Hello! In this article we will talk about “white” wages.

Today you will learn:

- What does white salary consist of?

- What signs indicate an official salary and what are its advantages;

- Why is it beneficial to use black and gray earnings in labor relations?

In labor legislation there is not and will not be any other salary other than the official one. Theoretically, in an ideal society, all accrued earnings should be reflected in accounting documents and, therefore, taxes should be paid on the entire amount to the state treasury. But in practice, that is, in real life, the ideal scheme is violated, and along with the phenomena of illegal wages, the concepts of white, gray and black wages entered the colloquial language and took root.

Legislation

If we consider this issue from the point of view of legislation, then there are no types of wages. Only one is officially established - white, and it is regulated by Chapter 6 of the Labor Code of the Russian Federation. There are no restrictions on setting the size and payment procedure. However, the following aspects must be observed:

- the salary cannot be less than the minimum wage

- minimum payment frequency: 2 times a month

The Tax Code assigns wages the status of basic income and withholds a tax of 13% of the total amount.

Video about white and black salaries:

Signs of white wages

Official wages must meet the requirements stipulated by law. They represent mandatory characteristics of legal remuneration for work. It is not for nothing that the white color symbolizes the honesty and transparency of all the activities of the enterprise.

| Item characteristics | Description |

| Employment | An employee is hired officially, that is, he is on the staff. Has rights and obligations documented in the employment contract, employment order, salary regulations |

| Salary | Fully reflected in all of the above documents |

| Payment method | It is issued either in cash through the cash desk in the organization itself, or transferred to a bank card. As a rule, a large organization enters into a service agreement with a bank, and all employees are issued cards to avoid queues in the accounting department on payday. |

| Payout frequency | By law, payments must be made at least twice a month. This is an advance and the salary itself. The exact dates are set by the employer himself |

| Pay slip | All employees are given pay slips along with their salaries, where all payments are spelled out in detail and each bonus is spelled out. The sheet also shows the amount of income tax deducted. The employer is obliged to withhold income tax from salaries and pay it to the budget. The very presence of a detailed payslip indicates transparent accounting and that the organization is not hiding anything. |

| Employment history | The book is filled out in full accordance with the Labor Code: indicating the terms of work, position and reason for dismissal |

Types of salaries

So, there are three types of wages, described in Table 1.

| Name | Characteristic |

| White | This is the salary that is reflected in all accounting reports and documents. Its receipt is accompanied by the direct payment of taxes to all necessary authorities. A person with such a salary is an official employee and has a concluded agreement with the employing company. |

| Gray | Represents a semi-official type, in which a person is an employee, but his remuneration is divided into two types - white and black. The first is official and is listed in all documents; the second is issued in an envelope and is not reflected anywhere. Using a gray salary provides the employer with the opportunity to reduce the amount of taxes paid. The main nuance for an employee is that the amount reflected in official documents is lower than it actually is. |

| Black | Salary that is not reflected in any document. The employee who receives it legally has the status of unemployed and, as a result, is not on the payroll and cannot defend his rights. The entire procedure is based on a personal agreement between the employee and the employer, which is also not supported by anything. |

Regulatory regulation is available only for one - white, but in special cases it can extend to gray and black.

What an employer expects for a black salary:

"Gray" salary

This is the so-called intermediate option. Trying to sit on two chairs at the same time. Moreover, this option is common in both small and large enterprises. Size, as they say, doesn't matter.

The essence of the scheme is to divide the salary into two components: the official one, which includes all mandatory deductions, and the unofficial one, which goes “by the way.”

This scheme is most beneficial for the employer: by paying part of the salary “in an envelope”, he saves significantly on insurance premiums.

Differences between types of remuneration

Table 2. Main differences between all types of wages.

| View | Differences |

| White | officially enshrined in documents legal protects the rights of the employee and makes it impossible for him to deceive |

| Gray | legal and officially listed in the accounting records divided into two parts - official and black legal protection of an employee’s salary is possible, but only for the official part |

| Black | illegal is not listed in any documents, and the person is not an employee of the company protection of rights upon receipt is impossible |

The choice of one type or another should be based not only on short-term, but also on long-term benefits.

Gray schemes from a legal point of view

The law does not provide for any other form of settlement between the employee and the employer, except for a completely official one.

Formally, the “gray” payment scheme does not directly contradict the law, because Officially, the employee is charged the minimum wage and deductions from it, and he voluntarily agreed to receive the rest in an envelope.

With a completely black scheme, the payment is not fully documented and the employee is not documented for the position. Similar situations often arise in small individual entrepreneurs, where the employer does not want to deal with additional paperwork, paying taxes for each employee, changing the form of taxation, or maintaining additional accounting documentation. It is much easier for him to issue wages without documentary entries.

In this case, the employee is not insured in any way in force majeure situations and the only minor advantage in his situation is that he can leave his position without mandatory service.

