Free legal consultation over the Internet 24 hoursLawyer on housing issues in St. Petersburg. Free legal consultation on labor disputes.

5/5 (10)

Employer benefit

Often, employees are faced with the fact that the head of the organization does not conclude an employment contract with them, or concludes, but does not indicate in the employment agreement, the full amount of the salary. The second case occurs much more often. This action is beneficial to the employer, but may negatively affect the rights of the employee.

By indicating only part of the salary in the employment contract, “unscrupulous” employers derive two benefits from this:

- Significantly reduce the tax burden, since payments to the Social Security Fund and the Pension Fund depend on the size of the salary;

- They gain an additional opportunity to influence an employee who, in the event of unfavorable circumstances, or simply at the request of the manager, may not receive the “gray” part of the salary.

Such registration of labor relations is a clear violation of the employee’s rights and labor standards, however, to confirm this fact, you will have to try.

Tax consequences of “gray” payments for the employer

The employer's tax liability for “gray” payments is directly related to non-payment of personal income tax and insurance contributions on the unofficial part of earnings. Responsibility for these charges arises under various articles of the Tax Code of the Russian Federation:

- For insurance premiums, Art. 122, which specifies 2 fine rates calculated from the amount of the unpaid payment - 20% (clause 1) and 40% (clause 3). To apply a higher rate, intent to understate the tax base must be revealed. When using a “gray” payment scheme, there is intent, so accruals will be made precisely from it.

- For personal income tax, in respect of which the employer is a tax agent, Art. 123, which provides only 1 rate option for calculating a fine - 20%.

However, tax risks are not limited to this, since the fact of establishing a “gray” salary entails suspicions that the employer has systematically hidden income from which such payments are made. Accordingly, during tax control, data on revenue will be carefully checked, the underestimation of the volume of which leads to a reduction in the tax bases for VAT, income tax, simplified tax system or unified agricultural tax. Tax liability for these taxes, as well as for insurance premiums, will arise under Art. 122 of the Tax Code of the Russian Federation.

Sanctions applied under Art. 122 of the Tax Code of the Russian Federation, do not relieve the taxpayer from the need to pay additional unpaid taxes, as well as pay penalties for late payment (clause 5 of Article 108 of the Tax Code of the Russian Federation). Therefore, the total amount of additional payments can be quite significant.

Exactly the same payments (unpaid tax and related penalties) will have to be made for personal income tax, since clause 9 of Art. 226 of the Tax Code of the Russian Federation, which prohibits the payment of this tax at the expense of a tax agent, since 01/01/2020, additions have been made allowing the Federal Tax Service to demand payment of its amounts additionally accrued based on the results of a tax audit. The personal income tax paid in such a situation will not reduce the tax base for taxes depending on the volume of revenue received (Letter of the Federal Tax Service of Russia dated March 10, 2020 No. SD-4-3/4109).

Of course, the specific amount of additional tax assessments by the Federal Tax Service will have to be justified (clause 6 of Article 108 of the Tax Code of the Russian Federation). However, tax authorities can only collect part of the evidence on their own. They will be supported by facts and the collection of additional information will be carried out by the investigative authorities (Letter of the Federal Tax Service of Russia dated July 13, 2017 No. ED-4-2 / [email protected] ).

Consequences for the employee

For an employee, receiving a “black” salary has a large number of negative consequences:

- Possibility of not receiving full salary for the time worked;

- Possibility of not receiving a full payment when leaving your job;

- Small vacation payments, which are most often calculated only from the “white” part of the salary;

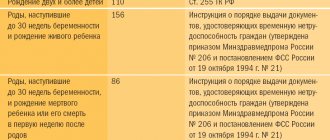

- A small amount of temporary disability benefits, which is calculated based on the official salary, and this correlation will be noticeable not only at the place of work, but also for two years after dismissal;

- Significant reduction in the level of maternity payments for women;

- Small pension contributions, which will result in small pensions in the future.

Responsibility of employees for receiving gray wages

When receiving a gray salary, the employee does not pay personal income tax on the amount of hidden income, which is 13%. The problem of gray wages also affects workers, because they actually hide their income and do not pay personal income tax in full. The following liability options are provided for employees in the Russian Federation (Article 198 of the Criminal Code of the Russian Federation):

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- imprisonment for up to 1 year;

- fine 100,000 – 300,000 rubles;

- arrest up to 6 months;

- forced labor for up to a year;

- recovery in the amount of two years' income.

