It is difficult to imagine today an enterprise that from time to time, and sometimes regularly, due to the specifics of its activities, does not send its representatives to solve production problems, expand the scope of its activities, train, or simply to exchange experience to other regions of Russia or even countries of the world.

Business trips, formalized in writing by the head of the organization to achieve set goals and a period presumably sufficient for their implementation to an area remote from the main location of the enterprise where a person works under an employment contract, are defined by labor legislation as business trips.

Both the employer sending an employee on a trip and the employee himself have questions about the deadlines within which the employee can be sent.

The manager is interested in what the law has to say about this from the point of view of the legal framework.

For a person sent on a business trip, this fact is also important, since he has to live away from home and family.

The generation that entered working life back in the days of the Soviet Union, which still continues to work today, remembers well that on the basis of Instruction No. 62 adopted by several departments of the USSR on April 07, 1988, a maximum period of business trip within the Union republics was provided for - 40 days.

However, the time spent on the trip was not taken into account during this period.

Employees involved in commissioning, construction and installation work could be sent on business trips for a period of no more than one year (clause 4 of Instruction No. 62).

Based on the instructions of the regulatory agencies, it was recommended to adhere to these deadlines even in cases where employees were sent on business trips abroad.

Many employers continue to take these standards into account, which, in principle, does not contradict current legislation.

Thus, the maximum period of business travel under the Labor Code of the Russian Federation 2021 is not mentioned at all in Chapter 24.

In addition, starting from 2008, the rules adopted in Resolution No. 749, approved on October 13, 2008, with subsequent amendments to it, have been in force.

Paragraph 4 of the Regulations on the specifics of sending employees on business trips, adopted by Resolution No. 749, emphasizes that the duration of an employee’s business trip is determined by the head of the enterprise, taking into account the volume, complexity and other features of the official assignment, without specifying specific limits.

How long is a business trip?

According to Art. 166 of the Labor Code of the Russian Federation, a business trip is a trip to carry out orders from the management of an enterprise, therefore, as soon as the event determined for the purpose occurs, it must end.

Paragraph 4 of Regulation No. 749 provides an explanation that the day of departure and return from a business trip to the location of permanent work is included in the period of a business trip.

Moreover, if the vehicle in which the posted employee gets to his destination departs from his location within 24 hours inclusive, this day is considered the day of departure.

In the case when the departure time of transport, according to boarding tickets, is from 0.00 o’clock, the next day is considered the day of departure.

According to the amendments made to Regulation No. 749, adopted by Resolution No. 1595 and which came into force in January 2015, regardless of what the maximum and minimum travel dates are, issuing a written order is sufficient to formalize sending an employee on a business trip.

In addition to the specified purposes of the business trip, the order approximately indicates the duration of its validity, depending on how much time may be needed to implement them.

It is important to understand that the actual maximum and minimum travel dates can be changed due to a number of prevailing circumstances.

For example, when setting up the “Customer’s” equipment, a seconded employee performed work on a day off and completed the tasks ahead of the deadline specified in the order.

In the event of illness of an employee sent to carry out an official assignment, or an unforeseen delay in travel (for example, due to weather conditions, the departure of an airplane was delayed), the period of business trip will actually be extended, which should also be documented in an additionally issued order.

Answers to common questions about the maximum duration of a business trip

Question No. 1: The employer arranged a business trip for an employee, which should begin on January 13. But the employee took the initiative, exchanged a plane ticket and flew to his destination 3 days earlier. Should the manager pay for these 3 days?

Answer: If the initiative to change the timing of a business trip did not come from the employer, he is not obliged to pay wages and daily allowances on those days that were not included in the travel period.

Question No. 2: Should weekends and holidays be taken into account when determining the timing of a business trip?

Answer: Yes, weekends and holidays are also taken into account in the total duration of the business trip.

