Author: Ivan Ivanov

Initially, it is worth remembering that a document of this kind is unique. This is because it can combine an invoice for payment and the agreement itself.

For this reason, it can hardly be called primary. With all this, many do not classify it as an agreement, although this is not the case: Article 434 of the Civil Code of the Russian Federation clearly indicates that an agreement can be signed in any way (orally or in writing).

Written form means a document that:

- includes information about the transaction;

- can be signed by both parties involved in this transaction.

Moreover, both requirements must be met simultaneously.

Please note: the invoice does not fully comply with these conditions. The exception includes only those transactions that may be subject to the legislation of the Russian Federation providing for special requirements. For example, the possibility of registration exclusively on certain forms, and so on.

The concept of an invoice agreement

Despite the fact that this document is not approved at the legislative level, the invoice agreement has a certain form that all participants in the transaction must adhere to when registering. The document is a written commitment that specifies what products or services are provided to the customer and how much he must pay for this transaction. Also, the invoice agreement must include deadlines and responsible persons.

Form

This is a two-way transaction, where some undertake to provide certain volumes of goods and services, and others to pay for the order. To clearly see what form the paper has, a sample invoice agreement is shown below. This contract is somewhat similar to a purchase and sale agreement, but has a more simplified form. Moreover, many businessmen take this paper as a basis for carrying out other operations in order to document the transaction.

Sample

On a note! Unlike a purchase and sale contract, an invoice or deed does not require the participation of a notary, and it can be called a budgetary tool for recording various transactions.

Prerequisites

Note that an invoice agreement will be such if there is an evidence base for the relationship between the parties. But what does it have to do with it?

Necessary factors may include:

- Volumes of services sold.

- Delivery times.

- Quality of services provided.

Only if all the rules are followed can an invoice become an agreement with legal force. During court proceedings, it is easier for judges to navigate its points and make fair decisions on the issue. If a one-time supply was ordered from foreign suppliers, and the contract does not have an invoice, then an accompanying document describing the terms of the transaction is required.

As mentioned above, it can conclude both in written and oral form. But entrepreneurs make agreements in writing. Why? Another control measure, because one-time deliveries require investment. It is necessary to list all essential conditions, such as price, subject, terms. Without them, it is difficult to provide a document with an evidence base for your contractual relationship with the other party; its legal force will be conditional without defining the points.

Its functions

This documentation takes the form of a completely standard agreement, which specifies basic information: details of the parties, details, a list of products or services provided and the amount to be paid. An invoice agreement is used to reduce the volume of paperwork. It contains information only on the merits, and does not require additional accompanying documents or confirmatory agreements. Most often, such a contract is used:

- For the sale of goods or services.

- You can use it to issue an invoice to another organization.

- To complete a transaction with mandatory clauses.

- Used in the form of an accompanying statement.

- Hiring workers on a fixed-term contract.

Example. The company orders a repair team and enters into an invoice agreement with them, which immediately indicates the scope of work, deadlines and amount to be paid. Once the work is completed, the paper is posted through the accounting department and the invoice is due.

Goods supply

Delivery and shipment of products has long been carried out under this contract at many enterprises. It can replace several papers at once and speed up the payment process. The customer receives payment immediately after the goods are delivered. In this case, the buyer does not have to pay the invoice separately and enter into an agreement.

Simplified form

This documentation contains all the necessary information.

Provision of services

To carry out the provision of services through accounting, you do not need to prepare a lot of documentation; it is enough to draw up an invoice agreement and indicate in it the nuances of the transaction. For example, one company orders a batch of products from another. The paper immediately indicates the volume of goods, delivery times, details of the enterprises and responsible persons. After the product delivery process has been completed, the customer submits the contract to the accounting department, and it is paid upon delivery.

It may also talk about deadlines and penalties if the products are not delivered on time, or indicate payments for providing low-quality goods. That is, the compiler can make the documentation narrowly focused. Despite the fact that the document does not have a legal form, the employer can rest assured that the agreement is legally valid. The main thing is that the act contains the signatures and seals of all participants in the process.

Important! The accounting department most often draws up such an agreement together with lawyers so that all the nuances are taken into account.

Controversial issues when using

No matter how simple the supply situation may be, even here unforeseen situations occur.

