VAT register for the “five percent” rule

The article from the magazine “MAIN BOOK” is current as of May 25, 2021.

Contents of the magazine No. 11 for 2021 L.A. Elina, leading expert When combining VAT-taxable and non-VAT-taxable transactions, separate accounting must be maintained. The “five percent” rule allows, in certain cases, to deduct all input VAT on expenses that relate to both taxable and non-VAT-taxable transactions. But separate accounting is still necessary.

General provisions on separate VAT accounting

If there are transactions taxable and not subject to VAT, it is necessary to keep separate records of input VAT for goods, works, services (hereinafter referred to as goods), etc. 4 tbsp. 149 of the Tax Code of the Russian Federation. The specific procedure for maintaining such records must be fixed in the accounting policy. 4 tbsp. 170 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated November 20, 2017 No. 03-07-11/76412.

The organization must distribute input VAT as follows. 1, 2 p. 4 tbsp. 170 Tax Code of the Russian Federation:

•VAT relating to goods used for VAT-exempt transactions must be taken into account in the cost of such goods. This will increase expenses for income tax purposes;

•VAT related to goods used for VAT-taxable transactions can be deducted;

•VAT on goods used simultaneously for taxable and non-VAT-taxable transactions (that is, VAT on general business expenses) is deducted in proportion to the share of revenue from taxable transactions in the total revenue for the quarter:

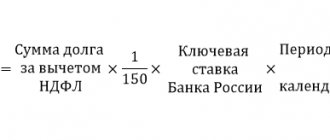

In the general case (if there was no income from the sale of securities), such a share is calculated according to the following formula Letters of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800, dated June 26, 2009 No. 03-07-14/61:

Please note that with this calculation:

•all revenue indicators are taken excluding VAT and for the tax period as a whole - quarter Letter of the Federal Tax Service dated March 21, 2011 No. KE-4-3/4414;

•in the composition of revenue it is necessary to take into account, in particular:

—revenue from taxable and non-VAT-taxable transactions;

—revenue from transactions that are not subject to VAT;

—revenue from the sale of goods outside Russia, Determination of the Supreme Arbitration Court of June 30, 2008 No. 6529/08; Letter of the Ministry of Finance dated December 22, 2015 No. 03-07-08/75085;

•there is no need to take into account income that is not recognized as sales revenue, for example:

—dividends on shares Letters of the Ministry of Finance dated January 16, 2017 No. 03-07-11/1282, dated July 8, 2015 No. 03-07-11/39228;

— discounts on bills Letter of the Ministry of Finance dated March 17, 2010 No. 03-07-11/64.

If during the quarter you received income from the sale of securities, then the formula for calculating the share will be somewhat more complicated. 5 clause 4.1 art. 170 Tax Code of the Russian Federation. The numerator of the formula will remain the same. But in the denominator when calculating the total amount of income, instead of income from the sale of securities, only “tax” profit from their sale must be taken into account. Letter of the Ministry of Finance dated November 26, 2014 No. 03-07-11/60111.

It is not difficult to calculate the discount during the summer sales period. But the calculations for checking compliance with the “five percent” VAT rule are not as easy as it seems

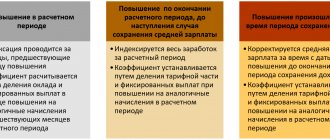

There are other nuances in separate VAT accounting. Thus, when purchasing fixed assets and intangible assets taken into account in the first or second month of the quarter, which are intended for participation in taxable and non-VAT-taxable activities, you can distribute input VAT:

•or in proportion to the share of VAT taxable revenue received in the first or second month. Consequently, the formula for determining the share of revenue will only include indicators for the first or second month of the quarter, respectively. 1 clause 4.1 art. 170 Tax Code of the Russian Federation. Then depreciation accrued starting from the next month will be calculated correctly and will not require adjustments in the future - even if the share of taxable revenue changes at the end of the quarter;

•or in a general manner - that is, based on data for the quarter as a whole. However, in this case, you will not be able to correctly calculate their full initial cost in the month of acceptance for accounting of fixed assets or intangible assets. This means that in the future it may be necessary to recalculate the amounts of depreciation accrued for the quarter. The only advantage of this approach is that in the month the fixed asset was accepted for accounting, you will not have to calculate a separate proportion for the distribution of VAT on a specific fixed asset or intangible asset.

