The Far North occupies a vast territory of Russia. Although the climatic conditions there are far from ideal for humans, millions of the country’s residents work and live in these areas permanently. This leads to additional stress on health, and working conditions for many professions in such regions become very difficult. In an effort to somewhat compensate a person for difficult living conditions, the state provides benefits and privileges for those who choose to work in the northern territories. They also apply to the length of service required to assign a pension. The concept of “northern experience” has even been introduced by law.

Northern experience for retirement

Northern experience is the total time that a person worked in the Far North and the territories that were equated to it. It is considered a special type of length of service and is taken into account when assigning a pension.

Reference! Whether a particular region or even a settlement is a territory of the Far North or equivalent to them or not is determined not only by geographical characteristics. To simplify and unambiguously answer questions, the Government of the Russian Federation issues Resolutions that list specific regions in which work makes it possible to “earn” a preferential pension.

Having northern experience is the basis for receiving the following preferences:

- the opportunity to retire earlier;

- increased amount of payments determined individually for each person;

- various benefits (for example, for the provision of housing).

Important! Only official work time is taken into account. A person must ensure that all relations with the employer are documented. Otherwise, after working for many years in difficult climatic conditions, a person may not receive the right to the required benefits. If an employer avoids drawing up an employment contract, you can contact the labor inspectorate for help.

What is included in the northern experience

Northern experience includes the time that a person officially worked at various enterprises in the Far North (and in equivalent areas). Some categories of citizens have the right to expect that periods of military service, study, as well as rest, travel, etc. will also be included in the northern period of service.

Reference! In the past, there was a different procedure for accounting for northern experience, but at present it is not applied and is not relevant.

Northern retirement experience for men and women

Millions of men and women work in the northern regions of the country. To obtain the right to retire early, citizens must simultaneously fulfill several conditions:

- score the required number of points – 30;

- obtain the necessary experience, including work in the north and any other areas;

- have northern experience - 15 years;

- reach the age established for early retirement.

To fully use the benefits for their intended purpose, men and women must have 15 years of northern experience. This norm is the same for both sexes. But if a woman has given birth to 2 or more children, then the requirements for northern experience will be reduced to 12 years.

For a long time, early retirement was set at 50 for women and 55 for men. But raising the retirement age also affects all those who work in the Far North. By 2023, it will be 55 years for women and 60 years for men.

The retirement age for “northerners” is being raised gradually – by 1 year each year. Moreover, in 2021 and 2021, they, like everyone else, have the right to receive a pension six months earlier than the deadline established by the new legislation. In 2021, women with full northern experience can count on receiving payments from the Pension Fund at 50.5 years, and men at 55.5 years. In 2021, for northern men, the retirement age will be 56.5 years, and for women – 51.5.

Retirement table by northern length of service

What will not be included in the northern retirement experience for men and women

The northern length of service does not include all periods of time that are counted in the normal period of employment. In particular, the following periods are not added to the period of work in the Far North:

- the time when the citizen did not officially work, even if he was registered with the employment service;

- period of training in various educational organizations (from vocational schools to universities);

- service in the ranks of the Armed Forces (with the exception of certain cases, for example, for career military personnel);

- leave to care for children up to 1.5-3 years old.

When working part-time, this period will be counted toward the length of service only if the person ended up working full-time. Although care leave is not included in the calculation, women have the right to include pre- and post-natal leave, paid on the basis of certificates of incapacity.

Features of pension formation

Working in the northern parts of the country's hemisphere is especially harmful for all citizens, so the state has established basic benefits that workers in the North can count on when applying for pension payments.

Peculiarities of calculating the Northern pension

Each district has its own coefficient, which depends on the climate, distance from a specific territory, as well as the level of negative impact on the citizen’s health. The coefficient significantly increases the total amount of pension payments for all types of contributions, such as: old age; disability; upon loss of a breadwinner.

When calculating a pension, not only the total length of service is taken into account, but also the following criteria:

- Military service;

- educational process;

- decree;

- part-time;

- advanced training courses;

- vacation;

- period of dismissal due to reduction.

Exceptions are: the period of leave during pregnancy (before and after childbirth); applying for a part-time position for two or more vacancies.

Design rules

To apply for a Northern pension, you must prepare the following documents:

- passport details;

- document confirming work experience;

- paper confirming the presence of northern experience;

- paper confirming the presence of dependents;

- certificate of registration at the place of residence;

- document on change of name;

- certificate of registration with the tax structure (if there is an individual entrepreneurship);

- military ID;

- paper confirming the fact of residence outside the country;

- document establishing a disability group.

