What is a business trip

A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166 of the Labor Code).

A trip to a branch of your organization that is located outside your permanent place of work is also considered a business trip. This is enshrined in paragraph 3 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel).

Automatically calculate the salary of a posted worker according to current rules Calculate for free

Reimbursement of travel expenses: employer's procedure

The procedure for reimbursement of expenses incurred by employees during a business trip is described below.

Step 1. Issuance of a business trip order

At the first stage, the employer draws up an order according to which the employee is sent on a business trip.

A business trip is the sending of an employee to another locality for the purpose of performing production tasks.

The document can be drawn up either in free form or using the unified T-9 form ⇒ Business trip order T-9_form.

The text of the document should indicate:

- name of the organization;

- Full name, position of the employee who is going on a business trip;

- place of business trip (locality);

- business trip period (from ___ to ___);

- purpose of the business trip (monitoring the activities of departments, replacing a temporarily absent employee, negotiations with potential clients, concluding a supply agreement, etc.);

- basis for a business trip (official assignment).

After the order is signed by the manager, the document is handed over to the employee who is going on a business trip for review.

Step #2. Issuing an advance for a business trip

Based on the business trip order, the employee draws up an application for an advance payment for the business trip. The advance payment is calculated based on the travel expense standards established by the local regulations of the enterprise.

The employee signs the application, submits it to the manager for approval, after which the document is sent to the accounting department as a basis for issuing an advance.

According to the Tax Code of the Russian Federation, an advance must be issued to an employee no later than the day before the start of the business trip.

An advance for a business trip can be issued in cash through the cash desk or transferred in non-cash form to the employee’s bank card - depending on the procedure provided for in the organization.

Who can be sent on a business trip

The employer has the right to send on a business trip a person who usually works in the same building or in the same city: an engineer, an accountant, etc. If the employee’s work is initially traveling in nature, a business trip is not issued for him. This applies, for example, to couriers and truck drivers.

An employee who works from home can be sent on a business trip on a general basis. This follows from Article 310 of the Labor Code, which states that homeworkers are subject to labor legislation and other acts containing labor law norms. This means that the provisions on business trips are fully applicable to homeworkers.

Please note: only employees who are on staff are allowed to be sent on a business trip. Specialists hired under a civil contract cannot be seconded.

What expenses are eligible for reimbursement on a business trip?

The list of expenses subject to reimbursement on a business trip is regulated by the provisions of the Tax Code of the Russian Federation. According to paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, travel expenses are included in other expenses associated with production and sales and are subject to reimbursement in the following composition:

| No. | Type of reimbursable travel expenses | Description of expenses |

| 1 | Travel expenses | When sending an employee on a business trip, the employer undertakes to pay travel expenses from the place of work (residence) to the place of business trip. Travel expenses by rail, air, land, and water transport are subject to reimbursement. |

| 2 | Living expenses | While on a business trip, the employee bears the costs associated with renting accommodation. These expenses are subject to reimbursement in accordance with the general procedure. The employer is obliged to compensate the employee for the costs of both renting a hotel room and paying for temporary accommodation services in favor of a private person. |

| 3 | Daily allowance | According to abc. 12 clause 3 art. 217 of the Tax Code of the Russian Federation, the employer pays the employee daily allowance for each day of stay on a business trip (including days en route) in the amount of:

|

| 4 | Registration of a visa, passport, invitation | In cases where an employee goes on a business trip abroad, to a country whose visit requires a visa, the employer compensates the employee for the costs associated with its application. Expenses for obtaining a foreign passport are also subject to reimbursement. |

| 5 | Consular, airport and other fees | Based on paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, the list of reimbursed travel expenses includes expenses for payment of consular fees, as well as other fees related to the right of passage, use of sea canals, etc. |

Duration of business trip

The employer is free to set any duration of the business trip based on the volume, complexity and other nuances of the upcoming trip (clause 4 of the Business Travel Regulations).

