How to prepare documents for vacation pay

1. Vacation schedule.

It is drawn up at least two weeks before the start of the calendar year, based on the wishes of employees, legal requirements and the interests of the employer. Both the employer (organization or individual entrepreneur) and employees are required to comply with the schedule (Article 123 of the Labor Code of the Russian Federation. There is a unified form No. T-7. It, among other things, contains columns 8 and 9. They must be filled out if the originally planned vacation was subsequently transferred. Keep personnel records for free in the web service

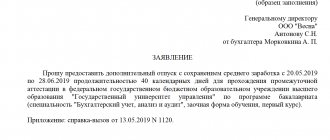

2. Employee statement. It is written when you need to go on vacation outside of your schedule. If the schedule is followed, then you can do without an application.

The employee must submit an application in advance so that the accounting department has time to calculate and pay vacation pay no later than three days before the start of the vacation.

Application example

General Director of LLC "ChOP "CheKa"

Mr. Dubinin I.O.

from security guard A.A. Simonov

Please provide me with annual paid leave for a period of 14 calendar days from November 1, 2021 to November 14, 2021.

October 29, 2021

______________/Simonov A.A./

3. Notification of the start of vacation. It is necessary if a person will rest according to a schedule. At least two weeks before the start of the vacation, personnel officers must notify the employee about this against signature (see “Rostrud reported whether it is necessary to notify employees about vacations that coincide with the schedule”). If the basis is not a schedule, but a statement, it is not necessary to notify the employee.

4. Order (instruction). It is needed both in case of going on scheduled leave and in case of filing an application. There are unified forms: No. T-6 (for one employee) and No. T-6a (for several employees).

Compose HR documents using ready-made templates for free

5. Note-calculation. Form No. T-60 is usually used. The first side contains the start, end, and rest dates. On the second side there are payment details.

6. Personal card. In the form No. T-2 there is a section VIII intended for information about leave.

7. Time sheet. The corresponding days should be indicated by a letter or numeric code (for annual basic paid leave these are “FROM” and “09”

Keep timesheets for free in an accounting web service

ATTENTION. Previously, organizations and entrepreneurs were required to use unified forms of personnel documents, in particular, forms No. T-2, T-6, T-6a, T-7, T-12, T-13 and T-60 (approved by resolution of the State Statistics Committee dated 01/05/04 No. 1). But now employers can do this voluntarily, or develop their own forms (information from the Ministry of Finance dated 12/04/12 No. PZ-10/2012).

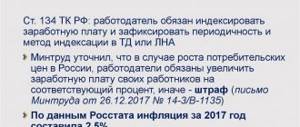

Legal basis for calculating vacation pay

The Labor Code of the Russian Federation is the main legislative document regulating the procedure, rights and responsibilities for the accrual and payment of vacation pay. If disagreements or conflicts arise between the parties, you can safely turn to Chapter 19 with the title “Vacations”.

Attention should be paid to the release of the Code, since legislation is constantly undergoing changes and amendments are made annually. If the relevance of the data is lost, the employee may look ridiculous during the dispute.

In addition to basic paid rest, an employee has the right to unpaid leave of no more than 14 days. The legal framework also regulates the period, its extension or postponement at the request of the employee or the initiative of the employer.

Increasingly, in the practice of vacations, there is a place for dividing it into parts; employers prefer to give their employees rest twice a year for two weeks. This option is legal and the basis for execution is Article 125 of the Labor Code of the Russian Federation.

All employees have the right to take cash equivalent, with the exception of those working in harmful and dangerous conditions and minor children. Among other things, the legal framework stipulates the right for a pregnant woman to receive annual leave before or after going on maternity leave.

Also, the letter of the Ministry of Health and Social Development dated December 7, 2005 No. 4334-17 determines the procedure for rounding the received figures (only up).

Separate documents include local legal acts of organizations: provisions on wages, vacations, bonuses and other material incentives for company employees, rules on regular and additional days of rest.

