Home / Family law / Change of surname

Back

Published: 02/16/2018

Reading time: 6 min

0

610

After changing your last name, you need to change not only your Russian passport, but also your TIN. To do this, a certificate of the established form is submitted to the Tax Inspectorate.

- Do I need to change my TIN when changing my last name?

- Rules for filling out an application for changing the TIN Package of attached documents

One of the spouses will have to go through the procedure for replacing the TIN when changing their surname after entering into a marriage or divorce. It may also be relevant for other individuals who, for one reason or another, changed their last name.

How can I get a TIN

The organization officially authorized to issue TIN to individuals and legal entities is the Federal Tax Service. You can initially request or restore a tax ID in the following ways:

- Contact the tax department in your area of residence and submit a standard application form (No. 2-2 Accounting) for consideration. In 5 days the form will be ready.

- Fill out an application on the website of the Federal Tax Service on the Internet and send it to any chosen tax authority.

- Submit a written application to the tax office by mail. At the same time, notarized copies of the necessary documents are attached.

- Get it at the multifunctional center.

Attention! Is it possible to make a TIN at the MFC? In theory, this is possible, but in practice, such a service is not available in all regions. Therefore, you should first verify this possibility by calling the selected center (the numbers are presented on the government services website).

How to change the TIN when changing your last name?

There are several authorities where you can contact: the State Services portal, the Federal Tax Service and the MFC.

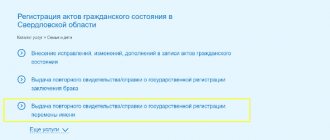

Replacing the TIN when changing your last name through Gosulugi

The State Services portal allows you to quickly update your Certificate without leaving your home – online. To carry out the operation, you need to go to gosuslugi.ru.

You don’t have to fill out an online form - just submit an application for a shift operation. You need to select the appropriate item in the menu of services provided by the Federal Tax Service.

In the case of an online replacement, you will still have to go to the Federal Tax Service office in person to get a new Certificate.

Attention! Re-issuing papers is a paid service, but the change process is free. So you need to be careful.

Replacement through the Tax Office

The Federal Tax Service provides the possibility of replacement by directly contacting the service and online at nalog.ru.

You can also send a representative to the department, but he must have a notarized power of attorney.

An individual can select a Federal Tax Service department by:

- place of residence;

- place of registration (in case of non-permanent residence);

- location of real estate or transport (in the absence of registration).

To carry out the procedure, simply fill out an application and attach a package of documents.

When replacing online, you need to find the corresponding page “Submitting an individual’s application for registration” on the website and follow the instructions offered there.

If a person has an account on the website (it can be obtained by contacting the Federal Tax Service), then the updated Certificate can be sent in electronic form with an electronic signature. This makes sense for entrepreneurs, but ordinary citizens are unlikely to use it electronically.

Changing the TIN through the MFC

There is an MFC in every district, so it is recommended to choose a branch at your place of residence. In such centers you can get a free consultation, so if difficulties arise, it is better to go to the MFC.

To carry out the procedure, you must bring a package of documents; the application is filled out on the spot.

Advantages of contacting the MFC

When registering a tax number through the MFC, there are a number of advantages:

- the center employee independently creates an application or helps to do it, which eliminates errors;

- photocopies of documents are certified on the spot, without the need to visit a notary;

- Any documents can be obtained here, even if they are missing (for example, by requesting in electronic form).

List of required documents

If a decision is made to re-issue the certificate after entering into a marriage with a change of surname, you should know what documents are needed to replace the TIN. The list of papers is small, but they are all required.

- Application for renewal of TIN in the established form.

- General civil passport of a person who has entered into a legal marriage.

- Paper about the place of residence, if the information in the passport is missing or does not coincide with the actual one.

- TIN document for the old surname.

- A document confirming marriage or divorce resulting in a change of surname.

As with the initial application to a tax institution to assign a TIN, you do not need to pay a state fee in case of re-issuance of the TIN certificate.

