How do individual entrepreneurs receive child benefits?

Like an ordinary individual, an individual entrepreneur has the right to child benefits. In this case, everything will depend on whether he transferred voluntary contributions to the Social Insurance Fund or not. If the individual entrepreneur did not have voluntary insurance in the Social Insurance Fund, then he is entitled to the following types of benefits:

- At the birth of a child in the amount of 16,350 rubles;

- Child care in the amount of 3120 rubles for the first child and for the second and subsequent ones 6131 rubles.

Important! If an individual entrepreneur voluntarily transferred contributions to social security, then he has the right to additional payments: maternity and child care benefits. The benefit amount is calculated based on the minimum wage, that is, the minimum amount.

Right to receive insurance coverage

For businessmen who have voluntarily entered into legal relations with the Social Insurance Fund, a special procedure has been established for receiving insurance coverage: the right to receive benefits arises only if insurance premiums are paid for the calendar year preceding the calendar year in which the insured event occurred.

If an individual entrepreneur has submitted a corresponding application to the Social Insurance Fund, but has not paid insurance premiums for the corresponding calendar year by December 31 of the current year, the legal relationship under the Social Insurance Fund in the event of temporary disability and in connection with maternity is considered terminated.

Thus, in order to acquire the right to receive insurance coverage under OSS in case of temporary disability and in connection with maternity in 2021, an individual entrepreneur must pay insurance premiums in the amount of 3,925 rubles. 44 kopecks until December 31, 2019.

Conclusion two: in order for a female individual entrepreneur to receive maternity benefits, she needs to register with the Social Insurance Fund in the calendar year preceding the year in which the insured event occurs and pay insurance premiums on time.

Payment of voluntary contributions to the Social Insurance Fund for individual entrepreneurs

Any entrepreneur can voluntarily enter into an agreement with the Social Insurance Fund and pay contributions. In the event of an insured event, he will be able to calculate compensation. If contributions are paid on time, payments can be received for the following insured events:

- Due to temporary disability due to illness or injury;

- In case of pregnancy and childbirth;

- On maternity leave.

In this case, a woman entrepreneur will be able to count on the following types of benefits:

- According to BiR;

- For early registration of pregnancy at the antenatal clinic;

- One-time payment at the birth of a child;

- Care for up to 1.5 years;

- Due to temporary disability.

After concluding an appropriate voluntary insurance agreement with the Social Insurance Fund, the individual entrepreneur will have to submit a quarterly report to social insurance in Form 4-FSS. This can be done both in paper and electronic form. In the first case, the report must be submitted by the 20th of the month following the reporting period, and in the second case - by the 25th.

Transfer of voluntary contributions

To receive additional payments, the entrepreneur must draw up a formal agreement with the Social Insurance Fund and timely transfer the statutory contributions. If a certain insured event occurs, the applicant can legally expect compensation. Among such situations are:

- Trauma and temporary disability.

- Pregnancy and subsequent childbirth.

- For taking into account early consultations.

- One-time payment for birth.

- Maternity care up to one and a half years.

Immediately after drawing up a formal agreement, the entrepreneur must submit a report to social insurance every quarter. The document is drawn up according to form 4-FSS. It can be submitted electronically or in paper form. The period for transferring funds depends on the type. The amount is calculated faster electronically.

The procedure for joining voluntary insurance

In order to become a voluntary policyholder, you need to contact the Social Insurance Fund at your place of residence and submit the necessary documents. You can also apply via the Internet through the State Services portal. Required documents include:

- application (form No. 108n);

- IP passport;

- TIN;

- certificate of state registration as an individual entrepreneur.

Persons engaged in specialized practice must provide supporting documentation. For example, a lawyer needs an appropriate certificate, and a notary needs a license.

Important! All photocopies of documents must be certified, and the originals will need to be provided for data verification.

5 days after contacting the FSS, the entrepreneur will be assigned an individual number, as well as a subordination code. Notification that registration has been completed by the individual entrepreneur will be sent in the appropriate notification.

Registration procedure

To use all voluntary insurance services for your benefit, you need to contact the Social Insurance Fund organization for registration. At the same time, you can act through a public service resource. A special application and papers are submitted:

- request in form No. 108Н;

- civil passport of an entrepreneur;

- TIN;

- official certificate of state registration and registration of individual entrepreneurs.