In addition to the Labor Code of the Russian Federation, working conditions and relationships in labor activities are regulated by federal laws:

- about employment of the population;

- about trade unions, their rights and guarantees;

- on the minimum wage;

- on state guarantees to persons working in the regions of the far north and other areas equivalent to them.

Calculation of vacation pay in 2021 (in calendar days)

The amount is calculated using the formula:

Amount of vacation pay = average daily earnings × number of calendar days of vacation

Calculation of average daily earnings

It depends on whether the billing period has been fully worked out or not, that is, 12 calendar months preceding the month the vacation begins.

If the billing period has been fully worked out, the formula given in Article 139 of the Labor Code of the Russian Federation is applied:

Average daily earnings = earnings for the billing period / 12 / average monthly number of calendar days (it is equal to 29.3)

If the billing period has not been fully worked out, or there were excluded days (sick leave, vacation, etc.), another formula is applied. It is given in paragraph 10 of the Regulations on the specifics of the procedure for calculating the average salary (approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922; hereinafter referred to as the Regulations):

Average daily earnings = payments that are included in the calculation of average earnings / (average monthly number of calendar days × number of fully worked months + number of calendar days worked in partial months)

Wherein:

Number of calendar days worked in an incomplete month = average monthly number of calendar days / total number of calendar days in a given month × number of calendar days in a given month attributable to hours worked

Calculate your salary and vacation pay for free in the web service

IMPORTANT. It happens that in the billing period there was not a single day actually worked, or actually accrued wages. Then the average earnings must be considered for the previous period of time equal to the billing period (clause 6 of the Regulations). And if there were no salaries and days worked even in the previous period, the actual earnings for the month in which the vacation began are taken into account. In the absence of such earnings, calculations are made based on the salary (clause 7 and clause 8 of the Regulations).

Accrual of vacation in 2021 (example)

Let's look at how vacation is paid according to the Labor Code of the Russian Federation (2018), using an example.

The employee was granted regular annual paid non-working days from 08/19/2018 for 14 days. The billing period is from 08/01/2017 to 07/31/2018. During this time the following were accrued:

- salary - 550,000 rubles;

- vacation pay in the amount of 42,000 rubles;

- sick leave payment - 19,452 rubles.

In the calculation period, 14 days of rest (September 2017) and 7 days of sick leave (February 2021) were used.

Determine the billing period:

- fully worked 10 months, or 293 days. (10 × 29.3);

- days worked for February 2021: 29.3 / 28 × (28 calendar days - 7 sick days) = 21.98 days;

- days for September 2021: 29.3 / 30 × (30 calendar days - 14 sick days) = 15.63 days.

A total of 330.61 days worked (293 + 21.98 + 15.63).

The base for calculating the payment is 550,000 rubles, since the amounts of vacation pay and sick leave are not included. As a result, the average daily earnings will be

550,000 rub. / 330.61 days = 1663.60 rub.

Vacation payment is made in the amount of RUB 23,290.34. (RUB 1,663.60 × 14 days).

IMPORTANT!

Payment for vacation under the Labor Code (Article 120) is not made for the holidays listed in Art. 112 Labor Code of the Russian Federation. But if during your vacation there is a non-working day due to the postponement of holidays, it must be paid.

Calculation examples

The billing period has been fully worked out

The employee goes on another paid vacation for 14 calendar days. Earnings for the billing period are 780,000 rubles. The accountant calculated that the average daily earnings are 2,218.43 rubles. (RUB 780,000 / 12 months / 29.3). This means that the amount of vacation pay is 31,058.02 rubles. (RUB 2,218.43 × 14 days).

The billing period has not been fully worked out

The employee goes on vacation from July 8, 2021 for 14 calendar days. His salary is 20,000 rubles.

The billing period is from July 1, 2021 to June 30, 2021.

In April 2021, the employee took sick leave for 10 days (from April 1 to April 10). Therefore, for April 2021, he received a salary in the total amount of 13,000 rubles.

Step 1. Determine the payments that are included in the calculation. 20,000 rub. × 11 months = 220,000 rub. (total amount of payments for fully worked 11 months, excluding April).