Rules for filling out an application

In order to avoid refusal to re-issue the TIN certificate, you must draw up the application correctly. The document is prepared in the approved form. The form can be downloaded from our website below. When filling out an application for a new TIN certificate, you should adhere to these rules.

- Information is entered electronically or manually, but in block letters.

- Each letter is recorded in a separate cell.

- Errors and strikethroughs must be excluded.

- The use of corrector (liquid) when filling out the application is prohibited.

- Each of the 3 pages is printed on a separate sheet.

Download sample application (.XLS)

At the beginning of each page, the previously assigned TIN, surname, patronymic of the person who changed the surname and wishes to obtain a new certificate are written. If a person does not have a middle name, the number 1 is entered in the specified field in the first cell. On the first page, the name of the applicant’s identity document is recorded and it is indicated who is submitting the application: the taxpayer himself or an authorized representative.

Information about the change of surname is recorded on the second page of the document. The year of last name change and the applicant’s gender are indicated (1 for a man, 2 for a woman). Data on place of birth and registration are entered. On the third page, data on the place of residence is filled out if they are not certified by a passport of a Russian citizen.

Required documents

Replacing the TIN in the MFC when changing your last name requires the presentation of a certain package of documents:

- a standard application form, filled out in full accordance with the rules (the form can be taken from the MFC or printed from the Internet);

- new passport;

- marriage certificate;

- a document on the basis of which the surname is changed (when acting on personal initiative);

- old tax identification number

Foreign citizens with temporary registration on the territory of the Russian Federation must have a corresponding entry in their passport. Persons staying in Russia temporarily must present a migration visa or entry card into the country.

What documents are needed when replacing a TIN?

To apply for a replacement, you must bring with you the main identification document - a passport.

But how to change the TIN if you don’t have a passport (for example, due to its loss)? A temporary passport can be used and can be obtained at the same time the old passport is collected, although the temporary copy is sometimes refused.

The application and package of documents can be sent by registered mail or by e-mail. In this case, copies of documents must be notarized.

The complete package of documents consists of:

- Passports.

- Certificates of registration and marriage/divorce.

- Old Certificate.

If the passport does not contain information about the actual place of residence, you need to prepare confirmation of registration at the place of stay.

But a situation may arise when an individual does not have registration at all: neither temporary nor permanent. Even then the operation can be carried out.

They register with the Federal Tax Service at the place of residence, stay or location of real estate or transport. So any situation can be solved.

Replacing the TIN in the MFC

To change the TIN when changing your last name, the MFC is selected on a territorial basis - by registration or by the address of attachment to a specific tax authority (for legal entities).

Sequence of steps:

- After confirming by telephone the availability of such a service at the selected center, they will find out the work schedule.

- They are sent to the MFC and make an appointment by picking up an electronic coupon at a stationary terminal. Then they wait on a first-come, first-served basis.

- With the support of a specialist, fill out the application form.

- Come to the department on the specified date to receive a completed form.

Attention! You can change your tax ID at the MFC free of charge and only by the applicant personally.

If this action is entrusted to a representative, a notarized power of attorney will be required. He also has the right to submit an application and documents. Why does the notary at the same time certify the copied passport of the citizen for whom the TIN is issued?

You can make an initial appointment at the center through the “My Documents” online portal. To do this, you will need to register and create a personal profile. If you have your own account on the State Services, you can use its data to authorize on the MFC website. Another way to make an appointment is to call the 24-hour MFC contact number or the number of a specific branch.

Is it necessary to change the TIN when changing your last name after marriage?

The first thing to note is the following: the taxpayer identification number remains forever the same as it was issued by the Federal Tax Service department upon first application.

Relevance is an important feature and a necessary feature of the taxpayer register, so it is updated regularly.

In turn, civil registry office employees are required to submit information about a change in the name of citizens.

Changing your TIN when changing your last name is a voluntary process. Therefore, the changed full name is not always indicated on the Certificate. It contains the personal data that was specified at the time of registration.

Important! Changes regarding the full name will necessarily be reflected in the register, regardless of the person’s application.

The update procedure is optional, but Federal Tax Service employees still recommend doing it to avoid potential misunderstandings.

