Issues discussed in the material:

- Duration of vacation for workers in the Far North

- Calculation of length of service for additional leave in the Far North

- Calculation of the number of days of additional leave

- Calculation of the amount of vacation pay in the Far North

- Conditions for granting vacation in the Far North to part-time workers

- Vacation of shift workers in the Far North

- Northern vacation to accompany a child to their place of study

- Compensation for travel to a place of rest for workers in the Far North

- The nuances of providing compensation for vacation expenses in 2020

- Cash compensation for vacation in the Far North

- Responsibility for failure to provide leave

Vacation in the Far North has its own characteristics. Moreover, they concern not only the duration of rest, but also some other points. For example, the procedure for determining length of service for additional leave or the right of parents to take days to accompany their children to the place of their admission to a particular educational institution.

All the specifics of providing leave to citizens working in the Far North are clearly regulated by law. Unfortunately, not all employers follow it to the letter, especially those working in the private sector. But if you know the norms established by the Labor Code of the Russian Federation, if necessary, you can always protect your rights.

Duration of vacation for workers in the Far North

Working citizens of our country are legally entitled to an annual leave of at least 28 days. However, in some cases the rest may last longer. For example, if a person works in the northern regions. There are several ways in which you can extend your vacation in the Far North.

A certain category of government workers can count on an extension of their vacation. For example, employees of the judiciary have a rest period of at least 45 working days, and employees of investigative agencies, police, and prosecutors have a rest period of at least 45 calendar days.

Also, residents of cold regions, in addition to vacation, can receive additional days of rest under general conditions:

- 24 calendar days if a person works in the Far North;

- 16 calendar days when a citizen lives in an area equated to the Far North;

- 8 calendar days, if the area does not belong to the above categories, but according to the law, northern wage supplements apply in it.

In addition, you can receive additional days of rest for other reasons. For example, if a person works in harmful production conditions. Vacation in the Far North can be increased if preferential days are added to the main ones.

Northerners have the right to go on vacation according to standard rules: after 6 months of working in one organization.

Vacations are distributed according to the schedule approved by the manager for 12 months. The Labor Code of the Russian Federation stipulates that citizens have access to vacation in the Far North both in summer and in winter, autumn or spring.

By law, a worker has the right to partial or complete combination of basic and preferential leave only for the last 24 months. In this case, the vacation should be no more than 6 months (taking into account the days that the person took without pay, as well as the time until he gets to the vacation spot).

In a situation where the duration of vacation is more than 6 months per year, unused days can be transferred to the next vacation period. Northerners are advised to think through their vacation schedule two years in advance.

If a worker quits without taking advantage of his vacation, then he must do the following: use the allotted rest and then leave work. However, this is only possible if the employee has not violated the norms of the Labor Code of the Russian Federation.

A work book serves as confirmation of the status of a northerner. It notes that the person works for a company located in the northern region.

Some organizations provide a certificate confirming northern experience. It is drawn up in free form, since the law does not regulate how it should be drawn up.

Note!

Citizens going on business trips to the northern regions do not receive any compensation payments or preferential leave.

Basic and additional rest for a shift worker

Regulation of the employment of citizens who perform rotational tasks is carried out on the basis of Chapter. 47 TK. On shift, according to Art. 297, is a work process involving the reconstruction or accelerated construction of facilities.

The procedure for labor tasks in areas with extreme or difficult climatic conditions is regulated by Resolution No. 794/33-82 and is applied on the basis of Art. 423 TTK.

Taking into account employment in special conditions, shift workers have the right to preferential rest. Features of northern leave for this category of workers include:

- duration – 28 calendar days annually (Article 115 of the Labor Code);

- receiving an additional week of time off (Article 117) if work is carried out in harmful or dangerous conditions;

- increasing the rest period based on local company documents;

- extension of vacation time for people employed in the Far North and comparable areas.

