Every day, the working population goes to enterprises, performs their duties, and also receives a salary. In some cases, the situation at work or among drivers may have a negative impact on the employee’s body, while the Labor Code determined the need to establish compensation or additional payments for work in harmful, dangerous and difficult working conditions, described whether a bonus is accrued for the harmfulness bonus under the Labor Code of the Russian Federation .

What activities are considered dangerous?

A deviating environment is one where there are factors that have a negative impact on human health. Among them are:

- physical exercise;

- harmful effects on the senses and central nervous system;

- external reasons (temperature, speed, humidity, sounds or vibration);

- IR, UV or X-ray waves;

- radioactive contamination;

- magnetic or electric waves;

- light levels or increased concentrations of chemicals or microorganisms.

In total, there are 4 main groups according to the level of influence on the body:

- optimal;

- acceptable;

- harmful;

- dangerous.

If the accepted standard values are exceeded, the risk of occupational diseases increases. To identify the group of “harmfulness” for the profession in question, it is necessary to carry out certification. If a discrepancy is detected between the positions and the workplace, regarding the information from the qualification directory, the bonus, preferential length of service, vacation and other preferences will be lost.

What are the special working conditions?

First of all, labor legislation understands special working conditions (Article 146 of the Labor Code of the Russian Federation) as follows:

- harmful or dangerous environment for the life and health of the employee;

- work in special climatic conditions.

The Labor Code of the Russian Federation itself and other legislative acts do not contain a precise definition of the term “special working conditions” , referring to them the situations listed above.

In practice, special conditions are often understood as conditions that deviate from the norm (Article 149 of the Labor Code of the Russian Federation), for example:

- working more than 8 hours (overtime);

- on weekends, at night, etc.

Reference. The list of harmful and dangerous conditions, on the contrary, is accurately reflected in Art. 117 of the Labor Code of the Russian Federation and Art. 14 Federal Law dated December 28, 2013 No. 426 “On special assessment of working conditions.”

These include the work environment, which can affect the employee’s body:

- there is a high risk of harm to health during work;

- there is a risk of developing an occupational disease;

- There is a threat not only to health, but also to life.

What is the surcharge for harmfulness calculated according to the Labor Code of the Russian Federation?

After an expert assessment of the SOUT, specialists determine the class. If a deviation from standard indicators is detected, the employer is obliged to provide benefits. In case of refusal to provide them, the managing person will be subject to punishment under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

When determining class 3 or 4, the following are provided:

- increasing payment to salary;

- days of paid additional leave;

- shortening the week.

No compensation was previously paid

Compensatory measures are not intended if conditions are within normal limits. However, in the course of carrying out the special assessment, inappropriate factors may be identified that increase the class. In this situation, it is necessary to establish an appropriate additional payment, as well as increase annual leave.

Repeated (regular) bonuses

During the routine certification of workplaces for employees and positions, the commission may make 1 of 2 decisions:

- confirmation of the hazard class, which obliges the employer to continue providing increased salary in the previously determined volume;

- reduction of compensation or its complete cancellation (when installing new equipment or reconstructing premises).

Reducing the measures provided while maintaining or deteriorating the parameters of the working environment is unacceptable. Also, if managers previously shied away from responsibilities, this does not deprive them of the right to receive it at the current time.

For what working conditions are they required to pay compensation?

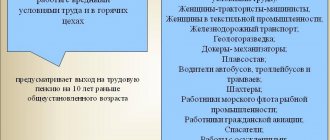

Concern for the health of the working class was one of the main directions in the USSR. Back in 1974, a list of industries, professions and workshops with particularly difficult working conditions was officially approved. In addition to the list, instructions were developed regulating the procedure for its use. Since that time, specialists whose work was associated with an unfavorable workplace environment have been awarded additional payments.

Currently, other professions have been added to the register. If the specialty in which a person works is approved in the list of specialties with particularly harmful conditions, then the additional payment is paid without certification. For other workers, you still need to confirm your rights. This can only be done by a commission that conducts workplace certification. She analyzes the work environment and makes a final decision confirming which harmful factor is causing the employee’s health to deteriorate.

In all regulations that prescribe additional payments to employees, only blue-collar occupations with severe factors appear. Office personnel can count on such compensation only if there is evidence of negative factors in the workplace. For example, the location of waste disposal sites or hazardous industries near the building.