Citizens engaged in special activities must submit an official document. For example, a notary should be shown a license, and a lawyer should be shown an official ID.

Important ! It is important to provide documents in copies previously certified by a notary.

The original must be attached to each copy. This is necessary to verify information. If everything is in order with the documents, 5 days after the application the entrepreneur will be assigned his own individual number and code of structural subordination. After successful registration, the entrepreneur will receive an official notification.

Voluntary contributions of individual entrepreneurs to the Social Insurance Fund

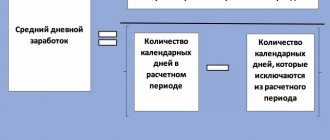

Important! In order for an individual entrepreneur to receive benefits, he must pay voluntary contributions. Their size is determined by the formula:

DV = minimum wage x T x 12, where

DV – amount of contributions payable for the year;

Minimum wage - the size of the minimum wage is taken based on the value established at the beginning of the year;

T – contribution rate, which is equal to 2.9%.

Payments must be made by the end of the current year. This can be done in one amount, or divided into parts. An individual entrepreneur can pay contributions from his own account or through a bank.

The amount of contributions will not depend on the period in which the individual entrepreneur submitted an application for voluntary insurance. He will have to pay the fees in full by the end of the year. If the amount is not paid in full, or the payment is not paid, the individual entrepreneur will be deregistered. In this case, no fines or penalties will be charged, and all amounts paid during the year to the entrepreneur will be returned back. In this case, the individual entrepreneur will not be able to count on benefits.

This year, only those entrepreneurs who paid their insurance premiums in full last year can receive insurance benefits.

Payment amount

Important ! To receive the benefits required by law, an entrepreneur must regularly pay voluntary insurance contributions.

The amount may vary. It is calculated using a special formula. It looks like this - DV = minimum wage x T x 12. The values of the indicators here are:

- DV – amount of transfers for the reporting year;

- The minimum wage is an official value;

- T – the established tariff of due contributions is 2.9%.

Contributions must be paid before the end of the reporting year. You are allowed to transfer the entire amount at one time, but you can pay in installments. Payment is allowed through the bank, as well as directly from the account. The amount of required contributions is also influenced when the entrepreneur submitted a request for voluntary insurance.

Important ! Contributions must be paid in full by the end of the year.

If you miss a payment, the entrepreneur will automatically be deregistered. Penalties and fines will not be assessed in this situation. The transferred amounts will simply be returned, and you also don’t have to count on benefits.

Maternity benefit for individual entrepreneurs

To receive benefits, an entrepreneur will need to contact the Social Insurance Fund and provide an application and sick leave. The application can be written in free form. The amount of payment in this case will depend on the number of days of vacation under the BiR. For a normal pregnancy and childbirth, this leave is provided for 140 days, for a multiple pregnancy - 194 days, and in the case of a complicated birth, another 16 days will be added to the sick leave . The amount of payment will be calculated based on the minimum wage established in the current period. To do this, the minimum wage is divided by the number of days in a month and multiplied by the number of days of vacation according to the BiR.

Features of receiving

As an ordinary citizen, an entrepreneur has the right to arrange for himself to receive child benefits. In this case, much will depend on the factor whether the amounts were transferred to the Social Insurance Fund. In the absence of voluntary insurance, such an opportunity will not exist.

You can only claim the following amounts:

- Birth of children – 16,350 rub.

- Standard child care – 3120 rubles for the first and 6131 rubles for the next.

Important !

If a person transferred funds to social insurance, you can receive additional payments. Such additional transfers include:

- maternity and pregnancy benefits;

- childcare related charges.

The amount of benefits provided is calculated based on the minimum wage. In other words, you can only receive minimum payments.

Payment upon early registration

In order to receive payment for registration in the early stages of pregnancy, a woman must contact an antenatal clinic no later than 12 weeks of pregnancy. In this case, she will be able to receive benefits in the amount of 628.47 rubles. You will need to contact the Social Insurance Fund for such a payment no later than 6 months from the end of your vacation under the BiR. As a rule, this benefit is issued together with the B&R benefit, since the certificate is issued simultaneously with the sick leave.

