the search for their parents;

compensation payments established by the labor legislation of the Russian Federation:

compensation payments established by the labor legislation of the Russian Federation:

a) in connection with a business trip, transfer, employment or assignment to work in another location;

b) due to wear and tear of a tool belonging to the employee;

c) sums of money paid by the organization in connection with the birth of a child, the death of relatives, and the registration of marriage;

9) insurance coverage for compulsory social insurance, with the exception of old-age pensions, disability pensions and temporary disability benefits;

10) pensions in case of loss of a breadwinner, paid from the federal budget;

11) payments to pensions in the event of the loss of a breadwinner from the budgets of the constituent entities of the Russian Federation;

12) benefits to citizens with children, paid from the federal budget, state extra-budgetary funds, budgets of constituent entities of the Russian Federation and local budgets;

13) funds of maternity (family) capital provided for by Federal Law of December 29, 2006 N 256-FZ “On additional measures of state support for families with children”;

14) the amount of one-time financial assistance paid from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, extra-budgetary funds, from funds of foreign states, Russian, foreign and interstate organizations, and other sources:

a) in connection with a natural disaster or other emergency circumstances;

b) in connection with a terrorist act;

c) in connection with the death of a family member;

d) in the form of humanitarian aid;

e) for providing assistance in identifying, preventing, suppressing and solving terrorist acts and other crimes;

15) the amount of full or partial compensation for the cost of vouchers, with the exception of tourist ones, paid by employers to their employees and (or) members of their families, disabled people not working in this organization, to sanatorium-resort and health-improving institutions located on the territory of the Russian Federation, as well as amounts full or partial compensation of the cost of vouchers for children under the age of sixteen to sanatorium-resort and health-improving institutions located on the territory of the Russian Federation;

16) the amount of compensation for the cost of travel to the place of treatment and back (including the accompanying person), if such compensation is provided for by federal law;

17) social benefit for funeral.

2. For alimony obligations in relation to minor children, as well as for obligations for compensation for damage in connection with the death of the breadwinner, the restrictions on foreclosure established by paragraphs 1 and 4 of part 1 of this article do not apply.

This is important to know: How to correctly deduct interest from wages on writs of execution

Withholding money from salary by bailiff

If a person refuses to pay his debts, and the creditor has confirmation of the rights to receive money from him, the second has the opportunity to file a claim in court to forcefully collect money from the debtor. When the court makes a decision in favor of the plaintiff, the defendant can still appeal, but is given no more than 10 days to do so. If there was no appeal, or the court made a similar decision again, after 30 days the court decision comes into force.

After this, the court decision is transferred to the Federal Bailiff Service, the losing party is recognized as a debtor, and the bailiff begins to do his job - forced collection of funds.

It also happens that the debtor no longer resists and independently sends a writ of execution to his management so that the accountant issues monthly deductions. Then it makes no sense to involve bailiffs. Withholdings will be made until the debt is fully repaid.

How is money withheld from your salary?

According to Article 98 Part 3 of the Federal Law “On Enforcement Proceedings”, interest on the debt may begin to be withheld from the day the accountant receives a writ of execution from the claimant or a bailiff’s order. The accountant or cashier who issues wages to employees must withhold from the debtor's salary the percentage of funds specified in the resolution, and then transfer or pay them to the debt collector within three days.

If the organization has the opportunity to issue advance payments to its employees, then 50 percent can also be withheld from them. The bonus, if there is one, will also be divided into two parts.

When a debtor is dismissed and transferred to another job, according to the law, the writ of execution is transferred to the department to another bailiff, who will continue to carry out enforcement actions in the territory under his jurisdiction. Debtors are always required to notify bailiffs about a change of place of work.

Percentage of deduction for writ of execution from salary: 20%

The amount of monthly deductions from the earnings of a company employee will depend on who and for what the employee must pay money. The percentage of deduction from wages under a writ of execution is determined by Labor legislation.

The smallest percentage that can be deducted from an employee's salary is 20%. Most often, exactly 20% of the total amount of income is withheld when the employee is obliged to compensate the employer for damage caused to the company, and also if the accountant mistakenly accrued more money than was due.

Holding Features

When making deductions from wages, you need to pay attention to the following nuances:

- withholding cannot apply to certain types of income, for example, state benefits or financial assistance from the federal budget, certain types of compensation payments, etc.;

- the fee for transferring money may be withheld from the employee in respect of whom this procedure is being carried out. This can be either a commission from a credit institution for processing a payment order or costs for transfer by mail. The percentage limitation established by law does not apply to these amounts;

- when a new requirement is received, the document is taken into account along with previously received ones, i.e., it is not postponed until the previous withholding requirements are fully satisfied;

- bailiffs can check how deductions are calculated, either on their own initiative or on the basis of a complaint from the claimant.

