The real tax burden is determined using the effective income tax rate. For domestic companies, the indicator allows you to quickly identify deviations from standard taxation and show accounting problems. Applying the settlement rate to foreign companies provides information about the level of control. The rate is determined as the average ratio of tax to enterprise income. This material will help you understand in more detail what an effective income tax rate is and what conditions exist for its payment.

The effective rate is calculated based on the results of the reporting period, the results of which the company submitted its reports. Control authorities use the indicator when preparing data to determine the need to audit domestic enterprises and the amount of taxation of controlled foreign companies (CFCs).

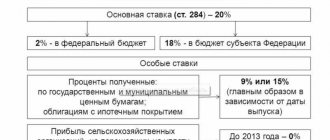

Effective income tax rate: what does the Federal Tax Service show for Russian enterprises?

The effective rate indicator is calculated when it is necessary to quickly determine the tax burden of an enterprise. Tax authorities, based on the data received, are preparing a plan for inspections of Russian enterprises. Features of using the indicator:

- Based on the calculation of the rate, the tax burden of domestic enterprises is determined.

- To control domestic enterprises, the calculation algorithm is used in relation to the main tax established depending on the adopted taxation regime.

- The calculation is made to obtain an express assessment of the deviation from the planned rate of 20% for income tax or 5 and 15% when paying a single tax.

The calculation of the effective rate is carried out by the audit departments of the Federal Tax Service when analyzing the activities of the enterprise. Limit indicators have been established; if these values are reduced, enterprises are subject to increased tax control. For trading companies, the rate should not be lower than 1%, for manufacturing enterprises – not lower than 3%.

Tax inefficiency: assessment and risks

The effective income tax rate is a quick and common way used by auditors to identify problems in a company's taxation. An express assessment shows a deviation from plans or standards, for example, 20% for a general taxation system, 5 or 15% for a simplified one.

An ineffective organization risks overpaying income taxes or losing in litigation. The situation can be improved by changing the accounting policy. At the same time, pay attention to the following:

what expenses are not deductible and how large their volume is;

how the authorized capital is formed and fixed assets are depreciated;

how tax deductions and overpayments are administered;

How large are the reserves for IT?

The effective tax rate is the real tax rate of a particular taxpayer, which is defined as the ratio of the tax actually accrued for the period to the tax base (economic base) for the same period.

The term “Effective Tax Rate” in English is effective tax rate or abbreviated as ETR.

Use of rate information by internal users

The need to calculate the indicator also arises among internal users and auditors. Based on the obtained indicator, the responsible persons of the enterprise draw a conclusion about the possibility of optimization and reduction of the tax burden.

If the enterprise detects that the rate exceeds the planned indicator, optimization is carried out by changing the conditions of the accounting policy. Enterprises have the opportunity to change the conditions for accounting for income and expenses, methods for writing off inventory items, methods for determining depreciation, and the procedure for maintaining tax accounting in relation to differences.

Application of the effective tax rate for the valuation of foreign companies

The effective rate is used in international financial reporting. The data is used by foreign companies doing business on the international market and having representative offices or activities in the Russian Federation. In the Tax Code of the Russian Federation, the term arose in connection with the introduction of the concept of taxation of CFC profits. The size of the effective rate indicator allows you to determine:

- The degree of influence of taxation on the company's activities. The income of a non-resident enterprise is exempt from income tax in the Russian Federation, provided that the effective rate is determined in the amount of more than 75% of the weighted average rate.

- Taxation of a CFC that is not a resident in the Russian Federation, but receives income in the country. If the share of a Russian company is at least 25% or 10% with the total participation of residents in the amount of 50% of the total share of the capital of the CFC, the company pays profit in the part attributable to the share of residents.

- Taxation of a company with entirely foreign capital. The indicator is used in IFRS to legalize the withdrawal of company capital to offshore zones. The tax authorities of the Russian Federation use rate calculations to control the activities of foreign companies and simplify work with them.

Based on the results of the analysis of the indicator, the Federal Tax Service determines the amount of tax paid and the possibility of tax exemption for companies with foreign capital.

What is a controlled foreign company?

The concept of “effective income tax rate” appeared in the Tax Code on January 1, 2015 in connection with the introduction of significant changes to the procedure for taxing the profits of foreign organizations.

