What the law says

The definition of the term and the procedure for applying the regional coefficient is given in the Labor Code of the Russian Federation (Articles 146, 148, 315, 316), and in Resolution of the Ministry of Labor No. 49 of September 11, 1995.

Regional coefficient is a mechanism for equalizing the income of Russians who live in regions with a special climate

. The indicator intended for indexing pensions and payments under employment contracts is established at both the federal and local levels (albeit with reservations).

In accordance with Art. 316 of the Labor Code, regional coefficients must be established by the Government of Russia, but at the same time they do not cancel any additional payments to local residents from local budgets. Regional authorities, through their regulations, can increase the size of regional coefficients. In this case, additional payment will be made from regional budgets.

State organizations will be required to apply increased coefficients, and commercial companies will independently decide

, use the federal indicator or the modified local one. As for the northern regions, for them the size of allowances and the procedure for their calculation are regulated by the Federal Law of February 19, 1993. No. 4520-1. The RK for residents of the Far North of the RK fluctuates in the range of 1.15 – 2.0, for those who work on Antarctic expeditions, the regional coefficient is 3.0. Bonuses for citizens working in the northern regions (Article 316 of the Labor Code) are set as a percentage of the salary and depend on length of service, location, and age.

Due to the fact that the Government of the Russian Federation has not adopted any documents on the introduction of regional coefficients

, when using them, employers must be guided by previously approved but still valid regulations, even those issued under the USSR.

Conditions for calculating the coefficient

When applying the coefficient, you need to multiply the accrued salary by it. In addition, additional payments (bonuses or allowances) must also be increased by this amount if they relate either to the amount of salary or to bonuses for employee achievements in activities.

Income tax is taken from the amount calculated as a result of these calculations.

Pensions granted due to the loss of a breadwinner are calculated in this way. Pension payments to the elderly and disabled are subject to recalculation.

The additional payment in question is expressed as a percentage and relates to the formation of salaries and incentive payments.

What incomes do regional coefficients apply to?

Payments increased by indexing by coefficients established by the government will be received by pensioners (only if they live in special territories, the additional payment is lost when moving), officially employed residents of the regions, and local residents receiving benefits. The coefficients apply to the following income:

- All payments from the employer provided for in a collective or employment agreement. Wages (tariff scale, salary). Minimum wage and all payments tied to it. Additional payments to wages (allowances for qualifications, length of service, for harmfulness, bonuses, compensation for temporary disability, if calculated based on the minimum wage, etc.). Salaries of citizens working part-time, with a flexible schedule, by season.

- Pension.

- Fixed benefits, which are determined based on average earnings on the basis of Federal Law No. 81 of May 19, 1995, Federal Law No. 255 of December 29, 2006. (pregnancy and childbirth, sick leave, child care).

Regional coefficients are not awarded

for the following types of workers' income:

- vacation pay;

- irregular or one-time financial assistance not provided for by the collective agreement or the employer’s accounting policy;

- travel allowances when an employee travels to a region not included in the list of special territories;

- compensation for temporary disability, if calculated not on the basis of the minimum wage;

- irregular bonuses;

- allowances for citizens for working in the conditions of the CS and regions equated to the Far North.

Dismissal due to staff reduction and northern bonus

In the event of an unstable financial situation, the company may make reductions. Dismissal in the north has its own characteristics and guarantees.

After the employer has completed all the reduction procedures common to the country, the employee must receive a calculation taking into account northern allowances and regional coefficients in the amount of average monthly earnings. In addition, the employer will have to pay him an average monthly salary for the entire period of job search, but not more than 3 months.

If, after being laid off, the employee registered with the Employment Service within 1 month and it was unable to give him a job, then by decision of the same service the employee may retain his average earnings for a period of 4 to 6 months.

Another privilege of KS employees is the continuation of their work experience for 3 months of job search, and sometimes for 6 months.

For which regions are regional coefficients provided?

In order for a territory to receive a status requiring equalization of incomes of the population, it must have special difficult conditions:

- unfavorable climate;

- bad ecology;

- lack of developed infrastructure;

- dependence of the population on transport;

- the presence of organizations with difficult working conditions or special types of activities.

For officially working citizens permanently residing in such regions, the employer is obliged to make payments taking into account the coefficient

(from 1.0 to 2.0, depending on the region), applying it from the first day of their employment.