In order to increase the amount of pension payments, you must additionally provide the following documents:

- official confirmation of work experience in the northern part of the country;

- reaching retirement age.

In addition to the basic documents, the future pensioner is required to fill out an application in accordance with the established rules of the Pension Fund. The future pensioner, his authorized representative, or the employer have the right to submit an application on the basis of written consent from the employee.

You may be interested in how to properly apply for a pension: step-by-step instructions. Pension Fund employees review the papers within 10 days. The PFR specialist notifies the applicant in writing about the results of the inspection. If incomplete information is detected, the future pensioner receives a letter from the Pension Fund 5 days after submitting the documentation to correct errors.

It is important to know! Property tax for pensioners

What should be the length of service?

Conditions:

- a period of work of at least 15 years for women and men;

- at least 20 years of experience in any northern point of the country;

Men : age - from 55 years; northern—15 years (20 years of experience in an area equated to the North); the total period of work activity is 25 years. Women : Age - 50 years; northern experience - 15 years (or 20 years); the total service life is 20 years.

Features of calculating length of service in the Far North:

- until 2002, one and a half years of total experience were accrued per 1 northern year of work;

- after 2002 - one year is equivalent to 9 months of work for northerners.

The location of the northern city also influences the accrual of seniority! Information about the base areas of the North is in Resolution of the USSR Council of Ministers No. 12 of 01/03/1983!

Interesting Facts:

- When moving to a more favorable climate, pensions are calculated according to the scheme of the new location. That is, the amount of pension contributions directly depends on the actual place of residence of the future pensioner. At the same time, the indicators of northern experience remain unchanged anywhere in the country.

- The pension of the Far North is increasing both in the insurance part and in the basic part. The base part is calculated taking into account the coefficient. When moving, the coefficient is not applied. And the size of the insurance pension does not change when you change your place of residence.

- The amount of northern pension payments is 30-50% higher than the usual pension figures in the country.

- Since 2008, a bill has come into force, thanks to which pensioners from the Far North will be able to receive additional bonuses, regardless of their place of residence. The data is enshrined in Federal Law No. 312 of 01/01/2008. The main condition is having a fully worked experience of 15 years (or 20 years for areas close to the Far North).

- The northern pension is formed for all citizens who have worked in the Far North for the required period of time, and citizenship does not matter.

Normative base

Let us define the entire list of regulatory documentation that governs all issues regarding the pensions of northerners:

- Federal Law No. 166 of December 15, 2001;

- Federal Bill No. 400 of December 28, 2013 (hereinafter referred to as FZ-400);

- Federal Law No. 173 of December 17, 2001;

- Government Decree No. 651 of July 14, 2014, No. 367 of April 28, 2016

Main advantages:

- retirement age comes 5 years earlier;

- reduction of length of service;

- increase in the basic amount of pension payments;

- adding a regional coefficient;

- military personnel have the right to both labor and military pensions.

It is important to know! Step-by-step pension registration

How to calculate northern experience

The standard is to consider northern experience separately. Every 1 year worked by a person in the Far North is counted as 1 year of insurance experience, and 1 year worked in equivalent areas is counted as 9 months special. length of service

For shift workers, their length of service includes not only the period of work itself, but also the time spent working, as well as the rest period between shifts.

If a person served in the Armed Forces until 1992 in units in the Far North, and then remained to work in such a region, then he is included in the special class. length of service and time of military service.

Important! As a standard, all calculations are made based on entries in the work book. If it is not clear from them where the person worked, then additional documents will be required. Particular attention should be paid to this point for employees of various branches with central offices of companies in other regions of the Russian Federation.

If the northern experience is more than 7.5, but less than 15 years, then the retirement age for a person is reduced by 4 months for every 1 year of northern experience.

Accrual procedure

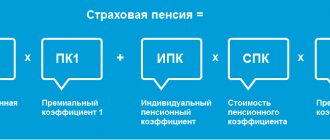

The process of calculating pension payments consists of two components:

- Fixed (basic) amount - determined by the state.

- The insured amount is determined from the total amount of pension contributions of the employer.

To determine the size of the pension, it is necessary to multiply the fixed indicator by the coefficient established for the region. And then we sum up the result obtained with the insured amount. Indicators of the basic part of the pension can be found in Federal Law-400. When calculating, you should pay attention to the following factors:

- They do not take into account the period when the employee was on the labor exchange and received the appropriate benefits.

- The period before and after childbirth is not included in the experience.

- Part-time work in two or more companies is not taken into account.

It is important to know! Pension in Moldova

As a result, when calculating a pension, periods of military service, educational activities and the actual period of work are also taken into account.