How does the process of establishing preferential incentives work?

The need to provide benefits is determined by Labor Legislation. The employer is obliged to take into account 3 factors.

Determine the amount

- The minimum amount of additional payment for harmful working conditions (harmfulness) is 4%.

- Increase in annual leave for representatives of 2nd, 3rd, 4th grades. Duration is 28+7 days.

- Shortened working week - no more than 36 hours (less than 8 hours per day).

Next, they check for the presence of industry agreements, which can determine increased rates for individual professions. So for the coal industry the standard rate has been increased by 10-20%.

Factor 3 - the establishment of compensation measures is carried out taking into account the requirements of the trade union.

LNA

The work and rest schedule is described in the Internal Regulations. If allowances are established, they are indicated in the Regulations on Remuneration.

Regulation through an employment contract

Taking into account Part 2 of Art. 57 of the Labor Code of the Russian Federation, all parameters are described in the employment contract at the time of employment. If the presence of “harm” is established after the next inspection of the SOUT, then the HR department prepares an additional agreement. In this case, it is necessary to collect the signatures of workers who confirm their consent.

Compensatory measures

It should be noted that the harmfulness of a place varies. It is divided into classes. But they all have the same characteristics associated with health effects.

Thus, additional payments and compensation must be made if, in the course of work, a person is exposed to:

- exposure to harmful and dangerous production factors exceeding the levels established by standards, namely if the functional state of the employee’s body is restored, as a rule, longer than before the start of the next working day;

- or if harmful factors are capable of causing persistent functional changes in the employee’s body, leading to the emergence and development of initial forms of occupational diseases or occupational diseases of mild severity;

- or if harmful factors lead to persistent functional changes in the employee’s body, leading to the emergence and development of occupational diseases of mild to moderate severity.

- exposure to harmful factors during the working day can create a threat to the life of an employee, and the consequences of exposure to these factors cause a high risk of developing an acute occupational disease

Each of the above factors must be reflected in the SOUT act, as well as in the contract.

If all documents are drawn up correctly, then the employee is entitled to a whole range of compensatory measures. These include (part 1 of article 92, part 1 of article 100, article 107, part 1 of article 117, part 4 of article 189, part 3 of article 219, part 2 of article 221 of the Labor Code RF):

- annual additional paid leave;

- reduction of work shift duration;

- increase in pay (at least 4% of salary);

- preferential retirement;

- free treatment, health improvement;

- provision of protective equipment at the expense of the employer.

Additional payment nuances

The legislation allows for compensation both in kind and in monetary terms. So, if people are exposed to chemicals, biological substances, radiation, then they are entitled to enhanced nutrition and milk.

The employee has the right to refuse products in order to increase cash payments. The administration is obliged to provide him with compensation in a convenient way.

Compensation amounts are not subject to taxation.

If factors that negatively affect health are eliminated, and additional payments continue, they are no longer considered compensatory. Therefore, taxes are levied on these amounts.

If harmful conditions are eliminated, the employer may stop paying workers extra. This happens only after the next SOUT. The employee is required to change the terms of the contract.

Subtleties of production organization

The entire cycle in which people work is not always harmful. It happens that only a certain area affects health, but in general the workshop is safe. Then compensation is accrued only for the time during which specific actions are performed. That is, its size decreases.

In such cases, the administration has two options:

- calculate a percentage bonus for each worker, taking into account the time of his contact with harmful factors;

- everyone should be paid a certain amount, not less than what is required by law.

As a rule, the second option is preferred. Each person gets some amount added to their salary.

Additional compensation

The above salary supplement (at least 4%) is mandatory. That is, if there is an appropriate SOUT, the employer cannot but accrue it. But the incentive doesn't stop there.

The collective agreement may establish additional pay for special working conditions. It is established in addition to that determined by law.

The surcharge is not compensation. This is an incentive payment. Taxes are taken from it without fail.

Let's sum it up

- Workers in industries that have a negative impact on health receive additional payments and compensation.

- Each place is subject to a special assessment in order to determine its harmfulness.

- Management is obliged to organize its implementation.

