Payment terms

The procedure for determining the amount of monetary remuneration for the implementation of labor functions is regulated by Chapter 21 of the Labor Code of the Russian Federation.

Article 136 establishes payment terms - no less than every 15 days. The exact date is determined in accordance with the clauses of the labor regulations at the enterprise, clauses of the collective agreement and the contract between the employer and his employee.

In this case, a specific date should not exceed 15 calendar days from the end of the period for which the monetary reward was accrued. The Government has also approved specific situations in which other deadlines may be established.

If the day of payment of funds coincides with a non-working day, the provision of the salary occurs on the previous day. As for vacation pay, they are provided three days before it starts.

Example 1. Salary calculation for an employee’s fixed salary for August 2021.

The editor of the Profi publishing house, Snezhana Borislavovna Razumovskaya, receives a monthly salary of 50,000 rubles. rub. She was not given additional payments, bonuses or other payments for August. It is necessary to calculate the salary amount for August.

| What to consider when calculating | ||

| 1 | 2 | 3 |

| Fixed salary amount: 50 thousand Russian rubles. rub. | Number of workers days in August 2021 (according to the production calendar): 22 | Of these, fully worked out by the editor Razumovskaya S.B.: 20 workers. days (since the employee was provided with 2 unpaid days off) |

It follows that you need to calculate the monthly salary amount as follows: 50,000 / 22 * 20 = 45,454 RUR. rub. From this amount, personal income tax is withheld in the amount of: 45,454 * 13% = 5,909 RUR. rub.

In total, editor Razumovskaya S.B. will receive for August 2021: 45,454 – 5,909 = 39,545 RUR. rub.

How to calculate salary based on salary

When calculating, three indicators are required to be taken into account:

- salary amount;

- income tax;

- number of days worked.

If additional circumstances are excluded (such as the provision of additional payments to the employee or the deduction of part of the funds from his salary), the procedure for establishing the salary amount is as follows:

- The established salary is divided by the number of working days of the month.

- The resulting value is multiplied by the actual days worked.

- The income tax for individuals is determined to be 13% of the product.

- Personal income tax is deducted from the amount and the employee’s salary is received.

To fully understand the calculation process, it is worth looking at an example with specific numbers.

- The salary is 20 thousand rubles.

- There are 18 working days in a calendar month.

- The employee took 3 days off without pay - the actual days worked were 16.

Based on these conditions, the calculation occurs as follows.

20,000/18*15=16,666 rubles – salary without tax deduction.

16,666 – (16,666*13%) = 14,500 rubles – salary in hand.

The procedure for determining the salary amount is quite simple, but it is worth considering that in real practice there are practically no such situations, since additional indicators are taken into account - bonuses, allowances, fines, deductions, etc.

If a person did not work on holidays

No one should lose their salary during the New Year holidays. In January, neither those who work for time payments nor those who receive piecework will receive less wages. It is calculated in this order:

- under the salary system, the full January salary is paid without reduction for days falling on the period from 01/01/21 to 01/10/21;

- how much an employee will receive for the period of work from January 1 to January 15 with a piecework or hourly salary - he is entitled to additional amounts for all days falling on non-working days in January, the amount of such payments is established by internal regulations, labor or collective agreement.

How is salary calculated based on salary in January 2021?

For “salary employees” who have worked the entire month, the final salary for January will not change compared to other billing periods. The accounting department will calculate the salary in full. If it is 35,000 rubles, the person will receive it. The average daily earnings will be higher, since the first month of the year has only 15 working days. For those salaried employees who were sick or went on vacation in January, their earnings will be significantly less - for each day they miss, they will lose more.

How are wages calculated for hourly wages for January?

“Hourly workers” also do not lose their salary in a short month if they have worked it in full. For them, it is not the average daily earnings that are calculated, but the hourly rate. But it only matters if the month is not fully worked out. Then earnings will decrease significantly, because with a small number of working hours (120 in total), the hourly rate is higher than usual.