The time off schedule is drawn up on the basis of current labor legislation (Article 123). If a shift worker has returned from vacation, but according to the time sheet he must rest between shifts, he may be assigned to another position until the brigade begins work.

The second option to resolve the situation is to temporarily transfer the employee to another shift.

Calculation of length of service for additional leave in the Far North

To determine the duration of vacation in the Far North 2020, you should adhere to the same principles as when calculating standard vacation. Should be considered:

- period of work, no matter how long the work week or work shift lasts;

- a period of time when a worker was legally released from work, both without and with pay. This includes weekends, holidays, vacations;

- duration of absence due to forced reasons: the person was illegally fired, was not allowed to work, or if he was unable to undergo a medical examination due to the fault of third parties;

- rest time without pay, which was provided at the request of the employee (no longer than 14 days per year);

- maternity leave, childbirth;

- duration of downtime due to the fault of the employer.

To determine length of service, it is necessary to take into account all calendar days from the moment a person is registered for a position until the last day of the working year.

The length of service for additional leave in the Far North does not include:

- days when the worker did not show up for work without a good reason (he was under the influence of alcohol, did not undergo training or medical examination due to his own fault);

- parental leave for children up to one and a half and three years.

Important! When working on a rotational basis, length of service is calculated differently. Here, the key importance is from which region the citizen goes on duty: the northern region or the region where the northern allowance is not available.

When can you replace it with money?

The minimum vacation per year lasts 28 days; resting less is prohibited by law. You can only compensate for those days of vacation that exceed these mandatory 28 working days - this is called compensation for vacation not taken. Where can an employee get these additional days:

- have the right to additional leave;

- additional days are provided, for example, for overtime or irregular working hours;

- remained from last year (we are talking only about additional days exceeding 28 calendar days).

In all these cases, the employee is not required to rest additional days, but can ask the employer to compensate them with money. But you will have to take 28 working days off during the year.

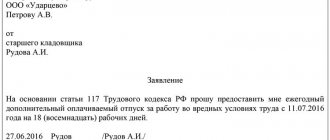

They receive money for vacation based on the employee’s personal application. Like any other, it is drawn up in writing in the name of the manager. There is no unified form, so write freely. In this article we will describe in detail how to draw up such a statement and provide a sample.

Calculation of the number of days of additional leave

How many days does a vacation last in the Far North? To determine the duration, use the following formula:

Kdo = Dx / 12 × Sg – Oi

How it stands for:

- Kdo – days of vacation in the northern regions for 12 months;

- Dks – days of additional rest, which are required by law;

- Сг – vacation experience received by a person while working in the northern region;

- Oi – days of additional rest that the employee used in the current year.

Features of the “northern” vacation for part-time workers

According to Art. 321 of the Labor Code of the Russian Federation, citizens carrying out activities parallel to their main work in harsh climatic conditions have the right to count on additional days of rest. The legislation strictly defines how many days of vacation in the North are for part-time workers. Employees who perform official duties at another enterprise in a region unfavorable for life and health for more than six months are entitled to 16 or 24 days of additional time off, depending on the subject of the country. According to Art. 286, the vacation of an external part-time worker must coincide with the rest period at the main job. If a citizen is employed in another organization for less than 6 months, additional time off is accrued by the manager in advance.

Calculation of the amount of vacation pay in the Far North

The employer is obliged to provide vacation pay no later than 3 days before the worker starts going on vacation. To determine the amount of cash payments due for additional leave, the average salary is taken into account. How to find out a person's average daily income? There is a special formula for this:

Sz = (FOT / 12) / 29.4

How it stands for:

- Сз – average daily wage for vacation;

- Payroll – a person’s salary for the year before the start of the month of rest.

- 29.4 – average monthly number of days per year.

When a citizen has worked for a company for less than 1 year, and there is a month in the period that was partially worked, the amount of wages received for the entire period should be divided by the number of days when the person was officially employed.

We determine the amount of days worked in full months. Therefore, we multiply 29.4 by the number of full months that the person worked. Next, we add to them the days of employment in an incomplete month. Then we divide the entire salary for the selected time period by the sum of these days.

