Line 041 of Appendix 2 to sheet 02 of the income tax return implies a breakdown of one of the types of indirect costs of the company indicated in line 040.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Line 041 displays the amounts of all taxes, without exception, that are to be displayed in the list of costs that reduce the organization’s income.

To eliminate the possibility of errors and inaccuracies, it is advisable to consider the procedure for filling out line 041 in more detail.

What has changed (updated)

Line 041 in the income statement is displayed in Appendix No. 02 to sheet 02 and is intended to disclose information regarding the amounts of tax payments accrued for the reporting period included in the list of indirect costs.

In past periods, the declaration was formed according to the form and rules that are reflected in the Order of the Federal Tax Service of Russia dated November 2014.

For reporting purposes, the form of this document and the rules for its formation have been updated based on the results of the entry into legal significance of the Order of the Federal Tax Service of Russia dated October 2021.

In relation to line 041, quite significant amendments were made, which are as follows:

| In the content of the wording itself, the name of the meaning | Which is displayed in the line, and also a mention of insurance premiums is added |

| Clause 7.1 of the Filling Rules has been adjusted | As a result, the indications were removed from it that insurance premiums intended directly for the Pension Fund of the Russian Federation, the Social Insurance Fund (in the field of temporary loss of legal capacity and maternity in particular), the Compulsory Medical Insurance Fund are not displayed in this line. |

But at the same time, together with taxation and fees, a mention was developed regarding insurance premiums that must be displayed in this line.

It is also necessary to pay attention to the fact that contributions in line 041 must be included starting from reporting periods for 2021. If an annual declaration was filed using the new form, there is no need to do this.

Page 041 in profit reporting

The profit reporting form was approved by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] The same order provides a detailed analysis of filling out the sections and lines of the profit report form for organizations. According to it, line 041 in the income tax return includes various payments (taxes, fees and contributions) that must be paid in accordance with the laws of the Russian Federation and which are taken into account as part of indirect expenses when calculating income tax.

In the income tax return, line 041 includes various payments (taxes, fees, etc.) that must be paid in accordance with the laws of the Russian Federation and which belong to indirect expenses when calculating income tax.

What has been updated in line 041 of the income statement?

Line 041 in the profit declaration is located in Appendix No. 02 to sheet 02 and is intended to disclose data on the amounts of tax payments accrued for the period that were included in indirect expenses.

Starting with reporting for 2021, the declaration form from the Federal Tax Service order dated September 23, 2019 No. ММВ-7-3/ [email protected] in effect. Compared to the previous form, line 041 has not changed. There were changes in this line, but much earlier.

Thus, reporting for 9 months of 2021 was submitted in the form approved. by order of the Federal Tax Service of Russia on October 19, 2016 No. ММВ-7-3/ [email protected] And this form has been used since the 2016 annual declaration. In the period 2015–2016 (except for the annual report for 2021), the declaration was drawn up according to the form and rules contained in the order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3 / [email protected] And just when updating this form in relation to Line 041 has undergone very significant adjustments:

- A mention of insurance premiums has been added to the text of the very wording of the name of the indicator reflected in the line.

- The text of clause 7.1 of the filling rules has been changed, as a result of which the indication that insurance premiums intended for the Pension Fund of the Russian Federation, the Social Insurance Fund (in terms of disability and maternity), and the Compulsory Medical Insurance Fund are not shown in this line, but on the contrary, along with taxes and fees there was a mention of insurance premiums, which should be reflected in this line.

At the same time, contributions in line 041 began to be included from the reporting periods of 2021. In the declaration for 2021, they should not have been included in this line (see letter from the Federal Tax Service dated April 11, 2017 No. SD-4-3 / [email protected] ).

What amounts are excluded from out-of-pocket expenses?

It is necessary to pay attention to the fact that payments for state duties should not be indicated on line 041 of income tax if:

- the obligation to transfer money as a state duty arose as a result of registering an asset from the list of non-current assets;

- the amount of the duty was added to the total amount of the valuation of the fixed asset at the time of its acceptance for direct accounting;

- in tax accounting, the calculated and paid duty was displayed as a component of other costs on the basis of Article 264 of the Tax Code.