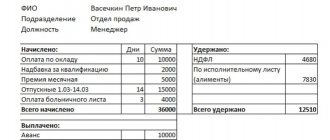

Statement form

Salaries are calculated by filling out a special statement - the final document, which reflects the final salary amount. Registration occurs both in the case of issuing funds through the cash register and when they are transferred to an account at a credit institution.

There are three forms in accounting:

- Calculated T-51 is the primary form of financial statements. Used if an employee receives accruals to his current account. If the company has chosen a non-cash payment method, then completing other forms is not necessary.

Payroll form T-51 - Payment T-53 - designed to provide salary not only to employees of the enterprise, but also to hired workers. The main difference from the previous statement is that T-53 does not indicate the number of actual working hours.

Payroll T-53 - Settlement and payment T-49 - the peculiarity of this form is to simplify the document flow at the enterprise, since the statement is a combination of the two previous ones. Used when paying employees in cash.

Payroll T-49

The most widely used calculation form is T-51.

Attention! The file cannot be used as a document. It is for informational purposes only.

Determining the amount of salary for 1 day is very simple: divide the fairly established monthly salary by the number of working days in a specific period. The resulting amount will reflect the daily monetary remuneration for performing labor functions.

Part-time work

In accordance with the norms of the Labor Code of the Russian Federation, if an employee performs prescribed work tasks on a part-time basis, then the salary must be calculated according to the actual time worked. In this case, the minimum wage (the standard of which depends on the region) is adjusted according to the quantitative indicator of labor hours.

To calculate the salary the following formula will be used:

ZPn=Ok/Chst*Chf,

Where:

- Ok – established salary;

- Chst – number of hours during a full working day;

- Chf – the number of hours actually worked.

An employee can switch to part-time work at his own discretion after receiving appropriate permission from his superiors.

Less than a month

It is worth understanding that the salary is paid to the employee in full if he performed the prescribed functions for the entire prescribed period. In the case of working for less than a full month, an employee can only count on part of the monetary remuneration, which is determined proportional to the number of days when the person actually worked.

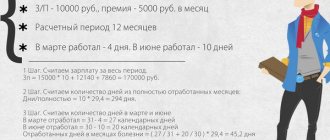

Calculating wages for a salaried employee who has worked for less than a full month

The formula in this case will look like this:

ZPn=Ok/Dst*Df,

Where:

- Ok – salary for a full month;

- Dst – number of standard working days;

- Дф – number of working days actually worked.

Calculation for an incomplete month is relatively often used in accounting practice, since this formula is considered relevant if the employee took time off, vacation, sick leave, etc.

How are night hours calculated?

Each hour of performing prescribed work tasks at night is calculated at an increased rate when compared with work under standard conditions.

The exact amounts are established in accordance with the clauses of the collective agreement, the terms of the employment contract, as well as the provisions of other local regulations and are adopted only taking into account the opinions of representatives of the organization’s employees (Article 154 of the Labor Code of the Russian Federation).

Payment for after hours and night hours

Moreover, this value should not be lower than the positions approved by the Government of the Russian Federation together with the Russian Tripartite Commission for the Regulation of Social and Labor Relations.

Shift work schedule

In accordance with Article 103 of the Labor Code of the Russian Federation, working on a shift schedule means performing labor functions in several shifts. It is usually introduced when the duration of the production process becomes higher than the established norm.

Remuneration is based on actual time worked. Accounting is carried out in special timesheets (forms approved by Order No. 173n): a timesheet for the use of working time and a salary sheet.

The possibility of implementing this regime should be reflected in the regulatory acts of the organization and the employment contract with employees.

After sick leave

Payment by an employer of funds to its employee on sick leave occurs taking into account the following factors:

- salary amount for the last 2 years;

- insurance experience;

- the number of working days when the patient was treated at home.

Scheme for calculating sick leave

When calculating, the main value influencing the amount of payments is length of service:

- if the period is less than 5 years - 60% of the average daily earnings for the last 24 months;

- if the period is from 6 to 8 years – 80%;

- if the period is more than 8 years – 100%.