However, the maximum duration is not indicated anywhere. Thus, a business trip can last as long as desired, up to several months or years.

The issue of minimum duration has not been fully resolved. Strictly speaking, a business trip can be considered a trip lasting more than one day. A one-day trip does not count as a business trip. This was recognized by the Supreme Arbitration Court of the Russian Federation in Resolution No. 4357/12 dated September 11, 2012 (see “SAC: payments in lieu of daily allowances for one-day business trips are not subject to personal income tax”).

But in practice, companies and entrepreneurs often send employees on day trips, and arrange them in the same way as regular business trips. In other words, they pay daily allowances, reimburse travel costs, etc. We will discuss below how to properly account for such expenses.

Typical entries for travel and daily expenses

| Dt | CT | Wiring Description |

| 71 | 50 (51) | Issuance of funds from the cash register (transfer to a bank card) for travel expenses |

| 20 (26, 44, etc.) | 71 | Reflection of travel expenses in production or sales expenses |

| 71 | 50 (51) | Reimbursement to an employee for overexpenditure on travel expenses from the cash register (account) |

| 50 | 71 | Refund of unspent funds paid for travel expenses |

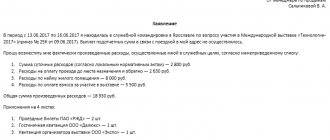

Example

Vasilkov I.I. sent from Moscow to Sukhum from December 10 to 16. The train departs from Moscow on December 10 at 07.44 and arrives in Sukhum on December 12 at 09.47, crossing the Russian border on December 12. Vasilkov I.I. Since December 17, I was on leave at the destination of the business trip and on December 20 I went back. The local regulatory act of the enterprise provides for the following daily allowance: RUB 1,000.00. — for business trips in Russia, RUB 2,500.00. - for business trips abroad.

For the period from December 10 to 11, the employee is paid a daily allowance in the amount of RUB 1,000.00, and starting from December 12 - RUB 2,500.00. for each day the employee is in a foreign country. Travel expenses are included in general business expenses.

The following travel expenses have been documented:

- Road – 15,000.00 rub. Moscow – Sukhum;

- Road – 14,000.00 rub. Sukhum - Moscow;

- For renting housing – 4 days * RUB 1,500.00. = 6,000.00 rub.

- Other travel expenses discussed with the employer – RUB 10,000.00.

Taxable personal income tax expenses:

- Daily allowance – 2*300.00 rub.;

- Road Sukhum - Moscow - 14,000.00 rubles;

- Total personal income tax – 2119.00 rubles.

The accountant generated the following entries for travel expenses:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| 09.12.2016 | 71 | 50 | 60 000,00 | Advance payment for travel expenses | KO-2 |

| 20.12.2016 | 26 | 71 | 15 000,00 | Road Moscow-Sukhum | Advance report |

| 20.12.2016 | 26 | 71 | 6 000,00 | Housing | |

| 20.12.2016 | 26 | 71 | 14 600,00 | Daily allowance | |

| 20.12.2016 | 26 | 71 | 10 000,00 | other expenses | |

| 20.12.2016 | 26 | 71 | 14 000,00 | Road Sukhum - Moscow | |

| 20.12.2016 | 50 | 71 | 400,00 | Return of unspent funds | KO-1 |

| 31.12.2016 | 70 | 68 | 2 119,00 | Personal income tax withheld from travel expenses |

First and last day of the trip

The first day of a business trip is the date of departure of a train, plane, bus or other vehicle. The last day of a business trip is the date of arrival of the corresponding vehicle at the locality where the place of permanent work is located.

When the vehicle departs (or arrives) before 24 hours inclusive, the day of departure (or arrival) is considered the current day, and from 00 hours onwards - the next day. If a station, pier or airport is located outside a populated area, the time required to travel to (or from) the station, pier or airport is taken into account.

What documents to submit when traveling on a business trip

First of all, it is necessary to draw up an order or instruction from the manager about sending him on a business trip.