What's more profitable?

It is impossible to determine the benefit of each salary in absolute terms - everything is individual. However, there are templates that will allow you to determine the most appropriate option:

- White - beneficial if the employee needs to receive official sick leave, as well as an old-age pension. Everything is taken into account and documented.

- Gray is beneficial when the employee does not care too much about the privileges of officialdom, and in exchange for them he is ready for increased wages.

- Black - there is a benefit only in cases where high pay is expected for work. You won’t have to pay any taxes or anything else—the full amount goes to the employee. However, there is a high risk of not getting it.

In some cases, they may intersect with each other, but basically everything is divided into similar profiles.

A little about salary in general

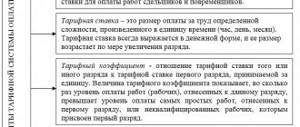

Wages are remuneration for an employee’s labor expressed in monetary form.

Its level depends on the complexity and amount of work, conditions, and qualifications of the performer. If work is paid based on a time period, the salary is time-based. If it is possible to keep track of the work performed, piecework payment is often used.

Salary is a broad and collective concept; it consists of several points that may differ in different organizations. But in general, salary refers to the total amount that the performer receives after deducting all taxes. All items can be easily tracked in the payslip, or “settlement”, which is issued to the employee every month.

Employee: is a white salary necessary?

So, what benefits and disadvantages does an employee have with an official salary (see Table 3).

| pros | Minuses |

| tax: depending on the circumstances, tax is withheld in the amount of 13% to 35% |

Some of them may no longer be relevant in the future due to changes in legislation.

Delay in payments

Finally, we’ll look at what to do if the official PO is delayed. So, how to force an employer to pay white wages? According to the law, the employer does not have the right to delay salary payments without special reasons - if the delay is 30 days or more, the employee has the right to contact the prosecutor’s office and the labor safety inspectorate. The employee is also entitled to compensation in the amount of 1/300 of the refinancing rate per day. Moreover, if there is a delay, employees may not fulfill their obligations and not come to the workplace.

Attention:

Today, delays are quite rare, since the labor inspectorate and prosecutor's office impose serious fines on the company for delays.

But before contacting the relevant authorities, we recommend communicating directly with the employer and finding out why the delay occurred and when approximately it will be paid. Due to the crisis, many companies have serious accounts receivable, which lead to similar situations. If you contact the authorities, it can finish off a company that is not firmly on its feet, and you will lose your job. It is best to negotiate with management if payments have been postponed for only a couple of weeks.

Employer: what does he get from his white salary?

Employers are also concerned with the type of wages they pay employees (see Table 4).

| pros | Minuses |

|

|

Important: the main role in analyzing the advantages and disadvantages for the employer is played by the jurisdiction in which the company’s main office is located.

Advantages of white wages

| Item characteristics | Description |

| Security | The employee has all the supporting documents in his hands; the employer will not be able to infringe on his rights, for example, by groundlessly depriving him of payments. Employee-employer relations in the financial aspect are as transparent as possible for both parties, manipulations are kept to a minimum |

| Prospects | The “whiteness” of salaries indicates the solidity and reliability of the company. Such companies value their reputation and are aimed at long-term cooperation with both partners and employees. Therefore, you can think about a career in this organization |

| Credit history | With the active development of lending systems, the issue of income confirmation, in particular, the 2-NDFL certificate, has become acute. It lists the person’s income by month for the requested period; on the basis of this certificate, the bank makes a decision on granting a loan or mortgage. A certificate that corresponds to reality can only be issued by the accounting department of “white” employers |

| Decent pension | The official employer, among other social contributions, makes payments to the pension fund, and at its own expense. Their size directly depends on the amount of accrued wages |

| No questions from the tax authorities | All purchased goods with a white salary will be easily explained - otherwise the origin of expensive purchases will be difficult to justify |

| Guaranteed minimum wage | According to the law, the employer will not be able to pay less than the minimum approved by the state. The minimum wage differs in different regions of the Russian Federation. The federal minimum wage from January 2021 was 11,280 rubles. |

Risks of gray and black schemes

All the main risks of gray and black wages are based on non-payment. The fact that they are not officially counted plays a key role in the case of applying for a loan from a bank or forming pension savings. The lack of legal protection for employees also increases the risk of being deceived.

A partial exception is the gray salary, since it contains part of the white one. As a rule, it is always less, which has consequences for official accounting. However, with it you can count on at least some payments.

Advantages and disadvantages of white salary

Now a little about the positive and some negative aspects of legal wages. Among the advantages of official income, it is worth dwelling on the following:

- All salaries are fully calculated and controlled by the employee. He can calculate in advance the amount of income due to him. Taxes are calculated from this salary and transfers are made to insurance and pension funds. This means that the worker will be compensated for the entire period of incapacity for work (if such occurs), benefits will be paid to the pregnant woman before and after the birth of the baby, and payment for the due leave will be calculated correctly and guaranteed, the duration of which cannot be less than that established by law (28 days).

