Good day. If anyone doesn’t know, Stefania Volna advises and advises you. I am telling you about my experience and knowledge in jurisprudence, which in total is more than 15 years, this makes it possible to give the correct answers to what may be necessary in various situations and now we will consider - Dismissal by agreement of the parties: compensation, application. If in your particular case you need an instant answer in your city or online, then, of course, it is better to get help on the website. Or it’s even easier to ask regular readers who have previously encountered the same question in the comments.

Attention please, the data may not be relevant at the time of reading, laws are updated and supplemented very quickly, so we look forward to your subscription to us on social media. networks so that you are aware of all updates.

When thinking about how to calculate the amount that a resigning employee will receive, it is necessary to take into account personal income tax and insurance premiums. According to the Tax Code of the Russian Federation, the employer pays a tax at a rate of 13 percent to the state treasury on wages not previously transferred and compensation payments for unused vacation. They are also subject to insurance premiums. Severance pay is exempt from deduction of income tax if its amount does not exceed the average three salaries, and for the regions of the Far North and equivalent - 6 average salaries. Insurance contributions are not deducted from severance pay if it does not exceed this limit. The amount of compensation above this threshold is subject to taxation, and an insurance fee is also paid from it.

The Labor Code of the Russian Federation does not provide for mandatory payment of severance pay for this type of dismissal. But Article 178 notes that the parties to the main agreement consolidating the employment relationship may provide for the transfer of compensation to the employee in other cases, including upon termination of mutual obligations by agreement. If the local regulations of the enterprise do not contain rules on the calculation of such payments, the parties independently determine the calculation of the amount and the calculation procedure. The following options exist:

Severance pay upon dismissal by agreement

According to the law, settlements with an employee upon dismissal by agreement of the parties must be made immediately on the day of resignation in full. This procedure is formalized by a certificate in form T-61. If on the day of dismissal the employee’s severance payment is made to him no later than the next day after his request for this. Otherwise, the company will be subject to administrative sanctions. The calculation note is filled out by an employee of the HR department and an accountant (you can download the form here). It should indicate:

IMPORTANT. Do not forget to give the employee a pay slip (the employer must develop and approve the form of this document himself). If payments are made in several stages, then in each case a new payslip is issued.

Based on the agreement, a dismissal order is issued (you can use the unified form No. T-8, approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1). In this case, in the line (column) “Grounds for termination (termination) of the employment contract (dismissal)” you must indicate: “Agreement of the parties, paragraph 1 of part one of Article 77 of the Labor Code of the Russian Federation.” And in the line (column) “Base (document, number, date)” you should write: “Agreement dated_ No. on termination of the employment contract dated_ No_”, or “Additional agreement dated_ No_ to the employment contract dated_ No_”, depending on how the agreement was concluded.

We recommend reading: Benefits for Labor Veterans St22 I23 of the Law on Veterans in 2021

How to dismiss by agreement of the parties: entry in the work book

The dismissal agreement may stipulate the employer’s obligation to pay the dismissed employee severance pay. For commercial organizations, the amount of such benefits is not limited by law (Article 349.3 of the Labor Code of the Russian Federation). In other words, the employer and employee can agree on absolutely any amount of compensation (severance pay).

If severance pay is established by a local act, an employment contract or a dismissal agreement, then these documents usually stipulate not only the fact of accrual and the amount of compensation, but also the timing of the payment of funds to the employee. For example, a time period after dismissal may be agreed upon during which the amount will be issued.