The setting of salary after leaving sick leave occurs in accordance with the already familiar formula - the salary is divided by the number of working days in the month and the number of days actually worked.

Vacation

As for calculating wages for an employee who has just taken his official vacation, in this case the number of days that he still has time to work in the current month is important.

The value itself is determined simply: the salary is divided by the number of working days in the established period and by the number of days actually worked.

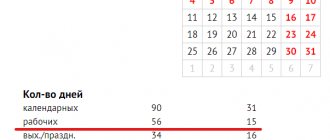

How to calculate if an employee worked on holidays

The January holidays will last from the 1st to the 8th, with the addition of two days off - January 9th and 10th - for those on a five-day vacation. Workers on a six-day workday go to work on Saturday, 01/09/2021. If the employee had to work on holidays, the employer is obliged to pay an increased amount for the work or provide an additional day of rest.

According to Art. 153 of the Labor Code of the Russian Federation, payment for work on weekends and holidays is made at least double the amount.

IMPORTANT!

If the employee has chosen an additional day of rest, he will still have to calculate additional pay for work on holidays.

The accountant worked during the January holidays, from the 4th to the 6th. No time off was provided; the entire month was worked. Here's how to calculate your salary for January 2021, taking into account holidays:

- Determine the accountant's salary: 45,000 rubles.

- Find out the cost of one holiday: 45,000 / 15 days. × 2 = 6000 rub.

- Calculate additional payment for holidays: 6000 × 3 days. = 18,000 rub.

Total income will be 45,000 + 18,000 = 63,000 rubles.

If the employee worked only half of the holiday, then calculate the additional payment based on the actual time worked.

Let's change the conditions of the example and make a calculation for the accountant if he took three days off. Let's look at how wages are calculated for January, taking into account holidays:

- We calculate the additional payment for work during the New Year holidays: 18,000.

- We calculate the salary: 45,000 / 15 days. × 16 days = 48,000.

- We determine the total January income: 18,000 + 48,000 = 66,000.

IMPORTANT!

If an employee only worked half a day on a holiday, he is entitled to a full day of rest. Such clarifications are contained in the letter of Rostrud No. 731-6-1 dated March 17, 2010.

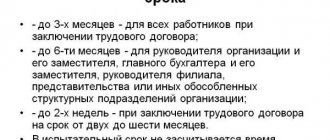

Payment after dismissal at your own request

Upon dismissal at his own request, the employee receives mandatory payments. Adjustment of their size depends on the following indicators:

- number of days worked;

- number of days of unused vacation;

- amounts that were accrued, but due to some factors were not paid to the employee on a timely basis.

Payments upon dismissal at one's own request

The payment terms in case of dismissal at one's own request are regulated by Article 140 of the Labor Code of the Russian Federation. According to established standards, the full calculation is carried out as follows:

- if the employee was at the workplace on the established day of dismissal and followed work functions, then payment of all amounts due must occur on the same day;

- otherwise, the funds will be received the next day after the dismissed employee made demands to the employer for a final settlement;

- If there is a disagreement between the parties about the amount of payments, then the employer is obliged to provide his former employee with an undisputed amount within the specified period.

It must be taken into account that the calculation procedure is clearly regulated by this legislation. Therefore, in case of violation of deadlines or failure to comply with other prescribed requirements, the employee has the right to file claims against the employer through the rights protection inspectorate, the prosecutor’s office or various judicial authorities.

Important! If found guilty, the defendant will be subject to various financial penalties.

Features of salary calculation for full and partial months

Calculating the amount of salary to be paid, both for a full and partial month, is essentially calculated according to the same principle. In order to calculate the payment, you need to know:

- monthly salary;

- number of workers days for a specific month;

- of which the number is slave. days actually worked;

- additional payments, allowances, bonuses and other incentive payments that are due to the employee for a given month.

Taking into account the listed amounts, you need to calculate the remaining (second) part of the salary . This is done according to the following formula: fixed salary / number of workers. days per month * number of workers worked. days for the same month.