The pension is calculated on the basis of instructions approved by the Ministry of Labor No. 2 of November 22, 1990!

The minimum level of insurance in 2021 is 8,000 rubles .

The total amount of the northern pension is 30-50% higher than normal pension contributions. Example of pension calculation: Basic data: Ivanov A.P.

worked in the Republic of Karelia for 25 years. The basic pension is 5,865.53 rubles. The regional coefficient is 1.15. Calculations are made as follows: Fixed level * coefficient for continued work + individual regional coefficient * 74.27 (cost of one pension point) = pension amount. Well, now let's move on to the numbers: 5,865.53 * 1.15 + 54.4 * 74.27 = 10,785.4 rubles For a simpler calculation, you can use a pension calculator, which will show the approximate size of the future pension in a few seconds. You can find it on the website www.pfrf.ru/eservices/calc. The received pension amount is conditional.

How to apply for a northern pension

The procedures for applying for a regular and northern pension are virtually no different. General regulations apply to them.

The procedure for applying for a pension includes 3 steps:

- Preparation of a package of documents. It may vary depending on the individual's situation.

- Checking the availability of all necessary papers and rights. This is an optional step, but it is better to check everything yourself in advance.

- Submitting an application for a pension and receiving a decision on it. The originals of all necessary documents are submitted along with the application.

What documents are needed

When contacting the Pension Fund, a person must confirm all the circumstances to establish it and determine the amount of payments. The package of documents may vary significantly depending on the situation of a particular person.

The general list of required papers includes:

- passport;

- work book and other documents confirming work activity;

- salary certificate for 5 consecutive years until 01/01/2002;

- certificate of change of full name or other data.

Other papers may be required to confirm pension rights. A person may not have some documents from the general list.

Important! If there are people who are disabled in the family of the future pensioner, then all the documents for them must also be submitted.

Where to submit documents

You can apply for registration at the territorial offices of the Pension Fund or MFC. The first option is convenient if you need to get advice right away, and the second allows you to reduce the time for submitting documents, and MFCs also work according to a convenient schedule.

For the convenience of citizens, it is also possible to submit an application through the State Services portal . But the original documents will still have to be submitted to the Pension Fund or MFC. You can also send it by mail or send it through a representative. In the latter case, the representative will also need a properly executed power of attorney.

What is the deadline for making a decision?

The standard period for making a decision on an application for a pension is 10 working days . But in practice it may increase if the package of documents is incomplete. It is recommended to seek advice from the Pension Fund several months in advance.

Part-time work comes with seniority

Part-time work comes with seniority. There are features that are associated with this type of work. If you work part-time, part-time, then, as far as I know, it depends on you whether you want it to be written down in your labor record that you work part-time or not. The most important thing is that the amount of part-time work does not unexpectedly become full-time work for the same money. The only negative is that in the case of sick leave and vacation, the amount of accrual will be half the rate.

The Labor Code of the Russian Federation defines a 40-hour work week as a full-time job; accordingly, half-time means a work duration of 20 hours per week. These hours can be distributed differently, depending on the agreements between the employee and the employer. For example, it could be 5 working days of 4 hours or 3 working days of 6 hours 40 minutes. Other options are also possible.

We recommend reading: Sample of a Garage Lease Agreement between an Individual and a Legal Entity

How to confirm northern pension experience

Usually, data from the work book is used to confirm northern work experience. But if a person worked in a division of a Moscow or other company, then the entry in it may be made incorrectly. Because of this, you will have to request certificates indicating specific periods of work on a rotational basis.

If a person needs to confirm a period of service in the Armed Forces for length of service, then he will need a military ID. All other facts are also confirmed by relevant certificates and extracts.

Read more: Confirmation of work experience for pension

Law on the registration of northern pensions

This year, the issue of assigning northern pensions is being dealt with by the Pension Fund of the Russian Federation or the municipality, if there is no authorized institution in the region.

The right is granted by a multifunctional center (MFC) if the structures (MFC and government bodies) have concluded a number of agreements.

Registration process:

- checking conditions (experience and age) and collecting documentation;

- personal visit to the relevant structures to initiate and submit an application for pension payment. The necessary list of documentation is attached to it. The application can be sent by an interested person (pensioner), official representative or employer with the written consent of the employee. After reception, civil servants are issued a receipt confirming the acceptance of the documentation;

- The application is reviewed within 10 days. The applicant is then notified in writing of the decision. Within 5 days he will be informed of his acceptance (if there are any errors in the registration). After the deficiencies are eliminated, the review begins again.

Note:

accrual of payments begins on the first day of the month in which the documents were submitted, but earlier than 30 days before the appropriate age for payment of the pension.

