Calculation of insurance premiums to extra-budgetary funds

Calculate insurance premiums on the last day of each month separately for each insured person and each type of contribution. In 2021, insurance premiums are paid for:

- compulsory pension insurance (OPI) at a rate of 22%;

- compulsory health insurance (CHI) at a rate of 5.1%;

- compulsory social insurance (OSI) for temporary disability and in connection with maternity (VNIM) – 2.9%.

Above are the basic contribution rates. For some policyholders, reduced and additional rates are provided. For details, see the material “Insurance premium rates in the table.”

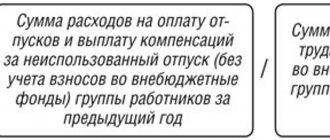

From April 2021, the part of the salary that is above the minimum wage is subject to insurance contributions at reduced rates. These tariffs are available only to those taxpayers who belong to small and medium-sized businesses. ConsultantPlus experts spoke in more detail about the new tariffs for insurance premiums. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The employer pays insurance premiums at his own expense to the tax office no later than the 15th day of the month following the month in which insurance premiums are calculated.

In addition to the above contributions, the employer pays insurance premiums against accidents at work to the Social Insurance Fund. The rate varies from 0.2% to 8.5% and depends on the main type of activity of the policyholder.

How to determine the tariff size, see here.

To calculate contributions, use the formula:

ATTENTION! When calculating the contribution base, take into account the approved limits. In 2021, the limits for VNIM are 966,000 rubles, for OPS – 1,465,000 rubles. Read more about applying limits here.

Employers must keep records of contributions for all funds separately.

To obtain information about contributions, account 69 “Social insurance payments” is divided into three sub-accounts, namely:

- 69.1 - information on contributions to OSS;

- 69.2 - information on contributions to compulsory pension insurance;

- 69.3 - information on contributions to compulsory medical insurance.

Subaccount 69.1 is further divided into second-order accounts (69.1.1 - social insurance for VNIM; 69.1.2 - injury insurance) or an additional subaccount of account 69 is used (for example, 69.11) to account for contributions for injuries.

This grouping by accounts allows you to track all movements of funds for each fund.

Calculation rules

Insurance coverage is accrued on almost all types of income of workers that they receive as remuneration for their work. For example, deductions for social needs were made from the following types of payments:

- salary (official salary or tariff rate);

- incentive and compensation payments (bonuses, additional payments for overtime, night and holiday payments);

- regional and territorial surcharges and coefficients;

- payment for regular labor holidays, as well as educational and other holidays;

- other types of payments (for example, travel allowances, additional payments for part-time work, and others);

- payments under GPC agreements, author's orders, contracts.

But all types of state benefits (sickness, pregnancy and childbirth, one-time payments), financial assistance, unemployment benefits, preferential payments, pensions and similar types of income are completely exempt from SV taxation.

Contributions listed: what kind of postings are made?

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (clause 3 of Article 431 of the Tax Code of the Russian Federation and clause 4 of Article 22 of the Law “On Mandatory Social Insurance” dated July 24, 1998 No. 125-FZ). When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The posting for payment of contributions (using the example of a pension fund) is as follows: Dt 69.2 Kt 51. Postings are made similarly for other subaccounts of each fund.

The accountant of Smiley LLC transferred the contributions untimely.

How to make a payment for insurance premiums, see here.

She reflected the following entries in accounting:

Dt 69.2 Kt 51 - 19,340.16 rubles;

Dt 69.3 Kt 51 – 6,708.58 rub.;

Dt 69.1 Kt 51 – RUB 1,483.88;

Dt 69.11 Kt 51 – 264 rub.

Transfer of insurance premiums for each fund must be carried out in separate payment orders. When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties. Penalties are calculated for each day of late payment from the day following the payment due date until the day of payment inclusive. The amount of the penalty interest is taken at the rate of 1/300 of the Central Bank refinancing rate, and for companies - 1/300 for the first 30 days of delay and 1/150 of the refinancing rate starting from 31 days.

Also, the accountant of Smiley LLC calculated the penalties using our calculator and transferred them to the budget. She reflected the following entries in accounting:

Dt 99 Kt 69 (for subaccounts) - penalties accrued.

Dt 69 (for subaccounts) Kt 51 – penalties are transferred to the budget.

See also “Accounting entries when calculating penalties for taxes.”

If the policyholder does not also provide a calculation of contributions to the relevant fund, an additional fine will be issued. It will be 5% for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The entry when calculating a fine or penalty will be Dt 91 Kt 69.1. Account 91 “Other income and expenses” is used here. True, there is another opinion that in this case you need to use account 99. The choice of account depends on the accounting procedure for such expenses adopted in accounting, which is enshrined in the accounting policy of the organization.

The material “Basic entries when paying penalties on insurance premiums” will help you figure out which account should be used to calculate penalties on insurance premiums.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of premiums, see the material “What is the responsibility for non-payment of insurance premiums?”

Find out about liability for late payment of taxes and contributions in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

When an accountant needs to accrue temporary disability benefits, they use the following entry: Dt 69.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

ATTENTION! Since 2021, all regions of the Russian Federation have joined the FSS pilot project “Direct Payments”. Our experts have prepared a guide for accountants. To avoid making mistakes in your calculations, study this material.

As for temporary disability benefits, the first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than calculated from the minimum wage (RUB 12,792 in 2021).

Mechanism and timing of writing off accounts payable

Accounts payable (hereinafter referred to as accounts payable) may arise for an organization to customers, suppliers, its own employees, founders, subsidiaries, lenders and the budget.