Difficult terrains include

The Far North and areas with similar climatic conditions, the Far East, the southern part of Eastern Siberia. The highest RK - 2.0 is used in Kamchatka and the Kuril Islands, the lowest 1.1 - in some areas of Kalmykia, Rostov region and Dagestan.

Maximum allowance amount

When calculating a percentage increase in wages for work in the Far North at an increased rate, observe the general restriction on its maximum amount in this region. That is, in the regions of the Far North, a bonus of more than 100 or 80 percent of earnings cannot be charged. And in areas equated to the regions of the Far North - more than 50 percent (for more details, see the table).

Such rules are provided for in paragraph 16 of the Instruction, approved by order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 2, and paragraph 6 of the Instruction approved by order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 3.

How to apply odds

The regional coefficient is a guarantee from the state that concerns the wages of residents of such regions

. The size and procedure for calculating and paying wages must be reflected by all employers in employment or collective agreements. The document must indicate the amount of remuneration for the work, as well as the amount of all federal and regional additional payments.

If such information is reflected in the collective agreement

, then when concluding an employment agreement you can make reference to this provision. All accruals in organizations are handled by the accounting department, which calculates earnings according to the scheme established by law. The resulting amount is multiplied by the coefficient corresponding to the specific area, due to which it increases.

The regional coefficient does not depend on the form of ownership of the organization, the place of its official registration, or the employee’s length of service. Regulatory acts do not provide restrictions on the maximum amount of income that is subject to indexation. The coefficient should be applied to every officially employed resident of the corresponding region who permanently resides and works there, a pensioner (for old age, long service, disability), and citizens receiving benefits.

The value of RK varies from 1 to 2, depending on the region

where a person lives. In some territories, the value of the coefficient is directly related to the category of workers. For example, in one area there will be different indicators for fishing industry workers and railway workers.

To find out what coefficient applies in the region, the employer can contact the local labor inspectorate

. All information can be found in specialized media, on thematic websites or in regulations.

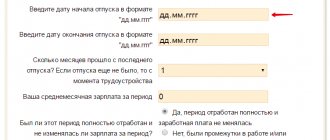

Salary calculator

It is easy to check the correctness of the salary paid, calculate the northern salary bonus, as well as the RK, using an online calculator via the Internet. All lines must be filled in.

The operation of the online salary calculator is intuitive. Using it, it is easy not only to check the correctness of payments, but also to find out how much tax has been withheld.

As a result, every employee can calculate their “hard earned income”, with all additional payments and tax deductions. It will become clear to check the correctness of the accruals and find out when the value of the northern ones will increase after studying the relevant law. And the size of the coefficient should be found in the local legislation of each region.

When applying for a job, a citizen must negotiate the salary amount with the employer.

But when you receive your salary in your hands, the amount may turn out to be completely different.

The amount that is negotiated when hiring is the salary, it is indicated in the employment contract. But the amount of money that the employee receives will depend on certain factors.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

What happens if you don’t apply the regional coefficient?

The regional coefficient is calculated for an amount exceeding the minimum wage, therefore, wages for citizens working in regions with difficult climatic conditions cannot be lower than the fixed amount of the minimum wage multiplied by the RK

. If this happens, it means that the employer has violated the norms of the Labor Code of the Russian Federation and penalties and other administrative penalties should be applied to him.

For delays in payment of wages, the responsible persons of the organization are liable in accordance with Art. 142 TK. The regional coefficient increases workers' earnings, so if it is not calculated, the employer faces a fine: for a legal entity - up to 50,000 rubles

., director -

up to 20,000 rubles

.

If such a violation is repeated, the manager may be suspended for 3 years, and the organization will be fined up to 100,000 rubles. If malicious intent or self-interest is detected on the part of the employer, the culprit will face criminal liability under Art. 145 of the Criminal Code. This article provides for imprisonment for a period of 1 year.

Industry agreements

Special rules for calculating percentage bonuses to wages for work in the Far North can be established in industry agreements. However, such agreements are binding for commercial organizations only if they join them (Article 48 of the Labor Code of the Russian Federation). For example, employees in the coal industry under 30 years of age are entitled to a preferential procedure for calculating bonuses. Unlike the general procedure, they have the right to a bonus from the first day of work. However, to do this, such employees must have lived in the Far North (equivalent areas) for at least five years. This is stated in paragraph 3.2.9 of the Industry Agreement on the coal industry for the period from April 1, 2013 to March 31, 2016. This agreement is binding only for those organizations that have joined it (clause 1.4 of the Industry Agreement on the Coal Industry for the period from April 1, 2013 to March 31, 2016). In this case, organizations of the coal industry are considered to have acceded to the agreement if, within 30 calendar days from the date of its publication, they have not sent a reasoned refusal to accede to the agreement to the Ministry of Labor of Russia (letter of the Ministry of Labor of Russia dated June 26, 2013 No. 14-4/10/2- 3480).