- If the employment relationship is terminated, the worker will receive full payment for all periods of non-vacation leave, severance pay (in case of layoff), and in some cases even additional financial assistance. The latter will depend on the terms of the company's collective agreement.

- The ability to confirm your level of regular official income with a certificate from your employer allows you to apply for a loan from a bank and get money for a mortgage. After all, financial institutions use government databases for inspections. They can make requests to the company to confirm the level of solvency of the employee.

- Considering that personal income tax is also deducted from wages, in some cases a citizen can claim tax deductions and return part of this amount from the state budget. For example, when paying for your own training.

Formation of tax payments

A greater understanding of how white wages work will come from the tax calculation example (see Table 5).

| Type of tax | Volume |

| Personal income tax | 13% |

| Pension Fund | 20% |

| FSS | 3% |

| FFOMS | 5% |

| Insurance | 0.3% |

Total: if an employee receives 40,000 rubles, then 17,280 rubles go to the state. — the employer pays this difference.

Why do employers use color-coded pay schemes?

Many companies operating in Russia use a gray remuneration scheme in practice. The main reasons are as follows:

- Taxes, contributions paid by the employer for the employee, plus the white salary itself eat up quite a portion of the organization’s budget. And in order to somehow reduce costs, but at the same time maintain official labor relations with the employee, a gray scheme was invented.

- Social guarantees, which are attractive for the employee, are, on the contrary, disadvantages for the employer. Therefore, companies with envelope payments can deprive their employees of vacation and sick leave without incurring any punishment for this.

Employer's responsibility to pay salary

An employer who does not pay wages on time may be subject to the following liability:

- Disciplinary. Provided by Art. 192 of the Civil Code of the Russian Federation - implies a reprimand, reprimand or dismissal of the responsible person.

- Material. Regulated by art. 234 of the Civil Code of the Russian Federation - the employee is compensated for delayed wages.

- Administrative. Liability is provided in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation - a fine of up to 70,000 rubles is issued.

- Criminal. Arrest for up to two years is expected if intentional retention is discovered during the investigation.

Responsibility is imposed on an individual basis.

What are the risks of circumventing the law?

Receiving unofficial wages is a direct violation of the law both on the part of the employer and on the part of the employee. Responsibility is provided to the fullest extent:

- For incorrect calculation of wages - a fine of 20% of the unfixed amount. For a deliberately low figure, for “black” payments - 40% of the unpaid amount.

- For the employer - an additional fine under Article 199 of the Criminal Code, if the amounts are large enough.

- For an employee who is caught receiving unofficial payments - prosecution for collusion with the employer.

Knowing this prospect, not everyone will agree to work according to the gray and black schemes. But that is not all. If the employer only faces punishment under the law, then the consequences for the employee can be much more severe.

Complaint to the Federal Tax Service and the Labor Inspectorate

You can write a complaint about the payment of black wages in free form, but to speed up the consideration of the application it is better to use a template.

You can submit in three simple ways:

- contact the Federal Tax Service or TI in person: come to the office and submit a completed application

- send via a form on the official website of one of the services

- send a message by mail: registered letter to the address of the territorial office of the service

The processing time for an application is usually 30 days.

What to do if you don’t pay a black salary

First of all, you should talk to the manager, but if he does not make concessions, then there is only one way out - appealing to the Federal Tax Service and the court. In the vast majority of cases, a court case for the payment of black wages is organized, unless the management decides to settle everything out of court. However, in order to win the debate, it is necessary to provide significant evidence such as payment receipts, witness statements, photographs, etc.

So, how profitable and whether it is worth receiving a white salary - everyone will decide for themselves. However, it is always worth paying special attention to this issue at the interview stage. This will avoid disputes in the future.

Top

Write your question in the form below

The concept of “black wages”

“Black” is a salary that is awarded to a person who is employed completely unofficially. This term appeared in the mid-90s of the last century and has since become firmly established in everyday use. It means a salary that is not documented anywhere.

Black income is received by people who are informally employed. They are greatly more beneficial to employers. The advantage for them is the absence of the need to pay taxes and fulfill social obligations. For ordinary employees, there are some disadvantages, among which the most obvious are the following:

- lack of all rights;

- inability to go on vacation;

- unpaid sick leave.

In addition, the company can fire an unofficial employee at any time and certainly will not pay him if any accident occurs at the enterprise. It is very difficult to ignore such disadvantages.

Unfortunately, not all of our citizens understand the incorrectness of calculating black wages. According to surveys, more than 40 percent of Russians agree to work without registration. At the same time, about 20% are not ready to completely reject this format of relations with the employer. Nevertheless, the situation is gradually improving - back in 2010, more than 51% showed a willingness to receive unpaid wages.