If an employee is on holiday on a day off, he is entitled to a daily allowance; if he was working, he is entitled to double daily allowance and the average salary (or single amount, if the employee wishes to take time off upon returning from a trip). Rate the quality of the article. Your opinion is important to us:

The maximum period for which a business trip can be arranged

Having carefully studied the regulatory framework that was fundamental in 2017 for registering a business trip, which is considered a business trip, we note the main requirements:

- the presence of a written order from the manager, defining: the purpose of separating the employee from the main workplace and sending him to another area;

- deadlines sufficient to complete the assigned task;

The manager determines the period for which the employee goes on a business trip.

The maximum duration of a business trip within the Russian Federation, as well as outside the Motherland, is currently not limited.

You need to understand that a business trip cannot continue indefinitely and must be completed with the fulfillment of the employer’s instructions, otherwise it may be regarded as a transfer of the employee to another organization (Article 72.1 of the Labor Code of the Russian Federation).

How many days can a business trip last and the registration process according to the norms of the Labor Code of the Russian Federation

The duration of business trips is established by law. If the employer does not comply with these standards, then the citizen has the right to protect his rights and interests in the prescribed manner. It should be taken into account that the duration of work trips may differ for people of different professions.

Maximum period of business trip according to the law of the Russian Federation

The duration of a business trip is set by the employer

Russian legislation does not contain precise instructions on the duration of work trips, but there is indirect evidence, primarily that the duration of the business trip is set by the employer. The dates of the trip must be clearly indicated by the head of the company; accordingly, the business trip cannot be unlimited - there is a direct indication of this in the Labor Code of the Russian Federation.

According to the provisions of the Government of the Russian Federation No. 749, employees of enterprises, by decision of the manager, can be sent on a long or one-day business trip. There are rules for calculating payments for this period, and maximum periods are established in additional legal acts and requirements, including in the internal acts of individual enterprises.

All days when a person is on a trip are considered business trips, even if during this period there are weekends and holidays. In addition, such days must be paid double. It is also possible to shorten or extend the trip after the head issues the relevant Order.

So, despite the fact that the law does not establish the exact duration of a business trip and its duration, when choosing the start and end date of the trip, several points must be taken into account:

- the amount of work to be done;

- place of arrival – Russia or foreign countries;

- complexity of the work;

- features of the execution of the order, the specifics of the company’s activities.

In most companies, internal regulations establish a maximum period of business travel - up to 40 days. But if necessary, it can be increased up to 1 year with the consent of the employee.

How long can a business trip last?

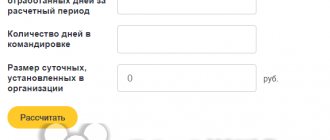

In 2021, Russian legislation does not establish how many days a business trip lasts, but in practice, the minimum duration of a work trip is 24 hours. Even if the employee was away for 5-10 hours, the employer is obliged to pay him for a full day of work. This period includes time spent on the road.

The maximum time is also not limited; the employer sets it himself, based on the principles of reasonableness and expediency.

For people of different professions, different periods of work trips may be established, based on the specifics of the work performed.

Thus, one day will not be enough for an employee of the Fire Safety Service to complete the task, but 24 hours will be enough for an accountant who travels to the suburbs to draw up a report.

It should be borne in mind that prolonged, long trips may be regarded by regulatory authorities as a transfer of an employee to work in another area.

Since such transfers must be properly documented, a business trip for a year or even several years will be considered illegal.

In order for an employer to avoid administrative liability, it is necessary to follow the internal regulations of the enterprise and set normal deadlines, and send an employee on work trips only with written consent.

From a serviceman

For military personnel, the maximum travel period is 40 days, excluding travel

The process of sending military personnel on business trips is regulated by the relevant regulatory act - Order of the Ministry of Internal Affairs of the Russian Federation No. 1150. This order contains an exact indication of how many days a military business trip lasts.

In accordance with this document, as well as the Instructions on the organization of business trips for employees of the Ministry of Internal Affairs and, accordingly, the Armed Forces of the Russian Federation, for military personnel, the maximum period of stay on a business trip is 40 days.

