Article 99 of the Labor Code of the Russian Federation: general information

Before approaching the study of Article 99 of the Labor Code of Russia, it is necessary to understand the working time standards. These are units that are fixed both at the level of legislation and in the employment contract signed between the employee and the employer. For certain categories of citizens, special labor standards are established, for example, for the disabled, minors, pregnant women, etc.

Article 99 establishes provisions regarding the conduct of work activities outside the time limits established by labor legislation or a contractual agreement. This type of activity is called overtime. It can only be carried out with the consent of the employee himself. Coercion in this case is not allowed.

Overtime work is paid according to the law and in accordance with the rules established by the employment contract. As a general rule, every hour of such work is paid double.

However, it cannot be said with complete confidence that overtime is only voluntary. In exceptional situations, an employee may be forced to work in the following situations:

- To prevent disasters.

- During martial law.

- To ensure the livelihoods of the population, etc.

The enterprise must keep records of this kind of processing.

How to get overtime work

Art. 99 of the Labor Code defines overtime work as work performed beyond the established duration of time at the initiative of the employer. An employee can be engaged to work outside the norm only with his consent. What does the labor inspectorate fine for according to the law?

Its duration cannot be more than 120 hours per year and 4 hours over 2 consecutive days. Those. it is possible to involve in work beyond the norm from time to time and only in specific cases, namely, when it is necessary:

- finish the work that was not completed during the shift, otherwise the equipment or mechanisms will be damaged;

- eliminate a malfunction that could stop the operation of the enterprise;

- continue work if a replacement does not show up.

The legislation establishes situations when an employee can be forced to work overtime without his consent:

- in the event of an industrial accident or natural disaster to prevent them or eliminate their consequences;

- in case of disruption of the water and gas supply systems, transport and communications for public works;

- in case of emergency or martial law.

Overtime work is not permitted for pregnant women and persons under 18 years of age. Disabled people and women with children under 3 years of age can be recruited only when this is not prohibited for them due to health reasons.

If employees, by agreement among themselves, go out to work for someone else on another shift and this is discovered during an inspection, then the regulatory authorities will consider this a violation and impose a fine on the company.

It is also unacceptable for them to regularly continue to work after the end of the day on verbal orders from their superiors.

The organization's personnel department must keep strict records of the time worked above the norm for each employee.

Working hours: what the labor code says about overtime

Labor legislation establishes such a concept as the normal duration of labor activity. It cannot exceed forty hours a week . Depending on the individual characteristics of each specific subject, daily norms are established. So, in some cases they are 8 hours.

Overtime work is all work that goes beyond the above limits both per day and per week.

It must be paid, otherwise the employee has the right to go to court for appropriate compensation and refuse overtime.

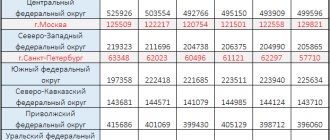

Working time standards for drivers

The peculiarities of work and rest of employees whose activities ensure the movement of vehicles are established by Chapter. 51 of the Labor Code and Order of the Ministry of Transport No. 15 of August 20, 2004. The drivers' work shift consists of:

- driving a vehicle;

- rest breaks on the road and at the final stop;

- preparatory work before leaving the garage and after returning from a trip;

- undergoing a pre- and post-trip medical examination;

- parking during loading and unloading;

- troubleshooting technical problems;

- downtime is not the fault of the driver;

- protection of the vehicle and cargo, if provided for in the contract.

According to clause 7 of Order No. 15, the driver’s working time cannot be more than 40 hours during the week. If the daily shift lasts 12 hours, then driving the car itself should take no more than 9 hours. The rest of the time is allocated to a medical examination, preparing the car for departure and final placement in the garage.

If, as a result of a special assessment, the driver’s working conditions are found to be harmful, he has the right to work no more than 36 hours a week.

In the case where the duration of working time is more than 40 hours during the week, its summarized accounting is introduced. A shift schedule is established for drivers. You can drive a car no longer than 56 hours per week and 90 hours in 2 consecutive weeks. It is allowed to work 10 hours a day, but no more than 2 times a week. Based on clause 25 of Order No. 15, the duration of rest between shifts should be 2 times greater than the duration of work on the previous day. If the driver worked for 12 hours, he must rest for at least 24 hours. Daily rest time should not be less than 12 hours.

The law does not prohibit the establishment of irregular hours or flexible working hours for drivers of passenger cars. On weekends and holidays, employees can only be hired with their consent.

