The policyholder is obliged to pay insurance premiums for himself and his employees (if he has the status of an employer) to extra-budgetary funds, in particular to the Pension Fund of the Russian Federation no later than the 15th day of the month following the reporting period, unless this date falls on a weekend or holiday (non-working) days (from 01/01/2017, payment of insurance contributions for compulsory pension, medical and some types of social insurance will be made to the Federal Tax Service). Otherwise, the last day for paying contributions is considered to be the first working day after the officially established weekend. In case of late payment of insurance premiums by the payer, a penalty is charged to the Pension Fund of the Russian Federation for each day of delay.

Payment order: basic rules for filling out the form

In 2021, payers must use the form of payment document (“payments”) approved by the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 (see Appendix 2).

Appendix 3 of this Regulation of the Central Bank of the Russian Federation contains the meanings of the codes used. The form for payment of penalties is filled out by the payer according to the rules specified in Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013 (as amended on April 5, 2017). In fact, it has no significant differences from the usual “payment”, which is issued when paying fees to the budget, with the exception of certain nuances.

| Payment order field | Name | What you should pay attention to (to pay penalties for all fees, except for injuries) |

| 104 | KBK |

OPS: 182 1 0210 160; Compulsory medical insurance:182 1 0213 160; VNiM:182 1 0210 160. |

| 106 | Basis of payment | The list of codes used is given in Order of the Ministry of Finance of the Russian Federation No. 107n. Encoding options when filling out the form: · self-payment (“PA”); · at the request of the Federal Tax Service (“TR”); · based on the inspection report (“AP”) |

| 107 | Taxable period | The period is determined depending on the previous field - the basis, namely: · for codes “ZD” and “AP” - write “0”; · for payment on demand, record the period noted in this request; · when paying penalties for a certain period, indicate this payment period |

When making a “payment” to pay off penalties for injuries due in fields “106”, “107”. “108”, “109” indicate zeros. If the basis for payment is a corresponding document from the Social Insurance Fund, then its details must be entered in the “Purpose of payment” field. The BCC for penalties on contributions for injuries did not change: 393 1 02 02050 07 2100 160.

Overdue tax advances

If an organization must make advance payments of tax during a tax period, then the obligation to make advance payments of tax is recognized as fulfilled in the same manner as established in relation to the tax as a whole for the period.

Thus, if advance tax payments are paid at a later date than those established by law, then penalties are charged on the amount of the debt on advances.

Let us remind you that advance payments are provided, in particular, for the following taxes.

Corporate income tax. At the end of each reporting period, firms usually calculate the amount of the advance payment based on the tax rate and profit calculated on an accrual basis from the beginning of the year to the end of the reporting period.

Organizational property tax. The amount of the advance payment for property tax is calculated based on the results of each reporting period in the amount of 1/4 of the product of the tax rate and the average value of property determined for the reporting period.

Transport tax. Organizations calculate the amount of advance tax payments at the end of each reporting period in the amount of 1/4 of the product of the corresponding tax base and tax rate. The legislation of a particular subject of the Russian Federation may cancel the obligation to make advance payments.

Land tax. The amounts of tax advances are calculated by those taxpayers for whom the reporting period is defined as a quarter. They determine these payments at the end of the 1st, 2nd and 3rd quarters of the current tax period as 1/4 of the tax rate as a percentage of the cadastral value of the land plot. The obligation to pay advance payments may be waived by local authorities.

If, at the end of the period, the amount of the calculated tax is less than the amount of advance payments payable during the specified period, then the “advance” penalties are subject to a commensurate reduction. This is stated in letters of the Ministry of Finance of Russia dated January 19, 2010 No. 03-03-06/1/9, dated March 18, 2008 No. 03-02-07/1-106, as well as in the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 26, 2007 No. 47.

