Home / Labor Law / Payment and benefits / Wages

Back

Published: March 15, 2016

Reading time: 7 min

2

17656

The tariff rate is a constant component of an employee’s salary, as opposed to a variable component - bonuses, compensation, allowances and additional payments.

Based on the tariff rate (salary), the salary paid to the employee for performing a certain amount of labor duties (labor standards) at a specified time is calculated. This type of payment is fixed and is the minimum guaranteed amount accrued for work. It is fixed as required by law in the employment contract, along with other conditions.

Tariff rates, depending on the time period, are divided into monthly, daily and hourly.

- What might it be needed for?

- Calculation methods Depending on the standard working hours per month

- Depending on the average monthly number of working hours per year

What is salary according to the Labor Code

The term “salary”, as well as the accompanying definitions “basic salary”, “official salary” and “wages” are deciphered in Art. 129 Labor Code of the Russian Federation. To understand how to calculate the salary from the salary and apply the appropriate formula, let’s understand these terms:

Based on the definitions given in the Labor Code of the Russian Federation, salary is the minimum fixed amount of money that the employer is obliged to pay to the employee for each month worked, subject to the fulfillment of the job duties assigned to him.

Recommendations from ConsultantPlus experts will help you check whether you have set the salaries of your employees correctly. Get free demo access to the system and go to the Ready-made solution.

Salary is a more expanded concept, which includes, in addition to salary, various additional payments, bonuses and bonuses to which an employee is entitled.

Salary and wages are the same in value if for a fully worked billing month the employee, in addition to the salary, is not accrued compensation and incentive payments.

Wages can be calculated not only on the basis of salary, but also on the basis of the tariff rate - a fixed amount of remuneration for fulfilling a standard of work of a certain complexity per unit of time (hour, day, decade, month) without taking into account compensation and additional payments.

The formulas for calculating wages based on salary and based on the tariff rate are different. Next, we will tell you how to correctly calculate salary based on salary.

How to calculate your bet

What is a unit rate? This is the rate established for the first category, which determines the amount of wages for an employee who does not have experience and qualifications in the tasks he performs. This is the minimum amount of earnings paid for a certain period of time. All ranks above the first depend on:

- Employee qualifications.

- Level of professional training of workers.

The tariff schedule at the enterprise is characterized by categories, that is, their entire complex, starting from the first to the sixth. It turns out that each category, which is higher than the previous one, is higher by a certain amount compared to the previous one, and the amount by which it exceeds the next indicator is a tariff coefficient.

It is worth noting that the minimum wage is set both at the state and regional levels, and the tariff is adopted at each enterprise separately. As a rule, this provision is set out in local acts of the enterprise or organizational structure. But as an exception, it can be noted that budgetary institutions use a different form of remuneration, that is, according to a single tariff schedule.

It’s easy to calculate the amount of payment due under the tariff yourself; to do this you need to know:

- Tariff coefficient.

- An indicator of the tariff rate.

How to correctly collect source data for payroll calculations

To calculate wages based on salary, initial data is collected:

- about the amount of salary;

- number of working days in the billing month;

- number of days worked in a month;

- payments due to an employee in addition to salary.

Where can I get this data from?

Salary size

Salaries for each position are reflected in the staffing table:

In addition, the salary amount must be specified in the employment contract:

And also reflected in the employment order:

See what a sample T-1 order looks like.

Number of working days in the billing month

The working days for each month are calculated based on the production calendar. This indicator depends on the length of the working week: from Monday to Friday (five-day week) or in another mode (for example, with a working Saturday):

Number of days worked in the billing month

This indicator for calculating wages is taken from a time sheet or other document with which the company records days worked, rest days and other periods (business trips, sickness absence, absenteeism, vacations, etc.).

The following materials will help you organize time tracking in your company:

- “Working time sheet according to form T-12 - form”;

- “Notations used in the time sheet”;

- “What is the shelf life of a time sheet?”

