What is a waybill and why is it needed?

A waybill is a form that confirms the driver’s right to use a vehicle and serves to record and control the operation of the vehicle and the driver. According to paragraph 2 of Art. 6 of the Law “Charter of Motor Transport and Urban Ground Electric Transport” dated November 8, 2007 No. 259-FZ, it is prohibited to use a vehicle without issuing a waybill.

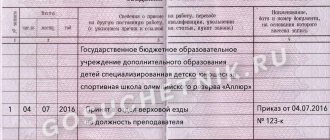

The form of the waybill was approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78, but it is not mandatory (see information from the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012). Starting from 01/01/2013, taxpayers have the right to develop their own form of waybill in accordance with the requirements of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, as well as provided that this document reflects the details established by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152, which include:

- name and number of the waybill;

- validity;

- information about the owner of the vehicle, namely: information about the name, address, telephone number and OGRN;

- information about the vehicle, including the date and time of pre-trip (or pre-shift) technical inspection;

- driver information.

Find out about the latest requirements for mandatory details of waybills from the materials:

For taxpayers who do not belong to the category of motor transport enterprises, a waybill is issued for every day or for another period not exceeding 1 month (see also letter of the Ministry of Finance of the Russian Federation dated November 30, 2012 No. 03-03-07/51). Motor transport enterprises are required to issue waybills daily, with the exception in this case of a business trip.

For self-pickup, TTN is not needed

Our supplier does not have its own warehouse; we pick up the goods using our own transport from the warehouse of another organization - the shipper. Do we need a TTN to confirm expenses?

You purchase goods on a self-pickup basis and transport them using your own transport; there is no carrier, which means you do not need to issue a TTN. To confirm the fact of purchasing the goods and accepting it for registration, form N TORG-12 is sufficient. Recently, this position was supported by the Supreme Arbitration Court of the Russian Federation (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 9, 2010 N 8835/10). The Ministry of Finance adheres to the same opinion (Letters of the Ministry of Finance of Russia dated January 31, 2011 N 03-03-06/1/42, dated June 15, 2010 N 03-03-06/1/413). Perhaps now, taking into account the position of the Supreme Arbitration Court of the Russian Federation and the opinion of the Ministry of Finance on this issue, tax authorities will not insist on issuing a TTN for self-pickup. And to confirm transportation costs, for example, to take into account the cost of gasoline, a waybill that justifies the trip is sufficient (Resolution of the Federal Antimonopoly Service VSO dated November 17, 2008 N A19-6488/08-50-F02-5714/08).

Shelf life of the waybill

To date, the storage period for the waybill is established by the following documents:

- by order of the Ministry of Transport of the Russian Federation dated September 18, 2008 No. 152;

- by order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558.

The order of the Ministry of Transport of the Russian Federation clearly states that the waybill must be stored for at least 5 years (clause 18), that is, at the request of the organization, this period can be increased. And if with the first order everything is extremely clear and simple, then with the order of the Ministry of Culture things are different.

Firstly, it stipulates that the storage period for the waybill is 5 years, subject to an inspection or audit by the regulatory authority during this period (Article 842 of the list of documents). Based on this, we can conclude that if no inspection has been carried out within 5 years, then the organization does not have the right to write off waybills. Secondly, the order of the Ministry of Culture stipulates that if the waybill is the only document confirming the harmfulness, danger, and severity of work, then its shelf life increases to 75 years.

For information on the storage periods for other documents given in Order No. 558, read the article “Storage period for accounting documents in an organization .

Due to the fact that the waybill is a primary document, its storage period is also regulated by:

- Tax Code of the Russian Federation, namely sub. 5 paragraph 3 art. 24;

- Law No. 402-FZ, namely Art. 29.

The Tax Code states that the storage period is at least 4 years, and according to the law on accounting, as well as by order of the Ministry of Transport of the Russian Federation, the storage period for a waybill is at least 5 years.

For what storage period is set for an invoice, see the material “What is the storage period for invoices? ”

The minimum shelf life of a waybill in an organization is 5 years, but do not forget that there are some situations when the shelf life of a waybill is significantly extended.

For information on how long it is necessary to store cash documents, see the material “What is the shelf life of cash documents? ”

How to file travel documents for a month

Registration of waybills is mandatory for all vehicles that the organization uses for its work. This applies to both rented vehicles and the company’s own vehicles.

At the same time, even if an employee uses his own personal transport, a waybill is still required. This gives him the opportunity to receive compensation and reimburse his own expenses.