- Compensation and additional payment are prescribed in the collective and labor agreement. Compliance with their conditions is mandatory for the employer who accrues and pays funds for labor.

Types of compensation measures

Among those workers who have the right to monetary compensation for harmful working conditions, other types of stimulation are also being considered.

Allowances

Additional payments are calculated monthly, and the amount is calculated from the base salary. In this case, the information is displayed in the payslip, since they are an addition to the salary.

Vacation

The beginning of vacation days is displayed in the schedule. However, to determine the number of days earned, the time of actual stay in the zone is taken into account. This is how the number of hours worked is calculated for each person. If the total number of days in the danger zone is less than the monthly average, the month is excluded from the calculation.

Shortening the working week

Hours are recorded through the Timesheet. It must reflect the abbreviation using the code "21" or "LC".

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

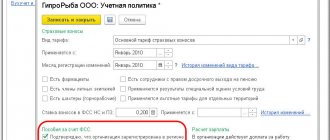

How to calculate the premium

Remuneration can be time-based or piece-rate. Let's calculate the premium for both types. In case of time payment, it can be calculated based on the hourly rate, daily rate and monthly salary.

To calculate wages with hourly wages, taking into account the bonus, we use the following formula:

(Hourly rate + Hourly rate x Percentage bonus) x Number of hours worked = Salary including bonus

When calculating wages taking into account the bonus with daily wages, the formula remains the same, however, instead of the number of hours worked, we multiply by the number of days worked. For monthly salary, use the following formula:

Salary + salary x bonus percentage = Salary

Let's look at the calculation using a specific example. For example, employee N worked in the workshop for 144 hours, this employee receives 120 rubles per hour. The employer has determined that for every hour the hourly rate increases by 15%. From this it follows that the employee will receive in a month:

(120 + 120*0.15)*144 = 19,872 rubles.

Reflection on the payslip

The bonus is considered part of the basic salary and is paid directly for work. This feature obliges the employer to display a separate column in the statement and indicate how much they pay for hazardous conditions - the amount of compensation payments for hazardous working conditions.

The need for taxation

Additional payment is accrued to workers in accordance with Art. 146 and 147. It is indicated on the receipt, and the amount is taken into account when calculating personal income tax in the manner approved by law.

Nuances of personal income tax taxation

If there is a need to establish additional compensation for harm at work in a collective agreement adopted by the organization, or by local regulations, then it can exempt such compensation from deducting personal income tax; it is necessary to confirm the compensatory nature. If supporting documentation is not available, then the additional payment is subject to mandatory personal income tax deduction.

The nuances of compensation for moral damage

According to the letter of the Federal Tax Service No. GD-4-11/4238 dated March 05, 2021, all types of increased fees based on compensation for damage for injury or deterioration of health are not subject to personal income tax. In case of moral damage, the court obliges the offender to pay compensation. Its size is determined by the nature of the moral or physical injuries caused, as well as the degree of guilt of the offender, taking into account reasonableness and fairness.

Amount of surcharge

At the legislative level, for the risk of loss of health when performing work in an unfavorable environment, a minimum amount of additional payment is established, amounting to at least 4% of the official salary of employees working in a normal environment. The percentage of the bonus factor for harmfulness is agreed upon between the staff of the enterprise or its representative committee and the employer.

When the amount of the surcharge is finally agreed upon, data on this will be reflected in the following documents:

- If there is a trade union committee, then the amount of additional payment is fixed in the collective agreement.

- In the employment contract between the applicant and the employer when hiring a person.

- The manager issues an order or other local act with the persons involved in it being familiarized with signature.

Unfortunately, a collective agreement is not one of the mandatory documents for all types of enterprises.

Therefore, Order No. 558 of the Ministry of Culture required each employer to have a Wage Regulation, which is a separate administrative document for the organization. It reflects the procedure for remuneration, including the amount of additional payments. Thus, the employer can increase this amount of funds independently, taking into account all the difficult working conditions of his employee.

Features of remuneration

The Labor Code regulates the relationship between workers and company management. So necessity is determined by Article 147, and Art. 219 guarantees compensation measures only for persons directly employed in an enterprise with negative factors. However, they are provided for positions and jobs that are assigned to employees according to the staffing table.

Refusal to assign additional payment to a person is recognized as a violation of the laws of the Russian Federation. Management in such situations is held legally accountable.