This is also important to know:

What is unemployment benefit and how to get it

In case of a primary violation, criminal liability is excluded if voluntary repayment of arrears has been made. If the law is violated on a particularly large scale, the sanctions become more severe.

Employers often take advantage of employees' liability to tax law and do not pay the unofficial part of the salary at all. In addition to the fear of employees for admitting that they are hiding their income, the employer takes advantage of people’s ignorance of the mechanics of how to prove that he receives a gray salary in court. An additional negative factor for an employee working with unofficial income is that all insurance payments in case of disability or maternity leave will be calculated based on officially declared income. This will significantly reduce the amount of future payments in the event of an insured event. To receive the full amount of payments, you will have to go to court and prepare evidence of payment of gray wages.

Black salary upon dismissal

It is necessary to remember that even if you receive a “black” salary, you can protect your rights, but this will be much more difficult than in the situation with official payments.

To get started, you need to complete the following steps:

- Find responsible witnesses who can confirm the information that the employee regularly received “black” wages and carried out the duties assigned to him by his manager;

- A conversation with the manager, in which you need to tell that all the evidence available to the employee, including witness statements, will be transferred to the prosecutor's office in the near future. Most often, such a warning will have an effect and contribute to the speedy settlement of payments by the employer.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Salary in an envelope: pros and cons

As a result of official employment and signing an employment agreement, the employee receives a real white salary. If a person does not have real employment, he will receive menial wages. This is the amount of money that the employee and employer agreed upon informally.

Employers often strongly recommend that applicants for a job in their organization do not enter into a formal employment contract, arguing that they will not have to pay taxes and, accordingly, the amount will be greater.

But in this situation there are more disadvantages for the employee than advantages:

- no contributions are made to the funded pension;

- a woman going on maternity leave will not receive the social benefits due to her from the Federal Migration Service;

- the Federal Migration Service will not accrue funds during maternity leave;

- lack of vacation pay;

- sick leave is not paid;

- if the company is liquidated or a person is dismissed due to layoffs, compensation is not paid;

- the work experience does not count, the necessary entries are not made in the work book;

- upon dismissal, previously unpaid wages are not compensated.

Thus, if you have to prove that you worked, it will be almost impossible to do so.

It turns out that the only plus (non-payment of personal income tax) is not worth all the difficulties that may arise later.

Application to the Prosecutor's Office

According to the Federal Law “On the Prosecutor's Office of the Russian Federation,” employees can submit a claim to the prosecutor's office in connection with violations of labor rights by the employer.

The employee writes the complaint in any form and sends it by mail to the prosecutor's office or delivers it in person with a mandatory mark indicating acceptance of the complaint.

Based on the results of consideration of the applicant’s claim, the prosecutor’s office must provide a documented, reasoned response to the victim, which can be appealed to a higher authority or in court.

Important! According to Article 10 of the Federal Law “On the Prosecutor's Office of the Russian Federation,” the prosecutor, if violations of the rights of an employee are found, takes measures to bring the perpetrators to justice, including administrative or criminal liability.

The essence of the dispute

An individual entrepreneur appealed to the arbitration court with a statement to declare illegal the decision of the Federal Tax Service Inspectorate No. 3 for the Rostov Region on the additional assessment of personal income tax and other taxes. The tax service revealed that for the reporting year the entrepreneur did not fully reflect in tax reporting, the wage book, and payroll records for the issuance of wages the amount of accrued and paid wages under employment contracts with individuals. The Federal Tax Service assessed additional personal income tax to individual entrepreneurs for all unrecorded amounts.

Complaint to the State Tax Inspectorate

The State Labor Inspectorate has similar powers, being a highly specialized supervisory body in the field of labor relations.

Before contacting the labor inspectorate, you need to collect evidence that a specific employee worked in the organization and was not paid a salary.

Such evidence may be testimony of witnesses (for example, colleagues), a recording of a telephone conversation, or advertisements.

