Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 9 min

0

1899

Every day, many companies offer their employees to switch to time-based wages. Time-based is a type of labor payment during which workers are paid according to a pre-agreed rate or salary. Payment is made exclusively for the time that the employee spent at work.

In this case, such time can be calculated in advance (in this case, a schedule for going to work is drawn up) or be arbitrary. In the latter case, wages are calculated based on the number of hours worked.

- When is it beneficial to use?

- What does it depend on?

- Types Simple

- Time-based bonus

- With a standardized task

- Mixed (piecework-time)

If a company cannot establish quantitative labor parameters, then it is more rational and profitable to pay employees a salary for the time worked.

The organization of time-based wages obliges the employer to comply with the following conditions :

- The HR department is required to keep a timesheet of hours worked, because without this document it will not be possible to legally organize labor remuneration.

- It is necessary to carry out tariffication for this category of workers. This must be done on the basis of internal regulations that must comply with the legislation of the Russian Federation.

- Compliance with internal norms and regulations that regulate the organization of work of all employees of the enterprise.

- Creation of all legal conditions for time workers for rational and legal work.

- Do not distinguish between those who work on a permanent basis and those who receive wages according to the time worked. They have the same rights and obligations.

What is a time-based form of remuneration (“time-based”)

Labor legislation provides for differentiation of earnings depending on the complexity and other working conditions. The specific form of remuneration is always specified in the contract that the employer enters into with the applicant upon his employment.

Take our proprietary course on choosing stocks on the stock market → training course

Time-based wages (earnings, payment, “time work”) are a common form of remuneration in which earnings are determined by:

- according to actual time worked;

- taking into account the qualifications of the employee and working conditions.

This is the most commonly used definition. It follows from this that the main thing in “time work” is qualifications and actual working of time.

An almost similar interpretation of this concept is given in TSB. The encyclopedia, in particular, says that time wages are a form of wages in which work is paid according to the time actually spent on work, and taking into account the actual level of qualifications of the employee.

Legal regulation of the application of time-based wages

The Labor Code of the Russian Federation does not establish special conditions or restrictions on “time work”. In general, the wage standards of Chapter. 21 (Articles 133-158) of the Labor Code of the Russian Federation. Based on:

- Art. 129 of the Labor Code of the Russian Federation (salary and its components).

- Art. 135 of the Labor Code of the Russian Federation (setting wages, independent introduction of a payment system in an organization).

- Art. 134, 143-144 of the Labor Code of the Russian Federation (tariffication of work, wages of public sector employees, its indexation).

- Art. 146-149 and art. 152-154 of the Labor Code of the Russian Federation (increase in wages when working in special, dangerous conditions, as well as on holidays, weekends, and at night).

- Art. 133 of the Labor Code of the Russian Federation (establishment of the “minimum wage” - minimum wage).

- Art. 100 of the Labor Code of the Russian Federation (peculiarities of the working time regime).

- Art. 91 of the Labor Code of the Russian Federation (about working time: concept, standard duration, calculation of norms, accounting).

The remuneration system approved by the organization and the specifics of labor incentives are recorded in local regulatory documents. These are:

- Regulations on the remuneration system;

- collective agreement;

- separate provisions on incentives and the applied remuneration system.

Individual incentive conditions may be specified in the employment agreement concluded with the employee. In practice, the following standards are also applied:

- RF PP No. 922 dated December 24, 2007 (actual edition dated December 10, 2016). On the calculation of average wages.

- RF PP No. 554 dated July 22, 2008. Minimum amount for increasing pay for night work.

Time-based piecework

This payment system is often called mixed. It fits perfectly:

- organizations involved in trade;

- enterprises with shift work, as it allows you to accrue additional money for exceeding the norm and overtime at night.

The calculation of time-based piecework wages can be made based on the following example. Let's say a machine operator makes cylinders for cars. For each product he receives 250 rubles. The daily rate of finished cylinders is 5 pcs. For each cylinder manufactured above the norm, the machine operator receives another 300 rubles. In a month (20 working days), the worker produced a total of 110 cylinders. And the average daily salary of a machine operator is 800 rubles.

Formula for determining time-based piecework wages:

Salary sir. = (∑p.-1 x ∑n. + ∑p.n. x ∑p.s.n.-1) x ∑r.d. + ∑d.o., rub., where:

- ∑p.-1—cost 1 pc. products;

- ∑n. — daily norm for production of products;

- ∑a.s. — the amount of exceeding the norm;

- ∑p.s.n.-1 - cost 1 pc. products in excess of the norm;

- ∑р.д. — number of working days;

- ∑d.o. - the amount of daily salary.

