Since the physical capabilities of employees with disabilities are limited to one degree or another, which is confirmed by the presence of a group, the law provides for preferences regarding the duration of working hours and rest. Let's say, paid leave for disabled employees is 30 days (no less), and if necessary, a person with disabilities has the right to increase the rest period to 60 days at his own expense.

In addition, involving an employee with a disability group in overtime work is permissible only with his written consent to this. Plus, the legislative acts clearly define the number of hours for workers with disabilities, that is, their working day may be shorter compared to healthy people. It is noteworthy that despite the enshrinement of this preference in the Labor Code of the Russian Federation, namely, the law on social protection of disabled people No. 181-FZ of November 24, 1995 (as amended on July 29, 2018), in many organizations the benefit is difficult to implement.

Peculiarities of labor regulation for disabled people

In accordance with the law, disabled people are a preferential category of workers who are provided not only with social protection, but also with certain types of guarantees and compensation aimed at creating favorable conditions for full implementation in work and adaptation in society.

Working conditions

In particular, disabled people have the right:

- for a shortened working week on the basis of Article 92 of the Labor Code of the Russian Federation, lasting 35 hours, while this category of workers is given the right to work a full week, but with additional pay and only with their consent, and in writing;

- to refuse to be involved in night work in accordance with Article 99 of the Labor Code of the Russian Federation, although with their written consent this category of workers can be involved;

- to refuse overtime work in accordance with the norms given in Article 99 of the Labor Code of the Russian Federation, and again, with written consent, the implementation of such work is quite possible.

Guarantees and benefits

Of course, disabled people have not only rights, but also some compensation, as well as guarantees, in particular:

- on the basis of Article 128 of the Labor Code of the Russian Federation, this category is entitled to leave without pay for 60 days , but on the condition that the provided days will be used only within one calendar year, because unused days are no longer carried over to the next year;

- pre-emptive right in case of reduction in accordance with Article 179 of the Labor Code of the Russian Federation, especially if disability occurs as a result of injury or illness received during the performance of direct duties, although, of course, work qualities and qualifications will still be assessed;

- and, according to the norms of Article 73 of the Labor Code of the Russian Federation, in the event of illness and before disability is established the employee must be offered another position , provided that it is vacant and the employee can perform new duties without compromising his health;

- quotas for jobs, in accordance with Article 21 of Federal Law No. 181;

- a ban on unjustified refusal of employment due to the presence of a disability group in accordance with Article 64 of the Labor Code of the Russian Federation.

Minimum wage

In accordance with Article 133 of the Labor Code of the Russian Federation, the salary of each employee must be at least the minimum wage for the established monthly standard of hours; this rule applies to all workers, regardless of belonging to preferential categories, that is, disabled people of groups 1 and 2, even performing their duties for only 35 hours per week, cannot receive wages less than the established minimum amount.

Working hours for a disabled person of the 2nd group

Hello, dear Olga Valerievna, regarding the essence of the question you asked, I can briefly explain the following: Your employer has no legal grounds to fire you and ask for it against your will. Don’t even think about resigning of your own free will; I repeat, your employer has no grounds and will not be able to legally fire you. If pressure is applied to you, contact the prosecutor's office at your place of residence.

We recommend reading: Where to go AntennaMoscow burned down

A citizen recognized as disabled is issued a certificate confirming the fact of disability, as well as an individual rehabilitation program. In accordance with Art. 224 Labor Code of the Russian Federation and Art. 11 of Federal Law No. 181 - Federal Law, the individual rehabilitation program for a disabled person (IRP) is mandatory for implementation by the organization, regardless of its legal form and form of ownership. However, a disabled person has the right to refuse to implement the IRP, both in part and in whole. In this case, in accordance with Part 7 of Article 11 of Law No. 181-FZ, the organization is exempt from responsibility for the implementation of the IPR of a disabled employee.

Remuneration for disabled people

Of course, in essence, disabled people are the same workers as all other workers, but since this category has some peculiarities, certain benefits are provided for them at the legislative level.

