Companies and individual entrepreneurs using the labor of hired specialists are required to submit quarterly reports to the tax authorities reflecting the procedure for calculating budget obligations for contributions. If the accountant made a mistake when drawing up the form, he needs to submit clarifications to the fiscal authorities. Otherwise, the company faces penalties. Practice shows that one of the most common situations is the need to adjust Section 3 of the calculation of insurance premiums due to incorrect indication of personal data of employees.

When do you need to submit a “clarification” to the tax authorities?

According to Art. 81 of the Tax Code of the Russian Federation, an updated calculation of insurance premiums must be submitted in a situation where an error made in the original version led to an underestimation of the amount of the budget obligation. If the amount of contributions turned out to be too high, the company decides on the need to submit a corrective form at its own discretion.

According to Art. 431 of the Tax Code of the Russian Federation, it is impossible to do without preparing a “clarification” when identifying the following discrepancies:

- the personal data of the insured person is incorrectly indicated;

- the amounts of payments for all employees are not equal to the amount of contributions for the company as a whole, reflected in the first section;

- There are errors in the numerical indicators of Section 3.

If there is one of the listed inaccuracies, the initial report will not be accepted by the tax authority. The accountant needs to redo the document, otherwise the company will be subject to penalties in accordance with Art. 119 of the Tax Code of the Russian Federation.

Nuances of submitting a corrective report on the DAM

The DAM corrective report for the 1st quarter of 2021 must be submitted if errors and inaccuracies are identified. Let's consider when filing an adjustment report is required:

Among the most common situations that require clarification, experts name the following:

- Errors were found in the data of insured persons: TIN, SNILS were incorrectly indicated or missing, the address does not correspond to the address classifier (KLADR), etc.

- Differences in the 6-personal income tax and RSV indicators were established. In some cases this is the norm, for example when transferring dividends, but more often these are still calculation errors. If discrepancies are justified, it is recommended to attach an explanation to the calculation.

Note! If errors in the DAM did not lead to an understatement of the tax base for contributions and do not relate to the personal data of employees, an update on the DAM for the 1st quarter of 2021 does not need to be submitted.

How to make adjustments to Section 3

The procedure for filling out the report, approved by Order of the Tax Service No. ММВ-7-11/551, states that the adjustment to Section 3.2 of the calculation of insurance premiums (data on payments and contributions for them) involves:

- entering initial data for all sections of the document;

- inclusion in Section 3 of information only on one insured person - an employee about whom incorrect information was previously provided.

In practice, following the explanations of the Federal Tax Service may lead to refusal to accept the report. The fact is that the program used by tax authorities is configured in such a way that the document will not pass the test for control ratios.

To avoid possible problems, we recommend that the accountant enter in the third section data on all insured persons previously included in the original document. Complete the lines as follows:

- in line 001 for all employees, indicate the adjustment number – 1–;

- transfer the correct information for all employees to Subsection 3.1;

- indicate the correct data from the original form in Subsection 3.2.

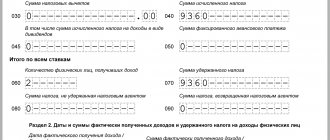

For an employee about whom a mistake was previously made, Section 3 of the adjustment to the calculation of insurance premiums must be filled out twice:

| First time | Rewrite the incorrect version from the original form. On lines 160-180 the value “2” is indicated, 190-300 - the value “0” is indicated. The “Adjustment No.” indicator will be equal to “1–”. |

| Second time | Write the correct information. In lines 160-180 indicate “1”, in 190-300 - enter the correct numerical data. The “Adjustment number” indicator will be “0. |

In order for the finished calculation to be verified by the tax authorities, in the second case, replace line number 040: if the values are the same, the document will automatically be refused acceptance.

ADVICE

When trying to download a report, the accountant will see a warning that the number of Sections 3 is one more than stated in line 010 of Subsection 1.1. Ignore it and send the corrected form to the Federal Tax Service.

To avoid penalties, you must submit the correct calculation before the “deadline”, i.e. the 30th day of the month following the expired quarter.

The Federal Tax Service will not accept a form with incorrectly filled in personal data, so the information will be considered not provided. Delay threatens the company with a fine of 5% of the amount of unpaid contributions (min – 1 thousand rubles, max – 30% of the budget obligation).