For April 2021, the employee was paid 13,000 rubles. Therefore, the amount used for calculation is 233,000 rubles (220,000 + 13,000).

Step 2. Determine the number of calendar days worked in April 2021 (not a fully worked month).

There are a total of 30 calendar days in April, and days worked (from the 11th, when the employee returned to work after illness) account for 20 calendar days (30 - 10).

Total in April 2021, 19.5333 days were worked (29.3 / 30 × 20)

Step 3. Determine the average daily earnings. It will be 681.6187 rubles. (RUB 233,000: (29.3 × 11 months + 19.5333 days)).

Step 4. Determine the amount of vacation pay.

Their value is 9,542.66 rubles. (RUB 681.6187 × 14 days).

There are no days worked in the billing period

The specialist will go on vacation from November 12, 2021. The billing period is from November 1, 2021 to October 31, 2021. At this time, the employee was on leave without pay.

The accountant determined the average earnings for the previous period, that is, for the period of time from November 1, 2021 to October 31, 2020. It amounted to 150,000 rubles. Based on this figure, the accountant calculated the amount of vacation pay.

Bonus in calculation of holiday pay

The employee will go on leave effective November 8, 2021. The estimated period is from November 1, 2021 to October 31, 2021. This time has been fully worked out.

In January 2021, the employee received a bonus for 2021 in the amount of 40,000 rubles.

Should this amount be included in the earnings accrued in the pay period and taken into account when calculating vacation pay?

Yes need. The letter of the Ministry of Health and Social Development dated 03/05/08 No. 535-17 states that in order to take into account the annual remuneration, two conditions must be met:

- the billing period has been fully worked out;

- the duration of the period for which the premium is paid does not exceed the duration of the billing period.

Once both conditions are met, 40,000 rubles. must be added to the payments that are included in earnings when paying for rest days.

Calculate “complex” salaries with coefficients and bonuses for a large number of employees

REFERENCE. If these conditions are not met, the premium is still taken into account. But not in full, but in proportion to the time worked in the billing period.

For other examples of accounting for bonuses, see the article: “Calculating vacation pay: how to take into account monthly, quarterly and annual bonuses.”

Calculation of vacation pay for salary increases

The employee's vacation begins on November 18, 2021. The billing period is from November 1, 2021 to October 31, 2021.

From November to December 2021 (2 months), the employee received a monthly salary of 40,000 rubles. Since January 2021, the organization has increased salaries for all staff. In January - October 2021 (10 months), the employee received 45,000 rubles. per month.

The accountant found the increase factor. It is equal to 1.125(45,000 / 40,000).

Earnings for the billing period amounted to 540,000 rubles ((40,000 rubles × 1,125 × 2 months) + (45,000 rubles × 10 months)).

For other examples of calculations for salary increases, see the article: “Accrual of vacation pay: calculation for salary increases and tax accounting for “rolling” vacation.”

Calculate your salary and vacation pay for free, taking into account all current indicators for today

How is vacation compensation calculated upon dismissal?

Those employees who lose their jobs due to the fact that they have violated in any way labor discipline or other procedures and rules established by the organization’s charter or the letter of the law in force in our country are not entitled to apply for leave followed by dismissal.

If a citizen resigns peacefully, that is, not under the article, but simply, for example, by expressing such a desire, or by agreement concluded with the employer, then the employer has the right to grant him such leave, although by law he does not do this in general. then you don’t have to.

If a manager violates the regulations on vacation pay, he will be punished financially by the state

In this case, the time period will be provided to the employee for the entire current year, and not just those working months that were worked in it. However, the amount of payments simultaneously due in connection with paid leave will be determined based on the time actually worked.

So, if the employer does not have such an opportunity or desire to provide a citizen with vacation before he ceases to be a member of the organization, he can simply pay him money for all vacation days that were not used.

Compensation will be calculated using the following formula: S:29.4:12*K.