An employee appeal is created in any form, but it must indicate all violations committed by the employer, the name and information about the employing organization, the name and address of the labor inspectorate, as well as information about the applicant (full name, address, contact phone number, email address) . The claim must be signed and dated.

You can send a complaint via mail, as well as using the inspection website, attaching scanned versions of documents.

Remember! When a complaint is received by the inspectorate, it must be considered within thirty days. Based on the results of consideration of the complaint, the inspectorate has the right to issue an order to the manager to eliminate violations of labor standards.

Gray wages for employees: judicial practice

When going to court, an employee must make sure that he himself has repaid all debts to the tax authorities. Otherwise, he may be punished along with the employer.

In addition, due to the fact that only the testimony of witnesses can serve as evidence, some trials end before they begin. This may also happen due to the fear or reluctance of the employees themselves, who receive a gray salary, to lose this type of income. Particularly principled citizens are trying to recover lost money in court. But this turns out to be not so easy. Courts most often refuse to award “gray” payments to employees.

Judicial practice in cases related to “gray” wages is very diverse. It is not always possible even for the tax authorities to prove the employer’s dishonesty, since it is quite difficult to identify the fact of unofficial salaries.

Application to the Federal Tax Service

Tax service specialists are closely monitoring cases of employees receiving “black” wages. Having learned that such violations are occurring in the company, the tax authority can apply sanctions against the manager provided for in Articles 122 and 123 of the Tax Code of the Russian Federation and bring him to justice.

responsibility. In addition, penalties may be applied to an “unscrupulous” employer for non-payment of insurance premiums.

In other words, having received a claim from an injured employee and carried out an inspection, the tax authority has the right to bring the manager to administrative responsibility, as a result of which he will have to pay a significant fine.

The complaint should include: name of the company; information about the applicant (full name, contact phone number); a detailed description of the fact of violation of the employee’s rights; date of transfer and signature. The application must provide detailed information about the salary, describe the essence of the violation, indicating only the actual facts.

If necessary, you can supplement the statement with available evidence. The more evidence, the greater the chances of a positive outcome of the claim consideration.

Watch the video. How to recover black wages:

Risks for the employee

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

When a citizen receives a “salary in an envelope” for his work, he takes a significant risk. The disadvantages of such activities include:

- Lack of social guarantees. In case of unemployment or disability, the person will not receive any assistance.

- There are a minimum of options on how to extract black wages if the employer refuses to pay voluntarily.

- The period of illegal work will not be taken into account in the insurance period, which will complicate receiving a pension.

- Possibility of prosecution by tax authorities for concealing income and non-payment of personal income tax. Sanctions for this crime include not only financial, but also criminal liability up to imprisonment.

- Vulnerability against illegal dismissal. Working for a “black” salary, a citizen cannot enjoy labor guarantees.

In order to combat the concealment of citizens' incomes and insufficient budget filling, legislative initiatives are being introduced to increase the responsibility of citizens in the case of working for a “salary in an envelope.”

Appeal to a judicial authority

If an appeal to the above-mentioned authorities does not bring effective results, the employee will have to go to court to establish the existence of an employment relationship and collect unpaid wages (if there was no official employment).

In such a situation, it is necessary to prove the fact that the worker worked in the company, as well as confirm the amount of wages guaranteed upon admission to work. If an employment contract was drawn up, but it contained a salary lower than what was actually paid to the employee, then the applicant will have to prove the actual amount of the salary.

When does the tax office become interested?

A number of supervisory government agencies are fighting the shadowing of the labor sector. The organization comes under scrutiny, which means inspections are carried out on several occasions. Among them:

- the declared salary level for employees with a certain qualification is lower than in a given industry or region;

- accounting documentation showed that management received less compensation than ordinary employees;

- employees move from higher paid positions to the specified organization at a lower rate;

- employees indicating a salary level higher than that stated in their employment contracts, for example, when lending;

- there are signals about the presence of gray or black circuits.

Read also: Payroll fund

The latter case means the presence of a complaint from employees, other persons, as well as an anonymous appeal.

It is worth considering that if there are lawsuits and a former employee appeals to the authorities, an inspection will be scheduled automatically, that is, the company will be taken under supervision, which will not allow it to avoid periodic inspections in the future.

Proof

During court proceedings, the employer must prove the following facts:

- employee receiving salary;

- timely payment of wages.