In particular, remuneration for working disabled people implies a special procedure.

With reduced working hours (shortened work week)

Thus, on the basis of Article 92 of the Labor Code of the Russian Federation for disabled people of groups 1 and 2, the working week is established at 35 hours, therefore, hours in excess of the norm established for them are already overtime work, which is subject to additional payment, even if the hours of work in general will be only 40 hours, which is the norm for all other workers.

That is, a disabled person can work no more than 35 hours a week, while the company is obliged to pay him the full salary for his position.

Although an employee of this category may agree to perform his duties for a longer time, say, 40 hours a week, but on the condition that the additional 5 hours will already be paid as overtime, on the basis of the same Article 152 of the Labor Code of the Russian Federation.

With a shift schedule

But with a shift schedule at the enterprise, problems may arise.

And given that disabled people, both groups 1 and 2, are contraindicated for a long working day, that is, as a rule, they can work no more than 7 hours a day, but the shift schedule implies a longer shift duration from 12 hours to 24 hours, and difficulties arise.

Therefore, in such a situation, a disabled person can only be employed on an individual schedule that does not violate the recommendations of doctors, which of course will affect the amount of his salary, which will be calculated in proportion to the time worked.

When recording working hours in total

Problems may also arise with the summary recording of working time at an enterprise, since such a mode of operation involves working with continuous production, which determines the presence of night work and floating days off.

[stextbox since, on the basis of labor legislation, it is prohibited to involve disabled people in work at night and on weekends, the company management will need the written consent of the employee to work with such a schedule.

Also, the company’s management will need to take into account the fact that the number of shifts, and therefore working hours, should be no more than 35 hours per month, and in case of cumulative accounting, the reporting period can be either a quarter or a half-year; an individual shift schedule will need to be developed for a disabled person in compliance with established standards.

Normative base

The special status of people with disabilities, as well as social guarantees aimed at protecting this category of citizens, is regulated by Federal Law No. 181, which states that a person with disabilities is a person who has a permanent loss of health due to illness or injury, as a result of which he is provided with a number of guarantees that are aimed not only at material support, but also at social adaptation, as well as the opportunity to realize oneself in different spheres of society.

However, despite the opportunities provided, not every disabled person can take full advantage of them, because the degree of health loss for each of them is different, which is determined by the same disability group and predetermines the list of benefits, as well as working conditions that must be created for a fruitful labor activity.

Disability groups

In particular, the first group of disabilities in most cases is not working, since a disabled person not only has permanent damage to the body for the rest of his life, but in most cases he cannot care for himself, not to mention work.

Although in some cases, when certain working conditions are created and assistance is provided, the same wheelchair users may well work on an equal basis with other people - for example, doing mental work.

But the second group is already working, because although disabled people require some help, they can still work.

For example, with partial loss of vision, an employee may well engage in physical labor, assembling the same sockets in the workshop, and with loss of hearing or speech, disabled people can be employed in almost any industry, doing both physical and mental labor.

The third group of disability assumes that the worker has only partial labor loss, which allows workers to be employed in any industry, but with some restrictions that involve increased workload.

In particular, disabled people are prohibited from being involved in work under hazardous conditions or in night or overtime work on the basis of Article 99 of the Labor Code of the Russian Federation.

Taxation

It should be noted that disabled people are not only guaranteed a decent remuneration for their dedicated work, taking into account the characteristics of their health, but also are provided with some tax benefits.

In particular, on the basis of Part 3 of Article 217 of the Tax Code of the Russian Federation, upon dismissal due to reduction, severance pay is not subject to taxes.

Also, on the basis of Article 218 of the Tax Code of the Russian Federation, disabled people are entitled to a tax deduction in the amount of 3,000 rubles:

- upon receipt of disability during the liquidation of consequences at the Chernobyl nuclear power plant;

- if you have the title of WWII veteran.

And a tax deduction of 500 rubles:

- disabled people of groups 1 and 2;

- persons participating in the liquidation of the consequences of the Chernobyl accident.

