Which form to use

Resolution of the State Statistics Committee dated November 28, 1997 No. 78 approved unified forms of waybills for cars, light taxis, trucks, special vehicles, and buses.

As of January 1, 2013, these forms became optional. However, some transport enterprises still continue to use these forms (for example, waybill form for freight transport No. 4-P). Until 2008, individual entrepreneurs used forms of waybills approved by Order No. 68 of the Ministry of Transport dated June 30, 2000 (for example, form No. PG-1 for a truck). In connection with the publication of Order No. 152 of the Ministry of Transport dated September 18, 2009, these forms were canceled.

Thus, today an organization or individual entrepreneur has the right to independently develop a form of waybill. It is important that such a document contains all the mandatory details that are specified in Order of the Ministry of Transport No. 152.

Fill out waybills indicating the route and mandatory details in a special service

What the law says

Based on the explanations of the terms used in clause 14 of Art. 2 of the Charter regulating legal relations in the provision of services by automobile and urban ground electric transport, as amended by Federal Law No. 259 of March 18, 2020, a waybill is a document that allows you to control the work of the driver.

As of January 1, 2013, the requirement to maintain accounting documentation according to a single unified template has been abolished.

Forms of waybills (vouchers) can be developed and approved by the owners or managers of enterprises and organizations, taking into account the specifics of the transport services provided.

The Ministry of Transport of Russia, by Order No. 152 (the latest edition is valid as amended on December 21, 2018), approved the procedure for filling out waybills.

The emphasis is on the fact that the form must be titled, have a number, and columns for entering mandatory information.

Forms can be ordered from a printing house or printed independently directly from the organization.

Mandatory list of details

The waybill (PL) must contain the following mandatory details:

- name and number of the waybill;

- information about the validity period of the waybill;

- information about the owner (holder) of the vehicle;

- information about the vehicle;

- driver information.

Name and number

The heading of the waybill indicates the type of vehicle, for example, “Truck waybill.” Numbering is in chronological order. It can be end-to-end throughout the year or start anew every month. The waybill number may contain alphabetic and numeric prefixes, separator characters, etc. It is important that in each subsequent document the significant part of the number increases by one.

Validity period of the waybill

The header of the travel document must indicate the date of its validity. If the PL is issued for several days, the start and end dates of its use are indicated. Usually they write like this: “Truck waybill No. ... from ...” or “Truck waybill No. ... (valid) from ... to ....”

Owner information

If the owner of the vehicle is a legal entity, you must indicate:

- organizational and legal form in accordance with the All-Russian Classifier of Organizational and Legal Forms OK 028-2012 (approved by order of Rosstandart dated 16.10.12 No. 505-st, valid as amended on 24.10.18);

- full name of the organization given in the constituent documents;

- actual location address;

- phone number;

- OGRN number from the legal entity registration certificate.

If the owner of the vehicle is an individual entrepreneur, you must indicate:

- FULL NAME;

- mailing address;

- phone number;

- OGRN number from the individual entrepreneur registration certificate.

Find out or check OKPO, INN and other counterparty codes

Find out or check OKPO, INN and other counterparty codes for free

Vehicle information

These include:

- vehicle model and trailer model (if available);

- state registration plate of the vehicle and state registration plate of the trailer (if available);

- date and time of the vehicle leaving the parking lot and returning back, as well as odometer readings (mileage in kilometers) when leaving and returning. This information is certified by authorized persons appointed by the head of the enterprise. The individual entrepreneur who owns the vehicle can certify this data himself.

- date and time of pre-trip or pre-shift monitoring of the technical condition of the vehicle. This information is also certified by responsible persons.

Driver information

They include:

- FULL NAME;

- dates and times of pre-trip and post-trip medical examination. This information is certified by the signatures of authorized medical workers.

Also see: “The Ministry of Transport explained how to conduct medical examinations of drivers and control the technical condition of vehicles.”

Cancel printing

This year, provisions of federal legislation remain in force, allowing legal entities with the organizational and legal form of LLC and JSC not to use a seal at all. If the management of such companies makes a corresponding decision, it must be recorded in their charter.

Thus, if the charter of an organization states that the company does not use a seal, then it is not placed on any document of such an organization. If a company decides to use a seal, then it must be placed only on those documents on which the law provides for this obligation.

Laws regulate only the minimum amount of information that must be provided in the form in question. Therefore, the company may decide that it puts its stamp on the waybill. It won't be a mistake. Only this decision needs to be recorded in your accounting policy. And we must remember that tax inspectors do not have the right to exclude expenses for such travel documents from the tax base.

Optional information

Usually the following additional information is indicated in waybills.

Standard fuel consumption is displayed in order to justify the costs of fuel and lubricants and classify them as costs that reduce the tax base when calculating income tax. Additionally, you can enter data on excess consumption or fuel savings, and indicate the volume and cost of refueling during the flight.

Also, in order to justify the costs of fuel and lubricants and confirm the reality of the trip for tax accounting purposes, it is advisable to indicate information about the route of transport . In this case, it is not enough to enter the addresses of the route checkpoints, travel time and distance traveled - you need a record confirming the fact of using the vehicle for production purposes (name of the cargo, information about the customer, etc.)