When there is a dispute about the amount of wages, each party is obliged to prove that they are right, that is, the injured employee will have to justify on what grounds he is claiming the amount of wages indicated by him.

If an agreement is drawn up with an employee, where not the entire salary is indicated, he needs to wait for the fact that someday disagreements will arise on this matter. Therefore, such employees need to obtain evidence in advance, even before a dispute occurs. The best thing has been since the time when the “black” wages became known.

Such evidence will be:

- recordings made on a dictaphone, where there is a mention of the amount of wages;

- any documentary evidence containing information about the full amount of the employee’s salary or its “gray” part. In particular, these may be double-entry bookkeeping statements;

- certificates for obtaining a loan;

- witness statements;

- applications for vacancies on the labor exchange.

It is better to collect this evidence in advance, since after a dispute arises, the manager simply will not provide some of it.

Remember! If an employment contract has not been drawn up with the employee, first you have to prove the very fact of the existence of an employment relationship and only then argue about the amount of wages.

Even if the applicant manages to prove that the company practices issuing “black” wages, this will not guarantee that the court will satisfy his demands.

Even if the judicial authority satisfies the victim’s claim, the employer may appeal the decision, and the proceedings will drag on for a long time.

Categories

In any organization, wages and social contributions are a significant part of the costs, so in order to reduce staff costs, employers hide part of the wage fund from taxes. Personal income tax (NDFL) is withheld from the official salary of all employees. The obligation to pay tax on wages paid to employees rests with the employer.

The personal income tax rate in Russia is one of the lowest - 13%. However, in addition to personal income tax, the employer is obliged to transfer insurance contributions to extra-budgetary funds to the budget, the amounts of which are very high. All this forces employers to pay wages “in an envelope”. In the letter of the Federal Tax Service of Russia for the city of Moscow dated 08.08.2007 No. 15-08/075418 (hereinafter referred to as the letter of the Federal Tax Service of Russia for the city of Moscow No. 15-08/075418) it is reported that payments to employees that are not taken into account for tax purposes are called by the tax authorities " shadow" or "gray" wages. Varieties of such wages are: unofficial wages, mainly issued “in envelopes”, insurance premiums and annuities paid through insurance companies (less common), as well as a number of other forms of hidden remuneration for labor. In our country, the practice of paying so-called gray wages is widespread; employers have developed many so-called optimization schemes.

Tax authorities are actively combating this situation and may pay attention to an organization if:

1) employee wages are below the subsistence level in the region, below the average market level (for a specific region), below the industry average wage;

2) the salary level of management according to official documents is lower than the earnings of ordinary employees;

3) information was received that the company makes wage payments “in envelopes” (for example, an anonymous call);

4) the employee’s salary at the new place of work is lower than at the old one (according to 2-NDFL certificates), that is, he changed jobs on less favorable conditions;

5) the employee provided the bank with certificates for obtaining a loan, which contain a larger amount of wages than in the actual report for a specific organization.

Let’s figure out what the consequences of paying wages “in an envelope” are to the employee and the employer.

CONSEQUENCES FOR THE COMPANY AND PERSONS RESPONSIBLE

What threatens an employer who issues wages “in an envelope” and does not withhold or pay personal income tax on it?

In accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the tax agent withholds personal income tax from the actual cash payments of the taxpayer or a third party on behalf of the taxpayer. The company may act as a withholding agent if it makes any payments to individual recipients of prizes, and if recipients of prizes instruct the company to make any payments to third parties.

According to Art. 122 of the Tax Code of the Russian Federation, non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other illegal actions (inaction), if such an act does not contain signs of a tax offense under Art. 129.3 of the Tax Code of the Russian Federation, entails a fine in the amount of 20% of the unpaid amount of tax (fee). But if non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction) are committed intentionally, this entails a fine in the amount of 40% of the unpaid amount of tax (fee) .

If tax officials have evidence of payment of salaries in “envelopes”, they will not ignore it. The tax inspectorate will ask from what income the company pays wages in “envelopes”. After all, this means that the sale or service from which the income was received is not shown (if the company is under the general tax regime, it had to pay VAT and income tax, and if under the simplified tax system, then the tax paid in connection with the application of the simplified tax system).