This period does not include the time spent arriving to the destination and back, to the military unit or home.

For military personnel, business trips may mean exercises in another region. Most often, the entire unit is delivered to the site of such exercises by special transport.

At the FPS officer

According to the internal instructions of the Ministry of Emergency Situations, the period of stay of a serviceman or employee cannot exceed five days. In this case, the time spent on the road is not taken into account.

However, in exceptional cases, fire crews or rescuers may be on a business trip for a longer period of time, without taking into account days of temporary disability and time spent on the road.

Extension of the period is carried out by no more than 5 days, subject to written permission from the head of the higher organization that called the employees to complete the assigned tasks.

An automatic extension of a work trip is possible if, as a result of force majeure circumstances, the employee was detained en route.

Such a delay must be confirmed by officials: heads of departments and garrisons, heads of the airport, station, pier, bus company.

Upon verification of these circumstances, an appropriate Resolution must be issued.

These rules apply to military personnel working in first responders. Another procedure for calculating business trips is possible for persons employed by the Federal Border Guard Service and engaged in activities to rescue people from emergency situations. So, in this case, the maximum period for an official to stay on a business trip is 40 days.

There is a certain procedure for calculating the period during which a Federal Border Guard Service employee can be on a work trip.

The calculation is based on the fact - how many days the citizen performed work duties outside his usual workplace.

At the same time, the calculation must be made according to actual data, and the figures should not differ from those indicated in the travel certificate. Includes travel days, weekends and holidays.

It may be difficult to determine the day of departure and arrival of the employee.

In accordance with the law, departure day is considered the day when an employee boards a plane, train, bus, boat and heads to his destination.

Accordingly, the day of arrival is the day when the vehicle stops at the starting point. All these dates must be documented.

From an employee of the enterprise

Resolution of the Government of the Russian Federation No. 749 was adopted, in accordance with which the rules for sending enterprise employees on business trips to carry out tasks set by the manager are established.

According to paragraph 4 of this Regulation, the head of the enterprise independently determines the timing of the business trip, taking into account many factors.

The complexity of the work and production needs must be taken into account.

Thus, in accordance with the law, an employee of an enterprise can be on a business trip for any period of time, but provided that the established periods do not contradict other legal norms and labor regulations.

The optimal duration of a business trip is from 24 hours to 40 days.

A longer period can be assigned only with appropriate registration and written permission from higher supervisory organizations, since an employee on a business trip cannot be transferred to work in another locality on a permanent basis. An employee who goes on a work trip must return from it - the agreement sets an end date.

If the employee completed the work within a few hours and returned to his workplace, there is no need to issue a travel certificate.

How to make changes to the duration of a booked business trip

In life, it is impossible to predict how events will unfold.

It happens that having sent an employee on a business trip, the need to achieve its goal simply disappears, or the employee completed the assigned task ahead of schedule.

The manager needs to recall the employee from a business trip.

It is logical that for this purpose an appropriate order is created, adjusting the timing of the business trip with justification of the reasons for their change.

Moreover, neither in the Labor Code, nor in Regulation No. 749, the legislator does not focus attention on this point and does not provide certain requirements for the preparation of documentation, unified forms.

Therefore, the employer has the right to issue a written order in any form or developed for such situations in the organization.

You can inform the posted worker that the period of his stay on official assignment has been changed by all available means: in a telephone conversation, sending a scanned copy of the order by e-mail, and others.

Upon return, the employee must personally familiarize himself with the original order.

What to do if you need to extend your business trip?

If the fulfillment of a task received when sent on a trip requires the presence of a specialist for more than the established period, for example, for technical reasons, or the person fell ill and could not do work for several days, by analogy with a recall from a business trip ahead of schedule, an order to extend the business trip may be issued.

The employee will also be familiarized with his signature after his arrival at the main workplace.

The only nuance that is important not to forget is that if the posted employee belongs to the category of persons who have certain guarantees and benefits that require the employee’s consent to perform official duties outside his main workplace, associated with traveling to another location for a certain period of time, consent to extend the business trip must be get again.