Insurance premiums

Of course, disabled people are a preferential category, which, however, is not a basis for providing certain benefits.

In particular, in 2021, enterprises with disabled employees will pay insurance premiums in full due to changes in legislation and, as a result, the abolition of reduced rates.

Calculation features

Taking into account some of the distinctive features of labor, the wages of disabled people are also calculated in a slightly different order.

3 group

In particular, for a disabled person of group 3, the salary will be calculated as follows.

Based on Article 58.2 of Federal Law No. 212, the enterprise will list:

- 22% to the Pension Fund;

- 2.9% in the Social Insurance Fund;

- 5.1% to the Compulsory Medical Insurance Fund.

Tax deduction will also be taken into account.

Example:

2nd group

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The salary of disabled people of group 2 is calculated in a similar way, but taking into account the fact that this group may have a large tax deduction - for example, 3 thousand, and in this case 19,068.9 rubles will be due for payment.

1 group

Employees with 1st disability group are subject to exactly the same benefits when calculating wages as those given above, that is, the tax deduction and contribution amounts will be equivalent.

Nuances

I would like to note that in addition to the above benefits, disabled people are entitled to a number of benefits that are also available to other employees.

Work on weekends and holidays

In particular, on the basis of Article 153 of the Labor Code of the Russian Federation, if there is written consent to hire a disabled person to work on a day off, the work of a disabled person must be paid at double the salary or hourly rate.

That is, if the employee was involved for 7 hours, the payment for employment on weekends and holidays will be calculated in the amount of 960 rubles, based on the above calculations and the salary amount.

Overtime work

In accordance with Article 99 of the Labor Code of the Russian Federation, if there is a written consent to overtime work, work for excessively worked hours is compensated in the amount established by the norms of Article 152 of the Labor Code of the Russian Federation, namely, one and a half times for 2 hours and double for subsequent hours.

That is, if a disabled person works an extra hour every day, then he will be paid not, for example, in the amount of 96 rubles, but in the amount of 144 rubles.

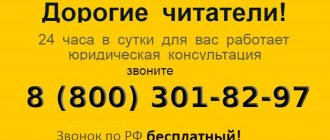

Have a question for a lawyer?

Yes, you understand correctly, these are different concepts.

According to Art. 93 Labor Code of the Russian Federation

When working part -time

An employee’s remuneration

is made in proportion to the time he works

or depending on the amount of work he performs.

The actions are legal. Wages are retained in full with a reduced working day (these are disabled people of groups 1 and 2), and not with part-time work.

08 November 2013, 16:41

According to Art. 23 of the Federal Law of November 24, 1995 N 181-FZ (as amended on July 2, 2013) “On the social protection of disabled people in the Russian Federation”:

Disabled people employed in organizations, regardless of organizational and legal forms and forms of ownership, are provided with the necessary working conditions in accordance with the individual rehabilitation program for the disabled person. It is not allowed to establish in collective or individual labor contracts working conditions for disabled people (wages, working hours and rest periods, duration of annual and additional paid leave, etc.) that worsen the situation of disabled people in comparison with other employees. For disabled people of groups I and II, a reduced working time of no more than 35 hours per week is established while maintaining full pay. Involvement of disabled people in overtime work, work on weekends and at night is permitted only with their consent and provided that such work is not prohibited for them due to health reasons. Disabled persons are granted annual leave of at least 30 calendar days.

Furthermore, in accordance with Art. 92 of the Labor Code of the Russian Federation, reduced working hours are established: for workers who are disabled people of group I or II - no more than 35 hours per week.

You are not entitled to a reduced duration; you have disability group III. The recommendation states part-time work (time), and not reduced working hours (which is actually not what you are supposed to do). You work part-time. According to Art. 93 of the Labor Code of the Russian Federation, when working on a part-time basis, the employee’s wages are paid in proportion to the time he worked

or depending on the amount of work performed by him.