What is “harmful production”

Production is considered harmful if it deteriorates the health of the worker over time. Such work activities include work at radiation facilities (nuclear power plants, etc.), chemical and other similar enterprises.

Also, industries in which mechanical, thermal and other injuries occur are considered harmful.

Classification of working conditions by degree of harmfulness

In Art. 14 Federal Law No. 426 of December 28, 2013 established 4 classes of hazards at work. Based on the degree of impact on the body, current working conditions are divided into the following types:

- Optimal (class 1) - in such working conditions they do not lose their health.

- Acceptable (class 2) - with such work, tired workers fully restore their strength and performance before starting a new shift.

- Harmful (class 3) - in such working conditions they worsen the general condition of the body and lose their health.

- Dangerous (4th class) - during such work they often become disabled or die suddenly.

Classes of working conditions according to SOUT

Class 3 hazards at work are divided into 4 degrees:

- The first is the working conditions at a specific chemical plant or other production, under the influence of which various functional changes occur in the body. At the same time, there is a persistent deterioration in health.

- The second is that workers develop various occupational diseases.

- The third is working conditions, under the influence of which the body is harmed to a moderate or mild degree. As a result, the worker is dismissed from work for health reasons and is prohibited from engaging in his previous work activity.

- Fourth, workers develop serious occupational diseases. In this situation, they lose their overall ability to work.

Attention! Workers are given a specific additional payment for harmful work. This money is paid along with the basic salary.

Main factors of occupational hazards

The main factors of occupational hazards are reflected in the Order of the Ministry of Health and Social Development of the Russian Federation No. 302n dated April 12, 2011. These include the following:

- harmful factors of the current labor process - working postures of workers, bending of the body, etc.;

- various chemical factors - working with clay, cement and many other harmful substances that worsen the health of the worker;

- biological certain factors - daily contact of workers with certain infections, specific viruses, etc.;

- physical specific factors - vibrations, various noises, temperature conditions, etc.

Classes of working conditions

Important! When working in an enterprise with the above-mentioned hazard factors, they undergo a medical examination regularly and without fail. At the same time, employees are paid various compensations and given a small bonus to the basic salary.

One-time charges

Almost all work situations can be classified as one-time situations. However, if normal labor relations are disrupted, the company manager makes appropriate additional payments. Such situations include:

- overtime work;

- going out on a weekend or public holiday;

- night shifts.

The amount is set according to the base rate regulated by the Labor Code of the Russian Federation, or increased if regulated by local regulations.

Climate

Increased wages are guaranteed to employees located in the Far North, as described in Art. 315-317, as well as Art. 10-11. The percentage depends on the region.

VUT

Activities in a hazardous area are paid according to the Labor Code of the Russian Federation with an additional payment of 4% of the basic salary; industry agreements are also taken into account, which increase the amount of compensation for harmful working conditions for selected categories who are entitled to it.

The degree of “harmfulness” is established based on the examination of the environmental control system.

Questions and answers

- I work in a kindergarten and receive a 12% bonus, my friend also works in a kindergarten, but for some reason her bonus is 10%. Is this legal?

Answer: This situation is completely legal, because the minimum wage increase is four percent of the salary established for jobs with optimal working conditions. The specific amount of wage increases at a particular enterprise is reflected in the collective agreement and in the employment contract with the employee.

- Can I refuse to undergo a regular medical examination even if I work in a hazardous workplace?

Answer: It is the employer's responsibility to provide employees whose jobs are classified as hazardous or hazardous with regular medical examinations.

In this case, workers cannot refuse to undergo medical examinations, because the ability to work in hazardous work is determined by a medical report provided after passing a medical examination. Rate the quality of the article. Your opinion is important to us:

How to pay for special situations

The procedure for calculating benefits is determined by the factors that led to the increase. In most cases, such increased fees are one-time in nature, but management positions must take into account recruitment restrictions.

Non-working day

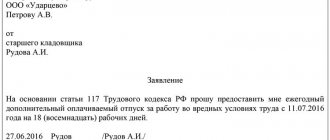

The involvement of employees is permissible only with written consent. Thus, a personal statement-agreement is prepared, as well as an order signed by the person who agreed. He is offered a day off or additional pay, as specified in Art. 153, part 4.