Individual entrepreneurs have relatively recently begun to use an invoice agreement in transactions and do not fully understand its essence. Such ignorance leads to issues that are resolved through the courts.

The whole problem lies in the incorrect definition of essential conditions. For example. The prepayment for the supply is 40%, it is paid before the start of supply. Afterwards, the remaining 60% of the amount is expected to be paid. The “after” clause does not mean “immediately.” The operation can take 1-2 days or 1-2 months. And everything will be within the framework of the agreement.

It is also worth remembering that the conditions also have a validity period. To avoid unclear situations, use the following wording: “This invoice agreement is the basis for payment”

There are also such moments. The customer paid for the supplies in advance, the agreement was put into effect. But the supplier is deliberately playing for time and is in no hurry to arrange supplies. In this case, you can go to court if the supplier continues to “pull rubber”, having your funds on the cash balance.

You can download a sample document from the link.

Who can issue an invoice agreement

The agreement is signed by all participants in the process, even if there are intermediaries to the final point. Therefore, the invoice can be issued by both the contractor and the customer. If the document is an offer, then it is enough for only the executing party to sign it, and if a full-fledged contract is drawn up with all the nuances spelled out, then written confirmation from both parties is required.

Background check required

That is why the agreement specifies such items as:

- Company details.

- Subject of the transaction.

- Deadlines.

- Terms of payment.

- Force majeure circumstances.

The contract must also contain an invoice, acts and invoices. Most often, a tabular form is used, which indicates the figures to be paid, including VAT.

Procedure for compilation

The invoice agreement is drawn up on an A4 sheet of paper - this is its main advantage and specificity.

The document has its own number and date of execution, which, after its conclusion or other confirmation of the fact of consent, is the date of commencement of the contractual relationship, provided that there is no other date in the agreement.

In addition, the name of such a document is “invoice agreement”. It is not allowed to specify another name, for example “Agreement” or “Account”. It is important to remember this in the process of making monetary payments or performing other actions that are provided for.

The document has the right to be signed by one of the parties to the transaction (in other words, the contractor), and also act solely as an offer, or be concluded by both interested parties: the customer and the contractor, in which case the document acts as an agreement.

The document itself includes several parts:

- Agreements containing all information, including significant and mandatory requirements. In particular, we are talking about the subject of the agreement and the period of its implementation, periods and methods of payment, the procedure for preparing accompanying documentation - the corresponding act of work performed, invoice, invoice, and so on.

- An invoice in which detailed information on the subject of the agreement, the volume of services provided, the cost of work, taking into account the required VAT (provided that the contractor is the payer) is indicated in a tabular version.

In a situation where a document is signed between a legal entity and an individual entrepreneur, the individual entrepreneur party can enter into an agreement independently or by a responsible person (for example, the head of a company).

In this case, it is imperative that in the agreement, near the signature of this person, it is necessary to indicate the details of the document that provide him with such rights in full, and to act on behalf of the individual entrepreneur. In most cases, such a document can be a notarized power of attorney.

If the document is considered an offer, one party – the contractor – must sign the invoice agreement, so it is enough to indicate only its details.

The form of the invoice agreement itself does not fall into the “unified” category. In addition, it is not at all necessary to comply with the conditions of Law of the Russian Federation No. 402 “On Accounting”, since it regulates exclusively contractual relationships and does not apply to the “primary” ones.

In this case, it is necessary to take into account the fact that the conditions of registration (written form, significant and mandatory conditions, the conclusion process) are strictly regulated by the Civil Code of the Russian Federation, in particular chapters 27-29.

Possible controversial issues during application

Initially, it is worth paying attention to the fact that if the customer of services has a desire to modify or re-execute the document into a standard or familiar form, the contractor retains the right to duplicate the contractual requirements in a separately drawn up agreement, the name of which is “Agreement”.

Moreover, the information can be transferred in full accordance with previously prescribed and at the same time supplemented with subsections on rights and obligations, acceptance, including possible court orders.

As for the possible isolation of the invoice itself from the document, this cannot be done provided that the executor does not have a form.

