When applying for a job, in addition to the employment contract, an apprenticeship contract may also be concluded if the employer plans to pay for the training of new employees in order to obtain highly qualified personnel. According to the terms of the agreement, if an employee is dismissed early, he is obliged to reimburse training costs by deducting money from his salary.

When a student agreement is not drawn up:

- Short-term training courses.

- Seminars.

- One-day training.

- Involving a specialist for lectures on your own initiative.

What is a student agreement?

Before understanding the grounds for deductions from wages, you need to familiarize yourself with the concept of a “student agreement”. It means an agreement concluded between an employer and an employee looking for a job, or with an already employed employee, if he needs to receive education on the job or without interruption from work, but the specialization in study and place of work coincides (Article 198 of the Labor Code of the Russian Federation).

Here is an example of when a student agreement is required:

Head of the ambulance station Kovalev S.A. wants to hire paramedic N.A. Popov, who already has the appropriate education. He is required to take advanced training courses lasting 3 months. All this time he can work with partial interruption from work, because The “day/night/48” schedule allows you to simultaneously study and perform work functions.

The SSMP has an agreement with an educational medical institution, where doctors are sent for vocational training. Popov N.A. got a job, and in addition to the employment contract, an apprenticeship agreement was concluded, according to which he is obliged to undergo training and work for the employer for three years after that.

What to do if a trained employee leaves early

Among the complex issues related to the calculation of compensation, there is also the issue of calculating the period of service. Let's say we have established that the employee must work for a year. Does this period include periods when he did not fulfill his job duties? Should we differentiate such periods based on the reasons for their occurrence? Is this period interrupted by an employee being called up for military training? Or being on sick leave? What if, immediately after sick leave, the employee goes on maternity leave and/or childcare leave for up to 1.5/3 years? What happens if he takes a vacation at his own expense? There are a lot of options and questions. The Labor Code of the Russian Federation does not contain an answer to any of them. Moreover, the approaches from the position of the company and the employee in this situation are diametrically opposed. The organization is interested in the employee applying the acquired knowledge in practice, because this is why he was sent to study. The employee, in turn, is interested in having the work stop as quickly as possible. After all, she essentially acts as a “burden” of his work. Not everyone likes the “work or pay” principle. Judicial practice also does not give us clear answers to these questions.

We suggest that when determining what to include in the working period, we should be guided by two principles:

1) payment.

If this time is paid by the employer, then it is logical that it will be included in the calculation of working hours. Accordingly, during the working period we include annual leave and study leave;

2) independence from the will of the employee.

If circumstances arise beyond the wishes of the employee, then unfavorable consequences cannot be imposed on him. Guided by the second principle, in the service period we include time of illness (confirmed by certificates of incapacity for work), time spent performing state or public duties (military training, participation in court as a jury, etc.). In addition to these two principles, there are also periods that by their nature are an integral part of the work schedule, although employees do not work in them. These are legal weekends and non-working holidays. They, in our opinion, should also be included in the working period. With a certain degree of convention, this also includes the provision of maternity leave and child care leave.

However, now we are voicing a position that minimizes the employer’s risks, that is, aimed at maximizing the implementation of all possible employee rights. Whether to accept this approach or not is up to the organization itself. In principle, nothing prevents the inclusion in the student agreement of more stringent conditions for calculating working hours. For example, granting parental leave for up to three years may interrupt the working period. Such leaves are quite long in time and the basis for their provision are events largely related to the will of the employee. Including them during the working period, in our opinion, will significantly upset the balance of interests of the employee and the employer. But this is debatable; it is quite possible that the court will think otherwise. Moreover, the question of feasibility also arises: will the employee be able to competently apply the knowledge and skills acquired during training after being on maternity leave for 3 years?

If the student agreement does not specify periods that interrupt the work period, then the general wording of the Labor Code of the Russian Federation on the obligation to work literally means that the employee undertakes not to terminate the employment relationship during the period agreed upon by the parties. Moreover, if there are legal grounds, he may not perform the labor function assigned to him. Therefore, under any circumstances, the most detailed procedure for calculating the working period must be included in the text of the student agreement.

How is the receipt of compensation for training costs reflected in the organization's accounting?