Timing and cost

After completing an application from a citizen, all submitted documents are sent to the territorial tax service for consideration and issuance of a new certificate. Then it is returned to the MFC, where it is handed over to the applicant.

The entire procedure takes no more than five working days. Sometimes, due to the excessive workload of tax employees, the period is extended to 10 days.

Reference! As already mentioned, this service is provided free of charge. Pay a state fee of 350 rubles. Only necessary when replacing a lost or damaged certificate.

Rules for replacing a certificate

So, is it necessary to change the TIN after marriage and what this procedure consists of? Let’s go into detail. Let's consider what actions to take and determine the list of required documents. You also need to know where the certificate is changed.

Who is authorized to issue a certificate

The authority to assign a code to a tax payer is vested in the territorial branches of the Federal Tax Service of the Russian Federation.

They prepare and issue certificates. For the initial assignment of a code, an application with a set of documents is presented. You can submit an application for assignment of a unique code by appearing in person at the institution, sending documents by post with notification, or online. When a tax authority assigns a TIN to a citizen, this unique number is entered into the unified database of taxpayers. Every tax institution in Russia has access to this information, regardless of location. Thus, where to change the TIN when changing your last name (more precisely, a certificate) is obvious: at the tax office.

In this case, there is no need to apply directly for a new document to the tax office that was involved in the procedure for assigning a TIN. You can submit an application and the necessary documents for re-issuing a certificate to the tax institution that serves taxpayers in the applicant’s area of residence at the time of filing the application or to the Multifunctional Center.

Additional Information

For any questions regarding obtaining and changing the TIN, it is recommended to contact the following numbers:

- Moscow -;

- Moscow region -;

- St. Petersburg and region;

- for regions –.

The previously functioning telephone number in St. Petersburg, through which one could request a service to obtain or replace a TIN, is currently not working. This procedure can only be carried out with a personal visit to the branch or via mail.

Reissuing a tax identification form when changing your last name is a mandatory action. This is stipulated in tax legislation. Ignoring this aspect will inevitably entail the imposition of penalties. In the social sphere, this will also add problems, since you will have to constantly prove your identity with many additional documents.

Do I need to change my Taxpayer Identification Number (TIN) when moving?

TIN is digital information that is located in the unified state system of the Federal Tax Service. Where the owner of the identification number is located does not determine his ability to pay taxes. Even if you have moved to another place of residence and intend to file a tax return, you just need to contact the territorial body of the Federal Tax Service. You can find out the address of the nearest one on the tax service website. The tax officer will not require a new registration or passport from you, because... He will be able to find information about you in the database based on the tax number provided.

Attention! Intentionally changing the TIN when selling a new apartment may be perceived as an attempt at fraudulent activity. The fact is that any financial transactions related to making a profit are subject to taxation. If you try to change your tax number or even just find out how to change your TIN when changing your last name or registration, you may be suspected of fraud with property and attempting to evade taxes. Changing your last name does not in any way affect the possibility of taxation, nor does the place of registration.

What are the differences between a TIN and a certificate?

It is necessary to distinguish between the concepts of TIN and certificates of its assignment. In the first case, it is a digital code that has no physical embodiment. It is located in the Federal Tax Service database and can be accessed from anywhere. For example, you can find out your TIN yourself on the website of the Federal Tax Service by entering your passport details, full name, and date of birth.

The TIN assignment certificate is the physical embodiment of the identification number. This is a document confirming that a citizen is registered with the Unified State Register and his ability to make deductions from profits in favor of the state. The certificate is issued in the form of a document on a unified form with the seal of the Federal Tax Service and attributes of protection against forgery.

The document on assignment of a tax number can be accidentally destroyed/lost, but the TIN itself cannot be lost, because all information in the tax service database is protected. If you have lost a document, it can be easily restored by contacting the local tax service with your passport, having first paid a state fee of 300 rubles. In this case, you will be given not the original, but a duplicate of the certificate. In this case, the document will contain the same data that matches the information about the taxpayer in the Federal Tax Service system.