The waybill is issued for one work shift and, upon completion, is submitted to the organization’s accounting department. All waybills are filed in a folder and stored for at least five years.

The exception when a waybill can be issued for a long time are cases when the driver’s business trip exceeds one day. In some cases, drawing up waybills for a month is possible if they are not the basis for calculating the driver’s wages, but are used only for maintaining records of transportation and operations performed.

If an organization uses a unified form of sheets, you should carefully ensure that all details are filled out.

Responsible for the correct completion of documents are the head of the organization and the persons responsible for the operation of vehicles.

“Voucher” for a passenger car

Most often, accountants in their work have to deal with primary documentation of passenger cars, the procedure for filling out which is explained in the letter of Rosstat dated 02/03/05 No. IU-09-22/257. Three officials must participate in the preparation of waybills - the driver, the dispatcher and the mechanic. The document states:

- Date, series and number of the waybill;

- Full name of the organization, its address and contact details;

- Make and license plate number of the vehicle;

- Driver's passport details and driver's license number;

- Detailed description of the route and destinations;

- Time to leave and return to the garage.

When filling out the waybill, the mechanic must indicate the brand of fuel, the amount of fuel used, as well as the speedometer readings. In this case, the speedometer reading at the beginning of the shift must coincide with its reading at the end of the previous one. The “Movement of Fuel” section must be filled out in particular detail so that costs for fuel and lubricants can be included as expenses in tax and accounting.

Fuel consumption rates are calculated based on the following documents:

- letters of the Ministry of Transport of Russia dated April 29, 2003 No. R–03;

- technical support from the manufacturer for a specific car model;

- control measurements for specific operating conditions.

The basic rate is calculated taking into account the characteristics of vehicle operation associated with climatic and road transport factors.

The Ministry of Transport, in a letter dated April 4, 2019 No. DZ-514-PG, explained that a waybill can be issued in one of the following ways:

- Write out a new waybill.

- Fill in the required details in the previously issued waybill:

- odometer reading;

- dates and times of the next departure and arrival of the vehicle;

- dates of monitoring of its technical condition and medical examinations.

However, all other details must remain unchanged.

From these clarifications it follows that waybills, even for one-day flights, can be issued for a period exceeding one day. The main thing is to put in them the odometer readings, information about departure and arrival, marks on medical examination and technical condition control before each flight and after returning from it.

A waybill can be issued for a day, a month or several days. On the waybill for a period of more than a day, indicate for each trip its date and time, odometer readings, notes on the medical examination and technical condition of the car (Letter of the Ministry of Transport dated 04.04.2019 N DZ-514-PG).

Nuances of storing waybills

It is recommended to use a separate logbook for waybills, and create a separate directory for storage. Depending on how large the enterprise is and what services it provides, the importance of this document will depend. If an organization directly provides transport services and provides its drivers exclusively with work cars, then waybills from simple local pieces of paper turn into almost the main labor document, according to which it is possible to keep track of spent budget resources.

Don't miss: the main article of the month from a practical expert

All rules and terms for storing personnel documents in a visual cheat sheet.

According to legislative acts, waybills can be located together with other shipping documents or contained in a separate form, but they must be easily accessible to the responsible person if a quick check is implied or a re-accounting of used budget funds is required.

Why do you need to keep track of travel documents?

By law, every entrepreneur (or organization) using cars for their activities is required to provide waybills and take them into account in the register. The form itself contains complete information about the trip: driver details, route, characteristics of the cargo.

The waybill serves as proof of fuel consumption during transportation. Based on this document, the taxpayer can write off fuel costs for vehicles. Also, the data contained in the documents simplifies accounting and payroll for drivers.

All organizations using vehicles in their work must keep a log of waybills. Is a unified form of travel log book mandatory? What is the period for storing it and what is the procedure for filling it out? You will find answers to the above questions, as well as a sample travel log of waybills in our article.

Storage periods for waybills

Nowadays, the storage periods for waybills are specified in two regulatory and legal government acts: order of the Ministry of Culture of the Russian Federation No. 558 and order of the Ministry of Transport of the Russian Federation No. 152. These documents indicate that waybills at enterprises must be stored for 5 years from the date of preparation and use , but, according to the personal preference of the manager, this period can be extended.

True, no questions arise if you are guided solely by the order of the Ministry of Transport. The resolution of the Ministry of Culture indicates that waybills must be stored for 5 years, provided that during this period the enterprise undergoes an audit. If no inspection was carried out by government agencies, then even after the expiration of the 5-year period, these documents cannot be sent for disposal.

About the storage periods for documents

Why is it important?