Percentage of deduction for writ of execution from salary: 50%

Further, the law allows you to withhold 50% of funds from your salary - this percentage is approved most often. In this amount, money is withheld in cases where it is required to transfer money to the creditor in accordance with the writ of execution or to pay alimony to the ex-wife for a child/children (if there is a voluntary agreement between the former spouses on the payment of alimony), as well as if collections are made for administrative violations committed or on the basis orders of bailiffs. Child support for minor children is rarely collected in this amount.

Loan deductions: no more than half

We have an employee who has deductions under a writ of execution in the amount of 1/3 of his salary for child support. And now another executive has come to ask for 50% deductions from his income to repay the bank loan he took out. How much can you keep from an employee in this case?

Let's figure it out. As already mentioned, when collecting alimony for minor children, up to 70% of earnings can be withheld. But when collecting in favor of the bank, you can keep no more than half of your earnings. How can these two rules be combined in the case under consideration? To answer, you need to refer to the provisions of paragraph 1 of Art. 111 of Law No. 229-FZ. It says: if the amount collected from the debtor is not enough to satisfy in full all the requirements for all enforcement documents, the order of satisfaction is established.

In particular, first of all, claims for the collection of alimony, compensation for harm caused to health, compensation for harm in connection with the death of the breadwinner, compensation for damage caused by a crime, as well as claims for compensation for moral damage are satisfied. Whereas the banks' demands for debt collection under contracts are satisfied only in the fourth place. Further, in paragraph 2 of Art. 111 of Law No. 229-FZ, it is said that each amount collected from the debtor is first directed to repay the first priority claim, and the claims of each subsequent priority are satisfied after the requirements of the previous priority are satisfied in full.

It turns out that in the situation under consideration, the employer first needs to fully “pay off” the requirements for alimony, because this is the first stage. To do this, it is enough to collect only a third of your earnings. This means that this requirement will be fulfilled in full, even if 50% of earnings are withheld. So there are no grounds for recovery beyond 50% of earnings (up to 70%) in this case.

The remaining part of the withheld half of the earnings after the transfer of alimony must be transferred according to the second writ of execution in favor of the bank. And in this way we act until the corresponding requirement of the bank is fully satisfied (clause 2 of Art. Law No. 229-FZ). Provided, of course, that the collection of alimony does not stop during this period.

Let's give an example. Let's assume that an employee's salary is 10,000 rubles per month. He has two minor children, for whose maintenance alimony is collected. The employee provided an application and documents for the corresponding standard tax deduction, and the amount of his income since the beginning of the year has not yet exceeded 350,000 rubles. Let's calculate the amount of deductions.

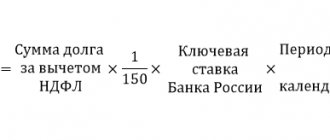

As we remember, by virtue of paragraph 1 of Art. Law No. 229-FZ, the amount of deduction from wages is calculated from the amount remaining after taxes are withheld. This means that in this case, the amount of deduction will be determined based on 9,064 rubles (10,000 - (10,000 - 1,400*2) * 13%). Accordingly, 4,532 rubles will be withheld for both writs of execution. (9064 ∕ 2). Of these, 3,021.33 rubles will be transferred to fulfill the requirements for payment of alimony. (9064*1/3), and the remaining part (RUB 1,510.67) will be transferred to fulfill the bank’s requirements.

Calculate your salary for free with deduction of alimony and standard deductions for personal income tax

Percentage of deduction for writ of execution from salary: 70%

If an employee independently submits an application to the accounting department to make deductions from wages, he can indicate any fixed amount or percentage of total income - all the conditions for withholding funds will need to be specified in the application.

But the amount of penalties is not limited to 50 percent - the law allows you to withhold 70% of income. But this is the maximum possible amount of penalties - it applies exclusively to cases of receipt of writs of execution. As a rule, we are talking about paying child support for children under 18 years of age. Also, 70% can be recovered to pay compensation for causing harm to the health of third parties, for committing criminal acts, and in cases where third parties have lost their breadwinner due to his death.

The difference between credit and alimony deductions

In accordance with family law, parents are obliged to equally participate in the upbringing and financial support of a common minor child, even if they have other debts. That is why alimony and credit obligations have different legal natures; they are paid independently of each other.

Can the conclusion of a loan agreement affect the amount of alimony payments? If the loan was concluded before the marriage, after its dissolution the second spouse is obliged to participate in the maintenance of the common child. The presence of a loan does not affect the amount of alimony. If the contract was drawn up during married life, the obligations are divided equally. The issue can be resolved in three ways:

- After divorce, obligations are divided in half, the amount of alimony payments does not change.

- The debt is transferred to the party that refused to raise and live with the minor. On this basis, a citizen can demand a reduction in the amount of alimony. At the same time, you can agree with the banking organization on debt restructuring.

- The entire debt goes to the parent with whom the child lives. In this case, he has the right to apply for an increase in the amount of alimony payments or a significant reduction in the monthly payment under the loan agreement.