For your information. Managers of companies that pay wages lower than the industry or regional average may be called to a “salary” commission, which includes tax officials and municipal officials. Many heads of organizations, after being called to a commission, usually increase wages. If the commission’s convictions do not work, the company may face an on-site inspection.

The following consequences of using “gray” wages are possible for the organization:

1) full on-site inspections of departments such as the tax inspectorate, internal affairs department, prosecutor’s office, Social Insurance Fund and others, during which numerous errors will be identified that relate not only to wages;

2) accrual of taxes payable, which the organization will be obliged to pay (calculation is made on the basis of information about the taxpayer available at the tax office);

3) accrual of penalties and fines for intentional non-payment of taxes.

The consequences of paying wages “in an envelope”, in addition to the organization, affect the manager, chief accountant, as well as other employees who were involved in the preparation of primary documents. In this case, they are recognized as accomplices and Art. 199 “Evasion of taxes and (or) fees from an organization” of the Criminal Code of the Russian Federation.

In accordance with Art. 199 of the Criminal Code of the Russian Federation, evasion of taxes and (or) fees from an organization by failure to submit a tax return or other documents, the submission of which in accordance with the legislation of the Russian Federation on taxes and fees is mandatory, or by including in a tax return or such documents knowingly false information, committed on a large scale, is punishable by a fine of 100 thousand rubles. up to 300 thousand rubles. or in the amount of wages or other income of the convicted person for a period of one to two years, or forced labor for a term of up to two years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years or without it, or arrest for a term of up to six months, or imprisonment for a term of up to two years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

The same act, committed by a group of persons by prior conspiracy or on an especially large scale, is punishable by a fine of 200 thousand rubles. up to 500 thousand rubles. or in the amount of wages or other income of the convicted person for a period of one to three years, or forced labor for a term of up to five years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years or without it, or imprisonment for a term up to six years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years.

CONSEQUENCES FOR WORKERS

There is an opinion that not only managers can be called to “salary” commissions, as has happened and is still happening, but also employees due to the focus of such commissions on identifying non-payment of personal income tax. However, in the letter of the Federal Tax Service of Russia dated December 2, 2009 No. 3-5-04/1774 (letter of the Federal Tax Service of Russia No. 3-5-04/1774), the tax authorities reported that they do not plan to call employees of “problem” organizations to the meetings of the mentioned commissions of the Federal Tax Service of Russia. At the same time, it is noted that an employee who received income from which tax was not withheld by the employer (tax agent) is obliged to independently declare such income at his place of residence before April 30 of the following year and pay it independently by July 15. Otherwise, he bears responsibility under the legislation of the Russian Federation. It follows from this that the obligation to pay personal income tax (13% of salary) lies with the citizens themselves, and the fact that the employer for some reason did not transfer it does not relieve employees from liability, since in accordance with paragraph 1 of Art. . 228 of the Tax Code of the Russian Federation, the obligation to calculate and pay personal income tax is also assigned to individuals in relation to income upon receipt of which personal income tax was not withheld by tax agents.

The tax agent cannot withhold the calculated amount of personal income tax when paying income to the taxpayer, for example, in the case when such income is paid in kind. If such a situation arises, the tax agent is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding the tax and the amount of the tax, and the taxpayer must pay personal income tax after the tax inspector has handed over notifications. The form of the tax notice was approved by Order of the Ministry of Taxes of Russia dated July 27, 2004 No. SAE-3-04/ [email protected] As stated in the letter of the Ministry of Finance of Russia dated April 17, 2009 No. 03-04-05-01/225, in the event of non-receipt of a tax notice, the taxpayer At the end of the tax period, he independently fulfills his tax obligation to pay the tax amount.