The fact is that any inspection of a driving school by any department is primarily based on the documentation presented during the inspection. The Instruction to conduct an inspection always indicates a list of documents that must be presented, and as a rule, there is the phrase “..and other documents necessary to achieve the results of the inspection.” You and I all know this. However, many people do not know otherwise.

In accordance with the Code of Administrative Offenses (CAO), punishment cannot be imposed if more than 3 months have passed since the discovery of the administrative offense committed. This does not apply to the so-called “continuing offences”, but they tend to be a significant minority. The procedure for imposing punishment is described in detail in the book “To the Director of a Driving School. Accessible and simple about the laws." From the above, it directly follows that if the inspectors have at their disposal documents characterizing the activities of the driving school only for the last three months, then the range of possible claims on their part against the activities of the driving school will be significantly reduced.

On the other hand, inspectors always demand that you show them documents for at least the previous one and a half to two years, and there are no legal grounds to refuse them this (if such documents are available at the driving school). Otherwise, this will be regarded as a failure to comply with the legal requirement of the authorized controlling person and will be subject to punishment under the same Code of Administrative Offenses. Thus, the only way not to demonstrate your activities to the inspectors in full is the legal absence of the requested documents. In this regard, the question arises about the standard storage periods for internal driving school educational, organizational and administrative documentation. Let's turn to the current legislation.

Federal Law of October 22, 2004 N 125 “On Archival Affairs in the Russian Federation” in Article 6 of Part 3 establishes that the Government of the Russian Federation specifically determines an authorized federal executive body that approves lists of standard archival documents indicating their storage periods. In pursuance of this provision of the law, the Government of the Russian Federation established that this function is assigned to the Ministry of Culture and Mass Communications of the Russian Federation.

The list of standard archival documents generated in the scientific, technical and production activities of organizations, indicating storage periods, was approved by Order of the Ministry of Culture and Mass Communications of the Russian Federation dated July 31, 2007 N 1182 and registered by the Ministry of Justice of Russia on September 27, 2007, reg. N 10194. In this regard, the previously existing “List of standard management documents generated in the activities of organizations, indicating storage periods”, approved by the head of the Federal Archive Service of Russia on October 6, 2000, was cancelled.

The new order of the Ministry of Culture lists more than 1000 positions of various types of standard management documents; the List itself is placed in the form of a table on more than 250 pages, so there is no possibility or need to present it here. Let’s just say that the List is of a general nature, is not specified for individual types of activities, and therefore can only serve as a guide for writing for each individual organization its own local regulations governing internal document flow. At the same time, of course, such local acts should not contradict the Order of the Ministry of Culture, which establishes general principles for approving storage periods for internal documents.

In order to understand these principles, you should still take the trouble to familiarize yourself with the full text of the order. In this article we will analyze approaches only to educational, personnel and accounting documentation.

Do I need to store damaged travel documents?

Situations often occur when a driver or any other employee of an enterprise may intentionally or accidentally damage a waybill while performing work duties. But under no circumstances should such documents be thrown away; canceled or deteriorated sheets of accounting for used resources and transport should be stored in a separate folder until the appropriate check is carried out by government agencies.

Early destruction of damaged waybills can only take place with the written permission of the immediate director of the enterprise, who agrees to assume possible responsibility for the disposal of deteriorated documentation. The disposal itself is carried out after drawing up a write-off act, signed by members of the inspection commission.

What waybills have the right to be stored at the enterprise?

In the modern world, there are a huge number of companies, one way or another, in need of their own or hired transport. For such institutions, a certain classification of waybills is provided, which can be used and stored in the archive after use in work:

- waybills for special vehicles (all available vehicles present in the organization’s fleet are taken into account);

- passenger taxi waybills (indicates the number of own cars used by hired taxi drivers);

- waybills for buses (transport for civil and transport transportation);

- waybills for non-public buses (buses for personal use);

- waybills for trucks (piecework and non-piecework).

The use and storage of waybills is intended for enterprises of any form of ownership, if they have their own vehicle.

How long to keep waybills in the organization

A waybill is a strict reporting form that displays basic information about the vehicle and driver, its validity period, and the owner of the vehicle.

If the company has a vehicle in operation on its balance sheet, then filling out the voucher is mandatory. Each document is assigned a serial number and is recorded in the accounting journal.

Vouchers carried out by the accounting department are subject to storage. The question often arises: “How long are waybills kept in an organization?” We find the answer in several legislative acts at once:

- Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 “On approval of mandatory details and the procedure for filling out waybills”;

- Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 “On approval of the “List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods”;

- Tax Code of the Russian Federation;

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”.