List of documents for processing payments to citizens of the Far North

The northern pension also provides a fixed supplement to the basic part of the pension of northerners. The northern coefficient for calculating pensions will still depend on the area of residence.

Documents for registration:

- application form;

- work book and other evidence of accumulated experience;

- a certificate from the place of registration and location of the enterprise where the person worked (if required).

A number of additional papers may be required:

certificate of dependent and disabled wards, as well as documents if there has been a change of full name. or the registration of place of residence has changed.

Important!

All papers must be filled out correctly. If errors are detected, the case review process will be stopped.

In what cases is early retirement possible according to northern seniority?

With permanent residence in the northern regions and experience in the fishing, reindeer herding or commercial sectors, representatives of indigenous peoples have the opportunity to retire even earlier by 5 years . This right applies to both men and women. At the same time, men must have at least 25 years of total experience, and women must have at least 20 years.

Read more: Early retirement

Legal regulation of the calculation of the northern pension

The pension amount is determined to ensure that benefits are properly taken into account.

The payment consists of two components:

- fixed part;

- the amount calculated from regular contributions to the Pension Fund.

An increased pension for northern residents and workers is provided for in all respects (basic and insured amounts).

Fixed part of payments for citizens living and working in difficult climatic conditions:

Table parameters are taken as a basis. The pension is calculated according to the following algorithm:

- the fixed volume is multiplied by the regional coefficient;

- the amount received is added to the amount calculated from the amount of regular payments to the Pension Fund.

Each pensioner is able to independently recalculate the amount of payments in order to verify the data.

Thus, the northern pension is an increased benefit provided for citizens who have worked for many years in difficult, cold conditions. To receive it, citizens must reach a certain age, have accumulated experience and live and work in the northern region. At the same time, the law on the northern pension when moving provides for the preservation of a fixed payment, but the regional increasing coefficient will no longer be taken into account.

Will the size of the pension for northern service remain the same when moving to another city?

Quite often, people, upon retirement, decide to move to another city or town with a more comfortable climate. At the same time, they retain the right to a previously assigned pension. But after registering in a new place of residence, the assigned amount of payments will be recalculated .

During recalculation, the accumulated points and length of service will remain the same, but the regional coefficient will change. It will be installed depending on the new region of residence. In some areas it may be completely zero. In fact, if you move, the size of your pension will be significantly reduced. The difference in payments can reach 60%.

Northern experience provides the opportunity to retire earlier than established by the general rules. But we must take into account that it is necessary to accumulate a certain number of years of such experience and fulfill a number of other conditions in order to be able to take advantage of the benefits.

All about northern experience: what it includes, how to calculate and confirm and other questions

The northern length of service for a pension for women is the same as for men, however, the requirements for general work experience are more flexible - you need to work for more than 20 years. Women who meet these requirements retire even earlier - at 50 (instead of 55). If a woman has two or more children, then she only needs 12 years in the Far North or 17 years in the adjacent territories to retire at 50.

Northern experience gives Russian citizens the right to some benefits: in particular, a person who has worked in the Far North or in areas adjacent to this area for a sufficient period of time can safely count on the fact that he will retire earlier and will receive more in his old age than an ordinary person Russian. The benefits are due to the fact that work in harsh climatic conditions can be harmful to human health. By providing a “northern” worker with an increased pension, the state not only thanks him for his voluntary risk, but also evaluates his contribution to the development of lagging regions.

We recommend reading: Since what year have snils existed?

Registration of pension

Upon reaching the appropriate age, a woman who wishes to retire must take the following actions:

- calculate the length of service, check the availability of the necessary documents;

- collect missing papers;

- apply for a pension.

How to confirm northern experience

Among the documents that are submitted to assign payments, the following should be highlighted:

- passport;

- SNILS (if available);

- marriage certificates (if changing surname), birth of children;

- work book.

The main document that confirms the right to benefits is the work book. If it contains inaccuracies, then the citizen must provide documents confirming the relevant periods of work. They can be certificates, extracts from orders, payment slips, and so on.

Where to contact

To apply for preferential security, you should contact the Pension Fund at your place of residence. In addition, it is possible to submit a pension application through the State Services portal.

In a number of regions, citizens can submit the appropriate package of documents through the MFC.

Women who have worked for a long time in northern conditions have the right to count on early retirement. Depending on the type of terrain, this requires 15 or 20 years of experience. If it is available, in 2021 women will begin to receive pension benefits at age 50.5. However, this age will increase to 55 years by 2023.