The essence of the “five percent” rule

Input VAT on total expenses associated with both taxable and non-VAT-taxable transactions can be fully deducted if for the corresponding quarter the share of expenses on transactions not subject to VAT does not exceed 5%. 4 tbsp. 170 Tax Code of the Russian Federation. That is, the following condition is met: Letter of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800:

Note that data on expenses, as the Ministry of Finance explains, must be taken from accounting Letter of the Ministry of Finance dated May 29, 2014 No. 03-07-11/25771.

Attention

Even if you can use the “five percent” rule, separate VAT accounting is required. If there is no separate accounting for input VAT, then it can neither be deducted nor taken into account in tax expenses. 4 tbsp. 170 Tax Code of the Russian Federation.

However, please note that:

•VAT on goods that are used exclusively in VAT-free transactions cannot be deducted, even if the “five percent” rule is met. The deduction applies only to VAT on general expenses. 4 tbsp. 170 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated 04/23/2018 No. 03-07-11/27256, dated 04/05/2018 No. 03-07-14/22135;

•the “five percent” rule cannot be applied to deduct VAT on goods used simultaneously for “imputed” and general activities. 4 tbsp. 170 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated December 25, 2015 No. 03-07-11/76106; Federal Tax Service dated May 16, 2011 No. AS-4-3/ [email protected] However, if, in addition to the “imputed” activities, there are “general regime” operations, some of which are subject to VAT, and some are not, then for that part of the VAT on general business expenses, which applies to the general regime, the “five percent” rule still applies.

VAT on general business expenses when combining UTII and the general regime

— Consider a situation where an organization has general business expenses related to three types of operations:

•to transactions subject to VAT;

•to transactions not subject to VAT, but related to activities taxed under the general taxation system;

•to transactions subject to UTII.

Input VAT on such general business expenses must be distributed by type of activity in proportion to the cost of goods shipped. 4, 5 clause 4, clause 4.1 art. 170 Tax Code of the Russian Federation:

•that part of the input VAT that accounts for general business expenses related to “imputed” activities cannot be deducted, even if the organization or entrepreneur follows the “five percent” rule. After all, for transactions subject to UTII, they are not VAT payers. Letter from the Ministry of Finance dated December 25, 2015 No. 03-07-11/76106; Federal Tax Service dated May 16, 2011 No. AS-4-3/ [email protected] ;

• the remaining part of the input VAT on general business expenses related to activities taxed under the general taxation system. 4 tbsp. 170 Tax Code of the Russian Federation:

-or is fully accepted for deduction - if the “five percent” rule is observed;

—or distributed between taxable and non-taxable transactions carried out within the framework of the general taxation system, in proportion to the value of the goods shipped. In this case, the amount of VAT attributable to general business expenses related to transactions subject to VAT is taken as a deduction. And VAT on expenses related to transactions not subject to VAT is not deductible and is included in the cost of purchasing the relevant goods, works or services.

However, when combining three types of operations, “imputed” expenses cannot be discarded when calculating the share of expenses attributable to VAT-free activities.

After all, when determining it, transactions that are not subject to VAT on all grounds must be taken into account. Letter of the Federal Tax Service dated 08/03/2012 No. ED-4-3 / [email protected] Among them, in particular, it is necessary to take into account:

•operations, the place of implementation of which is not recognized as Russia, Articles 147, 148 of the Tax Code of the Russian Federation;

•operations that are not recognized as subject to VAT in accordance with clause 2 of Art. 146 Tax Code of the Russian Federation Letter of the Ministry of Finance dated July 19, 2017 No. 03-07-08/45800.

Expenses for “imputed” activities and the “five percent” rule

— To apply the “five percent” rule, it is necessary to determine the share of expenses for transactions not subject to VAT. When calculating it, both in the numerator and in the denominator of the fraction, it is necessary to take into account, among other things, the costs of “imputed” activities. After all, these are transactions for which VAT is not charged. Resolution of AS PO dated September 22, 2015 No. F06-253/2015; AS SKO dated April 11, 2017 No. F08-1951/2017; FAS SKO dated 09.09.2013 No. A63-12167/2012 (Decision of the Supreme Arbitration Court dated 30.10.2013 No. VAS-14566/13 refused to transfer this case to the Presidium of the Supreme Arbitration Court for review in the order of supervision).