Order of the Ministry of Transport No. 152 defines a period of at least 5 years. Based on the above wording, a company can destroy documentation older than this period if its internal regulations do not establish a longer storage period.

Administrative liability for violation of the work and rest schedule of drivers

The provisions of Order No. 558 of the Ministry of Culture are not so clear. On the one hand, a time period of 5 years is also established. But this is provided that an inspection or audit is carried out at the enterprise during this time. If there was none, then the documents cannot be destroyed. However, if the waybill is the only document confirming difficult, harmful or dangerous working conditions, it will have to be stored for much longer - 75 years.

Subclause 5, clause 3, art. 24 of the Tax Code of the Russian Federation obliges the organization to store waybills for at least 4 years, since this document is used in calculating taxes. Article 29 No. 402-FZ defines this period as 5 years. Moreover, the countdown begins after the end of the reporting period.

Based on the above, the company is obliged to store vouchers for at least 5 years. If we are talking about dangerous, harmful production or work in difficult working conditions, then the period increases significantly - up to 75 years.

“Voucher” for a passenger car

Accountants often have to deal with (form No. 3). The procedure for filling out this unified form is explained in a letter from Rosstat dated.

Let's start with the fact that three officials are involved in issuing a waybill - a dispatcher, a mechanic and a driver. In transport organizations, waybills are issued by the dispatcher, in other organizations - by an authorized person.

The waybill is drawn up in one copy. In it, the dispatcher indicates:

- number, series of the waybill and the date of its preparation;

- name of the organization, its address and telephone number;

- make and license plate number of the car;

- last name, first name, patronymic of the driver, as well as his garage and personnel number;

- driver's license number and class of vehicles that the driver has the right to drive;

- task to the driver and delivery address;

- time of leaving the garage and time of return to the garage.

If the organization carries out licensed types of transportation, make a corresponding mark on the “license card” line, and also indicate the registration number and series of the card. If the car is used exclusively for the management needs of the organization, then a dash is placed in this line. The waybill must bear the stamp and seal of the organization that owns the car.

Information about the waybill issued to the driver is entered into a special journal. Unified form (form No. of this journal is given in Resolution No. 78.

The columns “Speedometer readings” and “Speedometer readings when returning to the garage” are filled out by the mechanic and certified by his signature. Moreover, the speedometer reading at the beginning of the next day must coincide with the reading at the end of the previous day. The difference between the speedometer readings at the beginning and at the end of the day should correspond to the daily mileage of the car. In addition, the mechanic indicates the brand of fuel, and also reflects the receipt and use of fuel and lubricants.

Rosstat specialists emphasize that the “Fuel Movement” section must be filled out in full with all details based on actual costs and instrument indicators. This requirement must be met so that costs for fuel and lubricants can be included as expenses in both accounting and tax accounting.

In a transport organization, the driver of the car receives fuel according to a refueling sheet, the number of which must be indicated in the waybill in the corresponding line.

In a regular organization, the driver often fills up at a gas station in cash and presents a cash register receipt to the accounting department. The receipt indicates the date and time of refueling, as well as the serial number of the receipt. This serial number can be indicated on the line “Filling sheet”. The tabular part of the waybill indicates the number of liters of fuel that was poured into the gas tank when refueling the car. The remaining fuel when leaving the garage and when returning to the garage is indicated based on instrument readings about the amount of fuel in the gas tank of a passenger car.

The indicator “Fuel consumption according to the norm” is indicated in accordance with the fuel consumption norms that are approved in the organization by order of the manager.

Fuel consumption rates can be calculated based on:

- guideline document of the Ministry of Transport of Russia dated April 29, 2003 No. R3112194-0366–03. Please note that this document is advisory in nature and is valid until January 1, 2008;

- technical documentation from the manufacturer for the specific model and modification of the vehicle being used;

- control measurements carried out for specific operating conditions (for example, within a city with frequent technological stops).

For passenger cars, as a rule, a basic rate per 100 km is established. Features of machine operation related to road transport, climatic and other factors are taken into account by applying correction factors to the basic standards.

To determine the standard fuel consumption, you need to multiply the number of kilometers traveled per day by the number of liters of fuel according to the standard per 100 km. And divide the resulting value by 100.

What is a waybill

This is a form of primary documentation confirming the driver’s right to drive a designated vehicle for a specified period of time and travel with it from the territory of the enterprise. The permit is used to record and control the work of the car and the driver.