The only basis for deducting training costs from your salary is the existence of an apprenticeship contract, which is concluded in addition to the employment contract. If there is none, the employer does not have the right to reimburse expenses forcibly or at the request of the employee himself.

Despite the fact that Art. 137 of the Labor Code of the Russian Federation imposes certain restrictions on retention; in this situation, it is necessary to be guided by the norms of Art. 249 of the Labor Code of the Russian Federation, where compensation is calculated in proportion to the time worked.

When restrictions apply:

- When an advance is paid, if the employee does not work until the end of the month.

- To return amounts overpaid by mistake.

- Upon dismissal before the end of the year, if the employee has already used paid leave.

Does an employer have the right to demand money for training?

An employee has the right not to return funds spent on his training in the following cases:

- the dismissal took place after the completion of the mandatory service period;

- payment from the workplace occurs for a good reason (does not depend on the will of the employee). In this case, the possibility of continuing the employment contract is excluded.

In other cases, the employer may require reimbursement of employee training costs upon dismissal. Costs incurred for training can also be recovered under the general rules for compensation for damages caused to the employer.

To compensate for the costs incurred by the organization, the head of the enterprise must issue an order to withhold from the employee the costs of his training. The order can be drawn up in any form.

Accounting entries

To calculate the amount of deduction, you need to calculate how many calendar days the employee worked after training and the amount of money spent on it. Accounting entries are also prepared:

- Debit 73, Credit 91-1, which reflects the total debt of the employee.

- Debit 70, Credit 73, which shows compensation for training expenses.

- Debit 50, Credit 73 – indicates the entry of debt into the cash register.

It is important to remember that, in accordance with Part 1 of Art. 248 of the Labor Code of the Russian Federation, by order of the employer, compensation may be collected, the amount of which does not exceed the employee’s average monthly earnings. No more than 20% of the salary can be withheld one-time (Article 138 of the Labor Code of the Russian Federation).

“To calculate average earnings, it is necessary to take into account the last 12 calendar months of the employee’s labor activity, as well as the average monthly number of calendar days,” says Yu.P., head of the department of labor law at the Higher School of Economics. Orlovsky.

The procedure for calculating compensation is the same for organizations operating in all industries, incl. and budget.

How is money collected from an employee?

Art. 248 of the Labor Code of the Russian Federation determines that the costs of training a resigned employee will constitute material damage for the employer. Accordingly, this amount cannot be withheld from payments due upon dismissal.

The first thing the employer must do is determine the amount to be reimbursed. This is done either based on the amount of time not worked or on the terms of the student agreement. After this, he is obliged to notify the employee by sending him a letter or handing it over for signature.

The employee can write a statement in which he authorizes the accounting department to deduct the necessary amount from the payments due to him, if it is sufficient. However, a citizen may agree to pay the required amount, but later. In this case, a repayment agreement is drawn up between the parties, which defines the payment schedule.

If within a month after receiving the notification about the need to make payments, the employee does not answer anything, and the amount to be reimbursed exceeds his average monthly earnings, then the employer collects all the necessary documents and goes to court.

How is withholding reflected for tax purposes?

Enterprises using the general taxation system must contribute compensation to unrealized income if an employee quits early (Article 250 of the Tax Code of the Russian Federation). In this case, income is defined as the amount of compensation as of the actual date the quitter recognized his obligation to pay expenses to the employer. If the obligation to pay compensation is recognized through the court, the date on which the court decision enters into force is indicated.

If the cash method is used, the amount of unrealized income will be equal to the amount of deductions from wages, and the date is the day when the compensation was made.

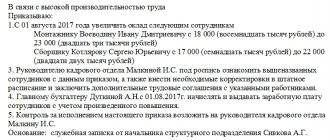

Let's look at a detailed example:

In March, the LLC sent an employee for training, spending 23,600 rubles. An agreement was drawn up with her, under the terms of which she must work at the enterprise for at least 12 months. The employee completed the course on May 7, and in December she decided to quit by submitting an application. According to the terms of the contract, she is obliged to compensate 7,177 rubles.

The employee’s salary for December was 25,000 rubles, and the employer has the right to withhold no more than 25%, i.e. only 4,350 rubles, which were deducted upon dismissal. The remaining 2,827 rubles. she contributed to the organization's cash desk in January.

