There are often cases when an accountant of a particular company or enterprise mistakenly calculated the salary of an employee upon dismissal. Moreover, the amount is much more than what is due. The employer himself could have made inaccuracies in the calculations.

Of course, if such a situation arises, the head of the company will try to withhold such “surplus” from the person. However, a subordinate is unlikely to agree to part with such an increase in salary. Overpaid wages and debts upon dismissal: what to do in such a situation?

Reasons for overpayment of wages upon dismissal and grounds for returning money

Please note that the overpayment is indeed refundable. However, this is not possible in all cases. The first thing you need to do is find out why the employee was credited with an “extra” amount of money. As a rule, this determines whether the subordinate should return it.

There can be two reasons for overpayment:

- A simple mistake was made when calculating wages. For example, the accountant mixed up the numbers or even added an extra zero;

- overpaid wages were accrued voluntarily in the absence of a calculation error. For example, an employee did not have the right to receive any substantial increase in salary, and due to the erroneous classification of his position as a citizen who is entitled to additional payment, he was awarded extra money.

It is worth noting that in the first case the person will have to return other people’s money. This is due to the fact that a counting error when calculating funds entails the obligation to return the amount in full. Excessive wages paid to a dismissed employee must also be returned without fail.

Withholding from employees' salaries to pay off their debt to the company where they work can be carried out by order of the boss to return amounts overpaid to subordinates. This can only be done if there are no disputes with employees.

We reflect the amounts of overpayment in accounting

In accordance with clause 80 of Instruction No. 162n [2], clause 102 of Instruction No. 174n [3], clause 105 of Instruction No. 183n [4], the employee’s debt arising from the recalculation of wages previously paid to him is reflected by the “red reversal of the next invoice correspondence:

Account debit 0 302 11 000 “Payroll calculations”

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

Account credit 0 206 11 000 “Payroll calculations”

At the same time, operations to adjust previously accrued vacation pay (wages), personal income tax and insurance contributions are reflected using the “red reversal” method.

Claims for compensation for damage incurred in connection with overpayment of wages to a former employee (including overpayment to a former employee for unworked vacation days upon his dismissal before the end of the working year for which he had already received annual paid leave) are reflected in the entry (Letter of the Ministry of Finance RF dated 09.11.2021 No. 02‑06‑10/65506):

Account debit 0 209 30 560 “Increase in accounts receivable for cost compensation”

Account credit 0 206 11 660 “Reduction of accounts receivable for wages”

Please note that the entry given in the letter from the Ministry of Finance for transferring debt from account 0 206 11 000 “Calculations for wages to account 0 209 30 000 “Calculations for compensation of costs” is introduced into instructions No. 162n, 174n, 183n by Order of the Ministry of Finance of the Russian Federation dated November 16. 2021 No. 209n [5].

Further, it should be noted: in their explanations in the above letter, Ministry of Finance officials note that the applied accounting methodology does not contain any restrictions on the codes of types of financial support (KVFO) (activities), within which calculations using account 0 209 30 000 can be reflected “Calculations for cost compensation.” Officials allow such transactions to be processed under KVFO 4 and 5.

Repayment of debt on overpayment of wages and vacation pay with the voluntary consent of the employee is carried out:

- or by depositing cash into the cash register or into the personal account of the institution;

- or through deduction from subsequent payrolls. Please note that the total amount of all deductions for each salary payment cannot exceed 20%, and in cases provided for by federal laws, 50% of the salary due to the employee (Article 138 of the Labor Code of the Russian Federation).

In accounting, debt repayment is reflected in the credit of account 0 209 30 000 “Calculations for compensation of costs.” In this case, standard entries are made, given in instructions No. 162n, 174n, 183n.

Amounts written off from the balance sheet in connection with the court declaring the guilty person insolvent are reflected in the credit of account 0 209 30 000 and the debit of account 0 401 10 173 “Extraordinary income from transactions with assets with the simultaneous reflection of debt on the off-balance sheet account 04 “Debt of insolvent debtors” .

Let's look at an example of how to reflect this operation in accounting.

A budgetary institution overpaid wages to an employee. Due to a technical error, the accountant mistakenly transferred funds twice to the employee’s bank card. For November 2021, he received a salary in the amount of 63,000 rubles. , personal income tax was withheld from it in the amount of 8,190 rubles.

However, instead of 54,810 rubles. 109,620 rubles were transferred to the card. Payment of wages was made through a subsidy allocated for the fulfillment of the state task

The employee, having discovered the overpayment, returned the excess to the institution's cash desk.

In accordance with Art. 1102 of the Civil Code of the Russian Federation, overpaid wages are recognized as unjust enrichment and must be returned by the employee to the institution. In the situation described in the question, there is no dishonesty on the part of the employee, therefore the employer cannot withhold the amount on his own initiative. In this case, in order to recover overpaid amounts, the employer is obliged to inform the employee in writing about the mechanism for the formation of overpaid amounts and the amount of their deduction (or repayment). In addition, in order to make deductions, the employee must agree with their amount.

He confirms his consent in writing.

According to the conditions of the example, the amount of overpayment occurred due to a double transfer of the same amount of wages, therefore, personal income tax and insurance contributions are not adjusted.

The following entries were made in the accounting:

| Contents of operation |

Payroll transactions

How to return incorrectly transferred wages?

Even in a situation where the head of an enterprise or other organization has the right to recover overpaid salary from an employee, there are a number of serious restrictions. For example, this can only be done with the consent of the employee.