If the share of expenses for transactions not subject to VAT is more than 5%, then:

•it will not be possible to fully claim VAT deduction for general business expenses - even in that part that relates to the general taxation system;

•it will not be possible to declare the full amount of VAT deduction for general production expenses that have nothing to do with imputation - if taxable and non-VAT-taxable transactions are carried out within the framework of such production.

That is, the taxpayer must, within the framework of the general rules for separate accounting of input VAT, determine which part of the VAT can be deducted and which part can be taken into account in the cost of purchased goods.

We develop a VAT register

Let's see how we can create a VAT register to check compliance with the “five percent” rule for a situation where, within the framework of the general regime, there are expenses associated with both taxable and non-VAT-taxable activities. For example, office rent and other general business expenses.

Reference

If imputation is combined with the general regime and within the latter there are transactions subject to and not subject to VAT, then the register for the “five percent” rule will be more complicated. However, expenses for “imputed” activities are extremely rarely less than 5% of the total expenses. It turns out that imputators are practically deprived of the opportunity to apply this rule.

Let's fill the register using a conditional example, assuming that:

•the organization is not a UTII payer;

•general business expenses are distributed between types of activities in proportion to income.

In our example, the share of expenses for transactions not subject to VAT (line 10) does not exceed 5% (1.4% 5%). Consequently, it is possible to deduct the entire amount of VAT on expenses that relate simultaneously to transactions subject to and not subject to VAT (line 3).

* * *

As you can see, separate VAT accounting is a rather complex and responsible matter. And the “five percent” rule doesn’t make it any easier. But it allows you to deduct more input VAT.

Other articles from the magazine "MAIN BOOK" on the topic "VAT - benefits / separate accounting":

Separate VAT accounting. The 5 percent rule

Anishchenko A.V., auditor

Magazine "Accounting in Trade" No. 3, March 2012

For a long time, the provision of the Tax Code of the Russian Federation on the possibility of not keeping separate records for VAT when carrying out transactions subject to and not subject to this tax caused controversy as to whether trading firms could apply it. Thanks to amendments made to the main tax document, this issue has been resolved in favor of taxpayers. But problems remain...

When you can not keep separate records

So, earlier in paragraph 4 of Article 170 of the Tax Code of the Russian Federation it was said that an organization (entrepreneur) has the right not to keep separate records in those tax periods (quarters) when the share of total costs for the production of goods, works, services, property rights, operations realization of the total cost of production. In this case, all amounts of “input” VAT are subject to deduction. However, this provision dealt only with “production costs,” so the question arose: does the benefit apply to trading companies? The Russian Ministry of Finance did not object to this. The financiers expressed their opinion on this issue in letters dated May 30, 2011 No. 03-07-11/149, dated January 29, 2008 No. 03-07-11/37. However, this position was not shared by the tax authorities (letter of the Federal Tax Service of Russia dated March 22, 2011 No. KE-4-3/4475). Since October 1, 2011, this norm has been set out in a new edition. Now 5 percent is calculated from the total amount of aggregate expenses for the acquisition, production and sale of goods, work, services, and property rights. So trading companies have the full right to apply the benefits.

How to justify your right to benefits

Now let's look at how a trading company can justify that it may not keep separate records.