To determine the number of days of employment in an incomplete month, we proceed as follows: divide 29.4 by the number of days in the month, then multiply by the number of days the person worked.

For clarity, let’s look at an example: a northerner works for 11 months and 7 days. During this period, he received an income of 241,590 rubles. We determine the number of days of employment in full months using the formula: 29.4 * 11 = 323.4 days. In the remaining month, if it has 31 days, there will be so many days worked for payroll purposes: 29.4: 31 * 17 = 16.12.

In total, over the course of a year, a person was employed for 323.4 + 16.12 = 339.52 days. Taking this into account, the average wage per day is 711.56 rubles. (241,590: 339.52).

Will there be a regional coefficient for vacation pay? This will not be done, since the coefficient, as well as the bonus, are taken into account as part of the payroll.

To calculate the amount of vacation pay, you should use the formula:

Co = Сз × Kddo

How it stands for:

- Co – the amount of vacation pay;

- Сз – average daily wage;

- Kdo – days of rest.

Thus, an employee of the northern region will receive 37,001.12 rubles for 52 days of vacation. (711.56 * 52 = 37,001.12). The amount of monetary remuneration is calculated in the same way if the person did not go on vacation (we multiply the unused days by the average salary).

If you combine the main and additional vacation, the average salary is determined for the calendar year before the combined vacation.

But when a person takes vacations separately, the average daily wage will also be calculated for everyone.

The procedure for calculating vacation pay

The amount of the benefit is affected by the employee’s average salary. Leave for employees of the Far North will be paid depending on daily income, for calculation of which in accordance with Art. 139 of the Labor Code of the Russian Federation, the amount of funds for the year is divided by 12 and the coefficient is 29.3 - the average monthly number of calendar days. The salary already includes percentage bonuses, so they are not additionally taken into account when calculating vacation pay. If the length of service at the current place is less than a year, then the amount of profit received must be divided by the number of days worked. To determine the period of performance of official duties, the coefficient 29.3 must be multiplied by the number of full months during which the labor activity was carried out. If the main and additional days of rest are not summed up, the amount of earnings is calculated separately for each period. To calculate vacation pay, the average daily profit is multiplied by the number of days off.

Conditions for granting vacation in the Far North to part-time workers

The legislation applies equally not only to main workers, but also to those who work part-time.

Part-time workers who work in the northern and equivalent regions, in addition to the annual basic paid and additional paid leave provided by law (provided on a general basis), can receive additional paid leave.

It is important that the management of the organization where the northerner works part-time is aware that annual paid leave must be provided at the same time as leave at the main place of work.

In the case where a person is employed part-time in a company where he has worked for less than six months, leave can be provided in advance.

In a situation where in a company where a person works part-time, the duration of annual paid leave is shorter than the duration of rest at the main place of work, the employing company, at the request of the worker, can provide him with leave without pay.

Legal regulation

Compensation for employees who work in difficult climatic conditions is provided on the basis of the following regulations:

- Chapter 50 of the Labor Code of the Russian Federation is entirely devoted to the specifics of regulating the labor of “northern” workers, and Article 321 directly establishes the employer’s obligation to provide additional leave to such employees.

- Law of the Russian Federation of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the Far North and equivalent areas.” The document specifies the right to additional leave and establishes its duration depending on the location in which the employee works.

- Resolution of the Council of Ministers of the USSR dated January 3, 1983 No. 12 “On introducing changes and additions to the List of regions of the Far North and localities equated to regions of the Far North, approved by Resolution of the Council of Ministers of the USSR dated November 10, 1967 N1029.” This document was adopted in the Soviet Union, but is still in force. Here, specific territories are identified (according to the constituent entities of the Russian Federation), where labor requires an increased time for the restoration of vital resources.