08 November 2013, 16:59

Employer's liability for late payments

Considering that a disabled person is the same employee as other categories of workers, the employer is obliged to comply with all the norms of the Labor Code of the Russian Federation and other federal acts in relation to this employee.

In particular, wages must also be transferred on time, otherwise the management of the enterprise faces both administrative and criminal liability, depending on the amount of debt, as well as on the time period that has passed since the last transfer on the basis of Article 5.27 of the Code of Administrative Offenses of the Russian Federation and Article 145.1 of the Criminal Code RF.

The Constitution of the Russian Federation specifies provisions according to which every person has the right to work. This rule also applies to people with disabilities who are considered disabled.

Accordingly, they have the right to get a job on an equal basis with others. Also, for such workers, the law provides for some features in the procedure for carrying out labor activities, for example, duration and remuneration.

- 1 Regulations on the remuneration of disabled people 1.1 How are disabled people paid when their workers are laid off?

- 1.2 Remuneration for disabled people of group 3

- 1.3 Remuneration for disabled people of group 2

- 1.4 Remuneration for disabled people of group 1

- 1.5 Minimum wage for disabled people with reduced working hours

- 1.6 Similar

How to draw up an employment contract correctly

When drawing up an employment agreement with citizens with health limitations, you need to take into account a number of features.

When drawing up a contract, you should pay attention to the following provisions:

- about how long the shift and work week will last;

- prohibiting calling for work beyond the norm in the absence of the written consent of the citizen;

- stipulate all issues relating to the special working conditions that the individual rehabilitation program (IRP) contains and which must be provided to the citizen (Article 23 of Federal Law No. 181);

- indicate that wages are accrued in full, even in cases of work on a reduced schedule.

Important! You need to know that people with II and III degree disabilities have the right to get a job in the same way as other citizens.

The legislation does not contain provisions according to which a person is obliged to inform the employer about the state of his health, and the IPR is used only as a recommendation.

If a citizen requires the provision of all required benefits, it is necessary to submit ITU conclusions in form No. 15003004IPR according to the sample from Appendix No. 1 of Order of the Ministry of Health and Social Development No. 379.

It is necessary to attach copies of this documentation to the citizen’s personal file in order to confirm benefits and work schedules for persons with disabilities of groups 1-3.

How is payment for disabled people with reduced working hours made?

Disabled people, regardless of the group they receive, are a preferential category of workers. The state provides their social protection, material support and monitors their adaptation to society.

Most of the assistance comes from paying compensation and providing certain preferential guarantees - travel, discounts on housing and communal services, utility bills, free medicines. An important adaptation factor is the employment of those citizens whose group provides the opportunity to work.

Citizens who have become disabled have the right to:

- Shortened work week. The work standard is 35 hours per week.

- Not involved in night duty.

- No overtime.

The legislation, however, does not prohibit voluntary consent to work beyond the norm or at odd hours. But any of the overtime must be paid by the employer as additional, above the norm, and cannot be compensated by time off.

Remuneration for disabled people of groups 1 and 2

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Depending on the degree of disability, a citizen has the right to certain benefits and compensation. Group 1 disability implies the inability to work due to complete loss of ability to work.

Such people often cannot even take care of themselves, let alone work. But today many of them still have the opportunity to work mentally.

The work schedule and wages for disabled people of group 2 are already significantly different from those of the first degree. After all, 2 is a working group.

This includes people with partial disability, for example, no or lost hearing, speech, or vision. This category establishes reduced labor standards.

In addition to the length of working hours, appropriate vacancies are selected for them.

How are disabled people of group 3 paid for part-time work?

Disability group 3 implies partial loss of ability to work. Such people can work in any industry, although they will have some restrictions.

If disabled, the employee must not be subjected to increased loads. It is prohibited to involve them in work with hazardous working conditions.

According to the Labor Code of the Russian Federation, it is impossible for workers with disability group 3 to be involved in night work or forced to remain at work beyond the prescribed hours per day. Remuneration for disabled people of group 3 working part-time must fully correspond to the amount approved in the employment contract.