What does irregular working hours mean according to Russian law?

The Labor Code of the Russian Federation establishes such a concept as irregular working hours. This is a rather specific concept that does not apply to all professions. As a rule, irregular working hours are established for employees of internal affairs bodies and other special departments, educators, etc.

This concept means that a citizen, in fact, can be involved at any time to perform his work duties, including outside normal hours, on weekends and holidays. As a rule, such work is paid higher. The list of positions with irregular working hours is established by internal local acts of the employer itself, local government laws or federal legislation.

Is working on weekends and holidays overtime?

Working on weekends and holidays can be caused not only by the need to complete one or another work activity, but also by the citizen’s schedule itself. It all depends on what exactly is stated in the employment contract.

So, if this day is a non-working day for a citizen, then bringing him to work can be regarded as overtime hours worked, and therefore, it will be paid accordingly.

How is it paid according to the Labor Code of the Russian Federation?

Payment for overtime work is calculated and regulated in accordance with labor standards, the number of hours worked, in accordance with additionally completed assignments, etc. As a rule, payment terms are established either in the employment contract or in the internal local acts of the employer, with which the employee must be familiarized with painting.

In general, the amount of payments cannot be less than twice the amount provided for payment of one hour in normal time. Compensation for work beyond the norm can be challenged in the labor dispute commission or in court.

What fine is imposed on an employer for overworking an employee?

Code of Administrative Offenses of the Russian Federation Article 5.27. Violation of labor legislation and other regulatory legal acts containing labor law norms

(as amended by Federal Law dated July 3, 2016 N 272-FZ)

(see text in the previous edition)

1. Violation of labor legislation and other regulatory legal acts containing labor law norms, unless otherwise provided by parts 3, 4 and 6 of this article and article 5.27.1 of this Code, -

entails a warning or the imposition of an administrative fine on officials in the amount of one thousand to five thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from one thousand to five thousand rubles; for legal entities - from thirty thousand to fifty thousand rubles.

2. Commitment of an administrative offense provided for by part 1 of this article by a person previously subjected to administrative punishment for a similar administrative offense -

shall entail the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles or disqualification for a period of one to three years; for persons carrying out entrepreneurial activities without forming a legal entity - from ten thousand to twenty thousand rubles; for legal entities - from fifty thousand to seventy thousand rubles.

3. Actual admission to work by a person not authorized to do so by the employer, in the event that the employer or his authorized representative refuses to recognize the relationship that has arisen between the person actually admitted to work and this employer as labor relations (does not conclude with the person actually admitted to work, employment contract), -

entails the imposition of an administrative fine on citizens in the amount of three thousand to five thousand rubles; for officials - from ten thousand to twenty thousand rubles.

4. Evasion or improper execution of an employment contract or the conclusion of a civil contract that actually regulates labor relations between the employee and the employer, -

shall entail the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from five thousand to ten thousand rubles; for legal entities - from fifty thousand to one hundred thousand rubles.

5. Commitment of administrative offenses provided for by part 3 or 4 of this article by a person who was previously subjected to administrative punishment for a similar administrative offense -

entails the imposition of an administrative fine on citizens in the amount of five thousand rubles; for officials - disqualification for a period of one to three years; for persons carrying out entrepreneurial activities without forming a legal entity - from thirty thousand to forty thousand rubles; for legal entities - from one hundred thousand to two hundred thousand rubles.

6. Non-payment or incomplete payment on time of wages, other payments made within the framework of labor relations, if these actions do not contain a criminal offense, or setting wages in an amount less than the amount provided for by labor legislation -

entails a warning or the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from one thousand to five thousand rubles; for legal entities - from thirty thousand to fifty thousand rubles.

7. Commitment of an administrative offense provided for by part 6 of this article by a person previously subjected to administrative punishment for a similar offense, if these actions do not contain a criminal offense, -

shall entail the imposition of an administrative fine on officials in the amount of twenty thousand to thirty thousand rubles or disqualification for a period of one to three years; for persons carrying out entrepreneurial activities without forming a legal entity - from ten thousand to thirty thousand rubles; for legal entities - from fifty thousand to one hundred thousand rubles.

Norm: how many hours of overtime are allowed per week, per month or year

Particular attention should be paid to the legislatively established standards that establish during what period of time a citizen can be involved in overtime work.