Amount of penalty for late payments for mandatory fees

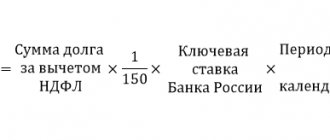

So, the penalty is charged at the key interest rate (in force during the period of non-payment) of the Central Bank of the Russian Federation for each overdue day (i.e. day of non-payment). The key rate for 2021 remains unchanged to this month - 7.50% per annum. For individual entrepreneurs and legal entities, when calculating penalties, depending on the number of overdue days, its application may be different.

| Payer category (penalty for all fees, except for injuries) | Applicable rates |

| IP | Delay up to 30 days: 1/300 of the key rate of the Central Bank of the Russian Federation |

| Entity | As for individual entrepreneurs, if the payment is overdue by up to 30 days: 1/300 of the Central Bank key rate. But if payment is not made for more than 30 days. this tariff for legal entities increases and already from 31 days of delay is equal to 1/150 of the key rate of the Central Bank of the Russian Federation |

Penalties for fees for injuries are invariably calculated as 1/300 of the Central Bank rate for the unpaid amount, and so on for each day of delay. The terms of non-payment and the category of the payer do not affect anything here.

Important! The general formula for calculating: the amount of unpaid fees * the number of days of non-payment * 1/300 of the rate of the Central Bank of the Russian Federation (or 1/150 of the rate of the Central Bank).

To calculate penalties for contributions for injuries, the period is taken from the first day of non-payment until the day of payment of the fees, inclusive. As for other fees, for calculation purposes the period from the first day of non-payment until the day preceding the insurance payment is taken into account.

The accounting department displays the penalty on the day of calculation (or the day when the decision of the regulatory body took effect) using the following entries: DT 99 KT 69 - accrual, as well as DT 69 KT 51 - its payment. Basis - Instruction approved by order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000.

Procedure for calculating penalties

The easiest way to calculate the penalties due is to use an online calculator. There are many similar resources on the Internet. But the taxpayer may not have access to the Internet or wants to check the accuracy of the calculation on his own.

There is a need to calculate the amount of penalties in the following situations:

- the deadline for transferring the mandatory insurance contribution, tax or fee has been violated;

- Due to an underestimation of the tax amount for some reason, the wrong amount was transferred to the budget.

You can consider these situations using the most popular tax, for which penalties are most often charged by tax inspectorates. We are talking about a tax applied on a simplified taxation system.

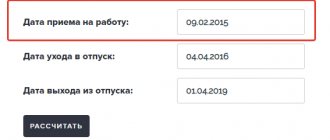

The obligation to pay an advance payment under the simplified tax system occurs for individual entrepreneurs and organizations 3 times a year (Article 346.19 and Article 346.21 of the Tax Code of Russia):

- 25th of April;

- July 25;

- the 25th of October.

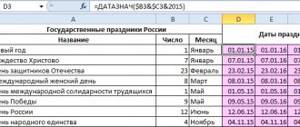

If this date is a holiday, the deadline for mandatory payment is postponed to the next working day after this date. Let’s say an organization paid tax under the simplified tax system on April 30. For 5 days of delay, penalties are considered, which must be transferred to the budget as soon as possible.

The situation when the amount of tax according to the simplified tax system was underestimated due to a calculation error is also a reason for calculating penalties. It is worth noting that for the amount of tax arrears (the difference between the obligatory payment amount and the transferred amount), penalties are accrued on the day the taxpayer actually repays the debt.

Example 1. Determining the period for calculating penalties for compulsory health insurance and injuries

Situation one. The organization was supposed to pay OPS contributions by October 31, 2021, but in fact the money was transferred on November 6, 2021. The total delay was 5 days (from 11/01/2021 to November 5 inclusive).

Situation two. The organization did not pay the injury fees on 10/15/2021 (as required), but later on 10/19/2021. Here you should take into account the first day of non-payment (10/16/2021) and the actual day of payment (10/19/2021). Thus, the period of delay was 4 days (October 16 - 19).

Calculation of penalties for mandatory pension insurance and social insurance contributions

So, in order to calculate the penalty for unpaid compulsory medical insurance, compulsory medical insurance, VNiM contributions, you need to adhere to the general calculation scheme, according to which the payer should:

- Set the period for which the penalty will be calculated (see example 1). For all fees other than personal injury fees, it starts on the first day of delinquency and ends on the day before the day the fees are due.