By prior means, for example, by telephone, the person must agree to stay late to complete the assigned work.

Such employees include:

- employees with children under three years of age;

- parents of children under five years of age raising without the help of a second spouse;

- persons who have a dependent child recognized as disabled;

- workers caring for incapacitated relatives, according to a medical report on the need for outside care;

- working disabled people.

Is it possible to extend a business trip without the employee’s consent?

A business trip on the instructions of management is part of the labor functions that must be performed by the employee by virtue of an employment agreement concluded with the company.

Therefore, an employee will be able to refuse to participate in a trip without being subject to disciplinary action if the administration agrees to this. This rule also applies to the extension of a business trip, since this is also a business trip.

You might be interested in:

Severance pay upon dismissal due to layoff: what payments are due, amount

Do not forget about the categories of citizens, when arranging a business trip, for whom the law establishes the obligation of the company’s management to obtain their prior consent for such trips.

These employees include:

- Those who have young children (under 3 years old), women or other persons who are raising these children in the absence of a mother.

- Persons who are raising children under 5 years of age alone.

- Persons providing medical care and supervision of close relatives.

- Disabled people working at the enterprise, except in cases where the trip affects their rehabilitation period.

Attention! Since these employees give initial consent to a business trip, they must also obtain consent to extend its duration. If such a person refuses this, then the duration of his business trip cannot be increased.

Advance issued for travel expenses when the timing of a business trip changes

According to Art. 168 of the Labor Code of the Russian Federation, the employer pays all material costs associated with the business trip.

Clause 10 of Regulation No. 749 provides for the issuance of an advance to pay for travel to the place of business trip and return home, for the rental of living quarters, and daily expenses associated with being away from a permanent place of residence.

It is clear that when returning from a trip ahead of schedule, there must be money left over for a longer period of stay and daily expenses, which, together with the submission of an advance report, must be deposited into the company's cash desk or returned to the current account.

At the request of the employee, the excess funds paid can be recovered from his salary.

If an employee completed a production task on time, but due to his personal affairs was delayed in the city (country) and returned later than the established deadline, he will not be compensated for these days in the amount of accommodation and daily expenses, and payment for travel on the return trip will also become unreasonable.

In the event that a business trip takes longer than planned, due to an unforeseen stop along the way or the additional time required to complete the task, the person must be compensated for additional expenses.

Moreover, in case of extension of the business trip, an advance payment for daily expenses and accommodation during the estimated period can be sent by postal order or transferred to the employee’s bank account.

Maximum duration of a business trip: the employee returned later

It happens that an employee, for certain reasons, returns to the company at his main place of work later than expected. Such changes entail additional payments; in addition, the HR department will be forced to document the end of the trip later than the previously approved date. The document should indicate the basis for extending the trip, this could be:

- impossibility of fulfilling the employer’s instructions within the time determined before the business trip;

- assigning an employee an additional amount of work;

- the presence of the employer’s interest in extending the business trip or the interest of the host company;

- delay/cancellation of an airplane flight or train departure;

- lack of travel tickets at the box office;

- an employee’s illness acquired during the trip or injury.

In any case, the employee is required to provide documentary evidence that the extension of the business trip was necessary if the trip was delayed due to his fault or due to the lack of travel tickets. As soon as the employee arrives, he must report within 3 days on the reasons for the delay.

If, before departure, the employee received money intended to pay for travel and accommodation during the business trip, and it was extended, the employer is obliged to instruct an accountant to recalculate the amount issued. When paying travel money, it is necessary to generate pay slips.

How is a day off on a business trip paid?

If an employee is forced, in order to get to the destination of a business trip, to travel on his scheduled day off or a non-working day by law (holiday), first of all, his consent must be obtained in accordance with the norms of labor legislation.

Clause 4 of Regulation No. 749 establishes that the days of departure and return from a business trip are included in the period of a business trip, that is, all expenses (accommodation, daily allowance) must be compensated.