To calculate the final salary, you need to find out the average daily output:

∑d.v. = 110 / 20 = 5.5 cylinders.

That is, the norm was exceeded by 0.5 cylinders. Then the time-piece wage will be:

Salary sir. = (250 x 5 + 0.5 x 300) x 20 + 800 = 28,800 rub. (excluding taxes).

How is time-based wage system different from other systems?

With “time work”, payment is made in proportion to the amount of time worked (hours, days, etc.). The main thing here is the qualitative result, not the quantitative one. Salaries are calculated according to the tariff rate or official salary. The use of ETS is allowed.

Important!

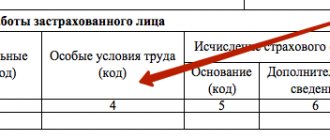

The main document on the basis of which time wages are calculated is the time sheet. time. Its recommended unified form T-13 was introduced by Decree of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004.

Time-based payment provides both positive and negative motivation. In the first case, a bonus system is used, which depends on the final result obtained and its quality. True, bonuses are distributed among all employees in proportion to earnings and taking into account the level of qualifications. In the second - fines and other material sanctions if an unsatisfactory result is obtained.

Piece-rate and time-based forms of remuneration: key differences

It should be noted that these are the two main forms of the tariff system of remuneration that employers use today. The main difference between them is that time-based wages depend solely on the actual time worked. The quality of work does not play a role here. The employee receives money regardless of how long he worked for the established time and even if he did not work, but was only present.

Piecework is influenced by the number of operations performed and units manufactured. products.

Here the use of working time is not taken into account. The main thing is volumes, payment is for the result, which, by the way, is obvious and amenable to accounting and evaluation. That is, the result can be calculated, and the quality can be observed. The more completed and produced, the more earnings will be. Therefore, the worker is interested in producing as much output as possible.

According to Art. 150 of the Labor Code of the Russian Federation, payment for work of different qualifications during “time work” is made according to the highest qualification. In a similar situation, the piecework form involves payment at the rates of the work that he performs.

Important!

It happens that an employee is assigned work that belongs to tariff categories (qualification categories) lower than those assigned directly to them. Then the employer is obliged to pay the difference between the categories.

Who uses time payment

Separately, it is worth mentioning who most often uses the time-based wage system. As a rule, these are those enterprises and organizations that provide various types of services to the population.

Also quite often, employers use “time work” in relation to certain categories of highly qualified specialists, such as engineers, doctors, lawyers, etc.

Thus, the time-based wage system, despite some of its disadvantages, is the most preferable for many employers. It allows you to save wages, keep employees from moving to other companies and at the same time ensure a fairly high quality of work performed.

Time-based form of remuneration: types, features

An employee’s earnings for a fully worked month with “time work” should not be less than the regional minimum wage.

If the employee did not work all the working hours, then earnings will be accrued to him only for the time actually worked. In the time-based form, all social guarantees, vacation, and sick pay are provided.

There are several types of time-based payment methods. They indicate that payment is not always based on a fixed salary. Let us further consider in detail all the types of “time-based” used.

Simple time system

In this case, the employee is paid for a specific amount of time worked. The volume of work (operations) performed is not taken into account here. According to the method of calculation, a simple “overtime” is:

- hourly;

- daily;

- monthly;

- annual.

To calculate the amount of salary to be paid, take the tariff rate (or official salary) and the actual time worked:

Salary = tariff. rate (due salary) * actual value worked out. time (1)

With an hourly or daily payment system, the calculation takes, respectively, the hourly (daily) rate and multiplies it by the number of hours (or days) worked.

A simple “time payment” is quite stable, it is paid “in any case”, but does not imply additional payments or bonuses.

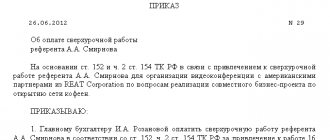

Time-based bonus payment with a standardized task

Provides for the assignment of a whole plan of work, which must be properly and efficiently executed within a specific time. When determining the amount of earnings, it is the fulfillment (and not overfulfillment) of this plan that is taken into account. The payment amount includes a time part (time work) plus additional payment for completed tasks.

Bonuses are provided for the quality of work performed or savings in raw materials.

Time-bonus system

Under this system, the employee is paid a salary for the time actually worked, plus a bonus for specific achievements.

The conditions and grounds for bonuses are developed and enshrined in the relevant local regulatory act (for example, in the Regulations on Bonuses). Bonuses are assigned for the quality (quantity) of work and can be set as a percentage of the tariff. rates (due salary) or a fixed amount.

Salary = tariff. rate (due salary) * actual value work time + bonus based on work results (2)

Time-based salary system

This is one of the most common payment systems. Salary - fixed salary per month. Taking this into account, the standard salary system takes into account actual time worked.