When contacting the FSS you will need to provide:

- Statement;

- IP passport;

- Certificate from the consultation.

One-time benefit for the birth of a child individual entrepreneur

If an entrepreneur has paid voluntary insurance contributions, he will be able to receive the payment due at the birth of a child. Its size is 16,759.09 rubles. If more than one child was born, the payment will be multiplied by the number of children. In those regions of the Russian Federation where a regional coefficient has been established, the payment will be increased by this coefficient.

The benefit can be received immediately after the birth of the baby and receipt of a certificate for it. Not only the mother, but also the father can apply for such a payment. In our case, the father is an entrepreneur.

You will also need to contact the Social Insurance Fund, submit an application and the necessary documents:

- Applicant's passport;

- Child's birth certificate;

- Birth certificate;

- A certificate confirming that the second parent did not receive such benefits.

The benefit will be accrued within 10 days from the moment the individual entrepreneur submits the application, and its payment will occur before the 26th day of the month following the month of application (

Benefit up to 1.5 years for individual entrepreneurs

The childcare benefit for a child under 1.5 years old will be paid in the amount of 40% of the minimum wage, but for the first child it should not be less than 3,142.33 rubles, and for the second and subsequent children - 6,284.65 rubles. To apply for benefits, you will need to contact the Social Insurance Fund - if the entrepreneur paid voluntary contributions, or to social security - if he did not draw up a voluntary insurance agreement.

When applying, you will need to submit the following package of documents:

- Statement;

- Passport;

- Birth certificate of the child and other children;

- A certificate from the employer confirming that the father does not receive such benefits.

You can apply for benefits not only for a born child, but also for an adopted child. In this case, you will need to confirm the fact of adoption with an appropriate document.

You can apply for benefits no later than 6 months from the date the child turns 1.5 years old. Moreover, regardless of the date of submission of the application, the benefit will be paid for the entire period from the beginning of parental leave. The benefit will be assigned within 10 days from the date of application.

Is an individual entrepreneur entitled to child care benefits?

Persons who have voluntarily insured themselves with the Social Insurance Fund have the right to claim (clause 4, article 2 of law No. 255-FZ) to receive not only maternity benefits, but also other amounts associated with the birth of children (art. 3 of law No. 81-FZ):

- for early registration of a pregnant woman;

- one-time payment at birth;

- care benefits.

The size of the first two payments for entrepreneurs is the same as for persons with employers. At the same time, not only the female individual entrepreneur, but also the second parent of the child can receive a one-time payment at birth, provided that these funds were not given to the mother.

But child care benefits for individual entrepreneurs are determined not from actual earnings, but from the amount of the federal minimum wage valid on the date of the insured event (clause 23 of the Regulations on the procedure for calculating benefits, approved by Resolution No. 375).

The amount of the benefit itself should (Article 15 of Law No. 81-FZ):

- be 40% of the calculation base (i.e. for individual entrepreneurs from the minimum wage);

- not be below the minimum possible value for it;

- do not exceed the maximum possible value.

Maternity leave does not have to be taken out for the mother. This can be done by the person actually caring for the child. If such a person has an employer, then the benefit received is calculated not from the minimum wage, but from real income. As a rule, they are higher, and therefore the calculation result is more profitable.

What benefits are available to individual entrepreneurs without an agreement with the Social Insurance Fund?

If an entrepreneur - a future or current mother - has not entered into an agreement with the Social Insurance Fund, then she is not entitled to payment under the BiR. But she can still count on some types of benefits:

- One-time benefit for the birth of a child;

- Payment to women who registered before 12 weeks of pregnancy;

- Monthly care allowance for up to 1.5 years.

In this case, you will need to contact social security and submit the following documents:

- Statement;

- Passport;

- Child's birth certificate;

- Certificate from the registry office about the birth of a child.

The benefit will be assigned within 10 days and paid no later than the 26th day of the month following the month of application. An entrepreneur can receive benefits in any way convenient for him: to a bank account, to cards, or in the form of a postal transfer (

When can an individual entrepreneur claim 2 maternity benefits per child?

Everyone on maternity leave should receive a subsidy for childbirth and pregnancy. According to the laws of our country, its duration is 140 days and it does not begin at an early stage, but continues after the pregnancy is resolved.