It is taken into account in the financial statements until maturity. If repayment does not occur, but the creditor does not take any action to collect the debt, after a certain time (statute of limitations), such a claim must be written off (clause 7, 10.4 of PBU 9/99).

The generally established statute of limitations by virtue of Art. 195, 196 of the Civil Code of the Russian Federation is 3 years from the moment the obligation arises.

Moreover, if during these 3 years the debtor, by his actions, actually acknowledged the existence of a debt, then the statute of limitations is interrupted and counted anew (the list of possible actions is contained in the resolution of the plenum of the Armed Forces of the Russian Federation dated September 29, 2015 No. 43).

Shortcomings in an organization are written off separately for each reason.

The first step towards writing off short-circuits is to carry out an inventory (drawn up by order of the manager).

We talked about how the inventory of receivables and payables occurs here.

And here you will find a sample order for conducting an inventory.

Based on its results, an inventory report is drawn up, which reflects the size of the shortfall in relation to each basis separately.

To identify shortcomings on insurance premiums, see the article “How can I find out the debt on insurance premiums?”

On the basis of such an act, as well as an accounting certificate, an order from the head of the organization is formed to write off the shortfall on a specific basis.

In business practice, many situations may arise that require the write-off of short-circuits. Let's look at the most common ones.

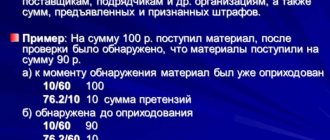

The most common case is the write-off of claims to suppliers and contractors for supplies (work, services). In accounting, such an operation is formalized by posting: D 60 K 91-1.

It is often necessary to write off a claim based on an advance payment received, for which deliveries were never made. To write off accounts payable, the posting should look like this: D 62 K 91-1.

For information on what to do with VAT in such situations, see the article “VAT when writing off accounts payable: problematic situations.”

It is also impossible to exclude the possibility of a shortcoming in front of personnel regarding wages or in cases where the accountable person has overspent the funds issued. As a general rule, if an employee has not been paid some part of the amount due (salary or bonus), then such debt is considered deposited and reflected in account 76. In this case, the following entry is used to write off accounts payable to personnel: D 76 K 91-1.

There are no specific rules regarding accountable persons, therefore the write-off of short-term debt to the accountable person in the amount of the overexpenditure incurred by him is documented by posting: D 71 K 91-1.

Claims to the founders regarding the payment of dividends are a common situation in times of crisis. Since the organization pays dividends from net profit, when unclaimed debt on dividends is written off, such profit is restored (Clause 9, Article 42 of the Federal Law “On Joint-Stock Companies” dated December 26.

According to accounting rules, settlements with staff are recorded on account 70, and with shareholders (who are not on staff) - on account 75. Depending on who exactly the participant is, such an operation is recorded in one of the following entries:

- D 75-2 (if the shareholder does not work in this organization) K 84;

- D 70 (if the participant is employed in the organization) K 84.

We suggest you read: How you can check your insurance premium calculations

Results

Attribute insurance premiums to cost accounting accounts 20,23,25,26,44, etc. To break down insurance premiums by type, use account 69 and various subaccounts. When transferring contributions to the budget, record the posting Dt 69 (for subaccounts) Kt 51. If during the reporting period there was sick leave paid for from the Social Insurance Fund, reflect it with the posting Dt 69 Kt 70.

Sources:

- tax code

- Law “On the Fund’s Budget...” dated December 2, 2019 No. 384-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxes according to the simplified tax system: features, postings, regulations, reporting

The single tax is 29,093 rubles. (RUB 193,950 * 15%). The following entries were made in the accounting of “Flagman”: Debit Credit Description Amount Document 99 68 Single tax Reflects the accrual of a single tax, which “Flagman” must transfer at the end of 2021, 29.093 rubles.

Attention

Tax return 68 Single tax 51 Tax transferred to the budget 11,239 rubles. Payment order of the simplified tax system according to the “income minus expenses 15%” scheme. Flagman LLC works on the simplified tax system according to the “income minus expenses” scheme.

This means that Flagman annually pays a single tax at the rate of 15% of the amount of net income (revenue minus documented expenses). The results of Flagman's activities in 2016 look like this:

- Revenue from the sale of office supplies – RUB 341,880;

- Expenses for renting premises for a store – 41,310 rubles;

- Purchase of goods and materials – 104,620 rubles.

Rental costs are confirmed by the contract and certificates of work performed (monthly), the purchase of goods and consumables is confirmed by invoices and receipts.

When determining the net income for the year, the Flagman accountant made the following calculation: 341,880 rubles. – 43,310 rub. – 104.620 rub.

Postings when calculating a single tax according to the simplified tax system

This is precisely the main advantage of “simplified”. An accountant, manager or third-party organization has to calculate the amount of tax under the simplified tax system. The ledger of expenses and receipts is filled out in written or electronic form. In the second case, after the expiration of the reporting period, all virtual records must be printed and certified first by the director of the company, and then by a tax officer.

The declaration in 1C for the simplified tax system is located in this way: reference book “Regulated reports” - Folder “Tax reports”. To favoritesSend by email Accrual of the simplified tax system (transactions and applicable accounts) is a seemingly simple question, but sometimes causes difficulties for accountants. Let's consider what transactions are generated in accounting when calculating the simplified tax system.

Accounting under the simplified tax system Accounts used in transactions for calculating tax under the simplified tax system Tax has been accrued under the simplified tax system - we make the posting Results Accounting under the simplified tax system Accounting in organizations using the simplified tax system is required. Most often, they belong to small businesses (SMB), and have the right to carry out accounting in a simplified form. In addition, they keep books of income and expenses, which for this taxation system are tax registers.