Law of November 24, 2014 No. 376-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation (in terms of taxation of profits of controlled foreign companies and income of foreign organizations)” introduced a new chapter 3.4 “Controlled foreign companies and controlling persons” into the Tax Code of the Russian Federation " In order to understand what the effective rate is, it is necessary to clarify what controlled foreign companies (CFCs) and controlling persons are. According to Art. 25.13 of the Tax Code of the Russian Federation, a controlled foreign company is a foreign organization that is not a tax resident of the Russian Federation. Accordingly, Russian taxpayers whose share of participation in these foreign companies is 50% (from 2021 - 25%) are called controlling persons.

See also the article “How a foreign company must confirm its location.”

The meaning of the innovations is that the profit of a CFC is recognized as the profit (income) of the controlling person and is subject to taxation in Russia in proportion to the share of ownership of the Russian taxpayer. This is stated in paragraph 2 of Art. 25.15 Tax Code of the Russian Federation.

ConsultantPlus experts have prepared step-by-step instructions on taxation of profits of controlled foreign companies:

Get trial access to the K+ system and upgrade to the Ready Solution for free.

Formula for calculating the effective rate

The effective rate is determined at the end of the reporting period based on the financial statements submitted by the company. Enterprises that do not have reporting standards developed separately for the company present data in accordance with the requirements of IFRS. The fact that a foreign company belongs to a state with which there is no agreement on the exclusion of double taxation obliges the enterprise to submit reports in accordance with the provisions of the Tax Code of the Russian Federation.

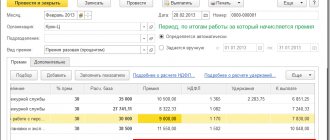

To calculate the effective rate of profit, the formula is used: C = N / P x 100%.

| Index | Index decoding |

| WITH | tax rate |

| N | the amount of tax withheld from the income of the enterprise (profit before tax minus net profit); |

| P | the amount of profit received in the reporting period before tax |

Calculating the effective rate can be quite complex for companies in countries using progressive tax rates.

Real state of affairs

An effective tax rate is an excellent way to assess the quality of tax management. This indicator makes it possible to identify problems in the work of employees who are responsible for taxation. Checking this is quite simple: if the indicator is above 20 percent, this means that the methods in tax accounting differ from management accounting. This may also indicate that tax accounting does not use all the opportunities to reduce the tax base: accelerated depreciation rates, depreciation bonuses, the formation of reserves, and so on. If, on the contrary, the effective tax rate is lower, this indicates obvious differences in accounting, lower tax rates, etc. In this situation, it is imperative to pay attention to transactions that underestimate the amount of tax. These actions may be illegal.

At the same time, profit before tax is considered as income reduced by expenses in accordance with the rules of RAS or IFRS, and not in accordance with the requirements of the Tax Code. If the expenses for profit tax purposes do not include all the costs of the enterprise, then the effective rate calculated on the basis of the profit received will be higher. Thus, the effective income tax rate is an express analysis that allows not only to identify the company’s problems, but also to determine the quality of work of employees responsible for tax accounting.

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Payment of profit calculated at the effective rate

The value of the effective CFC rate indicator is compared with the weighted average value. Enterprises of foreign jurisdiction do not pay tax if the effective rate reaches 75% or exceeds the figure. In this case, the company is not controlled and subject to income tax.

To obtain an exemption, additional conditions must be met: the country of residence of the foreign company must have an agreement with the Russian Federation on the elimination of double taxation and exchange tax information with domestic control authorities. Otherwise, the result of the company’s financial activities will be taxed under the laws of the Russian Federation.

Ratio of effective and weighted average rates

The weighted average rate affects all categories of profit received by the company. For example, when receiving profit from dividends, the weighted average rate is calculated according to the algorithm: Svz = (P1 x C1 + P2 x C2) / P1 + P2.

| Index | Index decoding |

| Svz | Weighted average rate |

| P1 | The amount of net profit received |

| P2 | Amount of dividends paid |

| C1 | Profit tax rate |

| C2 | Dividend tax rate |

An example of comparing the effective rate with the weighted average:

At the end of the reporting period, the company had a profit after tax in the amount of CU 150,000; dividends paid at the end of the period amounted to CU 21,000. The CFC tax amounted to 12,000 USD. To obtain data on the need for taxation, the following indicators are calculated:

- Effective rate: Se = 12,000 / 150,000 x 100% = 8%;

- Weighted average rate: Свз = (138,000 x 20% + 12,000 x 13%) / 150,000 x 100% = (27,600 + 1560) / 150,000 x 100% = 19.4%;

- We determine the bet ratio: CC = 8 / 19.4 x 100% = 41.2%.