When choosing a salary supplement, the employer makes payment per day at double the rate, and when working part-time, payment is also made at double the rate, but in proportion to the time worked.

When choosing time off, the salary for the day off is paid as 1 salary, but the day off will not be paid.

Overtime

Written consent is also required here. In this case, the employee remains at production beyond the time established by the contract.

If only 2 hours are worked, then 1.5 times the cost of 1 day is paid. The following hours are at the 2nd tariff, but the amount may be increased according to local regulations.

Night time

This category includes employees who work from 22:00 to 06:00. The involvement of pregnant women and minors is prohibited. The additional payment is established on the basis of: the standard salary is added to 20% of the hourly rate.

Ratio of compensation payments for hazardous working conditions

The smallest amount for VUT is 4% of the base salary provided for workers who are not in potential danger at work. The fact of the increase is recorded in the pay slip as a component of the salary that is paid for the specified period.

The amount can be increased at the request of employees or a trade union organization, which is described when signing a collective agreement. An increased percentage of additional payment for harmfulness can be established for selected categories in the staffing table or PVTR. If there were no negative influences from surrounding factors during hiring and they appeared later, then an additional agreement is prepared.

Additionally, existing inter-industry agreements are taken into account, which involve setting an increased percentage.

If the enterprise is located in the northern zone, then a regional coefficient is added to compensate.

When calculating the amount of payment for VUT, a combination of factors that deviate from the norm are taken into account and are determined using a point system:

| Working conditions | Calculation by points | Surcharge amount (%) |

| Heavy, harmful | less than 2.0 | 4 |

| 2.1 — 4.0 | 8 | |

| 4.1 — 6.0 | 12 | |

| Particularly heavy, particularly harmful | 6.1 — 8.0 | 16 |

| 8.1 — 10.0 | 20 | |

| more than 10.0 | 24 |

Scheme

Additional payment to an employee employed at VUT is calculated according to the following algorithm:

- monthly output is multiplied by the piece price per unit;

- the resulting value is divided by the total operating time per month;

- the result is then multiplied by the number of hours in the danger zone, as well as by the percentage (4% or more).

Thanks to the modernization of accounting technology from Cleverence, the formula is calculated automatically based on the entered data.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Calculation procedure

The calculation is carried out only after receiving the results of workplace certification.

During inspections, the commission determines to what extent the conditions do not correspond to favorable hygienic standards and assigns them one or another class of hazard.

Depending on these data, the accountant will calculate the following amounts :

- Employees working in a work environment of hazard classes 1 and 2 are not accrued interest on their salary for hazardous conditions.

- For workers whose work environment is assigned class 3, additional payment must be made in accordance with the severity of the influence from harmful factors. It also takes into account how long each person is exposed to the unfavorable environment. The amount received should range from 4 percent of the tariff rate to a maximum of 24%.

- Workers who are involved in a class 4 hazardous industrial accident are urgently removed from the labor process. They must be removed immediately due to the great risks to health and life. Only in the event of an emergency can they perform their duties and prevent the consequences of severe damage on a large scale.

Liability for non-payment

If a person does not receive the required compensation, the organization bears responsibility for this. In this case, employees have the right to refuse to stay in the “harmful” zone as social protection. Such actions can be taken after 15 days of delay and before payment. Employees also have the right not to come to work, having previously notified the employer of the reasons. However, it is important for employees to familiarize themselves with the list of professions when it is unacceptable to suspend the company’s activities, as described in Art. 142.

The organization is also involved in:

- To financial liability and pays the entire amount for the period, taking into account the percentage of additional payment for harmful working conditions for each day of delay based on the Central Bank rate. The company can also set an increased size - the main thing is not to reduce the minimum value.

- To administrative liability with a warning or a fine.

- In rare cases, criminal liability is possible for a manager in the form of financial sanctions and a ban on performing official duties, assignment of correctional labor or imprisonment.

Why should an employer pay extra?

Increased noise levels, low or high temperatures, humidity, working with chemicals, radiation - this is a small list of conditions under which an employee is entitled to a bonus.