Compensation under additional agreement upon dismissal

In addition, the employment contract or collective agreement may provide for other cases of payment of severance pay, as well as establish increased amounts of severance pay. According to Art. 57 of the Labor Code of the Russian Federation, if, when concluding an employment contract, no conditions were included in it, these conditions can be determined by a separate annex to the employment contract, or by a separate agreement of the parties, concluded in writing, which are an integral part of the employment contract. Thus, expenses in the form of payment of severance pay provided for in the additional agreement to the employment contract can be taken into account as part of expenses that reduce the tax base for corporate income tax. Labor legislation defines a list of situations in which the employer is obliged to pay severance pay upon termination of an employment contract. For example, severance pay in case of liquidation of a company, reduction in the number or staff of employees, etc. At the same time, the Labor Code allows for other cases of payment of severance pay to be provided for in an employment or collective agreement 1 . Sometimes a company agrees to pay an employee an additional one-time compensation upon dismissal and establishes such payment in the agreement on termination of the employment contract. However, this compensation is not provided for either in the list of mandatory payments under labor legislation, or in the labor or collective agreement. According to the courts, the agreement to terminate the employment contract is not part of it. It does not regulate relations related to the employee’s performance of a labor function. In this case, the income tax base cannot be reduced by the costs of paying compensation (compensation) to an employee upon dismissal 2 . However, the company may enter into an additional agreement with the employee to the employment contract, which will provide for the payment of severance pay upon its termination by agreement of the parties. The Russian Ministry of Finance and tax authorities in their recent letters explained that costs in the form of severance payments can be taken into account as part of expenses that reduce the income tax base. To do this, it is necessary 3 that such payment be provided for in an employment contract, an additional agreement (which is an integral part of it) or a collective agreement. Moreover, the text of the additional agreement must indicate that it is an integral part of the employment contract. Otherwise, the accounting of expenses for payment of compensation may be challenged by tax authorities. Below we provide a sample additional agreement to an employment contract. In earlier letters, the Russian Ministry of Finance opposed reflecting, when calculating the income tax base, the costs of compensation payments under an additional agreement to resigning employees 4 . Officials believed that these compensations are not directly provided for in Russian legislation, they do not meet the criteria of tax legislation and cannot be reflected as part of labor costs 5 .

Payment terms

Whether an employee will receive this type of compensation payment upon dismissal or not depends on many factors. Some organizations have a collective agreement that stipulates additional cases of assigning severance pay.

Useful video

The recorded earnings should include those payments to the employee that are assigned in the billing period and that are related to the employee’s work function. That is, salaries and bonuses should be taken into account; sick leave and maternity benefits, payment for business trips and vacations, and financial assistance should not be taken into account.

A reduction in production volumes, sales of products, goods and services inevitably leads to the need to reduce the number of personnel. Which categories of citizens are preferable and painless to dismiss? When a pensioner is laid off, is a benefit paid, and in what amounts is it tax deductible? – questions that arise for employers.

Severance pay is recognized as compensation in cases documented. Payment cannot be provided for dismissal at the initiative of the employer in accordance with the definition of the Supreme Court of the Russian Federation No. 5-KG 13-125 dated December 6, 2021. On this basis, a veiled severance pay to pensioners in case of staff reduction, formalized on paper as a payment by agreement of the parties, is considered illegal. This applies not only to preferential taxation, but can be interpreted as a violation of constitutional rights, since a pensioner has equal rights along with other categories of citizens.

Procedure for calculation and taxation

Termination of a fixed-term or open-ended contract under this article is mutually beneficial for both participants. Personnel changes include the veiled dismissal of retirees due to staff reductions, and compensation in the amount of several salaries significantly improves the financial situation compared to the payment of 2 salaries due directly upon reduction. Judicial practice in relation to the payment of compensation in the amount of the 3rd salary in the absence of employment is ambiguous, since receiving a pension, according to the courts, is nothing more than a benefit that protects against unemployment.

It is necessary to follow a certain algorithm of actions: first, you must put the agreement reached that the employee is leaving by mutual agreement in writing. When drawing up the document, the participation of the employee himself is allowed; he has the opportunity to offer more favorable conditions, including payment of compensation and its exact amount. It is advisable to indicate the following details in the agreement:

And yet: how to resign by agreement of the parties without problems for all participants in the process, if there are some specifics? The procedure for such termination of labor obligations is reminiscent of the procedure for terminating an employment contract at the citizen’s own request, but there are differences. Specifics of the process of terminating a contract on this basis:

Benefits and risks for the employer

In Russia, legislation provides the parties to an employment contract with the opportunity to separate by mutual consent. This method of terminating the relationship between an employee and an employer differs from dismissal at the employee’s own request. Article 78 of the Labor Code provides for such grounds for termination of a contract as dismissal by agreement of the parties. This option for ending cooperation is optimal if the relationship does not work out and is beneficial for each party.