Based on clause 5 of Regulation No. 749, remuneration for work on a business trip if an employee is involved in work on weekends or holidays is made in accordance with the Labor Code of the Russian Federation.

Art. 153 of the Labor Code of the Russian Federation obliges the employer to pay for work on weekends at twice the normal daily rate, regardless of the remuneration system in force in the organization, or to provide the employee with a day to rest at another time.

What is a business trip, how is it paid and processed in accordance with the Labor Code of the Russian Federation

The Labor Code of the Russian Federation guarantees benefits and compensation when sending employees on business trips. The legislative act regulates the registration, payment of daily expenses and duration. The Labor Code describes business travel as the performance of work functions outside the enterprise.

What is a business trip and legal regulation

Article 166 of the Labor Code defines a business trip. This is an order from the enterprise administration to an employee to perform tasks that require the personal presence of a representative. For example, a structural unit is located in another city and an urgent need to conduct an audit.

Article 168 of the Labor Code defines the costs that the administration is obliged to reimburse. This applies to government organizations and private enterprises.

The execution of work assignments is regulated by Ministry of Finance Instruction No. 62. The regulations on business trips, approved by Resolution No. 749 of the Government of the Russian Federation, did not cancel the instructions, but made a number of changes. Paragraph 11 of the document, in addition to travel expenses, rental housing and daily allowances, allows compensation for other expenses in agreement with the head of the enterprise.

A business trip includes the concept of employee travel:

- for the acquisition of inventories;

- for carrying out major repairs;

- on preparation and improvement of qualification level;

- to participate in meetings of joint stock companies.

The official assignment is carried out on the basis of the order of the manager. If an employee performs work that requires constant travel, this does not apply to business trips.

If an enterprise sends a worker on a business trip abroad, registration is carried out in accordance with the laws of the Russian Federation. The specifics are set out in the above-mentioned resolution No. 749. If a citizen is sent to a branch of an enterprise abroad or in another city, this is also the fulfillment of an official assignment.

You can send a person who works remotely on a business trip, the main thing is that he is on the staff. Only such employees are administratively subordinate to the manager.

To arrange a trip, the administration of the enterprise issues an order, which reflects:

- Purpose and duration of the task.

- Conditions that apply to the performance of work.

The employee is paid travel expenses and issued a certificate. An employee’s refusal of an official assignment is equivalent to a violation of labor discipline, except for the grounds that give such a right. At the end of the trip, the worker reports in writing.

Business assignments are divided into two types: within Russia and abroad.

In addition to these types, it is customary to divide work trips into the following types:

- planned and not according to plan;

- short-term: for one day and long-term;

- for one employee and group.

Legislative provisions for the period of business trip determine benefits and compensation. Salaries are calculated according to the average income of the employee.

Travel time

Explanations regarding the duration of the trip are provided by Regulation No. 749, which states that the day of departure and arrival is included in the period of the business trip. If departure is before the end of the day, this day is the beginning of the execution of the order. If the departure time is after 24:00, another day begins.

The law allows you to adjust the travel period depending on the circumstances. If the employee completes the task ahead of schedule, he can return to his permanent place of work. Illness is the basis for extending the period; for changes, a special order is issued.

There is no rule in the Labor Code that determines the duration of a business trip. Previously, the maximum period was no more than 40 days. The manager is currently installing it.

In this case, the following requirements must be met:

- Drawing up an order indicating the purpose, city or country, approximate time for completing tasks.

- The presence of an employment agreement, if the employee is not officially registered, he has the right to refuse.

- An employee's functional responsibilities should not be in the nature of constant travel; a business trip does not last indefinitely.

- Order end time.

In other cases, work can be regarded as a transfer to another organization, which is provided for in Art. 72 Labor Code of the Russian Federation.

Business trip destination

If production activities involve frequent business trips of employees, then a schedule is drawn up. Based on the document, an order is issued and an official assignment is drawn up.