Milk for being “harmful”

Each organization is required to conduct a special assessment of working conditions (special assessment of working conditions) once every five years. If, after an assessment, it is revealed that employees are working in harmful conditions, then the employer must compensate them for this and employees may be entitled to the following types of compensation:

- reduced working hours

- additional leave of at least 7 days

- issuing special items (for example, medical nutrition)

- early retirement

- treatment in sanatoriums

- issuance of special clothing

- salary supplement

The duration of additional leave does not exceed 7 days, and in order to receive it, the employee must work in hazardous conditions for more than one year.

Special clothing is required to be issued by the employer at those places of work where the employee is exposed to chemicals, radiation, high humidity, temperature changes and other adverse environmental conditions. The employer, at his own expense, must provide washing, drying and storage of special clothing, and it must also be provided to employees free of charge.

In addition to special clothing, factory workers often receive special food, such as free milk, as compensation. Moreover, at work where working conditions are particularly harmful, therapeutic nutrition should be provided. The norms for issuing and also the rules by which medical nutrition is provided are approved by Order No. 46 of February 16, 2009. Ministry of Health.

Of course, an assessment of how harmful working conditions can be carried out not only by a special commission, but also determined by the employer independently, for example, based on the presence of a particular position in special lists of hazardous professions. Of course, this method cannot be 100% correct and is considered outdated today.

Possibility of canceling surcharges

If new high-tech equipment is purchased at a production facility that reduces or completely eliminates the negative impact on humans, then the employer is exempt from the need to pay for harmful effects. Also, measures to ensure normal working conditions include the supply of personal protective equipment.

If the influence of factors is not eliminated in full, then the percentage may be reduced according to the totality. Decisions on additional payments (establishment or removal) are made by management based on the examination of the SOUT. If the outcome does not suit the employees, then they may disagree with the commission and contact a higher supervisory body demanding a re-check of the results.

Registration procedure

Payment of additional payments is based on the procedure reflected either in the collective agreement or in the local administrative document.

After certification, the following points are approved :

- the results obtained from assessing working conditions;

- a list of jobs by profession and position in which workers are involved in work in an unfavorable working environment.

The procedure for completing documentation for the accrual of additional amounts for harmfulness can be found in special Instruction No. 35 dated February 22, 2008 .

The supervisory authorities over employers regarding the calculation of additional payments for unfavorable working conditions are Rostrud and the State Labor Inspectorate in the constituent entities of the Russian Federation.

If the employer evades its obligations to accrue amounts for harm, then the worker or team must submit a written statement to the company administration. In case of an unreasonable refusal, the employee should apply for protection of his rights to the above-mentioned regulatory authorities with an application and a copy of the work record book to confirm the fact of employment in the organization. Based on the request received, they will check the existing conditions in the workplace and the presence of negative factors.

conclusions

An additional percentage for work in hazardous working conditions is a kind of compensation for harmfulness, potentially causing damage to the health of the employee.

Such a person needs special benefits, which the employer is obliged to provide for each workplace. However, modernization of production allows for the abolition of increased wages, but at the same time completely eliminates production risks. Thus, software from Cleverence allows you to automate internal production processes. Mobile accounting systems developed by our company help employees cope with assigned tasks much faster and more efficiently. Number of impressions: 1486

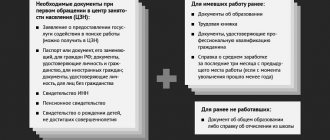

How to achieve the required payments, benefits and compensation

Often employers shy away from providing the required benefits “for harmfulness”. What should employees do in this case:

- Draw up a collective complaint together with the organization’s trade union. In your appeal, please indicate in detail the norms of the current legislation that the employer is violating, describe the harmful working conditions in which you work, and voice the requirements for eliminating the violations. The claim must be submitted to the employer against signature or by registered mail.

- If the issue is not resolved and the employer does not correct the identified violations, contact the labor inspectorate. In response to the request, an inspection will begin, based on the results of which a decision will be made on violations of the law regarding employees.

- To receive compensation for past periods, you will have to go to court. The statement of claim will have to be accompanied by evidence (statements, orders, employment contracts, witness statements) confirming the fact of violations and failure to provide benefits and compensation required by law for hazardous work.

About the author of the article

Natalya Evdokimova Accountant-expert, practical experience - more than 15 years.

Author of articles in online media on accounting, taxes, and personnel issues.