Reasons for referral to training

The basis for sending a person for training is:

- The contract, as a rule, is called a student agreement and is concluded with applicants before employment, as well as with persons entering an educational institution.

- An agreement is a document signed by both parties (employee and employer), which sets out the main provisions regarding training and work after completion of training.

Thus, speaking about the subject composition with which the contract is concluded, the following groups can be distinguished:

- Persons with whom the employer does not have a formalized employment relationship (applicants, students). In labor law, such relations are usually called “pre-labor”.

- Persons who have an employment relationship with an employer and are sent for training.

Expert commentary

Platonov Alexander

Lawyer

If an employee is sent to study, then another mandatory document related to the basis of the referral is an order to send him to study.

Obligation to pay

Important! According to labor law, an employee who has received education at the expense of the employer and has not worked for the established period is obliged to pay a sum of money in proportion to the time not worked.

Penalties cannot be established by contract or agreement. For example, in case of early dismissal, pay a penalty in the amount of 1,000,000 rubles. In judicial practice, there are often similar cases where the employer imposes a fine. However, in such situations, the courts side with the employee, recognizing this as an infringement of the employee’s rights, since the Labor Code of the Russian Federation does not provide for penalties, and these relations are regulated not by the Civil Code of the Russian Federation, but by labor law.

Is it possible to recover the full amount, regardless of the number of periods worked? This question often arises from an “offended” employer who wants to teach an ungrateful employee a lesson. Judicial practice, approved by the Supreme Court of the Russian Federation, has today developed in such a way that these actions are recognized as infringing on the rights of workers, and therefore violate labor legislation.

It is not uncommon for an employee who was sent to study to be expelled for poor academic performance. The employer has a natural question whether it is possible to recover the money spent from such an employee. In this matter, the court is on the side of the employer. Thus, the amount actually spent on training will be collected from this person.

For example, if a person was expelled at the end of the 1st year, then in fact he must pay not for all years of study, but for the 2 semesters that he completed.

In addition, it is necessary to pay attention to those expenses that are not included in the amount to be recovered.

Thus, in a review of the practice of the Armed Forces of the Russian Federation (“Review of the practice of courts considering cases of material liability of an employee”, approved by the Presidium of the Armed Forces of the Russian Federation on December 05, 2018) came to the conclusion that the funds spent on compensation for travel to the place of training, daily allowances, and maintaining average earnings did not subject to recovery, since these expenses would have been incurred if the employee did not study.

Article 249 of the Labor Code of the Russian Federation. Reimbursement of costs associated with employee training (current version)

1. The commented article determines the procedure and conditions for reimbursement to the employer of costs associated with training an employee if the employee quits without good reason before the expiration of the period stipulated by the employment contract or agreement on training at the expense of the employer.

In accordance with the commented article, such an obligation arises for an employee if the following prerequisites are met:

1) the employee is sent for training by the employer;

2) the training was carried out at the expense of the employer;

3) the employee quit his job before the expiration of the period stipulated by the employment contract or agreement on training the employee at the expense of the employer;

4) the reason for dismissal is not valid;

5) the condition on the employer’s obligation to pay for training, and the employee to work for a certain period after training, is provided for in an employment contract or a special training agreement concluded in writing.

2. The initiative to send for training at the expense of the employer can come from both the employer and the employee himself. The condition on the employer’s obligation to pay for training, and the employee to work for a certain period after training, can be included in the employment contract when concluding it or formalized by a special agreement during the period of his work with this employer. The specific period that the employee must work after training is determined by agreement of the parties.

3. The commented article does not establish a list of reasons that would be recognized as valid for the dismissal of an employee before the expiration of the period stipulated by the parties.

According to established practice, these reasons include:

— illness or disability of the employee that prevents him from continuing to work;

— violation by the employer of labor legislation, collective or labor agreements;

- illness of a child or other close family members;

- relocation of the husband (wife) to another area, etc.

In each specific case, the validity of the reason for early dismissal from work is determined by the employer. However, if the employee does not agree with the employer’s assessment of the validity of the reason, he may go to court. The question of whether the reason for dismissing an employee is valid before the expiration of the period stipulated by the parties can be decided by the court when considering the employer’s claim to recover from the employee the costs associated with the employee’s training.