If there were additional payments for a given month, then the above formula is slightly modified. The second remaining part of the salary is calculated as follows: (fixed salary + allowances + additional payments + bonus + other incentive payments) / number of workers. days for a specific month * day of work. days actually worked.

It should be taken into account that, according to Art. 91 of the Labor Code of the Russian Federation, the standard working week includes 40 hours, no more. Meanwhile, if an employee was on vacation, registered for work not at the beginning of the month (and in other situations), he may work less (for the week and for the month as a whole). In addition, by agreement with the employer, he can work 4 slaves. days per week or switch to a 6-7-hour shortened day.

These and other agreements reached regarding changes to the work schedule are subject to formalization. Under these circumstances, the initiative can come from the employee himself - then he writes a statement about his transfer to a specific work schedule. Next, the employer puts a visa on the application and it is transferred for subsequent processing to the personnel department.

What is typical is that the fewer hours (days) a person works, the less he receives. It is self-evident, with a reduced slave. day (week) earnings will be less. In such situations, the salary will be calculated using the first formula: salary / number of workers. days per month * number of workers worked. days in fact.

How to calculate the regional coefficient?

In regions with severe climatic conditions, high levels of radiation or variable terrain, a regional coefficient is added to the wages of workers (Article 148 of the Labor Code of the Russian Federation).

Regional coefficients for wages

Its size is established directly by a decision of the Government of the Russian Federation separately for each subject of the country. There is no general document that specifies all the values - a new decree is issued for each region.

For example, the lowest coefficient (1.15) is typical for the regions of the Ural Federal District.

Important: the indicator is not applied to the salary, but to the total amount before the tax on the income of individuals is removed from it.

In particular, when calculating, you will need to add up the salary with all allowances, and multiply the resulting amount by the established coefficient. It is worth considering that one-time additional payments are not taken into account - this applies to financial assistance and hospital payments.

In Chelyabinsk, an employee’s salary is 20 thousand rubles, the bonus is 3 thousand rubles. The calculation taking into account the coefficient is as follows: (20,000 + 3,000)*1.15=26,450 rubles - before tax.

Issued in hand - 26,450 - 13% = 23,012 rubles.

Withholdings and taxes

All payments for work on weekends (holidays) are subject to personal income tax and insurance contributions (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation, clause 1, article 420 of the Tax Code of the Russian Federation) in the usual manner. Such payments are recognized as labor costs in accounting and tax accounting, including under the simplified tax system (clause 3 of article 255, clause 6 of clause 1, clause 2 of article 346.16 of the Tax Code of the Russian Federation). If a person worked on holidays, the second salary for January is also subject to personal income tax and insurance premiums are charged on it.

So, the salary for the month in which any of the days listed in Art. 112 of the Labor Code of the Russian Federation, does not decrease compared to a normal full month. On the contrary, going to work on such days provides an opportunity to either increase your salary or earn an additional day off.

Legal documents

- Article 112 of the Labor Code of the Russian Federation

- Art. 112 Labor Code of the Russian Federation

- Art. 153 Labor Code of the Russian Federation

- Art. 153 Labor Code of the Russian Federation

- Art. 208 Tax Code of the Russian Federation

- Art. 420 Tax Code of the Russian Federation

- Art. 255

- Art. 346.16 Tax Code of the Russian Federation

- Art. 112 Labor Code of the Russian Federation

Accrual of piecework salary

The piece-rate payment system involves charging a set amount for each individual unit of output produced by an employee. In other words, his material reward depends on the amount of work performed.

The calculation is carried out according to the formula:

ZP=Unit*T+Unit*Tsv,

Where:

- Units – number of units produced;

- T – tariff per unit;

- Units – the number of units produced in excess of the norm;

- Tsv – tariff per unit above the norm.

Piece payment systems

In most cases, payment occurs for a period equal to a calendar month. But this condition can be changed - it all depends on the type of work and the number of people involved in the manufacture of products.