It should be remembered that the cost indicator that was taken into account during the period of deduction of the tax base is excluded from the value of the line in question.

This rule directly relates to excise taxes and personal income tax in particular imposed by counterparties. You should not display in this line the amount of income tax and the amount of payments transferred due to the existing environmental pollution.

In addition, penalties, fines and the fact of payment of arrears on existing tax obligations are not subject to inclusion in the list of indirect costs.

According to the established norms of tax legislation, in the income tax return in line 041 this year it is not necessary to include the calculated tax by participants in the gambling business.

In this case, an exception is made for business entities that provide employment on UTII, while combined with OSNO. The simplified tax system is not taken into account in this case.

In addition, it is necessary to separate expenses such as:

- accrued amounts for dividends;

- funds transferred directly to voluntary established forms of insurance;

- in line 041 it is impossible to include the amount of guarantee contributions contributed to the special fund;

- the amount of accrued and repaid debt obligations, including ceremonial events;

- Registration of cost assessments of the services of notary authorities in the area of their exceeding the norms that are established by tariffs for types of notary fees.

The group of such exceptions additionally includes all funds, without exception, that the direct employer transfers to the account of non-state pension funds.

This type of insurance premium is not under the control of the tax office. If government agencies use sanctions in the form of penalties against the enterprise, then such amounts should not be reflected in indirect costs.

Line 041 of Appendix 2 to Sheet 02 of the income tax return

Line 041 of Appendix 2 to sheet 02 of the income tax return is a breakdown of one of the types of indirect expenses of the organization reflected in line 040.

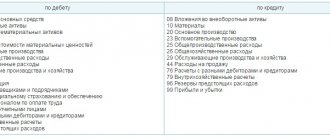

Line 041 shows the amounts of all taxes that are reflected as expenses that reduce the organization’s profit. Let's look at what taxes are reflected on line 041 of the income tax return. In the income tax return, filling out Appendix 2 is an important point. This section deciphers the costs that were associated with the production of products and their sales, as well as the organization’s losses and non-operating expenses.

Each line has its own amounts. Depending on the activity of the enterprise, the lines are filled in or blanks are placed in them.

What and which lines are filled in in the declaration:

- 010-030 – filled in by those organizations that determine expenses and income using the calculation method. Item 010 reflects the direct expenses of the organization. Lines 020 and 030 are filled in for expenses of small wholesale or retail trade.

- 040-052 – these items are filled out by all declarants who report their indirect expenses. The line 040 indicator should be equal to:

| Line "040" = | Line "010" | Line "020" | Line "023" | Line "027" | Line "030" |

- Line 041 – the amounts of taxes and fees are recorded. This line does not reflect:

- Indirect taxes that were billed to customers.

- Taxes that were calculated using the tax rate.

- Tax on the profit of the organization itself.

- State duties included in non-operating expenses.

- Insurance premiums.

- 042-043 for organizations that reflect the costs of capital construction in their calculations.

- 045 – expenses of companies that employ disabled people.

- 046 – expenses associated with the organization of disabled people, with the owners of houses for disabled people.

- 047 – expenses associated with the purchase of land.

- 048—051 – decryption of line 047.

- 052-055 - expenses for scientific research.

- 059 – indicates the amount spent on acquiring rights to property.

- 060 — the purchase price is indicated.

Filling out a profit declaration requires care and precision. Otherwise, during reconciliation, discrepancies will arise in the tax base, which may lead to questions from tax authorities.

In short, line 041 in the income tax return reflects the indirect taxes of the enterprise. It can reflect all amounts that directly go to reduce taxes (Chapter 25 of the Tax Code).

Line 041 deciphers the indirect costs incurred by the organization during the reporting period. It can reflect the amounts that were accrued and paid during cash settlement:

- Property tax on buildings and all company property.

- Research costs.

- Land duty.

- Tax on transport of the organization.

- Costs of using natural objects.

- Duty for the use of water transport for organizations with water transport.

And also in line 041 of Appendix 2 in the tax return, the figure that was accepted for deduction of VAT on assets is indicated. Some organizations have a controversial question whether to enter input VAT in line 041 for:

- Funds of the organization that have not been paid.

- Unfulfilled loan obligations.