How to calculate - formulas

To calculate the required northern coefficient, the amount of actual monthly earnings is multiplied by its size. If we write this briefly in the form of a formula, we get:

Formula:

Zsk = FOT X RK, where

- Zsk – wages taking into account the percentage bonus;

- Payroll – earnings for the period, without amounts for which the northern coefficient is not calculated;

- RK is the regional coefficient established for the region.

How is salary calculated using the example for Novosibirsk (2019)

Initial data:

At the end of March 2019, an employee working in Novosibirsk had the following earnings:

- Salary payment – 10,000 rubles;

- Monthly bonus – 16,000 rubles;

- Quarterly bonus – 11,000 rubles;

- Material assistance was issued - 3500 rubles.

It is necessary to calculate wages taking into account the regional coefficient established for Novosibirsk.

We do not take into account financial assistance in order to increase wages by the regional coefficient.

By Decree of the Government of the Russian Federation dated May 31, 1995 N 534, a coefficient of 1.2 was established in the Novosibirsk region. However, later the administration of the Novosibirsk region introduced Resolution No. 474 of November 20, 1995, which fixed a coefficient of 1.25 for its entire territory.

Therefore, to calculate salaries in Novosibirsk in 2021, you need to take a regional coefficient equal to 1.25 or 25 percent.

Calculation:

Zsk = (10000 + 16000 + 11000) x 1.25 + 3500 = 49750 rub.

This is the amount that will need to be paid to the employee at the end of March.

How is the percentage increase introduced by region?

The regulatory framework of the Russian Federation and the USSR, which does not contradict the Labor Code of the Russian Federation and is currently in force regarding the introduction of percentage northern surcharges, is extremely confusing and heterogeneous.

The fact is that for the same regions, different regulations may establish different regional coefficients, taking into account the industry to which a particular enterprise belongs and the source of financing its expenses.

Additional confusion into the issue is brought about by the right of regional authorities to establish coefficients in the territory entrusted to them that differ from those established by the “old” resolutions.

Therefore, before approving the percentage coefficient in a particular region, you should carefully analyze the current regulatory framework at both the federal and regional levels.

It must be remembered that only the minimum size of the northern coefficients is limited by law, and the organization has the right to set it for its employees in a larger amount.

Thus, the rule applies: the regional coefficient can be more than what is specified in the legislation, but not less.

The full list of documents is quite extensive, if we also equate with them the resolutions of local authorities, the provisions of which must be taken into account.

To establish a regional regional coefficient you need:

- Analyze the regulatory framework in force in the region, select a document that is relevant for a specific industry and category of workers.

- Find in the specified document the territory or locality where the employee’s workplace is located.

- Find in the selected document the minimum coefficient that indicates the territory where the workplace will be located.

- Make a decision to establish a minimum premium in accordance with the regulatory document, or to establish it in an increased amount in accordance with the financial capabilities of the company.

- Fix the selected size of the regional allowance in the local act.

Accrual procedure and recalculation

The regional coefficient is always calculated based on the conditions and how much time the employee spent in areas with a northern coefficient. This is all carefully checked and recorded exactly according to working hours.

If he works there constantly, then the coefficient will be calculated on all his earnings; if he travels to such regions periodically, then only the part that was earned in this region will be increased.

There are other conditions for which the employee will receive bonuses:

- Work experience, title and class in the specialty;

- Employees who were allowed access to information constituting state secrets;

- By length of service;

- For successful annual work;

- For working in a complex schedule: at night, daily, or combining several professions at once.

The increase in salary is also influenced by the age of the employee: for young people under 30 years old, the possibility of accelerated calculation of the bonus is provided:

- In regions 1 and 2 groups (that is, with a maximum increase of 100 and 80%), from the very beginning of work they will receive 20% of their salary. Every six months, the premium will increase by another 20%, but you will have to wait a whole year for the last 20% before the maximum rate.