On the appointed day, the worker receives a travel allowance, leaves the enterprise and hits the road. A note about the business trip is made in the exit schedule, and work activities take place in a new place.

When the task is completed, the worker comes back and submits a report that reflects information about the completion or lack of results and the reasons. The employee is required to present travel tickets and documents of residence.

Payment for business trips is regulated by Art. 167 Labor Code of the Russian Federation. Salaries are calculated on a daily basis. For the calculation, 12 months are taken that precede the travel time.

When an employee worked less, income for the actual time worked is taken into account.

If the work activity lasted several days, the following is not taken into account when determining the average salary per day:

- maternity leave;

- temporary disability benefits;

- payment for downtime days;

- other compensation when an employee received money but did not work, for example, during downtime.

To determine the average income per day, the salary for the entire time is summed up and divided by the number of days when the worker performed functional duties. The resulting amount is then multiplied by the number of days of business travel. This amount is an advance payment for which the employee must account for upon arrival.

If the amount received is less than the average monthly income, the administration pays extra. The accrual of additional funds is provided for by internal regulations. If it exceeds the average daily income, the advance is calculated according to this indicator.

Weekend

When an employee is sent for a long period of time, the time falls on the weekend. He can work or rest at his discretion. In case of work, a free day or double pay is provided. Labor activity is recorded in documents that the traveler submits to the accounting department at the main place of work.

The calculation procedure is established by Art. 139 Labor Code of the Russian Federation. If the day off falls on the day of departure or arrival from a business trip, the worker also receives double pay if there are supporting documents. Such conditions and reasons are reflected in the order. Increased payment is made for actual time worked.

Benefits for workers on business trips:

- increased pay for additional time;

- providing a day of rest;

- increase in vacation time;

- surcharge for overtime hours.

Organizations have the right to introduce types of compensation for overtime during a business trip. Working days of a business trip, overtime "SK". Accounting is carried out in days. Working time does not relate to the performance of functional duties, and the number of hours is not entered on the timesheet.

Business travel ban

Based on the Labor Code, the administration is obliged to ask permission for official travel from the following citizens:

- women who have children under three years of age;

- guardians of children under eighteen years of age;

- workers who independently raise a child under five years of age;

- persons with disabled children or relatives requiring care.

Failure to comply with this provision is a violation of Labor legislation.

Some citizens on the basis of Art. 259 and 203 of the Labor Code of the Russian Federation it is prohibited to send on business:

- Women in a pregnant position.

- Employees during the period of the apprenticeship agreement, if the work assignment is not related to training.

- Minors, except athletes and artists, according to the approved list by government decree.

To second a woman who has a child under three years of age, her written approval is required. A pregnant woman has the right to refuse business trips. If the administration sends such an employee, she will violate the provisions of Art. 259 Labor Code of the Russian Federation. It is not allowed to send pregnant women on business trips, to involve them in extra-standard work and at night, on weekends and holidays.

Procedure for paying daily allowances

Travel allowances are reimbursed for each day of business travel. Weekends and holidays, travel time, stops are also paid. For example, a worker leaves on Saturday and returns two weeks later on Sunday; these days are paid.

In Art. 166 of the Labor Code of the Russian Federation defines a business trip - this is a trip of a citizen on the basis of an order from the head of the administration to carry out an assignment in another place, which is associated with the employee’s expenses.

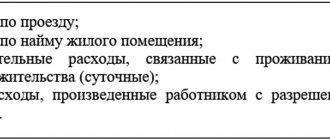

Therefore, on the basis of Art. 168 of the Labor Code of the Russian Federation must be reimbursed:

- purchasing travel tickets and paying for living space;

- daily allowance;

- motor vehicle insurance amounts;

- expenses for pre-sale of travel tickets;

- for bed linen on the train;

- other costs as agreed with the manager

Special hotel services: breakfast, dry cleaning, minibar and others are not included in the cost of accommodation, but are paid from the daily allowance. Hotel room reservations are reimbursed.