We recommend reading: Scholarship for Newlyweds

The amount of compensation upon dismissal, upon mutual agreement of the parties, must be fixed in the relevant written agreement. The law does not establish a strict amount of severance pay. Based on this, the employer has the right, when establishing it, to be guided by local documents or to specify the amount in the agreement on termination of the employment contract.

Compensation upon dismissal by agreement of the parties

Include the costs of paying employees severance pay, average earnings for the period of employment and compensation upon dismissal as part of labor costs. Moreover, expenses can include both benefits paid in accordance with labor legislation and additional compensation provided for in an employment or collective agreement. This follows from paragraph 1 and paragraph 9 of Article 255 of the Tax Code of the Russian Federation and is confirmed in the letter of the Ministry of Finance of Russia dated January 30, 2015 No. 03-03-06/1/3654. We are a municipal unitary enterprise, a common taxation system. Profit only at the end of the year. During the year, we fired people under the “Agreement of the Parties” (that’s what the order said and there is a signed agreement with each employee). We made the payment from account 91.2 “Other expenses”. The payment was made in a lump sum, in the amount of 2 or 3 times the average salary of the employee. Can we take these expenses into account in tax accounting and attribute them to profit in account 91.2 (NU)?

Please note => Commission on benefits and pensions for Chernobyl victims at the regional state administration of Donetsk

Severance pay upon dismissal by agreement of the parties

A frequent condition for dismissal by agreement of the parties is the payment of compensation to the employee, while the amount of such payment is not regulated - neither minimum nor maximum, payment is made in the amount agreed upon by the parties. To formalize the payment, there is no need to indicate the amount in the dismissal order, but the amount of payment must be indicated either in the local act, or in the employment contract, or in the termination agreement. In addition to dismissal at the initiative of the employee or employer, the employment contract may be terminated by agreement of the parties in accordance with Art. 78 of the Labor Code of the Russian Federation at any time and on the terms agreed upon by the parties. Often the parties agree on the payment of severance pay upon dismissal by agreement of the parties.

Benefits and risks for the employer

First of all, we note that there is no conflict with the outgoing employee, who receives an absolutely neutral entry in the work book, as well as additional cash payments. Consequently, the chances of future complaints and litigation are reduced (especially if the “compensation” is paid on time and in full).

We invite you to familiarize yourself with what taxes are paid on compensation for leave upon dismissal

If they do appear, then the fact of the stability of the agreement, mentioned as a “minus” for the employee, as a basis for dismissal, turns into a “plus” for the employer. If this document is properly executed, the employee’s chances of being reinstated at work (and therefore receiving payment for forced absence and moral damages) are not great.

However, we cannot say there is a complete absence of risks in the event of termination of the employment relationship by agreement of the parties. Thus, if an employer delays payment of the amounts specified in the agreement, he faces a fine under Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (for legal entities - up to 50 thousand rubles, for individual entrepreneurs - up to 5 thousand rubles).

https://www.youtube.com/watch?v=ytcreatorsru

Also, the fact that dismissal occurs “by agreement” does not mean that the employer will not be responsible for violations committed when preparing the relevant personnel documents (dismissal order, work book, etc.). In this situation, a fine can be assessed under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation (for legal entities - up to 50 thousand rubles, for individual entrepreneurs - up to 5 thousand rubles).