Previously, when sending employees on business trips, employers were required to approve job assignments and issue travel permits. However, now there is no need to do this. From this date, the actual length of stay of the employee at the place of business trip is determined by travel tickets presented upon return from the business trip. If the employee is sent on a business trip by personal transport, then the actual length of stay at the place of business trip the employee must indicate in the memo.

Note that for organizations that regularly send employees on business trips, it is better to prepare a local regulatory act, for example, a regulation on business trips. It should contain all the details: the amount of daily allowance, the amount of compensation for business trip expenses, etc. Such a document can become one of the decisive arguments in favor of the taxpayer during audits or in court.

Compose HR documents using ready-made templates for free

What is included in travel expenses?

As a rule, a business trip is an initiative of the employer and therefore must be fully provided for by him.

The manager is obliged to retain his subordinate’s workplace and compensate for all incurred costs associated with travel and work in another city.

The director's responsibilities include:

- pay wages (the amount is calculated for all subsequent days of stay and work outside the company’s territory, including time spent on travel);

- pay for accommodation, meals and other additional services for the entire period of stay in another city;

- pay daily allowances (the employee’s income is recalculated taking into account the increase in pay);

- compensate for other costs associated with work processes (travel, translation services, restaurant services, etc.).

Important! Payment of travel expenses does not include payment for housing and an increase in daily earnings in the event that the employee can return to his home at the end of his work.

How to fill out a time sheet

In the working time sheet (unified forms No. T-12 and T-13), working days that fell during a business trip are indicated by the code “K” or its digital equivalent “06”. The number of hours worked is not entered.

If during a business trip the employee worked on his day off or on a holiday, the report card is marked with the code “РВ” or its equivalent “03”. In the column reserved for the number of hours worked, the value previously agreed upon with the employer is indicated. If there was no agreement to work on a day off, the employer has the right not to indicate the number of hours in the timesheet and, as a result, not to pay for this time. This is stated in the letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291.

A situation is possible when on a day off the employee was on the road, that is, either going to the place of business trip or returning back. It is not entirely clear whether this time should be counted as worked. In our opinion, a road that falls on Saturday, Sunday or a holiday is nothing more than work. Therefore, in the work time sheet you should enter “РВ” (or “03”) and the number of hours actually spent on the road.

Keep timesheets for free in an accounting web service

Salary during a business trip

The business trip period is paid not in the same way as regular work, but according to average earnings (Article 167 of the Labor Code of the Russian Federation). Whatever the work schedule, average earnings are calculated based on the actual accrued wages and actual time worked for the 12 calendar months preceding the month when the business trip began.

Example

The employee was on a business trip from June 21 to June 25, 2021 (five working days).

All payments received by the employee for the period from June 2021 to May 2021 inclusive (12 months) are shown in table 1. Table 1

Payments to the employee for the period from June 2021 to May 2021

Month of billing period Type of payment Amount (rub.) June 2020 salary 30 000 July 2020 salary 30 000 August 2020 salary 30 000 September 2020 salary 30 000 October 2020 salary 30 000 November 2020 salary 30 000 December 2020 salary 5 714 sick leave 19 000 January 2021 salary 40 000 February 2021 salary 40 000 March 2021 salary 40 000 April 2021 salary 40 000 May 2021 salary 40 000 Total: 404 714 To calculate the average earnings, the accountant found out that out of the 12 months preceding the business trip, the employee worked only 11 fully, and from December 3 to December 25, 2021 (17 working days) was on sick leave. Sickness time must be excluded from the calculation period, and temporary disability benefits will not be included in the calculation. As a result, the average earnings were 385,714 rubles (404,714 - 19,000).

The accountant then calculated the number of working days in the billing period. It was 249 days. The number of working days taken into account when calculating average earnings is 232 (249 - 17). The average daily earnings is 1,662.56 rubles (385,714 rubles: 232 days). Salary during a business trip - 8,312.8 rubles. (RUB 1,662.56 x 5 days).