Vacation of shift workers in the Far North

The main difference between working on a rotational basis is that the worker receives additional guarantees by law. For example, the code guarantees the following benefits to shift workers:

- the employee receives a salary increase;

- the apartment is provided free of charge, or housing costs are compensated;

- travel to and from the watch is paid, as well as days of delay due to bad weather (at the daily rate).

If a person works on a rotational basis in the northern and equivalent regions, he has the right to receive additional leave. Then the length of service is calculated, on which the duration of the vacation depends. It is also necessary to take into account the days it takes workers to get to their place of work.

What does annual paid leave consist of in the northern regions and equivalent to the Far North:

- basic leave, the duration of which is at least 28 calendar days;

- additional leave for northerners – from eight days;

- additional rest, its duration may vary. For example, if a person has irregular working hours, he will receive at least 3 days of additional rest.

The more unfavorable the climatic conditions in which a citizen works, the more additional days of rest he will receive. The legislation distinguishes three categories of regions with cold climates, the duration of additional leave in which will differ. For example, in the Far North - 24 days, in regions equated to the north - 16 days, in other cold regions - 8 days.

In some situations, during the course of his work, a person works in several territories at once with different conditions for preferential rest. Then the duration of the additional leave is determined taking into account the time during which the citizen worked in each region.

If a person works in the Far North region, travel on vacation and the return journey will be paid for by the employing company once every 2 years. A person can plan a trip by any means of transport, except taxi. It is important that the holiday destination is in Russia. But this is only possible if the company operates in the northern and equivalent regions, which is financed from the federal budget.

What does the employer compensate for during preferential leave?

The employer compensates subordinates for the following expenses.

- The road to the vacation spot and back is for the subordinate and his close relatives. If a family goes on vacation by plane, the cost of the air ticket is reimbursed, including baggage fees. The same applies to traveling by train. If the family goes on vacation in their car, the employer reimburses the cost of the gasoline consumed.

- Accommodation in a hotel, inn, or rented apartment. However, in this case, the law sets a limit of 50 thousand rubles per person - more than this amount cannot be compensated.

- Spa treatment. The subordinate must contact a medical institution in advance to establish a list of medical procedures that will be carried out to restore his health. In order for the employer to compensate for treatment, the employee provides him with a certificate or report from the hospital containing a list of procedures that are subject to compensation.

- Excursions. The employee provides the employer with a list of excursions that were included in his trip. If the family additionally attended other entertainment events after arriving at the vacation spot, then they are no longer subject to compensation.

Attention! A subordinate can only claim reimbursement for vacation expenses if he vacationed within Russia.

All guarantees, allowances and incentives are indicated in the company’s internal documentation. These provisions contain detailed information about what employees classified in various categories are entitled to claim.

Only close family members of a northerner employee can take advantage of preferential leave compensation. But if a close relative does not live in the Far North, then he no longer has the right to claim the benefit.

If a part-time worker works in the Far North or in equivalent regions, then the cost of travel is compensated only at the main place of employment.

Shift workers are not entitled to vacation compensation, since this benefit applies only to those employees who not only work, but also live in the Far North region and equivalent territories. After all, the purpose of this benefit is to provide northerners with the opportunity to relax in other regions of the country.

Expert commentary

Kolesnikova Anna

Lawyer

Judicial practice is ambiguous regarding the issue of compensation for vacation with subsequent dismissal. Authorized persons state that if an employee is granted leave with subsequent dismissal, then the cost of travel will be reimbursed if the employee returns from the place of leave after its completion. Indeed, in accordance with the Labor Code of the Russian Federation, there is a connection between the payment of travel costs and the fact that the employee is granted and used annual paid leave.

Northern vacation to accompany a child to their place of study

A worker in the Far North can receive paid leave (14 days) if he needs to accompany a child under 18 years of age to an educational institution located in another region.

This type of leave can be obtained once for each child. In this case, the following conditions must be met:

- the mother or father has enough work experience in the north to receive leave;

- a person can document that the child is taking exams for admission to an educational institution in another region.