Also see “Calculation of insurance premiums for the 2nd quarter of 2021: due date and sample filling.”

Read also

26.12.2017

Letter dated July 3, 2017 No. BS-4-11/ [email protected]

The Federal Tax Service, in connection with incoming requests from territorial tax authorities and payers of insurance premiums on the issue of submitting updated calculations for insurance premiums for reporting periods starting from the first quarter of 2021 (hereinafter referred to as the calculation), reports the following.

Amendments to the previously submitted calculation are carried out by payers of insurance premiums by submitting an updated calculation in the manner prescribed by Article 81 of the Tax Code of the Russian Federation, taking into account the following provisions:

1. To clarify personal data identifying insured individuals, previously reflected in section 3 “Personalized information about insured persons” of the calculation, based on the Notification of clarification of the tax return (calculation) received from the tax authority / Notification of refusal to accept the tax return (calculation) ) and (or) that the calculation is considered not submitted (if the calculation is submitted electronically) or Notification of clarification of a tax document submitted on paper / Notification of refusal to accept a tax document presented on paper and (or) that that the calculation is considered unsubmitted (if the calculation is submitted on paper), or on the basis of a request for explanations received from the tax authority, insurance premium payers must fill out section 3 of the updated calculation as follows:

1.1. For each insured individual for whom inconsistencies are identified, in the relevant lines of subsection 3.1. calculation, personal data reflected in the initial calculation is indicated, in lines 190-300 of subsection 3.2. calculation in all acquaintances is indicated “0”;

1.2. At the same time, subsection 3.1 of the calculation is filled out for the specified insured individual, indicating correct (up-to-date) personal data and lines 190-300 of subsection 3.2. calculation in accordance with the established procedure, if it is necessary to adjust individual indicators of subsection 3.2 of the calculation - taking into account the explanations contained in paragraph 2.3 of this letter.

2. To adjust (clarify) information about insured individuals, with the exception of personal data, the updated calculation is filled out in the prescribed manner, taking into account the following:

2.1. If any insured individuals are not included in the initial calculation, then section 3 containing information regarding these individuals must be included in the updated calculation, and at the same time the indicators in section 1 of the calculation are adjusted;

2.2. In case of erroneous submission of information about the insured persons in the initial calculation, Section 3 containing information regarding such individuals, in which in lines 190 - 300 of subsection 3.2, must be included in the updated calculation. of the calculation, “0” is indicated in all familiar places, and at the same time the indicators of section 1 of the calculation are adjusted;

2.3. If it is necessary to change the indicators reflected in subsection 3.2 for individual insured persons. calculation, section 3 must be included in the updated calculation, containing information regarding such individuals with correct indicators in subsection 3.2. calculation, and if necessary (in case of a change in the total amount of calculated insurance premiums), the indicators in section 1 of the calculation are adjusted.

The Federal Tax Service of Russia instructs to bring this letter to the attention of subordinate tax authorities and ensure that insurance premium payers are informed via telecommunication channels.

Acting State Advisor of the Russian Federation, 2nd class S.L. Bondarchuk

How can I correct errors in the report?

To correct various errors in the report you must:

- To correct an error in an employee’s SNILS, you must indicate the serial number of the adjustment “001” on the title page, also attach section No. 1, as in the initial calculation, and this will also include section 3, filled out for the employee in whose SNILS there was an error. It is worth paying attention that for the same employee you must attach a copy of the insurance certificate, TIN and passport.

Important: the updated section No. 3 in relation to other employees who have not made mistakes does not need to be submitted.

- Error - in section No. 3 if, for example, the report did not include employees who are on maternity leave and receive child care benefits until the child reaches 1.5 years of age. This error needs to be corrected. In this situation, the accountant needs to submit the adjustment with number “001”. It will include section No. 1 and its annexes, which were contained in the original calculation. The information in the updated section No. 1 and appendices must be exactly the same as in the original calculation, that is, total for all employees. In addition to this, the updated calculation will include section No. 3 in relation to “maternity leavers” with the adjustment number “000” and completed line 210 of the subsection

- To correct an error in the amount, you must also make the adjustment following the number. Once again, double-check all amounts of accrued contributions and enter them in Section 1; in Appendix 2, double-check the amount of accrued wages.

pervyy_primer_4-3.jpg

The procedure for correcting the total indicators of Section 3 depends on what errors were made in the initial calculation:

- If the insured person was not included in the initial calculation at all, Section 3 is filled out for him, and at the same time the summary indicators of Section 1 are adjusted.