Note that some companies pay for business trips not according to average, but according to actual earnings. This option, although not entirely correct, is acceptable. The main thing is that the actual earnings during the business trip are not less than the average earnings, because otherwise the employee’s rights will be violated. To prevent this from happening, it is better to compare two salary values for each business trip: the first - based on average earnings, the second - based on actual earnings. And if the first value is not greater than the second, you can pay for the business trip based on the salary.

If a person worked on a business trip on his day off, and this is reflected in the timesheet, then such work must be paid double. There is an alternative option: at the employee’s request, provide payment in a single amount and give additional days off (Article 153 of the Labor Code of the Russian Federation).

How are travel allowances calculated?

The employer is obliged to pay the employee's travel expenses in full, subject to the provision of supporting documents. These can be tickets, checks, receipts for the use of any type of transport (river, sea, air, land), except for taxis for budgetary institutions. Tickets for the use of taxi services as travel expenses can only be accepted if other modes of transport are not available. The question is relevant for small settlements.

A list of restrictions has been established for federal public sector employees; it is presented in paragraph 2 of Resolution No. 916.

The situation is similar with living expenses (renting residential premises). Payment is made for actually incurred and confirmed expenses. In order to save money, the institution may set a limit on the cost of accommodation per 1 day. As, for example, it is established for federal civil servants - no more than 550 rubles. The law allows payment of excess costs by saving money on this expense item, but an order from the manager is required.

When calculating daily allowances for business trips in 2021, no maximum or minimum limit has been established, that is, the payment for one day on a business trip can be either 5 rubles or 10,000 rubles. Article 217 of the Tax Code of the Russian Federation establishes the maximum values for payments that are not subject to taxation: in Russia - 700 rubles per day and 2,500 rubles when traveling abroad. If the daily allowance in an organization exceeds the approved norms, then insurance premiums should be charged on the difference and personal income tax should be withheld.

For federal government employees, a daily allowance limit is set at 100 rubles per day.

Determine the average earnings for calculating travel allowances according to the rules:

- To calculate the average salary, take into account accrual data for the previous 12 calendar months. If the employee has not yet worked for one year, then make calculations for the period actually worked (Article 139 of the Labor Code of the Russian Federation).

- Exclude from the total number of days periods spent on sick leave, maternity leave or child care. Details about which periods to exclude are given in paragraph 5 of Resolution No. 922.

- From your total earnings, exclude accruals for sick leave, benefits, and parental leave. Accruals for a previous business trip should be included in the calculation.

We divide the resulting amount of total earnings by the days actually worked to obtain the average daily wage. Now we multiply the resulting figure by the number of days spent on a business trip.

IMPORTANT!

When calculating vacation pay, be sure to take into account the payment of average earnings for a business trip, since the employee worked (performed a job assignment). If we exclude travel payments from the calculation, the vacation pay will be less than if the employee did not travel anywhere. The posted employee retains his place of work (position), as well as his average earnings for the period of his stay on the trip, as stated in Article 167 of the Labor Code of the Russian Federation.

Reimbursement of travel expenses and daily allowances

The employer is obliged not only to pay the employee a salary during the business trip, but also to reimburse travel expenses. They are listed in Article 168 of the Labor Code of the Russian Federation. These are daily allowances, travel costs, rent for living quarters and other costs agreed with the employer. Let's look at each type of expense separately.

Daily allowance

The employee is entitled to daily allowance for each day he is on a business trip, including weekends and holidays, as well as for days on the road (clause 11 of the Business Travel Regulations).

Each employer is free to set the amount of daily allowance that it considers necessary. At the same time, it is not forbidden to approve different daily allowance amounts for different categories of workers. For example, a manager's per diem may be higher than an engineer's per diem. An employee returning from a business trip is not required to report on what he spent his daily allowance on. Simply put, the employee does not need to provide primary documents and an advance report on daily allowance to the accounting department.