For operations with health complications, the number of vacation days increases to 156. For multiple pregnancies, the period increases further and amounts to about 200 days. During this period, earnings are compensated for everyone who worked before the vacation. If there was no income, then no compensation is due. Mothers can receive money based on the following factors:

- Those with official employment.

- Persons liable for military service.

- Law enforcement workers.

- Full-time students.

- Individual entrepreneurs, law firms, notaries, and other women engaged in private activities.

- The unemployed can count on this additional payment only if they are registered with the Central Employment Service within a year after their dismissal.

The amount of the benefit will be directly related to earnings. For example, full-time students will receive benefits from a scholarship. Those who receive income from their employer will receive a payment based on average earnings. However, there is a limit on the amount. This year it is 912 thousand rubles.

Step-by-step instructions for registering an individual entrepreneur with the Social Insurance Fund to receive maternity benefits

In the case of individual entrepreneurs, the Social Insurance Fund is responsible for the subsidy. To ensure that help is not refused, the registration procedure must be followed exactly. The right of an individual entrepreneur to sick leave benefits is valid thanks to free social insurance.

After all, individual entrepreneurs pay their own insurance premiums, including medical ones. It is this factor that allows you to receive treatment under the policy for free, including sick leave and maternity leave.

Important!

For individual entrepreneurs, social contributions are paid of their own free will, but if they are not paid, then there is no subsidy for childbirth and pregnancy.

Instructions for an entrepreneur wishing to receive maternity benefits are as follows:

- Registration with the Social Insurance Fund.

- Payment of insurance premiums for voluntary social insurance.

For example, if maternity leave should occur in 2021, then the application to the fund must be sent in 2021 and 4221.24 must be paid by the end of the year.

You can register an individual entrepreneur with the Social Insurance Fund through government services. The application on the portal is generated automatically, and the list of documents is minimal:

- Passport.

- EGRIP.

- Certificate from the tax office.

You can contact the FSS in person, and these bodies work without registration. Another option for submitting an application is to contact the MFC. It is possible to send documents by mail.

Two types of maternity leave can be obtained by employees working under a contract, as well as those who own individual entrepreneurs; the law does not prohibit this approach to registration. At work, the amount of maternity pay will be the amount of average earnings for two years. Only it will be limited to a maximum coefficient of 322,192 rubles.

The employer's HR and accounting departments are responsible for benefits. These specialists need to submit a sick leave certificate and write a statement.

If you have an individual entrepreneur, you can contact the Social Insurance Fund, although by default private entrepreneurs are not entitled to maternity leave. When a woman engaged in private activities goes on vacation, no one compensates for the lost income.

However, voluntary social insurance will help those who expect to start a family and do not want to be left without financial support.

General provisions of the law on payments for children of individual entrepreneurs

In the Law on Compulsory Social Insurance, women individual entrepreneurs are not included in the list of persons entitled to maternity benefits due to the absence of an agreement with the Social Insurance Fund.

This problem is solved in favor of the expectant mother: maternity leave for individual entrepreneurs can be obtained if all the rules of voluntary social insurance are followed. The question, if I am an individual entrepreneur, how to get maternity leave in 2021, is extremely popular in women’s and legal forums, and each specific case is considered separately.

One of the latest news about maternity leave for individual entrepreneurs: the Pension Fund will exempt from mandatory contributions

Regulations

- The basics are set out in Federal Law 255 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

- For more details, see the “Rules for the payment of insurance premiums by persons who voluntarily entered into legal relations for compulsory social insurance in case of temporary disability and in connection with maternity”, approved by Decree of the Government of the Russian Federation of October 2, 2009 No. 790.

Pay to the Social Insurance Fund - and pregnancy benefits are guaranteed

How an individual entrepreneur receives maternity benefits is established by law.

According to Federal Law No. 255-FZ (Article 2, Part 3, 4), a woman must register with the Social Insurance Fund and pay a fixed contribution there.

For example, having entered into an agreement with the Social Insurance Fund in 2021, a woman must pay contributions for the entire year by December 31. The right to insurance coverage will begin on January 1, 2022. If an insured event, which is recognized as the first day of maternity leave, occurs in 2022, the individual entrepreneur will receive maternity benefits (maternity benefits) and another payment, which is discussed below.