The period with methods of payment for the provision of services is also considered important in the document. Often, contracts of this kind specify a payment period that is tied to the completion of the provision of services. For example, payment of 40% before the provision of any services, and payment of the remaining amount after. For this reason, it is extremely important to specify clear periods in the contract, since payment may otherwise last over a long period, quite legally.

In addition, the issue should be resolved regarding the duration of the conditions that are specified in the document after it gains its legal force, but before payment is made by the customer.

This measure is necessary for both parties, since the whole problem lies in variable market conditions, which may affect a possible modification of the agreement if the customer has not made payment on time.

For the majority, at the moment it remains unknown what an invoice agreement means. For this reason, a problem may arise about what to do: in the process of making payments, rely on the number and time in the contents of the document, or require a separate account to carry out such an operation. To avoid this kind of problem, the content of the agreement must include the phrase: “The drawn up agreement-invoice is the direct basis for making payments.”

If the customer himself desires, in addition to the document, an agreement can be concluded in a standard form. In such a situation, both documents must be identical.

Litigation

The document has already been concluded, payment in the required amount has been made, but the contractor has not started providing services. Is it possible, if such a document is available, to file a claim with a judicial authority and demand compensation for damages or penalties?

The answer is simple - of course, this possibility is allowed.

In such a situation, it is important to remember: according to the Civil Code of the Russian Federation, an agreement can be concluded in several ways:

- correspondence;

- acceptance of the offer, including the terms and conditions.

What does this mean? It follows from this that, regardless of whether the document is an offer for which payment is made by the customer, or signed as a separate agreement by both parties, it fully confirms the existence of the rights and obligations of each party.

In simple words, if one of the parties for any reason violated its obligations, the opposite party has every reason to file a claim with a judicial authority. Liability in such a situation will be determined in accordance with the legislation of the Russian Federation.

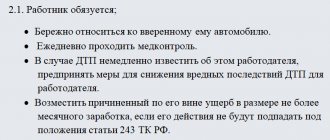

Instructions for filling

Even a simple employee can draw up an invoice agreement if, for example, he is a seller and does not sell products from the factory in cash. Below are step-by-step instructions for filling out:

- The header indicates the details of the contractor and the customer.

- The details of both parties are written down.

- The data of goods or services is indicated.

- Additional conditions apply.

- An invoice is issued for payment.

- The terms, delivery and payment procedures are specified.

- The total cost and prices of each item separately are indicated.

- The conditions for force majeure are indicated.

- The signatures and positions of the participants in the process and the seal of the organization are affixed.

Subject of the agreement

Note! This type of agreement is convenient because it combines a payment order and elements of a standard contract.

Questions on the topic

Question: I entered into an invoice agreement with an individual entrepreneur for cabinets, I have my own workshop with a license to work. He paid the first amount, as expected, and sent the shipment. But the second amount still does not arrive. There is no way to contact him. The agreement contains all his data and all the signatures. Should I file a claim against him?

Answer: First, try to notify him more. If you cannot contact him in any way, then only through the court. Such actions are a gross violation of the essential terms of the contract. You can demand from the court that it recover from the customer the entire necessary amount to cover the damage.

Cases in which an invoice for payment can be considered as an agreement

It is advisable to use an invoice agreement when we are talking about small volumes of products or short-term agreements. This contract can be concluded both between legal entities and individuals. The issue may concern the supply of goods and work, as well as elements of the agreement. An invoice agreement can act as a means of agreement, which spells out the nuances of the transaction. If force majeure situations are indicated, responsible persons are specified, penalties for failure to fulfill the terms of the contract are indicated, then such a document is considered as a standard contract, but with the possibility of issuing an invoice.

An invoice agreement is used by many small businesses. This document cannot be reusable and include several delivery periods for the same order; in this case, a more global version of the agreement is used; dates and volumes must be specified for each operation separately.

How to avoid mistakes

Judicial practice has long developed a mechanism to prevent possible errors in the process of drawing up a contract.

So, you can cope with this task if you take into account the following factors:

- The Contractor automatically agrees with the new form of the document if the customer decides, without changing the conditions, to transfer the form to a standard form.

- Brevity is the soul of wit. But not in this case. All points must be spelled out thoroughly and clearly, so that even a stranger, after reading the contents, understands what is described in it and on what basis the contractual relationship is conducted.