In tax accounting, daily allowances are written off as expenses without limitation. Daily allowances are exempt from personal income tax within the limit: for business trips within the country - in the amount of 700 rubles. for each day, for business trips abroad - in the amount of 2,500 rubles. for every day. If the company has established a daily allowance in excess of these amounts, then you must pay personal income tax on the excess. In the income certificate, the amount of excess daily allowance should be reflected as “other income”.

For business trips lasting one day (so-called “one-day business trips”), strictly speaking, daily allowances are not required. Despite this, most companies pay them. The Ministry of Finance of Russia, in letter dated May 17, 2018 No. 03-15-06/33309, proposed the following option for their accounting. If the employee has provided supporting documents, then the daily allowance should be regarded as reimbursement for other expenses associated with the business trip. Then they are fully exempt from personal income tax. If there are no documents, then you need to apply the limit, as in the case of longer business trips (see “The Ministry of Finance explained in which case expenses associated with a one-day business trip are fully exempt from personal income tax”).

In arbitration practice, there are examples when judges confirmed: daily allowances for a “one-day business trip” are exempt from contributions to the Pension Fund (Resolution of the FAS of the Volga District dated January 22, 2013 No. A65-27465/2011) and are included in expenses (Resolution of the FAS of the North-Western District of July 30 .12 No. A56-48850/2011).

Fare payment

The cost of travel to the place of business trip and back can be included in expenses on the basis of subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. In this case, the “input” VAT can be deducted (clause 7 of Article 171 of the Tax Code of the Russian Federation).

When reimbursing a business trip employee for travel expenses, there is no need to withhold personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation) and pay insurance premiums (clause 2 of Article 422 of the Tax Code of the Russian Federation).

However, the above norms can only be applied if travel costs are confirmed by primary documents (it is acceptable to accept a “primary document” issued in electronic form; letter of the Ministry of Finance dated 08.08.19 No. 03-03-06/1/59877). In practice, accountants constantly have questions about whether this or that document can be accepted as confirmation.

If the employee traveled by regular transport, he will have to provide a travel ticket. It is not necessary that the ticket be in the prescribed form. The main thing is that it contains the details, signature and seal of the carrier, as well as the name of the points of departure and arrival, the price (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated August 22, 2012 No. F03-3467/2012).

If we are talking about a taxi, then the supporting documents will be an order for the provision of a vehicle for transporting passengers and luggage, as well as a receipt for payment for passenger taxi services. The Ministry of Finance of Russia recalled this in letter No. 03-11-04/2/80 dated June 27, 2012 (see “The Ministry of Finance explained what documents can be used to confirm the costs of an employee’s travel by taxi to the place of business trip and back”).

In the case of air travel, you will need two primary documents: a ticket on which its cost is indicated, and a boarding pass. If the air ticket is electronic, then the supporting document is the itinerary receipt containing the required details: fare, total cost of transportation, form of payment, etc. If you lose your boarding pass, you must obtain a certificate from the air carrier. This opinion was expressed by the Russian Ministry of Finance in letter No. 03-03-07/33 dated September 21, 2011 (see “In case of loss of a boarding pass, the fact of a business trip can be confirmed by a certificate from the air carrier”).

Input VAT on an air flight can be deducted only if the tax amount is indicated on the ticket or on the itinerary receipt. The Ministry of Finance pointed this out in letter No. 03-07-11/01 dated January 10, 2013 (see “The Ministry of Finance recalled the procedure for deducting VAT on air tickets for business travelers”). The same rule applies if the employee used an electronic ticket (letter of the Ministry of Finance dated May 28, 2018 No. 03-07-07/36077; see “How to deduct VAT on electronic train and plane tickets”).

Payment for housing

The cost of travel to the place of business trip and back can be included in expenses on the basis of subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. In this case, the “input” VAT can be deducted (clause 7 of Article 171 of the Tax Code of the Russian Federation).

When reimbursing a business trip employee for travel expenses, there is no need to withhold personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation) and pay insurance premiums (clause 2 of Article 422 of the Tax Code of the Russian Federation).