Proportion calculation

To take advantage of the exemption (that is, to avoid separate accounting), a company or entrepreneur must calculate the proportion to prove that they comply with the specified five percent limit. And this is not easy. The fact is that paragraph 9 of paragraph 4 of Article 170 of the Tax Code of the Russian Federation is formulated so vaguely that the regulatory authorities have to interpret its provisions (for example, in the letter of the Ministry of Finance of Russia dated December 29, 2008 No. 03-07-11/387). So what is total cost? How to determine them, what type of accounting to use? As follows from paragraph 29 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated February 28, 2001 No. 5, accounting registers and calculations based on them are accepted by arbitration courts as evidence of determining expenses for the five percent limit. Taking into account this clarification, decisions of the FAS of the East Siberian District dated June 7, 2005 No. A74-3752/04-K2-F02-2489/05-S1 and the FAS of the North-Western District dated November 25, 2004 No. A66-563 were issued -04. The financiers also came to the conclusion (letter dated April 1, 2009 No. 03-07-07/26) that in this situation one should be guided by paragraphs 5 and 7 of PBU 10/99 “Organization expenses” (approved by order of the Ministry of Finance of Russia dated May 6, 1999 city No. 33n). It says that expenses for ordinary activities form: - expenses associated with the acquisition of raw materials, materials, goods and other inventories; – expenses arising directly in the process of processing inventories for the purposes of production, performance of work and provision of services and their sale, as well as the sale of goods; – expenses for the maintenance and operation of fixed assets and other non-current assets, as well as for maintaining them in good condition; – commercial, administrative expenses, etc. That is, we can say that total production costs must be calculated according to accounting rules. At the same time, as indicated in the letter of the Ministry of Finance of Russia dated December 29, 2008 No. 03-07-11/387, when calculating the five percent indicator of total expenses, both direct and other expenses are taken into account. But there is no specific procedure for distributing costs that cannot be specifically attributed to the sale of goods, works or services that are or are not subject to tax exemption. According to the author, the taxpayer has the right to independently establish the procedure for calculating the amount of total expenses, fixing it in the accounting policy. Another important point. If in the company’s accounting general business expenses are not distributed, but are immediately written off to financial results, then for the purpose of determining the five percent limit, a special calculation will have to be made for their distribution.

Calculation period

Paragraph 4 of Article 170 of the Tax Code of the Russian Federation talks about expenses during the tax period. Currently, the tax period for VAT is a quarter. Since value added tax is not calculated on an accrual basis from the beginning of the year, expenses to determine the five percent limit must be established for each quarter separately. At the same time, the provisions of paragraph 4 of Article 170 of the Tax Code of the Russian Federation apply only to the VAT tax period in which goods, works or services, the cost of which contains an “input” tax, were capitalized. Therefore, if the “input” VAT on the acquired asset was fully deducted, and in the subsequent tax period part of this asset is used in operations not subject to VAT, then the corresponding part of the “input” tax must be restored for payment to the budget. The right not to maintain separate accounting for an acquired asset appears only at the moment when the share of total expenses for the acquisition, production and sale of goods (works, services), property rights, transactions for the sale of which are not subject to taxation, does not exceed 5 percent of the total amount of total expenses for acquisition, production and sale. This right does not apply to subsequent tax periods. Now on to the positive side. Let us remind you that if goods, works or services are used exclusively in activities not subject to VAT, then the “input” tax on them is fully taken into account in their cost. But if a company has met the five percent limit, it has the right to deduct the entire amount of “input” VAT for a given tax period, including the part that relates to the above goods, works or services. This conclusion was confirmed in the letter of the Federal Tax Service of Russia dated November 13, 2008 No. ШС-6-3/ [email protected] Example.

