Author of the article: Lina Smirnova Last modified: January 2021 9420

Transactions for the gratuitous alienation of real estate must be formalized in strict accordance with the norms of current legislation. Most often, a donation agreement for a garage or other real estate is concluded between persons who are closely related. In certain situations (in order to avoid paying taxes), such an agreement is signed instead of a purchase and sale or exchange agreement. But it should be borne in mind that in this case such a transaction may be declared void by the court.

Restrictions and prohibitions

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

Registration of a deed of gift for a garage is not available to incapacitated and minor persons, as well as organizations. It is prohibited for the recipient of the gift to be employees of state or municipal institutions if their activities are related to the provision of services (goods) of any type. A minor may be the recipient of a gift. In this case, the mandatory participation of his guardian or representative is necessary.

To make a donation, you must be the owner of the object of the gift - a garage and land. In Russia, the alienation of a garage, which is what a donation is, cannot be carried out without transferring ownership rights to the land under the garage. A transaction executed without compliance with this rule will be considered void. Therefore, the donor first needs to register ownership of the garage and land.

Donation problems related to the status of the land under the building

Cooperative

If the garage is owned by the donor, it is legally registered, no problems should arise. It’s a different matter when the land under the building is not registered as property. Often garages are located on the territory of cooperatives. The shareholder (donor) pays for his participation in this organization once a month, quarter, etc. To register the garage as his own, according to Article 218, clause 4 of the Civil Code of the Russian Federation, he needs to pay the cooperative share in full. The composition of the documents also changes: in addition to the title papers for the garage itself, you need to find documents that certify its membership in this cooperative. And also obtain from the board a certificate confirming payment of the share contribution in full.

Only the title to the garage is registered!! But not to the ground that is under it. Theoretically, it is possible to register land by writing a corresponding application to the owner. Most often these are municipal authorities. But all members of the cooperative, without exception, must do this. And this is the main difficulty.

Inherited or lifelong ownership

For example, a person has a piece of land. There is a garage and several other buildings on it: a country house, a utility block, etc. They are properly registered, but the land remains in an unclear status. The land plot is located on the territory of SNT. The owner of the site will still have to register it. If the land was given to him before October 25 2001 , the citizen can take advantage of the right of dacha amnesty, which offers a simplified procedure for the privatization of a land plot, free of charge.

If the plot of land on which the garage is located was acquired at a later time, certain difficulties may arise. It is necessary to pay attention to N178-ФЗ. The law allows for the acquisition of land plots from the state, both at auction and without it. Moreover, without an auction, a person can count on certain lands.

In particular:

- For individual housing construction

- Creation of a farm.

- Agricultural production organizations.

- Housing development.

- Creation of infrastructure facilities.

The list is exhaustive. This means that adjustments can only be made to it through changes to the law. If the owner’s garage is located on land that is intended for one of the specified purposes, then he can buy it from the state without bidding at the cadastral value. In other cases, it will not be possible to do without an auction.

A deed of gift for a garage is quite simple to draw up. The main difficulties arise with the land. Both the donor and the recipient can solve legal problems. The law does not limit the donor’s right to transfer property into the ownership of the donee. Having accepted the gift, the recipient with the rights of the owner will be able to resolve issues regarding registration of land ownership. This must be done if the land plot on which the garage is located did not belong to the donor. There are certain delays in registering land: therefore, it is necessary to clarify its status, purpose, and type of permitted use. And the set of documents collected, as well as the procedure for purchasing land, depends on this.

When the garage is a member of the GSK

Participation in a cooperative is a voluntary decision of a citizen. The procedure for acquiring the right of ownership is regulated by Art. 218 of the Civil Code of the Russian Federation. According to the norms of the Civil Code of the Russian Federation, ownership rights do not begin from the moment of receipt of the membership book, but from the day when the share is paid in full. Changing the data in the membership book does not grant the right of ownership to the garage and land to the donee. Subsequently, if the real owner of the site desires, the garage can be demolished. Compensation for demolition is often very small.