When assessing the reasons for early termination of an employment contract, Art. 80 of the Labor Code, which classifies as valid reasons that determined the impossibility of continuing work, enrollment in an educational institution, retirement, established violation by the employer of labor legislation and other regulatory legal acts containing labor law norms, local regulations, the terms of a collective agreement, agreement or employment contract.

4. In accordance with the commented article, an employee who trained at the expense of the employer and left work without good reason without having worked after training for the period established by the employment contract or agreement, is obliged to reimburse the expenses incurred by the employer for his training, calculated in proportion to the amount not actually worked after completion of training. time.

Other rules may be established by the employment contract or training agreement. However, the general requirements enshrined in Part 2 of Art. 232 TK. In accordance with them, the contractual liability of the employer to the employee cannot be lower, and the employee to the employer - higher, than provided for by the Labor Code or other federal law. These provisions are also used by the courts when considering relevant disputes.

Thus, the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation recognized as legal the decision of the Dalnegorsky District Court of the Primorsky Territory dated December 26, 2011 and the Determination of the Judicial Collegium for Civil Cases of the Primorsky Regional Court dated March 6, 2012 on the refusal of Terneyles OJSC to satisfy the claim against M. for recovery from him the expenses incurred by the JSC for his training in full.

Resolving the dispute, the court, referring to the provisions of Art. 249, calculated the amount to be reimbursed to the plaintiff in proportion to the time actually not worked by the defendant after completing the training, and not in full of the funds spent on completing the training process, as the plaintiff demanded. At the same time, the court pointed out that the condition of the student agreement, which provides for full reimbursement by the employee of the cost of training, and not in proportion to the time worked after completion of training, contradicts the requirements of Art. 249, as well as Art. 232 of the Labor Code, according to which an employment contract may specify the financial responsibility of the parties, but the employer’s responsibility to the employee cannot be lower, and the employee’s to the employer - higher, than provided for by the Labor Code or other federal laws (Decision of the Supreme Court of the Russian Federation dated September 28, 2012 N 56-KG12-7).

Comment source:

Rep. ed. Yu.P. Orlovsky “COMMENTARY ON THE LABOR CODE OF THE RUSSIAN FEDERATION”, 6th edition ACTUALIZATION

ORLOVSKY Y.P., CHIKANOVA L.A., NURTDINOVA A.F., KORSHUNOVA T.YU., SEREGINA L.V., GAVRILINA A.K., BOCHARNIKOVA M.A., VINOGRADOVA Z.D., 2014

Problem situations

When filing a tax deduction for expenses incurred on training, a person may encounter several controversial situations that may cause difficulties in making mutual settlements.

Read also: Calculation of the average number of employees

For example, one of the controversial situations may be the payment of tuition by both parents at once, if only one of them is specified in the contract. The acts stipulate that partial compensation is paid only upon the application of the parent who made the payment.

Therefore, if the parents have evidence that they both made the payments, they can both claim a tax deduction in an amount proportional to the expenses they incurred.

Tuition and taxes

Based on clause 21 of Art. 217 of the Tax Code of the Russian Federation, personal income tax, you will not have to pay for compensation for the cost of study if the educational organization has a license and the employee is undergoing basic or additional educational programs. Insurance premiums from compensation are also not paid (clause 12, clause 1, article 422 of the Tax Code of the Russian Federation and clause 13, clause 1, article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ).

As for income tax, taking into account paragraphs. 23 clause 1 art. 264 of the Tax Code of the Russian Federation, the company has the right to take into account the costs of training employees. But provided that the costs were incurred on the basis of an agreement concluded by the taxpayer himself, and not by his employee (see Letter of the Ministry of Finance dated January 19, 2018 No. 03-03-06/1/2614).

IMPORTANT!

We recommend that you study the legislation of the region in which your organization is registered: it is possible that you are entitled to special subsidies for employee training. Thus, the Moscow authorities annually select legal entities that will be able to receive such compensation (see the regulations on selection in 2021 in the Order of the Department of Entrepreneurship and Innovative Development of Moscow dated February 10, 2020 No. P-18-12-32/20). Their size is no more than 120 thousand rubles for each employee who is studying secondary vocational or additional secondary vocational education programs.