In line 041 in the tax return, accruals are made on the basis of Art. 270 NK. It specifically identifies expense items that can be entered on line 041.

A competent accountant will not have any difficulties filling out this line in the declaration, especially since the indirect expenses of the enterprise have already been indicated in line 040.

- Banks

- Loans

- Insurance

- Finance

- Forex and stock exchange

All companies engaged in business and receiving revenue are required to pay a certain monetary compensation to the state treasury in the form of a duty. The methods of calculating duties in the form of tax payments also depend on what taxation system the company uses. Declarants applying general taxation fill out an income tax return.

Line 041 of Appendix 2 to Sheet 02 of the income tax return contains the amount of taxes and fees. These are the so-called other expenses of the organization or indirect expenses.

Line 041 in the income tax return records the figures accrued in the form of taxes and fees. They are reflected in the order established by Art. 270 NK. These are those items of enterprise expenses that are not taken into account when calculating the tax base.

What is not included in line 041:

- Calculation of dividends in monetary units.

- Sanctions, fines imposed on the enterprise, penalties.

- Amounts of contributions to the authorized capital.

- Expenses for the purchase of depreciation funds.

- Amounts contributed for voluntary insurance.

- Payments to non-state pension funds.

- Expenses incurred through compensation.

- VAT charged to the buyer.

What is included in line 041 of Appendix 2, sheet 02:

- Accrued transport tax.

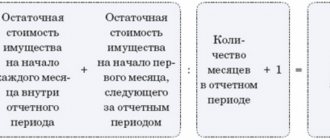

- Property tax. It is calculated both from the value listed on the enterprise’s balance sheet and from the value indicated in the cadastral passport.

- Duty on land used by the company.

- Government duty.

- Recovered VAT, which, according to tax law, is taken into account in other expenses.

The amount reflected in line 041 is also transferred to line 040 (indirect enterprise taxes).

Transcript page

It must be remembered that the declaration form is established by the Order of the Federal Tax Service of October 2021. The paragraphs contain detailed indicators on the basis of which the tax base of the current reporting period is determined, reflecting information from previous years, thanks to which it is possible to have a significant impact on the reported results of operations.

Line 041 of the income tax return is displayed in the second Appendix of sheet 02. Information must be entered in this field exclusively for the specific reporting period.

Last year, the list of values that must be summed for display on line 041 was adjusted.

The changes in the rules are largely due to changes in the status of insurance premiums itself.

Since last year, their accounting was subject to transfer to the jurisdiction of the tax authority, and the rules for regulating contributions are set out in detail in the tax legislation as a separate assigned tax obligation.

Speaking about what taxes line 041 should display, in this case we can talk about all types of obligations that are recognized as indirect costs.

The list of indirect expenses includes insurance deductions from the income of hired staff, as well as:

- some types of taxes;

- and fees.

In this case, exceptions can be made for amounts specified in tax legislation, in particular in Article 270.

From the list of so-called salary insurance contributions, they are separately taken into account by the Social Insurance Fund directly for injuries. This type of fee was not subject to registration with the tax authority in case of changes.

Indirect costs must be reported in the relevant income tax return using one of several methods:

| Directly linked to the fact of accrual of liabilities | If you use the accrual option |

| Directly linked to the date upon transfer of funds for the entire total amount of fees | If you use the cash method |

The amount of duties transferred by the company is also subject to direct display in line 041. They are taken into account on an accrual basis.

In standard situations, line 041 of income tax includes the amount of transport tax, as well as:

- obligations to pay property tax;

- and mineral extraction tax in particular.

The calculated amount of land tax should be included in the list of indirect costs. A similar rule applies to water tax and input VAT.

What specific taxes should be included in line 041?

From the title of Appendix No. 2 to sheet 02 and the text of the description of line 041 itself, it follows that all taxes accrued for the period related to production and sales and therefore reducing the profit base should be reflected in it. That is, these are payments to the budget listed in subparagraph. 1 clause 1 art. 264 of the Tax Code of the Russian Federation and related:

- to taxes and fees (property tax, transport tax, land tax, water tax, fees for the use of wildlife);

- restored VAT taken into account in profit expenses;

- insurance premiums for compulsory health insurance, compulsory social insurance (in terms of disability and maternity), compulsory medical insurance;

- state duty.