As for hourly wages, the rate per hour is determined and fixed in the employment agreement, as required by Art. 57 Labor Code of the Russian Federation. Something like this: “Set hourly wages at 300 rubles. at one o'clock".

Piece-time system

In fact, this is a kind of mixed form, which is a combination of “time work” and piecework wages. In this case, the salary is calculated taking into account the time worked and the amount of work done. The quality of the work, its complexity and working conditions are also taken into account.

It is used more often during shift work. The day shift is paid according to the volume of products produced, and an additional payment is provided for the night shift.

Mixed system

It can combine different forms, combine the features of a tariff and non-tariff system. Within the mixed framework they use:

- commission form (fixed percentage of income received from the sale of products, services, works);

- a system of floating salaries (the salary amount is determined monthly based on the results of work in the corresponding area - applicable for specialists, managers, administrative personnel);

- the so-called dealer mechanism (an employee buys the company’s products with his own money and sells them himself, and the difference between the purchase and sale prices is his income).

The conditions for calculating the stipulated bonuses are fixed locally, in the regulatory documents of the organization (Regulations on remuneration, employment agreement, other document).

When and where to apply

Time-based wages are usually used in organizations where it is impossible to calculate standards, volumes or quantities of products produced. Most often, the use of this form of payment is practiced by organizations that provide various services to the population (for example, minor household repairs).

Also, hourly wages are often introduced for highly qualified personnel : teachers, engineers, doctors, etc.

To organize the work of employees during temporary work, employers must maintain a working time sheet, as well as create a personal employee card with the tariff rate and amount of additional payments indicated here. An employer may establish different remuneration mechanisms for employees.

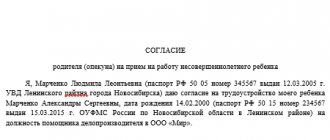

The form of remuneration at the enterprise must be specified in the employment contract or other local regulatory act. An employment contract with an employee on a time-based basis is concluded in a standard form.

The following can be used as a wording indicating a time-based form of payment: “Set the employee an hourly wage at the rate of 250 rubles per hour.”

If it is necessary to change piecework wages to time-based wages, an additional agreement is signed with the employee.

Which enterprises benefit from using time-based wages (area of use)

Most often, this form of payment is used for irregular work or if the operations performed are very difficult to account for. For example, in organizations that provide minor repair services to the public. This also includes public sector employees who can conduct business activities.

“Time work” can be set for part-time workers, temporary and permanent workers. This is how you pay for your work:

- administrative and management personnel;

- workers of servicing households, auxiliary production.

These could be, for example, doctors, engineers and other highly qualified specialists. We can say that today time-based payment is optimal for most organizations and is gradually replacing piece-rate payment.

Least of all, time-based work is used by commercial structures that seek to increase profits by increasing labor productivity. But if they use non-economic methods of motivation, then this form is used by them as a dominant one.

In what cases is it used?

Time wages are a way of paying employees whose work does not directly affect the overall productivity of the enterprise. It is obvious that the workshop foreman, with proper motivation, will complete more work orders if he is interested in this. The products produced during his shift are proportional to the effort expended.

The work of, for example, a teacher consists of “issuing” hours, i.e., actual lessons taught. A situation arises in which it is difficult to calculate how much work an employee has done: this month everyone has mastered the material, next two-thirds. And how can one even establish this for certain? But it is also necessary to evaluate the work somehow. This is where the time wage system comes to the rescue.

How to formalize labor relations when using time-based wages

The procedure for calculating wages (its amount, method of calculation) is determined before the start of the employment relationship. As is customary, this issue is resolved individually with the employee or according to a standard general template, depending on the prescribed standards in local regulations.

In the employment agreement, when establishing “time work”, the terms of payment for work must be specified, namely:

- the amount of the tariff. rates (or official salary);

- additional payments;

- allowances;

- incentive payments (bonuses).

The mandatory content of the employment agreement is determined by Art. 57 Labor Code of the Russian Federation. It is drawn up in two copies.

Elements of the tariff system

In fact, time wages are a value determined by multiplying the tariff rate by the time worked. The tariff rate is indicated as the absolute amount of wages per unit of time. The minimum tariff rate of the first category is used as the initial value. It is used both to calculate the basic salary and when calculating allowances. The totality of worker categories and the values of the corresponding coefficients form the tariff schedules.

Detailed information about the rates and labor standards that must be performed per unit of working time is contained in the tariff and qualification reference books. Thus, the size of a worker’s salary directly depends on his rank or category, as well as on the complexity of the duties performed. If work is carried out in harmful or difficult conditions, an increased rate is established.