Rodnaya Storona LLC is engaged in wholesale trade. In the first quarter of 2012, the company received revenue: - RUB 12,400,000. (including VAT - 1,891,525 rubles) - from the sale of goods subject to VAT; – 1,200,000 rub. – from the sale of goods not subject to VAT. The cost of goods sold (excluding VAT) was: – RUB 7,356,000. – for goods on which VAT is paid; – 760,000 rub. – for goods on which VAT is not paid. The Company maintains separate accounting of costs related to turnover subject to and not subject to VAT. According to the company, direct costs associated with the sale of taxable goods in the first quarter of 2012 amounted to 750,000 rubles. (without VAT). Direct costs related to the sale of goods not subject to VAT are 96,000 rubles. General business expenses that cannot be directly attributed to the sale of taxable or non-taxable goods will be equal to 950,000 rubles. (excluding VAT). As a method for distributing general business expenses for the purpose of determining the five percent limit, the company chose to calculate the share of revenue from the sale of tax-free goods in the total volume of sales of goods excluding VAT. This is enshrined in the accounting policies of a trading organization for tax purposes. Thus, the calculation of the limit will be as follows. First, it is necessary to establish the share of sales of non-taxable goods in the total cost of goods sold. It is equal to 11.42 percent (RUB 1,200,000 / (RUB 12,400,000 – RUB 1,891,525) × 100). Secondly, it is necessary to distribute general business expenses attributable to the sale of goods not subject to VAT, in accordance with their share in the total sales revenue. Their amount is 108,490 rubles. (RUB 950,000 × 11.42%). Thirdly, you should find the amount of general business expenses attributable to the sale of goods subject to VAT - 841,510 rubles. (950,000 – 108,490). Fourthly, the total costs associated with sales are calculated for the first quarter of 2012. Their total amount is 9,912,000 rubles. (7,356,000 + 760,000 + 750,000 + 96,000 + 950,000), including: – expenses associated with the sale of goods subject to VAT – RUB 8,947,510. (7,356,000 + 750,000 + 841,510); – expenses associated with the sale of goods not subject to VAT – 964,490 rubles. (760,000 + 96,000 + 108,490). Fifthly, it is necessary to calculate the share of total costs associated with the sale of goods not subject to VAT in the total amount of total costs associated with sales for a given tax period. It is 9.73 percent (964,490 rubles / 9,912,000 rubles × 100). That is, the share of total expenses on the sale of goods not subject to VAT exceeds 5 percent of the company’s total total expenses for a given tax period. Therefore, she will have to distribute the amount of “input” VAT between taxable and non-taxable transactions.

Such documenting of activities as separate accounting of VAT is required for the most accurate determination of the total share of “input” VAT that is accepted for deduction. These procedures should be carried out exclusively by professionals, since possible mistakes can lead to tax authorities removing all deductions and adding tax.

What is the “5 percent rule” for VAT and how to apply it

The need to maintain separate accounting for VAT arises both when an organization has export operations (not subject to value added tax) and when conducting other business transactions that are subject to VAT.

If an organization simultaneously carries out taxable and non-taxable transactions, taxation problems may arise. This applies to a greater extent to VAT. For example, how to apply input tax to a deduction when combining transactions of different types?

For such operations, the organization is required to maintain separate records. That is, take into account income and expenses separately for taxable transactions, and separately for non-taxable ones.

The main purpose of separate VAT accounting is the distribution of input tax in order to subsequently accept it for deduction. All input value added tax allows deduction of the application of the “5% Rule” on expenses related to both taxable and non-taxable VAT transactions, which include general business expenses.

In this article you will learn how to apply the “Five Percent Rule” for VAT in 2021 and will be able to see a detailed example of the calculation. When combining UTII and OSNO, this rule does not apply.

Advice for organizations conducting transactions that are subject to VAT

If an organization conducts operations that are subject to value added tax and only occasionally receives income from loans (or pays with bills of exchange from third parties), then it is recommended to include in the accounting policy such provisions on the use of the “Five Percent Rule” for VAT.

The use of this rule allows the organization to determine the amount of general business expenses that fall on non-taxable operations in proportion to the share of direct expenses for these operations in the total amount of expenses associated with the sale of products.

When applying the “Five Percent Rule”, if the organization provides loans, the share of expenses for non-VAT-taxable transactions will be equal to 0. Thus, it will be possible to take all VAT on general business expenses as a deduction.

Advice for organizations conducting transactions that are not subject to VAT

If an organization is engaged in operations that are not subject to value added tax on an ongoing basis, then in order to calculate the share of expenses for these operations, accounting should be organized in such a way that the following information is generated separately:

1. About the cost of sales, which are subject to VAT. 2. About the cost of sales, which are not subject to VAT. 3. About other costs associated with implementation:

- subject to VAT (for example, on the sale of fixed assets);

- exempt from VAT (for example, sales of securities).

4. About other expenses that are not related to sales (for example, interest received by the company on loans).

To make it more convenient to keep track of transactions, it is recommended to open separate sub-accounts. In addition, you can maintain separate registers.

We add that the organization should decide on the optimal procedure for calculating the share of general business expenses that fall on operations not subject to value added tax.

For example, the share of general business expenses attributable to operations that are not subject to VAT can be taken equal to one of the following ratios:

- the share of direct expenses for operations that are not subject to VAT in the total direct expenses for all operations that are related to the sale;

- the share of revenue from operations that are not subject to VAT in the total amount of sales revenue.