Create a staffing schedule for free using a ready-made template

There are advantages to dismissal by agreement of the parties and for the employer:

- simplicity of the dismissal procedure;

- lack of obligation to indicate the reason for termination of cooperation;

- the ability to minimize the negative consequences of parting with an unwanted employee (especially when there is a risk of leaking valuable information);

- the opportunity to negotiate the most convenient conditions for both parties;

- the opportunity to reduce staff in this way and get rid of an unwanted employee;

- challenging such an agreement in court is quite problematic.

The only risk is that pregnant women have the right to withdraw their own application, according to judicial practice.

Pregnant women

On accounting for expenses of payments made upon dismissal of an employee by agreement of the parties

In connection with the business reorganization, agreements were concluded with employees of the CJSC on the termination of employment contracts (including those that are an integral part of the relevant employment contracts), which stipulated the date of dismissal and the amount of payment associated with dismissal. The workers were dismissed on the basis of paragraph 1 of Article 77 of the Labor Code of the Russian Federation (dismissal by agreement of the parties). This legal position was developed in the Resolutions of the Federal Arbitration Court of the Moscow District dated August 22, 2013 in case No. A40-147336/12-115-1029 and No. F05-14514/2013 dated November 20, 2013, which directly applied it to the payment of compensation upon dismissal of employees due to agreement of the parties.

Order to dismiss an employee

The procedure for dismissal by agreement of the parties is reminiscent of the procedure for terminating an employment contract at the citizen’s own request, but there are also differences.

Specifics of the dismissal process on this basis:

- simplicity of design. The law only indicates the fact that there must be an agreement, the form is not defined. However, in order to avoid legal disputes, and proceedings in the field of labor law in judicial practice are considered one of the most difficult, it is recommended to follow a written form. And yet, the dismissal of an employee by agreement of the parties is usually quite simple; only a clearly expressed and documented expression of the will of the participants in the process is necessary;

- there is an opportunity to propose and agree on the terms of termination of the relationship. The employer and employee have the right to establish the period of work or the fact of its absence, the procedure for transferring cases, additional compensation, etc.;

- the desire must be mutual, pressure is unacceptable;

- the main difference from leaving voluntarily is the inability to revoke the decision to dismiss. It will not be possible to terminate this agreement unilaterally, since the document is signed by two persons at once. In this case, a separate document must be drawn up. There is one point here: the administration can terminate the contract by mutual consent with any employee, even single mothers or pregnant women. But pregnant women can refuse to fulfill such an agreement unilaterally: this is judicial practice based on the opinion of the highest courts (Determination of the Supreme Court of the Russian Federation dated September 5, 2014 No. 37-KG14-4).

The benefits of dismissal on this basis for an employee:

- the citizen himself can initiate the procedure;

- the specific reason for the desire to terminate the employment relationship may not be specified;

- there are no time limits for filing a resignation letter;

- you can reach an agreement with the employer at any time during your work activity, even during periods when dismissal is prohibited by law (for example, on vacation, if the parties have agreed on this);

- you can agree on the terms of termination of the contract and propose your own;

- this reason for termination of the relationship does not in any way affect the employee’s reputation;

- dismissal by agreement of the parties is often used as an alternative to expelling an employee due to his fault

Employee risks:

- the decision cannot be revoked;

- the trade union in this case does not exercise control over the actions of the employer;

- The law does not indicate the mandatory payment of severance pay; this is done only by separate agreement or if such a condition is in the collective agreement.

Some categories of workers have certain guarantees due to their work schedule or special status. Let's consider how to formalize dismissal with them by agreement of the parties.

Pregnant women

Women on maternity leave have a number of rights, including when terminating an employment contract. If an agreement is concluded to terminate the contract at the mutual request of the parties, no benefits apply (all payments and compensations must be specified in the additional agreement, otherwise the pregnant woman will not receive them).

Infringement of the rights of citizens in connection with reaching a certain age is prohibited by Article 3 of the Labor Code of the Russian Federation; the procedure is carried out in the same manner as in relation to other employees; pressure or other coercion is prohibited.