Payment of voluntary insurance premiums is made on time and in full. We also advise you not to forget to register with a medical consultation: no later than 12 weeks of pregnancy . For this, the expectant mother will receive an additional one-time benefit, which until February 2021 is 655.49 rubles (the next indexation is planned in February).

Take care of taxes

Maternity leave for individual entrepreneurs means suspension of activities. There are discrepancies in the laws regarding taxes. Therefore, it would be better to contact your tax office for clarification on paying taxes.

As a rule, during parental leave, business activities can be suspended and no tax must be paid.

What documents do you need to obtain from the antenatal clinic in order not to lose maternity benefits?

You need to contact the antenatal clinic for a sick leave. Usually this document is issued at 30 weeks of pregnancy, including for individual entrepreneurs. In this case, work in an individual entrepreneur will be considered part-time if the person has another official place of employment under a regular employment contract.

The form does not have a separate item for entrepreneurs. Although, if there is no place of work under an employment contract, the checkbox about employment in an individual entrepreneur will be placed in the main column.

It is worth noting that the fund does not have an electronic service with the ability to submit an application for assistance during pregnancy and childbirth. Perhaps this was done because the package of documents provides only the original sick leave. Therefore, you will have to contact the social insurance department in person.

The application form will be issued by Foundation employees, but it is also available on the official website. The document can be downloaded and filled out in advance. Several copies may also come in handy. You can correct the application directly at the fund or contact its employees for help. Responsive people will never refuse advice.

For example, a common mistake in filling out is the indication of the wrong TIN. In the application you need to write the numbers from your personal document, and not those that are in the registered individual entrepreneur.

In addition, the application immediately indicates the amount of the cash benefit. After the fact, it is calculated by the fund’s employees and presented to the applicant with a calculation protocol. The FSS website has a special calculator that you can use when filling out the application yourself. You can also check the amount calculated by employees here.

What documents should I prepare for the Social Insurance Fund in order to receive maternity benefits?

A sick leave certificate with a check mark indicating that you work for an individual entrepreneur can be submitted to the Social Insurance Fund. Additionally, you need to fill out an application and submit the following documents:

- A copy of the notice of registration with the Social Insurance Fund.

- Receipt confirming payment of contributions.

- Sick leave.

- Application.

- Copy of the passport.

- Certificate of registration with the tax authorities for individual entrepreneurs.

- Document from the Unified State Register of Individual Entrepreneurs.

- Bank details.

Important! FSS employees will pay special attention to the payment document. The financial indicator and payment terms will be checked for accuracy. If there are errors in the amount or late documents will not be accepted.

The document confirming the payment of contributions will be a copy of the bank payment slip. The payment order will necessarily indicate the amount in words and the date of payment. These aspects are especially important for the FSS.

What benefits does the FSS pay?

You can receive other types of monetary compensation from the social insurance association. For example, women are entitled to a subsidy for early pregnancy registration. It is read as a lump sum and goes to the account at the birth of the baby.

The amount in 2021 is set at 675.15 rubles. You won’t be able to get it twice, as you would with a maternity subsidy. You need to decide for yourself where it is best to arrange it.

A one-time benefit, which is paid at the birth of a baby, can also be received through the Social Insurance Fund. For him you need to submit an application, a certificate from the registry office, a document from the father about not receiving benefits at his place of work, a certified work book with information about the last place of employment.

The entrepreneur can also count on the usual monthly allowance for the baby. For individual entrepreneurs, the amount will be calculated based on the minimum wage. If there is a place of work under an employment agreement, it is better to contact the employer. For working women, this benefit is calculated from the average salary.

Important!

It is not possible to receive two child care benefits. The law prohibits this approach to registration.

How to calculate and obtain the maximum amount of maternity leave for an individual entrepreneur?

When calculating maternity benefits, it is necessary to be guided by the Order of the Minister of Labor and Social Protection of the Population of the Republic of Kazakhstan dated June 8, 2021 No. 217 “On approval of the Rules for calculating (determining) the amount of social payments, assignment, recalculation, suspension, renewal, termination and implementation of social payments from the State Social Fund insurance" (hereinafter referred to as the Rules).