Note that the waybill is not the only document that can justify the cost of fuel and lubricants. It is also permissible to use, for example, acts of write-off and acts of completed work for these purposes.

Please note: officials do not always recognize that a waybill is a priori a document confirming fuel costs (letter of the Ministry of Finance dated 06.16.11 No. 03-03-06/1/354). Therefore, if your organization is not a motor transport enterprise, it is advisable to include in the accounting policy order a provision on the use of waybills as supporting documents when writing off production costs for fuels and lubricants. Otherwise, tax authorities may not take the DP into account.

Also see:

“Practical advice on accounting and write-off of fuel and lubricants”;

“Costs on fuel and lubricants: what amount can be taken into account when calculating income tax?”;

“Is it obligatory to indicate the route in the waybill: clarifications of the Ministry of Transport and judicial practice.”

Maintain accounting and tax records for free in the web service

Not only tax officials, but also inspectors from the labor inspectorate may show interest in waybills. Therefore, among other things, the DP must confirm that the driver (drivers during shift work) complied with the work and rest standards prescribed by law during the trip. To do this, in the “Route” section or in a separate appendix to the waybill, you need to indicate the time and duration of the stops . These indicators must comply with the standards for shift changes and breaks for meals and rest. Such standards are contained in the Order of the Ministry of Transport dated August 20, 2004 No. 15 (see “Carriers must review the work and rest schedule of their drivers”). The relevant provisions must be enshrined in a collective agreement or agreement drawn up in accordance with the rules of the Labor Code.

It should be remembered that the waybill is not a document that serves as confirmation of the driver’s real working time for the purposes of calculating wages and for settling other relations between the employee and the employer. This is indicated in the Appeal Ruling of the Court of the Khanty-Mansiysk Autonomous Okrug - Ugra dated January 30, 2018 in case No. 33-567/2018.

Also see: “From January 1, new work and rest standards will be introduced for truck and bus drivers.”

How to fill out a waybill

Let us list some features of compiling waybills. So, it is obvious that the waybill is issued before the driver leaves for the route. If this document is not available, the traffic police will issue a fine.

Marks on pre-shift technical control are placed instead of marks on pre-trip control in the case when the driver makes several trips per shift using one waybill.

When several drivers work in shifts on one vehicle, waybills can be issued for each of them. But this is not necessary, since several drivers can be specified in one PL.

If several waybills are compiled, the departure time and odometer readings at the exit can be noted in the first one, and the return time and new mileage value can be noted in the last one.

Also see: “Is it necessary to issue a separate waybill for each day: the position of the Ministry of Transport.”

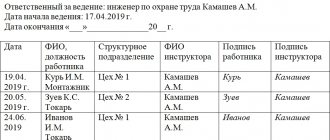

Persons certifying the data on the waybill must indicate their surname and initials after the signature. In this way the following is certified:

- time of departure and return of the vehicle and the corresponding odometer readings;

- the fact of passing pre-trip or pre-shift control of the technical condition of the vehicle;

- date and time of pre-trip and post-trip medical examination of the driver.

Sample filling

The voucher should contain information from the mechanic or master about checking the equipment. A specialist certified by the transport inspectorate is required to inspect the vehicle for breakdowns and malfunctions before the flight. How a mark can be made:

- “The technical equipment is working properly. Departure is permitted";

- “The car underwent a technical inspection before the trip.”

The type of mark that must be present is determined by the company. You can put a stamp. The main thing is that it contains the name of the mechanic who carried out the inspection, his signature, the time and date of the inspection.

Important! The information written by the doctor and the master is valid throughout the driver’s entire trip. When filling out a voucher, you must follow simple rules:

When filling out a voucher, you must follow simple rules:

- the document is issued only for one vehicle;

- the validity of the waybill is limited to the dates indicated on it, after the expiration of the period it is invalid;

- It is permissible to issue several vouchers for one vehicle if two or more employees drive the same vehicle on different shifts;

- if the entrepreneur does not manage the vehicle himself, then he will need to issue an order specifying the person authorized to take the odometer reading;

- the businessman must draw up a journal and note the issued vouchers in it.

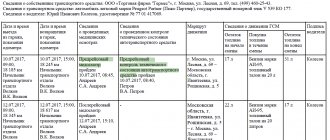

Where is the waybill registered?

Waybills are registered in a special journal. Previously, for this purpose it was necessary to use Form No. 8 “Logbook of the movement of waybills” (OKUD code 0345008), which was approved by Decree of the State Statistics Committee of November 28, 1997 No. 78. From January 1, 2013, it is not necessary to use standard forms of primary accounting documents. Therefore, now organizations and individual entrepreneurs have the right to develop their own forms of logbook for registering waybills. However, many continue to use the unified form No. 8.

Prepared waybills are filed in folders and stored for at least five years.

Responsibility for errors

Responsibility for the correct execution of documents rests personally with the head of the organization and authorized persons who are responsible for the operation of the vehicle. Those who sign the form are responsible for the accuracy of the data they certified. If, during an inspection, representatives of the Federal Tax Service identify violations in filling out the waybill, they have the right to exclude fuel and lubricants written off on it from expenses for profit tax purposes. Then the organization will have to pay additional tax, fines and penalties assigned by inspectors.