- If an individual included in the initial calculation by mistake needs to be excluded from the calculation, the initial data on him is “zeroed” by filling out subsection 3.2. zero indicators. At the same time, the summary indicators of Section 1 are also decreasing.

Example 2

The calculation of insurance premiums for the 1st quarter of 2021 mistakenly included employee Ivanov, who was dismissed from the company in December 2021. For section 3, an example of a “clarification” of the calculation of insurance premiums will look like this:

Correction of errors in section 3 “Calculations for insurance premiums”

If errors are found in the personal data of insured individuals, in the “clarification” it is necessary to fill out subsections 3.1 and 3.2, and this will have to be done twice:

- first, the data that was reflected in the initial “incorrect” calculation is entered into the corresponding lines of subsection 3.1, and in subsection 3.2, zero values are entered on lines 190-300;

- then another subsection 3.1 is filled in, but with the correct data, and subsection 3.2 reflects the corresponding amounts of payments and contributions.

Example 1

After marriage, the employee changed her last name from Chernova to Svetlova, but this was not taken into account when filling out the insurance premium calculation. The “clarification” will reflect the old and new surname, and the total indicators will be “reset to zero” and re-reflected in sections 3.2:

Deadlines for filing an adjustment DAM: what to pay attention to

A common situation is when errors and inaccuracies are discovered by the payer himself after submitting reports to the Federal Tax Service.

If an error is discovered before 04/30/2020 (the final deadline for submitting information for the 1st quarter of 2021), you must immediately submit the corrective DAM for the 1st quarter. If the arrears are paid before the due date for payment of the fee (before April 15, 2020 - for March), no sanctions are provided from the regulatory authorities (clause 2 of Article 81 of the Tax Code of the Russian Federation). If after, then penalties should be assessed and paid.

If an error is discovered after 04/30/2020 by the payer himself, he should pay the amount of contributions and penalties for late payment as soon as possible, and then submit an update on the DAM. This procedure will help avoid a fine (clause 4 of Article 81 of the Tax Code of the Russian Federation).

Our calculator will help you calculate penalties.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

***

If errors are detected that affect the tax base or the correctness of personal data, the payer’s responsibilities include filing a corrective DAM for the 1st quarter of 2021. In some cases, the Federal Tax Service does not apply sanctions when submitting clarifications. These include filing adjustments before the end of the reporting period, as well as cases where non-payment was identified by the payer independently, and fees and late fees were paid before filing the corrective calculation.

Even more materials on the topic can be found in the “Insurance Premiums” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to make adjustments to the “Calculation of insurance premiums” - 2018

The updated calculation is submitted on the form that was in effect during the period of submission of the initial report. From the beginning of 2021 to this day, the “Calculation of Insurance Premiums” form, approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551, continues to be in force.

The corrective “Calculation of Insurance Premiums”-2018 is filled out in the same way as the usual (primary) calculation, according to the rules approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/551, but taking into account some nuances (clause 1.2 of the Procedure for filling out the calculation):

- On the title page, in the “Adjustment number” field, enter the serial number of the updated report (1—, 2—, etc.). The same number is indicated in field 010 of section 3 when specifying personalized information.

- The “clarification” includes all sections and appendices to them (except for section 3 with personalized information) that were filled out in the previously submitted calculation, even if there are no changes in them, as well as new sections, if necessary.

- Section 3 “Personalized information about the insured” is filled out only for those individuals in respect of whom any corrections or additions are made.

- The adjusted reporting is submitted to the same Federal Tax Service where the initial calculation was submitted. Please note: if the “clarification” concerns periods before 01/01/2017, then it should be submitted not to the Federal Tax Service, but to the Pension Fund of the Russian Federation on the corresponding reporting forms that were previously in force.

The Federal Tax Service of the Russian Federation also explained how to correctly correct errors when filling out the “Calculation of Insurance Premiums” (letters dated July 18, 2017 No. BS-4-11/14022, dated June 28, 2017 No. BS-4-11/12446).