According to clause 43 of the Rules, when calculating the amount of social benefits in case of loss of income due to pregnancy and childbirth, the average monthly amount of income taken into account as an object for calculating social contributions is determined by dividing the amount of income from which social contributions were made over the last twelve calendar months (regardless depending on whether there were breaks in social contributions during this period) preceding the month in which the right to social payment occurred, by twelve according to the following formula:

SMDsvbr = (UNIT 1 + UNIT 2 + UNIT 3…….+ UNIT 12) / 12, where:

SMDsvbr - the average monthly income of a participant in the compulsory social insurance system;

ED - monthly income taken into account as an object for calculating social contributions.

According to paragraph 5 of Article 15 of the Law of the Republic of Kazakhstan dated December 26, 2021 No. 286-VI “On Compulsory Social Insurance”, the monthly object for calculating social contributions

from one payer should not exceed 7 times the minimum wage

established for the corresponding financial year by law about the republican budget. In 2021 it is 297,500 tenge (7 * 42,500).

Thus, in order for an individual entrepreneur to receive the maximum amount of maternity leave, the monthly income taken into account as an object for calculating social contributions must be 297,500 tenge. Accordingly, monthly social contributions will be 10,413 tenge.

The amount of social benefits in cases of loss of income due to pregnancy and childbirth

, is determined by multiplying the average monthly income taken into account as an object for calculating social contributions by the corresponding coefficient for the number of days of incapacity for work using the following formula:

SVbr = SMDsvbr x KKD, where:

SVBR - social payment for cases of loss of income due to pregnancy and childbirth, adoption of a newborn child (children);

SMDsvbr - the average monthly income of a participant in the compulsory social insurance system, determined in accordance with paragraph 43 of these Rules;

KKD - coefficient of the number of days of incapacity for work.

The coefficient of the number of days of incapacity for work is determined by dividing the number of days for which a sheet (sheets) of temporary incapacity for work due to pregnancy and childbirth was issued by thirty calendar days.

In this case, the value of the coefficient for the number of days of incapacity for work is rounded to one decimal place by applying the arithmetic rounding method (if the second decimal place up to 5 is rounded to 0, if from 5 and above - to 1).

An example of calculating the maximum amount of maternity leave:

SMD svbr = 297,500 tenge (297,500*12) / 12

KKD=4.2 (126/30)

SVBR=1,249,500 tenge (297,500*4.2)

Thus, when paying a monthly amount of social contributions during the year in the amount of 10,413 tenge, the individual entrepreneur is accrued the maximum amount of maternity benefits in the amount of 1,249,500 tenge.

If an individual entrepreneur wants to receive a “ more” amount, then he needs to find a job with another employer (not prohibited by law), accordingly, this employer will calculate the CO within 7 minimum wages. In this case, maternity benefits will be calculated for each payer separately.

What payments is an individual entrepreneur entitled to who does not make contributions to the Social Insurance Fund?

Individual entrepreneurs receive the right to insurance coverage only if they pay insurance premiums for the calendar year that precedes the period in which the insured event occurred.

If such contributions have not been made, then the individual entrepreneur has the opportunity to issue only an allowance for a child under 1.5 years old. However, you need to apply for it through social protection. The FSS will require a certificate of unpaid insurance premiums for voluntary insurance.

Maternal capital

This benefit is issued to all Russian mothers at the birth of a baby with Russian citizenship. It does not depend on whether the applicant is an individual entrepreneur.

At the same time, the same right to MK arises when adopting children with Russian citizenship. This event must occur on January 1, 2007 or January 1, 2021.

Moreover, in the case of adoption, the right also applies to men, but if he is the only adoptive parent of the first child. Previously, I did not use additional government support measures.

One-time benefit for the birth of a child

This subsidy for 2021 amounted to 18 thousand rubles. Workers in the Far North are entitled to increased benefits, increased by the regional coefficient. Money can be processed and received at the place of employment or at the Social Insurance Fund. If one of the spouses has a job, benefits can only be paid to an employed citizen.

In any case, to receive a subsidy you need the following documents:

- Application.

- Birth certificate.

- From the other parent’s place of work about non-receipt of benefits.