Part-timer

The dismissal procedure by agreement of the parties is carried out in the same manner, but the dismissal will be recorded at the main place of work.

If dismissed by agreement of the parties, the employee is not required to notify the employer two weeks in advance. Consequently, such a “resignation” is possible at any time, including “one day”. In certain situations, this can be considered a plus for both the employee and the employer.

Another advantage for the employee is the opportunity to receive additional monetary compensation upon dismissal “by agreement”. If an employee leaves of his own free will, such payments are not provided.

Among the disadvantages for the employee is the fact that the agreement of the parties is one of the most “strong” grounds for terminating an employment contract. It will be more difficult to challenge a properly executed agreement in court and be reinstated than if you were dismissed for other reasons. Especially if the employee received additional payments provided for in such an agreement.

Based on the agreement, a dismissal order is issued (you can use the unified form No. T-8, approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1). In this case, in the line (column) “Grounds for termination (termination) of the employment contract (dismissal)” you must indicate: “Agreement of the parties, paragraph 1 of part one of Article 77 of the Labor Code of the Russian Federation.”

The employee must be familiarized with the dismissal order against his signature.

Payment of severance pay upon dismissal by agreement of the parties

The payment of severance pay to an employee upon dismissal by agreement of the parties is not directly mentioned in this article, however, taking into account Part 4 of this article, the employment contract may provide for other cases of payment of severance pay and other compensation payments, as well as establish increased amounts of severance pay. In a similar way, taxation is carried out on severance pay paid upon dismissal to employees of an organization on the basis of an agreement to terminate the employment contract, which is an integral part of the employment contract (letter of the Ministry of Finance of Russia dated June 19, 2014 No. 03-03-06 /2/29308).

Dismissal of pregnant women

The Labor Code does not contain restrictions on the circle of persons who can be dismissed “by agreement”. This means that a similar method of terminating an employment contract is also permissible in relation to a pregnant woman, regardless of the stage of pregnancy. Including, the conclusion of an agreement is possible even after the employee goes on maternity leave.

But there is one caveat. If a woman found out about her pregnancy shortly after signing the agreement and, therefore, changed her mind about quitting, it is better to reinstate the employment contract. Otherwise, this can be done by the court based on the claim of a pregnant woman (rulings of the Supreme Court of the Russian Federation dated 06.20.16 No. 18-KG16-45 and dated 09.05.14 No. 37-KG14-4).

Therefore, before concluding an agreement to dismiss a pregnant employee, you need to make sure that she has previously submitted documents about her pregnancy. This could be a certificate of registration in the early stages of pregnancy, or an application for leave or time off due to pregnancy, etc.

Accounting for severance pay upon dismissal of an employee by agreement of the parties

In labor costs, the employer can include any accruals to employees in cash or in kind, incentive accruals and allowances, compensation payments related to work hours or working conditions, bonuses and one-time incentive accruals. A different situation arises with the imposition of insurance contributions on severance pay when an employee is dismissed by agreement of the parties. In accordance with subparagraph “e” of paragraph 2 of part 1 of Article 9 of the Federal Law of July 24, 2009 No. 212-FZ, all types of compensation payments established by law (within the limits of norms) associated with the dismissal of employees are not subject to insurance premiums, with the exception of compensation for unused vacation.

Please note => Pension calculator for those born before 1967

Drawing up a note-calculation in form T-61

With regard to the amounts that are transferred to all dismissed employees (wages for time worked, compensation for unused vacation, bonuses), the general rules of Article 140 of the Labor Code of the Russian Federation apply. Such amounts must be transferred on the last day of work.

But additional amounts provided for in the dismissal agreement (including severance pay) can be paid at other times, if this is expressly provided for in this document. Such conclusions are contained in the report approved by Rostrud.