The form of the document was officially developed by the State Statistics Committee of Russia, but starting from 2013, the enterprise has the right to independently develop its own voucher, reflecting the mandatory and required details required by the Ministry of Transport of the Russian Federation.

If an enterprise does not carry out passenger and cargo transportation, it has the right to issue a document for a period of no less than one day and no more than 30 calendar days.

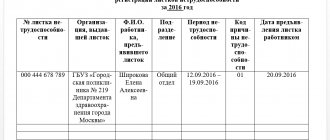

Need a magazine

In order to control the movement of waybills at the enterprise, you need to make entries in the appropriate journal. It, in particular, reflects the fact of issuing sectional waybills to drivers (clause 17 of section III of Order of the Ministry of Transport dated September 18, 2008 No. 152).

Typically, organizations and entrepreneurs use a unified form - Form No. 8, approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. However, if the company has such a need, then you can develop your own form. This is not prohibited by law.

Organizations of all forms of ownership, as well as individual entrepreneurs, must issue waybills. These entities must use transport to transport people and goods (luggage) for business purposes and for their own needs.

It happens that errors creep into the accounting log. The mistake made must be corrected according to the general rules (clause 7, article 9 of the Federal Law of December 6, 2011 No. 402-FZ):

- cross out an incorrect entry with one line so that it remains readable;

- make an o and indicate the correct entry;

- indicate the date the corrections were made;

- sign and full name of the employee responsible for maintaining the travel log book

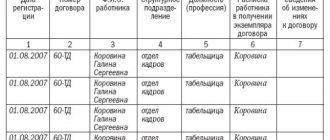

The procedure for filling out the traffic log, registering and issuing waybills

The log of movement, registration and issuance of waybills consists of two parts:

- A title page on which the name of the organization or individual entrepreneur, OKPO code, as well as the period for which the journal is filled out is written.

- The tabular part, which indicates:

- waybill number and date of issue;

- driver details and personnel number;

- car garage number;

- signatures of the persons responsible for maintaining the log: the driver - on receipt of the waybill;

- dispatcher (employee performing his functions) - about receiving documents from the driver;

- accountant - about checking and accepting the waybill for accounting.

A note is also made if necessary.

Information about all issued waybills is entered into the logbook for issuing waybills. There are no exceptions in this case. The journal has continuous numbering and is maintained in chronological order. After the journal is completely filled out, it is stitched, sealed and signed by the manager.

Keeping the journal is assigned to an employee appointed by order of the manager, or to an employee whose employment contract stipulates the responsibilities for maintaining a log of waybills.

Responsibilities for filling out waybills and their logbook can be transferred to another legal entity or individual entrepreneur on the basis of a service agreement. In this case, the responsibilities for filling out waybills and their logbook are assigned to the employees of the involved counterparty.

How long to store

Now let's talk about storing waybills. The period during which the company must ensure their safety is 5 years (clause 18 of section III of Order of the Ministry of Transport dated September 18, 2008 No. 152).

The retention period for the waybill is 5 years, subject to inspection or revision by the regulatory authority during this period. Based on this, we can conclude that if no inspection has been carried out within 5 years, then the organization does not have the right to write off waybills. You also need to understand that if the waybill is the only document confirming the harmfulness, danger, and severity of work, then its shelf life increases to 75 years.

However, the legislation does not establish a special procedure for storing these documents.

Waybills need to be stitched. This can be done using a stapler, thread or special equipment. The main thing is that after stitching it is possible to easily familiarize yourself with the documents and, if necessary, make copies. The company can take as a basis the instructions from the order of the Federal Archive of December 23, 2009 No. 76 and GOST R 7.0.8-2013 and arrange the storage of waybills according to the recommended rules.

Rule for everyone

Organizations and individual entrepreneurs engaged in the transportation of passengers and cargo must issue waybills. For these purposes, the head of the company appoints a responsible person.

A document must be drawn up for each vehicle that is engaged in the transportation of goods, luggage or passengers (clause 9 of Order of the Ministry of Transport dated September 18, 2008 No. 152). Moreover, this rule applies not only to motor transport enterprises - professional carriers, but also to ordinary organizations that use motor vehicles for their own needs. The main criterion is the presence of passengers or cargo.

The preparation of waybills solves a number of problems. Firstly, representatives of the Ministry of Transport, the State Traffic Safety Inspectorate, Roszdravnadzor and Rostrud can check the marks on the technical condition of the car and the employee’s medical examination, proving that the car is in good working order, and the driver has passed a medical examination and can drive it.

Secondly, the waybill is a primary document confirming the economic justification of the company’s expenses for the car (driver’s salary, fuel, etc.).