- Find out the interest rate of the Central Bank of the Russian Federation. The refinancing rate (also the key rate) may change; for 2021 it is 7.50%.

- Determine the formula for calculation taking into account overdue days. As is customary, if the number of days of delay is up to 30, then the indicator 1/300 of the key rate is substituted into the standard calculation formula. When the delay exceeds 30 days, then a penalty, starting from 31 days, is charged at 1/150 of the Central Bank key rate; accordingly, this indicator is substituted.

A general version of the formula: amount of fees * number of days of non-payment * 1/300 of the Central Bank of the Russian Federation rate (or 1/150 of the Central Bank rate).

If during the period for which the penalty is calculated, the key rate of the Central Bank changes, then this fact is taken into account. Accordingly, the required current rate indicators are substituted when calculating.

For example, the first 3 days of delay fall during the period of validity of the increased key rate (7.75%), and the remaining 10 days of delay do not fall within the period of validity of the rate of 7.50%. From here, the penalty for 3 days is calculated taking into account the rate of 7.75%, and for 10 days - at the rate of 7.50%.

As a result, the policyholder pays the entire amount of insurance premiums plus a penalty for overdue days.

What will happen for non-payment of fines?

If you do not pay the amount required by the tax authorities, there will be no penalty. The inspector will increase the amount of penalties until full payment is made. If the payer ignores all notifications, the Federal Tax Service has the right to file a claim and recover payment in court.

Fines

If an individual entrepreneur does not pay insurance premiums, then he does not fulfill his duties. And this is punishable by fines. Intentional non-payment will result in a double fine.

So, non-payment of contributions and underestimation of the calculation base are punished by 20% of the unpaid amount.

Intentional non-payment or under-payment is subject to a fine of 40% of the unpaid amount.

If a report is required for paid contributions, and it was not submitted on time, this is also punishable by a fine. The fine for such a violation is from 300 to 500 rubles. But if the individual entrepreneur not only forgot to submit the report, but also did not pay the fees, then another 5% of the unpaid amount for the last three months and for each full and partial month of delay is added to the fine.

If an individual entrepreneur must submit reports electronically, but for some reason submitted them in paper form, then this is punishable by a fine of 200 rubles.

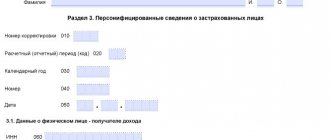

Violation of the deadlines for submitting the SZV-M or errors in the report are fined in the amount of 500 rubles for each insured person. If this report is submitted in the wrong way, then the fine is 1000 rubles.

Failure to submit reports to the Pension Fund on time or in full is punishable by a fine of 300 to 500 rubles.

For failure to submit 4-FSS on time, you will have to pay 5% of the amount of deductions for injuries for the last three months, as well as a fine of 300 to 500 rubles. If this report is submitted in the wrong way, the fine will be 200 rubles.

Criminal penalty

Failure to pay mandatory contributions may result in criminal penalties. This threatens responsible persons if non-payment is the result of a crime.

When you can avoid paying a penalty in case of late insurance payment

Under some circumstances, there is no need to pay the policyholder a penalty in case of late insurance payment. This is evidenced by the norms of the Tax Code of the Russian Federation, Federal Law of the Russian Federation No. 125 of July 24, 1998. Such exceptions, when a penalty is not charged, include, for example, the following situations:

- When calculating insurance premiums, the policyholder was guided by the written instructions of the authorized bodies, which resulted in arrears (in relation to Article 75 of the Tax Code of the Russian Federation, Article 26.11 of the Federal Law of the Russian Federation No. 125).

- The arrears arose due to an error made by the policyholder when filling out the payment document. The main condition: the mistake made can be corrected by clarifying the payment (in relation to Article 45 of the Tax Code of the Russian Federation, Article 26.1 of the Federal Law of the Russian Federation No. 125).