In letter dated 02.12.2009 No. 3-5-04/1774, the Federal Tax Service of Russia reminds: if a taxpayer obliged to submit a personal income tax return does not submit it, then he bears responsibility in accordance with clause 1 of Art. 119 of the Tax Code of the Russian Federation in the form of a fine in the amount of 5% of the unpaid amount of tax subject to payment (additional payment) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30% of the specified amount and not less than 1000 rub. In addition, the letter of the Federal Tax Service of Russia dated December 2, 2009 No. 3-5-04/1774 states that Art. 198 of the Criminal Code of the Russian Federation establishes criminal liability of an individual for evasion of taxes and (or) fees by failure to provide a tax return or other documents, the provision of which is mandatory in accordance with the legislation of the Russian Federation on taxes and fees, or by knowingly including in a tax return or such documents false information. So, according to Art. 198 of the Criminal Code of the Russian Federation for the specified offense committed on a large scale, an individual faces a fine of 100 thousand rubles. up to 300 thousand rubles. or in the amount of wages or other income of the convicted person for a period of one to two years, or arrest for a term of four to six months, or imprisonment for a term of up to one year. The same act, committed on an especially large scale, is punishable by a fine in the amount of 200 thousand to 500 thousand rubles. or in the amount of wages or other income of the convicted person for a period of 18 months to three years, or by imprisonment for a term of up to three years.

For your information. A large amount is an amount of taxes and (or) fees that amounts to more than 600 thousand rubles for a period within three financial years in a row, provided that the share of unpaid taxes and (or) fees exceeds 10% of the amounts of taxes and (or) fees payable. fees, or exceeding 1 million 800 thousand rubles, and a particularly large amount - an amount amounting to more than 3 million rubles for a period within three financial years in a row, provided that the share of unpaid taxes and (or) fees exceeds 20% of the due payment of taxes and (or) fees, or exceeding 9 million rubles.

Persons who have committed the crime of evading taxes and (or) fees from individuals for the first time, in accordance with Art. 198 of the Criminal Code of the Russian Federation are exempt from criminal liability provided that they have fully paid the amount of arrears and the corresponding penalties, as well as the amount of the fine in the amount determined in accordance with the Tax Code of the Russian Federation.

If the tax authority, as a result of a tax audit, reveals that the specified crime has been committed, then it is obliged to warn the taxpayer about sending materials to the internal affairs bodies to resolve the issue of initiating a criminal case in case of failure to pay arrears, penalties and fines in full.

In addition, employees who receive salaries “in an envelope” deprive themselves of pension savings, as well as the right to use tax deductions in full (letter of the Federal Tax Service of Russia No. 3-5-04/1774).

Thus, the personal income tax arrears will be withheld from the employee’s income. We also draw your attention to the fact that in accordance with the bill on amendments to the Criminal Code of the Russian Federation, an employee who agreed to pay “gray” wages is liable before the law on an equal basis with the employer for such actions.

GOLDEN MEAN

What should the salary be so that both employees and employers can sleep peacefully and not have to go to “salary” commissions? According to tax officials, which was expressed in a letter from the Federal Tax Service of Russia for Moscow No. 15-08/075418, the official wages of employees should not be lower than the industry average. Therefore, those organizations in which the official wages of employees are below this level come under the close attention of the tax authorities and, as a rule, additionally are paid money that is not included in the tax base, that is, hidden from taxation.

But we should not forget that any phenomenon has “two sides of the coin.” When resolving the issue with the “salary” commission and increasing wages, there is a risk of finding yourself a candidate for a visit to an unprofitable commission. The letter of the Federal Tax Service of Russia for Moscow No. 15-08/075418 focuses on the fact that the function of the tax authorities is not to increase wages for employees of the organization, but to bring hidden forms of remuneration out of the shadows. Thus, the calculation and payment of wages below the market average or below the subsistence level in itself is not a violation of the law and does not entail negative consequences. If an organization has clear arguments about why it pays its employees little (for example, the current financial situation in the organization), then no questions will arise.

It should be noted that when considering such cases, the court carefully considers all inspection evidence (even indirect). And if she manages to collect enough evidence, then most likely the court will side with the inspectorate.

When considering cases, the court involves workers as witnesses, asking them questions about wage payments. It must be remembered that there is criminal liability for giving false testimony.

Workers who receive salaries in an “envelope” also have a chance of going to prison. If they are admitted to receiving “gray” salary payments, employees may be accused of colluding with the employer, since, according to the logic of the tax authorities, an employee who receives a salary “in an envelope” knows that the company is underpaying personal income tax. At the same time, a company that has not paid tax on an employee’s salary in this case acts as a tax agent and only risks paying a penalty for late deduction of these funds to the budget.