Table 4. Explanation of the components of the formula used to determine the amount of compensation for unused vacation of a resigning employee

| Designation | Description |

| S | S – employee’s income for the last calendar year |

| TO | K – number of vacation days (usually 28 days) |

| 12 | 12 – number of months in a year |

| 29, 4 | Average monthly number of calendar days |

Example No. 1

Let’s imagine that employee Ivan Ivanov, at the time the decision to quit was made, had worked for the organization for 11 months from start to finish. During all this time in the company, he received 300 thousand rubles. Let's substitute the values into our formula: (300,000:29.4):12*28=23 thousand 809 rubles. It turns out that Ivanov, upon leaving the organization, will receive 23 thousand 809 rubles as compensation for missed vacation.

The calculation of vacation pay for employees who have worked for more than a year and those who have worked for less than a year is slightly different.

Example No. 2

Another employee of the Alpha organization, Petrov Petrov, worked there for only six months and 10 days in addition, while for the required time period he received 200 thousand rubles. In this case, the formula used will remain the same, only K, in this case it will be calculated as 2.33 * per N (previously we provided the formula for calculating this indicator), where the desired value (N) will be the number of months fully worked by the employee.

The result will be the following: (200,000:29.4)/12*14=7924. It turns out that upon dismissal Petrov will also receive monetary compensation from the employing organization, but its amount will be 7 thousand 942 rubles.

Example No. 3

The easiest way to carry out calculations is, of course, in cases where the period for which the calculation will be made has been fully worked by the employee. So let’s imagine that an employee of the Alpha organization, Semyon Semenov, was going to go on vacation for the 28 days allotted to him by law. Throughout last year, he received 30 thousand rubles every month. In this situation, we will simply need to substitute the values into the formula: 30,000: 29.4 x 28 = 28,571.43. It turns out that Semenov will receive 28 thousand 571 rubles 43 kopecks as vacation pay.

You can calculate your vacation pay yourself

Example No. 4

If the period was not fully worked out by the citizen, the calculations will become somewhat more complicated. So, let’s imagine that Alpha employee Grigory Grigoriev is going on vacation for 14 days. The amount of his salary received monthly will be 20 thousand rubles. At the same time, for two weeks during a certain billing period, Grigoriev was on sick leave, and this month his payments amounted to:

- 10 thousand rubles salary;

- 4 thousand 751 rubles as benefits.

In this situation, the amount of his salary will need to be multiplied not by 12 months, but by 11, in addition, the required 10 thousand rubles in payments will also be added to the formula. It turns out 230 thousand rubles. Now you need to determine the calendar days worked for the required amount of time:: 29.4 days * 11 months + 29.4 days: 30 days * 15 days = 338.1.

Now we calculate Grigoriev’s average salary for the required days: 230,000: 338, 1 = 680 rubles, 27 kopecks. This amount must be multiplied by 14 (the number of vacation days), and it turns out that Grigoriev, having gone on vacation, will receive a payment equal to 9 thousand 523 rubles 78 kopecks.

Calculator for calculating leave compensation upon dismissal

Go to calculations

Calculation of vacation pay in 2021 (in working days)

The amount is calculated using the formula:

Amount of vacation pay = average daily earnings × number of working days of vacation

The average daily earnings is equal to (clause 11 of the Regulations):

Average daily earnings = actual accrued wages / number of working days according to the calendar of a 6-day working week

REFERENCE. Vacation in working days is granted to seasonal workers (Article 295 of the Labor Code of the Russian Federation) and to those who have signed an employment contract for a period of up to two months (Article 291 of the Labor Code of the Russian Federation). In this formula, the actually accrued salary means the amount accrued from the first day of seasonal work (or a short-term contract) until the start of the vacation (read more about this in the article “Vacation for a fixed-term employment contract: when to provide it and how to pay”).

Vacation and vacation pay for part-time working weeks

Part-time work does not entail any restrictions on the labor rights of employees, including a reduction in the duration of their annual basic leave. This is confirmed in the letter of the Ministry of Social Policy No. 195/13/1334 dated July 15, 2011.