No less important is the issue of tax policy for separate accounting in relation to transactions that are not subject to VAT. It is worth paying attention to such points that are associated with the grounds for performing such operations, namely:

1. What preferential regimes are associated with taxation. 2. Are there any tax transactions that are not provided for in Article 149 of the Tax Code of the Russian Federation? 3. Availability of the right to exemption from VAT in case of insufficient amount of revenue received. 4. Sales of products (services or works) to other countries.

Tax policy of separate accounting in the presence of tax-free transactions

It is mandatory to take into account the reasons under which such transactions are carried out that are not taxed. These could be things like:

- All preferential regimes related to taxation;

- The right to exemption from VAT on the basis of insufficient revenue;

- The presence of taxation transactions where Article 149 of the Tax Code of the Russian Federation is not provided;

- Sales of goods or services outside the country.

In cases where there have been no sales of services or goods that are not taxed for a certain period of time, many entrepreneurs wonder whether it is necessary to keep separate VAT records in this case? The Ministry of Finance takes the position that the complete absence of transactions on exempt units of goods from value added tax is the basis for exemption from separate accounting.

Maintaining separate accounting for VAT: what to pay attention to

The vast majority of organizations deal with both taxable and non-taxable value added tax products.

Let us remind you that separate accounting for this tax is carried out according to the output VAT - at the cost of the products that were shipped. In this case, products may be subject to VAT or exempt from it. VAT included in the product price must also be taken into account.

However, there is no single methodology for maintaining separate VAT accounting. That is why you can use a convenient order for organization. The most important thing is that when maintaining separate accounting, transactions subject to VAT and those not subject to VAT are clearly distinguished.

The procedure for maintaining separate VAT accounting chosen by the organization must be enshrined in the general accounting policy of the company.

Failure to maintain correct separate VAT accounting may result in tax authorities recovering all input tax on items purchased for use in transactions that are and are not subject to value added tax. Such actions by tax officials will lead to the organization having shortfalls in VAT, which means fines and penalties cannot be avoided.

The Ministry of Finance believes that if there are no transactions on exempt units of goods from VAT, then this is the basis for exempting the organization from maintaining separate accounting for value added tax.

Maintaining separate accounting for VAT when exporting: main points

Separate accounting for VAT when exporting products is required. In this case, the raw materials that were used in the process of export operations (the amount of operations) must be submitted to the Federal Tax Service in the form of a declaration with a zero rate.

The norms of the current Russian legislation do not provide for a clearly defined methodology for determining the input VAT of goods for export. A convenient accounting method is chosen by the organization independently. The accounting procedure should be fixed in the relevant documents (in orders related to the accounting policy of the enterprise).

If the organization did not previously assume that it would export goods and applied regular input VAT on a general basis, then the tax that was paid can be restored. To do this, the organization submits a declaration (updated) and pays tax.

Example of calculation using the “5 percent rule”

If for a quarter the total share of expenses for the acquisition, as well as for the production of products, is no more than 5% (of all total expenses that are aimed at the production and sale of goods), then the organization is exempt from maintaining separate accounting for VAT. That is, input VAT submitted by suppliers (in one or another quarter) can be deducted.

What expenses are cumulative when applying the 5 percent VAT Rule?

Such expenses include the costs of purchasing goods, the costs of producing goods, and the costs of selling goods. Goods in this situation also include works, services and property rights.

Each organization must decide independently how to distribute total costs and reflect its decision in its accounting policies. Providing independence in resolving this issue is due to the fact that the Tax Code of the Russian Federation does not define the procedure for distributing total costs.

Change to the 5 percent VAT Rule from 2021

The 5 percent VAT rule until 2021 meant that input VAT could be deducted if costs within 5% were allocated only to non-taxable transactions.

From January 2021, the 5 percent VAT rule applies only if expenses are allocated to both types of transactions: taxable and non-taxable. But if spending is aimed only at non-taxable activities, then it is no longer possible to use the 5% rule. In this case, the amount of input tax must be included in the cost of services, goods, and works exempt from value added tax.

Example

Taxable expenses of the organization – 8,000,000 rubles. Tax-free expenses – 400,000 rubles. Expenses for general business needs amounted to 2,000,000 rubles.