Note!

We are not talking about “extra” days of rest here. By law, an employee can use basic or northern paid leave on selected days. He will have an advantage when drawing up a vacation schedule in the organization.

When a northerner has a child under sixteen years of age, he has the right to write a statement asking for an unpaid day of rest every month.

Leave regulations for parents when children arrive

Citizens who work in the North and have children under 16 years of age can receive additional leave. It is provided upon a written application from the employee without payment of monetary compensation.

Parents whose child is an applicant receive paid additional leave of 14 calendar days. The conditions for additional leave are specified in Art. 322 Labor Code and provide for:

- admission of minor children to a technical school, college, or university located in another region;

- providing time off for the period of admission of each child, if there are several of them in the family;

- parents’ work experience – from 6 months;

- the northerner has a document from an educational institution stating that the child is indeed an applicant.

The right to receive leave extends to guardians. The vacation period - northern or main - is issued on a date convenient for employees.

Compensation for travel to a place of rest for workers in the Far North

When a worker of the Far North goes on vacation in our country, the organization where he works is obliged not only to provide vacation pay, but also to pay for his travel, including a place in the luggage compartment.

Moreover, the payment is provided along with the first vacation. Then compensation can be received every second year of work, no matter when the first payment was made.

The following categories of northerners can count on annual payment for travel to their holiday destination: judges, prosecutors, and employees of investigative agencies. If a person works in a company that is financed from the state budget, or in government agencies, then money will be paid both for the employee and for his non-working spouse and children under the age of 18 living with him.

Thus, the amount provided will include payment for tickets and luggage (up to 30 kg) for each family member. An employee can go to a place of rest by personal car, train or bus (except for a taxi).

To receive a financial payment, the whole family must go on vacation to one place. However, they can return separately from each other.

For those who are government employees, there are restrictions on the maximum amount of fare depending on the chosen vehicle:

- train - a ticket will be paid for in the compartment car;

- by ship - the cost of a cabin of the first category of a ferry, the second category of river transport, the fifth group of sea transport;

- by plane - an economy class ticket will be paid for;

- bus - the cost of travel on the specified route (excluding taxis).

If a person decides to go on vacation by private car, the shortest route, as well as the minimum cost of travel, will be used to determine the amount of payment. It is defined as the cost of a seat in a reserved seat carriage on a train.

But if a person works in a government agency and plans to go on vacation using his own transport, he needs to collect receipts from the gas station. At the same time, he needs to confirm that he was in a vacation spot.

The amount of payments in this situation should not exceed the maximum fuel consumption for his car, which are established by the government of our country. The shortest route from home to the worker’s resting place will be taken into account.

To receive financial compensation, a person writes an application and submits it 3 days (or earlier) before the planned vacation.

The organization provides him with money equal to the approximate cost of travel. Then the amount is recalculated taking into account the documentation provided, which confirms travel. Moreover, a person will receive money even if he went on vacation without pay.

How is compensation for transportation costs to a vacation spot made if a citizen works for a commercial company in the northern and equivalent regions? In this case, the organization provides payments independently, in accordance with the concluded labor agreement, collective agreement, or local regulations. These documents indicate the amount of payments, as well as the conditions and rules for providing funds that the employee can use to pay for travel to the vacation spot and the return trip.

If agreement is reached between the company and the employee, the amount of payments may differ from that established in the Labor Code of the Russian Federation. The main thing is that the goal of providing compensation is achieved and the person is able to travel outside the northern region and relax.

Taxation of vacation compensation

Officials determined that the replacement of vacation with monetary compensation, as well as the amount of vacation pay, is subject to taxation in accordance with the general procedure. That is, insurance premiums should be charged on the calculated amount of compensation payment, then personal income tax should be withheld.

The company's costs for paying for vacation replacement should be included in labor costs when determining the taxable base for the organization's income tax. That is, by the amount of compensation paid for unused vacation, the tax base for income tax can be reduced.