Making corrections and eliminating most errors is possible by specifying the payment. The exception is: errors in the Federal Treasury account, the name of the addressee's bank. More information about such situations: Art. 45 Tax Code of the Russian Federation, art. 26.1 Federal Law of the Russian Federation No. 125.

To specify the payment, the policyholder must submit a free-form application to his INFS with a request to clarify the payment. The text should indicate: the number and address of the Federal Tax Service, the personal data of the applicant, payment details, the error made, the basis for its clarification (with reference to Article of the Tax Code of the Russian Federation). The application is then dated and certified by the personal signature of the applicant. A copy of the “payment” is attached to it. Everything together is submitted to the Federal Tax Service for consideration.

From when is it calculated?

For each tax, the Tax Code of the Russian Federation establishes a time frame within which the tax must be determined and transferred to the budget. Therefore, determining from what date the company will be subject to penalties in the form of penalties for each tax individually.

However, there is a rule according to which the penalty should be calculated starting from the next business day following the day set as the deadline for transferring the tax.

There are several events that may lead to the need to calculate penalties for taxes:

- There are no transfers of tax payments.

- The taxes were sent to the budget, but later than the deadlines established by law.

- Mandatory tax payments were partially made.

It is advisable for companies and entrepreneurs to make their own calculations and voluntarily transfer the received penalties to the budget. This will help either reduce or avoid the accrual of fines that already exist according to the law.

In addition, every taxpayer needs to know the list of cases in which the accrual of penalties can be avoided. These include:

- If there is an overpayment for a tax payment for which payment deadlines have been violated.

- If there are valid circumstances due to which the tax payment deadlines were violated. All such situations are strictly defined by legal norms; they are considered by inspectors on an individual basis upon presentation of supporting documents. For example, blocking a current account, being treated in a hospital, etc.

- When a taxpayer discovered an error in calculating tax that went unnoticed by the Federal Tax Service, he did not submit any corrective reports to correct it.

- The underpayment of mandatory payments was caused by an erroneous official explanation from representatives of the tax authorities. These can be compared to the messages of inspectors published on the tax website. Other publications on the Internet have no legal force.

You might be interested in:

Online maternity leave calculator for [year] year: basis for calculation, formulas and examples

Answers to frequently asked questions

Question No. 1: Community pension contributions were transferred on time, but according to an erroneous BCC. Will a sanction be applied in this case?

An error under the KBK is not a violation and not a basis for charging a penalty. As a rule, the payment is updated automatically. In fact, if the payment went through and arrived at the correct account, despite the existing errors, the payment can be specified through the Federal Tax Service.

The policyholder, who independently and promptly noticed an error in the payment document, has the right to clarify the payment by submitting an appropriate application to the Federal Tax Service. The following are also subject to clarification: the status of the payer, the tax period, as well as the basis for payment, etc. in accordance with Art. 45 of the Tax Code of the Russian Federation.

Question No. 2: Penalties on compulsory pension insurance contributions are paid at the request of the tax authorities. How to display this in the “payment”?

You need to write down the details of this requirement in fields “108” and “109”. For your information, when paying voluntarily, zeros are entered here.

Reflection of penalties in accounting

For the purposes of calculating income tax, expenses in the form of penalties, fines and other sanctions transferred to the budget (to extra-budgetary funds) are taken into account when determining the tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation).

The accrual of penalties for late payment of taxes (advance payments thereon) in accounting looks like this: DEBIT 99 “Profits and losses” CREDIT 68 “Calculations for taxes and fees”

- penalties are accrued for late payment of taxes (advance payments).

In accounting, the accrual of penalties for late payment of insurance premiums is reflected as follows: DEBIT 99 “Profits and losses” CREDIT 69 “Calculations for social insurance and security”

- penalties were accrued for late payment of mandatory monthly payments. As we can see, the penalties to be paid do not affect either the amount of the financial result in accounting or the size of the tax base. Therefore, there are no differences between them in accordance with PBU 18/02.

M.V. Grebenarov, tax consultant

Tax accounting and reporting

The “Tax Accounting and Reporting” berator brings together and correctly systematizes complete and detailed information on how to organize and maintain tax accounting. Find out more >>