Dismissal by agreement of the parties to personal income tax

It should be clarified that the severance pay (three salaries) will not be calculated from a specific amount (for example, received last month), but on the basis of average earnings calculated for the year (that is, the average annual salary multiplied by three). In general, upon dismissal, an employee may qualify for the following payments: It is legislated that in the event of dismissal, the employee will be paid 3 months' salary, plus compensation payments. However, this causes a lot of controversy and doubt, therefore, regarding the taxation of severance pay, it is limited to the fact that personal income tax is levied on that part of the funds that exceeds the amount of three times earnings. If a particular payment is higher than your average salary multiplied by three, then paying tax cannot be avoided.

Compensation for dismissal by agreement of the parties

However, in most cases, employers prefer to issue a document signed by the employee. The agreement then carries an additional informational and legal burden, and in addition to the main provisions, it fixes the procedure for transferring cases, determines the amount of compensation, etc. However, in practice there are many lawsuits, as a result of which employees were denied payment of severance pay, even when they were determined employment contract. For example, if a company goes bankrupt, judges recognize such terms of an employment contract as invalid. You should not provide an excessively high amount of compensation upon dismissal. This type of compensation does not create additional motivation for work; therefore, the court may refuse to pay an employee if there are negative financial consequences for the enterprise proven by the employer.

Where to go if you haven’t paid your dismissal pay?

The notary's office will help if you have documents on hand confirming the non-payment of the settlement.

The commission dealing with labor disputes operates under the patronage of the organization's trade union. But practice shows that this authority is not always able to defend the rights of workers.

In court, the employee will be able to recover from the employer everything that he owes, plus penalties and compensation.

How is compensation collected for delayed payments upon dismissal?

If payment is delayed, the dismissed employee has the right to demand compensation - the average daily wage for each day of delay.

The amount of late compensation may vary depending on:

- Grounds for dismissal;

- Type of employment contract;

- The rate at which the employee was employed;

- Does the fired person have a new job at the time of claiming compensation?

The court decides whether the claims of the dismissed employee can be satisfied. If the employer’s guilt is proven, the employee receives a settlement along with compensation. A fine may also be imposed on the employer: 4-20 basic units for an individual entrepreneur and up to 100 basic units for a legal entity. Officials guilty of delay may be subject to financial and disciplinary liability.

Summary

It is important to formalize the dismissal procedure correctly. Late payment of the settlement may result in a lawsuit and, in the best case, you will pay the dismissed person a full settlement and compensation, and in the worst case, a fine will be imposed on the company.

If you do not know how to properly fire an employee, seek advice from specialists. We will suggest the optimal solution based on your situation.

Update - March 2020

Dismissal by agreement of the parties: we part amicably

All that is required to carry out dismissal by agreement is the will of the employee and the employer, documented. Moreover, the entire procedure can take only one day - if the day the agreement is drawn up is the day of dismissal. Neither the employer nor the employee is required to notify each other in advance of their intention to terminate the employment contract. In addition, the employer does not need to notify the employment service and the trade union. Thus, it is obvious that it is much easier for an employer to “part” with an employee by agreement than, for example, by reducing numbers or staff. Such an agreement between the employee and the employer is the basis for dismissal, so it must be documented. However, the form of the dismissal agreement is not regulated, that is, the parties have the right to draw it up in any form. The main thing is that this document must contain:

Step by step registration procedure

How to dismiss an employee by agreement of the parties?

First stage

It is necessary to follow a certain algorithm of actions: first, you must put the agreement reached that the employee is leaving by agreement of the parties in writing. At the same time, the employee can also participate in the preparation of the document, proposing his own conditions, including payment of compensation and its exact amount. It is advisable to indicate the following details in the agreement:

- the reason for the decision to terminate cooperation is termination of the contract by mutual agreement;

- date of termination of the relationship, last working day;

- conditions;

- signatures confirming the expression of will.

Since the specific form that the document must meet is not approved by law, we can assume that a written agreement is acceptable in the form of:

- employee statements with the manager’s resolution;

- a separate document, agreement, in two copies.

Second phase

Registration of a dismissal agreement by agreement of the parties or an employee’s application in the manner established in the employer’s records management, for example in a special journal, delivery of the agreement to the employee against signature. It is recommended to indicate specifically that the copy was received in person.