However, there are important exceptions. Officials, namely representatives of the Ministry of Finance of Russia, expressed a certain position that cash payment of additional leave for harmful working conditions is not subject to personal income tax. The payment is exempt from taxation if the following conditions are met:

- We are talking only about additional leave for harmful working conditions of 2, 3 or 4 degrees.

- The duration of additional leave for harmful activities exceeds 7 calendar days. This norm must be documented (labor or collective agreement) and confirmed by the results of a special labor assessment.

- The amount of compensation for unused vacation, the procedure for calculating and transferring it are also set out in the local regulations of the organization. For example, the conditions and amount of payments are fixed in the collective agreement.

- The employer received the employee’s written consent to replace additional days of “harmful” leave with monetary compensation.

- The compensation payment was made in the established amounts, fixed in industry, inter-industry agreements and collective agreements.

If all these conditions are met, then the amount of compensation for unused additional leave for harmful working conditions exceeding the duration of 7 days is not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Let us note that representatives of the Federal Tax Service have not officially stated their position on this issue. This means that tax authorities may challenge this approach to taxation of compensation payments. Rationale: this issue is not regulated in the Tax Code of the Russian Federation.

There are no similar exceptions regarding insurance coverage. That is, pay insurance premiums in full to compensate for “harmful” vacations.

The nuances of providing compensation for vacation expenses in 2020

Due to the current situation in the country and the world (the spread of the COVID-19 virus), many workers working in the northern and equivalent regions, who could legally receive payments once every 2 years at the company’s expense, in order to get to their vacation destination (in Russia) and carry luggage back and forth, did not take advantage of this right.

For this reason, the government has adopted a resolution to resolve this situation. So, if a person who, by law, could receive payments to compensate for the costs of vacation, did not take advantage of this right in 2021 (due to restrictions introduced to prevent the spread of the COVID-19 virus), then all amounts due to him will be given next year.

When the specified period for which a citizen is granted the right to receive material payments ends in 2021, and the person did not go on vacation, the right to compensation for expenses in 2021-2022 can be exercised in 2022.

What to do if a citizen received compensation for expenses for a vacation trip in 2021, but was unable to use them due to restrictions imposed due to the pandemic? The money does not need to be returned to the employer company if the transport company provides an extension to 2021 of the date of fulfillment of obligations to transport the employee (taking into account previously paid fares).

The validity of travel and transportation documents for 2021 may also be extended if the money for travel and transportation documents has not been reimbursed.

What should employees do who paid for their travel and baggage allowance but were unable to go on vacation due to restrictions? They must, within 7 days from the date of leaving leave (the end of the period of implementation of the measures applied to the employee):

- return to the company the money that was allocated for the purchase of tickets and payment for baggage transportation, if the carrier returned them (based on the amount of compensation);

- inform the organization where he works that for 2021 the transport company will extend the fulfillment of obligations to transport the employee, taking into account the amount that he paid for travel earlier (or about the extension of the validity of travel and transportation documentation for 2021);

- report that the carrier refused to return payment for the ticket and transportation, did not extend the fulfillment of transportation obligations, confirming this with the necessary documentation. If necessary, the employing company can send a request to the carrier asking them to send supporting documents.

How to inform the employer in such a situation is prescribed in local regulations, and the opinion of the representative body of workers, if it exists, must also be taken into account.

A person must also report his expenses by providing original tickets for travel and baggage transportation or printed travel and transportation documentation if it was issued online. This is necessary in the case when the worker used tickets to get to a vacation spot and return home.

Documents must be provided within 3 working days after the person returns to work. In this case, it is necessary to take into account the duration of restrictive measures in force at the place of vacation or at the person’s place of work, if these measures applied to him.

How to draw up an order for payment of compensation

After the employer reviews the application and makes a positive decision, it is necessary to draw up an order. This will be the basis for payment of money.