However, the above standards can only be applied in a situation where housing costs are confirmed by primary documents (it is acceptable to accept a “primary document” issued in electronic form; letter of the Ministry of Finance dated 08.08.19 No. 03-03-06/1/59877). Namely, a strict reporting form independently developed by the hotel. It must contain the details that are listed in paragraph 3 of the regulations approved by Decree of the Government of the Russian Federation dated 05/06/08 No. 359**. In addition, the form must highlight the amount of VAT.

In practice, tax authorities often make claims when a hotel document contains a non-existent or “foreign” TIN. But arbitration practice on this issue is positive for taxpayers (see, for example, decisions of the FAS of the North-Western District dated November 15, 2012 No. A52-1635/2012, FAS of the Ural District dated 08/08/12 No. F09-6736/12).

If a posted worker paid for housing using a card, he must attach “paper” documents confirming the fact of payment to the advance report. Such documents include, in particular, the slip and receipt of the electronic terminal (letter of the Ministry of Finance of Russia dated October 6, 2017 No. 03-03-06/1/65253).

If the employee lost the supporting document or did not receive it at all because he lived in the private sector, then the expenses cannot be reflected in tax accounting, just as VAT cannot be deducted. Personal income tax from the amount of compensation must be withheld from an amount exceeding 700 rubles. for each day during a business trip within the country, and from an amount exceeding 2,500 rubles. for each day of a business trip abroad. Insurance premiums must be charged on the entire amount of unconfirmed housing expenses. This was reported by specialists from the Ministry of Health and Social Development of Russia dated November 11, 2010 No. 3416-19, the conclusion was confirmed by the judges (resolution of the Administrative Court of the North Caucasus District dated November 20, 2017 No. A32-1706/2017).

Fill out and submit 6‑NDFL and 2‑NDFL for free via the Internet

Payment for food

Tax officials believe that meals during a business trip should be paid for through daily allowances. Therefore, if the employer reimburses the cost of food separately, such expenses cannot be taken into account when taxing profits, and insurance premiums and personal income tax must be paid on them.

Even if the company does not pay daily allowances at all, but only reimburses food expenses, such expenses do not reduce profits and are included in the base for contributions and personal income tax. The fact is that the cost of food is not mentioned among travel expenses either in the Labor Code or in the Regulations on Business Travel.

Arbitration practice on this issue is contradictory. There are cases won by companies (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated 07.11.12 No. A40-112186/11-20-455). But there are also cases won by inspectors (see, for example, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 20, 2012 No. F03-912/2012).

In our opinion, it is safer to prevent a conflict and not reflect the cost of food in tax accounting, and it is better to pay contributions and personal income tax.

Taxation of personal income tax

Another important criterion that is taken into account when entering allowable expenses from a company is personal income tax and insurance premiums. They can either increase overall consumption or significantly reduce it.

So, according to Art. 217 of the Tax Code of the Russian Federation, Article 20 of Federal Law No. 125 and Article 9 of Federal Law No. 212, payment of the following travel expenses is not taxed:

- purchasing tickets for travel to and from a designated destination;

- payment for airport services and other fees;

- payment for taxi services throughout the business trip;

- funds spent on luggage transportation;

- payment of funds for renting a hotel room or other type of housing;

- payment for replenishment of a mobile account or other method of communication;

- means for registration and obtaining a passport and visa;

- payment for services for exchanging currency or a check at a bank branch.

This list is complete. All other types of services, such as payment for parking or dinner, must be paid taking into account the costs of personal income tax and other contributions.

Attention! Exemption from taxes is possible only if the funds spent have documentary evidence. In the absence of checks and receipts, the employer is obliged to pay personal income tax for the entire amount.

As for housing, if there are no documents, the employer must pay the insurance in full, and personal income tax in the amount of 700 rubles. (in the country), 2500 rub. (when traveling abroad).

There are often situations during which a detailed study of the provided checks for accommodation and housing is carried out, as a result of which it turns out that they are still subject to taxation by the state.