Donation procedure

Registration of a deed of gift for a garage follows a similar algorithm to donating a car or housing. The parties to the transaction need to prepare papers, draw up the text of the deed of gift, print out the agreement in the required number of copies, sign it and register it with Rosreestr. The law does not oblige the deed of gift to be notarized. Exclusively at the mutual desire of the parties. The duration of registration of a deed of gift in Rosreestr is 10 days. After registration, the final change of ownership of the garage and the land under it is carried out.

Preparing to formalize the agreement

Before issuing a deed of gift for a garage, the donor should perform some actions:

- Legalize your ownership.

- Realize that a gift is a gratuitous transaction.

- Make sure that the recipient can be one.

- Collect the package of required documents.

- Obtain spousal consent if the garage or land is jointly owned.

The donor should understand that the transfer of ownership of the garage and the land underneath it will occur immediately after registration of the deed of gift (Article 574 of the Civil Code of the Russian Federation). Unlike a will, it will be very difficult to cancel a decision after registration, and in the absence of grounds, it will be impossible.

What documents will be required?

To draw up a deed of gift for a garage, you will need papers for the object, for the land and for the right to draw up a deed of gift. According to the standard you need to prepare:

- passports;

- papers for the garage;

- certificate of ownership of the plot and garage;

- title documents;

- confirmation of the absence of a ban on alienation;

- consent of the partner (spouse);

- consent of other family members (optional);

- gift agreement. (sample for 2021, download).

If the garage is part of the GSK, then a certificate confirming the full repayment of the share and the absence of arrears in contributions of the cooperative member is additionally attached.

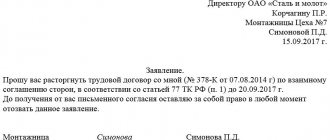

To finalize the documents for the garage, the deed of gift must be registered. To do this, you need to prepare and submit the following papers to the registrar:

- statement;

- passports;

- gift agreement (3 copies);

- receipt;

- title papers for the site and garage;

- spouse's consent;

- transfer act.

If registration is carried out by a representative, the registrar will require the original power of attorney and the representative’s passport.

How to draw up a deed of gift

A donation agreement for a garage can be drawn up by the participants in the transaction, a notary certifying the donation, or third parties, mainly lawyers or realtors. In practice, it is recommended to contact qualified specialists - lawyers or notaries. This way, donation participants can be confident that the document is drawn up correctly and reduce the risk of challenging it later.

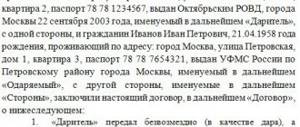

The garage donation agreement must be drawn up in writing. The form for drawing up the document is free. However, certain elements must be present. The deed of gift for the garage must have:

- Name;

- date and place of compilation;

- complete details of the donor;

- complete data of the donee;

- a detailed description of the subject of the gift;

- rights and obligations of the parties to the transaction;

- conditions for transferring an object (meaning a promise to donate);

- information that there are no encumbrances or prohibitions on alienation;

- the moment the agreement comes into full force;

- information about representatives;

- information about who bears the costs of registering the deed of gift;

- signatures of the parties;

- Attached documents.

A deed of gift is prepared in the required number of copies. If notarization is not used, then 3 copies are sufficient: 1 for the registrar, one for the participants. If a notary is involved, then another copy is needed. It is kept in the office files. All copies of the deed of gift are drawn up in the original and have equal legal force.

Garage donation agreement sample form

A garage is, first and foremost, a property. That is, you can do with it everything that is usually done with property. A garage can be bought, sold and even donated.

You can also use the garage. It is used not only to place a car. This is an excellent pantry in which supplies and, in general, everything that does not fit at home can be stored.

In addition, a garage is a good investment. Moreover, the increase in prices for such property exceeds the increase in bank interest rates. The ownership of such property is subject to registration. This process is regulated by the civil code.

How to register a garage donation

The peculiarity of donating a garage is that it is done absolutely free of charge. This is clearly stated in the legislation. That is, the contract should not have cost clauses. In addition, it cannot be stated in the gift agreement that the recipient will have an obligation to perform any actions.

If the document specifies some kind of reciprocal obligation of the donee, then a purchase and sale is formalized, not a donation.

Minors and incompetent people cannot participate in the relationships mentioned above. Civil servants are also prohibited from receiving or giving anything as a gift. In addition, certain legal entities (organizations) cannot receive gifts or give anything.