Conclusion: the ratio of the effective rate to the weighted average was 41.2%, which is less than 75%. Businesses are subject to taxation in the country under controlled foreign companies.

Reasons for the differences between effective and weighted average types of rates

Enterprises may have differences in effective and weighted average rates due to the peculiarities of conducting business and accounting for financial elements of reporting. In accounting, there are several possible reasons for discrepancies in indicators.

| Condition | Detailed characteristics |

| Differences in the procedure for generating accounting and tax profits | Differences arise when different standards are used for taxation and financial performance. The use of indicators allows you to pursue different goals - to show financial stability and reduce taxation |

| Using Tax Credits | Tax credits can reduce the effective rate to the weighted average |

| Using deferred income tax payments | When deferring tax payment to a future period, the effective rate in the current period will decrease relative to the weighted average, and in future periods it will increase |

General information ↑

One of the most reliable indicators of the efficiency of organizations of various types is the profit tax rate (effective).

It is this that most clearly makes it clear whether the enterprise is generating income, taking into account all taxes and various fees.

In Russia, the legislation is no less confusing than abroad, and therefore any enterprise manager or private businessman should thoroughly understand all the taxes paid by his enterprise.

What it is?

The effective income tax rate (in English - Effective Tax Rate) is the average or total value of the tax burden that is imposed on all income of a company.

In the same way, it is possible to reflect taxes on the income of a private person who does not conduct any business activity and receives all his income in the form of wages. The tax rate can be expressed in other ways.

But the effective rate most easily and clearly reflects the total amount of all kinds of taxes paid by the taxpayer (individual or legal entity).

Mathematically, the rate under consideration is expressed as a fraction, the numerator of which is the total amount of all taxes, and the denominator is the total income from all types of activities of the company or individual.

Knowing the exact value of the effective tax rate allows you to optimize your expenses.

This is possible for the following reasons:

- the tax rate under consideration makes it possible to assess the efficiency of the business as a whole, its profitability taking into account all mandatory expenses;

- Tax legislation is very complex, and understanding its intricacies is quite difficult for a non-specialist. The total cost of taxes is shown by the effective income tax rate, which allows a person who has no idea about tax legislation to evaluate the company’s return on investment.

Determination of tax burden

Tax burden is a value that makes it possible to assess how strongly tax payments influence the profitability and profitability of an enterprise.

Tax and supervisory government organizations calculate this parameter quite simply: they sum up all the costs of paying the tax burden and divide by the total income of the organization (or individual).

But there are other ways to determine this parameter. They differ according to the following criteria:

- according to the indicator that is used to compare the total number of tax payments;

- by type and structure of tax payments taken into account in calculating the tax burden.

Calculation of the tax burden using the method used by the Ministry of Finance of the Russian Federation:

- When using this method, a formula representing a fraction is used.

The amount of all taxes paid is taken and divided by the amount of revenue from sales and non-sales income.

To express the result as a percentage, you must multiply it by 100%. The formula looks like this:

where SKN is the total amount of all taxes; VRT – revenue received from the sale of all kinds of goods and services produced by the company; DV – non-operating income.

The disadvantage of this calculation method is the inability to take into account changes in the structural component of taxes on the tax burden itself.

This methodology takes into account only the tax capacity of manufactured products.

Payment of tax by a controlled company upon loss

A company operating on the international market may suffer a loss at the end of the reporting year. When calculating the profit of a CFC, the conditions of Art. 309.1 Tax Code of the Russian Federation. If, at the end of the reporting period, the company received expenses lower than income, no tax is paid. Losses received by controlled enterprises with foreign capital are not carried forward to future periods. Foreign-based enterprises that have zero profit or losses are classified as controlled.