Payments due to an employee in addition to salary

Premiums, additional payments, compensations, bonuses and other payments that an employee can count on in addition to salary are established in employment contracts, agreements, orders or other internal regulations (collective agreement, regulations on remuneration, etc.).

The following articles will introduce you to the nuances of assigning various additional payments and compensations to salary:

- “The procedure for paying bonuses under the Labor Code of the Russian Federation”;

- “Regulations on the provision of financial assistance to employees”;

- “Additional payment for combining positions according to the Labor Code of the Russian Federation.”

We will explain below how to calculate salary based on salary.

The second formula for an accountant

This option involves using the average annual number of labor hours as a basis.

We need to divide the annual rate by 12: this is how we get the monthly rate. The employee's salary should be divided by this.

Hourly rate = Employee salary / (Average annual standard / 12).

You can clarify the average annual standard in an accounting program or online source.

Case Study

For Vitaly Nikanorov, who works in a warehouse, a summarized accounting of hours worked is used. Vitaly’s salary is 25,000 rubles. In January he worked 130 hours, in February - 150, in March - 155.

Official data for 2021 states that the labor standard for 12 months is 1974 days.

The hourly rate for a warehouse employee is 151.98 rubles: 25,000 rubles. / (1974 hours /12 months). Using this indicator, the accountant calculates the amount of the employee’s salary in each month of the quarter:

- January - 19,756.84 rubles (151.98 rubles * 130 hours).

- February - 22,796.35 rubles (151.98 rubles * 150 hours).

- March - 23556.23 rubles (151.98 rubles * 155 hours).

At first glance, it seems that the second method is more complicated than the first. Actually this is not true. In the first case, the hourly rate must be calculated monthly, in the second it is enough to determine it once a year. The key advantage of the method is that the salary of each employee of the organization is directly proportional to the number of his actual outputs. This value does not depend on the number of holidays and weekends that fall in a particular month.

Similar articles

- An example of calculating total working time accounting

- Number of man-hours in 2017-2018

- How to calculate man-hours for a year

- Man-hours: calculation formula

- Number of man-hours worked by payroll employees

Basic calculation formula

The basic formula for calculating wages based on salary is:

Using the basic formula, you can calculate the salary if in the billing month the employee does not receive bonuses and other payments in addition to the salary.

We will demonstrate the calculation of salary based on an example.

Employees of Kornet LLC work on a five-day basis. The salary regulations of Kornet LLC indicate that the company's employees are paid a monthly bonus in the amount of 15% of the salary. But there is a limitation: the bonus is not paid if the employee did not fulfill the production plan in the billing month and/or received a disciplinary sanction.

Janitor Samoilov P.G. received a reprimand in January 2021 for absenteeism. As a result, out of 15 working days in January (according to the production calendar for a five-day working week), he worked only 14. His salary, according to the staffing schedule approved for 2021, is 16,250 rubles.

Considering that in the billing month P. G. Samoilov is not paid any additional amounts of an incentive or compensation nature, the basic formula can be used to calculate wages:

Salary = 16,250 rub. / 15 days × 14 days = 15,166.66 rub.

In this amount, P. G. Samoilov’s salary will be accrued for January 2021.

The basic formula cannot always be used. Typically, company employees are paid not in the amount of a “bare” salary, but with additional payments. Then the formula for calculating wages is used differently.

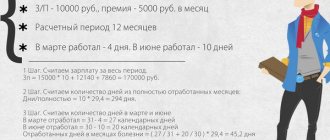

Calculation example

Tariff rate calculation example

Calculation formulas using hourly wages are simple. The main thing is to take into account how many hours are worked in a month and how many are supposed to be worked, according to the timesheet-calendar.

The arithmetic is simple. Calculations performed per month:

And so, the tariff rate is the standard number of hours worked per month. Nikanova T.B. worked as a technologist. Her salary is 40,000 rubles, but she must work a full 159 hours, but she worked more than the allotted time, that is, 167 hours. It turns out that she has overtime and wages need to be calculated according to the time worked. To do this, you need to calculate the tariff, that is, 40,000 divided by 159, that is, it turns out 251.57 rubles. And after taking into account the processing of 167-159, it turns out to be 8 hours.