The donor must fill out the donation document himself. You can also contact a lawyer.

Necessary documents drawn up upon donation

The donation of a garage must be accompanied by documentation.

List of papers that will be required to donate a garage:

- Passports of both participants are required. There may be more than two of them if the garage has several owners, or it is transferred, for example, to several persons at once. This could be a gift from a grandmother to both grandchildren at once, and so on.

- The garage must have ownership rights, and therefore a document where this is stated. You will also need a document explaining where this ownership right came from, for example, a purchase and sale agreement if the donor purchased the premises at one time.

- Technical certificate.

- The act of commissioning, coupled with a building permit, if the property arose as a result of construction.

- A price certificate from the BTI is attached.

- A certificate confirming that all membership fees for this garage have been paid to the cooperative and there is no debt.

- Consent of all members of the donor's family to the procedure in writing.

As a result of the transaction, an agreement is formed. Donation is precisely a legal transaction. And we must take a serious approach to its correct design. The transaction must be completed with registration in the state. authorities with the issuance of a certificate.

Below is a standard form and a sample garage donation agreement, a version of which can be downloaded for free.

Gift to a relative

The law does not prohibit a gift for a garage between close relatives. Family members have the right to enter into an agreement if they wish. However, the fact of the presence of kinship does not affect the registration procedure and procedures. Likewise, gifts between relatives are subject to the same restrictions as gifts between strangers. Procedurally, there is one difference: the package of documents is supplemented with papers confirming the relationship between the parties to the transaction. This is necessary in order to avoid paying tax later.

Documents for registration of the agreement

Of course, when a donation is made between relatives, they will not need to study each other’s passports. But in order for the agreement to be registered in Rosreestr, both parties to the agreement will have to provide the state registrar with a number of documents, namely:

- passports (for children under 16 years old - birth certificate). If legal representatives are involved in the transaction, then their personal documents must be present;

- certificate of ownership;

- cadastral passport of the garage;

- technical passport of the garage;

- documents on ownership of the land plot on which the garage is located;

- consent of the second spouse to donate a garage that is in common ownership of the spouses;

- notarized power of attorney if the contract is executed through representatives.

To register, each party to the transaction must write an application to Rosreestr. The original donation agreement will need to be attached to the application and package of documents.

The registration process with Rosreestr lasts up to 10 days.

Price issue

The cost of registering a deed of gift for a garage is formed from three components: the price for drawing up the agreement, for registering the transaction and the gift tax. There is no single price for preparing and drawing up a gift agreement. Each lawyer or realtor has the right to set an individual amount of payment for their services. By independently preparing the deed of gift by the participants in the transaction, you can slightly reduce costs. However, the risk will increase that the deed of gift will be challenged in court due to incorrect drafting of the agreement.

Donation registration

Registration costs consist of payment of the registration fee and the services of a representative if the parties do not apply to Rosreestr in person. The amount of the state duty is established by the norms of the Tax Code of the Russian Federation. Registration of a deed of gift for a garage consists of:

- registration of transfer of ownership of the garage;

- registration of transfer of ownership of land;

- transaction registration.

| Donor's expenses | Donee's expenses |

|

|

If you contact a notary

If the deed of gift is executed by a notary, then the costs increase by the amount that the notary takes for his work. How much a deed of gift for a garage costs from a notary depends on the size of the fee and payment for his consulting and technical services. The fee for certification of a deed of gift by a notary will be 0.5% of the cost of the garage and land, but not less than 300 rubles. and no more than 20,000 rubles. The price for consulting services is set by each notary individually.

Taxation

When donating a garage, the recipient of the gift is charged personal income tax. The tax amount is calculated based on the value of the gift - 13%. If the recipient of the gift is not a resident, then the personal income tax will be 30%. Tax payment occurs after filing a return for the previous year. That is, if the donation was made in 2021, then a declaration must be prepared by April 30, 2021, and the accrued tax must be paid by July 15, 2021. The 3-NDFL declaration is submitted to the local tax office in the region of residence of the gift recipient.