The calculation will be carried out using the following formula:

Costs associated with sales not subject to VAT (per quarter) / Total costs associated with sales (per quarter) X 100% ≤ 5%

5 percent rule for incoming VAT in 1s

The above ratio is calculated based on the cost of non-taxable goods sold in total sales. Let's consider another problem that presents the “5 percent” rule for VAT.

Calculation example. An enterprise engaged in wholesale and retail trade (paying VAT and UTII) must carry out double tax accounting. Even if work, equipment, or real estate are intended for “imputed” activities, VAT on them is not deductible.

If the services received or real estate purchased are intended to conduct transactions subject to VAT, then the tax charged is taken into account in full. If the purchased equipment will be used on “two fronts” at once, then a proportion must be drawn up. One part of the tax is deductible, and the second is included in the cost of goods. Suppliers presented a deduction of 180 thousand rubles. The coefficient for subsequent calculations is 0.875. The following can be deducted from purchased goods: 180 * 0.875 = 157.5 thousand rubles. The remaining 22.5 thousand rubles. should be reflected in the cost of goods. 5% Rule For those periods when the share of expenses on non-taxable transactions is less than 5% of the total amount of expenses, the company may not carry out separate accounting. The procedure for calculating the total amount of expenses when calculating the barrier is not established by law. An enterprise can develop its own justified methodology and consolidate it in its accounting policies. When calculating the share, all sales excluding VAT are taken into account: non-taxable transactions, sales on imputation, expenses for transactions outside the Russian Federation. As for the first group, both direct and general expenses are taken into account.

Let's get to the bottom of the problem

So, if a company simultaneously carries out taxable and non-taxable transactions, then problematic situations may arise in taxation. First of all, the disputes concern VAT. For example, how to apply input tax to a deduction when combining transactions of different types? Starting this year, officials have adjusted the rules.

In such circumstances, the company is required to maintain separate accounting records. That is, take into account income and expenses separately for taxable transactions, and separately for non-taxable ones.

But it's not that simple. For example, certain types of costs can be allocated to both types of activities: taxable and non-taxable. For example, general business expenses that are incurred to ensure the life of the entity as a whole, regardless of the specific type of transaction. For expenses of this nature, separate accounting for input VAT is applied: the 5 percent rule.

What does it mean? Let's say an organization provides two types of services. The first is classified as non-taxable, and the second is subject to full VAT. Thus, an enterprise has the right to accept input VAT on general business costs in full if expenses for non-taxable transactions do not exceed 5% of total (aggregate) expenses for the corresponding quarter.

IMPORTANT! The 5 percent VAT rule from 2021 applies only if expenses are aimed at both types of transactions: taxable and non-taxable. But if spending is aimed only at non-taxable activities, then it is no longer possible to use the 5% rule. In this case, include the amount of input tax in the cost of services, goods, and works exempt from value added tax.

Let us note that until 2021, officials took a different position. That is, previously it was possible to accept input VAT as a deduction if expenses within 5% were directed only to non-taxable transactions.

When you can not keep separate records

So, earlier in paragraph 4 of Article 170 of the Tax Code of the Russian Federation it was said that an organization (entrepreneur) has the right not to keep separate records in those tax periods (quarters) when the share of total costs for the production of goods, works, services, property rights, operations realization of the total cost of production. In this case, all amounts of “input” VAT are subject to deduction.

However, this provision dealt only with “production costs,” so the question arose: does the benefit apply to trading companies?

The Russian Ministry of Finance did not object to this. They expressed their opinion on this issue in letters dated May 30, 2011 No. 03-07-11/149, dated January 29, 2008 No. 03-07-11/37. However, this position was not shared by the tax authorities (letter dated March 22, 2011 No. KE-4-3/4475).

Since October 1, 2011, this norm has been set out in a new edition. Now 5 percent is calculated from the total amount of aggregate expenses for the acquisition, production and sale of goods, work, services, and property rights.

So trading companies have the full right to apply the benefits.

How to count

Calculate your share of expenses using the following formula:

If this rule is observed and the result obtained does not exceed 5%, then the input tax on total costs can be deducted in full without distribution.