- A certified extract from the employment record in case of contacting social security authorities.

- Document on divorce (if available).

No more than six months should pass from the date of birth. It is important to submit these documents on time.

Monthly allowance for child care up to 1.5 years

This new type of payment depends on the number of children in the family. For the first child you can get about 3 thousand rubles, and for subsequent children about 7 thousand rubles, and the money is transferred to the account monthly.

Dismissed mothers can count on benefits during pregnancy. At the same time, regarding the individual entrepreneur, its activities must be terminated. Additional payment is also provided to fathers who care for the child.

If the actual caregiver is a full-time student. If other relatives are caring for the child, they can also count on this help.

It can be completed through an application indicating all the information about the legal representative. Documents of the applicant and the child must be attached to the application. Additionally, you will need a certificate from your place of study, work, and the amount of benefits paid. Copies of papers confirming preferential status.

It is better to check with the receiving authority about the additional papers required for registration. Receipt of payment is regulated by Federal Law 81 of 1995, order 1012 of December 23, 2009.

Putin's payments

Among Putin's payments, the most popular were subsidies for 3- and 7-year-old children. His appointment is regulated by Presidential Decree No. 199 dated March 20, 2020.

According to the law, low-income parents have the right to assistance. This category usually includes families whose pre-tax income does not exceed the subsistence level. Another mandatory condition is Russian citizenship and permanent residence on the territory of the state.

For example, in the Novosibirsk region, the per capita monthly income for the 2nd quarter of 2021 amounted to 11,738 rubles. Half of this amount, 6,018 rubles, is calculated for each child aged 3 to 7 years.

Important! The government services website has a preliminary calculator that allows you to make an accurate calculation yourself. Income for calculation must be taken for June 2021, May 2021.

If during this period one of the family members did not receive income, then he had to be registered with the central bank. In general, we can say that payments can only be received by those families whose average per capita income did not exceed 11,738 rubles for the specified period.

The payment is of a declarative nature, so the receiving party will require an application and documents. It is especially important to pay attention to your bank account details. Currently, only Mir bank cards are accepted.

Regional benefit for a child under 16 (18) years of age

This monthly benefit is issued by social protection authorities, including persons with individual entrepreneur status. For example, in the Novosibirsk region the standard amount is 318.88 rubles. Some categories of parents are entitled to increased amounts:

A single mother, a divorced relative, those who have lost loved ones due to death, if one of the parents evades child support, deprivation of parental rights - 478.31 rubles.

Subsidies are established regularly. The offspring must receive education at a comprehensive school (no more than 18 years of age). Parents who are able-bodied, not working, or not on the stock exchange cannot receive money. But there are nuances here. For example, in rural areas you can take a certificate of subsidiary farming and indicate income from sales of personal production.

Application for benefits is general; you need an application, personal documents, and income certificates. It is better to check with specialists about other necessary documents.

If necessary, they can independently request most of the documents, but to do this they will need consent to the processing of personal information. Documents can be provided, including in the form of an electronic document.

If you want to independently study the basis for assigning this payment, you can study OZ 255 of 2004. This applies to the Novosibirsk region. Other regions have their own laws and regulations.

Additional benefits in Moscow at the birth of a child

For example, Moscow belongs to the advanced region and pays the largest number of benefits, compensations and benefits. The policy of the capital authorities is social; legislative acts pay a lot of attention to this area.

For example, a lot of financial assistance is provided to low-income families, social units with disabled minors, and parents with many children. Payments for these categories are 2-3 times higher than the Russian average. For example, young parents whose child was born before the age of 30 can receive additional amounts of money:

- For the first-born - almost 99 thousand rubles.

- For the second child – 140 thousand rubles.

- For each subsequent newborn – almost 200 thousand rubles.

- These monetary amounts are directly related to the cost of living. For Moscow this is 19 thousand 797 rubles.

- You can receive the indicated amounts after submitting an application to the MFC; for this you need:

- Personal passports of parents.

- Marriage worksheet.

- Birth sheet.

- SNILS.

- Confirmation of Moscow registration.

- Certificate of cohabitation with the child.

Attributes for transferring funds are indicated in the application. There are no exceptions for individual entrepreneurs in this case.