The donor never has to pay tax when donating a garage. The recipients are also exempt from paying personal income tax if they are close relatives of the donor. For the current period, close relatives are considered:

- children;

- parents;

- husband wife);

- brother (sister);

- grandmother grandfather);

- grandson, granddaughter).

Natural and adopted children, parents and guardians are given equal rights. Stepfathers, stepsons, and trustees are not recognized as close relatives.

Transaction options

If the donor decides to register a garage in the name of a close relative or other person, he can do this in one of the following ways:

- Draw up a contract yourself. Write down the essential conditions there. Sign together with the donee. Contact Rosreestr to register the transfer of ownership of the garage. Attach the required documents to the application.

- Contact a notary for services. The donor will bear the costs associated with paying for a visit to a lawyer. Tariffs are different everywhere, it all depends on the specific notary office. Although there are additional costs, this option is safer than the first. A notary, having legal knowledge, will accurately draw up an agreement, without inaccuracies or errors.

The contract does not need to be certified by a notary.

Download: Garage Donation Agreement (sample)

Cancellation algorithm

The garage donation agreement is canceled before registration with Rosreestr. The desire of the giver or recipient is enough. The donor may refuse to donate the object (garage), and the recipient may refuse to accept the gift. After registration, only invalidation of the deed of gift is available by challenging it. The contract can only be challenged in court. The donor or a third party has the right to file a claim if his rights are violated. That is, a third party can file a claim, for example, the spouse or heir of the donor, who receives the rights to the subject of the gift.

The procedure for declaring a deed of gift invalid and its cancellation is regulated by the Civil Code of the Russian Federation and the Code of Civil Procedure of the Russian Federation. Grounds for claim:

- incapacity of the parties;

- compulsion;

- misrepresentation;

- pretense of the transaction;

- harm to the donor (family members) to the recipient;

- violation of the contract form;

- procedural errors when signing a deed of gift.

You cannot cancel a gift if the donor simply changes his mind. Also, receiving a gift does not oblige the donee to provide any kind of service or assistance to the donor, such as annuity.

The main condition for making a donation

The condition for donating a garage, as for donating any other type, is the existence of ownership rights to the donated object. That is, in order to donate a garage, the donor must be its actual and legal owner.

Ownership of a garage in a garage-building cooperative arises from the moment the share is paid in full and is formalized by government agencies by issuing a certificate of ownership to the shareholder. If the share is paid, but the owner of the garage has not applied for registration of ownership, then he will not be able to dispose of the garage.

An option in this case would be to transfer to the donee the right of ownership of the shares in the State Joint Stock Company. In this case, a corresponding mark will be made in the GSK book, the donor will be excluded from the GSK, and the donee will be accepted in his place.

If the owner of the garage has registered ownership, then he will need to attach to the donation agreement:

- certificate of ownership of the garage issued by Rosreestr;

- BTI plan;

- cadastral passport;

- GSK certificate on pension accumulations.

If the garage does not belong to the GSK, but is a separate building registered in the register of real estate, then the donation agreement will require:

- BTI plan;

- Rosreestr certificate confirming ownership of the garage;

- cadastral passport not only for the garage, but also for the land plot on which it is located.

Regardless of the type of garage (GSC or individual building), the following will need to be attached to the contract:

- a certificate confirming the absence of tax debts from the Federal Tax Service;

- a certificate confirming that there is no encumbrance on the garage. You can obtain such a certificate from both the BTI and the Federal Registration Service;

- notarized consent of the donor's spouse for the gift, if the garage is the joint property of the spouses.

Donate or sell?

For close relatives who want to transfer property, donation helps avoid paying taxes. In case of sale, personal income tax is paid by the seller if the transaction amount exceeds the maximum value. The buyer pays the cost of the garage and the land underneath it. The negative side of the deed of gift for the donor is that the transaction is gratuitous. You cannot receive payment for donating a garage. If a sham transaction is detected, that is, the fact of a sale when registering a deed of gift for the purpose of tax exemption, the transaction is considered void.

Makarova Natalya Nikolaevna

Lawyer at the Legal Defense Board. He specializes in administrative and civil cases, compensation for damages from insurance companies, consumer protection, as well as cases related to the illegal demolition of shells and garages.