Agree with the employee to write off funds

So how can you write off wage arrears for a dismissed employee? There are situations when subordinates refuse to give their consent.

At the same time, article number 137 of the Labor Code does not indicate exactly how the employee’s consent should be formalized - in writing or orally. In order to avoid any problems or misunderstandings, consent should be recorded in writing.

It should be noted that the total amount of deductions by law should in no case exceed twenty percent. Consequently, the retention period extends over several months. Only by agreement of the parties is it possible to make compensation for damage by installments.

For example, a person undertakes to give not twenty, but ten percent every month. The employee must certainly sign an appropriate indemnity agreement indicating a specific time frame for the return of all funds.

Go to court to force collection of funds

If the employee does not intend to return the overpaid amount to the organization in which he works, then the management has the right to apply to the court with a corresponding application.

It is recommended to contact the district court. During the proceedings, the manager will have to prove the fact of a counting error or the employee’s guilt.

The statement of claim must be accompanied by copies and originals of the following documents:

- employment contract with a former employee;

- documents on calculation and payment of wages;

- error report;

- all kinds of notifications sent to a former subordinate with an offer to return the excessively accrued funds.

What an employer may face

In this case, the formation of an overpayment of insurance premiums should not be surprising. Adjustments to their accrual must be taken into account without fail in the current period in reports to the Social Insurance Fund; further payments will allow the resulting overpayment to be adjusted.

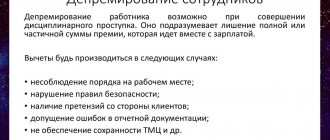

It is possible to do without written consent only in some cases described in the Labor Code of the Russian Federation (Article 137):

- the presence of a counting error, i.e. such an error that can be attributed to arithmetic;

- the calculation was made on the basis of false information received from the employee (for example, false documents for personal income tax deduction);

- the calculation was made on the basis of false information from the primary documents for calculating wages (for example, according to the documents, the production output standard was met, but in fact it was not).

Please note that these are not counting errors:

- determination of an incorrect calculation period for calculating amounts due to the employee;

- errors in determining the method of calculating wages, which served as the basis for subsequent accruals;

- technical errors;

- repeated payment of wages for the same period.

In such a situation, the employer should invite the former employee to voluntarily repay the debt. If he refuses, the organization will only have to file a lawsuit, or forgive the debt and write off the debit balance. Let's look at each of these options.

Report on detection of a counting error and notification of a dismissed employee

In order to record the legal fact of a counting error, it is recommended to draw up a commission act. Such a commission must include a chief accountant, as well as a payroll accountant.

The document indicates when, who and where the inaccuracy was identified. It is necessary to indicate the reason for its commission, as well as the exact amount of the salary. The paper is drawn up in two copies. It must be signed by all members of the commission.

One copy must be given to the former employee with notification of the need to return the excess wages received. The document requires you to indicate the exact amount and date by which the debt must be repaid.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

We comply with deadlines for reimbursement (withholding overpayments).

After establishing the reasons for the overpayment, it is necessary to remember the terms during which the overpaid amounts can be withheld from the employee.

By virtue of the provisions of Art. 137 of the Labor Code of the Russian Federation, the employer has the right to decide to deduct from the employee’s salary no later than one month from the end of the period established for repayment of incorrectly calculated payments, and provided that the employee does not dispute the grounds and amount of the deduction. As noted in the appeal rulings of the Moscow City Court dated 02.28.2013 No. 11-3853/2013, the Sverdlovsk Regional Court dated 05.22.2014 No. 33-7209/2014, if at least one of these conditions is not met, that is, the employee challenges the withholding or has expired month period, the employer loses the right to withhold these amounts and it can only be exercised in court.

Incorrectly Calculated the Dismissed Person What to Do

Sometimes an employee’s salary has to be supplemented after his dismissal. As a rule, this happens either when a mistake made in the past is identified, or in the case of “late” bonuses for past periods. Let's look at each of these situations.

If the company wins the case, the accountant will make the following entries: DEBIT 50 CREDIT 73 – 17,400 rubles. – vacation pay was returned by Petrov by court decision; DEBIT 70 CREDIT 44 – 20,000 rub. – Petrov’s vacation pay was reversed; DEBIT 68 CREDIT 70 – 2,600 rub. – personal income tax accrual has been reversed. Expenses in the amount of 20,000 rubles were canceled in tax accounting. In addition, if the employer wins, the accountant will reflect the excess withheld and paid income tax in the amount of 2,600 rubles. in the updated certificate 2-NDFL. Overpayment in the amount of 2,600 rubles. it will be counted against future payments to the budget.

The employee was overpaid (read more...)

About excessive payment of wages

So, who will reverse the past accrual to the expense accounts? :) huren96 06-02-2009, 14:51:02 This is the first time I encountered such a situation.... They overpaid only 30 rubles. And how many g......:)! What wiring should there be for this whole situation? Thank you in advance for your help! Ignatik 06-02-2009, 15:56:53 don’t just write it off, transfer it to 76 and before the expiration of the limitation period the amount of the overpayment will hang there, but it is best to recover from the person responsible for the overpayment. (carry out an INV to identify the deficiency and recover from the guilty person):mad:Why can’t it be written off if it was calculated incorrectly? The error was discovered more than 30 days later, it is not invoiced, taxes have been paid.

Attention

Now it is taken into account in expenses, and it (the excessively accrued and paid amount) needs to be taken out of expenses. We make a reversal of Dt20 (25,26,44) Kt70 - 30 rubles and Dt91.2 Kt70 - the same 30 rubles.