ATTENTION! If the state duty is included in the initial cost of fixed assets or intangible assets, it is not necessary to indicate it on page 041, because it is included in depreciation expense. If the state duty is taken into account as part of non-operating costs, then it must be shown on page 200 of Appendix No. 2 to sheet 02.

These will not include contributions for injuries paid to the Social Insurance Fund, as well as tax payments specified in Art. 270 Tax Code of the Russian Federation:

- for negative impact on the environment above the level of limit discharges and waste (clause 4);

- on voluntary insurance and non-state pension provision (clauses 6, 7), except for those taken into account as labor costs (clause 16 of Article 255 of the Tax Code of the Russian Federation), voluntary property insurance (Article 263 of the Tax Code of the Russian Federation) and life/health insurance of borrowers bank (clause 20.2 of article 291 of the Tax Code of the Russian Federation);

- taxes included in the purchase price (clause 19);

- debts on taxes and contributions written off under the legislation of the Russian Federation or a decision of the Government of the Russian Federation (clause 33).

Taxes reflected in line 041 will appear there as they accrue. This also applies to advance payments for taxes on property, transport, and land. The date of payment of the tax does not matter (letter of the Ministry of Finance dated September 12, 2016 No. 03-03-06/2/53182).

IMPORTANT! From 01/01/2021, the deadlines for payment by legal entities of transport and land taxes, as well as advance payments, are the same for all territories and are fixed at the federal level. Regional and local authorities no longer have the authority to determine payment dates. Taxes for the year must be paid no later than March 1 of the following year, and advances must be paid no later than the last day of the month following the reporting period. See here for details.

Read about the calculation of advance payments for transport tax in the article “Advance payments for transport tax”.

What is important to consider when filling out

When filling out line 041 in question, you need to pay attention to:

- transport tax;

- insurance premiums;

- state duty.

To eliminate the possibility of various misunderstandings, we will consider each situation separately. An income tax return form is available.

Transport tax

In the income tax return under consideration on line 041, the costs should take into account the amount of transport tax.

In particular, we are talking about advance payments for transport tax, in particular:

| For passenger vehicles | Which were not registered in the Plato system - in full |

| Registered in the system | Transport taxation minus the amount of payment for damage to road surfaces |

It should be remembered that from July 2021, owners of heavy vehicles do not have the right to separately write off advance payments for transport taxation and fees for compensation for damage to the roadway as expenses.

Payments to the Platon system are displayed in costs on line 040 in the area of excess over this type of taxation.

Insurance premiums

The corresponding insurance premiums from NS and PP do not fall into line 041 and must be included in the total amount of indirect costs. This is largely due to the fact that they, as before, are under the control of the FSS.

Briefly about the main thing

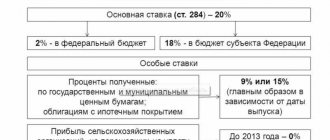

All organizations that apply the general taxation system are required to pay 20% of their company’s profits to the relevant budgets of the Russian Budgetary System. Confirmation of the correctness of calculations and completeness of transfers for this obligation is a declaration in the KND form 1151006.

Features of filling out, the current form and deadlines for submitting the report are disclosed in a separate material: “Income tax return in 2019: filling out and submitting.” Now let’s determine what line 041 of the income tax return includes.

What to consider in line 041

Based on the rules for filling out a tax return approved in Order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated 10/19/2016, line 041 - income tax 2021 (Appendix No. 2 of sheet 02) includes information on indirect expenses of an economic entity incurred in the reporting period.

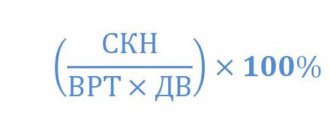

What are indirect costs? In this case, taxpayers should take into account the amounts of tax liabilities and payments for insurance premiums that were accrued and paid during the billing period. However, legislators have provided exceptions: operations named in Art. 270 of the Tax Code of the Russian Federation, are not included in indirect ones.

Let us recall that due to changes in fiscal legislation regarding insurance premiums (Chapter 34 of the Tax Code of the Russian Federation), information on insurance coverage is classified as tax payments. Therefore, it is subject to reflection in the appropriate columns of tax reporting.