Providing additional annual leave in accordance with Art. 7 and 8 of the Law on Leave for Part-Time Work has the following features:

01 - in calculating the time that entitles an employee to additional leave, days are counted when he was actually employed in work with harmful and difficult working conditions for at least half of the working day established for employees of these industries, workshops, professions and positions (clause

Calculation of vacation pay upon dismissal

Upon dismissal, the employer pays compensation for unused vacation if the employee did not have time to take off the allotted days. Compensation is calculated using the following formulas.

If vacation is counted in calendar days:

Amount of compensation = average daily earnings × number of calendar days of unused vacation

If vacation is counted in working days:

Amount of compensation = average daily earnings × number of working days of unused vacation

Average daily earnings must be determined in the same way as for calculating regular vacation pay.

How to calculate vacation pay for an incomplete year worked

Vacation is a certain period of time when an employee may not work, while maintaining his place in the organization, salary and position. Vacation is granted for a period of 28 to 45 days (it all depends on the position held and place of work).

In this case, the employer has the right to ask his employee to “split” the available vacation into several parts. Calculating vacation pay is a rather complex and time-consuming process, since various factors are taken into account:

- The length of time a citizen works in this position.

- His salary and salary indexation for the past period.

- Requirements of internal corporate documents.

Vacation pay for less than a full year is calculated according to the same system.

If an employee decides not to use his allotted vacation this year, he has the right to contact the employer with a request to issue him vacation pay.

In this case, the accountant must calculate the person’s average daily income, and also take into account periods when the citizen did not work. The formula for calculating vacation pay for an incomplete year worked will be as follows: the number of months when a citizen worked fully should be multiplied by the figure “29.3”. If a citizen has not fully worked the specified period, then the coefficient must be divided by the sum of calendar days in the month, and then multiplied by the sum of those months that have been fully worked.

Judging by the available statements, he officially received 50,000 rubles monthly without indexation. In July 2021, he decided to go on vacation.

(50,000 rubles × 6 months) / 29.3 = 10,238 rubles. This is exactly the amount that citizen Ivanov will receive.

Do not forget that the amount of vacation pay will be significantly reduced if the employee is absent from the workplace for some time. For example, if he went on a business trip for several days.

Why is the monthly average number of calendar days always equal to 29.3

This figure represents the number of calendar days in a year, reduced by the number of non-working holidays and divided by 12 months.

According to Article 112 of the Labor Code of the Russian Federation, 14 non-working holidays are officially established in Russia: January 1, 2, 3, 4, 5, 6 and 8 (New Year holidays), January 7 (Christmas Day), February 23 (Defender of the Fatherland Day), 8 March (International Women's Day), May 1 (Spring and Labor Day), May 9 (Victory Day), June 12 (Russia Day) and November 4 (National Unity Day).

Thus, to find the average monthly number of calendar days, you need to subtract 14 days from 365 (or 366) days, and divide the resulting result by 12 months. After rounding, the final value is 29.3.

Determination of earnings for the billing period

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

All payments accrued to the employee, which are provided for by the employer’s payment system, are taken into account, regardless of the sources of these payments (Article 139 of the Labor Code of the Russian Federation). In paragraph 2 of the Regulations, approved. By Decree of the Government of the Russian Federation of December 24, 2007 No. 922, there is an open list of such payments.

The following cannot be included in the calculation of average earnings:

- All payments accrued to the employee for the time excluded from the payroll period. They are listed in clause 5 of the Regulations. For example, average earnings for days of business trips and in other similar cases, social benefits, payments for downtime;

- All social benefits and other payments not related to wages. For example, financial assistance, payment of the cost of food, travel, training, utilities, recreation, gifts for children (clause 3 of the Regulations);

- Bonuses and remunerations not provided for by the remuneration system (clause “n”, clause 2 of the Regulations).

Bonuses (other remunerations) provided for by the remuneration system are taken into account taking into account certain features established by clause 15 of the Regulations.

Deadlines for payment of vacation pay

According to Article 136 of the Labor Code of the Russian Federation, payment for vacation is made no later than three days before its start. The countdown is carried out in calendar days (Article of the Labor Code of the Russian Federation). So, if the start of the vacation falls on Monday, the money must be paid no later than Thursday of the previous week (letter of the Ministry of Labor dated 09/05/18 No. 14-1/OOG-7157; see “Vacation starts on Monday: when should vacation pay be paid?”).