To recap what constitutes total expenses, the five percent rule. Such costs include expenses for the acquisition of goods or their production or sale, as well as for the purchase of works, services or property rights that will be used in carrying out both non-taxable and taxable transactions.

Please note that the procedure for distributing total costs is not fixed in the Tax Code of the Russian Federation. This means that each economic entity independently determines the order of distribution of this category of costs. This decision must be fixed in your accounting policies.

Arbitrage practice

A complete interpretation of “total expenses” is not provided in the Tax Code. Based on definitions in economic dictionaries, this term can be understood as the total cost of production of goods incurred by the taxpayer himself. The Ministry of Finance explains that when calculating this value, direct and general expenses for conducting activities are taken into account.

Judicial practice also does not allow us to draw an unambiguous conclusion regarding when separate VAT accounting should be carried out. The 5 percent rule, an example of which was discussed earlier, applies exclusively to manufacturing enterprises. According to the judges, trading companies cannot carry out separate tax accounting.

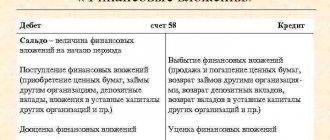

Transactions with securities raise even more questions. In particular, some judges, referring to Art. 170 of the Tax Code, they claim that when selling such assets, the 5% rule can be used. At the same time, the cost of purchasing securities does not affect the proportion. That is, almost always the amount of expenses will be less than 5%, and the payer will be released from the obligation to keep double records.

In other court decisions there is a reference to PBU 19/02, which states that all transactions with the Central Bank in NU and BU relate to financial investments. In addition, organizations do not have expenses associated with the formation of the cost of such assets. That is, income from such transactions is exempt from taxation. Therefore, the organization must submit full VAT for deduction.

Transactions on the sale of a legal entity’s share in the management company of another organization are not subject to VAT. Therefore, in such cases double counting is always carried out.

Let's look at an example

Let's look at how the 5 percent VAT rule is determined and an example calculation.

The total expenses of Vesna LLC for the 3rd quarter of 2021 amounted to 1,550,000 rubles, including for:

- Implementation of consulting services - 1,300,000 rubles.

- Provision of educational services (not subject to VAT) - 50,000 rubles.

- General business expenses - 200,000 rubles.

According to the current accounting policy of Vesna LLC, the company decided to distribute general business expenses in proportion to the revenue received for each type of service. Thus, for the 3rd quarter, revenue amounted to 4 million rubles, including:

- Consulting services - 3,500,000 rubles.

- Educational services - 500,000 rubles.

We distribute OCR.

For consultation:

200,000 × (3,500,000 / (3,500,000 + 500,000)) = 175,000 rub.

For educational services:

200,000 × (500,000 / (3,500,000 + 500,000) = 25,000 rubles.

Now we calculate the share of costs for non-taxable services:

(50 000 + 25 000) / (1 300 000 + 50 000 + 200 000) × 100 % = 4,84 %.

Since 4.84% is less than 5%, it means that Vesna LLC has the right to deduct all input value added tax presented by suppliers and contractors for the 3rd quarter of 2021.

Accounting algorithm

You may be interested in: What is an insurance company?

Structure and functions To understand what VAT rate should be applied to goods and how to determine the amount of input tax, you can use the following sequence of actions:

1. Calculate the amount of VAT claimed that can be deducted. If the purchased goods can be directly attributed to activities exempt from taxation, then VAT is included in its cost. In other cases, the tax amount is deducted.

2. At the next stage, you need to apply the “5 percent” rule for VAT, an example of the calculation of which was presented earlier. First, the amount of expenses for non-taxable transactions is determined, then the total costs are calculated and the formula is applied:

% neoreg. oper. = (Normal / Total) x 100%.

If the resulting ratio exceeds 5%, then separate accounting of the amounts should be carried out.

3. Tax amounts with and without VAT are calculated, then they are summed up and the ratio is determined:

% calc. = (Sum of region / Sum of total) * 100%.

The following determines the VAT on OSN payable:

Tax = VAT charged * % deducted.

4. The marginal cost is calculated:

VAT limit = VAT claimed - VAT deducted

or

Cost = (Amount of goods shipped, but not taxable / Total sales volume) * 100%.