Advanced formula: how to take into account additional payments

If, in addition to salary, an employee receives incentive and compensation payments, an expanded formula is used to calculate wages:

Moreover, if the employee worked all working days in the billing month (KRD = KOD), this formula takes the form:

How to calculate the salary amount if the employee is paid a bonus or other additional amounts? Let's continue the previous example, changing the conditions in it.

Let's assume that the janitor P. G. Samoilov worked in January without any comments or disciplinary sanctions. Then he will receive a bonus (15% of the salary) in addition to his salary. And to calculate wages, you can use an extended formula (without adjusting the salary for days worked):

Salary = 16,250 + 16,250 × 15% = 18,687.5 rubles.

How to calculate salary for part-time work? ConsultantPlus experts know the answer to this question. Get trial access to K+ and you can see the calculation formulas and solution for this example.

How to calculate salary

To accurately calculate the hourly tariff rate in 2020, you need to consider:

- employee's monthly salary;

- week type (5-day or 6-day, 40-, 36- or 24-hour);

- number of hours of operation in 2021

Let's find out how to calculate the hourly tariff rate from the hourly salary using examples.

Employee Ivanov has a monthly salary of 50,000 rubles. According to the employment contract, his working hours are from 8:00 to 17:00 5 days a week. On July 24, he worked late and left the office at midnight. We need to determine how much extra he will be paid for overtime.

IMPORTANT!

According to Article 152 of the Labor Code of the Russian Federation, for the first 2 hours of processing, one and a half hours of processing is due, for subsequent ones - double. And Article 96 recommends adding at least 20% of the NPV for night work (from 22:00 to 06:00).

It is important to consider the following points:

- in general, processing for July 24 is 7 hours;

- the first 2 hours are paid at one and a half times the rate;

- the next 5 hours - in double mode;

- the last 2 hours are considered night time and are paid with an additional 20% of the NTC.

So, in July 184, Ivanov’s NPV is 50,000 / 184 = 271.7 rubles.

We will make a breakdown of the time worked overtime and at night.

| ChTS | Time | Overtime | 20% for working at night |

| 271,7 | 17:00-18:00 | 407,55 | – |

| 271,7 | 18:00-19:00 | 407,55 | – |

| 271,7 | 19:00-20:00 | 543,4 | – |

| 271,7 | 20:00-21:00 | 543,4 | – |

| 271,7 | 21:00-22:00 | 543,4 | – |

| 271,7 | 22:00-23:00 | 543,4 | 54,34 |

| 271,7 | 23:00-00:00 | 543,4 | 54,34 |

The total premium for July 24 will be (407.55 × 2) + (543.4 × 5) + (54.34 × 2) = 815.1 + 2717 + 108.68 = 3640.78 rubles.

Results

Salary is the minimum fixed amount of wages for a fully worked calendar month, excluding additional incentive or compensation payments.

To calculate salary based on salary, it is necessary to adjust the salary amount by the number of days worked in the billing month. Additional payments are added to the calculated amount if the employee has the right to receive them in accordance with the employment contract or other internal regulations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Minimum size

The legislation does not establish a minimum hourly wage rate in 2021. But when calculating it, it is necessary to take into account the following: the minimum monthly salary of an employee who has worked the full working time cannot be lower than the minimum wage. From January 1, 2019, the federal minimum wage is 11,280 rubles. It is obvious that the hourly wage rates of workers for 2021 will not be lower than those calculated from the minimum wage.

The hourly tariff rate from the minimum wage for a 40-hour work week is calculated using the formula:

If a regional minimum wage has been established in the region where the organization operates, the company should focus on it. For example, in Moscow the minimum wage is 20,195 rubles, and in St. Petersburg - 18,000 rubles.