ATTENTION. The law does not establish the earliest date when an employer is required to pay vacation pay. This means that a company or individual entrepreneur can issue money four, five or more days before the start of the vacation, and this will not be a violation.

Compensation for unused vacation must be issued on the day of dismissal, or no later than the next day after the request for payment is submitted (Article 140 of the Labor Code of the Russian Federation).

Personal income tax and insurance contributions from vacation pay

The accountant needs to charge personal income tax on the entire amount of vacation pay and withhold it when paying the money to the employee. The tax must be transferred to the budget no later than the last day of the month in which the employee received the money (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Vacation pay is subject to contributions: pension, medical, social insurance in case of temporary disability and in connection with maternity, as well as contributions to the Social Insurance Fund “for injuries”.

ATTENTION. It often happens that the start of vacation and the accrual of vacation pay occur in different months. For example, the vacation begins on December 1, 2021, and vacation pay is calculated and issued on November 26, 2021. When should contributions be calculated? In the month of accrual of vacation pay. In our example - in November.

Calculate your salary, contributions and personal income tax for free in the web service

Components

The accrual of vacation pay confronts the accountant with the problem of calculating the amount of money earned to determine the average daily earnings. There are several fundamental nuances here, because the average salary does not include all payments from the employer. The most troubling moment for employees is the question: is the bonus included? This is due to the piecework-bonus wage system in many enterprises. So what is included in vacation pay and what is not?

Watch a video about calculating vacation pay

What is included in vacation pay

To calculate the average daily earnings, which is the basis for calculating vacation payments, you need to add up all the amounts received by the employee during the billing period, usually the year, from which income tax was withheld and divide by the coefficient of the average number of calendar days per year.

When calculating average income, payments are taken into account:

- the basic salary, which is calculated according to salary, according to the tariff schedule, according to piecework and bonus wages;

- commission payments, percentages of sales included in employee salaries;

- wages paid in a form other than cash or money transferred to an electronic salary card;

- remunerations transferred to officials of government agencies, deputies, members of the election commission, and municipal employees;

- fees for artists, journalists, writers;

- royalties;

- salaries of teachers and teachers, additional payments for exceeding hours beyond the curriculum, additional payments for classroom management;

- bonuses for working with highly classified documents and information;

- additional payments for managing a site, team, etc.;

- payments for night time, work on weekends, if they are a mandatory schedule of the enterprise;

- territorial coefficients of wage premiums (“northern”);

- additional payments for harmful and dangerous working conditions;

- bonuses included in the remuneration system;

- other payments included by the employer in the enterprise’s payment system.

What is excluded?

By law, previous vacation pay is not included in the calculation of vacation pay, even if it falls within the pay period.

The full list of excluded amounts includes:

- payment for additional time worked (weekends),

- vacation pay,

- one-time bonuses that are not included in the remuneration system of an organization, company, enterprise,

- any payments for periods when the employee retained wages (periods of training, business trips, strikes, etc.),

- payment for temporary disability certificates;

- maternity benefits,

- time off, vacation at your own expense;

- social payments and benefits,

- compensation for food and travel,

- material aid.

The question arises: is downtime due to the fault of the employer or other reasons independent of him and the employee, but paid in any case? You can answer that it is not included, since this time cannot be considered worked, but only paid.

In cases where the employee did not use part of the vacation, but quits, the accountant is obliged to calculate vacation pay for the unused period. If there are excessive days off, the employee, on the contrary, according to the recalculation made, will have to compensate the company for part of the amount of vacation pay or work until the end of the billing period at his own request.

Please note that the employee has the right not to go on vacation for no more than 2 years in a row. If this period is exceeded, vacation days are lost, and the company may be subject to fines and sanctions from regulatory authorities. Vacation should not be compensated by any payments.

The decision on liquidation is made by the founder. See how to close an LLC with one founder. Summary consolidated reporting is maintained by large holdings. Read about the features of the procedure.

Where can I get sick leave if a person has not been sick? There are several options.