- In regions with a 50 and 30% bonus, the employee will initially receive a 10% bonus, and every six months the bonus will increase by another 10%.

For people over 30 years old, a slightly different scheme is used:

- For areas of groups 1 and 2, accruals will increase by 10% every 6 months until it reaches a maximum of 100% for the first group of regions and 80% for the second.

- For Group 3 localities, charges will increase by 10% each year until charges reach 50%.

- For group 4, for the first year the premium will be 10%, then for every 2 years 10% will be added until it increases to a maximum of 30%.

The northern coefficient is not included in the minimum wage.

Rules for calculating SN in case of changing a group of locations

Rules for calculating SN in case of a change in group of locations

How will SN be calculated if an employee changes his place and location of work? There are two possible scenarios:

- Transition from 1 or 2 groups to 3 or 4;

- Transition from 3 or 4 groups to 1 or 2;

In the first case, the SN will be 10% for every 12 months worked in areas of category 1 or 2. The accrual of additional payments will begin one year after the employee begins duties in a new place.

Example:

MBKU "Kontur" is located in the Chukotka Autonomous Okrug (1 gr., max CH - 100%). Istomina, 34 years old, worked as a secretary for 3 years 8 months. On November 1, 2015, I got a job at MBOU Secondary School No. 5, located in the Krasnoyarsk Territory (3rd grade, max SN - 50%).

The additional payment for work in the Chukotka Autonomous Okrug is calculated as follows:

For 3 years worked: 3*10% = 30%

For 8 months worked: 8/12*10 = 6%

The total amount will be: 30% + 6% = 36%.

From November 1, 2021, SN will increase by 10% in accordance with the accrual rules, becoming equal to 46%. In another year it will reach the maximum possible figure - 50%.

In the second case, the SN will be 10% for every 12 months worked in areas of category 3 or 4. The promotion will take place in due course.

Benefits and guarantees

In addition to the increased salary, thanks to different coefficients and accruals, residents working in the Far North have government benefits:

- Additional leave, which is paid by the employer - 24 days for the most severe regions and 16 for milder ones.

- Compensation for transport to the holiday destination and back, because due to the significant distance from other regions, transport tickets can be very expensive.

- If there is a medical certificate, the employee can travel free of charge to another city where the necessary examination or treatment will be carried out.

- Shorter work week.

- Parents can take additional paid days off for the period when the child enters school. In addition, every month parents have the right to take one day off at their own expense.

- Housing subsidies.

- Such workers retire earlier: with maximum work experience, men will retire at 55, and women at 50.

It is very difficult to live and work in such harsh conditions, so the state is trying to do everything possible to improve the lives of its citizens in such difficult conditions.

Significant salary increases and various benefits can make life in such difficult places more pleasant.

You can learn more about regional coefficients from the video:

Territories equivalent to northern ones

The Northern coefficient is calculated in many regions, taking into account the following factors:

- Climate – very cold, or vice versa, hot climate significantly worsens working conditions;

- Infrastructure in the region, how easy it is to get to it, availability of transport;

- Environmental situation in the region;

- Scope of activity of the enterprise.

The main regions where additional earnings coefficients will be awarded are the Far North, Far East and the south of the East Siberian region.

Coefficient size by region (clickable):

A region is classified as the Far North if there are no major roads along which one can easily reach this region, and the climate in these areas is very cold. Therefore, employees who agree to work in such difficult conditions are offered an increase of 2, and in some places even 3 times.

For example, Murmansk is located in the North-West of the Russian Federation beyond the Arctic Circle, and although it is considered one of the warmest northern cities, the working conditions here are still difficult - cold changeable weather, cool summers, and most importantly - the polar night, which is 40-50 days the city is covered in darkness. Therefore, the northern coefficient here is 1.5.

The Trans-Baikal Territory is one of the few where the northern coefficient applies throughout the entire region, and not in selected cities. The coefficient here is 1.4.

Severodvinsk is located in conditions equivalent to the Far North; it rains or snows almost all year round, and it is very rarely sunny and warm. It is quite difficult to work in such conditions, so the regional coefficient here is 1.4.

Many cities in the Krasnoyarsk Territory belong to the cities of the Far North or are equivalent to them; winters here are cold and long, and summers are quite short.

The average regional coefficient in the Krasnoyarsk Territory is 1.5; in more severe areas, for example, Norilsk, it can reach 1.8.