Disability groups

To register a disability, you must undergo a medical and social examination, which, depending on your health condition, will assign you a disability group.

Characteristics of available groups:

- The first is the most difficult and most dangerous. Issued only to people who are unable to perform self-care. Does not move at all, or does it with the help of other people. Consciousness is clouded, and memory and speech suffer during this process. Basically, disabled people who have the first group do not carry out work activities;

- The second group of disabilities has characteristics in the form of partial loss of previous qualities. For example, if previously a person could move, now he can only stand up and walk using special equipment. To employ a disabled person of the second group, it is necessary to change the conditions in which he can carry out work activities. Such conditions include light and sound. For example, a person partially deprived of vision can only work where there is sufficiently bright light, otherwise he will not see anything;

- The third group - a disabled person differs from a healthy person in slowness. This quality manifests itself both at work and when answering simple questions. But it is worth saying that in this case a person can take care of himself.

After passing a medical examination, a person receives a conclusion from the commission in the form of a certificate of the established form. The certificate contains the person’s data and information about the assigned disability. The resulting decision also contains data on work activity, which indicates at what rate the person can work (full, half and 0.25).

What is the minimum wage

Employment time is reduced for citizens with the first and second disability groups. According to Art. 133 of the Labor Code of the Russian Federation, the amount of wages paid should not be lower than the minimum established for a certain number of hours worked. Also, disabled people must be paid a salary no lower than the minimum wage, regardless of the fact that they work 35 hours.

They are provided not only with preferential conditions when hiring, but also with other privileges from the state. In certain cases, they are provided with assistance in the form of subsidies for the purchase of housing, care for a caregiver, exemption from contributions to the Pension Fund, social services, etc.

Thus, a distinctive feature of payments to persons with disabilities when they get a job is working in a reduced schedule while maintaining the full rate of remuneration. The law also provides certain benefits for such citizens.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

How are disabled people's salaries calculated?

The amount of earnings for people with disabilities is established by law, and certain rules must be followed when calculating it.

You should take a closer look at the procedure for calculating wages and deducting contributions from it for accidents:

- the minimum amount that must be paid per month is established by the Labor Code of the Russian Federation;

- Every citizen who has a disability and works officially is entitled to a salary;

- a salary supplement is paid for hours worked;

- bonus payments are added to this amount;

- 13% tax is deducted from the total amount;

- The amount of accident insurance is subtracted from the remainder.

These are the rules for calculating earnings for citizens whose capabilities are limited. At the same time, regardless of whether a citizen with a disability works full-time or short-time, the employer is obliged to put a mark on the time sheet indicating a full working day.

Watch the video. Employment of disabled people:

Benefits and special conditions

In addition to the above rules, the employer must take into account other features of the work of citizens with disabilities (group II or III):

- payment for 30 vacation days provided annually is made at the expense of the employing company (Article 23 of Federal Law No. 181);

- persons with disabilities have the right to receive vacation days without pay (due to personal circumstances) - up to 60 per year;

- in accordance with the laws of the Russian Federation, it is prohibited to engage citizens with disabilities in overtime and night work if they refuse this (Articles 96, 99, 113 of the Labor Code), and if they agree, everything must be done in writing, after which the paper is signed by the employee.

Tax benefits are also provided for persons with disabilities.

In case of leaving a job due to layoffs, no tax is charged on severance pay (Article 217, Part 3 of the Tax Code).

In the case of participation of a citizen with disabilities in measures to eliminate the results of the accident in Chernobyl or in the Great Patriotic War, this is the basis for receiving a tax deduction of 3 thousand rubles.

Article 94. Duration of daily work (shift)

The duration of daily work (shift) cannot exceed:

for workers aged from fifteen to sixteen years – 5 hours, for workers aged from sixteen to eighteen years – 7 hours;

for students of general education institutions, educational institutions of primary and secondary vocational education, combining study with work during the academic year, from fourteen to sixteen years old - 2.5 hours, from sixteen to eighteen years old - 4 hours;

(as amended by Federal Law No. 90-FZ of June 30, 2006)

for disabled people - in accordance with a medical report issued in the manner established by federal laws and other regulatory legal acts of the Russian Federation.