Third stage

Issuance of the corresponding order. To compile it, there is a unified form T-8. Clause 1 of Art. is indicated as the basis for termination of the contract. 77 of the Labor Code of the Russian Federation, since it provides a general list of grounds for termination of a contract. And already in the line “Base” - a document expressing the mutual will of the employer and employee. The employee also gets acquainted with the order by signature.

Fourth stage

Calculation in the accounting department with obtaining the necessary certificates.

Fifth stage

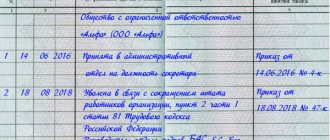

Making an entry in the work book. Registration of the transfer of the work book with confirmation of receipt of the document in the form of the employee’s signature in a special journal.

The rules for dismissal by agreement of the parties include mandatory registration of the employee’s work book.

The grounds for dismissal are given in full, the wording exactly corresponds to the text of the law, Art. 77 Labor Code of the Russian Federation. The entry is certified by the responsible employee and sealed; the employee himself must also sign and receive the document.

The exact wording in the work book upon dismissal on this basis: “The employment contract is terminated by agreement of the parties, paragraph 1 of part one of Article 77 of the Labor Code of the Russian Federation.” Instead of “employment contract terminated,” it is permissible to write “dismissed.”

https://www.youtube.com/watch?v=ytaboutru

Of course, the employee is interested in what is paid upon dismissal by agreement of the parties. Full payment upon dismissal is required.

The types and forms of documents on the basis of which dismissal is carried out by agreement of the parties are not defined by law. Likewise, there is no established procedure for such dismissal.

In practice, employees often take the initiative to terminate the contract by agreement of the parties, submitting a corresponding application to the HR department. However, such a statement is not mandatory - dismissal “by agreement” will be legal without it.

We suggest you familiarize yourself with the Driver's rights when stopped by the traffic police || Is it possible not to give the license into the hands of the inspector?

The main document when parting with an employee under Article 78 of the Labor Code of the Russian Federation is the agreement of the parties to the employment contract. However, the law also did not establish any requirements for the form of this agreement.

Prepare a termination agreement for free using a ready-made template

Payments and compensation upon dismissal by agreement of the parties

The employer, in accordance with the agreement, regulates the amount of compensation payments when there is mutual agreement to terminate the employment contract. He has the right not to determine any benefits. By law, an employee receives only those payments that are stipulated in labor legislation. Such an agreement cannot be terminated unilaterally. But when a new contract is drawn up, the old one becomes invalid. When a specialist quits in this way, he is not required to work for two weeks in his old place. Termination takes place very quickly, within 24 hours, but only when this is stipulated in the concluded contract. In any case, the final decision on working time is made by the employer.

Dismissal by agreement of the parties: procedure, compensation

- Agreement with the signature of each party;

- Details of an open-ended or fixed-term employment contract that must be terminated;

- The date of the employee’s last working day and, accordingly, the end date of the employment relationship;

- The amount of compensation due to the employee in accordance with labor legislation and the organization’s charter;

- Date and place of signing the agreement. Without these details, the document is not recognized as valid;

- Employee details: full name and position;

- Full name of the employing company;

- Indication of the organizational and legal form of the employing organization;

- Details of the person authorized to sign securities (director, head of the human resources department, authorized representative, etc.): full name and position;

- employer's tax identification number;

- Signatures of the parties to the agreement and their transcripts.

An important feature of this process is voluntariness. That is, neither party has the right to force the other to make an appropriate decision. An attempt at such coercion is criminally punishable if the coerced party applies to the appropriate authorities.

21 Dec 2021 marketur 136

Share this post

- Related Posts

- Benefits for widows of WWII veterans

- Sample application for maternity benefits

- Transfer the insurance part of the pension to the funded part

- Where to go to apply for group 2 disability benefits