As with the application, there is no approved form for such an order. It can be drawn up in any form, following the usual requirements for administrative documents. Be sure to include:

- Organization details: full name, address. You can use a standard form, where this information is already contained in the header.

- Date and place of compilation.

- Name (Order) and topic of the document (On replacing part of the vacation with a cash payment).

- Grounds for provision. Here you need to refer to Article 126 of the Labor Code of the Russian Federation.

- The main part. For example, it can be formulated this way: “To assistant coach S.S. Semenov. replace with money part of the annual paid leave granted for the period of work from November 6, 2021 to November 6, 2021 in the amount of 3 (three) calendar days.” It should also be mentioned here that the order was drawn up on the basis of the employee’s personal statement (be sure to provide details).

- Position, full name and the signature of the director of the organization, as well as the date of preparation.

- Block for signatures of employees who must read the order.

Cash compensation for vacation in the Far North

In what situations can a person refuse a vacation and take advantage of payments? This is possible in the case when a person quits and does not go on vacation or replaces rest days with financial compensation.

To calculate the amount of payments, the hours worked are taken into account. To determine the amount if a person quits, take the monthly number of vacation days, taking into account all types.

When the employer is located in the northern region, workers have the right to annual leave of 28 days of basic and 24 days of preferential rest. Thus, the total number of vacation days is 52 days. If we recalculate for a month, the duration will be 4.33 days of rest (52 days: 12 months = 4.33).

For example, a person worked for 8 months in one company, so he will receive payment for 34.64 days of vacation (4.33 * 8 = 34.64). However, in the case where a northerner worked for more than 12 months and refused to rest, he will be provided with compensation payments in full for the first and second year in proportion to the time spent on work.

The employee has the right to receive financial payments instead of part of the paid leave, which is more than 28 days.

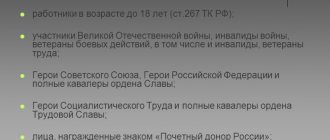

This means that residents of the Far North and equivalent regions can completely or partially refuse additional rest, which is 24 days, and receive money for it. However, pregnant workers, as well as persons under 18 years of age, and those who work in hazardous industries when rest is necessary due to unfavorable working conditions, will not be able to do this.

To determine the amount of compensation in the situations described above, they follow the same principles as in the case of vacation pay. The basis of calculation is the average daily wage for 12 months. When a northerner worked for less than a year, it is necessary to take into account only the time worked.

To provide financial compensation if you refuse to take a vacation, you must write an application. But the company where a northerner works is not obliged to provide payments in lieu of vacation. According to the law, a person can be refused, and he will have to go on vacation.

Territories belonging to other regions of the North

Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12 defined the regions of the Far North and all territories that are equivalent to it. The list of other regions of the North is not fixed by any regulatory act. Moreover, the Labor Code of the Russian Federation provides such a category of northern territories in Art. 321 doesn't even mention it. However, the obligation to provide an eight-day northern additional permit to workers in such territories is established by Art. 14 of the Law of the Russian Federation No. 4520-I.

To classify a territory as a district under consideration, two conditions must be met:

- The territory is not recognized by the Far North, nor is it equated to it.

- It is subject to a percentage premium and a regional coefficient is applied.

The corresponding allowances and coefficients should be established by the Government of the Russian Federation, which follows from Art. 315–316 Labor Code of the Russian Federation. However, as of 2021, the relevant regulatory documents have not been published, therefore, by virtue of Part 1 of Art. 423 of the Labor Code of the Russian Federation, in order to resolve the issue of recognizing a locality as a region of the North, one should be guided by the legal acts of the Russian Federation and the former USSR, which previously established coefficients and premiums. This is precisely the rule provided for in Part 1 of Art. 423 of the Labor Code of the Russian Federation (in particular, this is confirmed by order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 2).

Important! The opportunity to receive an 8-day “northern” vacation is the only privilege for workers in the northern regions that are not classified as the Far North and equivalent areas. Other benefits entitled to northerners (including compensation for vacation expenses) are not provided to them.