- Choose specific deadlines for implementing the conditions. The wording “after” or “later” will play a cruel joke on you. Especially if you are a supplier. In this case, you will receive part of the amount before the deliveries are made, and you will wait a very long time for the second half, because the customer interpreted the “payment after delivery” clause as an ambiguous period. Remember this if you enter into a one-time agreement

Experts' opinion

Let's look at an example. The company only has an invoice for the provision of services. It contains these provisions: name, quantity sold, cost, availability of payment order. Can this invoice serve as confirmation of the execution of a supply agreement? Yes, if the following conditions are met:

- The document is addressed to a specific person.

- From the invoice you can understand who exactly issued it.

If all these conditions are met, then the check is analogous to the execution of a supply agreement in a simple form. How is this conclusion justified? Let's look at it in detail. There are two definitions of a contract from a legal point of view:

- A contract is a transaction that fixes the will of several people or firms (Article 153-154 of the Civil Code of the Russian Federation).

- An agreement is a document fixing the conditions for the occurrence of obligations.

Paragraph 1 of Article 161 of the Civil Code of the Russian Federation states that transactions are carried out in writing. But drawing up an agreement is not the only method of completing a transaction. An agreement, on the basis of paragraph 2 of Article 432 of the Civil Code of the Russian Federation, can be concluded through the submission of an offer. An offer is a proposal to conclude an agreement. One participant makes an offer, and the other accepts this offer.

The considered methods of concluding an agreement are used if the law does not have specific requirements for the transaction being made (Article 434, 550 of the Civil Code of the Russian Federation). For example, if it is not a real estate transaction. That is, if the offer contains all the essential conditions, it replaces the contract. Payment by check is an acceptance, implying the conclusion of a contract. In this case, there is no document signed by the buyer and seller. But it does not matter. This conclusion is confirmed by these regulations:

- Government Decree VAS No. 981/98 of October 6, 1998.

- Resolution of the Federal Antimonopoly Service of the North-Western District No. A44-80/2008 dated May 4, 2009.

- By FAS Resolution No. Ф09-1968/09-С5 of April 13, 2009.

Why even raise the question of whether a check can be a contract? This becomes relevant when conflict situations arise. This is especially important in the context of litigation. Let's look at an example. The company began to cooperate with the supplier. She orders products from the latter for a certain amount.

Form and details of the supply invoice

The agreement does not have a unified form, but it has a certain structure, the formation of which will not take much time.

You can find out what a claim under a supply agreement is and how to draw it up correctly by following the link. The document consists of two tables and several paragraphs. In this case, it must contain the following details:

- Supplier – name of the organization, legal address, registration numbers;

- A table with a sample payment document, which must contain - TIN, KPP, account number, name of the recipient, recipient's bank and all its details;

- Next comes the name of the document and the date of its formation;

- After which the name of the supplier and payer is indicated;

- Name of the product indicating the quantity, price per piece, total amount with VAT highlighted as a separate line;

- After which the main conditions of this document are indicated;

- Addresses and details of the parties;

- Signatures and seal.

Sample of filling out a supply invoice.

Filling out an invoice on a prepared form must be completed in the following steps:

- Enter the full details of the supplier;

- Fill in the fields about the recipient organization - TIN, KPP, name. Here you will learn how to restore your TIN if lost;

- Enter the number and date of paper generation;

- Specify the recipient's details;

- Clarify the obligation that is the basis for issuing an invoice - agreement;

- Fill in the columns of the table containing information about the products;

- Indicate a list of responsible persons with their signatures.

Important: be sure to emphasize the allocation of VAT, even if the supply is not taxed.

How to draw up a protocol of disagreements for a contract for the supply of goods - read in this article.

What should be indicated in the document?

There is no unified sample invoice agreement for the supply of goods (performance of work). Therefore, the parties have the right to determine its content independently.

The document form should include the following information:

- names of the parties;

- TIN, legal address, bank details of the supplier;

- subject of the agreement;

- composition of supplied goods (works, services), their cost;

- duration of the agreement;

- delivery order;

- bill payment procedure;

- dispute resolution procedure;

- other conditions (at the discretion of the parties).

If necessary, you can add other information to the document that is included in a regular contract (clause on containers and packaging of goods, force majeure, the procedure for paying fines, etc.).