Pension reform for northerners (latest news)

On October 3, 2021, the President signed a law amending pension legislation, including raising the retirement age in Russia, which will apply in particular to northerners. If by the end of 2021 they could become pensioners upon reaching 50 and 55 years of age (if they have the necessary northern experience), then after the reform these standards will be increased by 5 years - to 55 and 60 years.

Changes will occur gradually, with a gradual increase in standards during the established period - from 2021 to 2023. Therefore, citizens of different years of birth will retire at different ages according to the schedule provided by law.

It is worth noting that the pension reform will not affect mothers with two children who have the required northern experience; reindeer herders, fishermen, commercial hunters living in the areas of the KS or ISS; northerners who work in hazardous or heavy production. For them, all stipulated standards and conditions remain the same.

Raising the retirement age for residents of the Far North

The main change in the pension reform from 2021 is the gradual increase in the retirement age, including for northerners. The retirement age for northerners who have accumulated the required amount of northern experience will be increased according to the following principle:

- From 2021 to 2023, the standard will be increased annually by 1 year until the final values of 55/60 years are established for women and men.

- In the first two years (2019-2020), an additional benefit is provided - payments can be issued six months earlier than the deadlines established by the new law: in 2021, women aged 50.5 years and men aged 55.5 years will be able to become pensioners;

- in 2021 - at 51.5 and 56.5 years, respectively.

If you have incomplete northern work experience, a proportional reduction in the retirement age from 2021 will be carried out relative to the new standards, taking into account the envisaged schedule for increasing the age. From 2023, the reduction will be carried out relative to the final standards - 60 years for women and 65 years for men.

Retirement schedule by year for northerners

During the transitional provisions of the new law on retirement age, the year of registration of the northern pension will depend on the year of birth of the future pensioner, since the values of the standards will be adjusted annually. The planned reform will affect only those citizens who must become pensioners from 01/01/2019 - these are women born in 1969 and men born in 1964.

The retirement schedule by year for northerners is presented below in table form:

| Women | Men | When will they be able to apply for a northern pension? | ||

| DR | PV | DR | PV | |

| 1st half of 1969 | 50,5 | 1st half of 1964 | 55,5 | 2nd half of 2019 |

| 2nd half of 1969 | 2nd half of 1964 | 1st half of 2020 | ||

| 1st half of 1970 | 51,5 | 1st half of 1965 | 56,5 | 2nd half of 2021 |

| 2nd half of 1970 | 2nd half 1965 | 1st half of 2022 | ||

| 1971 | 53 | 1966 | 58 | 2024 |

| 1972 | 54 | 1967 | 59 | 2026 |

| 1973 | 55 | 1968 | 60 | 2028 |

Note: DO - date of birth; PV is the value of retirement age.

Thus, women born 1969-1972 and men born in 1964-1967 who have the required amount of northern experience will be subject to the transitional provisions of the new law. This means that not final age standards will be established for them, but gradually increasing from 0.5 to 4 years.

For the female population born in 1973 and male since 1968 The final provisions of the law will apply - they will be able to become pensioners upon reaching 55 and 60 years of age (if they have the required work experience in the KS and ISS areas).

Retirement in areas equated to the Far North in 2021

If they have sufficient northern experience, citizens who have worked in areas equated to the Far North (FN) also have the legal opportunity to retire 5 years earlier. Until the end of 2018, the retirement age standards for citizens working in the ISS areas were set at 50 and 55 years, but due to the reform, starting in 2021, these values for them are also increasing to 55 and 60 years.

- In addition to reaching the established age, you must have work experience in the northern regions in the prescribed amount. The legislation establishes that in order to retire early, northerners must have 20 years of work experience in the ISS.

- When developing incomplete work experience for a northerner, the retirement age will be reduced, and the calculation is made by equating the length of service in the ISS to the time of work in the CS areas in the following proportion: one full year of work in the ISS areas is counted as 9 months of work in the CS. The counting order can be summarized in a table:

| Period of work in the ISS, in years | The corresponding period of work in the Far North | |

| years | months | |

| 1 | 0 | 9 |

| 2 | 1 | 6 |

| 3 | 2 | 3 |

| 4 | 3 | 0 |

| 5 | 3 | 9 |

| 6 | 4 | 6 |

| 7 | 5 | 3 |

| 8 | 6 | 0 |

| 9 | 9 | |

| 10 | 7 | 6 |

| 11 | 8 | 3 |

| 12 | 9 | 0 |

| 13 | 9 | |

| 14 | 10 | 6 |

| 15 | 11 | 3 |

| 16 | 12 | 0 |

| 17 | 9 | |

| 18 | 13 | 6 |

| 19 | 14 | 3 |

| 20 | 15 | 0 |