Unified tariff schedules are developed by both the state and commercial enterprises. To comply with the norms and rules of labor legislation, as well as the correct assignment and determination of categories, tariff and qualification requirements and a qualification directory for various positions and areas have been introduced. Based on them, the management of the enterprise issues its own tariff schedule or adheres to the state unified tariff system.

Advantages and disadvantages of time-based wages

Obvious advantages of “time-based”:

- Constant income. Workers always receive wages, even if something happens, for example, with equipment. That is, the influence of these and other external factors does not affect payments.

- Low staff turnover. People like this kind of work and are interested in it. They rarely quit and are not inclined to change jobs.

- Efficiency in the event of difficulties associated with labor standardization, when it is almost impossible to calculate the volumes, (quantity) of services, products produced.

- Lack of negative motivation, as well as team cohesion, minimizing conflicts.

- Accessible tracking of hours worked, simple management of personnel policies.

The main disadvantages of “time-based”:

- Minimal employee motivation. Their earnings do not depend on their efforts. This drawback can be eliminated through the use of a piece-time system or the establishment of bonuses.

- Despite the high responsibility of the team, labor injustice often occurs. Individual workers do the work of others, but they all receive the same pay.

- Significant risks associated with instability of performance and decline in financial performance.

- Ineffective in emergency situations.

Time-based salary

This form of payment is always fixed. To receive a full salary, the employee must fulfill the quota daily. If the norm is exceeded, the employee will receive the same money as usual. This is the main disadvantage of this form of payment, since he will not have the motivation to make more products than required.

Time-based wages can change up or down only at the time of receiving sick leave or vacation.

The advantage for the employer and the department at the enterprise that deals with payroll is that it does not have to be calculated. The fact is that the salary specified in the contract agreement is the same salary. That is:

Salary = ∑о., rub., where:

- Salary — time-based salary;

- ∑o. - salary amount.

As mentioned earlier, its amount will change only in the event of sick leave, vacation, or in those rare cases when the employee does not meet the standards within a month. Let’s say that a programmer’s monthly salary under a contract is 45,000 rubles, and the number of working days is 20, of which the employee was on sick leave for one week (5 days). At the same time, to pay for sick leave, an employee’s salary is 2,500 rubles. in a day. Then the salary will be calculated according to the formula:

Salary = ∑о. / ∑р.д. x ∑f. + ∑d.z. x∑n.d., rub., where:

- ∑o. — salary amount;

- ∑р.д. — number of working days in a month;

- ∑f. — number of days actually worked;

- ∑d.z. - the amount of daily earnings;

- ∑n.d. — number of non-working days (sick leave/vacation).

We have: Zp.o. = 45,000 / 20 x 15 + 2,500 x 5 = 46,250 rub. (excluding taxes).

conclusions

From a variety of forms of remuneration, each enterprise chooses the optimal one for itself or uses several forms in combination for different categories of employees.

If an employee’s work cannot be determined from a quantitative point of view, it is definitely worth using a time-based or time-based bonus form of remuneration (for example, for managers, the entire administrative and managerial apparatus and specialists).

The piecework form of remuneration is used only in cases where quantitative characteristics can be determined. In this case, the employee is motivated: the more he does, the more he will receive (usually applied to basic production workers).

The bonus component in any form of remuneration is intended solely to motivate employees; whether to apply it or not directly depends on the financial capabilities of the enterprise.

What is more profitable for whom?

Employers benefit more from the introduction of a piece-rate system. Because they pay exactly for the volume of products or work that was completed without unjustified overpayments.

However, this approach can also have a positive effect on staff. If employees show high productivity and are able to exceed the target, then their diligence will also be rewarded with a corresponding increase in earnings.

In turn, the time-based uniform is of great benefit to employees. Although performance evaluation can be based on completed tasks, it is often difficult to monitor the quality and effectiveness of actions.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

As a consequence, the employer pays wages based on working hours. But what the person did and how productively the person worked becomes a secondary issue.

This is important to know: Grounds for termination of alimony payments

Time-based bonus salary

Time-based bonus wages are a type of time-based wages that involve the possibility of using bonuses. Additional payments allow you to motivate employees to achieve high qualitative or quantitative indicators. The head of an enterprise can apply the following types of bonuses:

- fixed amounts;

- as a percentage of salary.

But the time-bonus wage system is not used in all enterprises. Its main disadvantage is the need to constantly monitor employees to determine the effectiveness of their work. But such a salary is calculated very simply - a bonus is added to the amount of the required salary for the time actually worked.

This is important to know: Additional agreement on extension of the contract: sample