Thus, the permissible rate of processing per day is not established by law, but the rate of processing for two days is established. Its maximum size is 4 hours. Overtime should not exceed 120 hours per year. The law does not provide for a monthly norm. Daily and monthly output can be regulated at each specific enterprise by issuing internal local legal acts, without violating legislative requirements.

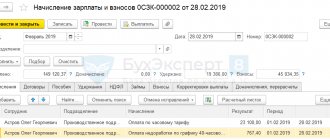

Accounting for “extra” working hours, how to calculate and process them

Recycling must be properly recorded. For this purpose, a special working time log is created, which is maintained and filled out by the employer, and additional hours worked by the employee are also entered there.

This is a written document that must include the following columns:

- Full name of the employee;

- his position;

- his standard working hours;

- number of processing hours.

A separate act regulating the procedure for making payments by an employee should stipulate the corresponding payments for overtime.

Overtime is calculated in hours.

How is recycling calculated?

Expert commentary

Kamensky Yuri

Lawyer

According to Art. 99 of the Labor Code of the Russian Federation, overtime is considered to be the time that an employee worked outside the working day established by the employment contract. The number of hours in a standard workweek should not exceed 40. Any period of time that an employee works beyond this period must be paid. It is not allowed to work more than 4 hours for two days in a row.

Article 99 of the Labor Code of the Russian Federation

“Overtime work” (more details)

If the company cannot take into account the duration of working hours during a week or month, then the local acts of the organization must approve the accounting period for the number of hours that each employee worked separately. This period can be a month or a quarter. The maximum permissible period for recording working hours is 1 year. An exception is made for specialists working in harmful or dangerous working conditions. For this category of employees, the accounting period is three months. For technological or organizational reasons, for employees working in harmful or dangerous conditions, the period can also be extended to a year.

The employee must work out the required quota for the accounting period in full. The task of organizing the labor process at the enterprise rests with the employer. He also keeps records of working hours (shifts) in accordance with Order of the Ministry of Health and Social Development No. 588n. For certain categories of employees, the duration of working hours, including overtime, may be strictly limited by law. If there are frequent overtimes, a summarized accounting of working hours is needed. It is relevant if the organization has a shift schedule.

Order of the Ministry of Health and Social Development of the Russian Federation dated August 13, 2009 N 588n

“On approval of the Procedure for calculating the norm of working time for certain calendar periods of time (month, quarter, year) depending on the established duration of working time per week” (more details)

Consent or application for processing working hours: sample

As noted above, processing can be formalized with the consent of the worker. He can reflect his consent both in the initial employment agreement and enshrine it in a separate act.

The agreement is a written document that includes the following elements:

- Indication of the employer.

- Indication of the employee.

- Expression of consent to overtime and the number of hours.

- Date and signature.

As a rule, such statements are attached to the working time log, where overtime is recorded.

Sample document for download. ⇐

Download the labor code with the latest changes

Previously, there was a Labor Code. Now it has been replaced by the Labor Code of the Russian Federation, which has the following structure: sections, chapters and articles.

It establishes provisions on the shift schedule, the maximum number of days that can be worked overtime, etc.

TK with the latest changes is possible. ⇐

Thus, in accordance with the Labor Code of the Russian Federation, there is a possible option for receiving additional payment for your work - working overtime. This consent can be obtained by submitting an application directly to the employer. In accordance with the articles of the Labor Code of the Russian Federation, such hours must be paid in double amount.

Processing payment procedure

Payment for overtime hours is made in the following order:

- The wage system adopted at the enterprise is taken into account; Daily, shift, and hourly wages are taken into account.

- If an employee receives payment for each shift, then the amount must be divided by the number of hours of the shift. The result is that the resulting indicator will be payment for each hour worked.

- The first two hours of overtime must be paid at 1.5 times the rate, the rest - at double the rate of payment for a standard labor hour.

Expert commentary

Gorbunova Olga

Lawyer

The employer can approve its own reward system for overtime, which cannot be less than the stipulated payment for each hour. The employer is obliged to draw up shift schedules in accordance with the accounting standard of working time in production. An independent working time recording period can be developed for a specific category of employees.

Article 152 of the Labor Code of the Russian Federation

“Payment for overtime work” (more details)

A schedule must be provided at each enterprise. The document must contain the following information:

- Duration of each work shift.

- Breaks for rest and lunch - at least half an hour.

- The order of rotation of employees on shifts.

Management is required to count the time worked by each employee. Time recording is carried out according to a timesheet - according to Form T-12 or T-13, or the employer develops his own template. Overtime over 120 hours is considered at the end of the accounting period.