The daily rate is no more than 700 rubles, which is not taxed. A larger amount may be established in a collective agreement and internal regulations.

But tax is withheld from the difference in daily allowance between the legal norm and the larger amount.

For example, according to a collective agreement, the amount of travel allowances is 1000 rubles, therefore, the accounting department must withhold tax from 300 rubles.

Another expense item is documents for travel by any type of transport to a destination, for which there are no rules or restrictions. If you need to get to an airport or train station that is far from work, then travel costs are included in travel expenses.

The collective agreement may include an addendum for compensation for other transportation costs. For example, if a worker used a taxi or rented a car, then it is allowed to compensate for the money spent based on clarifications from the Ministry of Finance.

If the trip was using the driver’s personal transport, it is necessary to provide a memo indicating the start and end of the business trip, kilometers traveled, city, order number.

The amount of compensation for accommodation depends on the type of housing. The company does not pay for additional services such as work clothes, exercise equipment and a sauna at the hotel.

But the organization can determine daily expenses individually depending on the employee’s position. Therefore, the money limits are different. For management personnel, the amount of travel allowances may be overestimated; for ordinary employees, the daily allowance may be less.

Travel expenses report

The company must provide the employee with financial resources that he can save. Daily allowances are calculated for the number of business trips, this also includes the cost of rental housing and weekends.

If the employee does not provide documents for the money spent or checks, then he will have to count on a refund in accordance with the norm of Art. 168 Labor Code of the Russian Federation. This takes into account various types of payments. For example, an employee paid with money or a bank card.

When paying in cash for a hotel room, he provides a receipt; when renting housing, he provides an agreement, transport tickets, invoices for accommodation and other documents. If payment was made by card, then a fiscal or hotel receipt. Communication services and expenses for baggage transportation and airport service fees are reimbursed. The dates on all documents must coincide with the travel time.

https://www.youtube.com/watch?v=22vPRvalE0E

Under civil agreements, workers are not sent on business trips. Based on Art. 450 of the Civil Code of the Russian Federation, in the case of sending a person working under a civil contract, it is necessary to make an addition to the agreement5 on the performance of work, as well as the procedure for compensating costs. A business trip order is not issued, since the contractor is not on staff.

According to the Civil Code of the Russian Federation, civil contracts include: agreements for contract work, assignments, commissions, transportation and provision of services. Therefore, the procedure for referral and compensation is included in the text of the agreement.

The contractor's expenses include:

- for travel and accommodation;

- for traffic insurance;

- tax fees;

- fuels and lubricants;

- car parking and others.

The exception is daily allowance payments, which are provided only for officially registered employees.

If an employee overspent the advance and used personal money, he can submit a written request for compensation of costs with supporting documents.

In relation to state organizations, the procedure for paying daily allowances is established by special provisions of the Government of the Russian Federation, the authorities of the constituent entities of the Federation, and local municipalities.

Daily allowances for business trips abroad are calculated according to a distinctive scheme. The tax-free limit is 2,500 rubles. Money is issued in the currency of the country where the business traveler is going. During the journey through Russian territory, the amount is issued in ruble equivalent, for entry into another state in the currency that is used there.

Nuances

Upon returning from a business trip, the worker is required to report to the accounting department about the amount spent within three days.

He needs to provide the following:

- report on the expenditure of travel funds;

- advance payment.

The duration of a business trip is not limited by the Labor Code of the Russian Federation. It is important to comply with working hours and days off.

Foreign citizens can work if they have a patent in the territory where they will perform duties. Without a permit, work activity cannot last more than 10 days. If an employee is a highly qualified specialist, he has the right to work without a patent for a month. Workers in creative professions are not limited in terms of deadlines.

For some employees, a business trip is the best time and holiday. For others - a terrible event, a lot of inconvenience and separation from family. Therefore, single people are more willing to change their usual work environment, but for married people this is a problem.

Source: https://tvoeip.ru/kadry/kodeks/komandirovki