(as amended by Federal Law No. 90-FZ of June 30, 2006)

For workers engaged in work with harmful and (or) dangerous working conditions, where reduced working hours are established, the maximum permissible duration of daily work (shift) cannot exceed:

with a 36-hour work week – 8 hours;

with a 30-hour work week or less – 6 hours.

A collective agreement may provide for an increase in the duration of daily work (shift) compared to the duration of daily work (shift) established by part two of this article for employees engaged in work with harmful and (or) dangerous working conditions, subject to the maximum weekly working hours time (part one of Article 92 of this Code) and hygienic standards for working conditions established by federal laws and other regulatory legal acts of the Russian Federation.

(Part three as amended by Federal Law No. 90-FZ of June 30, 2006)

Duration of daily work (shift) of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists jobs, professions, positions of these workers, approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, can be established by a collective agreement, a local regulatory act, or an employment contract.

(Part four was introduced by Federal Law No. 90-FZ of June 30, 2006, as amended by Federal Law No. 13-FZ of February 28, 2008)

How are disabled people paid for their work during a shortened working day?

When paying for the work of citizens with disabilities, payments are made in a special order, in addition, their working day has a different duration in accordance with the Labor Code of the Russian Federation.

According to the provisions of Art. 92 of the Labor Code of the Russian Federation, for persons with disabilities of groups 1 and 2, a benefit is provided in the form of a reduction in working time, which should not be more than 35 hours per week. When working additional time in excess of the norm, the employer is obliged to calculate payment in the amount due in case of overtime.

When using a benefit that allows you to work 35 hours on a five-day schedule, payment is provided at the full rate. If a citizen himself wants this, he can work 40 hours along with other workers. At the same time, according to Art. 152 of the Labor Code of the Russian Federation, the employer is obliged to pay overtime.

Persons with disabilities can work part-time. In this case, wages are paid to them in the same manner as to other part-time workers. The working day lasts the same as everyone else’s – 4 hours.

Remuneration for disabled people of group 2 with reduced working hours

Persons with the second disability group are considered to have partial working capacity. They are provided with certain benefits and incentives from the state. This group includes citizens who have partially lost the ability to work, for example, with the absence or loss of hearing, speech, and vision.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

For such persons, reduced work standards are established. In addition to reducing working hours, necessary vacancies are being selected for them.

If a person gets a job officially, he cannot be paid less than what is established in the Labor Code of the Russian Federation.

Special mention should be made about working on a shift schedule. Citizens in the second group can work 7 hours a day. Based on this, earnings will be calculated based on recalculation taking into account work time. Even in cases where the required number of hours is not worked, the employer is responsible for additional payment.

Remuneration for disabled people of group 3 with reduced working hours

Citizens of the third group are not entitled to the benefit of reducing working hours. That is, they must work 40 hours a week. Such rules are set out in Art. 91 Labor Code of the Russian Federation.

If medical documents indicate the need to reduce the working day, the employer is responsible for establishing a part-time working day or shift.

In the first case, payment for work is made in the general manner. In the second option, payments are made in proportion to production time or according to a piece-rate payment system.

Part-time work does not affect either the number of vacation days or the procedure for calculating length of service.

When calculating the earnings of employees with disabilities of the third group, deductions are required:

- 22% - to the Pension Fund;

- 2.9% – in the Social Insurance Fund;

- 5.1% - to the Compulsory Medical Insurance Fund.

Then tax deductions are made.

Working conditions and rights at work for disabled people of group 3

It happens that under one pretext or another, employers refuse to hire such people. This is completely wrong and illegal. It is possible to refuse employment on a legal basis only if there are no vacancies in principle, and if the existing vacancy due to working conditions is contraindicated for a particular job seeker. Let's consider how a citizen with a disability can get a job and what are the rights of a group 3 disabled person at work.