Common mistakes

Error: The accountant made deductions from the employee’s salary before paying personal income tax on the income.

Comment: Deductions based on writs of execution and at the request of an employee cannot be made before personal income tax and insurance contributions are deducted from income.

Error: An employee was denied a deduction of 80% of funds from his salary after the employee submitted an application to the accounting department for a voluntary withholding of funds to pay alimony.

Comment: An employee has the right to independently decide what percentage of deductions should be made from his income if a higher percentage is declared than the law provides.

Accounting services in Irkutsk

The Family Code of the Russian Federation does not oblige the employer to withhold alimony from the employee’s income more than once a month (Article 109 of the Family Code of the Russian Federation). After all, alimony is a monthly penalty. In addition, the organization can determine the exact amount of employee income from which alimony should be withheld only at the end of the month. No such restrictions have been established for other penalties. At the same time, we advise determining the amount of the advance taking into account deductions. Otherwise, when calculating deductions only once at the end of the month, you may be faced with the fact that the employee’s salary minus personal income tax and the advance payment already paid will not be enough to collect the entire amount of alimony. Or the second part of the salary will be significantly less than the first. After all, there is no need to withhold personal income tax from the salary advance. For example, an advance is paid monthly in the amount of 50 percent of the salary. And child support for minor children amounted to 70 percent of the employee’s income. Then the salary for the second half of the month (50% minus personal income tax for the entire month) is simply not enough. And inspectors may accuse the company of not fully withholding alimony from the debtor. The fine can be up to 100,000 rubles. (Part 3 of Article 17.14 of the Code of Administrative Offenses of the Russian Federation).

When withholding money from employees under writs of execution, it is important to comply with the maximum limit established by law. It can be 50 or 70 percent. If there is only one writ of execution, then there are no particular difficulties with the calculation. It’s another matter if the employee received two writs of execution. Or if it is necessary to withhold not only the employee’s debt under the writ of execution, but also the debt that this employee has to the company itself.

Answers to common questions about the percentage of deduction from wages under a writ of execution

Question #1: I broke a window in the store where I work. The cost of the display case is 100 thousand rubles, and now the employer withholds 50% of my salary every month. Is this legal?

Answer: No, if an employee must repay a debt to the company where he works, the percentage of salary deduction cannot exceed 20%. In addition, if you have not signed an agreement on full financial liability, according to which you are obliged to reimburse the full cost of damaged or lost property, the employer does not have the right to withhold money in an amount greater than your monthly salary.

Question No. 2: Can I quit my job if deductions are made from my salary to pay off a debt to the bank?

Answer: Yes, you have the right to resign, but the bailiffs must be notified of your new place of work, since deductions will continue to be made at the new place of work.

Rate the quality of the article. Your opinion is important to us:

The employee received several enforcement documents

If a company receives several writs of execution for an employee, then a logical question arises for the accountant: how to properly make deductions. In this case, it is necessary to refer to Article 111 229-FZ, which establishes the order of repayment of claims. For individuals it will look like this:

- Alimony, compensation for harm to health and life, damage caused by a crime.

- Mandatory payments to the budget and extra-budgetary funds.

- Other requirements.

When enforcement documents are received for debt collection under the claims of one queue, they are executed in calendar order.

How much can be withheld from an employee's salary?

BY NUMBERS.

The accountant incorrectly calculated the employee's insurance length and, as a result, accrued him 5,000 rubles more in disability benefits. During the audit, auditors from the Social Insurance Fund discovered this error and refused to reimburse the company for the overpayment. According to Law No. 255-FZ, the company has the right to recover this money from the employee’s salary. Let’s say that at the time of retention it is equal to 30,000 rubles. First, personal income tax is withheld in the amount of 3,900 rubles. (RUB 30,000 x 13%). Of the remaining amount, 26,100 rubles. (30,000 – 3900) the maximum deduction amount is calculated. It is equal to 5220 rubles. (RUB 26,100 x 20%). Consequently, the company can recover the entire excess amount of benefits from the employee at a time. If the company determined the amount of deductions taking into account personal income tax, then the accounting department would not be able to collect the entire overpayment of benefits at once. The total amount of deductions in this case would be 6,000 rubles. (RUB 30,000 x 20%). Therefore, the benefit

But many labor inspectorates consider a different interpretation of the concept of “deductions from wages” to be correct - UNP

said Mikhail Malyuga, deputy head of the State Labor Inspectorate of Moscow. According to him, “first the company is obliged to withhold personal income tax from the salary, and only then deduct the required amount within 20, 50 or 70 percent of the remaining funds. This procedure does not directly follow from the Labor Code. But, for example, Article 65 of Law No. 119-FZ clearly states that the amount of deductions under executive documents is calculated from the amount remaining after taxation. This approach can also be used for deductions from wages without executive documents.” A similar position is taken by Nina Kovyazina, head of the department of labor relations and remuneration of the Ministry of Health and Social Development of Russia*.